22NW, LP is one of the largest shareholders of Catalyst Biosciences, Inc with ownership of approximately 6% of the Company’s outstanding shares.

SEATTLE, Sept. 27, 2019 /PRNewswire/ --

Dear Catalyst Biosciences, Inc. Shareholders:

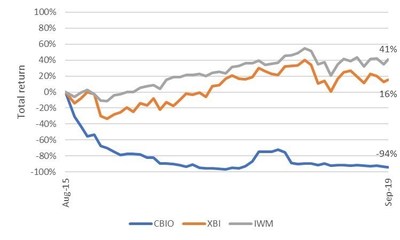

22NW, LP ("22NW" or "we" or "us") is one of the largest shareholders of Catalyst Biosciences, Inc (the "Company") with ownership of approximately 6% of the Company's outstanding shares. We believe the current Board of Directors and Executive team at Catalyst have failed its shareholders as evidenced by a lifetime share price decline of roughly -94%, compared to the +16% and +41% returns of the SPDR S&P Biotech and iShares Russell 2000 ETFs, respectively, over the same time period.1,2

Our plan to remedy the situation and unlock the Company's intrinsic value is three-fold: 1) place independent members on the Company's Board of Directors that directly represent CBIO shareholders; 2) initiate strategic alternatives to sell the company; and 3) cease rubber-stamping excessive executive compensation agreements. Proper corporate governance and management oversight could help unlock the intrinsic value we see in the Company. Failing these steps, we believe a simple liquidation could generate significant returns for the Company's shareholders as the Company's cash balance is $7.82/sh, which is 33% higher than the current share price.3

Shareholders should recall the reverse-merger transaction details with Targacept which placed many of the Company's current Board Members in control that closed in August 2015. We believe these Board Members have failed shareholders in every meaningful way. Operationally, the Company accumulated more than $100 million in losses4, no drugs were advanced to or beyond Phase 35, and no new significant strategic partnerships were formed in the same period. Accountability and transparency diminished, too. The current Executives immediately ceased quarterly calls with its investors once the reverse merger was completed.

We believe the two primary factors guiding the current Board and Executive team are their lack of ownership in the Company and friendly co-investment history. Based on the latest filings, Nassim Usman, Augustine Lawlor, Jeff Himawan, and their respective private-equity sponsors, Morgenthaler, Healthcare Ventures, and Essex Woodlands collectively own less than 3% of the Company and have not made material equity purchases in the Company since the merger was completed.

We believe these Board Members exhibit a disproportionate amount of control over the Company's strategic priorities and do not represent shareholders. In fact, the top five actively managed shareholders in the Company, including us, own nearly a third of the Company and have no representation on the Board. We find this is offensive considering the exceptionally weak execution and share price performance that has occurred under the existing Board. The time for change is now.

More concerningly, these insiders have individually profited the most from the Company's current "go-it-alone" tactic that required frequent shareholder dilution. The Company's 'Compensation Committee,' which includes Augustine Lawlor, Jeff Himawan, Eddie Williams, and Errol Souza, awarded its "Named Executive Officers" with nearly $15 million of pay since fiscal year 2015:6

|

Named Executive Officers |

Nassim Usman |

Fletcher Payne |

Howard Levy |

Other |

Total |

|

2015 |

$ 2,367,260 |

$ 916,061 |

$ - |

$ 1,429,967 |

$ 4,713,288 |

|

2016 |

569,634 |

383,659 |

414,104 |

695,833 |

2,063,230 |

|

2017 |

1,835,273 |

779,223 |

932,226 |

- |

3,546,722 |

|

2018 |

2,442,313 |

969,476 |

1,198,847 |

- |

4,610,636 |

|

Total |

$ 7,214,480 |

$ 3,048,419 |

$ 2,545,177 |

$ 2,125,800 |

$ 14,933,876 |

The current CEO, Nassim Usman, pocketed more than $7 million since 2015. We believe shareholders should be concerned with the Company's Executive team's willingness and ability to siphon value away from the Company as the Company's drug prospects get brighter. Based on our research of Healthcare Ventures and Essex Woodlands, we were not surprised to see a lopsided compensation arrangement in favor of the Company's Executives, but this needs to end immediately.

All told, we do not believe the current executive team is capable of, or incentivized to, realize maximum shareholder value from its current drug pipeline. One of the Company's top drug prospects, MarzAA, demonstrated positive clinical trial results in July 2019. Since the news was disclosed, we see no evidence that management took concrete steps to solicit strategic investors in the Company and explore options that could require the management team to relinquish control. Despite the good news, the Company's share price is down about -37%7, which we believe represents a complete failure on the part of the Executive team to appropriately convey the positive developments at the Company to the market. At time of writing, the Company is valued less than the cash held on its balance sheet, which suggests to us other market-participants also place very little faith in the Company's Executive team. We believe the poor executive leadership and lack of ownership in the Company by its leaders represents a significant hinderance to unlocking the Company's intrinsic value.

Through our 6% ownership, we demand Board representation that will maximize shareholder value– now is the time for shareholders to apply pressure to the existing Board. Failing to place our representatives on the Board, we believe Catalyst Biosciences should immediately initiate a strategic sale process for the Company and/or aggressively pursue established partners for the drugs in the Company's pipeline.

About 22NW, LP:

Founded in 2015, 22NW Fund is a Seattle-based value fund with $150 million of assets under management. The firm specializes in small and microcap investments and has a multi-year investment horizon.

1 Bloomberg, total return for the period August 20, 2015 through September 20, 2019.

2 Outstanding shares, sourced from Bloomberg, increased from about 760,800 shares (reverse-split adjusted) to about 12,008,500 shares between September 30, 2015 and September 20, 2019.

3 As of September 20, 2019.

4 Measured by the change in retained earnings for the period beginning September 30, 2015 and ending June 30, 2019.

5 Per clinicaltrials.gov registrations.

6 Based on the 'Summary Compensation Table' found in Catalyst Biosciences' annual proxy filings.

7 Bloomberg, total return for the period beginning July 5, 2019 and ending September 20, 2019.

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/22nw-catalyst-biosciences-needs-change-now-300926557.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/22nw-catalyst-biosciences-needs-change-now-300926557.html

SOURCE 22NW