AI-Powered Cell and Gene Therapy Manufacturing Market is experiencing a major acceleration, valued at USD 14.69 billion in 2025 and projected to exceed USD 122.86 billion by 2034, advancing at a robust 26.62% CAGR. Integration of AI, machine learning, and automated bioprocessing is reshaping scalability, quality control, vector development, and end-to-end manufacturing workflows.

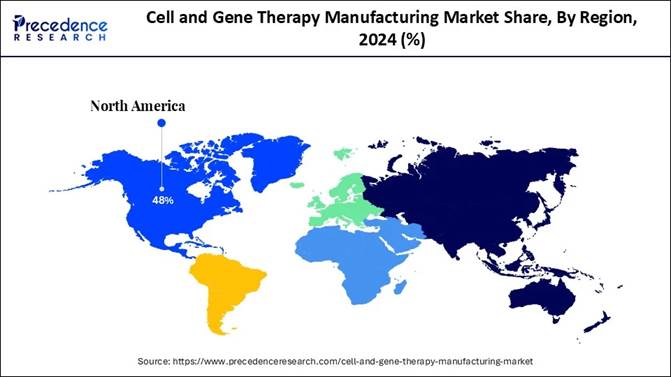

North America dominated the global landscape in 2024 with 48% revenue share, supported by strong regulatory incentives and mature biotech clusters. Meanwhile, Asia Pacific is emerging as the fastest-expanding hub for CGT manufacturing. Increasing demand for personalized medicine, breakthroughs in gene editing (CRISPR, TALENs), expanding clinical pipelines, and rising CDMO outsourcing are driving unprecedented growth across cell therapy, gene therapy, and vector production segments.

The Full Study is Readily Available | Download the Sample Pages of this Report@

https://www.precedenceresearch.com/sample/4758

Cell and Gene Therapy Manufacturing Market – Key Highlights

🔹 The global cell and gene therapy manufacturing market reached USD 11.60 billion in 2024 and is on track to hit USD 122.86 billion by 2034.

🔹 The industry is set for rapid expansion with an impressive CAGR of 26.62% from 2025 to 2034.

🔹 North America led the global landscape in 2024, commanding 48% of total revenue, driven by advanced biotech hubs and strong regulatory support.

🔹 Asia Pacific is projected to witness the fastest growth through 2034, supported by increasing investments and expanding biomanufacturing capabilities.

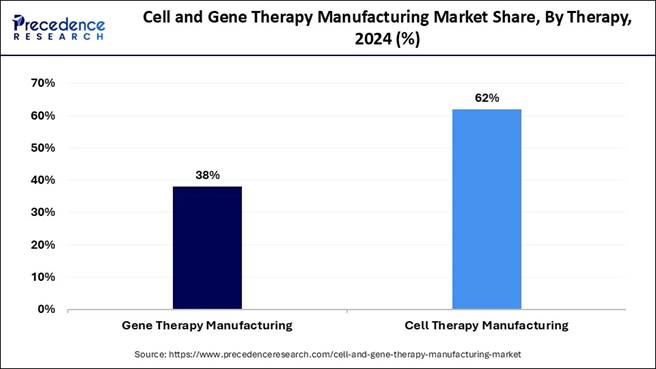

🔹 Cell therapy manufacturing dominated by therapy type, contributing over 62% of the 2024 revenue.

🔹 Gene therapy manufacturing is expected to record substantial growth during the forecast period as clinical pipelines expand.

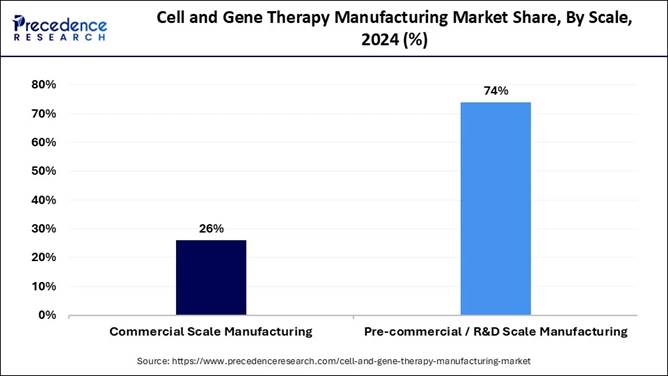

🔹 By scale, precommercial/R&D manufacturing held the largest share at 74% in 2024, reflecting rising early-stage research activity.

🔹 Commercial-scale manufacturing is forecast to grow the fastest as more therapies receive approvals.

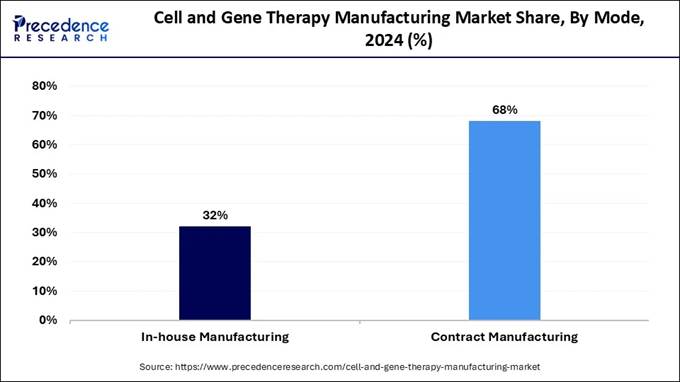

🔹 By mode, contract manufacturing captured over 68% of the market in 2024, highlighting strong outsourcing trends.

🔹 In-house manufacturing is anticipated to grow notably as larger companies bring capabilities under their control.

🔹 By workflow, process development held the top share at 19% in 2024, emphasizing the need for scalable and consistent processes.

🔹 Vector development is set to be the fastest-growing workflow segment, supported by rising demand for high-quality viral vectors.

Cell and Gene Therapy Manufacturing Market Overview

The cell and gene therapy manufacturing market is significantly transforming the overall treatment landscape for genetic diseases, cancers and rare diseases. Several factors drive the market’s growth, including new advancements in gene editing technologies, such as CRISPR, increased awareness in the general public and rising global investments in personalized medicine. The rising prevalence of health concerns all over the world coupled with the growing acceptance of gene therapies has further contributed to the market’s growth and development.

In addition to that, advancements in automated manufacturing processes, modifications in supply chain infrastructure and a surge in strategic collaborations between pharmaceutical companies and research institutions are more such factors that are boosting expansion.

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

How Is AI Transforming the Cell and Gene Therapy Manufacturing Market?

Artificial Intelligence (AI) is reshaping the Cell and Gene Therapy (CGT) Manufacturing Market by driving a shift from manual, variable, and slow processes toward automated, predictive, and scalable production systems. The integration of AI into CGT manufacturing optimizes each stage—from discovery to commercialization, reduces failure rates, accelerates timelines, and improves the consistency and quality of life-saving therapies.

1. AI Enhances Manufacturing Efficiency and Scalability

AI automates traditionally labor-intensive bioprocessing steps such as cell expansion, culture monitoring, vector development, and purification. Machine-learning algorithms analyze large volumes of data in real time, enabling more stable processes, reduced batch variability, and faster scale-up—one of the biggest hurdles in CGT manufacturing.

2. AI Improves Quality Control and Batch Release

Advanced computer vision and predictive analytics help detect contamination, genetic inconsistencies, or cell behavior deviations far earlier than traditional QC methods. This ensures higher batch success rates and significantly reduces production costs, which is crucial for therapies that cost hundreds of thousands to manufacture.

3. AI Accelerates Vector Development and Optimization

Vector engineering—especially viral vectors—is one of the most complex parts of CGT manufacturing. AI speeds up the design, testing, and selection of optimal vectors, helping manufacturers achieve better transduction efficiency, safety, and yield. This shortens development timelines and increases production capacity.

4. AI Enables Digital Twins for Process Simulation

Digital twins allow manufacturers to test, simulate, and optimize bioprocess conditions before applying them in real-world manufacturing. By predicting how cells will behave under different parameters, companies can avoid costly trial-and-error experiments and move therapies toward approval more quickly.

5. AI Supports Personalized and Precision Therapies

For patient-specific therapies such as CAR-T therapy, AI helps automate cell identification, isolation, and expansion, enabling faster turnaround times. AI-supported manufacturing systems reduce human error, improve patient-to-patient consistency, and support the scalability of individualized treatments.

6. AI Drives Cost Reduction Across the Value Chain

CGT manufacturing is expensive, but AI reduces costs by:

- minimizing batch failures

- automating manual steps

- reducing the need for large manufacturing footprints

- optimizing supply chains and scheduling

These improvements help make advanced therapies more accessible and affordable over time.

7. AI Strengthens Regulatory Compliance and Data Integrity

AI systems support real-time documentation, automated reporting, and regulatory tracking to meet stringent FDA and EMA standards. This enhances transparency, data integrity, and audit readiness—key requirements for commercial CGT manufacturing.

💡 Gain Deeper Insights on AI in Cell and Gene Therapy Manufacturing 👉 https://www.precedenceresearch.com/ai-precedence

What is the Growth Potential of the Cell and Gene Therapy Manufacturing Market?

The increasing prevalence of genetic disorders, chronic diseases, and complex types of cancers is a major factor that is driving the demand for cell and gene therapies. As healthcare providers and researchers all over the world continue to look for new ways to address the root causes of diseases, this particular market offers a promising avenue for long-term solutions.

Genetic disorders such as cystic fibrosis, muscular dystrophy, and hemophilia, along with various types of cancer, can be quite difficult to treat with just traditional methods. That is where cell and gene therapy comes into play as it can help to create modified or new proteins, increase disease-fighting protein production and also reduce disease-causing protein levels.

Another factor which is driving the growth of the market is the rapid advancements of gene editing technologies. Techniques such as CRISPR-Cas9, TALENs, and ZFNs (Zinc Finger Nucleases) are gaining traction in today’s day and age, revolutionizing the way genetic diseases are treated by enabling precise alterations to the DNA of cells. These innovations allow for the development of targeted gene therapies, making treatments more effective and personalized, thus propelling the market forward.

📥 Dive into the Complete Report ➡️ https://www.precedenceresearch.com/cell-and-gene-therapy-manufacturing-market

What are the Key Trends in the Market?

🔸The market is witnessing a rising number of therapies that are shifting from preclinical stages to clinical trials and commercialization, and hence, the need for specialized manufacturing services is on the rise.

🔸Rising investments in research and development activities continue to have a strong impact on the global market. These investments are driven further due to increasing private equity and capital infusion, especially in the life sciences sector.

🔸The market is also seeing a rise in strategic partnerships and agreements between pharmaceutical companies and CDMOs, backed further by supportive government initiatives and fundings, thus playing a crucial role in propelling market growth.

🔸The market also has versatile applications in treating a wide range of conditions such as cancers, autoimmune diseases, urinary problems, infectious diseases and other applications. This continuous research and experimentation help to boost innovation.

What is the Key Challenge Faced by the Market?

Despite multiple growth prospects, the market does have its fair share of challenges that could potentially hinder its growth. One such primary challenges is the high costs that are associated with the manufacturing or production processes. The manufacturing process for such therapies is highly complex as it requires advanced technologies, robust facilities, and a highly skilled labor. This can be challenging for small scale and medium scale companies, particularly in under developed regions that lack adequate financial resources.

Moreover, the production process often involves custom, small-batch runs, particularly for personalized treatments, which also increases the cost even more. The process necessitates rigorous quality control measures to ensure safety and efficacy. This level of precision and customization leads to high production costs, making these therapies expensive and limiting their scalability and accessibility and thus, slowing down market growth and development.

Cell and Gene Therapy Manufacturing

Market Report Coverage: Report Coverage Item Details / Value-Added Info Market Size (2034) USD 122.86 Billion Market Size (2025) USD 14.69 Billion Projected CAGR (2025–2034) 26.62% Dominant Region (2024) North America Base Year 2024 Forecast Period 2025 to 2034 Segments Covered Therapy Type, Scale, Mode, Workflow, Regions Geographical Scope North America, Europe, Asia-Pacific, Latin America, Middle East

& Africa (MEA) Therapy Types Included Cell Therapy (stem cell & non-stem cell), Gene Therapy Scale Categories Pre-commercial / R&D, Commercial-scale Manufacturing Mode of Manufacturing Contract Manufacturing, In-house Manufacturing Workflow Segments Cell Processing, Cell Banking, Process Development, Fill &

Finish Operations, Analytical & Quality Testing, Raw Material Testing,

Vector Production, Others Regional Breakdowns Market analysis and projections provided separately for each

region (North America, Europe, Asia-Pacific, Latin America, MEA) Market Share by Segment (2024 Baseline) Cell Therapy manufacturing contributed > 62% of total revenue;

Pre-commercial/R&D manufacturing held ~74% share; Contract Manufacturing

mode captured ~68% share Fastest-growing Segment (Forecast) Vector Production / Gene Therapy Manufacturing workflow

anticipated to grow at the highest rate Key Growth Drivers Rising demand for personalized medicine, increasing gene therapy

clinical pipeline, technological advancements (e.g. gene-editing, viral

vector engineering), rising outsourcing to CDMOs, growth in biomanufacturing

infrastructure globally Major Challenges Addressed High cost of manufacturing, complexity of small-batch personalized

therapies, regulatory & quality-control demands, need for scalable and consistent

production processes Target Readership / Users Biopharma companies, CDMOs, Contract Manufacturers, Investors,

Strategy Consultants, Regulatory & Quality Assurance teams, Market

Researchers, Healthcare Policy Makers Use Cases of Report Market sizing & forecasting, Strategic planning, Investment

decision-making, Competitive benchmarking, Segmentation analysis,

Entry/expansion strategy in new regions, Workflow & capacity planning

Immediate Delivery Available |

Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/4758 Expanding Landscape of Cell and Gene

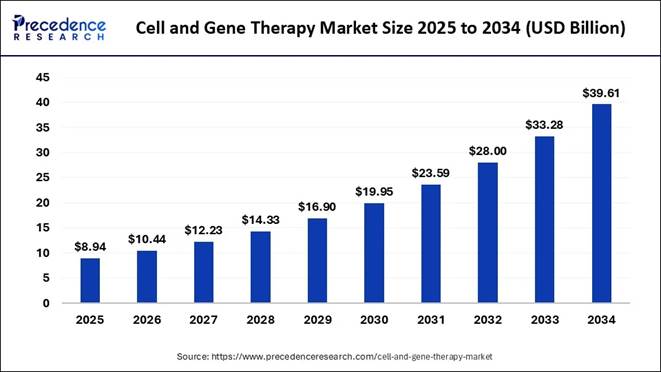

Therapy: Global Market Momentum Strengthens The global Cell and Gene Therapy Market is

valued at approximately USD 8.94 billion

in 2025, and is projected to cross to USD 39.61 billion by 2034, representing a

robust CAGR of 17.98% from 2025‑2034. The broader Cell and Gene Therapy Market

is growing rapidly, driven by breakthroughs in gene editing, viral and

non-viral delivery systems, and rising adoption of personalized medicine. With

an expanding clinical pipeline and increasing approvals, the market size is

expected to grow significantly over the coming years (in line with

manufacturing market trends). Key companies at the forefront of this

growth include major biopharma and biotech players such as Novartis, Roche,

Thermo Fisher Scientific, Lonza, Catalent, Samsung

Biologics, Merck KGaA, Miltenyi Biotec, Takara Bio, Bluebird

Bio, and others leading clinical development, manufacturing, and

commercialization efforts. These firms — along with a growing number

of emerging biotech startups — are investing heavily in next-generation

therapies such as CRISPR-based gene editing, AAV and

lentiviral vector delivery, iPSC-derived cell therapies, and CAR-T / cell-based

immunotherapies. As more therapies move from preclinical to clinical and

commercial stages, the global cell and gene therapy market is expected to

accelerate substantially, reinforcing its position as a key pillar of future

healthcare. Note: This report is

readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for

decision-making. Cell and Gene Therapy Manufacturing Market Regional

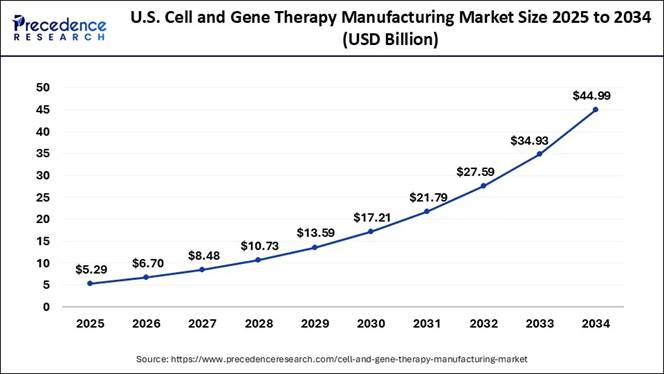

Analysis What is the U.S. Cell and Gene Therapy Manufacturing

Market Size? According to Precedence Research, The U.S. cell and gene

therapy manufacturing market size is estimated at USD 5.29 billion in 2024 and

is projected to touch around USD 44.99 billion by 2034, poised to grow at a

CAGR of 26.82% from 2025 to 2034. The Complete

Study is Now Available for Immediate Access | Download the Sample Pages of this

Report@ https://www.precedenceresearch.com/sample/4758 How Did North America Dominate the Cell and Gene Therapy

Manufacturing Market? North America dominated the market in 2024. This dominance can

be attributed to its supportive regulatory environment FDA implemented

initiatives, such as regenerative medicine advanced therapy and breakthrough

therapy designations, to accelerate the development. The region also benefits

from high investments in research and development. We can see that the region also focuses on targeted

therapeutic areas, and is quick to adopt advanced technologies, thus driving

the market growth. Through all these factors, we can see how North America has

strategically positioned itself as a global leader and competitor. What Factors Make Asia Pacific the Fastest Growing Region

in the Cell and Gene Therapy Manufacturing Market? Asia Pacific is emerging as the fastest-growing region in

the cell and gene therapy manufacturing market due to a powerful combination of

rising healthcare investments, accelerating

clinical trial activity, and strong governmental support for advanced

therapeutics. The region benefits from cost-efficient biomanufacturing capabilities,

rapid infrastructure expansion, and an influx of global pharmaceutical players

establishing manufacturing bases to reduce production costs and increase

capacity. Growing prevalence of genetic and chronic diseases, coupled

with expanding access to genomic diagnostics, is driving demand for advanced

therapies. Additionally, regulatory reforms, especially faster approval

pathways and incentives for innovative

biologics are enabling quicker commercialization timelines compared to

Western markets. Together, these elements position Asia Pacific as a rapidly

maturing hub for CGT development, manufacturing, and clinical deployment. China Cell and Gene Therapy Manufacturing Market Trends: China represents the largest and most advanced cell and gene

therapy manufacturing ecosystem in Asia Pacific, driven by a combination of

aggressive government investment, a rapidly expanding biotech sector, and

strong academic–industry collaboration. Over the past decade, China has positioned CGT as a national

strategic priority, resulting in dedicated funding programs, tax incentives,

and fast-track regulatory channels to accelerate innovation. The National

Medical Products Administration (NMPA) has streamlined approval processes for

clinical trials and has aligned many guidelines with global regulatory

standards, enabling faster initiation of CGT studies. Cell and Gene Therapy Manufacturing Market Segmental

Insights Therapy Insights Which therapy segment dominated the market in 2024? The cell therapy manufacturing segment dominated the market

in 2024. This segment is popular as it includes helping to increase stability,

potency, reproducibility, purity, batch size, and product yield and decreasing

manufacturing cost and time. It also makes use of automation and digital

systems in order to reduce costs and improve operational efficiency in the cell

therapy manufacturing process. It also helps to scale up and streamline

manufacturing processes to deliver therapies rapidly to patients, thus making

it a popular segment. The gene therapy manufacturing segment is estimated to grow at

the fastest rate during the forecast period. This segment includes the

production of therapeutic products that are able to manipulate or modify gene

expressions for therapeutic uses. Gene therapy development and manufacturing

does have several benefits over other customized solutions. The advantage of

this segment lies in the fact that it offers improved resource utilization,

effective coordination of diverse functions and streamlined decision-making. Scale Insights Which scale segment led the market as of this year? The precommercial R&D scale manufacturing segment led

the cell and gene therapy manufacturing market as of this year. This segment is

popular because it offers job creation, customization, flexibility, and

cost-effectiveness over large-scale manufacturing. It has also shown innovation

and adoption more quickly, leading reduced production downtimes, accuracy and

improved overall efficiency. The commercial scale manufacturing segment is expected to be

the fastest-growing during the forecast period. This growth is because this

segment offers safety, cost-effectiveness, efficiency, and accuracy. Additionally,

it also ensures that resources are used specifically, thus increasing

productivity and reducing costs. Mode Insights Which mode was the most dominant segment as of this year

in 2024? The contract manufacturing segment was the most dominant

segment as of this year in 2024. This dominance is due to its ability to focus

on innovation and core competencies, its easier-to-scale production and

flexibility, reduced errors, more quality control, access to bulk purchasing

and skilled labor. As the market for cell and gene therapies continues to

rapidly change, this segment is expected to gain a competitive advantage. The in-house manufacturing segment is anticipated to have

the fastest growth during the forecast period. The advantage of this segment

lies in its lower carbon footprint, reduced supply chain risks, shorter lead

times, better communication, and direct management over the overall product

consistency. Small biotechnology

companies developing cell and gene therapies often lack resources, capacity and

infrastructure, leading to increased strategic partnerships with contract

manufacturers. Workflow Insights Which workflow segment held the largest market share in

2024? The process development segment held the largest market

share in 2024. This segment aims to decrease costs while simultaneously improving

quality. It can help to produce modified or new proteins in the cell, increase

the production of working proteins, and reduce the specific disease-causing

proteins. It can be applied to all process elements, such as cell

characterization, cell isolation, optimization of cell culture media, removal

of impurities, and scale-up. The vector development segment is predicted to have the

fastest growth rate all throughout the forecast period. Viral vectors have

always been traditionally used for the treatment of various disorders, such as

metabolic, cardiovascular, muscular, infectious as well as various types of

cancer. The high penetration of manufacturing services in this space is the

major factor contributing to the segment’s growth. ✚ Related

Topics You May Find Useful: ➡️ Cell and Gene Therapy CDMO Market: Explore how contract development and manufacturing organizations

are enabling scalable and efficient CGT production. ➡️ Cell and Gene Therapy Infrastructure and

Delivery Models Market: Discover how advanced

infrastructure and innovative delivery models are shaping therapy accessibility

and efficiency. ➡️ Cell and Gene Therapy Quality Control and

Analytics Market: Analyze the critical role of quality

control and analytical tools in ensuring safety, efficacy, and regulatory

compliance. ➡️ Cell and Gene Therapy Clinical Trials Market: Track the expanding pipeline of clinical trials and how they are

accelerating next-generation therapy approvals. ➡️ Stem Cell Manufacturing Market: Gain insights into innovations in stem cell production, scaling

strategies, and global adoption trends. ➡️ Cell and Gene Therapy Infrastructure and

Delivery Models Market: Understand the evolving

landscape of infrastructure investments and delivery strategies enabling

personalized therapies. Cell and Gene Therapy Manufacturing Market Key Players ➢ Wuxi Advanced

Therapies ➢ Merck

KGaA ➢ Novartis

AG ➢ F.

Hoffmann-La Roche Ltd ➢ Thermo

Fischer Scientific ➢ Miltenyi

Biotec ➢ Takara

Bio Inc. ➢ Bluebird

Bio Inc. ➢ Hitachi

Chemical Co., Ltd. ➢ Cellular

Therapeutics ➢ Boehringer

Ingelheim ➢ Samsung

Biologics ➢ Catalent

Inc. ➢ Lonza Recent Developments 🔸 In February 2025,

Bluebird bio, Inc. announced that it has entered into a definitive agreement to

be acquired by funds managed by global investment firms Carlyle and SK Capital

Partners, in collaboration with a team of highly experienced biotech

executives. David Meek, former CEO of Mirati Therapeutics and Ipsen, is

expected to become CEO of bluebird upon closing. Carlyle and SK Capital will

provide bluebird primary capital to scale bluebird’s commercial delivery of

gene therapies for patients with sickle cell disease, β-thalassemia, and

cerebral adrenoleukodystrophy. Source: https://www.carlyle.com

🔸In

November 2025, India launched its first indigenous CRISPR-based gene therapy

for Sickle Cell Disease, a condition that disproportionately affects tribal

communities. The therapy, named “BIRSA 101” in honour of tribal freedom fighter

Bhagwan Birsa Munda, was unveiled by Union Minister of State for Science and

Technology (Independent Charge) Dr. Jitendra Singh. The breakthrough treatment

was developed by the CSIR–Institute of Genomics and Integrative Biology (IGIB),

showcasing India’s ability to create cutting-edge therapies at a fraction of

global prices. (Source: https://www.daijiworld.com) Segments Covered in the Report By

Region By Therapy 🔹

Cell Therapy Manufacturing → Stem

Cell Therapy → Non-stem Cell Therapy 🔹

Gene Therapy Manufacturing By Scale 🔹

Pre-commercial/ R&D Scale Manufacturing 🔹

Commercial Scale Manufacturing By Mode 🔹

Contract Manufacturing 🔹

In-house Manufacturing By Workflow 🔹

Cell Processing 🔹

Cell Banking 🔹

Process Development 🔹

Fill & Finish Operations 🔹

Analytical & Quality Testing 🔹

Raw Material Testing 🔹

Vector Production 🔹

Others 🔹 North

America 🔹

Europe 🔹

Asia Pacific 🔹Latin

America 🔹Middle

East & Africa (MEA) Thanks for reading you can

also get individual chapter-wise sections or region-wise report versions such

as North America, Europe, or Asia Pacific. Don’t Miss Out! | Instant Access to

This Exclusive Report 👉

https://www.precedenceresearch.com/checkout/4758 You can place an order or ask any

questions, please feel free to contact at sales@precedenceresearch.com

| +1 804 441 9344 Stay Ahead with Precedence

Research Subscriptions Unlock exclusive access to powerful market intelligence,

real-time data, and forward-looking insights, tailored to your business. From

trend tracking to competitive analysis, our subscription plans keep you

informed, agile, and ahead of the curve. Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription About Us Precedence Research is a global market intelligence and

consulting powerhouse, dedicated to unlocking deep strategic insights that

drive innovation and transformation. With a laser focus on

the dynamic world of life sciences, we specialize in decoding

the complexities of cell and gene therapy, drug development, and oncology markets,

helping our clients stay ahead in some of the most cutting-edge and high-stakes

domains in healthcare. Our expertise spans across the biotech and pharmaceutical

ecosystem, serving innovators, investors, and institutions that are redefining

what’s possible in regenerative

medicine, cancer care, precision therapeutics, and beyond. Web: https://www.precedenceresearch.com ✚ Explore More Market Intelligence from Precedence Research: ➡️ Generative AI in Life Sciences: Explore how AI innovations are revolutionizing drug discovery,

research efficiency, and precision medicine. ➡️ Biopharmaceuticals Growth: Understand the accelerating expansion of biologics, therapeutic

proteins, and cutting-edge pharma pipelines. ➡️ Digital Therapeutics: Discover how technology-driven treatments are reshaping patient

care and improving clinical outcomes. ➡️ Life Sciences Growth: Gain insights into emerging opportunities, market expansion, and

innovation trends in the life sciences sector. ➡️ Viral Vector & Gene Therapy Manufacturing: Analyze the production advancements powering next-generation gene

therapies and precision medicine. ➡️ Wellness Transformation: See how consumer wellness trends are shaping supplements,

functional foods, and lifestyle-driven markets. ➡️ Generative AI in Healthcare: Unlocking Novel

Innovations in Medical and Patient Care:

Explore AI applications enhancing diagnostics, treatment personalization, and

patient engagement. Our Trusted Data Partners: Towards Healthcare | Nova One

Advisor | Onco Quant | Statifacts Get Recent News 👉

https://www.precedenceresearch.com/news For Latest Update Follow Us: LinkedIn

| Medium | Facebook | Twitter

📥 Download

Sample Pages for Informed Decision-Making 👉 https://www.precedenceresearch.com/sample/2445