The

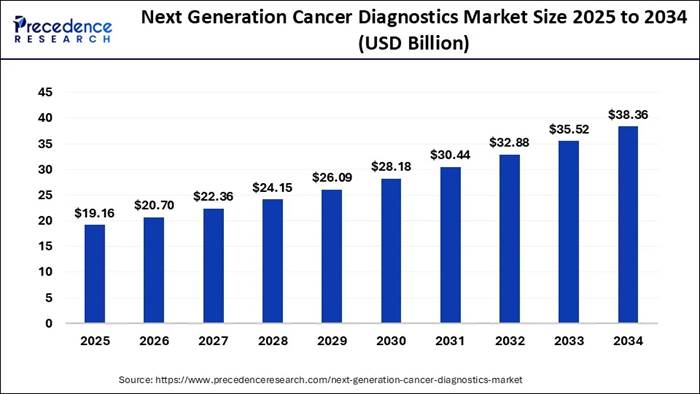

global next-generation cancer diagnostics

market size is expected

to be worth USD 38.36 billion by 2034, increasing from USD 19.16 billion in

2025. The market is expanding at a solid CAGR of 8.02% between 2024 and 2034. The

growing prevalence of cancer combined with the expanding ageing population is

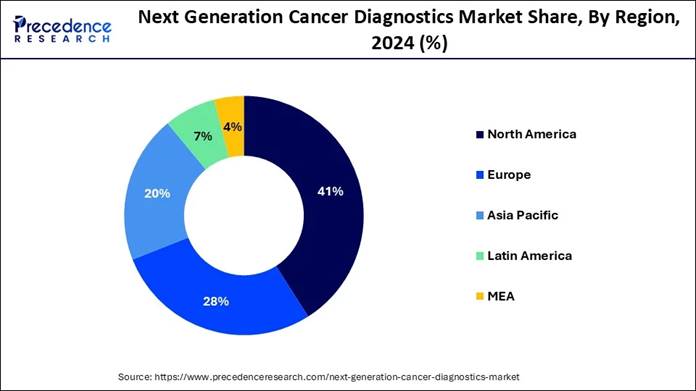

propelling demand for next-generation cancer diagnostics. North America held

41% of the market in 2024, while Asia Pacific is set for a 12.1% CAGR from 2025

to 2034.

Note: This report is readily

available for immediate delivery. We can review it with you in a meeting to

ensure data reliability and quality for decision-making.

📥 Download Sample Pages for

Informed Decision-Making 👉 https://www.precedenceresearch.com/sample/3246

Next-Generation Cancer Diagnostics Market Key Takeaways

🔸North America accounted for the largest market share of 41% in 2024.

🔸The Asia Pacific is expected to grow at a double-digit CAGR of 12.1% from 2025 to 2034.

🔸By technology, the next-generation sequencing segment held the major market share of 37.1% in 2024.

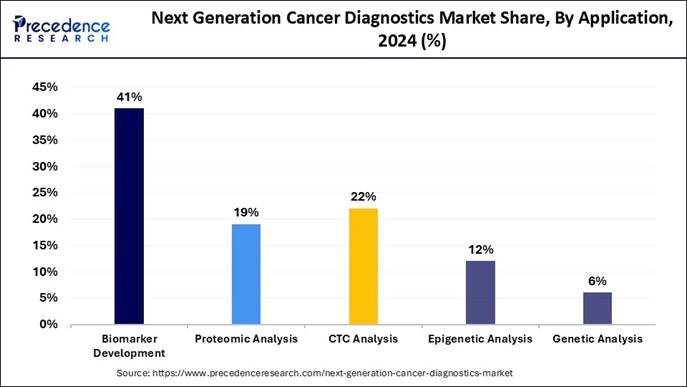

🔸By application, the biomarker development segment contributed the biggest market share of 41% in 2024.

🔸By application, the genetic analysis segment is expanding at a notable CAGR of 11.2% between 2025 and 2034.

🔸By cancer type, breast cancer is expected to grow at a CAGR of 10.1% from 2025 to 2034.

🔸By function, the therapeutic monitoring segment captured the highest market share of 26% in 2024.

Next-Generation Cancer Diagnostics Market Overview and Industry Potential

Revolutionizing Detection: The Rise of Next Generation Cancer Diagnostic

The next-generation cancer diagnostics market is anticipated to experience significant growth in the coming years, akin to the increasing need for more accurate, faster, and less invasive treatment for cancer detection. Furthermore, by finding at early stages by analyzing DNA and RNA, the next generation cancer diagnostic industry is likely to gain major attention across the globe.

Browse Detailed Insight 👉 https://www.precedenceresearch.com/next-generation-cancer-diagnostics-market

Next-Generation Cancer Diagnostics Market Opportunity

The emergence of liquid biopsy is anticipated to create lucrative opportunities in the market during the forecast period. Also, several companies have seen in investing heavily in developing an affordable liquid biopsy, which is likely to attract a heavy patient base from the developing and developed regions.

Next-Generation Cancer Diagnostics Market Restraint

The higher testing cost and data complexity are expected to hamper the industry growth in the coming years. Moreover, the requirement of advanced machines and bigger data systems can create severe expenses, which is likely to create growth barriers for the new market entrants.

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

Case Study: How a Regional Cancer Center Transformed Outcomes with Next-Generation Diagnostics

Background

A regional oncology center serving nearly

25,000 patients annually faced recurring challenges in early cancer detection,

treatment personalization, and timely monitoring. Traditional diagnostic

workflows—dependent on tissue biopsies and basic molecular tests—often produced

delayed results, limiting the ability to tailor therapies and detect recurrence

early.

Challenge

The center struggled with three critical issues:

➢Slow diagnostic turnaround, often taking 2–3 weeks for full molecular profiles.

➢Limited ability to identify actionable genetic mutations, restricting the use of targeted therapies.

➢Invasive, repeated biopsies, creating discomfort and procedural risks for patients.

These bottlenecks hindered precision oncology adoption and affected treatment effectiveness, especially for aggressive cancers such as lung and colorectal tumors.

Intervention: Adoption of

Next-Generation Cancer Diagnostics

In 2024, the center integrated a combined next-generation diagnostic platform

that included:

→ High-throughput NGS panels covering 500+ cancer genes.

→ Liquid biopsy for circulating tumor DNA (ctDNA) to enable non-invasive surveillance.

→ AI-assisted genomic interpretation tools for rapid variant classification.

The deployment was supported by partnerships with diagnostic companies providing sample-to-answer workflows and cloud-based reporting.

Implementation Highlights

🔹Established an in-house molecular lab equipped for NGS and digital PCR.

🔹Trained oncologists and pathologists in genomic-guided treatment selection.

🔹Integrated automated data pipelines into the hospital’s electronic health record (EHR) system.

🔹Launched a pilot for patients with lung, breast, colorectal, and pancreatic cancers.

Impact and Measurable Outcomes

Within the first 12 months of implementation, the center recorded:

→ Diagnostic turnaround time reduction: From 21 days to 5–7 days for full genomic profiles.

→ Higher mutation detection rate: Actionable mutations identified in 56% of tested patients compared with 28% previously.

→ Earlier intervention capability: Liquid biopsy detected treatment resistance 3–5 months earlier than imaging or symptoms.

→ Targeted therapy enrollment increase: 40% rise in precision therapy usage due to clearer biomarker-driven stratification.

→ Reduced patient burden: 30% decline in repeat invasive biopsies, improving patient experience and compliance.

Clinical Significance

🔹Patients with lung cancer receiving EGFR-, ALK-, or KRAS-guided therapies demonstrated improved response rates due to faster mutation identification.

🔹Breast cancer patients undergoing minimal residual disease (MRD) monitoring via ctDNA experienced earlier relapse detection, allowing timely treatment adjustments.

🔹Oncologists reported more confident decision-making supported by integrated genomic dashboards and AI-based predictions.

Strategic Benefits for the Cancer Center

➢ Enhanced reputation as a precision oncology hub in the region.

➢ Stronger collaboration with pharmaceutical partners conducting biomarker-driven clinical trials.

➢I mproved operational efficiency and reduced diagnostic outsourcing costs.

Conclusion

This case demonstrates how next-generation cancer diagnostics—NGS, liquid

biopsy, and AI-driven analytics—can fundamentally restructure cancer care

delivery. By enabling early detection, personalized treatment planning, and

real-time monitoring, the oncology center not only improved patient outcomes

but also strengthened its position as a leader in advanced cancer care.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/3246

Next Generation Cancer Diagnostics Market Report Coverage

|

Report Attribute |

Key Statistics |

|

Market Size in 2025 |

USD 19.16 Billion |

|

Market Size in 2026 |

USD 20.70 Billion |

|

Market Size by 2034 |

USD 38.36 Billion |

|

Growth Rate (2025-2034) |

CAGR of 8.02% |

|

Largest Market Region |

North America (~41% share in 2024) |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2034 |

|

Segments Covered |

Technology, Application, Cancer Type, Function, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Leading Technology Segment (2024) |

Next-Generation Sequencing (~37.1% share) |

|

Leading Application Segment (2024) |

Biomarker Development (~41% share) |

|

Fastest Growing Application Segment |

Genetic Analysis (CAGR ~11.2%) |

|

Fastest Growing Cancer Type Segment |

Breast Cancer (CAGR ~10.1%) |

|

Leading Function Segment (2024) |

Therapeutic Monitoring (~26% share) |

|

Fastest Growing Function Segment |

Prognostics (~10.2% CAGR) |

|

Regional Growth Highlight |

Asia-Pacific expected to grow at ~12.1% CAGR |

|

Key Market Drivers |

Rising cancer prevalence; ageing population; technological advancements; growing adoption of NGS and liquid biopsy |

|

Key Market Opportunities |

Expanding use of liquid biopsy; increasing commercial-level collaborations; adoption of AI-driven diagnostics |

|

Key Market Restraints |

High cost of NGS; complex data processing; requirement for advanced infrastructure |

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Next-Generation Cancer Diagnostics Market Key Regional Analysis:

How North America Leads the Global Next Generation Cancer Diagnostics Market?

North America held the dominant share of the next-generation cancer diagnostics market in 2024, owing to early access to the advanced technology and greater healthcare spending in the current period. Furthermore, the presence of the advanced biolabs, large biobanks, and integration of the genomic data into routine is driving the industry growth in the region.

The region benefits from a high prevalence of cancer coupled with early adoption of cutting-edge technologies such as NGS, liquid biopsy, and AI-driven pathology. In addition, the presence of major biotech and pharmaceutical players, along with large-scale precision medicine initiatives, further accelerates innovation and commercialization. All these factors enable North America not just to invest in next-generation diagnostics, but to integrate them deeply into standard clinical workflows, giving it a dominant share in the global market.

What is the U.S. Next-generation Cancer Diagnostics Market Size and Growth Rate?

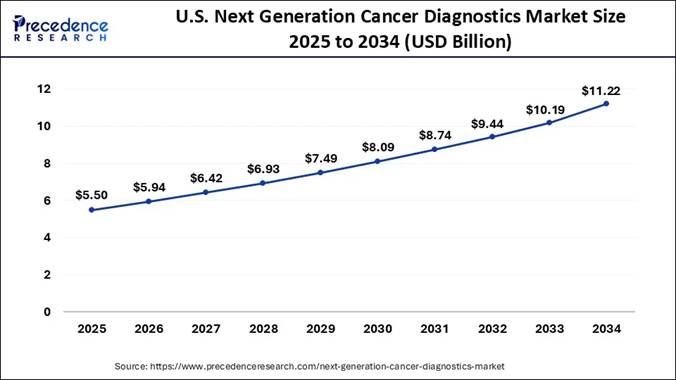

According to Precedence Research, The U.S. next generation cancer diagnostics market size is calculated at USD 5.50 billion in 2025 and is predicted to grow from USD 5.94 billion in 2026 to USD 11.22 billion by 2034, growing at a healthy CAGR of 8.22% between 2025 and 2034.

The Complete Study is Now Available for Immediate

Access | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/3246

U.S. Next-generation Cancer Diagnostics Market Trends:

🔹 Key growth drivers include robust reimbursement frameworks, FDA approval of comprehensive genomic profiling assays, and national precision oncology programs that expand access.

🔹 There is increasing adoption of liquid biopsy and minimal residual disease (MRD) monitoring, as clinicians recognize the value of minimally invasive, real-time tools for tracking treatment response and cancer recurrence.

🔹 A strong presence of leading diagnostics companies supports rapid innovation, commercialization, and scaling of next-generation assays.

What's Powering Asia Pacific’s Rapid Growth in Cancer Diagnostics?

Asia Pacific is expected to expand notably during the forecast period, due to growing cancer cases, improving healthcare infrastructure, and the government's focus on precision medicine. Countries like China, India, and Japan are investing in large-scale genetic databases and diagnostic innovation programs.

Simultaneously, large public–private partnerships and national cancer control programs are pushing early detection and personalized therapy into the mainstream. These combined forces are fueling an accelerated adoption of advanced diagnostics across both urban centers and more remote areas, positioning Asia Pacific as one of the fastest-growing markets globally.

Key Government Efforts in Asia Pacific to Boost Cancer Diagnostics

🔹Launching national cancer control programs that prioritize early detection through molecular diagnostics.

🔹Funding population-scale genomics initiatives to improve cancer risk stratification and tailored diagnostics.

🔹Encouraging public–private collaborations to scale up molecular testing infrastructure in underserved regions.

🔹Expanding reimbursement coverage for advanced tests, such as NGS panels and liquid biopsy, especially in developed markets.

🔹Supporting regional alliances and initiatives to strengthen cancer detection infrastructure, data systems, and research capacity.

🔹Piloting AI-driven screening programs using portable diagnostic tools for early detection of common cancers in community health settings.

🔹Investing in diagnostic lab capacity (NGS, digital pathology) across hospitals and cancer centers to improve access in both urban and rural areas.

Next Generation Cancer Diagnostics Market Segmentation Insights:

Technology Type Insights:

Why Did the Next Generation Sequencing Segment Dominate the Market in 2024?

The next-generation sequencing segment held the largest share of the next-generation cancer diagnostics market in 2024, owing to it allow the detailed mapping of the genetic mutation of cancer cells. Furthermore, the affordability and faster results have provided greater attention to the segment in recent years. As pharmaceutical companies expand targeted therapy pipelines and clinicians increasingly rely on genomic insights for therapy selection, NGS continues to dominate the market as the most powerful tool for cancer diagnosis, prognosis, and personalized treatment planning.

DNA microarrays represent the fastest-growing segment of the next-generation cancer diagnostics market because they offer a powerful combination of high-throughput genomic analysis, rapid turnaround time, and significantly lower cost compared with sequencing-based methods. Their ability to simultaneously assess thousands of gene expression patterns makes them ideal for early cancer detection, tumor classification, and personalized treatment planning.

As precision oncology expands, clinicians and researchers increasingly rely on microarray-based gene-expression panels for identifying prognostic markers and therapy response indicators. Continued technological improvements, simplified workflows, and growing clinical acceptance have further accelerated their adoption, positioning DNA microarrays as one of the most dynamic and rapidly advancing technologies in cancer diagnostics.

Application Type Insights:

How the Biomarker Segment Maintains Its Dominance in the Current Industry?

The biomarker segment maintained the largest share of the market in 2024 because identifying unique biological indicators helps detect cancer early and predict how patients will respond to treatment. Biomarkers such as specific genes, proteins, or molecules act like cancer fingerprints.

Biomarker-based tests are widely adopted in clinical workflows due to their high sensitivity, non-invasive or minimally invasive nature (especially in liquid biopsies), and strong validation across multiple cancer types. Additionally, pharmaceutical companies rely heavily on biomarkers to guide drug development, stratify patients for clinical trials, and support companion diagnostics, further boosting demand.

Proteomic analysis is emerging as a rapidly growing application in the next-generation cancer diagnostics market because it provides insights that genetic testing alone cannot offer. While genomics reveals the potential for disease, proteomics captures real-time cellular activity by examining the proteins that drive cancer growth, signaling, and metastasis. This makes proteomic analysis especially valuable for identifying early biomarkers, understanding tumor behavior, and predicting treatment response at a functional level.

Advances in mass spectrometry, protein microarrays, and bioinformatics have significantly improved sensitivity and throughput, enabling clinicians and researchers to detect subtle protein-level changes linked to cancer progression.

Cancer Type Insights:

The breast cancer segment has gained a major share of the next-generation cancer diagnostics market in 2024, because it's one of the most common and well-researched cancers globally. Early detection through advanced diagnostics greatly improves survival rates, making testing essential. Early detection is critical for improving survival rates, and next-generation tools such as NGS panels, liquid biopsies, gene-expression assays, and biomarker-based tests are increasingly used to identify genetic mutations, assess recurrence risk, and guide personalized treatment strategies. The strong presence of well-established screening programs, widespread awareness initiatives, and substantial research funding has further accelerated adoption of innovative diagnostic methods in this area.

Lung cancer is the fastest-growing segment in the next-generation cancer diagnostics market because it has one of the highest global incidences and mortality rates, creating urgent demand for more accurate and earlier detection methods. Unlike traditional screening tools, next-generation diagnostics—such as NGS panels, circulating tumor DNA (ctDNA) liquid biopsies, and advanced biomarker assays—enable the identification of actionable mutations like EGFR, ALK, ROS1, and KRAS, which are critical for selecting targeted therapies. As precision medicine becomes standard in lung cancer treatment, clinicians increasingly rely on these molecular tests to match patients with highly specific drugs and immunotherapies.

Function Insights:

The therapeutic monitoring segment has gained a major share of the next-generation cancer diagnostics market in 2024, because doctors increasingly need real-time data on how well a cancer treatment is working. Advanced tests can measure tumor DNA or cell markers in blood samples during therapy, showing whether the drug is effective.

These tools allow doctors to track treatment response, identify emerging drug resistance, and personalize therapy plans based on dynamic molecular data. As targeted therapies and immunotherapies become more widely used, the need for continuous monitoring grows, since patient outcomes depend heavily on timely interventions. The convenience of minimally invasive blood-based testing, combined with rising adoption of precision medicine, has positioned therapeutic monitoring as one of the most essential and widely utilized applications in next-generation cancer diagnostics.

✚ Related Topics You May Find Useful:

➡️ Oncology Molecular Diagnostic Market — Precision tools accelerating early tumor detection and therapy matching

➡️ Lung Cancer Diagnostics Market — Advancements improving detection of high-mortality respiratory malignancies

➡️ Breast Cancer Diagnostics Market — Innovations shaping early screening and personalized treatment decisions

➡️ Diagnostic Testing Market — Expanding role of rapid and high-accuracy testing across global healthcare

➡️ CRISPR-Based Diagnostics Market — Gene-editing technology enabling ultra-sensitive pathogen and mutation detection

➡️ Minimal Residual Disease Testing Market — Molecular assays redefining relapse prediction and treatment monitoring

➡️ Esophageal Cancer Molecular Diagnosis Market — Biomarker-driven approaches enhancing detection of aggressive GI cancers

➡️ Epigenetics Diagnostics Market — Methylation-based testing uncovering early disease signals beyond genomics

➡️ Next-Generation Sequencing Library Preparation Market — Workflow advancements streamlining high-throughput sequencing for clinical and research applications

Top Companies in the Next-generation Cancer Diagnostics Market:

🔸GE HealthCare — provides molecular imaging agents for oncology diagnosis and monitoring, enabling non-invasive tumor visualization and theranostic insights.

🔸 Koninklijke Philips N.V. — integrates high-resolution imaging and digital pathology with AI-driven workflows for cancer detection and treatment planning.

🔸Novartis AG — supports companion diagnostics and molecular profiling to match patients with targeted and radioligand cancer therapies.

🔸 F. Hoffmann‑La Roche Ltd — offers advanced NGS-based oncology assays and novel sequencing chemistries for comprehensive tumor profiling.

🔸Illumina, Inc. — provides high-throughput NGS platforms and comprehensive gene panels for precision oncology.

🔸QIAGEN — develops “sample-to-insight” NGS workflows and companion diagnostics for somatic cancer mutations.

🔸Agilent Technologies, Inc. (Dako) — offers IHC-based companion diagnostics to stratify patients for immunotherapy.

🔸Abbott — builds molecular cancer tests to detect key gene mutations and guide targeted therapies.

🔸Thermo Fisher Scientific Inc. — provides FDA-approved NGS assays and collaborates with pharma to co-develop precision oncology diagnostics.

🔸Janssen Pharmaceuticals, Inc. — partners with diagnostics companies to develop companion diagnostics that identify patients likely to benefit from targeted therapies.

What is Going Around the Globe?

🔹In August 2025, Mainz Biomed received regulatory approval in Switzerland for its non-invasive ColoAlert® colorectal cancer screening test. The approval allows the company to expand access to advanced early-detection tools. It marks a major step in the brand’s European market growth.

🔹September 2025, Mainz Biomed officially launched ColoAlert® in the Swiss market following regulatory clearance. The rollout includes partnerships with regional laboratory networks to support distribution. The expansion increases the availability of non-invasive screening options.

🔹March 2025, Noul presented its miLab™ CER platform, an AI-powered cervical cancer screening technology. The device performs automated cell analysis directly on hardware without cloud processing. This approach enables faster, more accessible diagnostics in clinical settings.

🔹In May 2025, Immunovia announced plans to launch its next-generation pancreatic cancer blood test in the United States. The test targets individuals at high risk and is intended for use in surveillance programs. The commercial rollout is expected to broaden early-detection capabilities.

Next-Generation Cancer Diagnostics Market Segmentation:

By Technology

🔹Next-generation Sequencing

🔹Lab-on-a-chip (LOAC) & Reverse Transcriptase-PCR (RT-PCR)

🔹qPCR & Multiplexing

🔹Protein Microarrays

🔹DNA Microarrays

By Application

🔹Biomarker Development

🔹Proteomic Analysis

🔹CTC Analysis

🔹Epigenetic Analysis

🔹Genetic Analysis

By Cancer Type

🔹Lung Cancer

🔹Colorectal Cancer

🔹Breast Cancer

🔹Cervical Cancer

🔹Others

By Function

🔹Therapeutic Monitoring

🔹Prognostics

🔹Companion Diagnostics

🔹Cancer Screening

🔹Risk Analysis

By Region

🔹North America

🔹Europe

🔹Asia-Pacific

🔹Latin America

🔹Middle East and Africa

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or Asia Pacific.

Don’t Miss Out! | Instant Access to This Exclusive Report 👉 https://www.precedenceresearch.com/checkout/3246

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a global market intelligence and consulting powerhouse, dedicated to unlocking deep strategic insights that drive innovation and transformation. With a laser focus on the dynamic world of life sciences, we specialize in decoding the complexities of cell and gene therapy, drug development, and oncology markets, helping our clients stay ahead in some of the most cutting-edge and high-stakes domains in healthcare. Our expertise spans across the biotech and pharmaceutical ecosystem, serving innovators, investors, and institutions that are redefining what’s possible in regenerative medicine, cancer care, precision therapeutics, and beyond.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Nova One Advisor | Onco Quant | Statifacts

Get Recent News 👉 https://www.precedenceresearch.com/news

For Latest Update Follow Us: