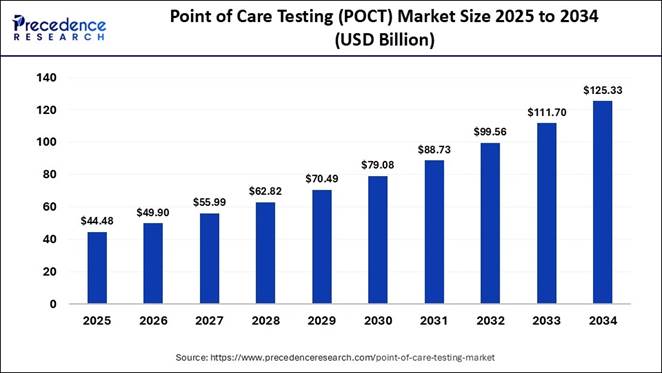

According to Precedence Research, the global point of care testing (POCT) market size will grow from USD 44.48 billion in 2025 to nearly USD 125.33 billion by 2034, with a healthy CAGR of 12.20% from 2025 to 2034. Driven by the rising demand for rapid diagnostics, AI-enabled testing solutions, and decentralized healthcare delivery.

The global point of care testing (POCT) market size is expected to be worth over USD 125.33 billion by 2034, as technological advancements, improved clinical outcomes, and increasing adoption of home-based and near-patient testing accelerate global uptake. Robust investment in molecular diagnostics, growing prevalence of chronic and infectious diseases, and expanding access to connected, real-time testing platforms are further strengthening the market’s growth trajectory.

The Complete Study is Now Available for Immediate

Access | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/2270

Point of Care Testing Market Highlights:

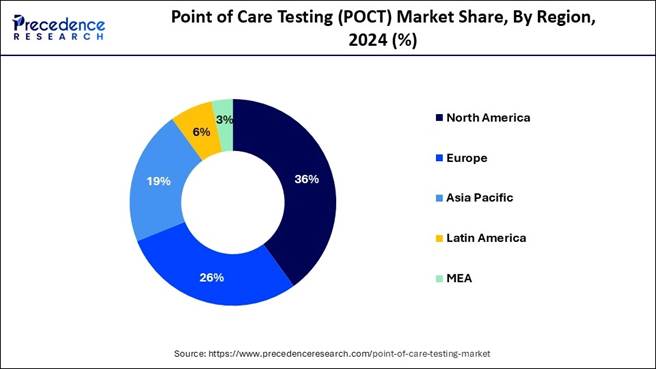

🔹 North America remained the leading regional market in 2024, supported by advanced healthcare infrastructure, high diagnostic adoption, and strong presence of key market players.

🔹 Asia Pacific is projected to register the fastest CAGR during the forecast period, driven by rapid healthcare digitization, growing chronic disease burden, and expanding diagnostic accessibility.

🔹 Europe emerged as another significantly growing regional market in 2024, propelled by robust reimbursement systems and continuous technological innovation.

🔹 Glucose monitoring products dominated the market in 2024, owing to the rising prevalence of diabetes and increasing uptake of continuous glucose monitoring solutions.

🔹 Pregnancy and fertility testing products are expected to grow at the highest CAGR, fueled by increasing consumer awareness, home-based testing adoption, and expanding women’s health innovations.

🔹 Lateral flow assays led the platform segment in 2024, benefiting from their ease of use, rapid results, and broad clinical applicability.

🔹 The molecular diagnostics platform is anticipated to record the fastest CAGR, driven by rising demand for high-accuracy testing and the integration of advanced genomic technologies.

🔹 Clinical laboratories dominated the end-user segment in 2024, supported by high testing volumes, specialized equipment usage, and skilled workforce availability.

🔹 Hospitals, critical care centers, and urgent care centers are set to grow at the fastest CAGR, attributable to increasing adoption of point-of-care diagnostics and rising demand for rapid clinical decision-making.

➡️ Become a valued research partner with us https://www.precedenceresearch.com/schedule-meeting

Point of Care Testing Market Overview and Industry Potential

What is Point of Care Testing?

There is a rising importance of the point of care testing market due to the potential of this testing in delivering faster results and better care. Point of care diagnostics delivers faster treatments by the use of rapid C-reactive protein (CRP) testing equipment, protein chip technology, biosensors, and immunofluorescence testers. These tools and technologies help to detect conditions like cardiovascular disease, diabetes, and infectious diseases like HIV and hepatitis.

The strong global brands in diagnostics include Beckman Coulter, Cepheid, Leica Biosystems, and Radiometer. These leading diagnostics companies witness a competitive market position, strong channel, consistent revenue growth, higher margin businesses, and leadership assessment.

Major Trends in the Point of Care Testing Market

How will the Point of Care Testing Market Progress Globally?

🔹Strong Global Brands: The life sciences, biotechnology, and diagnostics sectors are strongly associated with each other due to their leading market positions. The shift in medicine towards biologics, the growth of the biologics R&D pipeline, the increasing focus on genomic medicine, and high investments in bioprocessing have driven notable revenue growth in the biotechnology and life sciences sectors. There is a huge adoption of gene editing and sequencing technologies, and global investments in basic and applied research capacity in the life sciences. The penetration of molecular diagnostics, the point-of-care trend in healthcare, improved standards of care, skilled labor shortages, and automated solutions have witnessed a notable growth of the diagnostics sector.

🔹Accelerated Revenue and Sales Growth: One of the leading companies in the point of care testing market is Abbott Laboratories, which has maintained a steady performance in the first half of 2025, with 14.8% of its U.S. medical device sales in 2025. The other leading company, named Danaher Corporation, reported its 2024 revenue of approximately $6.8 billion in biotechnology, approximately $7.3 billion in life sciences, and approximately $9.8 billion in diagnostics. The prominent market players, like Beckman Coulter, are accelerating drug discovery and improving patient diagnosis, and Cytiva is reducing biologic manufacturing costs.

✚ Turn AI disruption into Opportunity. Click to Get the Insights Shaping Tomorrow.

Growth Factors in the Point of Care Testing Market

What are the Major Driving Forces for the Point of Care Testing Market?

🔹Innovations Improving Patient Diagnosis: DxI 9000 immunoassay analyzer is the flagship product of Beckman Coulter, which is leading with optimized workflow and 100 x more sensitivity than traditional immunoassay analyzer systems. It provides favorable opportunities in Alzheimer’s diagnostics.

🔹Global Health Workforce Boosting Point of Care: The World Health Organization (WHO) estimated the shortage or decline of 11 million health workers by 2030. This shortfall will raise the need for point-of-care solutions for clinicians. Moreover, Africa has experienced the challenges of only 3% of the global health workforce and 24% of the global disease burden, which raises the need for innovation.

What is the Role of AI in the Point of Care Testing Market?

Artificial intelligence contributes to point-of-care diagnosis by delivering higher accuracy, faster results, and improved workflow efficiency. AI-powered point-of-care testing is ideal in low-resource settings. It reduces healthcare disparities and enhances accessibility in these areas. AI devices are useful in anemia screening in rural areas of India, with 94% accuracy and diagnosis done within hours rather than long weeks.

📥 Dive into the Complete Report ➡️ https://www.precedenceresearch.com/pharmaceutical-cdmo-market

Opportunities in the Point of Care Testing Market

What is the Potential of the Point of Care Testing Market?

🔸In December 2024, PocDoc secured £5 million in funding to grow and expand its digital diagnostics business. (Source: https://www.digitalhealth.net)

🔸In November 2025, Johnson & Johnson Impact Ventures invested in ThinkMD’s AI-enabled clinical decision software that enhances the availability and accuracy of clinical decision-making at the point-of-care. (Source: https://www.jnj.com)

🔸In May 2024, Cipla invested up to Rs 26 Crore in a point-of-care testing firm named Achira Labs, a company leading in point-of-care medical test kits. (Source: https://economictimes.indiatimes.com)

Limitations and Challenges in the Point of Care Testing Market

What are the Potential Concerns Related to the Point of Care Testing Market?

🔹 Clinical Diagnosis Issues: The clinical staff with minimal technical knowledge often perform diagnostic tests. The challenges arise due to a lack of understanding of the process. Precise care should be taken during every step of the point-of-care test.

🔹 Execution of Point-of-Care Testing: The specific challenges arise during a step-by-step implementation of point-of-care tests at multi-specialty hospitals for children. These issues are related to training, competency, POCT instrumentation, quality control issues, data management, patient identification errors, and proper handling of reagents and consumables.

Point of Care Testing Market Report Scope

|

Report Coverage |

Key Statistics |

|

Market Size (2025) |

USD 44.48 Billion |

|

Market Size (2026) |

USD 49.90 Billion |

|

Market Size (2034) |

USD 125.33 Billion |

|

CAGR (2025–2034) |

12.20% |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2034 |

|

Segments Covered |

Product Type, Platform, Mode of Purchase, Testing Type, End-User, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

2024: Leading Region |

North America — over 46% market share |

|

Fastest-Growing Region (2025–2034) |

Asia Pacific — projected CAGR ~12.38% |

|

Top Product Type (2024) |

Glucose monitoring products — 27% revenue share |

|

Leading Platform (2024) |

Lateral flow assays — 36% revenue share |

|

Leading Mode of Purchase (2024) |

OTC testing products — 59% share |

|

Glucose Monitoring Segment Value (2024) |

USD 8.91 Billion |

|

Biosensors Segment CAGR |

9.2% CAGR |

|

Pregnancy & Fertility Testing CAGR |

8.1% CAGR (2025–2034) |

|

Diagnostic Centers End-User CAGR |

7.8% CAGR |

|

Key Market Drivers |

Rising chronic disease cases, increased R&D in diagnostics, expanding healthcare infrastructure, growing adoption of home/self-testing |

|

Key Market Challenges / Restraints |

High cost of advanced devices, shortage of skilled diagnostic professionals |

|

Key Opportunities |

Rapid demand in emerging markets, government support & reimbursement, technological innovations (biosensors, molecular diagnostics), rising self-testing adoption |

Don’t Miss Out! | Transform Your Market Strategy 👉 https://www.precedenceresearch.com/checkout/2270

Case Study: Enhancing Clinical Outcomes Through AI-Powered Point-of-Care Diagnostics in Rural India

Background

In 2024, a collaborative initiative between a leading diagnostics provider and multiple state health departments in India sought to address persistent diagnostic delays in underserved rural regions. Traditional laboratory-based testing often took 5–14 days, leading to late treatment, increased disease severity, and higher healthcare costs. Key challenges included limited diagnostic infrastructure, shortage of trained staff, and long travel times to centralized labs.

Solution Implemented

A new AI-enabled POCT ecosystem was deployed across rural PHCs (Primary Health Centres) featuring:

🔹 Portable, battery-operated POCT analyzers for hemoglobin, glucose, CRP, and infectious diseases

🔹 AI-powered decision support system integrated directly into the POCT device

🔹 Cloud-based real-time data sharing with district hospitals

🔹 Training for frontline health workers enabling non-specialists to perform diagnostics accurately

🔹 Smartphone-linked diagnostics for automated interpretation and reporting

Notably, AI-based anemia screening tools were implemented, capable of delivering 94% accuracy compared to reference lab systems, and providing results within 10 minutes instead of weeks.

Outcomes Achieved (2024–2025)

|

Impact Parameter |

Before POCT Deployment |

After AI-Enabled POCT Deployment |

|

Average diagnosis time |

5–14 days |

Under 20 minutes |

|

Hb & glucose screening coverage |

32% of rural population |

74% of rural population |

|

Error rates in diagnosis |

High (manual interpretation) |

Reduced by >60% |

|

Treatment initiation |

Often delayed |

Same-day initiation for >80% of patients |

|

Health worker dependency |

Specialist-driven |

70% tasks handled by frontline staff |

Public Health Impact

🔹 Early detection of anemia resulted in 37% reduction in severe anemia cases within one year.

🔹 AI-assisted infectious disease testing enabled faster referral for dengue, malaria, and HIV.

🔹 Maternal health indicators improved due to routine pregnancy, glucose, and hemoglobin POCT screenings.

🔹 Healthcare costs dropped significantly due to reduced hospitalizations and fewer complications.

Why This Matters for the POCT Market

This case study demonstrates how AI-enabled,

decentralized POCT systems are not only technologically advanced but also clinically

transformative, especially in low-resource settings.

It showcases real-world evidence supporting market drivers such as:

→ Rising adoption of home and near-patient testing

→ AI integration improving diagnostic accuracy

→ Expansion of decentralized healthcare models

→ Strong government involvement and funding

This is exactly the type of transformation fueling the 12.20% global CAGR projected through 2034.

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Point of Care Testing Market Key Regions Outlook:

How does North America Dominate the Point of Care Testing Market in 2024?

North America dominated the market in 2024, owing to the significant investments from the public and private sectors to boost the development and the wide adoption of point-of-care technologies. The National Institute of Biomedical Imaging and Bioengineering (NIBIB) established the Point-of-Care Technologies Research Network (POCTRN) to boost the development of ideal point-of-care diagnostic technologies. This plan is driven through collaborative efforts between scientific and technological capabilities with clinical need.

In December 2024, the National Institutes of Health (NIH) announced honored more than $4 million in funds and support services to three diagnostic technology developers for HIV viral load detection or the HIV viral load monitoring program.

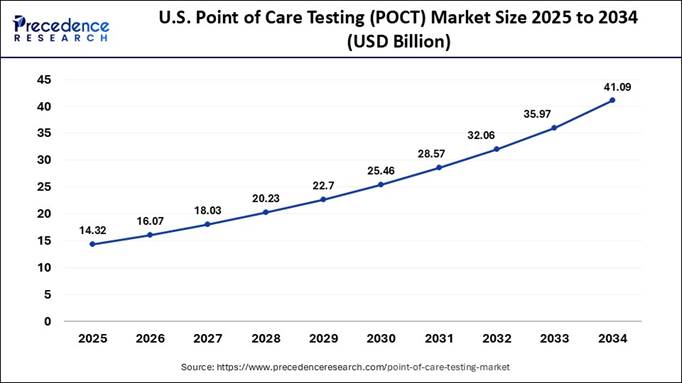

How Big is the U.S. Point of Care Testing Market?

The U.S. point of care testing market size is projected to exceed USD 41.09 billion by 2034, increasing from USD 14.32 billion in 2025, with a healthy CAGR of 12.38% from 2025 to 2034.

U.S. Point of Care Testing Market Analysis

In March 2025, Johnson & Johnson announced an increase in the U.S. investment to more than $55 billion over the next four years. In the last year, the U.S. Food and Drug Administration (FDA) approved marketing of the first point-of-care hepatitis C RNA test.

The U.S. FDA also collaborated with Safe Health Systems through the ‘Open Connected Diagnostics’ initiative. This initiative aims to boost the implementation and adoption of connected diagnostics capabilities, driving the point of care testing market.

Note: This report is readily available for immediate delivery. We

can review it with you in a meeting to ensure data reliability and quality for decision-making.

📥 Download Sample Pages for Informed Decision-Making 👉 https://www.precedenceresearch.com/sample/2270

Why is Asia Pacific the Fastest-Growing Market for Point of Care Testing?

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period due to the rise of home testing, proactive health management, and the preference for home-based testing kits. The notable product launches and acquisitions related to diagnostics in the year 2024 were witnessed by Roche Diagnostics India, Qiagen, and F. Hoffmann-La Roche Ltd.

The targeted investments were made in high-impact areas like oncology, AI diagnostics, and medical diagnostics. The regional collaborations and conferences, supportive policies, and reimbursement drive the Asian Pacific point of care testing market.

India Point of Care Testing Market Analysis

India is advancing with enhanced anemia diagnostics and accessibility through policies and recommendations for effective anemia management. The government of India Anemia Mukt Bharat (AMB) as a national initiative to create systemic approaches for anemia prevention, detection, and management strategies.

Why is Europe Considered a Notable Region in the Point of Care Testing Market?

Europe is expected to grow at a notable rate in the market in 2024. This regional growth is attributed to the shift towards clinics, pharmacies, and homes for decentralized healthcare. In March 2025, the EU4Health under the European Commission invited applications for tenders to develop point-of-care diagnostic medical devices that help in antimicrobial susceptibility testing.

In May 2024, the Paris-based En Carta secured €1.5 million in pre-seed funding to advance a platform for early Lyme disease detection. European countries like Germany, the UK, and France are introducing national strategies to adopt point-of-care testing as a strategic tool for public health.

Germany Point of Care Testing Market Analysis

The Federal Ministry of Health of Germany introduced several changes in the healthcare system in the year 2025, which include digitalization and hospital reform. The private companies achieved innovations in the German point of care testing market, including strategic supply agreements with laboratory chains and new diagnostic tools for sepsis.

Point of Care Testing Market Segmentation Insights:

How does the Glucose Monitoring Products Segment Dominate the Point of Care Testing Market in 2024?

The glucose monitoring products segment dominated the market in 2024, owing to the most recent advances in diabetes technology for better diabetes management. These solutions provide real-time information about glucose trends, glucose levels, and direction and rate of change. The four major continuous glucose monitoring devices used in clinical use include sensors developed by Medtronic, GlucoWatch®, DexCom™, and Abbott Diabetes Care.

The pregnancy and fertility testing products segment is expected to grow at the fastest CAGR in the point of care testing market during the forecast period due to their assistance in detecting ovulation and timely intercourse, diagnosing infertility causes, guiding treatment, and proactive health management. These products confirm pregnancy, monitor maternal and fetal health, inform decisions, and ensure safety before treatment. They monitor chromosomal and genetic conditions, maternal health conditions, and abnormal pregnancies.

What made Lateral Flow Assays the Dominant Segment in the Point of Care Testing Market in 2024?

The lateral flow assays segment dominated the market in 2024, owing to the simple-to-use diagnostic test to validate the presence or absence of a wide range of biological entities. They are ideal for qualitative and quantitative analysis. Lateral flow immunoassay tests are very crucial and versatile within point-of-care diagnostics.

The molecular diagnostics segment is estimated to grow at the fastest rate in the point of care testing market during the predicted timeframe due to the importance of next-generation sequencing (NGS) and genomic tools in revolutionizing the medical practice. These tools enable a rapid and detailed analysis of a patient’s genetic material for cancer and other disease diagnostics, and inform treatment decisions. NGS is ideal for quickly sequencing thousands of genes or the whole genome.

How did the Clinical Laboratories Segment Dominate the Point of Care Testing Market in 2024?

The clinical laboratories segment dominated the market in 2024, owing to their role as diagnostic powerhouses in the in vitro diagnostics. They perform the analysis of various disorders related to cholesterol levels, pathology, immunology, genetic markers, and many more. These laboratories guide treatments, track disease progression, and inform personalized care plans.

The hospitals, critical care centres, urgent care centres segment is anticipated to grow at a notable rate in the point of care testing market during the upcoming period due to the significance of critical care units in enhancing patient recovery. Critical care is a specialized form of healthcare provided in the ICU when a person faces severe injury or life-threatening illness. The hospitals, critical care centres, and urgent care centres provide advanced life-support equipment, constant monitoring, and rapid medical interventions.

✚ Related Topics You May Find Useful:

➡️ Point-of-Care Diagnostics Market: Explore how rapid testing technologies are reshaping real-time clinical decision-making worldwide

➡️ Point-of-Care Glucose Testing Market: Track advancements improving diabetes monitoring and portable glucose management systems

➡️ Point-of-Care Molecular Diagnostics Market: Discover how molecular platforms enable faster pathogen detection at the patient’s side

➡️ Point-of-Care Biosensors Market: See how biosensor innovation is driving real-time, non-invasive diagnostic accuracy

➡️ Veterinary Point-of-Care Diagnostics Market: Understand the rapid growth in on-site diagnostics improving animal health management

➡️ Point-of-Care Lipid Test Market: Analyze demand for quick cholesterol and lipid testing across primary care settings

➡️ Point-of-Care Infectious Disease Diagnostics Market: Learn how decentralized testing is strengthening global infectious disease control

➡️ Esoteric Testing Market: Gain insight into specialized, high-complexity diagnostic tests transforming precision medicine

➡️ Artificial Intelligence Diagnostics Market: Explore how AI-driven tools enhance detection, prediction, and clinical workflows

➡️ PCR Technologies Market: Track innovation in PCR platforms powering rapid, sensitive genetic testing

Point of Care Testing Market Leading Players

➢ Precision

➢ Ascensia Diabetes Care Holding AG

➢ LifeScan IP Holdings, LLC

➢ Mankind Pharma

➢ OraSure Technologies, Inc

➢ Menarini Diagnostics s.r.l

➢ ACON Laboratories

➢ Trinity Biotech plc

➢ Nova Biomedical

➢ Sysmex Corporation

➢ Johnson and Johnson

➢ Biosensor Inc

➢ Abbott Laboratories

➢ bioMrieux SA

➢ Becton Dickinson and Company

➢ Danaher Coraporation

➢Fluxergy

What is Going Around the Globe?

🔸In October 2025, Johnson & Johnson Impact Ventures invested in Phelcom to advance quality and affordable eye care across the globe. Source: https://www.jnj.com

🔸In February 2024, the World Health Organization (WHO) announced the launch of a new supplement in BMC Infectious Diseases on point of care testing. Source: https://www.who.int

Segments Covered in the Report

By Product Type

🔹 COVID-19 testing kits

🔹 Glucose monitoring products

→ Meters

→ Strips

→ Lancets and Lancing devices

🔹 Cardiometabolic Monitoring Products

→ Cardiac maker testing products

→ Blood Gas / Electrolyte testing products

→ HbA1c testing products

🔹 Infectious disease testing products

→ Influenza testing products

→ HIV testing products

→ Hepatitis testing products

→ Sexually Transmitted Diseases testing products

→ Healthcare-associated Infection testing products

→ Respiratory infection testing products

→ Tropical disease testing products

→ Others

🔹 Coagulation monitoring products

→ PT / INR testing

→ ACT / APTT

🔹 Pregnancy and fertility testing products

🔹 Pregnancy testing products

🔹 Fertility testing products

🔹 Cancer marker testing products

🔹 Urinanalysis testing products

🔹 Cholesterol testing products

🔹 Hematology testing products

🔹 Drugs-of-abuse testing products

🔹 Fecal Occult testing products

🔹 Others

By Platform

🔹 Lateral Flow Assays

🔹 Dipsticks

🔹 Microfluids

🔹 Molecular Diagnostics

🔹 Immunoassays

By End-User

🔹 Clinical laboratories

🔹 Ambulatory care facilities and physician offices

🔹 Pharmacies, retail clinics & E-comm platforms

🔹 Hospitals, Critical care centres, Urgent care centres

🔹 Home care & self-testing

Others

By Region

🔹 North America

🔹 Europe

🔹 Asia Pacific

🔹Latin America

🔹Middle East & Africa (MEA)

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or Asia Pacific.

Don’t Miss Out! | Instant Access to This Exclusive Report 👉 https://www.precedenceresearch.com/checkout/2270

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a global market intelligence and consulting powerhouse, dedicated to unlocking deep strategic insights that drive innovation and transformation. With a laser focus on the dynamic world of life sciences, we specialize in decoding the complexities of cell and gene therapy, drug development, and oncology markets, helping our clients stay ahead in some of the most cutting-edge and high-stakes domains in healthcare. Our expertise spans across the biotech and pharmaceutical ecosystem, serving innovators, investors, and institutions that are redefining what’s possible in regenerative medicine, cancer care, precision therapeutics, and beyond.

✚ Explore More Market Intelligence from Precedence Research:

➡️ Digital Therapeutics: How software-based interventions are restructuring chronic-disease management and clinical-grade behavioral therapy

➡️ Life Sciences Growth: Forces driving expansion across biotech, biopharma, and advanced therapeutic platforms

➡️ Viral Vector Gene Therapy Manufacturing: Manufacturing constraints, scalability limits, and innovations shaping next-generation gene-delivery systems

➡️ Wellness Transformation: How prevention-centric health models are shifting consumer behavior, product pipelines, and care delivery

➡️ Generative AI in Healthcare: How generative models are unlocking new diagnostics, clinical automation, and patient-care innovations

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Nova One Advisor | Onco Quant | Statifacts

Get Recent News 👉 https://www.precedenceresearch.com/news

For Latest Update Follow Us: