Timetable for the Offering (Graphic: Business Wire)

Pharnext (Paris:ALPHA):

NOTICE

This press release must not be published, transmitted or distributed, directly or indirectly, on the territory of the United States, South Africa, Canada, Australia or Japan. It does not constitute a public offer of securities or any other solicitation to purchase or subscribe to securities in the United States or in any other country. Securities may only be offered, subscribed or sold in the United States following registration pursuant to the U.S. Securities Act of 1933, as amended (the ‘U.S. Securities Act’), or in the context of an exemption to this registration requirement. The securities of Pharnext as mentioned in this press release have not been and will not be registered under the U.S. Securities Act and Pharnext has no intention to undertake any public offer in respect of its securities in the United States.

Pharnext, a French biopharmaceutical company developing an advanced portfolio of products in the field of neurodegenerative diseases, announces today the successful completion of its initial public offering on "Public Offering” compartment of the Euronext Alternext stock exchange in Paris by way of an Open Price Offering ("OPO”) and a Global Placement ("Global Placement”, together with "OPO” and the "Offering”) and raised €31 million.

The order book includes tier-one French and European institutional investors as well as renowned industrial investors.

"Today we are pleased to announce the success of our initial public offering on the Alternext market of Euronext Paris, an important milestone in Pharnext’s growth and its innovative approach that seeks to develop a new generation of drugs that will offer a high level of efficacy and safety to the greatest number of patients at an affordable price,” says Daniel Cohen, CEO and Founder of Pharnext. "We wish to thank our historical shareholders who back and support us as well as the new partners who have joined us during the IPO, such as Financière Arbevel, Galapagos, Dassault Group, Claude Berda, and Institut Mérieux. This IPO will primarily serve to finance our Phase 3 study of type 1A Charcot-Marie-Tooth disease for adults and prepare/initiate the pediatric study and to launch Phase 2b for Alzheimer’s disease.”

Pharnext’s Board of Directors, meeting today, has set the IPO price at €10.82 per share. 2,854,920 new shares will be issued in the respect of the OPO and the Global Placement, representing a capital increase of €30.9 million, of which €5.5 million by offsetting receivables held.

Based on a total amount of 10,784,6171 shares to be admitted to trading and a price of the IPO price of €10.82 per share, Pharnext’s market capitalization will be approximately €117 million.

The subscription commitments detailed in the transaction memo were fully served.

The 2,854,920 new shares subscribed in the Offering have been allocated as follows:

- Global Placement: 2,669,313 shares allocated to institutional investors (i.e. 93.5% of the total number of new shares issued); and

- OPO: 185,607 shares allocated to the public (i.e. 6.5% of the total number of new shares issued).

The settlement and delivery of the shares newly issued under the OPO and the Global Placement process will occur on 15 July 2016.

The shares will then be traded in the "Public Offering” compartment of the Alternext market of Euronext in Paris on a single listing line entitled "ALPHA” (ISIN code FR0011191287; mnemonic code ALPHA) at the start of trading on 18 July 2016. In addition, the automatic conversion of the bonds issues in 2014 will be effective on 18 July 2016 and will lead to the issuance of 1,502,797 new shares.

No stabilization operation will be settled so as a consequence neither will be an Over-Allotment option.

A liquidity contract with Gilbert Dupont, that complies with the code of ethics issued by the AMAFI and approved by the French AMF on March 21, 2011, will be launched at the beginning of the trading of the shares on 18 July 2016.

PHARNEXT IS THE PIONEER OF A NEW PARADIGM FOR THE DISCOVERY OF MEDICINAL DRUGS: PLEOTHERAPY, UNIQUE APPROACH THAT COMBINES AT LOW DOSES EXISTING DRUGS, REPOSITIONED INTO NEW INDICATIONS

- Optimal efficiency for candidate drugs at this stage of clinical development,

- An excellent safety profile for candidate drugs at this stage of clinical development,

- Potential application to any disease including neurodegenerative diseases,

- An estimated saving of 5 years in the development of a drug,

- Price of the drugs should be more affordable,

- Extensive and solid intellectual property rights.

WITH ITS IPO PHARNEXT AIMS TO:

- To finance all the costs related to the PLEO-CMT Phase 3 initiated at the end of 2015 with regard to the treatment of the Charcot-Marie-Tooth Neuropathy type 1A with PXT3003 for adults the results of which should be published in the second half of 2018, and to prepare and initiate a PXT3003 pediatric clinic,

- To finance all the costs related to the preparation and the initiation of the next Phase 2 study to be conducted with regard to the treatment of Alzheimer's disease with PXT864, the initiation of which should occur in the second half of 2017 for results expected in 2019-2020,

- To reinforce the financial structure, including the repayment of financial debts.

TERMS OF THE OFFERING

-

Price of the Offering

- OPO and Global Placement were priced at €10.82 per share

- Pharnext’s market capitalisation amounts to approximately €117 million after the capital increase2.

-

Size of the Offering and gross proceeds

- 2,854,920 new shares were issued in the respect of the OPO and Global Placement

- the gross proceeds received by Pharnext amount approximately to €30.9 million.

-

Breakdown of the Offering

- Global Placement: 2,669,313 new shares allocated (i.e., approximately €28.9 million or 93.5% of the total number of shares offered)

- OPO: 185,607 new shares allocated (i.e., approximately €2 million or 6.5% of the total number of shares offered)

- In respect of the OPO, A1 and A2 orders will be allocated up to 100%.

-

Lock-up undertakings by the Company and existing shareholders

- For the Company: from the date on which the guarantee agreement is signed for 180 calendar days after the payment and delivery date, subject to certain usual exceptions.

- For 98.9% of existing shareholders and holders of dilutive instruments: commitment to keep 100% of their shares over 180 days; 90% of their shares over 270 days; 80% of their shares over 360 days; and 50% of their shares over 540 days, subject to certain usual exceptions detailed in the prospectus related to the Offering; this commitment covers only the whole of transferable securities of the Company which they held prior to the IPO.

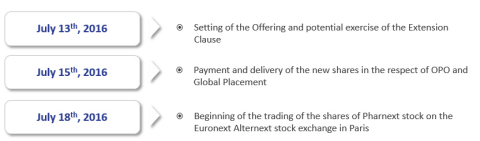

- Timetable for the Offering

-

Identification codes for the Pharnext stock

- Description: PHARNEXT

- ISIN code: FR0011191287

- Mnemonic code: ALPHA

- Compartment: "Public Offering" Alternext Paris compartment

- Business segment: 4573 - Biotechnology

-

Financial intermediary

- Gilbert Dupont acts as the only Lead Broker and Bookkeeper Partner

- Information available to the public

Copies of the prospectus for the Offering and the admission of the shares of Pharnext stock on the Euronext Alternext stock exchange in Paris approved by the AMF on 24 June 2016 under number 16-275 composed of the Document de Base registered on 2 June 2016 under the number I. 16-050 and a transaction memo (including a summary of the prospectus), are available free of charge upon request from the Pharnext company (11, rue des Peupliers, 92130 Issy-les-Moulineaux, France) as well as on the websites of the company (www.pharnext-corp.com) and of the AMF (www.amf-france.org).

- Risk factors

The company draws the attention of the public to Chapter 4, "Risk Factors”, of the Document de Base registered with the AMF and Chapter 2, "Market Risk Factors That May Noticeably Influence the Securities Being Offered”, of the transaction memo.

ABOUT PHARNEXT

Pharnext is an advanced clinical stage biopharmaceutical company founded by renowned scientists and entrepreneurs including Professor Daniel Cohen, a pioneer in modern genomics. Pharnext focuses on neurodegenerative diseases and has two lead products in clinical development: PXT3003 is currently in an international Phase 3 trial for the treatment of Charcot-Marie-Tooth disease type 1A and benefits from orphan drug status in Europe and the United States. PXT864 has generated positive Phase 2 results in Alzheimer’s disease. Pharnext is the pioneer of a new drug discovery paradigm: pleotherapy. The Company identifies and develops synergic combinations of repositioned drugs at low dose. These "pleodrugs” offer several key advantages: efficacy, safety, and intellectual property including several composition of matter patents already granted. The Company is supported by a world-class scientific team.

For more information please visit www.pharnext.com