The United States’ relatively high costs have become a political issue on both sides of the aisle. Here’s how international pharmaceutical prices stack up.

Pictured: Stacks of coins on top of block towers of various sizes/iStock, patpitchaya

In our highly polarized time, the idea that prescription drugs in the U.S. are priced unfairly compared with other countries is a rare issue that draws support from both sides of the aisle.

Before leaving office, for example, former President Donald Trump signed an executive order stating that Medicare would not pay more for certain drugs than the lowest price for that medication in any member country of the Organisation for Economic Co-operation and Development. (The order was quickly challenged with lawsuits and ultimately pulled.) And Independent Senator Bernie Sanders, long a proponent of lower drug prices, stated earlier this year that “We pay by far the highest prices in the world for prescription drugs, in some cases 10 times more than the people of any other country.”

As PolitiFact noted at the time, differences in the prices of most drugs are not so stark. In fact, for generic drugs—which make up the bulk of prescribed medications in the U.S.—prices are on average 16% less than those in 32 comparator countries, according to a Rand Corporation analysis of 2018 prices. A further caveat is that analyses such as this one look at the list price of drugs, which don’t reflect any discounts negotiated by pharmacy benefit managers or health insurers.

Data source: Rand Corporation/Graphic by Nicole Bean for BioSpace

With that said, in many cases U.S. payors and patients are shelling out for more than their international counterparts. The Rand Corporation’s analysis found that prices for brand-name drugs were an average of 344% of those in comparison countries. There’s considerable variability, however, not only among different drugs but also countries: Prices in the U.S. were on average 70% higher than in neighboring Mexico, but a whopping 679% higher than in Turkey.

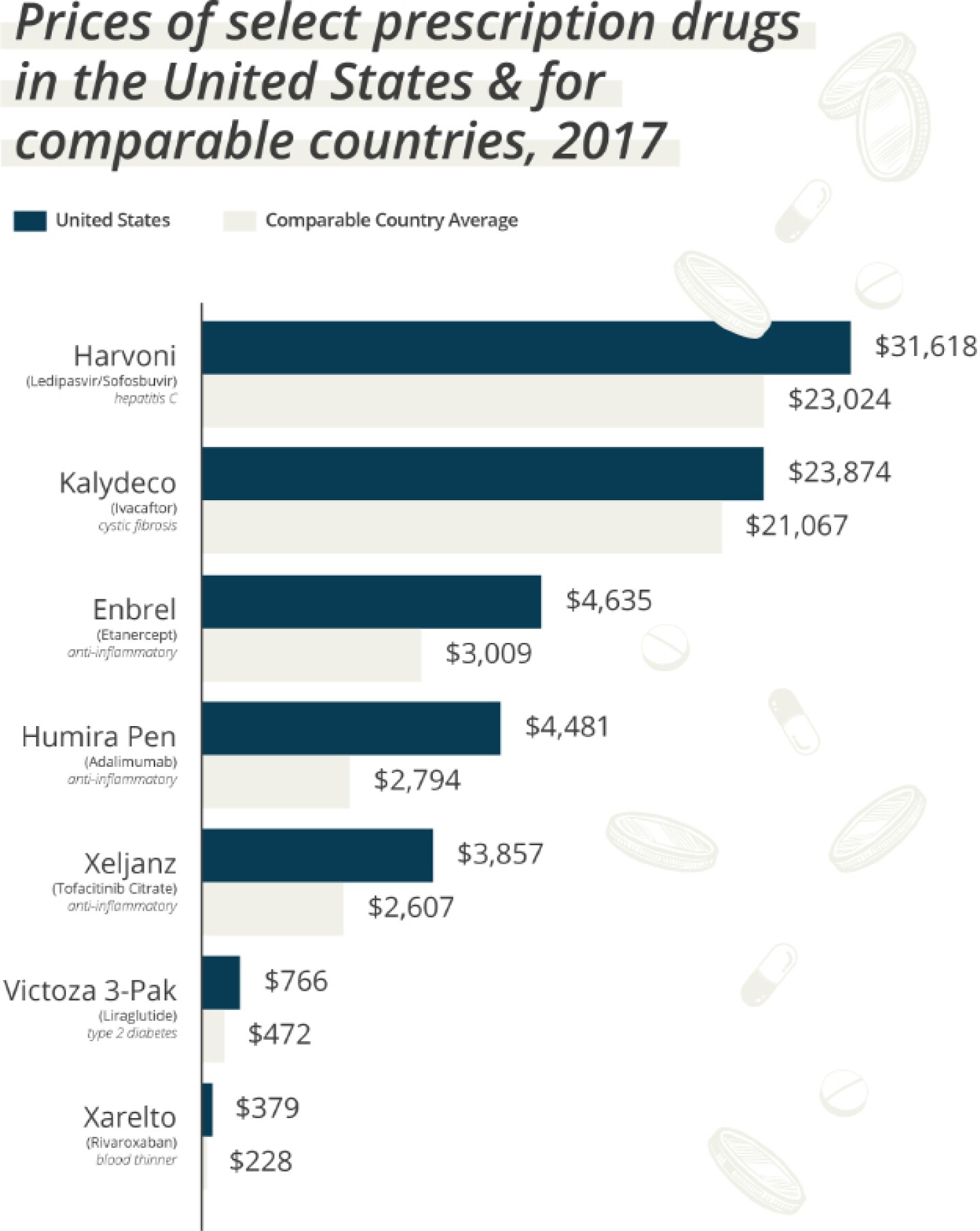

Data source: Health Care Cost Institute and the International Federation of Health Plans via Peterson-KFF Health System Tracker/Graphic by Nicole Bean for BioSpace

Breaking the cost down by individual drugs, a Peterson-KFF Health System Tracker analysis of 2017 data found that Abbvie’s Humira, used to treat various forms of arthritis and other inflammatory conditions, is 423% more expensive in the U.S. than in the U.K., and 186% more expensive than in Germany. A report from the U.S. Government Accountability Office (GAO) found that in 2020 Anoro Ellipta, used to treat chronic obstructive pulmonary disease, cost $248 in the U.S., $64 in Australia, $76 in Canada and $49 in France. The cost of the chronic hepatitis C pill Epclusa, meanwhile, was $14,437 in the U.S., $8,668 in Australia, $16,204 in Canada and 9,211 in France. The GAO used estimated post-discount prices in the U.S. but used gross prices for comparison countries, and noted that as a result, “the actual differences between U.S. prices and those of the other countries were likely larger than GAO estimates.”

There are measures afoot to curb prescription drug prices domestically. Perhaps most notably, last year’s Inflation Reduction Act will enable the U.S. government to begin negotiating the prices of drugs covered under Medicare—that is, if none of the legal challenges to it succeed. This past summer, House Democrats introduced the Lowering Drug Costs for American Families Act, which would expand the number of drugs whose costs could be negotiated each year, although The Hill noted it stood little chance of passage in the Republican-led House. Undeterred, last week Democratic Congressman Pat Ryan introduced the more bluntly-titled Stopping Pharma’s Ripoffs and Drug Savings For All Act, which takes aim at drug patents. Whatever the chances of success for measures such as these, the country’s relatively high drug prices are likely to receive further attention in the coming election year.

Shawna Williams is a senior editor at BioSpace. She can be reached at shawna.williams@biospace.com or on LinkedIn.