OncoSec Medical Incorporated (NASDAQ: ONCS) (the “Company” or “OncoSec”), a company developing late-stage intratumoral cancer immunotherapies, today announced the release of a detailed presentation highlighting the Company’s strategic rationale – and benefits for shareholders – of the proposed transaction with Grand Decade Developments Limited,

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20191220005311/en/

(Graphic: Business Wire)

The full presentation is available at https://advancingoncosec.com/wp-content/uploads/2019/12/oncosec-investor-presentation-12-18-19.pdf.

In the presentation, OncoSec notes that the Transaction:

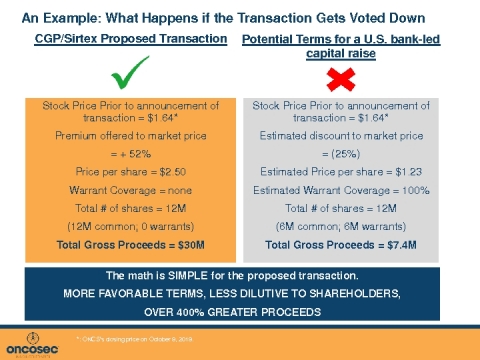

- Represents an immediate $30 million cash infusion at $2.50 per share, representing a 53% premium to the closing price ($1.64) the day prior to announcing the Transaction.

- Reverses OncoSec’s history of raising cash on weak and highly dilutive terms.

- Eliminates the need to raise capital for the foreseeable future.

- Provides the capital needed to complete the two ongoing TAVO™ KEYNOTE clinical trials.

- Eliminates the need to raise capital today in a challenging and weak microcap biotech market.

- Both the Transaction and a potential alternative banker-led transaction (see image above) may utilize nearly ALL of the Company’s available shares and Alpha has previously made it difficult to appropriately increase OncoSec’s authorized share count.

In the presentation, OncoSec also addresses the ongoing attempts by Alpha Holdings, Inc. (“Alpha”) to prevent the special meeting to vote on the Transaction from ever happening by resorting to litigation and a potentially disenfranchising proxy scheme.

“University of Delaware Professor Charles Elson reviewed Alpha’s latest proxy and the response from OncoSec. Elson is a corporate governance expert. ‘I’m unfamiliar with anyone withholding proxies to prevent a quorum. I’ve seen investors withhold their own proxies, but this strikes me as unfair to other shareholders. It’s a very hard move,’ he said.” (The Deal, 12/5/19)1

- Alpha is soliciting your votes – but has admitted that it may not end up casting any of them if that helps Alpha prevent a quorum.

- This demonstrates blatant contempt for shareholder rights and Alpha’s disregard for the voices of other OncoSec shareholders.

- We believe Alpha has caused significant confusion among our shareholders and could be in violation of the proxy rules designed to protect shareholders.

- Alpha’s director appointee on the OncoSec Board of Directors (the “Board”) voted against the Transaction, including against submitting it to a shareholder vote. We believe that if Alpha had its way, this Transaction would never have even been made known to shareholders.

- Alpha has also filed a class action against OncoSec seeking to prevent the shareholder meeting to vote on the Transaction from ever occurring.

Moreover, in its latest letter, Alpha has now resorted to personal attacks against President and Chief Executive Officer, Daniel J. O’Connor.2 Alpha’s statements regarding Mr. O’Connor’s intentions cannot be further from the truth.

- Over the last two years, Mr. O’Connor has collaborated with management and the Board to conduct a comprehensive and thorough strategic review process to find the best solution for OncoSec’s stock and its shareholders, including engaging in discussions with ~175 companies, hiring four financial advisors, holding ~70 meetings/presentations and exploring ~22 prospective partners.

- After exploring all available options, the Transaction with CGP/Sirtex was the only viable option that resulted from these efforts.

In Alpha’s latest gambit, they say, “… we have been speaking with financial advisors and are prepared to lead a consortium to raise up to $30 million in financing on less onerous terms if the China Grand Takeover is defeated.” Leaving aside that this Transaction is not a “takeover,” Alpha has known about the Transaction for several months and only now they are “prepared to lead” a “consortium” to raise capital “up to” $30 million? OncoSec shareholders should see this for what it is--a last-ditch effort to try to prevent shareholders from voting for a very real $30 million cash infusion in exchange for a wing and a prayer.

Separating Alpha’s Fictions from Reality

Alpha Fiction: Torreya Partners LLC (“Torreya”), a financial advisor to the Company, has a “financial incentive” to recommend the Transaction and is not independent.

Reality: Torreya, like all other banks, is organized so that it can both broker a deal and provide an independent review of the same transaction. Torreya operates in the highly regulated banking industry and it is incumbent on it to ensure that it has the appropriate structures to ensure that it can provide an independent review of a transaction it brokered. Without any justification, however, Alpha asserts that, because Torreya will receive a fee for brokering the Transaction, its report was somehow tainted or not independent. Please ask yourself, would Torreya put their bank at risk by not respecting their role as an unbiased and independent reviewer of the Transaction with CGP and Sirtex?

Alpha Fiction: Torreya indicated the deal price should have been higher.

Reality: False. Torreya provided a fairness opinion to the Board that stated “…it is our opinion that, as of [October 7, 2019], the Consideration to be paid to the Company pursuant to the Agreement is fair, from a financial point of view, to the Company.”

Alpha Fiction: A “no talk” agreement prevents OncoSec from exploring better options from third parties.

Reality: There are no better options. Over the past 24 months, we have reached out to over 175 companies and held approximately 75 meetings and the Transaction was the only viable option that came out of this massive outreach. Alpha knows this. Alpha offers nothing other than a vague potential consortium and urging you to vote “no” on an excellent and unique opportunity presented by the Transaction.

Alpha Fiction: A license agreement with CGP does not require CGP to actually develop or sell products, giving CGP the right to shelve TAVO™.

Reality: False. CGP is required to use “commercially reasonable efforts” to develop and market TAVO™. CGP cannot simply “shelve” it because doing so would be in violation of the license agreement.

Alpha Fiction: OncoSec “falsely” claims Alpha may not be able to solicit proxies.

Reality: Not true. OncoSec believes Alpha’s proxy solicitation violates the terms of the August 30, 2018 stock purchase agreement between the Company and Alpha (the “SPA”), pursuant to which Alpha made an investment in OncoSec. The SPA provides that Alpha will not engage in any solicitation of proxies with regard to any matter involving OncoSec, subject to certain exceptions that OncoSec believes are not applicable. Despite this, Alpha is now soliciting proxies in opposition to the Transaction.

Additional information about the Transaction and how to vote can be found at https://advancingoncosec.com/.

Vote "FOR" the CGP/Sirtex Transaction on the WHITE Proxy Card Today

If you have any questions on how to vote, please contact the Company’s proxy solicitor at the contact listed below:

MORROW

SODALI

509 Madison Avenue, Suite 1608

New York, NY 10022

Stockholders Call Toll Free: (800) 662-5200

E-mail: ONCS@morrowsodali.com

About CGP

CGP is a public company listed on the Hong Kong stock exchange with a market capitalization of approximately $1.8 billion USD. CGP develops, manufactures and distributes pharmaceutical products and medical devices to retailers and medical organizations. CGP currently distributes its products to approximately 6,000 hospitals and approximately 30,000 pharmacies and has a sales team of more than 2,000 employees. CGP also has significant experience in R&D and product commercialization in China. Such experience dealing with the relevant Chinese regulatory bodies makes CGP an ideal strategic partner for OncoSec as it looks to gain regulatory approval to introduce TAVO™ to the Chinese market. For more information, visit www.chinagrandpharm.com.

About Sirtex

Sirtex is a global healthcare business company with offices in the U.S., Australia, Europe and Asia, working to improve outcomes in people with cancer. Sirtex’s current lead product is a targeted radiation therapy for liver cancer called SIR-Spheres® Y-90 resin microspheres. More than 100,000 doses have been supplied to treat patients with liver cancer at more than 1,000 medical centers in over 40 countries. Sirtex’s global focus on drug development makes it a natural partner for the Company as it looks to develop and introduce TAVO™ into markets around the world. For more information, visit www.sirtex.com.

About OncoSec Medical Incorporated

OncoSec Medical Incorporated (the “Company,” “OncoSec,” “we” or “our”) is a late-stage biotechnology company focused on developing cytokine-based intratumoral immunotherapies to stimulate the body's immune system to target and attack cancer. OncoSec's lead immunotherapy investigational product candidate – TAVO™ (tavokinogene telseplasmid) – enables the intratumoral delivery of DNA-based interleukin-12 (IL-12), a naturally occurring protein with immune-stimulating functions. The technology, which employs electroporation, is designed to produce a controlled, localized expression of IL-12 in the tumor microenvironment, enabling the immune system to target and attack tumors throughout the body. OncoSec has built a deep and diverse clinical pipeline utilizing TAVO as a potential treatment for multiple cancer indications either as a monotherapy or in combination with leading checkpoint inhibitors; with the latter potentially enabling OncoSec to address a great unmet medical need in oncology: anti-PD-1 non-responders. Results from recently completed clinical studies of TAVO have demonstrated a local immune response, and subsequently, a systemic effect as either a monotherapy or combination treatment approach. In addition to TAVO, OncoSec is identifying and developing new DNA-encoded therapeutic candidates and tumor indications for use with its new Visceral Lesion Applicator (VLA), to target deep visceral lesions, such as liver, lung or pancreatic lesions. For more information, please visit www.oncosec.com.

TAVO™ trademark of OncoSec Medical Incorporated.

SIR-Spheres® is a registered trademark of Sirtex Medical US Holdings, Inc.

Risk Factors and Forward Looking Statements

This release, as well as other information provided from time to time by the Company or its employees, may contain forward-looking statements that involve a number of risks and uncertainties that could cause actual results to differ materially from those anticipated in the forward-looking statements. Forward-looking statements provide the Company’s current beliefs, expectations and intentions regarding future events and involve risks, uncertainties (some of which are beyond the Company’s control) and assumption. For those statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “should,” “will” and “would” and similar expressions (including the negative of these terms). Although we believe that expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. The Company intends these forward-looking statements to speak only at the time they are published on or as otherwise specified, and does not undertake to update or revise these statements as more information becomes available, except as required under federal securities laws and the rules and regulations of the SEC. In particular, you should be aware that the strategic transaction with CGP and Sirtex may not close or may close on materially different terms, that Alpha may succeed in obtaining the relief it seeks in its litigation against the Company, in whole or in part, even though the Company believes that Alpha’s litigation is entirely without merit and that the success and timing of our clinical trials, including safety and efficacy of our product candidates, patient accrual, unexpected or expected safety events, and the usability of data generated from our trials may differ and may not meet our estimated timelines. Please refer to the risk factors and other cautionary statements provided in the Company’s Annual Report on Form 10-K for the fiscal year ended July 31, 2019 and subsequent periodic and current reports filed with the SEC (each of which can be found at the SEC’s website www.sec.gov), as well as other factors described from time to time in the Company’s filings with the SEC.

1 https://pipeline.thedeal.com/article/20002779/index.dl. The Company has neither sought nor obtained consent from any third party for the use of previously published information.

2 12/17/19 Alpha Holdings Press Release: https://www.businesswire.com/news/home/20191217005873/en/Alpha-Holdings-Sends-Open-Letter-OncoSec-Stockholders

View source version on businesswire.com: https://www.businesswire.com/news/home/20191220005311/en/

Contacts

Company Contact:

Investor Contact:

Morrow Sodali

Chris Rice / Mike Verrechia

800-662-5200

ONCS@morrowsodali.com

Media Contacts

Gem Hopkins

Head of Corporate Communications

858-210-7334

ghopkins@oncosec.com

or

Sloane & Company

Dan Zacchei / Joe Germani, 212-486-9500

dzacchei@sloanepr.com / jgermani@sloanepr.com

Source: OncoSec Medical Incorporated