Shareholders Urged to Vote Their GREEN Proxy or GREEN VIF to Strengthen Board with Three New, Highly Qualified Independent Nominees

Shareholders Urged to Vote Their GREEN Proxy or GREEN VIF to Strengthen Board with Three New, Highly Qualified Independent Nominees

VICTORIA, British Columbia--(BUSINESS WIRE)-- ILJIN SNT Co., Ltd. (“ILJIN”) today sent a letter to shareholders of Aurinia Pharmaceuticals Inc. (NASDAQ:AUPH, TSX:AUP) (“Aurinia” or the “Corporation”), highlighting the governance failures and director conflicts under the current board of directors, correcting misleading information disseminated to shareholders by Aurinia on June 7, 2019 and urging shareholders to vote their GREEN proxy or GREEN VIF to strengthen the board.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190610005681/en/

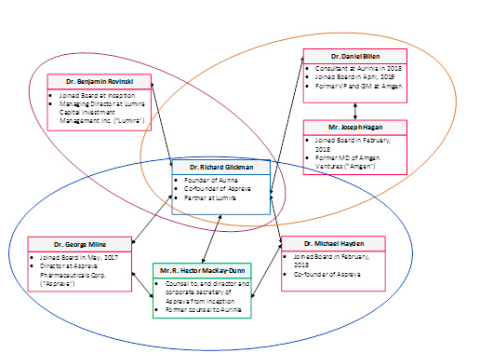

Aurinia Board of Directors Web of Interconnected Relationships (Graphic: Business Wire)

ILJIN, a founding shareholder of Aurinia which together with certain affiliates holds an approximately 14% ownership interest in Aurinia, is seeking support for three exceptional nominees for election as directors at the annual meeting: Dr. Robert Foster, Mr. Soon-Yub (Samuel) Kwon and Dr. Myeong-Hee Yu. These director nominees represent an independent and highly experienced minority slate of directors who are committed to bringing both good governance and their technical, business and scientific expertise to the progression and ultimate commercialization of Aurinia’s impressive pipeline of pharmaceutical solutions.

Young-Hwa Kim, Chief Executive Officer of ILJIN, said, “At this pivotal moment for Aurinia, it desperately needs an independent, experienced board of directors that is aligned with shareholders’ interests and can effectively support management with the execution of a long-term strategy to realize voclosporin’s tremendous potential. The status quo is unsustainable. Shareholders cannot afford to continue with a revolving door of CEOs, bloated executive compensation or a myopic, all-or-nothing strategy, all of which are the legacy of the current board, handpicked by its former chairman, Mr. Richard Glickman.”

Mr. Kim also noted, “We were disappointed to read Aurinia’s recent press release which criticized ILJIN, its longest and most committed shareholder, as an ‘activist,’ for having the audacity to propose numerous standard-practice governance improvements that are critically necessary to introduce independence to a conflicted and myopic board. To also deliberately misrepresent that ILJIN is seeking to control the board of directors demonstrates disregard for the truth and disrespect for shareholders. As we have communicated consistently and repeatedly, ILJIN is nominating a total of only three directors and has specifically recommended shareholders withhold their votes from Dr. Hyuek Joon Lee, ILJIN’s current board representative.

“Aurinia is simply trying to scare shareholders into maintaining the status quo for the benefit of the Glickman cadre of conflicted directors. Aurinia’s future is in shareholders’ hands, and we ask them to support our minority slate at the upcoming annual general meeting, and not succumb to this misdirection and fearmongering.”

Shareholders are urged to read the circular and vote ONLY the GREEN proxy or GREEN VIF on or before 5:00 p.m. (Mountain time) on June 21, 2019, so that it can be deposited in advance of the proxy cut-off. Shareholders who have already voted and wish to change their vote in support of the three independent nominees can do so by simply executing the Green proxy, as a later dated Green proxy will cancel an earlier vote. Shareholders requiring any assistance in executing their GREEN proxy or voting instruction form, can call Gryphon Advisors Inc. at: 1-833-266-0365 or 1-416-661-6592 or email inquiries@gryphonadvisors.ca.

For ease of voting, shareholders are encouraged to visit www.AHealthierAurinia.com and click on the “Vote Now” button. A copy of the information circular is available on Aurinia’s SEDAR profile at www.sedar.com.

The full text of ILJIN’s letter to fellow Aurinia shareholders follows:

June 10, 2019

Dear Fellow Shareholders,

As you know, ILJIN SNT Co., Ltd. (“ILJIN”, the “Concerned Shareholder” or “we”) and its affiliated companies (collectively, the “ILJIN Group”) are significant shareholders of Aurinia Pharmaceuticals Inc. (“Aurinia” or the “Corporation”) and long-time, enthusiastic believers in the commercial potential of voclosporin.

We have for nearly six years remained behind the scenes, attempting to quietly and constructively improve Aurinia’s corporate governance and related executive compensation matters, board composition, operational acumen and financial management through active engagement with Aurinia’s board and management. For the past two and a half years in particular we have made repeated, good-faith efforts to engage Aurinia on these issues, including identifying no fewer than 27 distinct deficiencies and potential improvements on the basis of prevalent corporate governance practices among Aurinia’s peers, including the adoption of executive share ownership guidelines, director share ownership guidelines and clawback policies.

To date, the current board has enacted NONE.

Against this backdrop of protracted attempts to facilitate positive organizational change, all with nothing to show for it but a string of broken promises, ILJIN finally determined to enlist the assistance of other shareholders to reconstitute a minority of the board to drive the changes that are so badly needed.

To support ILJIN’s call to action, we mailed you an information circular dated June 2, 2019 (the “ILJIN Circular”) containing a comprehensive analysis of Aurinia’s current governance, independence, compensation and other problematic practices that we believe conclusively demonstrates the depth of the organizational dysfunction that must be uprooted for Aurinia to thrive. To the extent you have not yet reviewed the ILJIN Circular we would invite you to visit www.aHealthierAurinia.com or www.sedar.com under Aurinia’s SEDAR profile or reach out to our strategic shareholder advisor and proxy solicitor Gryphon Advisors Inc. at: 1-833-266-0365 or 1-416-661-6592 or email inquiries@gryphonadvisors.ca.

On June 7, 2019, Aurinia finally responded to the ILJIN Circular. Regrettably, though not unexpectedly given our experiences over the past several years of attempted engagement, Aurinia elected to:

- both deny there is anything wrong with their corporate governance practices while simultaneously committing to hollow promises of improvement;

- denigrate their largest shareholder, ILJIN, as an “activist” notwithstanding the litany of obvious deficiencies that ILJIN has identified in good faith over many years of patient ownership and the investment of over $60 million;

- blame ILJIN for this costly and unnecessary proxy contest;

- knowingly mischaracterize our nomination of three independent nominees with no prior relationship to ILJIN or each other as an attempt to gain control of the board;

- attack our minority slate as lacking commercialization expertise when it has as much or more commercialization expertise than the directors ILJIN would propose to replace; and

- attack ILJIN’s flexibility and attempts to find a complement of directors that would be agreeable to Aurinia in a negotiated compromise board, while foisting upon shareholders an 11th hour nominee pulled from Mr. Glickman’s rolodex and professing to have run a comprehensive board refreshment process.

Aurinia’s response to the ILJIN Circular can leave absolutely no doubt:

YOUR BOARD IS CONFLICTED AND REQUIRES IMMEDIATE CHANGE

Management’s claims of a “board renewal” are spin.

While the company has presented shareholders with a narrative of change borne out of an ongoing evaluation of board composition, nothing could be further from the truth.

It is clear that Aurinia only undertook a limited board refreshment in the immediate run-up to the annual general meeting this year because the board realized that its repeated stonewalling of ILJIN’s requests for change were coming to a head and it was hopeful that it could present shareholders with a believable story of self-improvement.

Second, it is just as clear that this board refreshment process was half-hearted, having begun by identifying its own current corporate solicitor, Mr. Stephen Robertson, as a suitable independent nominee, only to then trump the insanity by now offering shareholders Aurinia’s former solicitor and long-time colleague of Mr. Glickman, Mr. R. Hector MacKay-Dunn.

Are shareholders to believe that countless worthy candidates were considered and ultimately rejected by this board because they failed to meet the unimpeachable degree of expertise, accomplishment and independence resident in Aurinia’s two corporate solicitors?

To present Mr. MacKay-Dunn as the face of a new, independent board only affirms the issues of the current board. Even a cursory review of his professional history reveals that Mr. MacKay-Dunn is a long-time trusted lieutenant of Mr. Richard Glickman. His addition to the board would serve as just one more brick in the wall of hand-picked Glickman affiliates that stands in the way of the adoption of any meaningful reforms and makes a mockery of any professed concern for independence.

Plain and simple, this is not an independent board – it is a legacy of relationships

The chart below illustrates the web of interconnected relationships between each of the current board members (excluding ILJIN’s representative, Dr. Joon Lee) and former Chairman and Chief Executive Officer Mr. Richard Glickman.

Aurinia Board of Directors Web of Interconnected Relationships (See Graphic Above)

What is the net effect of these interlocking relationships? Let us give you one example.

On Friday, May 24, 2019, we provided our advance notice to Aurinia in respect of our intention to nominate independent directors for consideration by shareholders at the upcoming annual general meeting. Rather than engage in constructive discussions with us, the Aurinia Board felt it imperative to inform Mr. Glickman (no longer a director or officer of the company) of this material, non-public information to which he very quickly called one of our highly qualified and independent nominees to berate him for standing for election.

If you needed confirmation as to lack of independence of this board from the self-interested influences of Mr. Glickman, this example shines bright as a warning to all shareholders.

Aurinia’s Reluctant Governance Improvements – Baby Steps where Strides are Needed

Given how complacent Aurinia has been in relation to its deficient governance practices over the past several years, it is somewhat surprising how quickly it has trumpeted its very recent governance improvements. What Aurinia has conveniently neglected to mention, however, but which should be obvious to shareholders now, is that all of such changes are the result of ILJIN’s pressure. Without constant pressure and the potential for public embarrassment, Aurinia’s board of directors would undertake no meaningful improvement.

Each of the following, for instance, was undertaken only after sustained pressure from ILJIN over a period of months:

|

1. |

Separation of Roles of Chairman and Chief Executive Officer – ILJIN had long expressed governance concerns with Mr. Glickman being both the Chairman and CEO, even with the ostensible independent management of the board residing in the lead director, Mr. Lorin J. Randall. With the appointment of Peter Greenleaf as Chief Executive Officer the roles were split to reflect good corporate governance practice. |

|

|

2. |

Advisory Vote on Executive Compensation – ILJIN had also long articulated concerns with Aurinia’s compensation practices and ultimately suggested that in the interests of increasing the ability of shareholders to exercise some oversight on those practices Aurinia adopt a “say on pay” advisory vote at the annual shareholders meeting. Aurinia has for the first time proposed such a resolution at the pending meeting. |

|

|

3. |

Change Board Composition to Improve Independence – Although the process by which Aurinia identified and nominated Mr. MacKay-Dunn was flawed and resulted in an entirely non-independent candidate being proposed for election at the annual general meeting, recognition of the need to change at all only arose as a result of ILJIN’s continued pressure for improved governance practices. Mr. MacKay-Dunn was only nominated by Aurinia at the eleventh hour and under heavy pressure from ILJIN regarding Aurinia’s previous candidate, Mr. Stephen Robertson, the corporate solicitor for Aurinia. |

|

Each of those changes had to be forced upon an unwilling board of directors. Unlike Aurinia’s current directors, ILJIN’s three nominees can be expected to proactively implement best practices for corporate governance and executive compensation rather than begrudgingly adopt face-saving cosmetic changes. Aurinia deserves directors that are more interested in your best interests than defending their legacy and relationships.

The Hallmark of the Company Has Been a Revolving Door of CEO’s and Bloated Compensation

In its six years of existence post-Isotechnika, Aurinia has had six CEOs. On the other hand – and at the core of many of the concerns ILJIN has about Aurinia’s governance – the Corporation had only one Chairman during every one of these CEO appointments, Mr. Richard Glickman.

It is clear that the CEO position has been nothing but a revolving door for Aurinia during Mr. Glickman’s reign as Chairman. Regardless of the stage of Aurinia’s growth, its success in achieving objectives or its massive potential, CEOs under Mr. Glickman and his board haven’t stuck around.

This revolving door has to stop moving. Mr. Glickman is now retired and should no longer be influencing strategic direction and the success of its current CEO, but this is clearly not the case. Under the current web of Mr. Glickman’s hand-picked directors, including his anointed successor Mr. George Milne as Chairman, the same dynamics that have led to the constant departure of prior CEOs and Aurinia’s current sky-high executive compensation and muddled operational strategy will continue to play out in the boardroom.

We shareholders cannot allow this to continue. The Corporation, which should be governed and operated with a focus on shareholder wealth creation, is instead operated as if it were Mr. Glickman’s private company. It is incumbent on shareholders to add independence and experience to our board to ensure that Aurinia can benefit from the stability and consistency of a single, unifying CEO during this critical period of transition.

Not only is the revolving door of CEOs bad for continuity, the efficient discharge of strategic priorities and market perception, it has been unbelievably costly for Aurinia and its shareholders. After serving for a short period, these individuals keep their large stock options or make arrangements to extend the exercise of their stock options. Each time, shareholders have been left with nothing but poor performance and severance costs. There can be no doubt that Aurinia’s board has failed to provide the appropriate strategic oversight and support necessary to retain its CEO and enable them to succeed, and has repeatedly paid for its failures through annual golden hellos and goodbyes to the benefit of insider CEOs.

From its first full year following the merger with Isotechnika through to and including 2018, total compensation paid to the five highest paid executive officers grew a total of approximately 23% to over $5.0 million.

Regrettably this trend continues under the current board of directors. With the hiring of Aurinia’s new CEO, base salary for the CEO has gone from US$504,000 to US$650,000 (with a one-time potential cash bonus of US$250,000 if Mr. Greenleaf survives under Mr. Glickman’s watchful eye for more than a year), with equity compensation increasing from 1,050,000 to 1,600,000 stock options. Those represent single year increases of nearly 30% on salary and over 50% on equity compensation.

Finally, Aurinia’s Future is in Shareholders’ Hands

In our years of dialogue with the Aurinia board and management about the Corporation’s challenges, our message has remained constant. We believe that Aurinia requires, and its shareholders deserve, a board of directors that:

- Embodies corporate governance best practices, rather than flouting them.

- Aligns board and executive compensation and expenses with shareholders’ interests, rather than rewarding non-performance.

- Demonstrates true independence from one another and management (current and former), rather than looking out for each other first.

- Supports and accelerates the Corporation’s strategy execution, rather than sitting idly by as the Corporation potentially squanders its tremendous opportunity.

Upon their successful election, we expect that our nominees, through the Governance & Nomination Committee and the Compensation Committee, as applicable, will help implement governance and compensation best practices at Aurinia to unlock shareholder value and rebuild shareholder confidence, as laid out in detail in ILJIN’s information circular in connection with the upcoming Annual General Meeting of Shareholders to be held on Wednesday, June 26, 2019, available at www.AHealthierAurinia.com.

ILJIN’s Highly Qualified, Independent Nominees

ILJIN has nominated three independent directors to strengthen the board, remove conflicts and give Aurinia shareholders control of their company:

- Dr. Robert Foster is largely responsible for the discovery of voclosporin, the keynote drug upon which Aurinia’s pipeline of pharmaceutical products is based, and was the former CEO of both Isotechnika Pharma Inc., a predecessor to Aurinia, and Aurinia itself. Dr. Foster is one of the most respected pharmaceutical scientists in the world and brings a proven ability in the discovery, development and commercialization of pharmaceuticals.

- Mr. Soon-Yub (Samuel) Kwon has extensive experience advising both domestic and international healthcare-related companies over a broad range of transactional and regulatory matters. He brings over 30 years of legal and business acumen to his role as director.

- Dr. Myeong-Hee Yu has over 30 years of extensive international biotechnology experience, both as a researcher and through numerous advisory and committee roles within government and private industry. She has played a key role in the development of Korea’s biotechnology industry, earning numerous national and international awards and publishing over 120 articles in major scientific journals.

Aurinia has misleadingly stated that ILJIN is nominating three directors, which when taken with ILJIN’s existing representative Dr. Hyuek Joon Lee, will give ILJIN control of the board. Aurinia conveniently neglects to acknowledge that ILJIN has expressly recommended that shareholders WITHHOLD their votes for Dr. Lee and that one of our three nominees is intended as a replacement. As such, ILJIN does not want to, nor can it with a three (3) director minority slate, take control. Rather, ILJIN wants to give all shareholders more control. ILJIN’s nominees have no prior relationships with each other of any nature and have been selected because they have the requisite expertise and can be expected to act independently of each other and of ILJIN.

Aurinia has also made much noise of a contrived concern about ILJIN’s nominees not having the expertise or qualifications that it needs at this critical time and as it proceeds to commercialization. As evident from the foregoing brief summary of our nominees’ qualifications in relation to the discovery, development and commercialization of pharmaceuticals, however, there can be no doubt as to our nominees being very qualified for the role. What should not be ignored is that 2 of the 3 incumbent directors that ILJIN has targeted for replacement (Dr. Lee and Mr. MacKay-Dunn) have no commercialization expertise at all and their replacement with our nominees would be an enhancement of the board’s capabilities in that regard.

Don’t be fooled by Aurinia’s self-serving mischaracterizations of our intentions, our nominees or their own abilities to progress voclosporin through to commercialization.

Manufacturing a Crisis: Aurinia’s Unwillingness to Spare you this Proxy Battle

As shareholders should now appreciate, notwithstanding our efforts to encourage Aurinia to improve its corporate governance and compensation practices and reduce its expenses for the benefit of all shareholders, ILJIN has been met by the Aurinia board with deflection and denial at every turn. In fact, throughout our entire period of dialogue on these issues at no time has Aurinia or any member of its board of directors ever even acknowledged formally or informally the validity of any of ILJIN’s concerns. Nonetheless, Aurinia has clutched at the lowest of the low-hanging fruit of corporate governance improvements in its management information circular as it looks to appease the growing dissatisfaction of shareholders at the upcoming Meeting. All of these steps toward improvement were previously suggested by ILJIN and ignored.

Aurinia could have avoided this entire painful and costly process if it had treated its shareholders with respect, acknowledged its governance shortcomings and worked collaboratively to resolve them, all entirely outside of public purview. That outcome, of course, was never possible with the current incumbent board, who default to equal measures of arrogance and cronyism when called upon to lead.

The same is true as it relates to our proposed nominees and our attempt to refresh and revitalize the board of directors and dispatch the groupthink and conflicted allegiances that have served only to impede the improvements that are so needed. Think about who is being unreasonable:

First, ILJIN proposed simply to substitute its existing nominee in the months prior to the annual general meeting.

Aurinia said NO.

Second, ILJIN proposed three (3) independent nominees to be mutually agreed upon for election at the annual general meeting and an additional one (1) which would ostensibly be ILJIN’s nominee, but in the context of a proposal to search for an additional director or director(s) for an expanded board of directors, ensuring that ILJIN would never have real or apparent control of the board of directors.

Aurinia said NO.

Aurinia instead proposed one (1) nominee for ILJIN, one (1) nominee as Aurinia’s corporate legal counsel (as a stand-in for a Canadian director to be chosen later and following the meeting) and one (1) independent nominee to be mutually agreed upon, again in the context of an expanded board of directors with one (1) additional director yet to be determined.

Consider that. This proxy contest has in essence resulted from the failure of Aurinia to:

- accept Dr. Foster, the person largely responsible for the discovery of voclosporin and with a greater understanding of the drug and its potential than virtually anyone, as a mutually agreeable candidate in lieu of Aurinia’s own corporate counsel (as a stand in for a Canadian “player to be named later”…a dubious governance practice in its own right that kicks sand in the face of shareholder rights); and

- negotiate on two (2) additional independent nominees on a mutually agreed basis rather than simply providing ILJIN a right to provide input on the director selection process. While ILJIN has now proposed Dr. Yu and Mr. Kwon as highly qualified and independent directors to fill those roles, had Aurinia been at all willing to discuss other candidates it is certain that mutually agreeable candidates could have been found.

Far from an effort by ILJIN to take real or effective control of the board of directors of Aurinia, this proxy contest simply further highlights the abject failure of the current board of directors of Aurinia to elevate the best interests of Aurinia above their personal ambitions and maintaining their cadre of close personal relationships on the board.

Rather than attacking our nominees, attempting to subvert shareholder democracy at every turn and engaging in a public campaign predicated upon deception and trickery, Aurinia could have worked in your best interests to collaboratively agree with ILJIN qualified independent directors. Instead, the lasting legacy of self-preservation and entrenchment at the expense of pragmatism and practicality has prejudiced shareholder best interests yet again.

You have the opportunity to help rectify the failures of this board to negotiate a reasonable resolution by electing the Concerned Shareholder’s independent nominees to the board of directors. Don’t let this opportunity pass.

For more information or if you require assistance with voting your accompanying GREEN universal proxy or voting instruction form, please contact our proxy solicitation agent, Gryphon Advisors Inc., using the contact information set out below and on the front and back pages of the Proxy Circular.

We believe the Proposed Nominees have the required discipline and skill set to take Aurinia to the next phase of its existence and are confident that you will come to the same conclusion. We welcome all Shareholders to join us and vote for change. We look forward to your support.

Aurinia’s future is in your hands.

Sincerely,

/s/

(signed) “Young-Hwa Kim”

Chief Executive Officer

ILJIN SNT Co., Ltd.

Advisors and Counsel

Stikeman Elliott LLP is acting as Canadian legal counsel to ILJIN. Gryphon Advisors Inc. has been engaged as proxy solicitation agent and Gagnier Communications has been engaged by ILJIN as communications advisor.

Legal Notices and Disclaimers

The data, information and opinions contained or referenced herein (collectively, the “Information”) is for general informational purposes only for the shareholders in order to provide the views of ILJIN regarding certain changes that it is requesting to the composition of the Aurinia board of directors and other matters which it believes to be of concern to shareholders described herein. The Information is not tailored to specific investment objectives, the financial situation, suitability or particular need of any specific person(s) who may receive the Information and should not be taken as advice in considering the merits of any investment decision. The views expressed in the Information represent the views and opinions of ILJIN, whose opinions may change at any time and which are based on analysis of disclosure and filings with respect to and/or made by Aurinia and other issuers that we consider to be comparable to Aurinia, and from other third party reports (see “Disclaimer Respecting Publicly Sourced Information” in the Circular, a copy of which is available on SEDAR at www.sedar.com or on www.aHealthierAurinia.com). ILJIN disclaims any obligation to publicly update the Information, except as required by applicable law.

The Information contains forward-looking statements or forward-looking information within the meaning of applicable securities laws (collectively, "forward-looking statements"), including in respect of ILJIN and the impact of ILJIN’s Nominees on the Corporation. All statements and Information, other than statements of historical fact, contained or referenced herein are forward-looking statements and forward-looking information, including, without limitation, statements regarding activities, events or developments that ILJIN expects or anticipates may occur in the future. Such forward-looking statements and information can be identified by the use of forward-looking words such as “will”, “expect”, “intend”, “plan”, “estimate”, “anticipate”, “believe” or “continue” or similar words and expressions or the negative thereof. There can be no assurance that the plans, intentions or expectations upon which such forward-looking statements and information are based will occur or, even if they do occur, will result in the performance, events or results expected.

ILJIN cautions readers not to place undue reliance on forward-looking statements and information contained or referenced herein, which are not a guarantee of performance, events or results and are subject to a number of risks, uncertainties and other factors that could cause actual performance, events or results to differ materially from those expressed or implied by such forward-looking statements or information, including but not limited to those set forth in the Circular under the heading “Forward-Looking Statements and Information” and those risks and uncertainties detailed in the continuous disclosure and other filings of Aurinia and certain members of Aurinia’s peer groups with applicable securities regulatory authorities, copies of which are available on SEDAR at www.sedar.com or on the Electronic Data Gathering, Analysis, and Retrieval at www.sec.gov. Shareholders are urged to carefully consider those factors.

The forward-looking statements and information contained or referenced herein are expressly qualified in their entirety by this cautionary statement. The forward-looking statements and information contained or referenced herein are made as of the date of the ILJIN Circular and ILJIN undertakes no obligation to publicly update such forward-looking statements or information to reflect new information, subsequent events or otherwise, except as required by applicable laws.

View source version on businesswire.com: https://www.businesswire.com/news/home/20190610005681/en/

Contacts

Investors:

Gryphon Advisors Inc.

North American Toll-Free Number: 1-833-261-9730

Outside North America, Banks, Brokers and Collect Calls: 1-416-661-6592

Email: inquiries@gryphonadvisors.ca

Media:

Gagnier Communications

Dan Gagnier / Jeffrey Mathews

1-646-569-5897

Source: ILJIN SNT Co., Ltd.