In this deep dive, BioSpace examines what’s next for Leqembi, the true cost of anti-amyloid antibodies, and what other Alzheimer’s treatments are coming down the pipeline.

In this deep dive, BioSpace takes a close look at Leqembi (lecanemab), the Alzheimer’s therapy developed by Eisai and Biogen that was approved last year. Leqembi was the first real treatment option to target a suspected underlying cause of the disease: amyloid beta plaques. (The companies’ Aduhelm, the only other anti-amyloid therapy on the market, was hugely controversial and never available to most patients.)

Here, BioSpace examines what’s next for Leqembi, the true cost of anti-amyloid antibodies, and what other Alzheimer’s treatments are coming down the pipeline.

The Big 3

The FDA granted accelerated approval to the first anti-amyloid antibody, Biogen and Eisai’s Aduhelm, in June 2021, but rather than being a breakthrough for Alzheimer’s patients, the approval set off a firestorm of resignations and debate over the relative merits of the drug. More than two years later, the companies have all but pulled Aduhelm from the market as they shift their focus to the much more widely accepted Leqembi. Meanwhile, the FDA has yet to green-light Eli Lilly’s donanemab—a potential direct competitor to Leqembi—but that announcement is anticipated any day now.

Jun. 7, 2021: FDA approves Aduhelm, going against a near-unanimous vote against the drug by a neurological advisory committee.

Jun. 7-11, 2021: Three members of the committee resign in protest of Aduhelm’s approval.

Jan. 6, 2023: FDA grants accelerated approval to Leqembi.

Jan. 19, 2023: FDA issues a Complete Response Letter to Eli Lilly denying donanemab accelerated approval.

Jul. 6, 2023: FDA grants Leqembi full, traditional approval.

Jul. 17, 2023: Following a Q2 submission to the FDA for traditional approval, Eli Lilly presents full data from the Phase III TRAILBLAZER-ALZ 2 study of donanemab.

Oct. 27, 2023: Around 800 U.S. patients have been treated with Leqembi.

Dec. 31, 2023: Eli Lilly expected regulatory action on donanemab’s submission for traditional approval by the end of 2023, but so far, the FDA has not responded.

Jan. 31, 2024: Biogen announces it will halt sales and development of Aduhelm.

Feb. 6, 2024: Eisai reports that as of Jan. 26, 2,000 U.S.-based patients have been treated with Leqembi. Company executives say meeting its target of treating 10,000 patients by the end of March 2024 would be “challenging.”

Leqembi by the Numbers

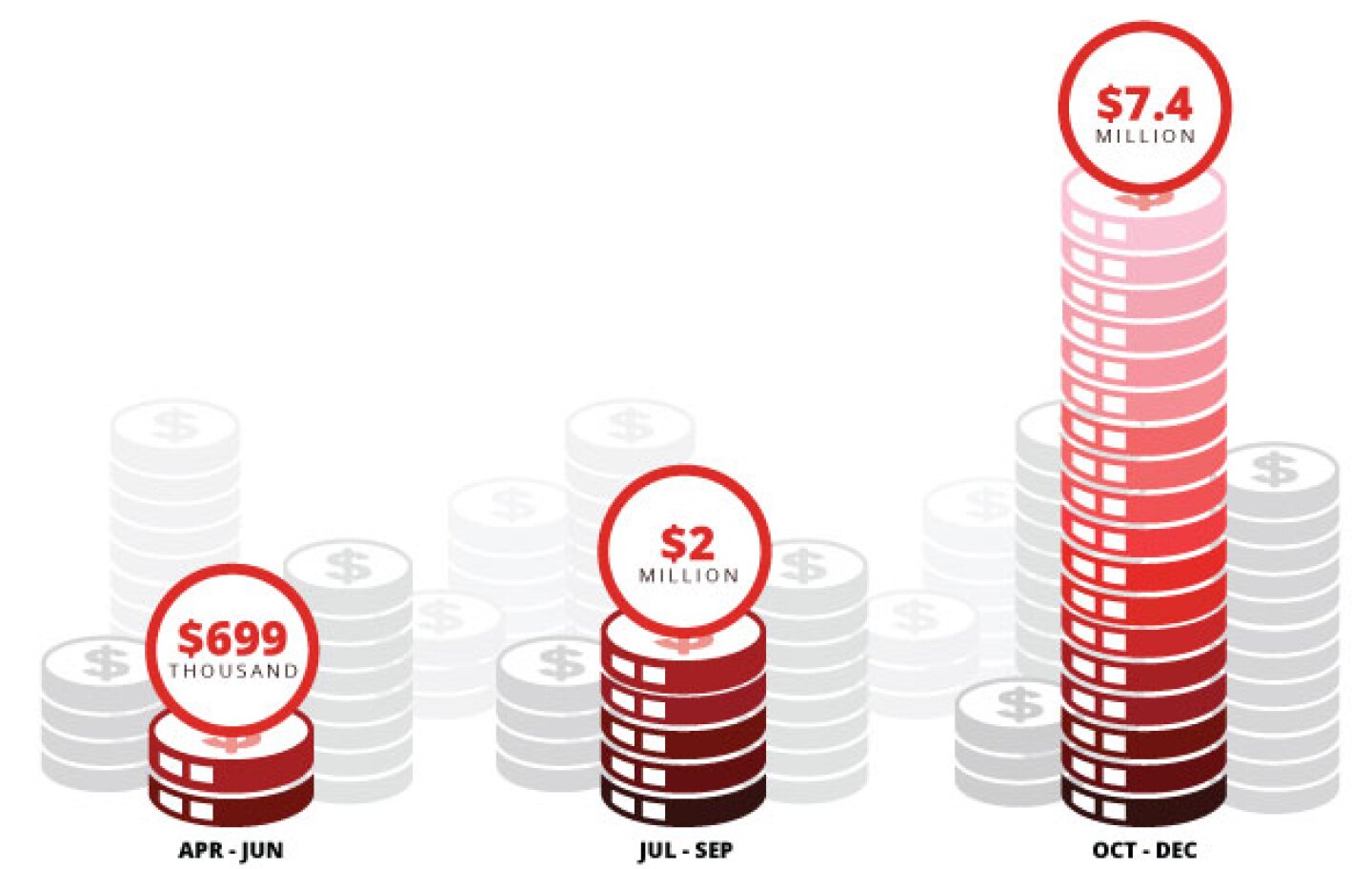

Leqembi, which is priced at $26,500 per year, is beginning to earn money for its developers. Revenue jumped from $2 million in the three months following full approval to more than $7 million in the last quarter of the calendar year.

Note: Data taken from Eisai’s Q2 and Q3 revenue reports. Converted from yen Feb. 7, 2024.

The cost of Leqembi will be split between patients and the U.S. healthcare system.

20%

The percentage of Leqembi’s cost many Medicare patients will have to pay out-of-pocket

$109,000

The potential average Medicare cost of treatment per patient per year

$8.9 billion

The total cost to Medicare if 5% of Alzheimer’s patients take Leqembi

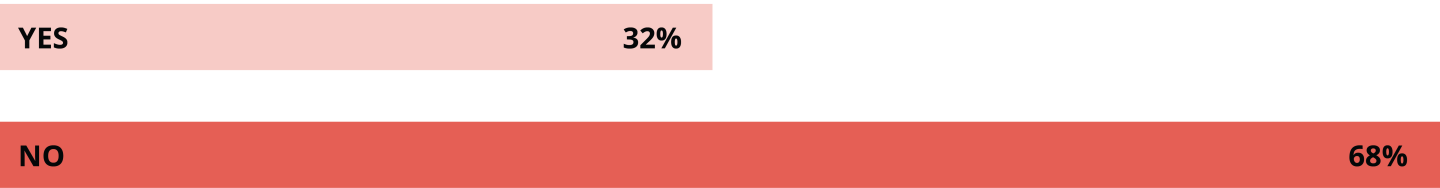

Poll: The clinical benefits of Eisai and Biogen’s Leqembi—as well as Eli Lilly’s donanemab—have been heavily debated. In a Phase III trial, Leqembi reduced clinical decline by 27% after 18 months compared to placebo, but some experts say the effect is modest and may not be noticeable. Do you believe the current data show a benefit worthy of Leqembi’s $26,500 per year price tag?

Alzheimer’s Pipeline: Leqembi Combos and Other Assets to Watch

At the top of the list of potential treatments is Lilly’s donanemab, another anti-amyloid drug. In Phase III, donanemab was slightly more effective than Leqembi on one scale of cognitive and functional impairment.

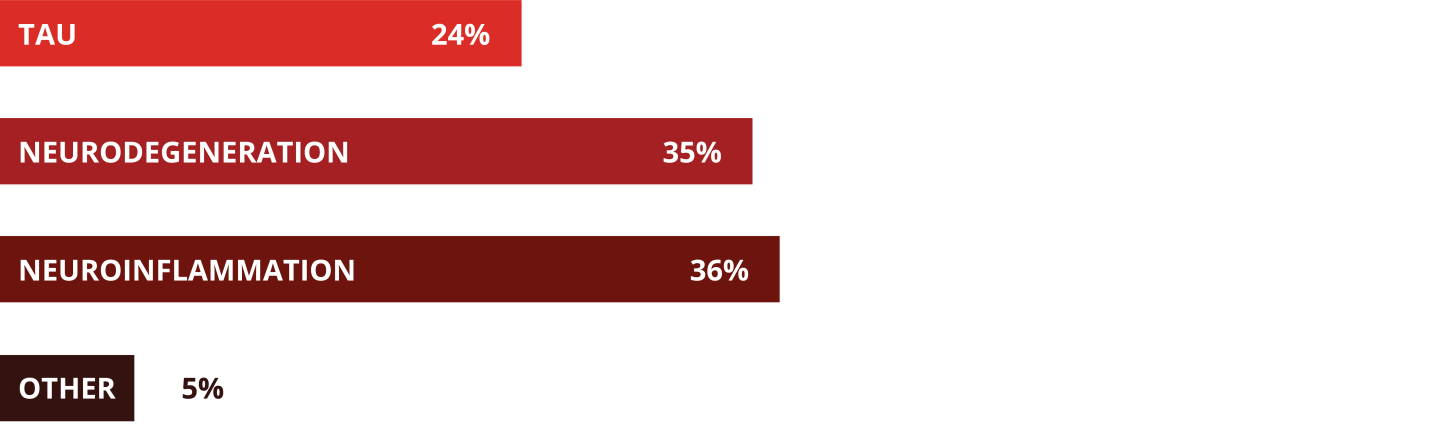

But the pipeline of investigational Alzheimer’s therapies is ample, with numerous targets. Athira Pharma’s investigational small molecule fosgonimeton, Roche’s next-gen gambit trontinemab and AB Science’s tyrosine kinase inhibitor masitinib are all in clinical development. Eisai also has two molecules directly targeting neurodegeneration in Phase I, and Cerevance, Alector Therapeutics and Vigil Neuroscience are all seeking to flay neuroinflammation with candidates targeting TREM2, the KCNK13 gene and the NLRP3 inflammasome.

Experts agree that Alzheimer’s is a multi-faceted disease that is likely to require a cocktail of treatments attacking different targets, many of which could work in concert with Leqembi. Eisai, for example, is developing E2814, an anti-tau antibody intended to prevent the spread of tau seeds within the brain. A current Phase II/III trial uses Leqembi as the base therapy.

Poll: What will bring the next breakthrough? Therapies targeting:

This article was originally published as a Special Edition of ClinicaSpace, BioSpace‘s weekly newsletter covering biopharma research and clinical trials.

For more insights like the above, subscribe to ClinicaSpace below.