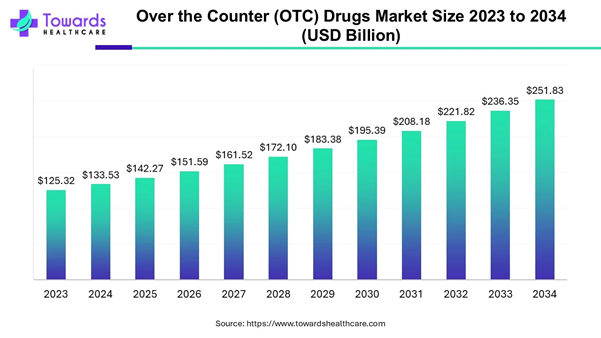

The global over-the-counter (OTC) drugs market size was valued at USD 133.53 billion in 2024 and is expected to grow to USD 142.27 billion by 2025. Looking ahead, the market is projected to reach approximately USD 251.83 billion by 2034, expanding at a compound annual growth rate (CAGR) of 6.55% from 2025 to 2034.

Get a sneak peek into the key trends and data shaping the OTC Drugs Market: https://www.towardshealthcare.com/download-sample/5429

Around the world, the market is driven by a growing geriatric population linked with chronic conditions, rising preference for self-treatment of minor ailments and preventative care, and with the expansion of e-commerce. Besides this, increasing awareness about OTC drugs, advancements in drug formulation, including fast-dissolving tablets, extended-release drugs, and combination products, are contributing as growth factors in the market growth.

The Over the Counter (OTC) Drugs Market Highlights

• North America held the biggest revenue share of the market in 2024.

• Asia-Pacific is expected to grow rapidly during the forecast period.

• By product type, the cough & cold products segment dominated the market in 2024.

• By product type, the analgesics segment is expected to grow at the fastest CAGR in the upcoming years.

• By dosage form, the tablets segment led the over the counter (OTC) drugs market in 2024.

• By dosage form, the ointments segment is expected to register rapid expansion over the projected period.

• By route of administration, the oral segment was dominant in the market in 2024.

• By route of administration, the topical segment is expected to grow fastest during 2025-2034.

• By distribution channel, the drug stores & retail pharmacies segment dominated the global over the counter (OTC) drugs market in 2024.

• By distribution channel, the online pharmacies segment is expected to show rapid growth during the forecast period.

Market Overview: Expansion of Online Retail Mode

The drugs that can be purchased without a prescription are termed as over the counter drugs. Generally, the over the counter (OTC) drugs market is fueled by accelerating self-care trends, increasing geriatric population, the convenience of accessing OTC medications, and the growth of online retail channels. Whereas, currently, developments like raised accessibility of certain drugs as OTC options through a process called "Rx-to-OTC switch," and an expansion in private label OTC product sales.

Access comprehensive market statistics and growth metrics in our detailed OTC Drugs Databook: https://www.towardshealthcare.com/download-databook/5429

Applications in Diverse Disease Conditions: Major Potential

Different kinds of OTC drugs are employed in several illness conditions, including pain relief in headaches, muscle aches, menstrual cramps, and other types of pain, with inclusion of other products like cough suppressants, decongestants, and antihistamines, OTC creams, ointments in minor skin conditions, such as acne, eczema, and fungal infections. Nowadays, numerous developments are going on in the area of multivitamins, vitamin D, and calcium supplements for comprehensive health and wellness.

Misuse and Rising Substance Abuse: Major Challenges

Due to potential incorrect self-diagnosis and the subsequent consumption of the wrong medications or taking extra doses are leading to the emergence of challenges in the over the counter (OTC) drugs market. As well as some OTC medications, including cough syrups, are prone to abuse, particularly among teenagers.

The Over the Counter (OTC) Drugs Market: Regional Analysis

North America registered dominance in the market in 2024. Due to the emergence of major factors such as innovations in drug delivery systems and formulations in this region are resulting in highly efficacious and convenient OTC products, appealing to consumers. A raised emphasis on online pharmacies and digital platforms is boosting the adoption of OTC drugs with enhanced access and availability.

Whereas, in the U.S., a major growth is impelled by simplified regulatory approval processes for these medications to launch novel drug candidates around the globe. Along with this, among the consumers, increased health awareness is putting a step towards the use of OTC drugs for controlling minor conditions and encouraging complete wellness.

For instance,

• In May 2025, Egypt and, US partnered through the agreement with US-based Dawah Pharma to manufacture and export pharmaceutical products and nutritional supplements to global markets, with a planned focus on North America and Europe.

Canada is focusing on lifestyle-relevant disorders such as obesity and diabetes, especially among the geriatric population is fueling the demand for OTC pain relievers and other related medications. Besides this, regulatory agencies are highly approving the shift of a few drugs from prescription to OTC mode, further boosting the availability options.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

The Asia Pacific is Anticipated to Grow at the Fastest CAGR During 2025-2034

Rapid expansion of Asia Pacific is driven by a robust pharmaceutical hub with increased movement towards OTC drugs, leading to a rise in market growth and benefits of drugs in this region. As well as expansion of retail pharmacies with enhanced distribution channels, OTC medications will be more available to a broader consumer base. Moreover, the over the counter (OTC) drugs market in ASAP is propelled by increasing disposable incomes, with escalated expenses, especially in healthcare products, including OTC drugs.

In India, the growing various infectious conditions and allergies among the rising population are increasingly demanding OTC drugs with easy access and cost-effective properties. Also, the Indian public is focusing on the adoption of natural supplements, calcium supplements, and other healthcare management medications, with enhanced production of these OTC drugs from many pharmaceutical industries in India. The major advancements are also emerging in India for online retail pharmacies, influencing the market growth.

For this market,

• In April 2025, Pincode, the hyperlocal delivery app developed by PhonePe, expanded its healthcare footprint with the unveiling of a 24-hour online medicine delivery service in Bengaluru, Mumbai, and Pune.

China has with accelerated geriatric population, and the middle class and rising disposable incomes are making efforts to maintain overall health by coupling with OTC medications. Along with this, the Chinese government is widely encouraging self-care and the application of OTC drugs for minor illnesses to decrease the burden on the healthcare system.

The Over the Counter (OTC) Drugs Market: Segmentation Analysis

By product type analysis

The cough & cold products segment held a major revenue share of the market in 2024. The segment is impacted by rising cases of common colds and coughs, especially among susceptible populations such as children and the elderly. Also, the growing accessibility of these medications through different retail modes is boosting their adoption.

On the other hand, the analgesics segment will expand rapidly, with the enhanced prevalence of chronic pain and musculoskeletal concerns in the elderly population being a significant driver for the market expansion. Along with this, increased shift towards self-care treatment is boosting the segment's development.

By dosage form analysis

The tablets segment held a major revenue share of the over the counter (OTC) drugs market in 2024. Advantages of this dosage form are ease of administration, its familiarity and suitability for different therapeutic areas, including pain relief and cold & flu, to digestive issues and vitamin supplementation, with accurate dose, and portability are impacting their wide-range adoption.

Whereas, the ointments segment is estimated to register the fastest expansion, due to rising skin allergies, eczema, and fungal infections, and the wide need for long-term management is driving this segment. Also, these ointments are available in various retail areas, including pharmacies, supermarkets, and online stores, with their cost-effectiveness.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

By route of administration analysis

The oral segment dominated the over the counter (OTC) drugs market in 2024. Mainly, tablets and capsules are widely used in different conditions with ease of administration at home or at any place without any need for medical supervision. Through e-commerce and online pharmacies, these oral medications are convenient and accessible to purchase.

On the other hand, the topical segment is predicted to show the fastest growth in the upcoming years. Because of its enhanced accessibility, affordability, and growing cases of skin-related issues, it is supporting segment growth. Moreover, currently, accelerating topical analgesics are broadly adopted in pain relief through topical application is boosting the adoption of topical ROA.

By distribution channel analysis

The drug stores & retail pharmacies segment led the global over the counter (OTC) drugs market in 2024. The increasing number of retail pharmacies and drug stores, particularly in urban areas and near residential locations, where they can receive valuable advice and recommendations from pharmacists among consumers, significantly impacts the segment expansion.

However, the online pharmacies segment will show rapid expansion due to the increased adoption of e-commerce, enhanced internet usage, and boosted convenience of online shopping. This expansion is escalated by the COVID-19 pandemic, which has surged consumers towards contactless healthcare alternatives.

Elevate your healthcare strategy with Towards Healthcare. Enhance efficiency and drive better outcomes schedule a call today: https://www.towardshealthcare.com/schedule-meeting

Top Companies and Their Contributions to the Market

|

Company |

OTC Contributions & Offerings |

|

Abbott Laboratories |

Pioneer in OTC continuous glucose monitors (FreeStyle Libre, Lingo, Libre Rio), making diabetes prevention and wellness monitoring accessible without prescription. Offers nutrition and consumer health products like Ensure, Pedialyte, Glucerna, and BinaxNOW COVID-19 rapid tests. |

|

AccuDial Pharmaceutical Inc. |

Innovator of weight-specific dosing systems for pediatric OTC medications. Its rotating label technology simplifies dosing for children’s cough, cold, pain, fever, and allergy treatments. |

|

Bayer AG |

Major player in OTC analgesics and pain relief (aspirin, ibuprofen). Actively leads in M&A and prescription‑to‑OTC switches, fueling growth in self-care markets. |

|

Bristol‑Myers Squibb |

While primarily a prescription‑drug firm, it contributes to the OTC market through co-marketing and legacy partnerships of select allergy and digestive health remedies deployed globally. |

|

Cipla |

Indian leader in the spread of affordable OTC drugs for respiratory, allergy, vitamins, and chronic disease management. Growing its presence through digital channels and local manufacturing. |

|

GlaxoSmithKline plc |

One of the largest OTC portfolios worldwide. Offers pain relief, respiratory, digestive, and wellness supplements. GSK has pursued notable prescription-to-OTC switches such as Alli (orlistat) through consumer‑health joint ventures. |

|

Glenmark Pharmaceuticals |

Expands its OTC roster in emerging markets, notably India. Offers analgesics, cough, cold remedies, skincare, and vitamins, leveraging regional distribution. |

|

Merck |

Brought Oxytrol (oxybutynin) to OTC as a patch for overactive bladder. Maintains consumer health via digestive remedies, vitamins, and topical skin treatments. |

|

Mylan N.V. |

Key contributor of affordable OTC generics such as ibuprofen, acetaminophen, antihistamines, and digestive aids distributed globally, especially in developing markets. |

|

Novartis AG |

Strong OTC consumer health business (allergy, digestive health, pain relief). Gained scale by partially divesting to GSK and pursuing prescription-to-OTC switches like Prevacid 24HR. |

Over the Counter (OTC) Drugs Market Companies:

• Abbott Laboratories

• AccuDial Pharmaceutical Inc.

• Bayer AG

• Bristol-Myers Squibb Company

• Cipla

• GlaxoSmithKline plc

• Glenmark Pharmaceuticals

• Merck

• Mylan N.V.

• Novartis AG

• Pfizer Inc.

• Procter & Gamble

• Sanofi S.A.

• Teva Pharmaceuticals

Major Companies' Recent Developments

|

Company/Organization |

Latest Updates |

|

Vegan Minerals (March 2025) |

Launched a 100% plant-based and sustainable calcium ingredient called Calcea |

|

Abbott Laboratories (September 2024) |

Launched its over-the-counter continuous glucose monitoring system in the U.S. |

|

Bayer (October 2024) |

Unveiled a first-of-its-kind in the healthcare industry, polyethylene terephthalate (PET) blister packaging on its renowned brand, Aleve, including a partnership with pharma packaging specialist Liveo Research |

|

Abbott Laboratories (August 2024) |

Partnered with Medtronic, with the incorporation of Abbott’s FreeStyle Libre technology and Medtronic’s automated insulin delivery (AID) system and smart insulin pens. |

|

Walmart Pharmacy (October 2024) |

Launched same-day pharmacy delivery |

How is the Over the Counter (OTC) Drugs Market Progressing?

• In June 2025, Amazon collaborated with Orange Health Labs to introduce at-home diagnostic services, including 1,000+ tests, fast sample collection, and digital reports.

• In May 2025, Dexcom, an American healthcare company, partnered with the Oura app, with the official launch of integration with Stelo, an FDA-cleared over-the-counter (OTC) glucose biosensor.

• In March 2025, Glenmark Pharmaceuticals launched constipation treatment medicine polyethylene glycol 3350, powder for solution, used in the US.

• In February 2025, Well Pharmacy, the UK’s leading independent pharmacy chain, unveiled its new Online Doctor service in partnership with Expert Health Ltd.

Over the Counter (OTC) Drugs Market: Segmentation

By Product Type

• Cough & Cold Products

• Analgesics

• Vitamin & Dietary Supplements

• Gastrointestinal Products

• Sleep Aids

• Otic Products

• Wart Removers

• Mouth Care Products

• Ophthalmic Products

• Botanicals

• Antacids

• Smoking Cessation Products

• Feminine Care

• Others

By Dosage Form

• Tablets

• Hard Capsules

• Powders

• Ointments

• Soft Capsules

• Liquids

• Others

By Route of Administration

• Oral

• Parenteral

• Topical

• Others

By Distribution Channel

• Drug Stores & Retail Pharmacies

• Hospital Pharmacies

• Online Pharmacies

By Region

• North America

• US

• Canada

• Asia Pacific

• China

• Japan

• India

• South Korea

• Thailand

• Europe

• Germany

• UK

• France

• Italy

• Spain

• Sweden

• Denmark

• Norway

• Latin America

• Brazil

• Mexico

• Argentina

• Middle East and Africa (MEA)

• South Africa

• UAE

• Saudi Arabia

• Kuwait

Access the full potential of the OTC Drugs Market with our in-depth, ready-to-use report: https://www.towardshealthcare.com/price/5429

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Gain access to the latest insights and statistics in the healthcare industry by subscribing to our Annual Membership. Stay updated on healthcare industry segmentation with detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead of the curve with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities in the dynamic world of healthcare: Get a Subscription

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire

For Latest Update Follow Us: https://www.linkedin.com/company/towards-healthcare

Browse More Insights of Towards Healthcare:

The over-the-counter (OTC) analgesics market is set to grow steadily, increasing from USD 31.74 billion in 2025 to USD 44.02 billion by 2034, at a CAGR of 3.7% over the forecast period.

The legal marijuana market is expected to witness explosive growth rising from USD 40.24 billion in 2025 to an impressive USD 135.06 billion by 2034, expanding at a robust CAGR of 14.4%.

The global cocaine intoxication treatment market is valued at USD 17.91 million in 2024, reaching USD 19 million in 2025, and is forecasted to hit USD 32.15 million by 2034, growing at a CAGR of 6.05%.

The strongyloidiasis treatment market is moving upward, growing from USD 1.1 billion in 2024 to USD 1.15 billion in 2025, and projected to reach USD 1.72 billion by 2034, at a CAGR of 4.5%.

The bronchitis treatment market will grow from USD 6.85 billion in 2024 to USD 7.21 billion in 2025, and is likely to reach USD 11.45 billion by 2034, expanding at a CAGR of 5.28%.

The artificial lung market is gaining traction, expected to rise from USD 2.51 billion in 2024 to USD 2.78 billion in 2025, and climb to USD 7.05 billion by 2034, with a strong CAGR of 10.84%.

The sandhoff disease treatment market is set to grow from USD 260 million in 2024 to USD 274.95 million in 2025, eventually reaching USD 456.42 million by 2034, at a CAGR of 5.75%.

The optic nerve atrophy treatment market is projected to increase from USD 2.53 billion in 2024 to USD 2.75 billion in 2025, and reach around USD 5.87 billion by 2034, growing at a CAGR of 8.85%.

The chronic disease treatment market is experiencing significant momentum, rising from USD 8.37 billion in 2024 to USD 9.74 billion in 2025, and is forecasted to hit USD 38.02 billion by 2034, with a rapid CAGR of 16.34%.

The facial feminization surgery market is on a notable growth path, with expectations of generating substantial revenues potentially reaching into the hundreds of millions between 2025 and 2034.