September 26, 2016

By Mark Terry, BioSpace.com Breaking News Staff

Pfizer has been considering splitting into two companies since at least 2012. This was clearly at the forefront during its attempts to merge with Dublin-based Allergan . The company announced today, however, that after lengthy evaluation, it has decided not to split the company.

The idea was to split off its newer, high-growth drug and its more mature, often off-patent drugs, into two separate companies. This way the high-growth would not be dragged down by the mature brands. The two units are known as Pfizer Innovative Health and Pfizer Essential Health.

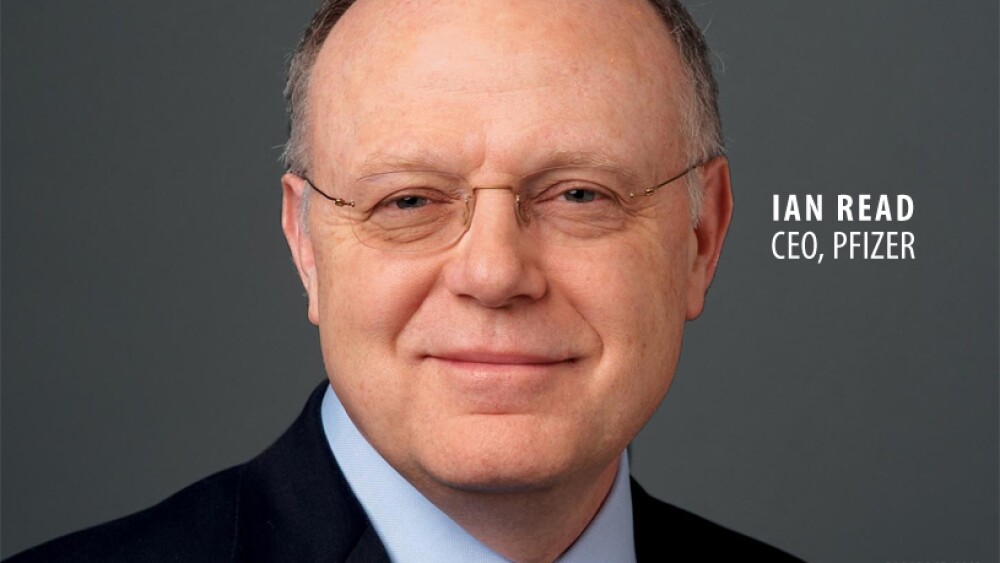

“With this decision, our two distinct businesses will remain separately managed units within Pfizer, which we believe is currently the best structure to continue to deliver on our commitments to patients, physicians, payers and governments, and to drive value for our shareholders,” said Ian Read, Pfizer’s chairman and chief executive officer, in a statement. “We believe that by operating two separate and autonomous units within Pfizer we are already accessing many of the potential benefits of a split—sharper focus, increased accountability, and a greater sense of urgency—while also retaining the operational strength, efficiency and financial flexibility of operating as a single company as compared with operating as two, separate publicly traded companies. We will continue to generate the financial information necessary to preserve our option to split our businesses should factors materially change at some point in the future.”

Pfizer Essential Health markets brands such as Lipitor, to lower cholesterol, Premarin to treat symptoms related to menopause, and Lyrica, for pain. In 2015, Pfizer Essential Health raked in $22.09 billion.

Pfizer Innovative Health focuses on developing and marketing new therapeutics. In 2015, that unit brought in $26.76 billion.

Although the company indicates it spent a great deal of time evaluating the decision, it seems likely that the recently acquisition of Medivation and last year’s addition of Hospira, as well as the collapse of the Allergan deal, were significant factors.

“When we first explored the trapped value question several years ago,” said Frank D’Amelio, Pfizer’s executive vice president of Business Operations and chief financial officer, in a statement, “market valuations of other companies suggested that our two businesses could potentially be worth more as separate companies than they are together in a single company. However, over time, any potential gap between Pfizer’s market valuation and an implied Sum of the Parts (SOTP) market valuation has closed. In our analysis, we concluded that splitting into two companies at this time would not enhance the cash flow generation and competitive positioning of the businesses and the operational disruption, increased costs of a split and inability to realize any incremental tax efficiencies would likely be value destruction.”

The company indicates it believes both units are “poised to grow.” The Essential Health unit now has a dedicated research-and-development capability with the Global Product Development Group. In the last six years, it has received 20 new drug approvals and launched numerous products, including Ibrance, Xalkori, Bosulif, Inlyta, Eliquis, Prevnar Adult and Trumenba.

Pfizer Innovative Health is also growing, and was bolstered by the acquisition of Anacor and the as-yet-closed Medivation acquisition.

The company also stated, “Over the same period, Pfizer captured approximately $32 billion from the disposition of its Capsugel and Nutrition businesses, and the IPO and share exchange associated with the spinoff of its Animal Health business, and has returned $88.1 billion to shareholders through dividends and share repurchases since 2010.”

Pfizer is currently trading at $34.26.