Investment in Midwest healthcare companies remained steady in 2018, with $2.5 billion in capital raised by 438 companies

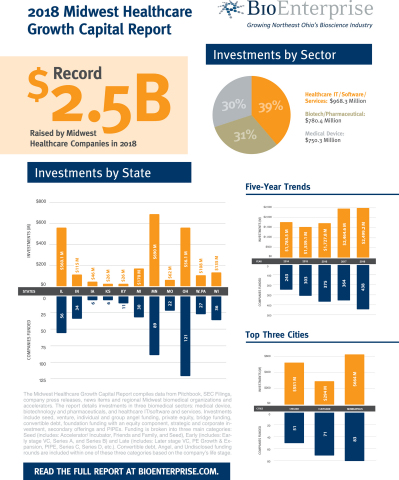

CLEVELAND--(BUSINESS WIRE)-- Investment in Midwest healthcare companies remained steady in 2018, with $2.5 billion in capital raised by 438 companies. That amount of investment validates the record increase of 43% seen in 2017, demonstrating the sustained interest among investors in biomedical companies in the Midwest. These were the findings of the 2018 Midwest Healthcare Growth Capital Report, published annually by BioEnterprise, which tracks capital investments made in biomedical companies across 11 Midwestern states in three sectors – medical device; biotechnology and pharmaceuticals; and health IT/software and services.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190321005361/en/

2018 Midwest Healthcare Growth Capital Report Highlights (Photo: Business Wire)

“The significant increase in the number of Midwest biomedical companies receiving funding over the last two years shows that there is a healthy and growing pipeline of startups that will continue to fuel this industry’s growth,” says Aram Nerpouni, president and CEO of BioEnterprise. “Over the last five years alone, investment in Midwest healthcare companies has risen by 40%, evidence that investors are finding the Midwest as an ideal location for startups.”

2018 MIDWEST HEALTHCARE GROWTH CAPITAL REPORT HIGHLIGHTS

- Health IT Leads Sector Performance: Total investment in health IT/software and services companies reached $968.3 million (39%) in 2018, followed by biotech and pharma at $780.4 million (31%) and medical devices at $750.3 million (30%).

- Five-Year Performance: Investment in Midwest healthcare companies has increased by 40% over the last five years, and the number of companies receiving funding has increased by 80%.

- Top-performing States: Minnesota led the Midwestern states in the amount of investment dollars attracted in 2018 with $690 million, followed by Ohio with $562 million and Illinois with $560 million. Ohio led the pack for the number of companies receiving funding with 121 (28% of total companies), followed by Minnesota with 89 (20%) and Illinois with 56 (13%).

- Top-performing Regions: The five Midwestern regions attracting the most investment dollars were Minneapolis ($664 million), Chicago ($551 million), Cleveland ($294 million), Columbus ($163 million) and Detroit-Ann Arbor ($125 million).

- Later-stage Funding Dominates: Later-stage investments made up the majority of the capital raised by Midwest healthcare companies in 2018, though more than half of the deals were in the seed stage. Of the total $2.5 billion raised, 61% consisted of later-stage investments (138 deals), followed by early-stage (20%; 164 deals) and seed funding (13%; 256 deals)

Click here to view the full report. BioEnterprise compiles the annual Midwest Healthcare Growth Capital Investment Report with the support of regional partner organizations such as MATTER, Medical Alley Association, BioOhio, Rev1Ventures, CincyTech, JumpStart and others. The report is funded in part by the Fund For Our Economic Future, the Cleveland Foundation and the Burton D. Morgan Foundation.

METHODOLOGY

The Midwest Healthcare Growth Capital Report compiles data from Pitchbook, SEC Filings, company press releases, news items and regional Midwest biomedical organizations and accelerators. The report details investments in three biomedical sectors: medical device, biotechnology and pharmaceuticals, and healthcare IT/software and services. Investments include seed, venture, individual and group angel funding, private equity, bridge funding, convertible debt, foundation funding with an equity component, strategic and corporate investment, secondary offerings and PIPEs. Funding is broken into three main categories: Seed (includes: Accelerator/ Incubator, Friends and Family, and Seed), Early (includes: Early stage VC, Series A, and Series B) and Late (includes: Later stage VC, PE Growth & Expansion, PIPE, Series C, Series D, etc.). Convertible debt, Angel, and Undisclosed funding rounds are included within one of these three categories based on the company’s life stage.

ABOUT BIOENTERPRISE

BioEnterprise is a business formation, recruitment, and acceleration effort designed to grow the Northeast Ohio healthcare industry. Located in Cleveland, at the Global Center for Health Innovation and in University Circle, BioEnterprise provides management counsel and support services to health IT, medical device, and biopharmaceutical companies. In addition, BioEnterprise convenes and leads strategy for industry-building initiatives such as the Medical Capital Innovation Competition, HIT in the CLE and the Global Center for Health Innovation. BioEnterprise partners are Case Western Reserve University, Cleveland Clinic, The MetroHealth System and University Hospitals. Additional technology partners include the NASA Glenn Research Center, Cleveland State University and BioOhio. Since 2002, BioEnterprise and its partners have created, recruited and accelerated more than 350 health IT, medical device, and biopharmaceutical companies, and have helped these companies raise more than $3 billion in new funding. To learn more: www.BioEnterprise.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20190321005361/en/

Contacts

Jennifer Keirn

Senior Director of Marketing & Communications

BioEnterprise

216.929.0682

jkeirn@bioenterprise.com

Angela Martin

Dix & Eaton

216.241.2148

amartin@dix-eaton.com

Source: BioEnterprise