Aytu BioPharma, Inc. (the Company or “Aytu”) (NASDAQ:AYTU), a commercial stage pharmaceutical and consumer health company providing pediatric-focused prescription drugs and cost-effective consumer health solutions, today announced financial and operational results for the quarter ended March 31, 2023.

- Total prescriptions increased 32% compared to Q3 2022 to highest level in Company history

- Company to host conference call today at 4:30pm ET

ENGLEWOOD, CO / ACCESSWIRE / May 11, 2023 / Aytu BioPharma, Inc. (the Company or "Aytu") (NASDAQ:AYTU), a commercial stage pharmaceutical and consumer health company providing pediatric-focused prescription drugs and cost-effective consumer health solutions, today announced financial and operational results for the quarter ended March 31, 2023.

Q3 2023 Commercial Highlights (3 months ending March 31, 2023)

- Total net revenue was $22.7 million, a decrease of 6% from the $24.2 million in net revenue in the year-ago quarter. Revenue during Q3 2023 was impacted by a one-time $1.2 million channel inventory adjustment due to an ADHD products price increase instituted on April 1, 2023. Excluding this impact, net revenue would have been $23.9 million, in-line with the year-ago quarter.

- Record total quarterly prescriptions of 153,452, a 32% increase over Q3 2022.

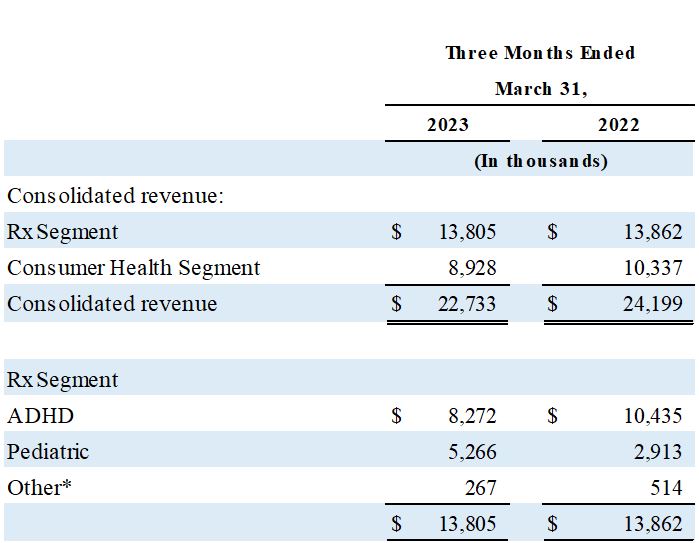

- Net revenue from the Company's Rx segment was $13.8 million during Q3 2023 compared to $13.9 million in the year-ago quarter.

- ADHD products (Adzenys XR-ODT® and Cotempla XR-ODT®) net revenue decreased by 21% to $8.3 million from $10.4 million in the year ago quarter.

- Pediatric products (Poly-Vi-Flor®, Tri-Vi-Flor®, and Karbinal® ER) net revenue increased 81% to $5.3 million, from $2.9 million in the year-ago quarter.

- Consumer Health revenue during Q3 2023 was $8.9 million, a decrease of 14% over the year ago quarter due largely to the continuing shift away from the segment's direct mail channel to focus on the higher contribution margin OTC medicines e-commerce channel. The segment's core OTC medicines e-commerce portfolio revenue grew 13% over the year-ago quarter.

- Gross margins improved to 56% in Q3 2023 compared to 52% in the year-ago quarter.

- Net loss during Q3 2023 was $(7.2) million, or ($1.93) per share, compared to $(53.3) million, or ($35.90) per share, in Q3 2022.

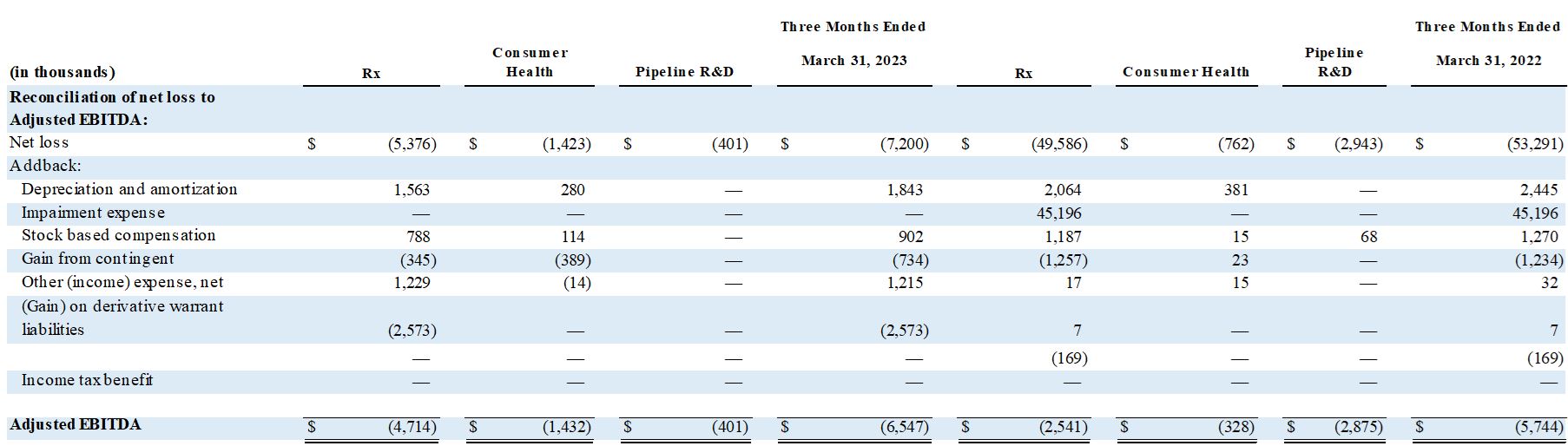

- Total Adjusted EBITDA1 was $(6.5) million in Q3 2023 compared to $(5.7) million in the year-ago quarter. Expenditures attributable to the suspended Pipeline R&D were approximately $401,000 in Q3 2023.

- Cash and equivalents levels held steady at $19.2 million against $19.5 million in the sequential quarter.

1 Aytu uses the term EBITDA, which is a term not defined under United States Generally Accepted Accounting Principles. The Company uses this term because it is a widely accepted financial indicator utilized to analyze and compare companies on the basis of operating performance. The Company believes that presenting EBITDA by segments allows investors to evaluate the various performance of these segments. The Company's method of computation of adjusted EBITDA may or may not be comparable to other similarly titled measures used by other companies. We believe that net loss is the performance measure calculated and presented in accordance with U.S. GAAP that is most directly comparable to EBITDA.

Management Discussion

"Our core Rx segment continues to perform at a high level, with record total prescriptions written during the quarter," commented Josh Disbrow, Chief Executive Officer of Aytu BioPharma. "The 32% growth in total prescriptions is a testament to the strong execution of our commercial team, coupled with the unique capabilities of the Aytu RxConnect platform. Importantly, we believe that the 27% ADHD prescription growth over the same quarter last year bodes well for the long-term growth and future profitability of the business. We expect these positive impacts will be visible once the new pricing and channel effects normalize and as patients move past their annual prescription deductible resets, which occur this time each year. We're pleased with the growth of the prescription segment and are excited to see the momentum continue."

"We continue the strategic transition we implemented within our Consumer Health segment as we phase out of the direct mail channel with a focus on OTC medicines and their e-commerce sales, which resulted in sales on Amazon increasing 13% compared to the year ago period. With the launch our C'rcle Health branding initiative later this year, which we believe will improve our return on ad spend, we believe we will see future improvement within this segment as we focus on segment profitability."

"Overall, our Rx segment continues its significant script growth, and despite the accounting adjustment on our ADHD segment, scripts are at record levels. Additionally, we are successfully executing against our various gross margin enhancements strategies, including the recent progress we have made to finalize the manufacturing of our ADHD products to a third-party facility. We also recently announced the partial sublease of our Grand Prairie manufacturing facility. We still have work to do to fully enhance the benefits within our Consumer Health segment, but with a keen focus on improving growth and profitability in both our segments, I believe we are in position to end fiscal 2023 on a high note," Disbrow concluded.

Segment Reporting

*Other includes discontinued or deprioritized products.

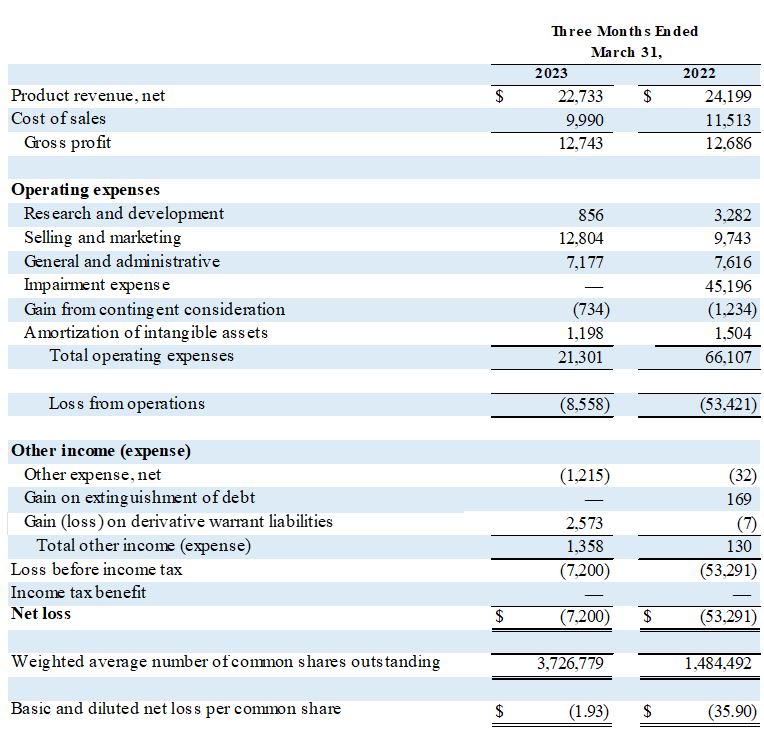

Q3 2023 Financial Results

Net revenue for the third quarter of fiscal 2023 was $22.7 million, compared to $24.2 million for the third quarter of fiscal 2022.

Net revenue from the Rx segment in the third quarter of fiscal 2023 was $13.8 million, consistent with the quarter a year ago. Pediatric products (Poly-Vi-Flor®, Tri-Vi-Flor®, and Karbinal® ER) net revenue increased 81% to $5.3 million, from $2.9 million in the year-old quarter. ADHD products (Adzenys XR-ODT and Cotempla XR-ODT) experienced a 21% decrease in net prescription revenue to $8.3 million in the third quarter of fiscal 2023 despite a 32% increase in total prescriptions written. The disconnect between script growth and net revenue in ADHD is primarily attributable to a one-time $1.2 million channel inventory pricing adjustment due to a price increase enacted on April 1, 2023, as well as changes in payer mix and the resetting of the underlying patient health insurance deductibles at the beginning of calendar 2023.

Net revenue from the Consumer Health segment was $8.9 million in the second quarter of fiscal 2023, a decrease of 14% over the same quarter last year. Net revenue was impacted by the Company's strategic decision in fiscal 2022 to pivot its efforts to the more efficient, higher margin ecommerce channel, with a primary focus on improving its visibility on, and sales of, value OTC medicines through Amazon and the Company's websites. The segment's core Amazon OTC medicines business grew 13% over the same period last year.

Gross profit was $12.7 million, or 56% of net revenue, in the third quarter of fiscal 2023, compared to $12.7 million, or 52% of net revenue, in the same quarter last year.

Operating expenses, excluding impairment expense, changes in contingent consideration, and amortization of intangible assets, were $20.8 million in the third quarter of fiscal 2023 compared to $20.6 million in the same quarter last year. There were no impairment expenses this quarter as against last year's $45.2 million. Research and development expenses were $856,000 in the third quarter of fiscal 2023, compared to $3.3 million in the same quarter last year. Of this $856,000, $401,000 were expenses associated with the recently suspended pipeline programs.

Net loss during the third quarter of fiscal 2023 was $(7.2) million, or $(1.93) per share, compared to $(53.3) million, or ($35.90) per share, in last year's third quarter.

Adjusted EBITDA (see Table A-1) was $(6.5) million in the third quarter of fiscal 2023, compared to $(5.7) million in the year ago quarter.

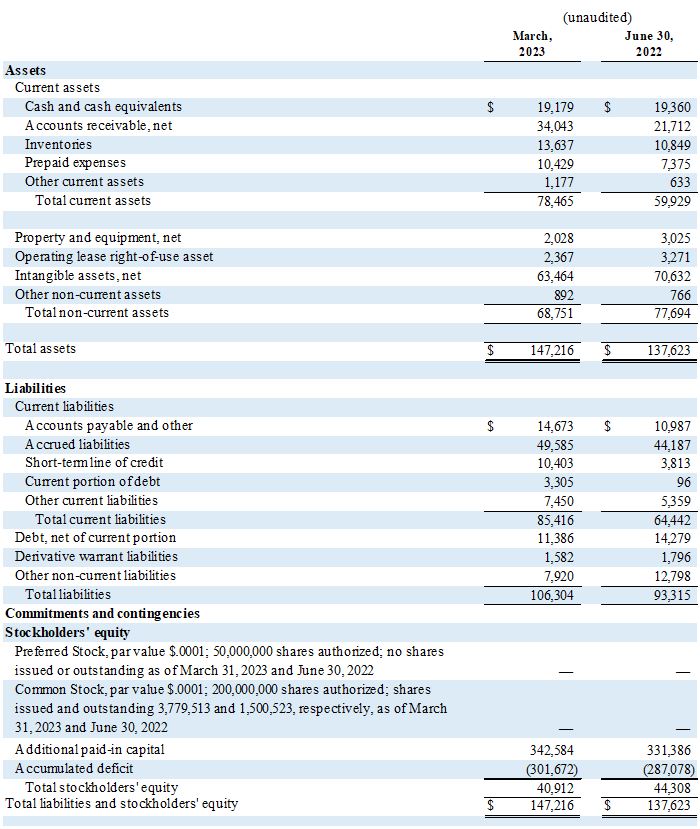

Balance Sheet and Operational Improvements

Cash and cash equivalents on March 31, 2023, were $19.2 million compared to $19.5 million on December 31, 2022.

In April 2023, Aytu received U.S. Food & Drug Administration (FDA) approval of the Adzenys XR-ODT Prior Approval Supplement (PAS) enabling the transfer of manufacturing of Adzenys to the Company's third-party manufacturer. Additionally, the Cotempla XR-ODT bioequivalence study has been successfully completed, with the Company expecting to submit the Cotempla site transfer PAS to the FDA in the middle of calendar 2023, with approval expected thereafter. The manufacturing transfer is expected to further improve the gross margins of Adzenys XR-ODT and Cotempla XR-ODT.

Further, in May 2023, the Company announced the sublease of approximately 30% of the Company's Grand Prairie manufacturing facility.

Conference Call Details

Aytu will host a conference call today, Thursday, May 11, 2023, at 4:30 PM Eastern Time to discuss financial results for the third fiscal quarter of 2023 for the quarter ended March 31, 2023.

The conference call will be available via telephone by dialing toll free 888-506-0062 for U.S. callers or for international callers 973-528-0011 and using entry code 371594. A webcast of the call may be accessed at https://www.webcaster4.com/Webcast/Page/2142/48110.

A webcast replay will be available on the Investors News/Events section of the Company's website through July 11, 2023. A telephone replay of the call will be available approximately one hour following the call, through May 25, 2023, and can be accessed by dialing 877-481-4010 for U.S. callers or 919-882-2331 for international callers and entering replay access code 48110.

About Aytu BioPharma, Inc.

Aytu BioPharma is a pharmaceutical company commercializing a portfolio of commercial prescription therapeutics and consumer health products. The Company's prescription products include Adzenys XR-ODT® (amphetamine) extended-release orally disintegrating tablets (see Full Prescribing Information, including Boxed WARNING) and Cotempla XR-ODT® (methylphenidate) extended-release orally disintegrating tablets (see Full Prescribing Information, including Boxed WARNING) for the treatment of attention deficit hyperactivity disorder (ADHD), as well as Karbinal® ER (carbinoxamine maleate), an extended-release antihistamine suspension indicated to treat numerous allergic conditions, and Poly-Vi-Flor® and Tri-Vi-Flor®, two complementary fluoride-based prescription vitamin product lines available in various formulations for infants and children with fluoride deficiency. Aytu's consumer health segment markets a range of over-the-counter medicines, personal care products, and dietary supplements addressing a range of common conditions including diabetes, allergy, hair regrowth, and gastrointestinal conditions. To learn more, please visit aytubio.com.

Forward-Looking Statement

This press release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, or the Exchange Act. All statements other than statements of historical facts contained in this press release, are forward-looking statements. Forward-looking statements are generally written in the future tense and/or are preceded by words such as "may," "will," "should," "forecast," "could," "expect," "suggest," "believe," "estimate," "continue," "anticipate," "intend," "plan," or similar words, or the negatives of such terms or other variations on such terms or comparable terminology. All statements other than statements of historical facts contained in this presentation, are forward-looking statements. These statements are just predictions and are subject to risks and uncertainties that could cause the actual events or results to differ materially. These risks and uncertainties include, among others, risks associated with: the company's plans relating to the Company's ability to efficiently wind down clinical development and reduce spend associated with AR101 and Healight™, the Company's ability to complete the manufacturing transfer of Adzenys XR-ODT® and Cotempla XR-ODT®, the company's overall financial and operational performance, potential adverse changes to our financial position or our business, the results of operations, strategy and plans, changes in capital markets and the ability of the company to finance operations in the manner expected, risks relating to gaining market acceptance of our products, risks related to the ongoing COVID-19 pandemic and its impact on our operations, our ability to effectively integrate operations and manage integration costs following our acquisitions, our partners performing their required activities, our anticipated future cash position, regulatory and compliance challenges and future events under current and potential future collaboration. We also refer you to (i) the risks described in "Risk Factors" in Part I, Item 1A of Aytu's most recent Annual Report on Form 10-K and in the other reports and documents it files with the Securities and Exchange Commission.

Contacts for Investors:

Mark Oki, Chief Financial Officer

Aytu BioPharma, Inc.

moki@aytubio.com

Robert Blum or Roger Weiss

Lytham Partners

AYTU@lythampartners.com

AYTU BIOPHARMA, INC.

Condensed Consolidated Statements of Operations

(In thousands, except share and per-share)

(Three Month Period Unaudited)

AYTU BIOPHARMA, INC.

Condensed Consolidated Balance Sheets

(In thousands, except share and per-share)

Table A-1 - Segment Adjusted EBITDA (Quarterly)

SOURCE: Aytu BioPharma, Inc.

View source version on accesswire.com:

https://www.accesswire.com/753874/Aytu-BioPharma-Reports-Third-Quarter-of-Fiscal-Year-2023-Financial-Results