March 20, 2017

By Alex Keown, BioSpace.com Breaking News Staff

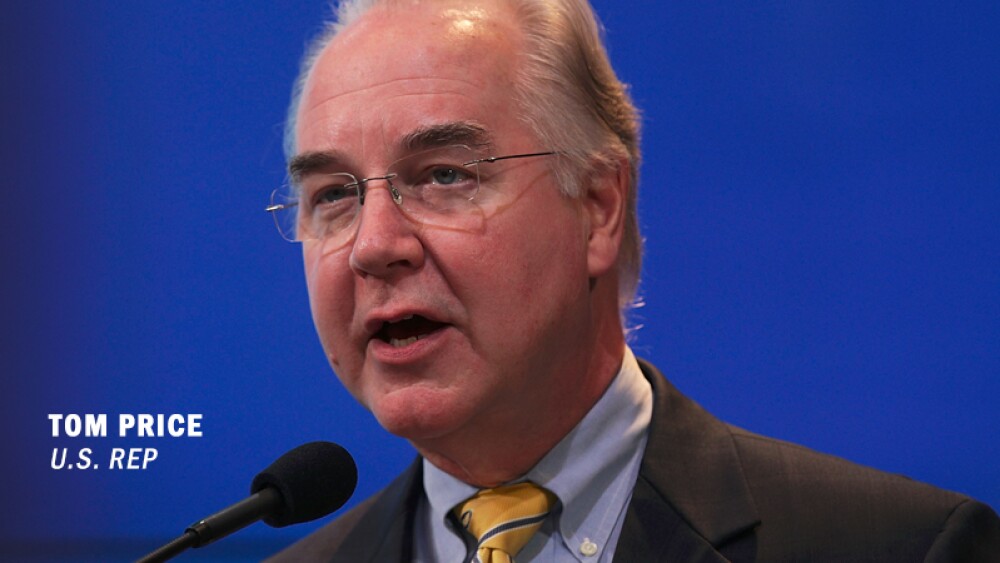

NEW YORK – Former U.S. Attorney for the Southern District of New York Preet Bharara was known for taking on pharma and life science players, as well as public officials, accused of malfeasance and corruption. One investigation he was heading included stock trades made by U.S. Health and Human Services Secretary Tom Price, according to reports.

Bharara was terminated from his role as U.S. attorney last week by President Donald Trump. Incoming presidents often relieve U.S. attorneys and replace them with their own appointees. Bharara did not step down when initially asked by the administration and later said he was fired. However, one case that Bharara was looking into involved investments made by Price when he was a U.S. congressman. During Price’s confirmation hearings, questions over his holdings in multiple healthcare companies were raised by some lawmakers.

When Price was being confirmed he said in a letter that he planned to divest his portfolio of stock in 43 different healthcare companies. In a Jan. 11 letter sent to the ethics office in HHS, he said he will sell off his stocks within 90 days of confirmation in order to avoid any conflicts of interest. Among his investments are several biotech and pharma companies, including Amgen , Athena Health, Biogen , Bristol-Myers Squibb , Eli Lilly , Innate Immunotherapies, Jazz Pharmaceuticals , McKesson Corp. , Pfizer and Thermo Fisher Scientific .

Some lawmakers questioned if Price had violated the 2012 STOCK Act which says members of Congress cannot use nonpublic information to profit from stock deals and it also requires lawmakers to disclose trades, ProPublica said. Trades he made while serving as a member of the powerful Ways and Means Committee were concerning to some lawmakers. Price was never under investigation himself, but Kaiser Health News reported ethics experts who said his trades made during the investigation “shows he was unconcerned about financial investments that could create an appearance of impropriety.”

ProPublica said as a member of Congress, Price took up the cause of healthcare companies “and in one case urged a government agency to remove a damaging drug study on behalf of a pharmaceutical company whose CEO donated to Price’s campaign.”

Some investments made by Price that have been singled out include discounted stock purchases of Australia-based Innate Immunotherapeutics that is developing a drug for multiple sclerosis. The company had hoped to gain an Investigational New Drug status to expedite approval, ProPublica reported.

Another holding that has raised concern among some lawmakers included shares of Zimmer Biomet. Following his acquisition of shares valued between $1,001 and $15,000, Price introduced legislation to delay regulations that could have hurt that company’s bottom line, Business Insider said. Price said that trade was made without his knowledge by his broker.

During his confirmation hearings, Price said his transactions were made legally and with transparency. On March 19, Price said on ABC News’ “This Week with George Stephanopoulos,” that he was unaware of the investigation being conducted by Bharara’s office.

Although little has been said of the investigation launched by Bharara, the former U.S. attorney tweeted that he knew what New York’s Moreland Commission felt like after it was disbanded. That commission had been formed to investigate state government corruption, but was later disbanded by the governor within a year “as its work grew close to his office,” ProPublica said. Bharara later charged associates with the governor and won convictions of several state lawmakers, according to reports.