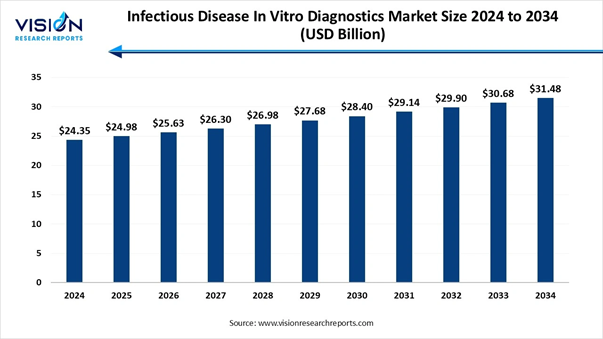

The global infectious disease in vitro diagnostics market size was evaluated at USD 24.35 billion in 2024 and is anticipated to increase from USD 24.98 billion in 2025 to reach around USD 31.48 billion by 2034, growing at a CAGR of 2.6% from 2025 to 2034, a study published by Vision Research Reports.

The growth is driven by the developing worldwide occurrence of infectious diseases and the growth in diagnostics technologies. Other crucial factors include the rising geriatric population, the growth of antimicrobial resistance, and readiness for future pandemics.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Preview the Report Before You Buy – Get Sample Pages 👉 https://www.visionresearchreports.com/report/sample/41672

What is Infectious Disease in Vitro Diagnostics?

Infectious diseases are illnesses that occur when small living beings enter the body and multiply. Viruses, bacteria, fungi, and parasites are instances of organisms that can cause illness. Several organisms live in and on the body. Some of the infectious diseases can be transmitted from one person to another.

Symptoms of the infectious diseases change depending on the cause of the infection. But they frequently include tiredness and fever. Home and rest remedies can clear up severe infections. But other infections can be dangerous, and diagnosis could include hospital care.

In vitro diagnostics tests are frequently referred to as IVD tests that play an important role in classifying, managing, and tracking diseases. The word” in vitro” literally means “in glass,” which refers to tests that are performed outside the human body, generally in a controlled laboratory setting.

Infectious Disease in Vitro Diagnostics Market Key Highlights:

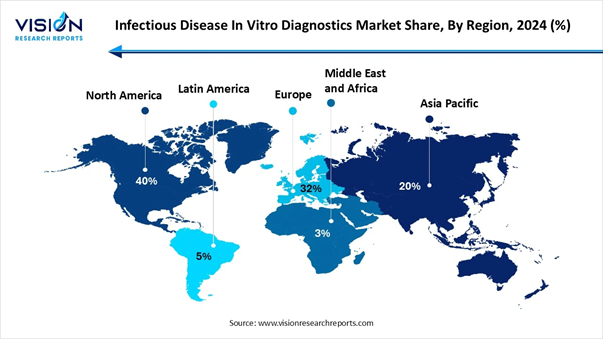

• By region, North America held the market with largest share of 40% in 2024.

• By region, Asia Pacific Infectious Disease In Vitro Diagnostics market is projected to witness the fastest CAGR from 2025 to 2034.

• By product, the reagents segment led the market in 2024, contributing the largest revenue share of 68%.

• By technology, the immunoassay segment contributed the largest market share of 36% in 2024.

• By technology, the microbiology technology segment is projected to record the fastest CAGR during the forecast period.

• By application, the COVID-19 application segment registered the maximum market share of 15% in 2024.

• By application, the HIV segment is anticipated to grow at the noteworthy CAGR from 2025 to 2034.

• By test location, central laboratories dominated in 2024, capturing 49% of the overall market share.

Latest Trends in the Infectious Disease in Vitro Diagnostics Market:

• Point-of-Care Testing: Rapid and portable testing options for usage at or convenient to the patient’s bedside are a main focus, which lowers updating times and developing results, particularly in emergency and remote settings. At the time of the COVID-19 PANDEMIC, there was an urgent need for developed, accurate, fast, and reliable POCT.

• Hub and spoke models: There is a trend towards more tailored, hub and spoke testing models that enable IVD to be personalized to particular or regional needs and demands.

• Decentralized and home-based testing: The move towards over-the-counter and home-based testing became a main trend during the pandemic, which developed patient ease and lowered the load on the healthcare facilities. Instance count, easy-to-use self-test kits, and home-collection kits.

• Liquid biopsy: This non-intrusive procedure tracks bodily fluids like blood in order to detect diseases that include infectious ones. It serves as a less invasive alteration to regular biopsy methods.

• Climate Change: Climate change is contributing to the spread of vector-borne diseases, such as dengue, which are usually found in tropical regions of the world, including Arizona and California, particularly with no travel history.

• Potential for immune memory loss: Big measles outbreaks can be among the top numbers of other infections because measles wipes out immune memory for other infections.

Discover the Full Market Insights 👉

https://www.visionresearchreports.com/infectious-disease-in-vitro-diagnostics-market/41672

Infectious Disease in vitro diagnostics Market: Major Insights in 2025

|

Category |

Details |

|

Major Applications |

IVDs assist both quantitative and qualitative analysis. Procedures like as enzyme-linked immunosorbent assay (ELISA), polymerase chain reaction and next-generation sequencing that enables laboratories to manage particular pathogens within hours instead of other days. |

|

Market Potential |

It is projected at a CAGR of USD 28.05 billion in year 2030 as the drivers measure growing prevalence of infectious diseases like hepatitis,HIV and developments in molecular diagnostic like NGS and PCr and rising urge for quick point-of-care testing. |

|

Key Strategic Drivers |

The main strategic driver of the infectious disease in vitro diagnostics market are a integration of technological inventions, public health demands and developing healthcare models. The COVID-PANDEMIC mainly developed several of these drivers , that highlighted the complicated importance of accurate, fast and accessible diagnostics tools and machines. |

|

Critical Challenges |

The critical challenges for the infectious disease in vitro diagnostics count technical restrictions, hurdles linked to accessibility , logistical and regulatory complications and developing cybersecurity threats. |

|

Regional Momentum |

The regional momentum of infectious disease in vitro diagnostics displays an move ,with the Asia -Pacific region developing as the fastest -developing market due to growing healthcare infrastructure and rising infectious disease commonness ,as while North America tracks the biggest market share which is driven by high level technology and strong R&D. |

Infectious Disease In Vitro Diagnostics Market Dynamics

Opportunity

What is the Market Opportunity for the Infectious Disease In Vitro Diagnostics Market?

There is a trend towards tailored medicine, which counts personalising treatment plans to a particular's genetic makeup and disease profile, that motivates the urge for IVD tests which can identify specific biomarkers or genetic variants linked with several diseases. Organizations that can grow inventive tests that precisely identify these biomarkers or genetic variants are predicted to experience main growth possibilities in the future.

On the other hand, blending of digital health technologies, such as mobile health apps, artificial intelligence, and wearable sensors, is making new opportunities for the IVD organisations in order to make inventive diagnostics tests which can be used in conjunction with these technologies. For example, digital health technologies could be utilised to track disease progression or provide diagnostics feedback in real-time that delivers clinicians with valuable insights into patient health.

Key Challenges

What is the Limitation for the Infectious Disease In Vitro Diagnostics Market?

Acceptance risk is at a very high level in the in vitro diagnostics sector, as it needs huge validation and regulatory approval before they are disclosed in the industry. Furthermore, healthcare providers and patients may be unwilling to accept new IVD products or the technologies that pose issues linked to price, reliability, and accuracy, too. If a new product or technology fails to earn a huge spread of adoption, it can result in financial losses for the producer and restricted advantages for the patients.

Technological Advancements in Infectious Disease in Vitro Diagnostics Market

Biosensors have developed as a powerful machine for the early detection of infectious diseases that delivers sensitive, rapid, and cost-effective diagnostics. These devices mix biological recognition characteristics with physicochemical transducers in order to check pathogens with high sensitivity and specificity. The growth of biosensors has updated infectious disease diagnostics, specifically in resource-limited settings, in which regular methods such as polymerase chain reaction (PCR) and the enzyme-linked immunosorbent assay (ELISA) can be inaccessible.

Infectious Disease In Vitro Diagnostics Market Report Coverage

|

Report Attribute |

Key Statistics |

|

Market Size in 2025 |

USD 24.98 Billion |

|

Market Size in 2026 |

USD 25.63 Billion |

|

Market Size in 2030 |

USD 28.40 Billion |

|

Market Size in 2032 |

USD 29.90 Billion |

|

Market Size by 2034 |

USD 31.48 Billion |

|

Growth rate from 2025 to 2034 |

CAGR of 2.6% |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2034 |

|

Segments Covered |

By Product, By Technology, By Application, By Test Location |

|

Companies Covered |

Roche Diagnostics, Abbott Laboratories, Siemens Healthineers, bioMérieux SA, Thermo Fisher Scientific Inc., Hologic, Inc., Qiagen N.V., Becton, Dickinson and Company (BD), Luminex Corporation, and Danaher Corporation. |

For Orders or Inquiries, Don’t Hesitate to Reach Out: sales@visionresearchreports.com

Infectious Disease In Vitro Diagnostics Market Regional Analysis

How did the North America Dominate the in Vitro Diagnostics Market for Infectious Diseases?

The North America region has several trends in infectious diseases in the United States and has displayed both issues and development as Artificial Intelligence is making major strides in the industry of liquid biopsy, as featured in the United States region. The AI machines that copy human intelligence with the assistance of reasoning, learning, and self-correction are proving to be highly smooth in terms of surgical and diagnostics interventions.

Particularly, AI is updating liquid biopsy in vitro diagnostics by developing early disease checking, real-time monitoring, and tailored medicine, too. By checking biomarkers such as circulating tumour DNA (cTDNA) and extracellular vesicles from non-invasive samples, like in blood, the AI-driven algorithms have created data analysis and predictive precision.

With instance to this,

• In the year 2025, the number of seasonal influenza cases reached a record high. In early May, an estimated 480,000 confirmed influenza cases were officially reported in the United States, with more than 96% of them among influenza A.

• Canada has also witnessed an incredible development in influenza infection rates, specifically in February and March, as the number of latest weekly influenza cases in Canada has reached tens of thousands and reached the peak in the 2023 -2024 flu season.

Canada: Key Growth Drivers in the Infectious Disease in Vitro Diagnostics Market:

• Advanced molecular diagnostics: Technologies like as Polymerase Chain Reaction (PCR) and Next-Generation Sequencing are becoming more smooth, cost-effective, and fragile too. These stages allow quicker, accurate pathogen identification that frequently tracks multiple pathogens simultaneously.

• Integration of AI tools and Digital: The acceptance of artificial intelligence and machine learning is developing the accuracy and speed of data analysis. The AI-powered algorithms are utilised in predictive analytics and digital technology in order to develop diagnostics workflows.

• Shift to point-of-care testing: There is a rising urge for fast, decentralized diagnostics that can be managed outside the regular laboratory settings, like ambulances, clinics, and at home too. POC Technologies serve faster-changing periods and facilitate quicker clinical decisions.

• Homecare and self-testing: Inventions like at-home HPV and other self-collection kits are enabling patients to have a more active role in their health management, as they make a new and fast-growing segment in the industry.

• Healthcare system modernization: Government initiatives are concentrated on stretching and updating healthcare potential, particularly in underserved regions. This counts funding in high-level diagnostics stages and cloud-linked laboratory systems.

Why is Asia Pacific the Fastest-Growing Region in the Market?

The Asia Pacific region is the main trend as it shows the development of infectious diseases that include the latest developing pathogens and the re-development of previously generated ones. This is being driven by an integration of dense populations, environmental updates, and rapid urbanization, like climate change and deforestation, too. While the mortality rates have improved in some spaces, like the complete example of communicable diseases, they remain high, specifically for zoonotic diseases and vector-borne diseases, too.

This region is a main hotspot for zoonotic diseases that start in animals and spread to humans. Instances include Hendra virus, Nipah virus, and different influenza strains like H5N1. Human encroachment on intensive farming, wildlife habitats, and the legal and illegal wildlife trade increases the risk of these events.

The region experiences a high prevalence of AMR because of elements like weak public systems, irrational drugs, and the availability of low-quality and counterfeit medicines. Southeast Asia and East Asia have been a main central part for the growth and spread of opposition to antimalarial and other drugs, too.

With an instance of this,

• In August 2025, the World Health Organization (WHO) revealed a new target product profile in order to guide the growth of in vitro diagnostics tests for bacterial infections in young infants and newborns that lead to neonatal sepsis, which is a top cause for infant deaths worldwide. (Source: https://www.who.int)

• In July 2025, Asian Development Bank (ADB) President Masato Kanda disclosed the launch of the Universal Health Coverage Practitioners and Experts Knowledge Exchange and Resources, which is a regional point-to-point learning link in order to develop universal health coverage across the Pacific and Asia. (Source: https://www.adb.org)

Need a Tailored Version of the Report? | Get Customization Options Here: https://www.visionresearchreports.com/report/customization/41672

Infectious Disease in Vitro Diagnostics Market Segmentation Analysis

Product Analysis

Why did the Reagents Segment Dominate the Infectious Disease in Vitro Diagnostics Market?

The reagents segment has dominated the market in 2024 as reagents are a complicated element in the sector of medical diagnosis. These substances are utilised in tests performed and samples such as urine, blood, tissue in order to detect infections, diseases, and other medical conditions. The IVD reagents play a crucial role in current healthcare by serving precise and timely information which governs clinical decision-making.

Also, the growth of in vitro diagnostics reagents have changed the way diseases are detected and tracked, shifting from standard biochemical analyses and rudimentary observation.

The software segment is predicted to rise at the fastest rate. The software has become famous in infectious disease in vitro diagnostics as it automates complicated procedures, develops diagnostics precision, and generates data for both public health surveillance and individual patient care. The COVID-19 pandemic has mainly accelerated this trend as it features the demand for quick, smoother, and linked diagnostics tools and machines.

Software automates and smooths laboratory workflows, which mainly reduces the period needed to process large volumes of samples, specifically for molecular tests like PCR. Apart from this, AL and ML algorithms can manage big, complicated datasets from machines, medical imaging, and clinical records, too. This assists in checking designs that human analysis might not check, which improves diagnostics accuracy for diseases like tuberculosis, malaria, and COVID-19, too.

Technology Analysis

Why did the immunoassay Technology Segment dominate the Infectious Disease in Vitro Diagnostics Market?

The immunoassay technology segment has dominated the market in 2024, as infectious disease immunoassays play an important role in analyzing and checking different pathogens that cause harm to human health. These assays use the body’s immune feedback to check the presence of particular antibodies or antigens linked with infectious agents. At the core of infectious disease immunoassays are the principles of immunology.

The immune system generates antibodies with respect to the presence of foreign elements like viruses, bacteria, or other pathogens. Immunoassays develop these natural defense mechanisms by utilising particular antigens and antibodies to check and quantify the targeted molecules.

The microbiology segment is predicted to grow at the fastest rate. Microbiology technology became famous in terms of infectious disease in vitro diagnostics because of its transformation from slow and culture-dependent procedures to fast, molecular techniques, and automation too. This update was being driven by the urgent clinical demand for faster, more precise diagnoses to combine antibiotic resistance and improve patient outcomes.

The usage of robotic systems and high-throughput machines has updated labs, which lowers manual labour and allows the processing of several samples at one time. Automated machines minimize human error, develop consistency, and manage large volumes of testing efficiently.

Application Analysis

Why did the COVID-19 Segment dominate the Infectious Disease in Vitro Diagnostics Market?

The COVID-19 application segment has dominated the market with a 15% share in 2024 as the COVID-19 pandemic gained force, which urges development for not only quicker testing but also testing in much higher volumes. That urge was a struggle in order to align when it comes to RT-PCR Testing, as a result of laboratories that shifted times and a limitation of reagents.

The feedback to that time has been the growth of the latest diagnostics technologies, such as next-generation sequencing (NGS) and CRISPR.

The HIV segment is predicted to grow at the fastest rate. Human Immunodeficiency Virus (HIV) is a single-stranded RNA retrovirus that targets the human immune system, leading to Acquired Immunodeficiency Syndrome. Its transmission can come through blood transfusions, sexual contact, or from mother to child during childbirth, pregnancy, and breastfeeding.

The growth of the disease does not occur immediately after the infection. It basically takes many years before AIDS symptoms appear in a person infected with HIV.

Test Location Analysis

Why did the Central Laboratories Segment Dominate the Infectious Disease in Vitro Diagnostics market?

The central laboratories segment has dominated the market with a 49% share in 2024 as they gained attention in vitro diagnostics (IVD) initially due to the developing globalization and complexity of the clinical trials, along with the demand for tailored testing. In the 1980s, the pharmaceutical sector identified the need for a more constant and reliable strategy for clinical trial testing that laid the basis for the central lab model. The growth of specialized testing further changed their role. So, the central labs smooth the complicated logistics of tracking, collecting, and storing biological samples from different global sites. They have also centred all the data into a single database, which is important for the regulatory submissions.

The point-of-care segment is predicted to grow at the fastest rate. Point of care testing, often referred to as POC testing, as near-patient testing or simply POCT, is a kind of testing which is handled either at or near the site of patient care by a particularly trained medical professional. The potential of POCT to serve timely diagnosis and treatment has also proved advantageous for patients with different medical conditions. It does not matter that it is a rapid C-reactive protein (CRP) testing machine, biosensors, immunofluorescence testers, or the protein chip technology, so every design of POCT can assist in tracking such infections.

Recent Developments in the Infectious Disease in Vitro Diagnostics Market

• In December 2024, Korean in-vitro diagnostics organization Precision Biosensor, which has entered into a supply agreement with NIPRO Corporation, a Japanese medical device and pharmaceutical company, will officially expand its presence in the Japanese industry with a clinical chemistry product for human application. (Source: https://www.koreabiomed.com)

• In November 2024, QIAGEN, a Frankfurt Prime Standard, revealed the plans in order to shift towards its QIAstat-Dx operations in the Barcelona space to a new site in the Esplugues de Llobregat as a space of multi-layer investment to expand this business. (Source: https://www.businesswire.com)

• In January 2025, Applied Biocode, a top company in molecular diagnostics panel testing, is delighted to reveal a major development to its BioCode Gastrointestinal Pathogen Panel, with the revelation of nucleic acid extraction claim for the hugely accepted ThermoFisher Scientific KingFisher stage. (Source: https://www.businesswire.com)

Browse More Insights:

• U.S. In Vitro Diagnostics Market: https://www.visionresearchreports.com/us-in-vitro-diagnostics-market/39223

• Europe In Vitro Diagnostics Market: https://www.visionresearchreports.com/europe-in-vitro-diagnostics-market/40997

• In Vitro Diagnostics (IVD) Market: https://www.visionresearchreports.com/in-vitro-diagnostics-ivd-market/41147

• In Vitro Diagnostics Quality Control Market: https://www.visionresearchreports.com/in-vitro-diagnostics-quality-control-market/41321

• DNA Diagnostics Market: https://www.visionresearchreports.com/dna-diagnostics-market/40777

• Skin Cancer Diagnostics Market: https://www.visionresearchreports.com/skin-cancer-diagnostic-market/41462

Top Companies in the Infectious Disease in Vitro Diagnostics Market:

• Abbott Laboratories: Abbott Laboratories is prevalently known as Abbott and is an American multinational medical healthcare and devices organisation that has its headquarters in Abbott Park, Illinois.

• Roche Diagnostics: Roche Diagnostics is a classification of Roche. It develops and mixes diagnostics solutions that solve current challenges and develop tomorrow’s needs. With more than 100 countries, it delivers the sector’s most comprehensive coverage of molecular diagnostics, diagnostics solutions, and decision-support solutions.

• bioMérieux SA: It is a French multinational biotechnology organization that was founded and is headquartered in Mercy-I-Etoile France, which is close to Lyon.BioMérieux is available in 44 countries and delivers in more than 160 countries through a large network of distributors.

• Thermo Fisher Scientific Inc.: Thermo Fisher Scientific is a top company in delivering science, with an annual revenue of approximately USD 40 billion. Their mission is to allow users to create a world that is healthier, safer, and cleaner. Every global team serves an uncommon integration of inventive technologies that brings pharmaceutical services and convenience through our sector-leading brands.

• Hologic Inc.: Hologic Inc. is an inventive medical technology organisation whose aim is to allow healthier lives everywhere, each day. While we discover and make cutting-edge products and services that advantage everyone, we are particularly passionate about those that develop women’s health and well-being.

• Becton, Dickinson and Company

• Danaher Corporation

• Luminex Corporation.

Infectious Disease In Vitro Diagnostics Market Segmentation

By Product

• Instruments

• MRSA

• Streptococcus

• Clostridium difficile

• VRE

• CRE

• Respiratory Virus

• Candida

• TB and drug-resistant TB

• Gastro-intestinal panel testing

• Chlamydia

• Gonorrhea

• HPV

• HIV

• Hepatitis C

• Hepatitis B

• COVID-19

• Other Infectious Diseases

• Reagents

• MRSA

• Streptococcus

• Clostridium difficile

• VRE

• CRE

• Respiratory Virus

• Candida

• TB and drug-resistant TB

• Gastro-intestinal panel testing

• Chlamydia

• Gonorrhea

• HPV

• HIV

• Hepatitis C

• Hepatitis B

• COVID-19

• Other Infectious Diseases

Software

• MRSA

• Streptococcus

• Clostridium difficile

• VRE

• CRE

• Respiratory Virus

• Candida

• TB and drug-resistant TB

• Gastro-intestinal panel testing

• Chlamydia

• Gonorrhea

• HPV

• HIV

• Hepatitis C

• Hepatitis B

• COVID-19

• Other Infectious Diseases

By Technology

• Immunoassay

• Molecular diagnostics

• Microbiology

• Others

By Application

• MRSA

• Streptococcus

• Clostridium difficile

• VRE

• CRE

• Respiratory Virus

• Candida

• TB and drug-resistant TB

• Gastro-intestinal panel testing

• Chlamydia

• Gonorrhea

• HPV

• HIV

• Hepatitis C

• Hepatitis B

• COVID-19

• Other Infectious Diseases

By Test Location

• Point of Care

• Central Laboratories

• Others

By Regional

• North America

• Europe

• Asia Pacific

• Latin America

• Middle East and Africa (MEA)

Instant Delivery Available | Purchase This Exclusive Research Report Now: https://www.visionresearchreports.com/report/checkout/41672

You can place an order or ask any questions, please feel free to contact at: sales@visionresearchreports.com

About Us

Vision Research Reports is a premier service provider offering strategic market insights and solutions that go beyond traditional surveys. We specialize in actionable market research, delivering in-depth qualitative insights and strategies to global industry leaders and executives, helping them navigate future uncertainties. Our offerings include consulting services, syndicated market studies, and bespoke research reports.

We are committed to excellence in qualitative market research, fostering a team of experts with deep industry knowledge. Our goal is to help clients understand both current and future market trends, empowering them to expand their portfolios and achieve their business objectives with the right guidance.

Web: https://www.visionresearchreports.com

Our Trusted Data Partners

Precedence Research | Statifacts | Nova One Advisor

For Latest Update Follow Us: LinkedIn