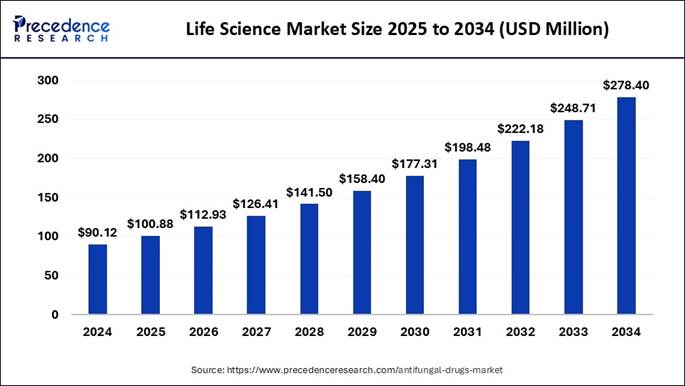

According to Precedence Research, the global life science market size will grow from USD 100.88 billion in 2025 to nearly USD 278.40 billion by 2034, with an expected CAGR of 11.94% from 2025 to 2034.

The life science market is experiencing rapid growth and is expected to reach approximately USD 112.93 billion in 2026, driven by the increasing prevalence of chronic and infectious diseases and the growing demand for advanced diagnostic and therapeutic solutions. The market is further expanding due to significant advancements in biotechnology and genomic research. The growing emphasis on personalized medicines and the adoption of innovative technology are projected to drive market growth in the coming years.

Note: This

report is readily available for immediate delivery. We can review it with you

in a meeting to ensure data reliability and quality for decision-making.

📥 Download Sample Pages for

Informed Decision-Making 👉 https://www.precedenceresearch.com/sample/6255

Life Science Market Key Takeaways

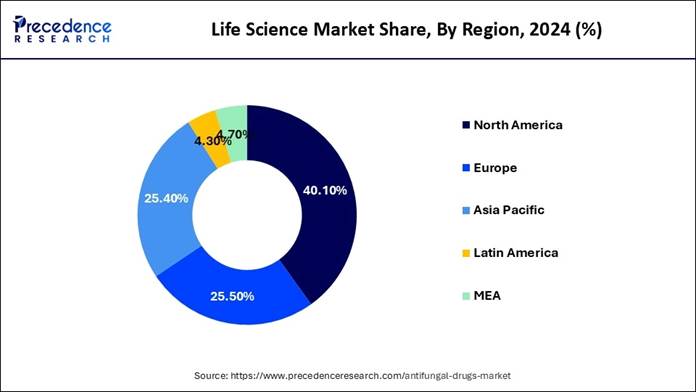

🔹North America accounted for the largest market share of 40.10% in 2024.

🔹Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

🔹By type, the biotechnology segment held the major market share in 2024.

🔹By type, the life science tools segment is growing at a significant CAGR between 2024 and 2034.

🔹By application, the drug discovery and development segment contributed to the highest market share in 2024.

🔹By application, the clinical trials segment is expected to grow at a notable CAGR from 2025 to 2034.

🔹By therapeutic area, the oncology segment held a largest market share in 2024.

🔹By therapeutic area, the immunology segment is expanding at a strong CAGR from 2025 to 2034.

🔹By end-user, the pharmaceutical companies segment generated the biggest market share in 2024.

🔹By end-user, the biotechnology companies segment is expected to grow at a fastest CAGR from 2025 to 2034.

Life Science Market Size and Forecast 2025 to 2034

→ Market Size in 2025: USD 100.88 Billion

→ Market Size in 2026: USD 112.93 Billion

→ Market Size in 2031: USD 198.48 Billion

→ Forecasted Market Size by 2034: USD 278.40 Billion

→ Global CAGR (2025-2034): 11.94%

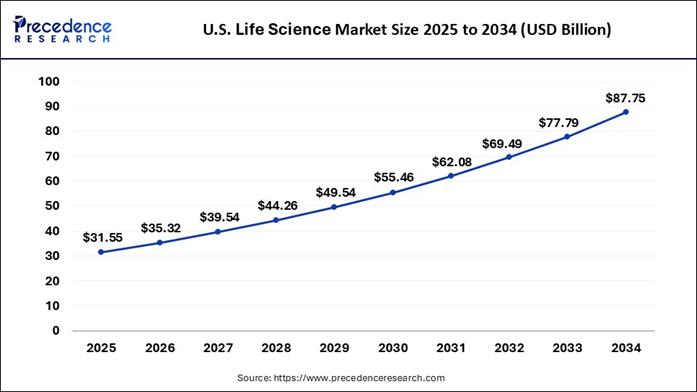

→ U.S. Market Size in 2025: USD 31.55 Billion

→ U.S. Market Size in 2026: USD 35.32 Billion

→ U.S. Market Size in 2034: USD 87.75.79 Billion

→ U.S. Market CAGR:

(2025-2034): 12.03%

→ Largest Market in 2024: North America

→ Fastest Growing Market: Asia Pacific

The Next Frontier: Life Sciences Powering the Future of Human Health

The life science market is anticipated to experience fast-paced growth in the coming years, akin to the sudden shift towards the improvisation of human health through technology and innovation in recent years. Moreover, factors such as advances in artificial intelligence, genetics, and data analytics are gaining traction with investment firms and analysts in recent years.

Major Applications in Life Sciences

|

Application Area |

Description |

Notable Developments |

|

Drug Discovery & Development |

Utilization of AI and big data to accelerate the identification of potential drug candidates. |

Increased adoption of next-generation AI by biopharma. |

|

Diagnostics & Medical Imaging |

Advanced imaging techniques and AI algorithms for early disease detection. |

Enhanced precision in identifying conditions like cancer and neurological disorders. |

|

Genomics & Precision Medicine |

Tailoring medical treatment to individual genetic profiles. |

Growth in personalized therapies and genomic sequencing technologies. |

|

Biomanufacturing & Bioprocessing |

Production of biologics, including vaccines and monoclonal antibodies. |

Advancements in cell culture and fermentation processes. |

|

Digital Health & Remote Monitoring |

Use of wearable devices and telemedicine for patient monitoring. |

Expansion of digital health platforms and mobile health applications. |

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

Healing Through Data: AI Unlocks the Next Era of Personalized Care

The development of AI-driven personalized medicine may drive substantial financial gains in the manufacturing sector during the forecast period. Moreover, by analyzing the major and rare genetic data, lifestyle factors, and health records, artificial intelligence has created lucrative opportunities in the sector nowadays. Also, the shift towards early disease detection has gained global attention in recent years

Recent Breakthroughs in Life Science Industry:

🔸Artificial Intelligence in Drug Discovery: AI is increasingly used to automate the generation and review of regulatory documents, simplifying the submission process and enhancing regulatory intelligence.

🔸Brain-Computer Interfaces (BCIs): Rapid advancements in BCI technology, allowing patients to control digital interfaces with their thoughts.

🔸Longevity and Wellness Investments: Significant funding initiatives are supporting startups focused on longevity technologies within medical, nutrition, well-being, and movement sectors.

Also Read 👉 Artificial Intelligence In Drug Discovery Market Size to Surpass USD 16.52 Bn by 2034

Major Limitations in Life Science Market: High-cost Barriers Slow Innovation in Advancements

The high cost of research and long product approval timelines are expected to hamper the industry growth in the coming years. Developing new drugs or genetic therapies can take more than ten years and cost billions of dollars. Many smaller firms struggle with limited funding, and regulatory processes are complex. Data privacy and ethical concerns around genetic manipulation also slow adoption.

Life Science Market’s Regulatory Landscape: Global Regulations

|

Country / Region |

Regulatory Body |

Key Regulations |

Focus Areas |

Notable Notes |

|

United States |

Food and Drug Administration (FDA). |

Food, Drug, and Cosmetic Act (FD&C Act) |

Product Safety and Efficacy |

Regulates and approves drugs, biologics, and medical devices. |

|

European Union |

European Medicines Agency (EMA) |

EU Clinical Trials Regulation (EU No 536/2014) |

Safety Monitoring |

Continuously monitors the safety of all authorized medicines throughout their lifecycle. |

|

China |

National Medical Products Administration (NMPA). |

"Drug Administration Law (DAL) |

Accelerated Innovation |

Prioritizes accelerated review for innovative and urgently needed drugs and medical devices. |

Browse Detailed Insight 👉 https://www.precedenceresearch.com/life-science-market

Case Study: AI-Driven Drug Discovery Revolutionizing Oncology Research

🔸Company: Roche Holding AG

🔸Segment: Drug Discovery &

Development

🔸Region: North America

Background:

The growing complexity of

cancer biology

and the limitations of traditional drug discovery methods have driven life

science companies toward artificial intelligence (AI) integration. Roche

Holding AG,

a global leader in pharmaceuticals and diagnostics, has adopted AI-based

platforms to enhance its oncology research and drug discovery process. The

initiative aims to reduce development time, improve clinical trial accuracy, and boost the

success rate of novel cancer therapies.

Challenge:

Roche faced increasing R&D expenditure and long development timelines—averaging

10–12 years—from concept to market approval. Traditional methods often led to

inefficiencies in molecule identification and patient trial selection, delaying

the introduction of life-saving treatments. Additionally, the growing volume of

genomic and clinical data presented an overwhelming challenge for manual data

processing and decision-making.

Solution

Implementation:

To overcome these barriers, Roche implemented an AI-powered discovery platform

in collaboration with NVIDIA’s Clara Discovery and BioSymetrics. The system

leverages machine learning algorithms to analyze multi-omics datasets,

including genomics, proteomics, and metabolomics. By integrating

patient-derived tumor models and bioinformatics tools, the platform predicts

molecular interactions and optimizes compound selection for specific cancer

targets.

AI also enhanced Roche’s clinical trial management through predictive analytics. The company deployed AI-driven tools to identify ideal patient cohorts, reducing attrition rates during trials. This approach allowed real-time monitoring of patient responses, enabling adaptive modifications to trial protocols.

Results:

🔸Drug Development Efficiency: Roche reduced early-stage drug screening time by nearly 35%, accelerating the identification of promising compounds for oncology pipelines.

🔸Clinical Trial Optimization: AI algorithms helped improve patient stratification accuracy by 40%, resulting in more precise and faster trials.

🔸Cost Reduction: The digital transformation led to an estimated 20% reduction in R&D costs, driven by minimized trial delays and optimized molecular targeting.

🔸Innovation Outcome: In 2024, Roche successfully advanced three AI-identified oncology candidates into Phase II trials, with two demonstrating significant efficacy in targeting HER2-positive cancers.

Strategic

Implications:

This case exemplifies how AI is redefining the global life science market. As

Roche’s adoption demonstrates, data integration across genomics, imaging, and

clinical datasets enhances predictive precision, creating a competitive

advantage in oncology research.

Moreover, this success has encouraged broader collaborations across academia, biotech startups, and tech firms—demonstrating how AI-driven life science innovation is driving the next era of personalized medicine.

Key Takeaways:

🔸AI adoption in life sciences accelerates R&D timelines and improves treatment accuracy.

🔸Data analytics transforms oncology research by connecting genomic insights with patient outcomes.

🔸Strategic partnerships between pharma, tech, and biotech firms are central to future innovation in the life science industry.

🔸The success of Roche’s case signals a broader market shift, aligning with the global trend of 11.94% CAGR growth in life sciences from 2025–2034, as noted by Precedence Research.

Conclusion:

Roche’s AI integration illustrates the transformative potential of digital

health and advanced analytics within life sciences. The case highlights how

innovation at the intersection of biotechnology, AI, and clinical research

accelerates the delivery of effective therapies—validating the forecasted rise

of the global life science market to USD 278.40 billion by 2034.

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Life Science Market Report Scope

|

Report Coverage |

Details |

|

Market Size in 2025 |

USD 100.88 Billion |

|

Market Size in 2026 |

USD 112.93 Billion |

|

Market Size by 2034 |

USD 278.40 Billion |

|

CAGR (2025–2034) |

11.94% |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2034 |

|

Dominating Region in 2024 |

North America |

|

Fastest Growing Region (2025–2034) |

Asia Pacific |

|

Segments Covered |

Type, Application, Therapeutic Areas, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

|

Leading Segment (By Type) |

Biotechnology |

|

Fastest Growing Segment (By Type) |

Life Science Tools |

|

Leading Segment (By Application) |

Drug Discovery & Development |

|

Fastest Growing Segment (By Application) |

Clinical Trials |

|

Leading Segment (By Therapeutic Area) |

Oncology |

|

Fastest Growing Segment (By Therapeutic Area) |

Immunology |

|

Leading Segment (By End-User) |

Pharmaceutical Companies |

|

Fastest Growing Segment (By End-User) |

Biotechnology Companies |

Don’t Miss Out! | Access Exclusive Market Insights – Now at USD 3,900

(Save USD 1,000) 👉 https://www.precedenceresearch.com/checkout/6255

Life Science Market Key Regional Analysis:

How Big is the U.S. Life Science Market?

According to Precedence Research, the U.S. life science market size is calculated at USD 31.55 billion in 2025 and is estimated to increase from USD 35.32 billion in 2026 to nearly USD 87.75 billion by 2034, growing at a healthy CAGR of 12.03% from 2025 to 2034.

U.S. Life Science Market Trends: A Powerhouse of Innovation and Investment

The United States remains the undisputed global hub for life science innovation, research, and commercialization. The country’s leadership stems from its robust ecosystem of biotechnology giants, pharmaceutical powerhouses, academic research institutions, and digital health innovators. With a strong foundation of government support, private sector investment, and advanced healthcare infrastructure, the U.S. life science market is entering a phase of unprecedented expansion.

A significant driver of this growth is the country’s massive R&D expenditure, which accounts for nearly 40% of global biopharma research funding. The National Institutes of Health (NIH) continues to play a pivotal role, allocating billions annually toward genomics, precision medicine, and advanced therapeutics. Simultaneously, venture capital inflows into biotech startups have reached record levels, fueling innovation across cell and gene therapy, immuno-oncology, and biomanufacturing.

The integration of artificial intelligence, machine learning, and data analytics in the life sciences sector has transformed traditional research workflows into intelligent, automated ecosystems. U.S.-based companies such as Thermo Fisher Scientific, Illumina, and Pfizer are pioneering AI-enabled platforms that accelerate drug discovery, optimize clinical trials, and enhance patient outcomes. Moreover, partnerships between tech leaders like Google Cloud and healthcare organizations are enabling scalable solutions for precision medicine and diagnostics.

The biomanufacturing revolution is another cornerstone of the U.S. market. The government’s focus on strengthening domestic production of biologics and advanced therapeutics has resulted in new biomanufacturing facilities and public-private partnerships under initiatives like the Biomedical Advanced Research and Development Authority (BARDA). These efforts not only enhance supply chain resilience but also establish the U.S. as the preferred location for large-scale biopharma production.

The country’s regulatory leadership, particularly through the U.S. Food and Drug Administration (FDA), ensures that innovations reach the market efficiently without compromising patient safety. The FDA’s adaptive regulatory frameworks for digital health, AI-based diagnostics, and gene therapies are creating a favorable environment for product approvals and market entry.

Additionally, personalized medicine and genomics continue to gain momentum. The increasing affordability of genetic testing and next-generation sequencing (NGS) has enabled pharmaceutical companies to design highly targeted therapies. The precision medicine movement—supported by U.S. institutions such as the Broad Institute and the Mayo Clinic—has shifted the healthcare paradigm from treatment to prevention and early intervention.

The expansion of life science clusters such as Boston-Cambridge, the San Francisco Bay Area, and North Carolina’s Research Triangle Park reinforces the country’s dominance. These hubs attract global talent and investment, with integrated academic-industry collaborations that accelerate innovation cycles.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/6255

Why North America Dominates the Global Life Science Market: The Innovation Engine of the World

North America stands as the epicenter of the global life science industry, accounting for the largest market share of 40.10% in 24 and driving the majority of global R&D breakthroughs. The region’s dominance is built on a unique combination of scientific leadership, technological maturity, and financial strength that together create a thriving innovation ecosystem.

A core pillar of this leadership is its advanced R&D infrastructure, supported by globally recognized research universities, dedicated biotech clusters, and strategic public-private collaborations. The United States and Canada collectively host thousands of life science research institutions and incubators, including the Massachusetts Institute of Technology (MIT), Stanford University, and the University of Toronto — all of which play a pivotal role in generating intellectual property and spinning off high-impact startups.

Massive healthcare and R&D investments further strengthen North America’s position. The region consistently leads in both public and private sector spending, with the U.S. alone accounting for over 45% of global biopharmaceutical R&D expenditure. Initiatives such as the U.S. NIH’s “All of Us” research program and Canada’s Strategic Innovation Fund have fueled innovation in precision medicine, genomics, and digital health. This heavy investment has accelerated the translation of scientific discovery into commercial therapies and technologies.

North America also benefits from a mature clinical trial ecosystem. The region’s regulatory clarity, robust ethical frameworks, and access to diverse patient populations allow for faster and more reliable trial outcomes. The U.S. Food and Drug Administration (FDA) and Health Canada maintain stringent yet adaptive regulations that encourage innovation while maintaining safety standards—making the region a preferred destination for global clinical research.

Another defining advantage is the strong presence of global pharmaceutical and biotech leaders, including Pfizer, Johnson & Johnson, Amgen, Thermo Fisher Scientific, and Gilead Sciences. These companies continually invest in next-generation technologies such as cell and gene therapy, AI-driven diagnostics, and biomanufacturing facilities. Their ongoing product launches and collaborations with startups are reshaping the competitive landscape of the global life science market.

Additionally, government support and innovation-driven policies have created a fertile environment for sustained growth. The U.S. government’s commitment to biomedical innovation through initiatives like Operation Warp Speed and the Advanced Research Projects Agency for Health (ARPA-H) has accelerated the commercialization of cutting-edge medical solutions. Meanwhile, Canada’s focus on biomanufacturing capacity expansion and life sciences talent development underscores the region’s long-term strategic vision.

The region also leads in digital transformation within healthcare, integrating artificial intelligence, big data analytics, and telehealth into mainstream medical systems. These advancements are improving disease prediction, treatment personalization, and patient engagement, reinforcing North America’s technological dominance.

Is Asia the Next Global Hub for Life Science Innovation? The Rise of the

Eastern Powerhouse

Asia Pacific is rapidly transforming from a manufacturing-driven region into a strategic innovation hub for global life sciences. With accelerating investments in biotechnology, pharmaceuticals, and healthcare technology, the region is poised to reshape the global competitive landscape. The combination of cutting-edge research, a strong talent base, and favorable government policies has positioned Asia as the next frontier for life science breakthroughs.

A key growth catalyst lies in the surge of biotech innovation across countries such as China, Japan, South Korea, India, and Singapore. These nations have made significant strides in developing world-class research ecosystems and translational medicine programs. China’s National Medical Products Administration (NMPA) has streamlined approval pathways to encourage faster commercialization of new drugs and devices, while Japan and South Korea continue to lead in regenerative medicine, cell therapy, and precision healthcare technologies.

The expansion of healthcare infrastructure across Asia Pacific further amplifies market potential. Rising healthcare expenditure, the construction of new research hospitals, and the integration of digital health solutions are enhancing patient access to advanced medical services. India’s growing network of biotechnology parks and South Korea’s bio-clusters—such as the Osong Bio Valley—illustrate how regional ecosystems are fostering innovation through collaboration between academia, startups, and multinational corporations.

In addition, Asia’s growing role in clinical trials is reshaping the global R&D landscape. The region offers access to diverse patient populations, lower operational costs, and faster enrollment rates, making it an attractive destination for global pharmaceutical firms. Countries like China, India, and Australia are now among the top markets for global clinical research organizations (CROs), supporting drug discovery, development, and post-market surveillance.

Government initiatives across the region are also fueling long-term growth. Programs like China’s “Healthy China 2030,” India’s “National Biopharma Mission,” and Japan’s “Society 5.0” are driving innovation through increased funding, talent development, and cross-border partnerships. These policies are transforming Asia into a self-sustaining ecosystem capable of developing and exporting advanced life science technologies.

The digital transformation of healthcare is another defining factor behind Asia’s emergence as a global hub. With rapid adoption of AI, big data analytics, cloud computing, and wearable technologies, Asia Pacific is bridging the gap between clinical research and personalized care. Singapore, for instance, has become a leading center for AI-driven precision medicine, while India’s digital health startups are pioneering telemedicine and genomic diagnostics for underserved populations.

Multinational companies are recognizing Asia’s strategic value. Global players such as Roche, Pfizer, and Novartis are expanding their R&D and manufacturing presence across China, India, and Singapore to leverage cost advantages and innovation potential. Simultaneously, homegrown firms like WuXi AppTec, Biocon, and Takeda are emerging as influential global players, competing directly with Western counterparts.

✚ Related Topics You May Find Useful:

➡️ Life Science Analytics Market: Explore how data-driven insights are reshaping R&D, clinical trials, and patient outcomes in the life sciences industry.

➡️ Life Science Instrumentation Market: Understand how technological innovation in analytical tools and precision instruments is advancing molecular and biochemical research.

➡️ Life Sciences BPO Market: Examine how outsourcing in clinical, regulatory, and R&D functions is optimizing operational efficiency for biotech and pharma companies.

➡️ AI in Life Science Analytics Market: Discover how artificial intelligence is accelerating drug discovery, diagnostics, and personalized treatment planning.

➡️ Life Science Logistics Market: Analyze how temperature-controlled logistics and digital tracking systems are transforming biopharmaceutical supply chains.

➡️ Life Science Chemical and Instrumentation Market: Learn how integrated chemical solutions and analytical instrumentation are powering next-generation laboratory research.

➡️ NLP in Healthcare and Life Sciences Market: See how natural language processing is unlocking insights from medical data and scientific literature for faster decision-making.

➡️ Generative AI in Life Sciences Market: Find out how generative AI models are revolutionizing molecular design, protein engineering, and virtual experimentation.

➡️ Next Generation AI in Life Sciences Market: Track how advanced AI architectures are redefining diagnostics, clinical intelligence, and predictive modeling in life sciences.

➡️ Artificial Intelligence in Life Sciences Market: Gain insight into how AI-driven automation is improving research accuracy, trial efficiency, and patient outcomes.

➡️ Biotechnology Market: Examine how biotechnological breakthroughs are driving innovation across therapeutics, genomics, and sustainable bio-manufacturing.

Life Science Market Segmentation Analysis:

Type Analysis:

Why Did the Biotechnology Segment Dominate the Market in 2024?

The biotechnology segment held the largest share of the life science market in 2024, owing to its coverage of the biggest industrial and medical breakthroughs. Moreover, by helping scientists to work faster and more precisely than traditional equipment, the biotech tools have gained major industry attention in recent years.

Application Type Analysis:

How the Drug Discovery and Development Segment Maintains Its Dominance in the Current Industry?

The drug discovery and development segment maintained the largest share of the market in 2024 because every major pharmaceutical and biotech company relies on it to create new treatments. Modern tools like Al, genomics, and molecular modeling help researchers find effective drugs faster and at lower cost.

The life science tools sector is projected to achieve the highest CAGR over the forecast period. This growth is fueled by swift progress in genomics, proteomics, and cell biology, which is increasing the need for diverse reagents in research and development. Innovations in biotechnology and genomics, the expansion of personalized medicine, and rising demand for biopharmaceutical products are key drivers supporting the segment’s growth.

Therapeutic Area Analysis:

The oncology segment has gained a major share of the life science market in 2024, because cancer remains one of the world's biggest health challenges. There's massive demand for better, faster, and safer treatments. Advances in immunotherapy, targeted drugs, and precision diagnostics have revolutionized cancer care.

The clinical trials segment is anticipated to register a strong CAGR during the forecast period, driven by the rising demand for innovative therapies. The increasing incidence of chronic conditions such as cancer, diabetes, and cardiovascular diseases is fueling the need for new and effective treatments, thereby boosting the requirement for clinical trials. Additionally, advancements in medical research are facilitating the development of novel therapies, further increasing the demand for trials to assess their safety and effectiveness.

By End User Analysis:

The pharmaceutical company segment maintained the largest share of the market in 2024 because it uses life science research directly to develop and commercialize new medicines. They invest heavily in R&D labs, clinical trials, and advanced technology to speed up innovation. Many pharma firms partner with biotech startups and academic labs to turn discoveries into market-ready drugs.

The immunology segment is expected to experience the fastest growth over the forecast period, driven by the rising prevalence of autoimmune disorders, advancements in immunotherapy, and growing recognition of the immune system’s role in disease treatment. These factors are also prompting substantial investments in research and development, fostering innovation and the introduction of new therapies.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Top Companies in Life Science Market:

🔹 Thermo Fisher Scientific Inc. – Provides analytical instruments, laboratory equipment, reagents, and consumables for research and diagnostics.

🔹 Danaher Corporation – Offers life sciences tools, diagnostic equipment, and biotechnology solutions.

🔹 Roche Holding AG – Specializes in pharmaceuticals and diagnostics, particularly in oncology and personalized healthcare.

🔹 Merck KGaA (MilliporeSigma) – Supplies chemicals, lab materials, and biopharmaceutical manufacturing solutions.

🔹 Pfizer Inc. – Focuses on innovative pharmaceuticals and vaccines for various therapeutic areas.

🔹 Johnson & Johnson – Develops pharmaceuticals, medical devices, and consumer health products.

🔹 Agilent Technologies Inc. – Provides analytical instruments, software, and laboratory services for life sciences and diagnostics.

🔹 Illumina, Inc. – Leads in genomic sequencing and array-based solutions for genetic analysis.

🔹 Becton, Dickinson and Company (BD) – Produces medical devices, laboratory equipment, and diagnostic systems.

🔹 Bio-Rad Laboratories, Inc. – Offers life science research and clinical diagnostic products and systems.

🔹 Abbott Laboratories – Provides diagnostics, medical devices, nutrition, and branded generic pharmaceuticals.

🔹 GE HealthCare – Supplies medical imaging, monitoring, biopharmaceutical manufacturing, and diagnostics technologies.

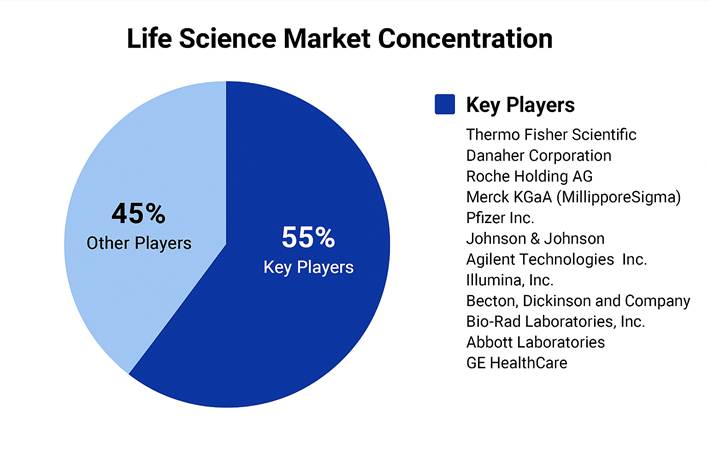

Life Science Market Concentration: Competitive Landscape Overview

The global life science market is moderately to highly consolidated, characterized by the strong presence of multinational corporations that dominate product innovation, research funding, and technological integration. The market concentration is primarily distributed among a handful of companies—Thermo Fisher Scientific, Danaher Corporation, Roche Holding AG, and Merck KGaA—each commanding substantial market shares through diversified portfolios and global R&D networks.

|

Market Concentration Metric |

Details |

|

Market Structure |

Moderately to Highly Consolidated |

|

Top 5 Companies’ Combined Share (Estimated) |

~45%–55% of Global Market Revenue |

|

Market Leaders (Tier 1) |

Thermo Fisher Scientific Inc., Danaher Corporation, Roche Holding AG, Merck KGaA (MilliporeSigma), Pfizer Inc. |

|

Emerging Innovators (Tier 2) |

Agilent Technologies, Illumina Inc., BD (Becton, Dickinson and Company), Bio-Rad Laboratories Inc., Abbott Laboratories, GE HealthCare |

|

Market Focus |

Biotechnology tools, pharmaceuticals, diagnostics, genomics, and life science instrumentation |

|

Competitive Drivers |

R&D intensity, mergers & acquisitions, digital transformation, global expansion, and integration of AI and genomics |

|

Technological Edge |

Companies are leveraging AI, bioinformatics, and automation in lab workflows to accelerate drug discovery and biomanufacturing efficiency |

|

Recent Trend in Concentration |

Slightly increasing due to large-scale acquisitions and strategic collaborations by top players (e.g., Thermo Fisher’s acquisitions, Danaher’s Cytiva deal) |

|

Regional Concentration |

North America and Europe remain primary bases of operation; Asia-Pacific emerging as innovation and production hub |

|

Barriers to Entry |

High capital investment, regulatory complexities, and intellectual property intensity |

|

Market Dynamics Outlook |

Ongoing consolidation expected, with established players investing heavily in emerging biotech startups and digital platforms to expand market dominance |

The life

science market concentration reflects a strategically competitive but

innovation-driven environment. Large corporations dominate the upstream

research tools and downstream diagnostic applications, while mid-sized biotech

firms continue to inject innovation through specialization. The sustained

M&A activity and integration of AI-based life science tools indicate that

market power will increasingly concentrate among companies with cross-domain

capabilities—bridging laboratory technology, pharmaceuticals, and digital

health.

→

Detailed competitive intelligence and share breakdown available in the Global

Deep Dive Report (USD 3,900 – Limited-Time Offer) @ https://www.precedenceresearch.com/checkout/6255

What is Going Around the Globe?

🔹 In January 2025, MaxisIT announced the release of Site Copilot, the latest innovation built on the cutting-edge DTect AI platform under MaxisIT’s Agentic AI suite to address critical challenges faced by clinical trial sites, such as regulatory compliance, quality management, and patient engagement by streamlining workflows and improving sponsor-site collaboration to compliance issues, and risks in data quality and patient engagement. (Source: https://www.maxisit.com)

🔹In April 2025, Abu Dhabi launched the

groundbreaking life sciences cluster, reinforcing its position as a global hub

for biotechnology, MedTech, and digital health. Developed by the Abu Dhabi

Department of Economic Development, Abu Dhabi Investment Office (ADIO), and the

Department of Health, Abu Dhabi, the Health, Endurance, Longevity, and Medicine

(HELM) cluster is designed to drive healthcare innovation by attracting

international investment and delivering lasting benefits to global populations.

(Source: https://www.businesswire.com)

Life Science Market Segmentation:

By Type

🔹 Biotechnology

• Genomics

• Proteomics

• Metabolomics

• Bioinformatics

🔹Pharmaceuticals

• Branded Drugs

• Generic Drugs

• Biosimilars

🔹Medical Devices

• Diagnostics

• Therapeutic Devices

• Wearables

🔹Life Science Tools

• Instruments

• Reagents & Consumables

• Analytical Tools

🔹Digital Health Solutions

• AI in Life Sciences

• Cloud-based Solutions

• Health Informatics

By Applications

🔹Drug Discovery and Development

🔹Diagnostics

🔹Therapeutics

🔹Clinical Trials

🔹Research & Development

By Therapeutic Areas

🔹Oncology

🔹Cardiology

🔹Neurology

🔹Immunology

🔹Rare Diseases

🔹Infectious Diseases

🔹Others

By End-User

🔹Pharmaceutical Companies

🔹Biotechnology Companies

🔹Academic & Research Institutions

🔹Hospitals & Clinics

🔹Others (Contract Research Organizations (CROs), and Government Organizations)

By Region

🔹North America

🔹Europe

🔹Asia-Pacific

🔹Latin America

🔹Middle East and Africa

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or Asia Pacific.

Don’t Miss Out! | Instant Access to This Exclusive Report 👉 https://www.precedenceresearch.com/checkout/6255

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a global market intelligence and consulting powerhouse, dedicated to unlocking deep strategic insights that drive innovation and transformation. With a laser focus on the dynamic world of life sciences, we specialize in decoding the complexities of cell and gene therapy, drug development, and oncology markets, helping our clients stay ahead in some of the most cutting-edge and high-stakes domains in healthcare. Our expertise spans across the biotech and pharmaceutical ecosystem, serving innovators, investors, and institutions that are redefining what’s possible in regenerative medicine, cancer care, precision therapeutics, and beyond.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Nova One Advisor

Get Recent News 👉 https://www.precedenceresearch.com/news

For Latest Update Follow Us: