January 13, 2017

By Alex Keown, BioSpace.com Breaking News Staff

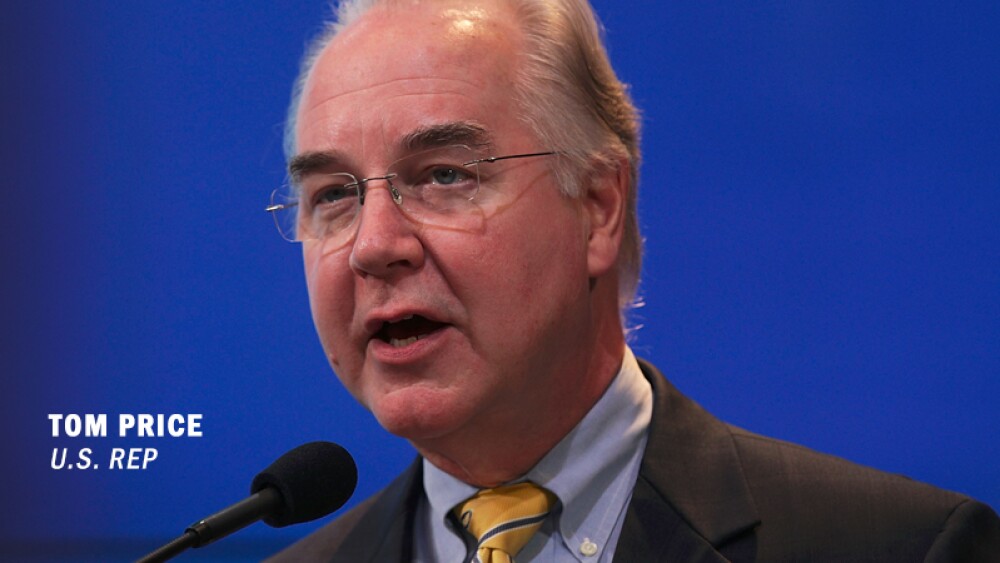

WASHINGTON –U.S. Rep. Tom Price, the man tapped to helm the Department of Health and Human Services under the administration of President-elect Donald Trump, will divest his portfolio of stock in 43 different healthcare companies.

In a Jan. 11 letter sent to the ethics office in HHS, he said will sell off his stocks within 90 days of confirmation in order to avoid any conflicts of interest. Among his investments are several biotech and pharma companies, including Amgen , Athena Health, Biogen , Bristol-Myers Squibb , Eli Lilly , Innate Immunotherapeutics, Jazz Pharmaceuticals , McKesson Corp. , Pfizer and Thermo Fisher Scientific . The Boston Business Journal reported that Price’s holdings in Biogen and Athena Health are between $1,001 and $15,000 each. His Thermo Fisher stock is valued at less than $1,001. Stat News reported Price’s investments in Innate Immunotherapies range between $50,001 and $100,000.

In his letter, Price also said that during his tenure as Secretary of Health and Human Services, neither he nor any member of his family, will not acquire interest in businesses listed on the U.S. Food and Drug Administration’s prohibited holdings list. He also said he will not become involved directly or indirectly with industries in the pharmaceutical world, development of veterinary products, healthcare management or delivery companies or companies involved with the development of food or beverages.

Price’s divestment announcement came after concerns were raised by some lawmakers over his holdings in an industry that he would directly oversee. Public Citizen, a consumer rights group that has been described as left leaning, filed a complaint with the Office of Congressional Ethics and the Securities and Exchange Commission, seeking an investigation into complaints of insider trading. The complaint said Price, among others, traded large amounts of shares in pharmaceutical and biotech companies all while working on legislation that impacted those industries.

In addition to divesting himself of those stock holdings, Price also said he will step aside from his position as managing partner of Chattahoochee Associates, a Georgia-based surgical group. Price is an orthopedic surgeon. He said he will continue to have financial interest in the group, but will only derive passive investment income. Price also said he will “retain limited partnership interests in the following entities that own property rented to healthcare-related tenants” in Diagnostic Ventures of Roswell LLC and RMC3 LLC.

Price also said he would resign as a delegate from the American Medical Association. He said he would not participate in any matters in which the AMA is involved with for up to one year.

Price is scheduled to go before the U.S. Senate for his confirmation hearings on Jan. 18.