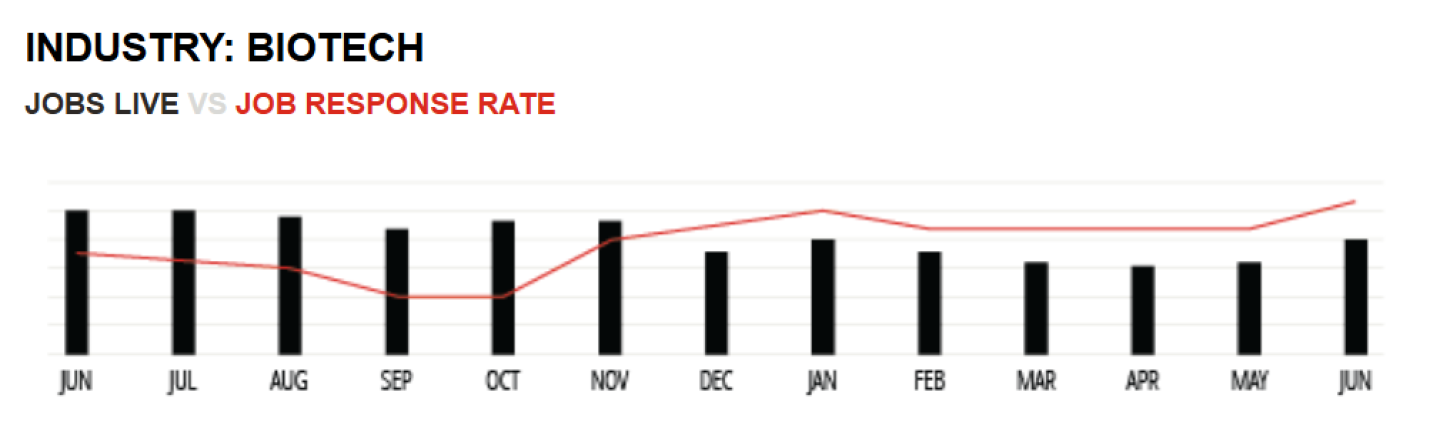

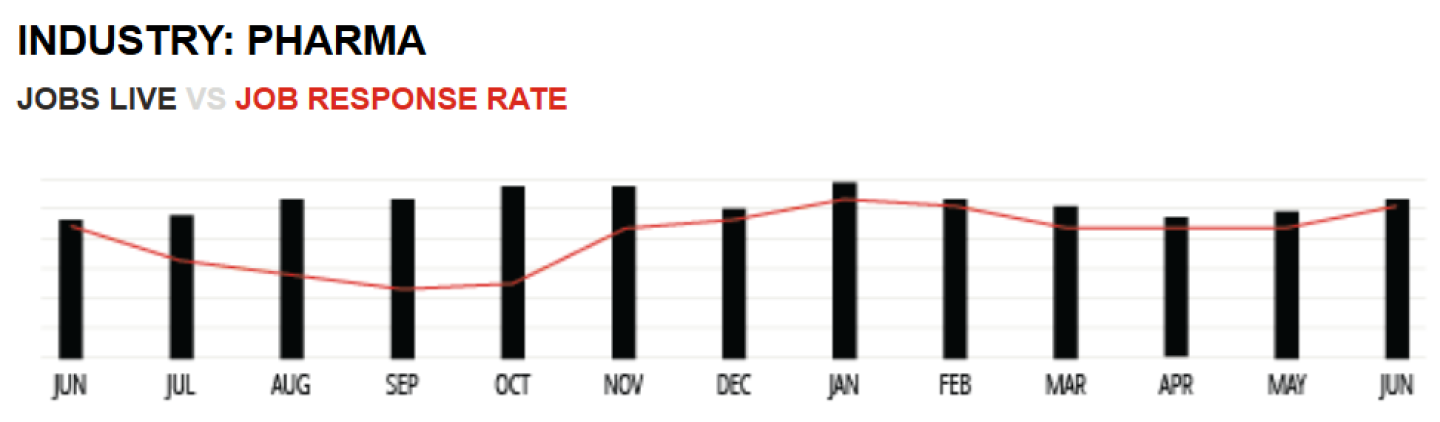

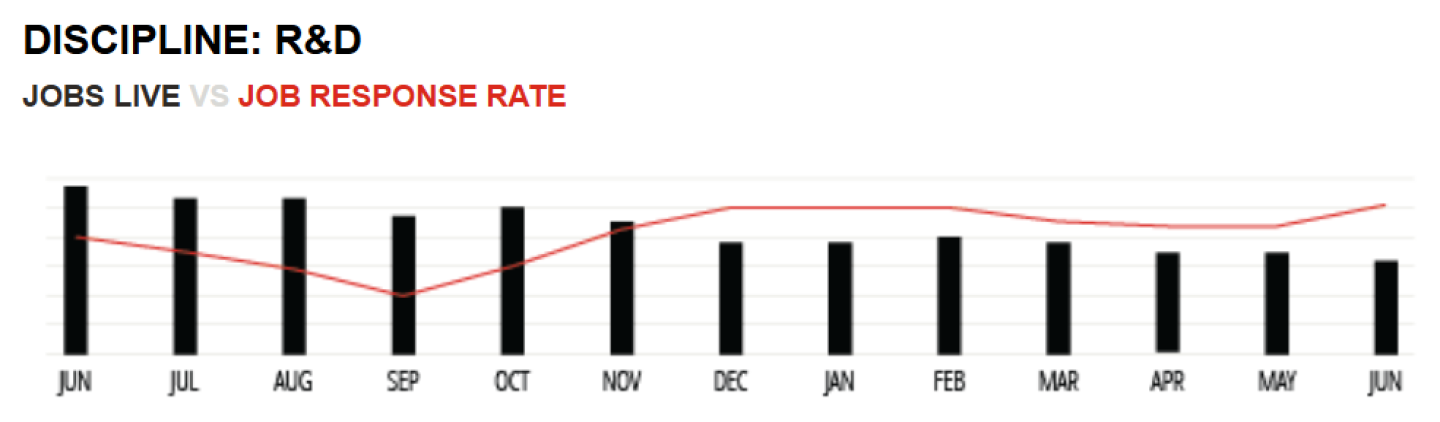

For the second quarter of 2024, there were 25% fewer jobs posted live on BioSpace compared to the same quarter of 2023. The year-over-year job response rate rose from 14.6% to 15.3%.

As biopharma layoffs continue moving people into the labor market, year-over-year numbers for jobs live on BioSpace show that there are fewer open roles, and more people are applying for them.

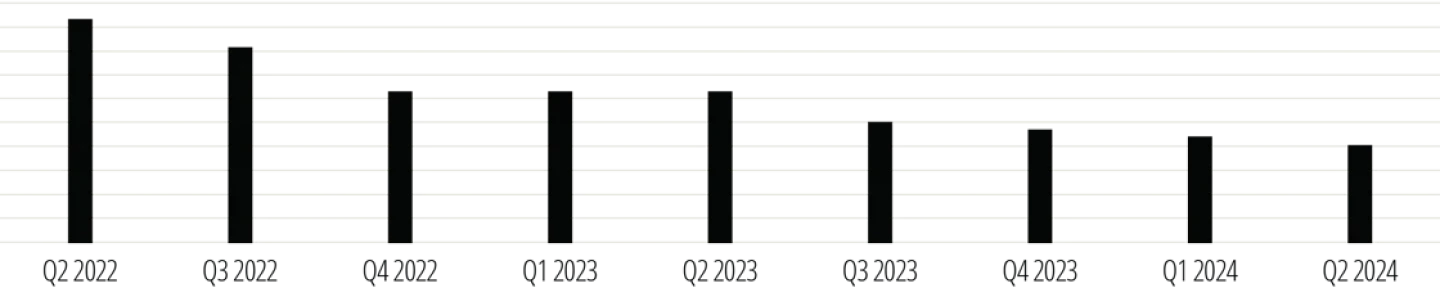

AVERAGE JOBS LIVE, Q2 2022-Q2 2024

- From Q2 2023 to Q2 2024, there was a 36% decline in the average number of jobs live.

- From Q2 2022 to Q2 2024, there was a 56% decline in the average number of jobs live.

For the second quarter of 2024, there were 21,184 jobs posted live on BioSpace, down from 28,086 in the same quarter of 2023, a 25% decrease. The job response rate—the percentage of people applying to positions after viewing them—rose from 14.6% in the second quarter of 2023 to 15.3% in the second quarter of this year.

The year-over-year decrease in jobs live on BioSpace aligns with findings in recent industry reports.

- Biotech R&D and pharma/medicine manufacturing industries grew by just 0.2% in the 21 months following June 2022, according to a CBRE report.

- Massachusetts’ life sciences jobs grew by only 2.5% in 2023 compared to a 7.8% annual average increase from 2020 to 2022, according to a MassBioEd report.

- The San Diego regional area had 2.5% fewer life sciences jobs in 2023 than in 2022, according to a Biocom California report. Other areas in California also experienced year-over-year decreases. The number of life sciences workers declined 2.1% in Orange County, 1.3% in the Bay Area region and 1.2% in the Greater Los Angeles region.

The Job Search: An Inside Look

Most biopharma professionals (77%) plan to look for work in the second half of 2024, according to a BioSpace career planning survey that closed this week. Of the 502 survey respondents, 55% will actively look, and 22% will casually look. While 18% won’t look, they may consider the right opportunity if it comes along.

For some, there’s urgency in finding a new position, as 43% of survey respondents are unemployed. Of those, roughly a quarter (24%) have been out of work for six to 12 months. Nearly the same number (23%) have been unemployed for three to six months.

Many survey respondents expressed concern about—and frustration with—the job market as well as doubts about staying in the industry. Comments include:

- “Far too many people have been laid off and very few job opportunities are open. Competition is very stiff for the job seeker.”

- “It’s never been more difficult to find a job in biopharma.”

- “No job or company seems ‘safe’ at the moment. Start-ups have been struggling to raise sufficient funding for over a year and the largest pharma companies are engaging in waves of tremendous layoffs.”

- “I would like to leave the Biopharma industry and take my 25 years of operations experience with me but I’m not sure which industry my skill set matches up to.”

What to Expect: Employer Perspective

The majority (84%) of respondents are concerned about what’s ahead for the rest of 2024, according to a BioSpace survey of those involved with—or who have insight into—talent acquisition and workforce planning activities. There were 66 respondents to the survey, which closed this week.

According to survey respondents, 21% anticipate making layoffs in the second half of 2024, and 41% are concerned about their company’s stability or performance for the rest of the year. However, when asked if they’re actively recruiting, 56% of those surveyed said yes, and 32% predicted the number of open roles will increase in the second half of 2024.

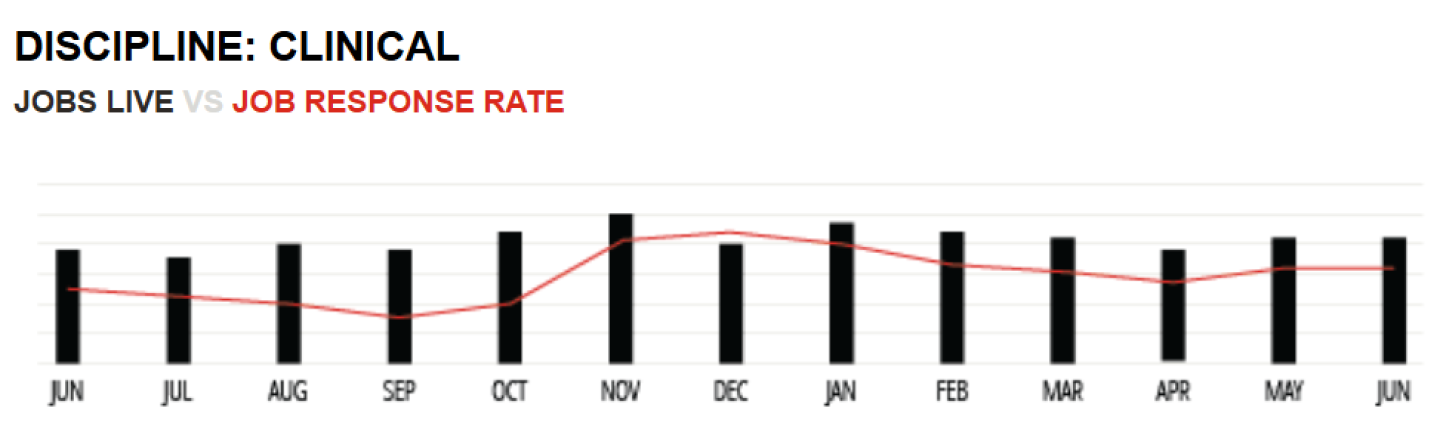

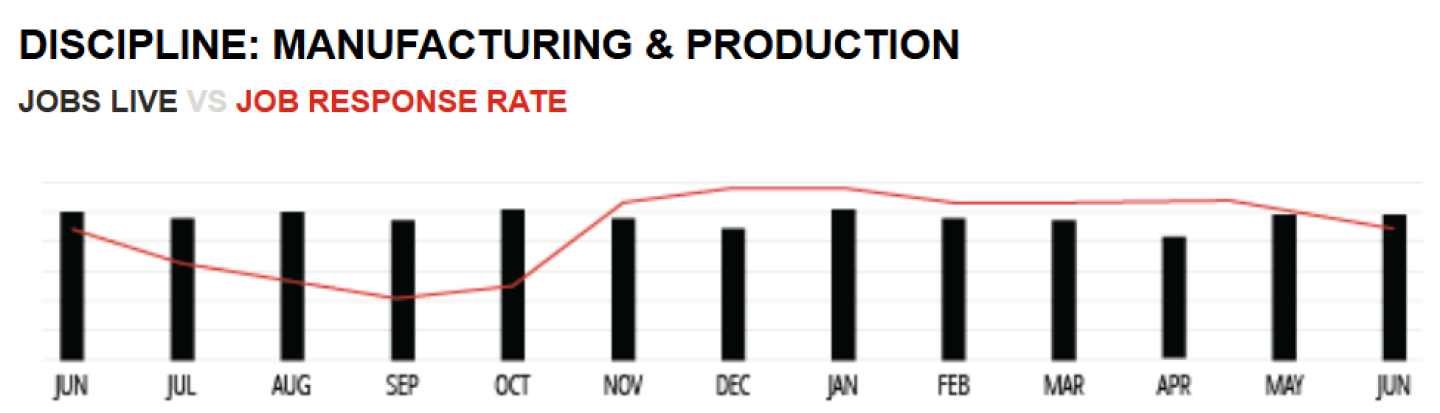

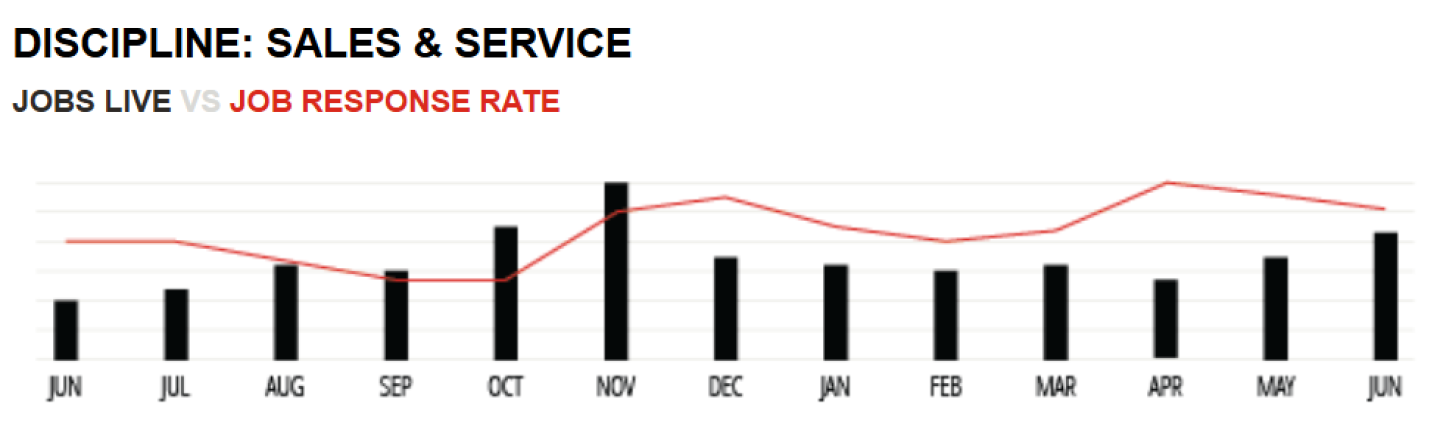

Most survey respondents identified which disciplines they expect to hire for during the remainder of the year. The top areas were research and development (47%); manufacturing and production (47%); clinical (37%); quality assurance and control (32%); and regulatory (27%).