The global Pharma 4.0 market size is accelerating rapidly, reaching USD 19.64 billion in 2025 and expected to be worth to USD 81.20 billion by 2034 at a double-digit 19.20% CAGR. Driven by automation, AI, IoT, and advanced analytics, Pharma 4.0 is transforming drug development and manufacturing with smarter, more efficient, and highly connected production systems.

The pharma 4.0 market is driven by increasing digitalization, automation, and the adoption of advanced analytics to enhance manufacturing efficiency and regulatory compliance.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/3187

Pharma 4.0 Market Highlights

🔹 Market Momentum: The global Pharma 4.0 market is set to reach USD 19.64 billion in 2025, reflecting strong early-stage adoption of digital transformation across the pharmaceutical sector.

🔹 Long-Term Growth: The market is projected to soar to USD 81.20 billion by 2034, driven by rapid integration of smart manufacturing, automation, and data-driven innovation.

🔹 Robust CAGR: Expect a powerful 19.20% CAGR between 2025 and 2034, highlighting the sector’s shift toward intelligent, connected pharmaceutical ecosystems.

🔹 Regional Leadership: North America led the global market in 2024 with a commanding 35.29% share, supported by advanced infrastructure and early adoption of Pharma 4.0 technologies.

🔹 Rising APAC Influence: Asia Pacific is poised for significant expansion throughout the forecast period, fueled by rising investments in automation, AI, and next-gen pharmaceutical manufacturing.

🔹 Technology Spotlight: The Artificial Intelligence (AI) segment is expected to deliver substantial growth, transforming operations through predictive analytics, automation, and real-time decision-making.

🔹 Application Growth: Drug discovery and development will remain a high-growth application segment as Pharma 4.0 accelerates R&D efficiency and speeds time-to-market.

🔹 End-User Surge: Biotechnology companies are projected to witness rapid adoption, leveraging smart technologies to optimize production, enhance quality, and scale innovation.

What is the Pharma 4.0 Industry?

Pharma 4.0 refers to the digital transformation of the pharmaceutical industry through technologies including Artificial Intelligence (AI), the Industrial Internet of Things (IIoT), robotics, and advanced data analytics. These technologies facilitate a connected and intelligent manufacturing capability to enhance efficiency, quality, and compliance for every step in the process, from drug discovery to distribution. The adoption of Pharma 4.0 enables real-time data monitoring, predictive maintenance, and digital twins to decrease operational error and downtime while controlling product quality.

The continuing use of blockchain technology for supply chain transparency and AI-based analytical tools for quicker clinical decision-making are indicative of its rising importance. Regulatory agencies such as the FDA and EMA are also supporting the direction of Pharma 4.0 to a patient-centric, automated, data-centric pharmaceutical system.

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

Major Government Initiatives for Pharma 4.0:

🔸 US FDA Emerging Technology Program (ETP) - This program helps pharmaceutical firms propose and validate novel manufacturing technologies (like continuous manufacturing, advanced analytical tools) in early stages, giving them regulatory feedback and support before full approvals.

🔸 FDA Emerging Drug Safety Technology Program (EDSTP) - Launched by the US FDA, this initiative focuses on using AI, ML, and other modern technologies in pharmacovigilance and post-market surveillance to improve drug safety monitoring.

🔸

Made

in China 2025 - China’s industrial policy includes biopharma and medical

products among its priority sectors, aiming to upgrade its pharmaceutical

manufacturing capabilities through automation, innovation, and greater

domestic value‑addition.

🔸 European Blockchain Regulatory Sandbox & Digital Strategy (EU) - The EU has established regulatory sandbox environments (e.g., for blockchain) under its digital strategy to allow legal/regulatory experimentation and deployment of emerging technologies with guidance, thus enabling safer, regulated adoption of traceability, transparency, etc in supply chains.

🔸 Harmonisation & Digitalisation of Regulatory Workflows in India - India’s CDSCO (Central Drugs Standard Control Organization) has moved many regulatory processes online (e.g., drug/device import, licensing, approvals) via unified digital platforms, improving transparency, standardisation, and faster interactions between the govt and industry.

✚ Turn AI disruption into Opportunity. Click to Get the Insights Shaping Tomorrow.

What are the Key Trends of the Pharma 4.0 Market?

🔹 Digitalization of Manufacturing Processes: Pharmaceutical companies are transforming traditional manufacturing with technologies like IoT, digital twins, and smart sensors to enable real-time monitoring and control. This results in improved efficiency, reduced errors, and more agile responses to production demands or disruptions.

🔹

Adoption of

Connected and Smart Devices: Wearables, sensors, and connected devices are being used in

clinical trials and patient monitoring to collect real-time health data.

These tools enhance patient engagement, improve data accuracy, and support more

adaptive and efficient clinical processes.

🔹 Cloud Computing and Data Analytics: Cloud platforms are enabling scalable, secure, and collaborative environments for storing and analyzing vast amounts of pharmaceutical data. Advanced analytics empower companies to optimize operations, forecast demand, and streamline supply chain and R&D activities.

🔹 Focus on Regulatory Compliance and Data Integrity: With strict regulatory requirements, Pharma 4.0 emphasizes secure data handling, audit trails, and real-time compliance monitoring using digital tools. Automation and digital record-keeping reduce human error and ensure adherence to global standards like FDA 21 CFR Part 11 and EU Annex 11.

🔹 Personalized Medicine and Precision Manufacturing: The rise of personalized therapies is driving demand for flexible, small-batch manufacturing supported by modular production and automation technologies. Pharma 4.0 facilitates the efficient production of customized treatments while maintaining high quality and compliance standards.

📥 Dive into the Complete Report ➡️ https://www.precedenceresearch.com/pharma-4-0-market

Pharma 4.0 Market Opportunity

How is AI Integration Representing a Breakthrough Opportunity in Pharma 4.0?

Integrating Artificial Intelligence (AI) brings a new era in Pharma 4.0. By providing predictive analytics or predictive machine learning models, AI is changing the dynamics of drug discovery, drug manufacturing, and drug monitoring. In 2025, various large pharmaceutical companies such as Pfizer and Novartis expanded their collaborations with AI technology to screen molecules or enhance manufacturing effectiveness.

🔹In June 2025, XtalPi, an AI-powered drug R&D company, announced a strategic collaboration with Pfizer to advance its AI-driven drug discovery and materials science simulations. This collaboration aims to improve the accuracy of physics-based methods with AI models for small molecule medicine discovery and development optimization. (Source: worldpharmaceuticals.net )

🔹The European Medicines Agency (EMA) also took steps toward creating regulatory frameworks using AI, indicating a continuing institutional perspective of support. This is a very strong opportunity to support broader adoption of Pharma 4.0 beyond only digital consulting frameworks.

Pharma 4.0 Market Key Challenges

Data Integrity Failures

Data integrity failures are a primary hindering factor to the pharma 4.0 market, a concern for digital systems, lab reports, or automated records being tampered with, falsified, or otherwise "not trustworthy". Regulatory bodies, such as the US FDA, have also observed increasing reports of such infractions: for example, a contract research organisation (CRO) in Mumbai, Raptim Research, had studies from 2025 rejected over falsified data and improper implementation of good laboratory practices.

Similarly, Indian API manufacturers such as Global Calcium Pvt. Ltd. were cited for the lack of review of complete raw data and had incomplete audit trails. Such breaches deteriorate trust, lead to fines from regulators, cause delays in product approval, and raise product cost, causing many companies to reconsider outright embracing Pharma 4.0 technologies without a stronger, proven network of systems in place.

Pharma 4.0 Market Regional Report Scope

|

Report Attributes |

Details |

|

Market Size in 2025 |

USD 19.64 Billion |

|

Market Size in 2026 |

USD 23.16 Billion |

|

Market Size by 2034 |

USD 81.20 Billion |

|

Growth Rate (2025–2034) |

CAGR 19.20% |

|

Largest Market |

North America (≈35.3% share) |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2034 |

|

Segments Covered |

Technology, Application, End-User, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Historical Data |

2021–2023 market performance included for trend analysis |

|

Market Share Analysis |

Covers competitive share of key players and emerging innovators |

|

Technology Breakdown |

AI, IoT, Big Data Analytics, Cloud Computing identified as major technological pillars |

|

Application Focus |

Drug Discovery, Development, Manufacturing, Quality Assurance, and Compliance |

|

End-User Mapping |

Pharmaceutical companies, Biotechnology companies, CMOs/CDMOs, and CROs |

|

Key Market Drivers |

Demand for digital transformation, need for data integrity, GMP automation, real-time analytics |

|

Market Opportunities |

Adoption of AI-powered smart manufacturing, personalized medicine workflows, digital QC |

|

Value Chain Analysis |

Includes technology suppliers → integrators → pharma manufacturers → distributors |

|

Regulatory Landscape |

Covers FDA, EMA, and GMP 4.0 compliance and digital maturity models |

|

Competitive Landscape |

Multiple players evaluated based on innovation, technology capability, and global footprint |

|

Scope of Customization |

Precedence Research highlights options for regional deep-dives and segment-level granularity |

|

Coverage of Industry Trends |

Automation in biomanufacturing, smart sensors, cloud-integrated MES/LIMS, predictive maintenance |

|

Data Sources |

Combination of primary interviews, secondary databases, investor presentations, and regulatory filings |

|

Pricing Analysis |

Includes assessment of automation costs, digital solutions pricing, and ROI calculations |

|

Porter’s Five Forces |

Included to assess market competitiveness and investment attractiveness |

Pharma 4.0 Market Regional Insights

What is the U.S. Pharma 4.0 Market Size?

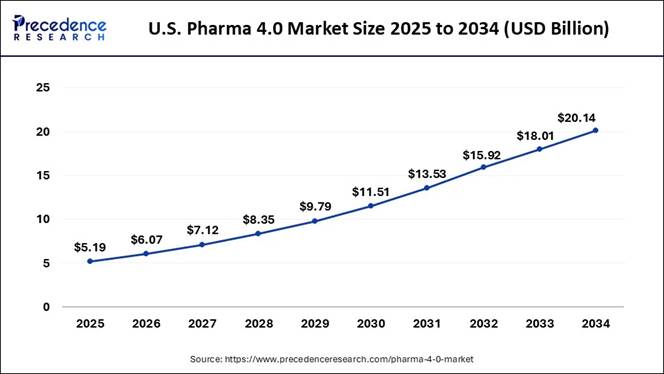

According to Precedence Research, the U.S. pharma 4.0 market size is estimated at USD 5.19 billion in 2024 and is anticipated to reach around USD 20.14 billion by 2034, grow at a healthy CAGR of 16.30% from 2025 to 2034.

What makes North America a Leader in Pharma 4.0?

North America is well-positioned in the pharma 4.0 market with a share of 35.29% in 2024, as it has a strong pharmaceutical infrastructure, an advanced R&D ecosystem, and early adopters of digital technology (i.e., AI, IoT, analytics, etc.) in processes, from drug R&D to manufacturing. North America enjoys the world's largest biopharma companies, FDA regulatory initiatives for digital validation, and advanced investment into smart manufacturing. In addition to infrastructure and investment, North America has a substantial level of cloud infrastructure and skilled labor, which allows for more advanced digital transformation in key production and quality processes.

The U.S. dominates the regional market due to its robust pharmaceutical and biotechnology ecosystem, advanced digital infrastructure, and strong government and regulatory support. With major global pharma companies, research institutions, and tech giants headquartered in the U.S., the country leads in adopting advanced technologies like AI, IoT, and automation in pharmaceutical manufacturing and R&D. Regulatory initiatives from the FDA, such as the Emerging Technology Program, further encourage innovation by guiding the integration of new manufacturing technologies.

Note: This report is

readily available for immediate delivery. We can review it with you in a

meeting to ensure data reliability and quality for decision-making.

📥 Download

Sample Pages for Informed Decision-Making 👉

https://www.precedenceresearch.com/sample/3187

Why is Asia Pacific the Fastest-Growing Region?

Asia Pacific is the fastest-growing region in the pharma 4.0 market, as countries such as China, India, Japan, and South Korea are rapidly modernizing their pharmaceutical industry.

Governments and jurisdictions are supporting digital manufacturing and “Industry 4.0” programs to improve efficiency and global competitiveness. There is a rapid expansion of exported pharmaceuticals and clinical research activities, and the adoption of automation and AI-based quality management systems is supporting the regional advancement. Partnerships between local manufacturers and international tech companies are also accelerating smart pharma infrastructure.

Country-level Investments & Funding for Pharma 4.0 Industry:

🔹 Canada - The Canadian government invested CAD $62 million in Entos Pharmaceuticals to establish a biomanufacturing and R&D facility focused on next-gen therapeutics and vaccines. An additional $29.77 million was allocated to expand Pharmascience’s facility in Quebec, modernizing production with advanced automation technologies.

🔹 United States - The U.S. provided approximately $52.9 million in federal funding to support the Advanced Pharmaceutical Manufacturing (APM) cluster in Virginia, aiming to expand domestic production of essential medicines. A further $14 million was granted to the API Innovation Center to strengthen U.S. capabilities in manufacturing active pharmaceutical ingredients using advanced technologies.

🔹 United Kingdom - The UK committed £70 million to establish new medicines manufacturing centres to accelerate drug development and digital production methods. An additional £14 million was allocated through the Sustainable Medicines Manufacturing Innovation Programme to fund nearly 30 projects enhancing manufacturing efficiency and sustainability.

🔹 European Union - The EU launched the IPCEI Med4Cure initiative, offering up to €1 billion in public funding across six member states to support innovation in pharmaceutical production, APIs, and digital manufacturing platforms. Another €403 million was made available through the IPCEI Tech4Cure project to support advancements in health tech and pharma digitalization.

🔹 India - India’s government-backed Bulk Drug Park Scheme offers capital assistance for setting up large-scale bulk drug parks with shared infrastructure for testing, waste treatment, and utilities. One such project in Una, Himachal Pradesh, involves combined investments from central and state governments, with the total projected investment exceeding ₹8,000 crore.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Pharma 4.0 Market Segmentation Insights

Technology Insights

What is the Leading technology of the Pharma 4.0 Market?

In terms of technology, Artificial Intelligence (AI) takes precedence in the market, driving improved therapeutics development, predictive modeling, and process optimization. AI provides pharmaceutical companies the ability to decrease timelines in R&D, reduce operating costs, and improve accuracy in decision making, and thus is the leading technology in today's Pharma 4.0 ecosystem. AI enables rapid analysis of vast biological and chemical datasets to identify potential drug candidates faster and more accurately than traditional methods. It significantly reduces the time and cost of preclinical research by predicting drug-target interactions, optimizing compound structures, and identifying biomarkers.

The Internet of Things (IoT) is quickly rising in importance as the fastest-growing technology, where devices, sensors, and equipment are connected together to enable optimized manufacturing environments, strengthen tracking of supply chains, and provide real-time monitoring. Since pharmaceutical operations are always looking for innovative ways to improve efficiency, comply, and minimize downtime, IoT uses are growing quickly.

Pharma 4.0 Market Size, By Technology, 2022 to 2024 (USD Million)

|

Technology |

2022 |

2023 |

2024 |

|

Cloud Computing |

1,454.69 |

1,715.70 |

2,025.25 |

|

Artificial Intelligence (AI) |

3,367.26 |

3,955.60 |

4,650.64 |

|

Big Data Analytics |

1,829.26 |

2,163.93 |

2,561.98 |

|

Internet of Things (IoT) |

5,398.80 |

6,334.37 |

7,438.17 |

Application Insights

What Application Remains at the Forefront of Pharma 4.0?

The drug discovery and development remains the application segment at the forefront of Pharma 4.0, as Pharma 4.0 technologies are revolutionizing research pipelines, enabling greater molecular analyses and faster translation of therapeutics. New and innovative tools can replicate in vivo simulations, which saves time and reduces costs in bringing products to market. The representation of the most cost-intensive, data-heavy, and time-consuming phase of the pharmaceutical lifecycle, making it a prime candidate for digital transformation through Pharma 4.0 technologies.

The manufacturing segment is the fastest-growing in the market because it is the most impactful area for digital transformation, offering immediate gains in efficiency, quality, and compliance. Technologies like automation, IoT, AI, and real-time data analytics enable smart and continuous manufacturing, reduce human error, support predictive maintenance, and ensure regulatory compliance through enhanced traceability. These innovations allow pharmaceutical companies to produce drugs faster, more reliably, and with greater flexibility, especially important in a market moving toward personalized medicine and agile production models.

Pharma 4.0 Market Size, By Technology, 2022 to 2024 (USD Million)

|

Application |

2022 |

2023 |

2024 |

|

Drug Discovery and Development |

3,401.05 |

4,015.29 |

4,744.45 |

|

Clinical Trials |

2,052.60 |

2,416.06 |

2,846.28 |

|

Manufacturing |

6,596.35 |

7,738.24 |

9,085.30 |

End User Insights

Who is the Leading End-user in the Pharma 4.0 Market?

The leading end-user category is pharmaceutical companies utilizing advanced digital capabilities in areas such as AI, cloud computing, and big data analytics across research and development, manufacturing, and regulatory compliance. Pharmaceutical companies are the largest end-users, investing significantly in digitalization while concentrating their innovation strategies on Pharma 4.0. As primary stakeholders in drug development and manufacturing, they invest heavily in digital tools, such as AI, IoT, automation, and cloud platforms to optimize operations, improve product quality, and reduce costs. With increasing pressure to innovate, respond to market demands faster, and meet global regulatory standards, pharmaceutical companies are leading the charge in implementing Pharma 4.0 solutions across the entire value chain, from R&D to distribution.

CROs (Contract Research Organizations) and CMOs (Contract Manufacturing Organizations) are the fastest-growing end-users in the market by implementing Pharma 4.0-enabled digital capabilities to create efficiencies in service and regulatory compliance while allowing for faster outsourcing of clinical trials and manufacturing. The pharmaceutical industry's continued growth is pushing rapid automation on a global scale. The CROs and CMOs are adopting advanced Pharma 4.0 technologies, such as automation, AI-driven analytics, digital twins, and smart manufacturing systems, to offer faster turnaround times, improved quality, and regulatory-compliant solutions.

Pharma 4.0 Market Size, By End User, 2022 to 2024 (USD Million)

|

End User |

2022 |

2023 |

2024 |

|

Pharmaceutical Companies |

6,228.46 |

7,302.07 |

8,567.95 |

|

Biotechnology Companies |

4,113.40 |

4,846.63 |

5,715.35 |

|

CROs and CMOs |

1,708.14 |

2,020.89 |

2,392.74 |

Don’t Miss Out! | Instant

Access to This Exclusive Report 👉 https://www.precedenceresearch.com/checkout/3187

✚ Related Topics You May Find Useful:

➡️ Pharmaceutical CDMO Market: Explore how outsourcing, biologics growth, and advanced manufacturing are reshaping drug development strategies

➡️ Pharmaceutical Inspection Machines Market: Understand how automation and AI-driven quality control are elevating safety and compliance

➡️ AI in Pharmaceutical Market: Track how AI is accelerating drug discovery, boosting clinical trial efficiency, and transforming pharma operations

➡️ Marine Pharmaceutical Market: Discover how marine bioactives are emerging as novel sources for next-generation therapeutics

➡️ Pharmaceutical Market: Analyze global drug demand, R&D investment, regulatory shifts, and major industry expansion trends

➡️ Contract Pharmaceutical Fermentation Services Market: Learn how fermentation outsourcing is supporting biologics, biosimilars, and complex molecule production

➡️ Pharmaceutical Contract Manufacturing Market: See how CDMOs are driving efficiency, scale, and innovation in global drug manufacturing

➡️ Pharmaceutical Filtration Market: Gain insights into filtration technologies improving purity, sterility, and process reliability

➡️ Pharmaceutical Water Market: Explore how rising quality standards are increasing demand for purified, WFI, and ultrapure water systems

➡️ RFID in Pharmaceuticals Market: Understand how RFID is strengthening supply chain security, anti-counterfeiting, and inventory visibility

➡️ Pharmaceutical Excipients Market: Examine how novel excipients are enhancing drug stability, bioavailability, and formulation flexibility

➡️ Pharmaceutical Capsule Filling Machines Market: Track advancements in high-speed, precise, and automated capsule-filling technologies

Top Companies in the Pharma 4.0 Market

➢ Microsoft Corporation: Microsoft enables Pharma 4.0 through cloud computing, AI, and data analytics via its Azure platform.

➢ Oracle Corporation: Oracle supports digital transformation in pharma with cloud-based ERP, SCM, and data integrity solutions.

➢ ABB: ABB offers automation and digital technologies to optimize pharmaceutical manufacturing processes.

➢ Honeywell International Inc.: Honeywell provides industrial automation and analytics tools to enhance compliance and operational efficiency in pharma.

➢ Cisco Systems, Inc.: Cisco delivers secure networking and IoT solutions for connected pharmaceutical environments.

➢ Siemens Healthcare GmbH: Siemens Healthineers integrates AI and digital diagnostics to accelerate pharmaceutical R&D and production.

➢ GE Healthcare: GE Healthcare offers bioprocessing and digital tools to advance pharma manufacturing and regulatory compliance.

➢ IBM Corporation: IBM applies AI, blockchain, and hybrid cloud to improve traceability, research, and data-driven decisions in pharma.

➢ Amazon Web Services, Inc.: AWS provides scalable cloud infrastructure and AI services to power digital transformation in the pharmaceutical sector.

Recent Developments

🔹 In February 2025, Utthunga Strategic collaborated with VindAir Engineers and Windair Techno Projects to develop its smart infrastructure, Pharma 4.0, and pharmaceutical manufacturing solutions. This collaboration aims to provide smart solutions for both the pharma and healthcare industries. ( Source: industrialautomationindia.in )

🔹 In September 2025, Lenovo launched GOAST v4.0. The 4th generation of its Genomics Optimization and Scalability Tool. This high-performance computing solution delivers 3x higher throughput, cost efficiency, and faster life-saving discoveries. (Source: expresspharma.in )

Segments Covered in the Report

By Technology

🔹 Cloud Computing

🔹 Artificial Intelligence (AI)

🔹 Big Data Analytics

🔹 Internet of Things (IoT)

By Application

🔹 Drug Discovery and Development

🔹 Clinical Trials

🔹 Manufacturing

By End-User

🔹 Pharmaceutical Companies

🔹 Biotechnology Companies

🔹 CROs and CMOs

By Region

🔹 North America

🔹 Europe

🔹 Asia Pacific

🔹Latin America

🔹Middle East & Africa (MEA)

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or Asia Pacific.

Don’t Miss Out! | Instant Access to This Exclusive Report 👉 https://www.precedenceresearch.com/checkout/3187

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a global market intelligence and consulting powerhouse, dedicated to unlocking deep strategic insights that drive innovation and transformation. With a laser focus on the dynamic world of life sciences, we specialize in decoding the complexities of cell and gene therapy, drug development, and oncology markets, helping our clients stay ahead in some of the most cutting-edge and high-stakes domains in healthcare. Our expertise spans across the biotech and pharmaceutical ecosystem, serving innovators, investors, and institutions that are redefining what’s possible in regenerative medicine, cancer care, precision therapeutics, and beyond.

Web: https://www.precedenceresearch.com

✚ Explore More Market Intelligence from Precedence Research:

➡️ Digital Therapeutics: How software-based interventions are restructuring chronic-disease management and clinical-grade behavioral therapy

➡️ Life Sciences Growth: Forces driving expansion across biotech, biopharma, and advanced therapeutic platforms

➡️ Viral Vector Gene Therapy Manufacturing: Manufacturing constraints, scalability limits, and innovations shaping next-generation gene-delivery systems

➡️ Wellness Transformation: How prevention-centric health models are shifting consumer behavior, product pipelines, and care delivery

➡️ Generative AI in Healthcare: How generative models are unlocking new diagnostics, clinical automation, and patient-care innovations

Our Trusted Data Partners:

Towards Healthcare | Nova One Advisor | Onco Quant | Statifacts

Get Recent News 👉 https://www.precedenceresearch.com/news

For Latest Update Follow Us: