Sun Life has released its annual research report on high-cost claims and medical trends. Cancer again topped the list of the 10 most common and costliest medical conditions, with an increase of 16 percent in 2020 despite the likely missed screenings during lockdown early in the pandemic.

|

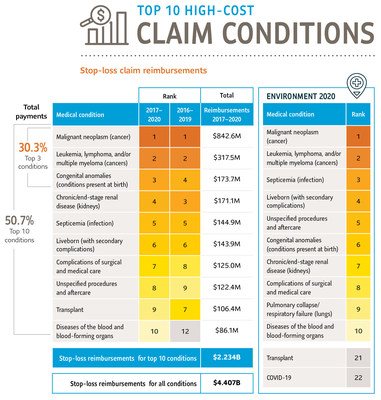

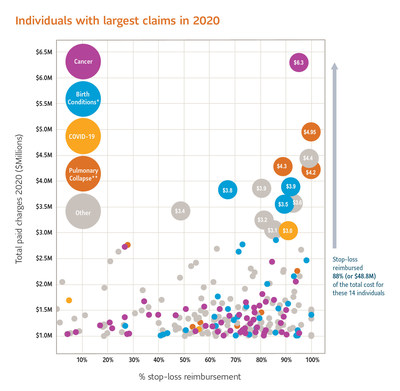

WELLESLEY, Mass., June 2, 2021 /PRNewswire/ -- Sun Life has released its annual research report on high-cost claims and medical trends. Cancer again topped the list of the 10 most common and costliest medical conditions, with an increase of 16 percent in 2020 despite the likely missed screenings during lockdown early in the pandemic. The report also showed that mental health claims increased by 21 percent in 2020 from 2019, with alcohol or opioid abuse and depression being the most common conditions. Septicemia (infections), one of the most common secondary conditions as a result of COVID-19, was also on the list of costliest conditions, as well as congenital anomalies (conditions present at birth, such as a heart defect) and kidney disease. This year's report analyzed claims from 2017–2020 for more than 45,000 members. Sun Life will present a webinar on June 8 to provide insights on the report, with Jennifer Collier, R.N., senior vice president of Stop-Loss & Health; Mike Huppert, vice president of Actuarial & Risk Management; and Lisa Hundertmark, R.N., director of Clinical Services. Click here to register. "We monitor these trends closely to make sure our employer clients and their employees get the care and support they need," said Collier. "Delayed screenings during the pandemic may result in some conditions, particularly cancer, being more advanced in their progression than they normally would have been at the time of diagnosis. It is crucial to support members with serious medical conditions and make sure they have access to the proper care and treatment, which is why we recently announced our intention to acquire PinnacleCare, a leading U.S. healthcare navigation provider that will help our members find the best physicians and centers of excellence for their specific condition." Mental health spotlight "Mental health is health," added Collier. "Often the symptoms and signs are harder to detect, even in the people we see or talk to every day. We encourage our clients to continue focusing on workplace mental health, which will foster positive impacts to their employees' overall health and well-being." Other key takeaways from Sun Life's report include: COVID-19 cost factors

Cancer trends

Specialty drug costs

Million-dollar claims

Other pandemic impacts

"Medical trends that we see through our research reports prompted us to take a step back to consider how people utilize and interact with their healthcare, and how we can better serve our clients' evolving needs with new capabilities," said Dan Fishbein, M.D., president of Sun Life U.S. "Through concepts like care navigation, in-depth research, and investments in digital benefits solutions, we are doing more to help our clients and support our members." Stop-loss insurance provides financial protection for employers who self-fund their medical plans, which provides more plan design flexibility and cost-containment options, but also means the employer takes on financial risk. According to Kaiser Health, 67 percent of U.S. workers are in a self-funded health plan. Sun Life is the largest independent stop-loss provider in the country, covering more than 4.5 million lives. About Sun Life Sun Life Financial Inc. trades on the Toronto (TSX), New York (NYSE) and Philippine (PSE) stock exchanges under the ticker symbol SLF. In the United States, Sun Life is one of the largest group benefits providers, serving more than 55,000 employers in small, medium and large workplaces across the country. Sun Life's broad portfolio of insurance products and services in the U.S. includes disability, absence management, life, dental, vision, voluntary, supplemental health and medical stop-loss. Sun Life and its affiliates in asset management businesses in the U.S. employ approximately 5,500 people. Group insurance policies are issued by Sun Life Assurance Company of Canada (Wellesley Hills, Mass.), except in New York, where policies are issued by Sun Life and Health Insurance Company (U.S.) (Lansing, Mich.). For more information, please visit www.sunlife.com/us. Forward-looking information Certain statements in this news release are forward-looking within the meaning of applicable securities laws and are subject to inherent risks, uncertainties and assumptions. Some of these assumptions and risks and uncertainties are described in Sun Life Financial Inc.'s (the "Company") news release announcing the acquisition of PinnacleCare under the heading "Forward-looking information", the Company's annual information form for the year ended December 31, 2020 under the heading "Risk Factors" and the Company's other filings with Canadian and U.S. securities regulators. The results or events predicted in these forward-looking statements may differ materially from actual results or events and we cannot guarantee that any forward-looking statement will materialize. Except as may be required by law, we do not undertake any obligation to update or revise any forward-looking statement made in this news release. See Section O – Forward-looking Statements of the Company's 2020 annual MD&A for additional information concerning forward-looking statements. Media contacts: Connect with Sun Life U.S.

SOURCE Sun Life U.S. |

||

Company Codes: Manila:SLF, NYSE:SLF, Toronto:SLF |