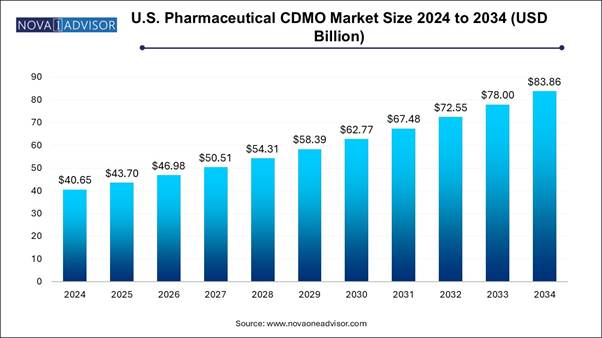

The U.S. pharmaceutical CDMO market size is expected to be worth around 83.86 billion by 2034, increasing from USD 40.65 billion in 2024, representing a healthy CAGR of 7.51% from 2025 to 2034.

The U.S. pharmaceutical CDMO market is growing due to CDMOs significantly speeding up the product expansion timeline for pharmaceutical organizations by combining different stages of the drug development process. CDMOs provide expertise in formulation, scale-up activities, and regulatory compliance, which allows them to effectively manage and implement challenging projects from conceptualization to emerging market readiness, shortening the cycle time essential to launch novel products.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.novaoneadvisor.com/report/sample/8991

U.S. Pharmaceutical CDMO Market Highlights:

⬥︎By service type, the active pharmaceutical ingredient (API) manufacturing segment contributed the highest market share of 66% in 2024.

⬥︎By service type, the finished dosage formulation (FDF) development and manufacturing segment is projected to grow at a significant CAGR of 8.2% during the forecast period.

⬥︎By research phase, the phase III segment captured the biggest market share of 35% in 2024.

⬥︎By research phase, the phase II segment is expected to grow at a solid CAGR of 7.8% during the forecast period.

Market Overview and Industry Potential

The U.S. pharmaceutical CDMO market is expanding rapidly due to CDMOs offering an integrated method by merging drug development solutions with manufacturing abilities for pharmaceutical and biotechnology organizations. Pharmaceutical companies involve CDMOs to leverage their integrated services, which help pharma companies reduce operational expenses and developmental challenges while improving efficiency and speed in bringing products to the market.

Report Scope of U.S. Pharmaceutical CDMO Market

|

Report Coverage |

Details |

|

Market Size in 2025 |

USD 43.70 Billion |

|

Market Size by 2034 |

USD 83.86 Billion |

|

Growth Rate From 2024 to 2034 |

CAGR of 7.51% |

|

Base Year |

2024 |

|

Forecast Period |

2024-2034 |

|

Segments Covered |

Product, Application, End User, and Regions |

|

Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

|

Key Companies Profiled |

Thermo Fisher Scientific Inc., Laboratory Corporation of America Holdings, Catalent, Inc, Cambrex Corporation, and Others. |

How is Rising Demand for Biologics and Biosimilars Act as Supportive Factor for U.S. Pharmaceutical CDMO Market?

The increasing demand for biologics and biosimilars in the United States, driven by advances in production technology and the increasing cases of diabetes, cancer, and cardiovascular conditions. The growing production of monoclonal antibodies, hormones, vaccines, and immunomodulators is among the top candidates of biologics in the US. Growing demand for CDMOs with biologics capabilities. Partnering with CDMOs is an attractive option for biosimilar organizations to achieve the intended clinical performance and industrialization through enhancing R&D efficiency and lowering production costs, which drives the growth of the market.

⬥︎For Instance, In 2023, in the US, savings from the use of biosimilars increased by more than 30 %, to $12.4 billion. Since their introduction, biosimilars have generated $36 billion in savings.

⬥︎In January 2025, Tanvex BioPharma, Inc., a contract development and manufacturing organization (CDMO) for biologics and a biosimilars products company, announced the successful completion of its acquisition of Bora Biologics Co., Ltd., a subsidiary of Bora Pharmaceuticals. Following this acquisition, Tanvex's CDMO services will operate under the name Bora Biologics, continuing to be owned by Tanvex.

Buy Now Full Report: https://www.novaoneadvisor.com/report/checkout/8991

Top Biopharma Products Drive Growth in CDMOs

|

Marketed Biologic |

Reporting Company |

2023 Sale ($USD) Million |

2024 Sale ($USD) Million |

|

Keytruda |

Merck & co. |

$25000 |

$20937 |

|

Comirnaty/BNT162b2 |

Pfizer |

$15300 |

$37806 |

|

Humira |

Abivie and Eisai |

$14400 |

$21237 |

|

Eylea |

Bayer |

$12900 |

$9647 |

|

Dupixent |

Sanofi |

$11600 |

$9100 |

|

Stelara |

Johnson & Johnson |

$10900 |

$9723 |

|

Daerzalex |

Johnson & Johnson |

$9740 |

$7977 |

What are Latest Trends in U.S. Pharmaceutical CDMO Market?

⬥︎In December 2024, SK Pharmteco, a global contract development, manufacturing, and analytical testing organization serving the pharmaceutical and cell & gene therapy industries, announced the launch of a brand unification initiative. This strategic move brings together the expertise and capabilities of several industry-respected organizations under the unified SK Pharmteco brand.

⬥︎In October 2024, National Resilience, Inc., a technology-focused biomanufacturing company dedicated to broadening access to complex medicines, announced that its subsidiary, Resilience Government Services, Inc., has been awarded nearly $17.5 million in novel funding from the Administration for Strategic Preparedness and Response’s (ASPR) Center for Industrial Base Management and Supply Chain (IBMSC), part of the U.S. Department of Health and Human Services, to support the domestic production of key starting materials and active pharmaceutical ingredients for essential medicines.

⬥︎In July 2024, CordenPharma is pleased to share significant progress on its growth initiatives with a >€1 billion strategic investment in peptide development and manufacturing. The company’s ambitious expansion plans are set to propel its Peptide Platform business beyond the €1 billion sales milestone by 2028, reinforcing CordenPharma’s position as a market leader in integrated supply of small to large-scale services from APIs to Drug Products, for both Injectable and Oral Peptides.

Increasing Digitalization in CDMO: Market’s Largest Potential

Increasing adoption of digital technology in healthcare CDMO is creating the opportunity for market growth, as most pioneering CDMOs embrace the digital revolution to deliver pristine consumer service by offering operational efficiencies and insights. Major pharma and biotech firms are also rapidly adopting modern digital tools and technologies to renovate healthcare manufacturing. A significant advantage of digitalization in the pharmaceutical sector is creating documentation processes safer and more efficient. Digitalization substantially improves the quality of key manufacturing processes like documentation and materials management, making them more effective and more consistent.

⬥︎In June 2025, Agenus Inc., a leader in immuno-oncology innovation, announced it had signed definitive partnership agreements with Zydus Lifesciences Ltd., including its subsidiaries/affiliates, hereafter referred to as “Zydus,” designed to accelerate clinical development, scale global manufacturing, and expand patient access to botensilimab and balstilimab (BOT/BAL).

U.S. Pharmaceutical CDMO Market Analysis:

In the U.S. rapid increase in pharmaceutical CDMO due to growing healthcare outsourcing is being driven by an increase in clinics, hospitals, research facilities, and clinical laboratories. The US has a large number of biotech companies, with 10 % of the world's total, which is driving the growth of the market. The US is a hub to 85 % of the world’s small, research-intensive biotech firms, including Johnson and Johnson, Moderna, Amgen, and Pfizer. Increasing prevalence of chronic disease. For instance, around 90% of the annual $4.1 trillion health care expenditure is attributed to managing and treating chronic diseases and mental health conditions, which drives the growth of the market.

By Service Type Analysis:

The active pharmaceutical ingredient (API) manufacturing segment dominates in the U.S. pharmaceutical CDMO market, as healthcare companies are opting for API manufacturing so that their drug formulation process becomes inexpensive and more convenient. Active pharmaceutical ingredient (API) contract manufacturing represents the overall development of pharma drugs with the help of contract manufacturing through outsourcing to other companies. The demand for APIs has steadily increased incoming the years, increasing by factors such as the increasing prevalence of chronic diseases, an aging population, and the continuous pursuit of novel treatments.

On the other hand, the finished dosage formulation (FDF) development and manufacturing segment is expected to grow significantly during the forecast period as finished dosage forms (FDF) present the end consumable product provided to patients, including tablets, injectables, capsules, and topical formulations. The production of these forms is the culmination of widespread research, manufacturing, and development processes.

CDMOs offer an inclusive range of services that cover the whole lifecycle of a drug product, from initial development to commercial production. These offer expertise in formulation development, clinical trial manufacturing, analytical testing, and extensive commercial manufacturing.

By Research Phase Analysis:

The phase III segment dominates the U.S. pharmaceutical CDMO market, as phase III trials support identifying any particular patient subgroups that benefit more from the drug, enabling personalized treatment strategies. Phase III trials offer significant evidence of a drug's effectiveness.

It also supports researchers to assess the drug's capability to achieve the desired results in a huge patient population. By involving a significant number of participants, phase III trials offer a more precise representation of the drug's effectiveness. Phase III trials play an essential role in increasing the adoption of the novel medicine by healthcare providers.

The phase II segment is expected to grow significantly during the forecast period, as phase II clinical studies present a significant point in defining medicine costs, and phase II is a poor predictor of drug success. Effectiveness in phase II trials could be evaluated using the same phase III endpoint when practicable or a validated surrogate endpoint like tumor response, a time-to-event endpoint, or a biomarker.

U.S. Pharmaceutical CDMO Market Companies:

• Thermo Fisher Scientific Inc.

• Laboratory Corporation of America Holdings

What is Going Around the Globe?

⬥︎In April 2025, AGC Biologics launched a novel dedicated cell and gene business division. While other cell and gene CDMOs are closing sites and downsizing their workforce, the new AGC Biologics Cell and Gene Technologies Division offers unparalleled support and scientific ability, backed by an abundant global development and manufacturing network in three regions.

⬥︎In March 2025, CDMO Partnership Reimagined Novartis' contract manufacturing. To ensure the development and reliable supply of medicines to patients around the world, pharmaceutical and biotech companies increasingly rely on CDMOs, their capabilities, and their output.

⬥︎In May 2025, through strategic acquisitions made by New York–based investment firm Altaris, Minaris Regenerative Medicine and the U.S. and U.K. operations of WuXi Advanced Therapies have been combined to form Minaris Advanced Therapies, a global cell therapy CDMO and testing partner. The company is headquartered in Philadelphia, Pennsylvania.

You can place an order or ask any questions, please feel free to contact at sales@novaoneadvisor.com | +1 804 441 9344

Related Report –

⬥︎Active Pharmaceutical Ingredients Market- https://www.precedenceresearch.com/active-pharmaceutical-ingredient-market

⬥︎Pharmaceutical Analytical Testing Market- https://www.precedenceresearch.com/pharmaceutical-analytical-testing-market

⬥︎Pharmaceutical Packaging Market- https://www.precedenceresearch.com/pharmaceutical-packaging-market

⬥︎Pharmaceutical Temperature Controlled Packaging Solutions Market- https://www.precedenceresearch.com/pharmaceutical-temperature-controlled-packaging-solutions-market

⬥︎Pharmaceutical Water Market- https://www.precedenceresearch.com/pharmaceutical-water-market

⬥︎Pharmaceutical Contract Packaging Market- https://www.precedenceresearch.com/pharmaceutical-contract-packaging-market

⬥︎Pharmaceutical Chemicals Market- https://www.precedenceresearch.com/pharmaceutical-chemicals-market

⬥︎Pharmaceutical Manufacturing Market- https://www.precedenceresearch.com/pharmaceutical-manufacturing-market

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. pharmaceutical CDMO market

By Service Type

• Active Pharmaceutical Ingredient (API) Manufacturing

º Small Molecule

º Large Molecule

º High Potency (HPAPI)

• Finished Dosage Formulation (FDF) Development and Manufacturing

º Solid Dose Formulation

• Tablets

• Others (Capsules, Powders, Etc.)

• Liquid Dose Formulation

• Injectable Dose Formulation

• Secondary Packaging

By Research Phase

• Pre-Clinical

• Phase I

• Phase II

• Phase III

• Phase IV

Immediate Delivery Available | Buy This Premium Research https://www.novaoneadvisor.com/report/checkout/8991

About-Us

Nova One Advisor is a global leader in market intelligence and strategic consulting, committed to delivering deep, data-driven insights that power innovation and transformation across industries. With a sharp focus on the evolving landscape of life sciences, we specialize in navigating the complexities of cell and gene therapy, drug development, and the oncology market, enabling our clients to lead in some of the most revolutionary and high-impact areas of healthcare.

Our expertise spans the entire biotech and pharmaceutical value chain, empowering startups, global enterprises, investors, and research institutions that are pioneering the next generation of therapies in regenerative medicine, oncology, and precision medicine.

Web: https://www.novaoneadvisor.com/

Contact Us

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87934 22019

Europe: +44 7383 092 044

Email: sales@novaoneadvisor.com

Our Trusted Data Partners:

Precedence Research | Towards Healthcare | Statifacts

For Latest Update Follow Us: LinkedIn