The U.S. DNA manufacturing market is growing due to increasing healthcare sector growth, advancements in technology, and growing demand for personalized medicine and cell and gene therapies. Advanced DNA technology is playing a significant role in enhancing health conditions through the development of novel vaccines and pharmaceuticals.

The treatment approaches are also upgraded by developing monitoring devices, diagnostic kits, and novel therapeutic strategies. DNA technology transformed the development of bioscience and led to dramatic changes in the healthcare system.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.novaoneadvisor.com/report/sample/9162

U.S. DNA Manufacturing Market Highlights:

• By type, the synthetic DNA segment dominated the market with the largest share in 2024.

• By type, the plasmid DNA segment is expected to show the fastest growth over the forecast period.

• By grade, the GMP grade segment held the largest market share in 2024.

• By grade, the R&D grade segment is expected to register the fastest growth during the forecast period.

• By application, the cell and gene therapy segment captured the largest market share in 2024.

• By application, the oligonucleotide-based drugs segment is expected to show the fastest growth during the forecast period.

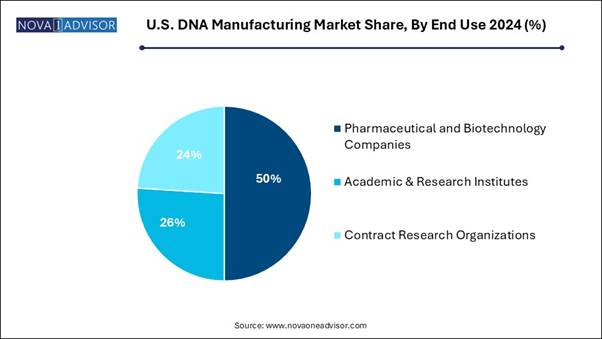

• By end-use, the pharmaceutical and biotechnology segment generated the highest market revenue in 2024.

• By end-use, the Contract Research Organizations (CROs) segment is expected to register the fastest CAGR over the forecast period.

Market Overview and Industry Potential

The U.S. DNA manufacturing market is expanding rapidly due to the increasing DNA technology, which includes changing genetic material outside an organism to get improved and desired results in living organisms or as their products. This advanced technology involves the insertion of DNA fragments from various sources, which have a required sequence of genes, through a suitable vector. DNA technology is a significant development in science and technology which made human life easier. The role of DNA technology in creating a clean environment and attracting the resistance of plants to diverse adverse factors (drought, pests, and salt) has been broadly recognized.

What are Recent Advancements in DNA Manufacturing Services?

Recent advancements in recombinant DNA technology it developed to treat various diseases, like infections and cancer. In many types of cancers, the immune system is suppressed or limited, enabling cancer cells to grow. Recombinant DNA introduces genes that hinder the growth of tumors or induce apoptosis (programmed cell death) in cancerous cells.

Recombinant DNA vaccines translate tumor antigens, leading to protein expression that triggers the immune system to target cancer cells. These vaccines are emerging for cancers such as melanoma, breast cancer, and prostate cancer.

⬥︎ For Instance, In May 2025, Elegen, the leader in next-generation cell-free DNA manufacturing, announced the early access launch of ENFINIA IVT Ready DNA. An expansion of its ENFINIA platform, this new product is delivered ready-to-use with the requisite poly(A) tail already encoded.

Report Scope of U.S. DNA Manufacturing Market

|

Report Coverage |

Details |

|

Market Size in 2025 |

USD 3.25 Billion |

|

Market Size by 2034 |

USD 14.75 Billion |

|

Growth Rate From 2025 to 2034 |

CAGR of 18.29% |

|

Base Year |

2024 |

|

Forecast Period |

2025-2034 |

|

Segments Covered |

Type, Grade, Application, End-use |

|

Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

|

Key Companies Profiled |

AGC Biologics, Catalent, Charles River Laboratories, Danaher (Aldevron), Eurofins Genomics, GenScript,Lonza, Thermo Fisher Scientific Inc. , Twist Bioscience, VGXI, Inc. |

What are Recent Trends in U.S. DNA Manufacturing Market?

■︎ In April 2025, Applied DNA Sciences, Inc., a leader in PCR-based DNA technologies, announced that LineaRx, Inc., the Company's majority-owned subsidiary, completed a long-term initiative to source critical input materials for its LineaDNA and LineaIVT platforms from U.S.-based suppliers. The initiative, undertaken in response to the 2024 BIOSECURE Act and customer demand for a U.S.-based supply chain, comes as the biopharmaceutical industry progressively considers reshoring manufacturing operations to the U.S. in response to potential tariff impacts and to ensure a stable supply chain.

■︎ In April 2025, UK-based Entos Pharmaceuticals, a clinical-stage genetic medicines company, entered into a research partnership with Norway-based Circio Holding, a biotechnology company specializing in circular RNA technology for next-generation nucleic acid medicines, under which Entos will develop and validate proteolipid vehicle (PLV) formulations of Circio´s circular RNA expression vectors and DNA vectors.

■︎ In June 2025, the U.S. National Science Foundation announced a $25.5 million investment to support fundamental research and workforce development goals in enabling future generations of U.S. manufacturing. This year's awards will support seven research grants and nine seed projects across 36 institutions and companies through the NSF Future Manufacturing (NSF FM) program.

Increasing Adoption of Automation in DNA Manufacturing: Market’s Largest Potential

Increasing adoption of automation in DNA manufacturing technology drives the growth of the market, as it is a well-established assembly procedure of DNA fragments in a multiplexed, high-throughput fashion, enabling various configurations to be tested concurrently. Automated DNA sequencing uses a fluorescent dye to label the nucleotides in place of a radioactive isotope. The fluorescent dye is an environmentally friendly chemical, and it has no particular handling or discarding needs. Instead of using X-ray film to read the sequence, a laser is used to stimulate the fluorescent dye. The fluorescent emissions are composed of a charge-coupled device that can determine the wavelength.

⬥︎ For Instance, In February 2025, Maravai LifeSciences, Inc. announced that it had completed its previously announced acquisition of Officine Bio’s DNA and RNA business. This acquisition combines Officine Bio's AI-enabled mRNA design platforms with Maraval and Tri Link Biotechnologies’ leading drug substance manufacturing capabilities, offering customers comprehensive expertise and advanced technologies for quick, calculated progression through the mRNA sequence-optimization phase and in clinical testing and commercial manufacturing.

What to Expect from U.S. in DNA Manufacturing Market till 2040?

The United States is increasing DNA manufacturing size to meet the rising demand for vaccines, advanced therapies, and research. Developing the bioscience sector in the U.S. is significant to addressing the global most pressing challenges from epidemics and national security to preventive health and environmental sustainability. Health tech industry leaders and scientists overcome great obstacles each day to advance innovative solutions and support people to lead healthier lives in this country.

⬥︎ For Instance, in 2023, the nation’s bioscience industry employed nearly 2.3 million Americans across almost 150,000 U.S. business establishments in each U.S. state. The sector indirectly helps nearly 8 million additional jobs.

Top Companies in DNA Manufacturing in United States

|

Company Name |

Founded Year |

Description |

|

Shape Therapeutics |

2018 |

Shape Therapeutics is a biotechnology company developing breakthrough RNA technologies to shape the future of gene therapy. |

|

Antheia |

2015 |

Antheia leverages synthetic biology to produce biosynthetic Key Starting Materials (KSMs) and Active Pharmaceutical Ingredients (APIs) for essential medicines in a more efficient, agile, and sustainable approach. |

|

APTITUDE MEDICAL |

2011 |

Aptitude Medical Systems develops point-of-care and over-the-counter diagnostic tests for sexually transmitted infections, including chlamydia, gonorrhea, and trichomoniasis. |

|

Ansa Biotechnologies |

2018 |

Ansa Biotechnologies is advancing a novel way to make DNA that will be cleaner, faster, and more precise than existing methods. |

|

Kano Therapeutics |

2021 |

Kano Therapeutics believes that innovative drugs require innovative supply chains. Kano is building a bio-infrastructure company to address the high bioprocessing capacity crunch in therapeutic manufacturing for cell and gene therapy companies. |

|

Mammoth Biosciences |

2017 |

Mammoth Biosciences is attaching the diversity of nature to power the next generation of CRISPR products. |

|

Elegen Corp. |

2017 |

Elegen is making a suite of advanced technologies to achieve DNA writing with supreme quality, cost, and speed. |

Buy Now Full Report: https://www.novaoneadvisor.com/report/checkout/9162

U.S. DNA Manufacturing Market Segmentation Analysis:

By Type Analysis:

The synthetic DNA segment dominates in the U.S. DNA manufacturing market, as it is used in genetic treatments to accurately treat inherited disorders or target cancer mutations with accuracy. Synthetic DNA is progressively used for gene therapies because of its fast production and enhanced scalability as compared to the outdated plasmid-based procedure. Synthetic DNA is developing as a convincing alternative to traditional plasmid-based methods. It is manufactured enzymatically, providing significant benefits like reduced production time, advanced purity, and the removal of bacterial sequences and antibiotic resistance genes.

On the other hand, the plasmid DNA segment is expected to grow significantly during the forecast period as it provides numerous advantages, advancing it to extensive use in genetic engineering and biotechnology. Their comparatively small backbone size makes DNA ideal for vector purification and isolation, while the circular structure makes them resistant and stable to degradation than linear DNA. It is used for various disease treatments.

By Grade Analysis:

The GMP grade segment dominates the U.S. DNA manufacturing market, as GMP-grade DNA shortens regulatory pathways and lowers development challenges, advantages that are vital in the fast-paced arena of advanced therapies. GMP-grade DNA production manufacturing service helps the manufacturing and quality testing of plasmid DNA as a starting material or substance for medicines or gene therapy products.

The R&D grade segment is expected to grow significantly during the forecast period as it provides numerous key advantages, such as enabling ground-breaking research, enabling the development of novel diagnostics and therapies, and promoting innovation in different fields such as medicine and environmental science. It enables for exact manipulation of genetic material, leading to a deeper understanding of biological procedures and the potential for creating new solutions.

By Application Analysis:

The cell and gene therapy segment accounted for the largest market share in 2024, as these therapies have strategies to treat genetic disorders by providing novel DNA to particular cells or correcting the DNA. Gene transfer methods, also known as gene addition, re-establish the missing function of a defective or missing gene by adding a novel gene to affected cells. DNA plays a significant role in gene therapy as it enables the replication of the presented gene.

On the other hand, the oligonucleotide-based drugs segment is expected to grow significantly during the forecast period as it is short single strands of synthetic DNA or RNA that ais as the starting point for various synthetic biology and molecular biology applications. From genetic testing to forensic research and next-generation sequencing, an oligo will be the starting point. These drugs have many advantages, such as strong specificity, short development cycle, convenient design, and rich targets.

By End User Analysis:

The pharmaceutical and biotechnology segment accounted for the largest market share in 2024, as synthetic DNA manufacturing is a technology that is significant in biotechnology and research to allow the manufacture of DNA constructs. Those constructs are used for genetic manipulation and numerous applications in a variety of fields, including medicine and molecular biology, and agriculture. Gene expression, gene editing, and protein production are the main purposes of pDNA. It plays an important role in advanced biotechnology and biopharmaceuticals. From gene therapy to vaccine development, pDNA is a central component driving progress in medicine.

Contract Research Organizations (CROs) are expected to grow significantly during the forecast period as CROs provide flexible and result-based contract arrangements. Those who formally tie their success to that of the healthcare programs they are overseeing are well able to embrace an ownership mentality and recover their perception as an aligned partner. CROs are a great resource, and they play a significant role in the achievement of major studies and in supporting the development of much-needed drugs and treatments for patients.

Some of the Prominent Players in the U.S. DNA Manufacturing Market

• Catalent

• Danaher (Aldevron)

• Eurofins Genomics

• Lonza

• Thermo Fisher Scientific Inc.

• Twist Bioscience

• VGXI, Inc.

What is Going Around the Globe?

⬥︎ In June 2025, ProBio, a global contract development and manufacturing organization (CDMO) specializing in cell and gene therapy, announced the opening of its flagship Cell and Gene Therapy Center of Excellence at the Princeton West Innovation Campus in Hopewell

⬥︎ In May 2025, Acuitas--Aldevron, a global leader in the production of DNA, RNA and protein, together with Integrated DNA Technologies (IDT), a global leader in genomics solutions, announced the successful manufacture of the world’s first personalized CRISPR gene editing drug product to treat an infant with urea cycle disorder (UCD).

You can place an order or ask any questions, please feel free to contact at sales@novaoneadvisor.com | +1 804 441 9344

Related Report

⬥︎Viral Vectors & Plasmid DNA Manufacturing Market- https://www.precedenceresearch.com/viral-vectors-and-plasmid-dna-manufacturing-market

⬥︎Plasmid DNA Manufacturing Market- https://www.precedenceresearch.com/plasmid-dna-manufacturing-market

⬥︎U.S. Plasmid DNA Manufacturing Market- https://www.precedenceresearch.com/us-plasmid-dna-manufacturing-market

⬥︎Telecom Electronic Manufacturing Services Market- https://www.precedenceresearch.com/telecom-electronic-manufacturing-services-market

⬥︎U.S. DNA Nanotechnology Market- https://www.precedenceresearch.com/u-s-dna-nanotechnology-market

⬥︎U.S. Targeted DNA RNA Sequencing Market- https://www.precedenceresearch.com/u-s-targeted-dna-rna-sequencing-market

⬥︎Pet DNA Testing Market- https://www.precedenceresearch.com/pet-dna-testing-market

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. DNA Manufacturing Market.

By Type

• Plasmid DNA

• Synthetic DNA

º Gene Synthesis

º Oligonucleotide Synthesis

By Grade

• GMP Grade

• R&D Grade

By Application

• Cell & Gene Therapy

• Vaccines

• Oligonucleotide-based Drugs

• Others

By End-use

• Pharmaceutical and Biotechnology Companies

• Academic & Research Institutes

• Contract Research Organizations

Immediate Delivery Available, Get Full Access @

https://www.novaoneadvisor.com/report/checkout/9162

About-Us

Nova One Advisor is a global leader in market intelligence and strategic consulting, committed to delivering deep, data-driven insights that power innovation and transformation across industries. With a sharp focus on the evolving landscape of life sciences, we specialize in navigating the complexities of cell and gene therapy, drug development, and the oncology market, enabling our clients to lead in some of the most revolutionary and high-impact areas of healthcare.

Our expertise spans the entire biotech and pharmaceutical value chain, empowering startups, global enterprises, investors, and research institutions that are pioneering the next generation of therapies in regenerative medicine, oncology, and precision medicine.

Web: https://www.novaoneadvisor.com/

Contact Us

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87934 22019

Europe: +44 7383 092 044

Email: sales@novaoneadvisor.com

Our Trusted Data Partners:

Precedence Research | Towards Healthcare | Statifacts

For Latest Update Follow Us: LinkedIn