More than 1.3 million participants could lose benefits

|

MCLEAN, Va., Nov. 1, 2018 /PRNewswire/ -- The multiemployer pension plan crisis has deepened.

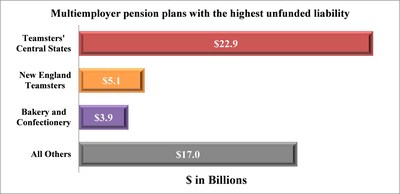

As many as 121 multiemployer pension plans covering 1.3 million workers are underfunded by $48.9 billion and have informed regulators and participants that they could become insolvent within 20 years because they don't have the money to pay the full promised benefits. These findings are from a new analysis by Cheiron Inc., the actuarial consulting firm, of the latest annual financial reports filed by multiemployer plans with regulators. Cheiron's analysis comes as a bipartisan congressional panel faces a looming deadline to recommend solutions for the multiemployer pension plan crisis. "In just this past year, 15 more plans have informed regulators that they are failing," said Joshua Davis, a principal consulting actuary at Cheiron who analyzed the filings. "While some plans are trying to meet their financial challenges by seeking permission to cut benefits, it appears that most plans are waiting to see if Congress can find a legislative solution." Cheiron's August 2017 study found 114 multiemployer pension plans were underfunded by $36.4 billion, based on the latest regulatory filings available at the time. Some plans have since terminated because all the employers withdrew. Even after removing these plans, the number of failing multiemployer pension plans increased by 6.1 percent, based on the latest publicly available information. The plans in this year's study have total assets of $40.7 billion and liabilities of $89.6 billion. Just three of the plans account for $31.9 billion or 65 percent of the total unfunded liability of all the failing multiemployer pension plans and cover 567,625 participants or 43.7 percent of the 1.3 million participants of all the financially troubled multiemployer pension plans. The most notable addition is the New England Teamsters and Trucking Industry Pension Fund which has $5.1 billion in underfunding, second only to the Central States, Southeast and Southwest Areas Pension Plan. The United Mine Workers of America 1974 pension plan, with $3 billion in unfunded liabilities, dropped to the fourth place this year. A combination of factors led to the financial crisis of multiemployer pension plans—the downturn of the stock market during the Great Recession, declining industries resulting in fewer active participants, and employers exiting the plans either through bankruptcy or by withdrawing from the plans, leaving the remaining employers responsible for the unfunded liabilities. All the failing multiemployer plans informed regulators that they are in "critical and declining" status and expect to become insolvent within 20 years, as required by the Multiemployer Pension Reform Act of 2014. The study does not include plans that have already become insolvent or terminated because all the employers withdrew. Nor does it include plans that are termed "safe," "endangered," or "critical" under the law. The Pension Benefit Guaranty Corporation, the federal agency which guarantees participants a minimum pension even if their plans fail, has said that it expects its insurance program for multiemployer pension plans will run out of money by the end of 2025. The PBGC covers about 1,400 multiemployer pension plans with approximately 10 million unionized workers. Multiemployer pension plans, also known as Taft-Hartley plans, are industry plans that cover unionized workers and pensioners. They are jointly sponsored by employers and labor unions. Cheiron Inc. is an independent full-service pension and healthcare actuarial and financial consulting firm advising public employers, multiemployer plans, non-profit organizations and corporations.

SOURCE Cheiron Inc. |