October 8, 2014

By Riley McDermid, BioSpace.com Breaking News Sr. Editor

In the Halloween spirit yet? BioSpace is—and we decided to start off the countdown to Oct. 31 with the first feature in a four part series covering the spookier aspects of biotech.

This week we look at some Vampire Venture Capitalists: Activist investor-run funds that have wielded their influence inside the boardroom to get as much value out of a company before either selling it or exiting for massive returns on their original investment.

The money involved is nothing to sneeze at—in the last 10 years, activist-run funds have returned nearly 267 percent on average, more than double that of the Standard & Poor’s 500 index. In that spirit, below are BioSpace’s picks for the top five biggest VC Vampires in biotech today.

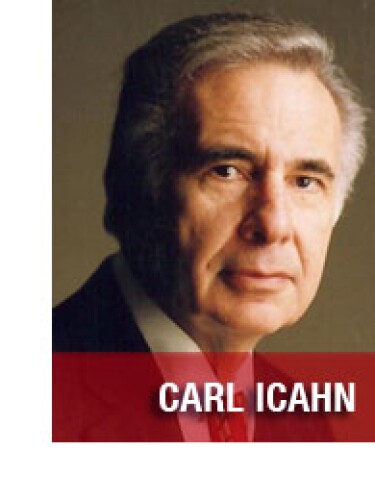

1. Carl Icahn

The number one spot on all activist investor lists will inevitably belong to Carl Icahn, the famous corporate raider who made his fortune and name in the 1980s, and hasn’t appeared to take a vacation since.

The majority shareholder of Icahn Enterprises, he’s been vocal that today’s bull market has “never been a better time for activist investing,” and his numbers have backed him up: IEP saw a ROI of 1,622 percent from January 1, 2000 through July 31, 2014, and at least some of that money came directly from his biotech portfolio.

Most famously, in May 2013 Icahn was instrumental in forcing out Forest Labs CEO Howard Solomon. A major shareholder and board member, Icahn had only to show “misgivings” about Forest’s management and the CEO was history—a testament to how powerful “brand name” investors like Icahn and Warren Buffet can be at getting exactly what the want with a minimum of fuss.

Past biotech successes have been thwarting Mylan’s attempted acquisition of King Pharmaceuticals and an early (and lucrative) position with Biogen—but you can bet there are many, many more to come.

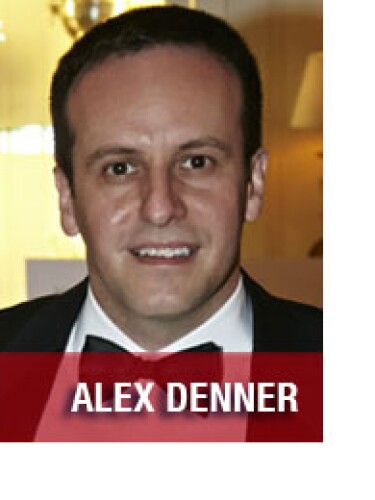

2. Alex Denner

No biotech investor list would be complete without significant mention of Denner, who first met Icahn while trying to flip the troubled but promising ImClone. After Denner was able to shepherd the company’s marquee-name experimental drug ramucirumab all the way through the approval process, he quickly capitalized on the market’s good will and brokered ImClone’s $6.5 billion exit to Eli Lilly . Denner rolled from that success right into engineering Genzyme ’s sale to Sanofi to the tune of $20 billion.

More recently, Denner was front and center when obesity-drug maker VIVUS found itself in his crosshairs when major shareholder First Manhattan, which controls 9.9 percent of the company, criticized its solo launch of weight loss panacea Qsymia, which has met with sales disaster after disaster. So far Denner has been stymied finding a partner or even an offer for VIVUS, which is currently the fourth most shorted stock on the NASDAQ.

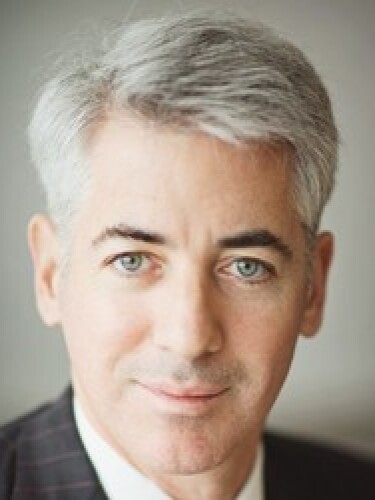

3. Bill Ackman

Perhaps no activist investor has had a bigger year in 2014 than Bill Ackman, whose championing of a hostile takeover of Botox maker Allergan from rival Valeant Pharmaceuticals has been making biotech headlines (and court dockets) since March. Ackman’s $15 billion hedge fund Pershing Square Capital Management is a top shareholder in Valeant, which has been attempting a hostile takeover of Allergan since April. Valeant quickly upped its offer over a series of weeks and eventually launched a tender offer.

Ackman’s charm with behind-the-scenes approaches to similar stakeholders has paid off, with T. Rowe, the company’s second largest shareholder, urging Allergan to hold off on major acquisitions before a Dec. 18 board meeting. Ackman is also rumored to have been instrumental in talking shareholder advisory firm ISS into asking Allergan to give its shareholders a chance to vote on any large, buyout-blocking acquisitions—paving the way for a smoother transition should Valeant triumph.

4. Peter Kolchinsky

An excellent example of when knowledge meets power, former Harvard virology doctoral recipient Kolchinsky has put his brainpower to work behind RA Capital Management, with astonishing results in biotech specialization. Realizing a 41 percent gain annually since 2002, RA Capital is more recently associated with its activist antics at drugmaker Novavax , where Kolchinsky has helped push the fund to an all-time “street projected return” of 200 percent.

Thus far, RA Capital has a stake worth almost $30 million in Novamax, a slice that comprises 9.6 percent of its total 13F portfolio. A co-founder of the Harvard Biotech Club, Kolchinsky is a prime player who is well known for mentoring smart, savvy biotech students hoping to hobnob with industry executives—and make a killing in the process.

5. Daniel Loeb

Last, but certainly not least, we come to Loeb, who although he has been somewhat quiet lately after tangling with Ackman last year over a massive investment in Herbalife, certainly lives on in many a biotech exec’s nightmares for his scathing activist investor letters sent to managers at companies in which he was invested. Most famously is a Sept. 23, 2005 letter to Ligand Pharmaceuticals CEO David Robinson, in which he wrote Robinson was “the worst CEO in biotech,” continuing with “I must wonder how in this day and age the Company’s Board of Directors has not held you and [Ligand C.F.O.] Paul Maier responsible for your respective failures and shown you both the door long ago—accompanied by a well worn boot planted in the backside.”

A similarly brutal dressing down of management of Nabi Biopharmaceuticals in April 27, 2006 was crystal clear about what all these investors expect once they become involved in a company’s life cycle:

“If you have not read our filing, and the demands that we make therein, I strongly urge you to do so immediately,” wrote Loeb at the time. “I’d also encourage each of you to review a history of Third Point’s prior ‘activist investments’ to get an idea of how we have approached similar situations in the past (i.e., when we determine that a company has substantial asset value that is not reflected in the stock price due to poor corporate management and board oversight). Any one of these examples may serve as an object lesson for what the Board and Nabi management may expect should we not hear promptly.”

Don’t Miss