SEATTLE, WA--(Marketwire - January 07, 2009) - Pacific Biometrics, Inc. (OTCBB: PBME) ("PBI" or "the Company"), a leading provider of specialty central laboratory and contract research services, today announced that the Company has paid all of the remaining principal and interest outstanding on its borrowings from Laurus Master Fund, Ltd. ("Laurus") and Franklin Funding, Inc. ("Franklin Funding").

In May 2004 and January 2005, the Company entered into financing arrangements with Laurus that consisted of the issuance of $2.5 million and $1.5 million, respectively, in secured convertible notes. The remaining principal and interest due under the May 2004 Note was paid July 28, 2008. The remaining principal and interest due under the January 2005 Note, totaling $50,317 was paid on December 30, 2008, approximately one month prior to the note's maturity date of January 31, 2009.

In November 2005, the Company entered into a loan and security agreement with Franklin Funding providing for a non-revolving equipment line of credit against which a total of $350,000 was borrowed. The final payment of principal and interest was paid in the amount of $46,462 on December 29, 2008.

"The retirement of both the Laurus and Franklin Funding debt facilities clearly illustrates the substantial progress that our Company has made in recent years, and our balance sheet is now essentially debt-free with the exception of various outstanding capital equipment leases," stated Ron Helm, Chairman and Chief Executive Officer of Pacific Biometrics, Inc. "As we previously noted when announcing first quarter operating results, PBI generated $372,000 in cash flow from operating activities during the three months ended September 30, 2008, which represented a 175% improvement when compared with the prior-year quarter. These operating cash flows, along with cash generated in the October-December period, allowed us to retire the remainder of the outstanding Laurus and Franklin Funding debt."

About Pacific Biometrics, Inc. (PBI)

Established in 1989, PBI provides specialized central laboratory and contract research services to support pharmaceutical and diagnostic manufacturers conducting human clinical trial research. The Company provides expert services in the areas of cardiovascular disease, diabetes, osteoporosis, arthritis, and nutrition. The PBI laboratory is accredited by the College of American Pathologists, New York State, and the Lipid Standardization Program. PBI's clients include many of the world's largest pharmaceutical, biotech, and diagnostic companies.

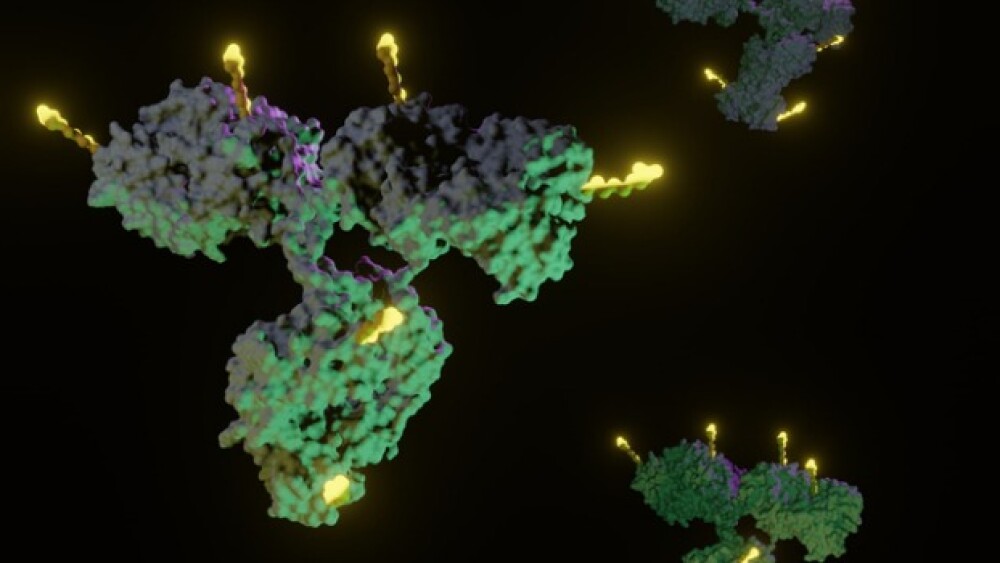

Pacific Biomarkers, Inc., incorporated February 1, 2008 as a wholly-owned subsidiary of PBI, focuses specifically on the emerging field of biomarker assay development and testing. Services include validating and performing ligand-binding assays for novel clinical biomarkers, immunogenicity testing, and multiplex testing.

PBI is headquartered in Seattle, Washington, and its common stock trades on the OTC Bulletin Board under the symbol "PBME." For more information about PBI, visit the company's web site at www.pacbio.com.

Safe Harbor Statement under the Private Securities Litigation Reform Act of

1995: This press release includes forward-looking statements including,

but not limited to, the growth in revenues and backlog that may result from

established and new services, including our biomarker services, our

strategic planning and business development plans, impacts on our financial

results, our future growth, and the viability and acceptance of our

products and services in the market. These forward-looking statements are

subject to a number of risks and uncertainties that may cause actual

results to differ materially from those described in the forward-looking

statements. These risks include, but are not limited to, our ability to

bid on and win laboratory services contracts, client changes or early

terminations of studies, variability in backlog, the success of our

marketing and business development efforts, competition in the industry,

and our ability to manage growth, as well as the risks and other factors

set forth in our periodic filings with the U.S. Securities and Exchange

Commission (including our Form 10-K for the year ended June 30, 2008).

For additional information, please contact:

Ron Helm

CEO

(206) 298-0068

or

RJ Falkner & Company, Inc.

Investor Relations Counsel

(800) 377-9893

Email Contact