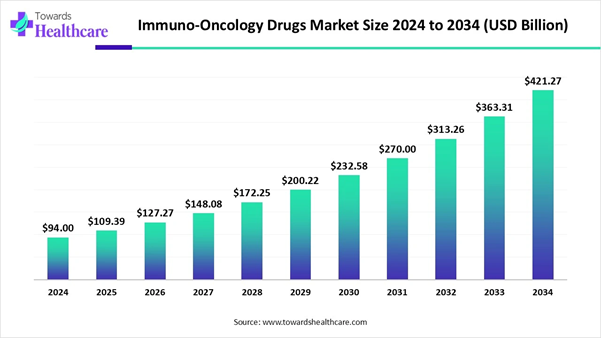

The global immuno-oncology drugs market is valued at USD 94 billion in 2024, rising to USD 109.39 billion in 2025. It is expected to reach approximately USD 421.27 billion by 2034, expanding at a compound annual growth rate (CAGR) of 16.34% from 2025 to 2034.

The immuno-oncology drugs market is increasing due to it is used to strengthen the immune system by modifiable the immune microenvironment, enabling immune cells to attack and clear tumor cells at numerous important nodes. North America is the dominant as increasing significant research and development (R&D) activities and presence of a favorable regulatory environment.

Explore essential insights and highlights from the Immuno-Oncology Drugs Market with our free sample: https://www.towardshealthcare.com/download-sample/5863

Market Summary

The immuno-oncology drugs market is expanding due to increasing recent FDA approvals, including novel uses of Imfinzi and bispecific antibodies. Increasing pharmaceutical partnerships, like BMS-BioNTech and AstraZeneca’s innovation, are driving development. North America is the dominant market due to increasing R&D and government support. Asia Pacific is fastest fastest-growing due to increasing cancer incidence, expanding therapies, and indications.

Key Takeaways

➢ North America is dominant in the immuno-oncology drugs market in 2024, with a 50% share.

➢ Asia Pacific is estimated to grow at the fastest CAGR from 2025 to 2035.

➢ By modality, the checkpoint inhibitors segment for the largest market revenue in 2024, with a 52% share.

➢ By modality, the CAR-T cell therapies segment is estimated to fastest-growing over the forecast period, 2025 to 2035.

➢ By indication, the melanoma & lung cancer segment is dominant in the market in 2024 with a 45% share.

➢ By indication, the “cold” solid Tumors segment is expected to register the fastest growth over the forecast period, 2025 to 2035.

➢ By line of therapy, the second-line & beyond segment is dominant in the market in 2024.

➢ By line of therapy, the first-line approvals segment is expected to register the fastest growth over the forecast period, 2025 to 2035

➢ By combination strategy, the IO monotherapy segment is dominant in the market in 2024.

➢ By combination strategy, the IO + Other IO segment is expected to register the fastest growth over the forecast period, 2025 to 2035.

Market Overview

The Immuno-Oncology (I-O) drugs market comprises therapies that harness the body’s immune system to fight cancer. Unlike traditional treatments, I-O therapies, such as immune checkpoint inhibitors, CAR-T cell therapies, and cancer vaccines, stimulate or restore immune responses against tumor cells.

This market is driven by rising global cancer incidence, durable clinical responses from I-O drugs, and increasing regulatory approvals for novel therapies. The market is seeing strong investment from pharma and biotech, with continued innovation in next-gen immune modulators, bispecifics, and tumor microenvironment-targeting agents.

Stats Table

|

Metric |

Details |

|

Market Size in 2025 |

USD 109.39 Billion |

|

Projected Market Size in 2034 |

USD 421.27 Billion |

|

CAGR (2025 - 2034) |

16.34% |

|

Leading Region |

North America (By 50% Market Share) |

|

Market Segmentation |

By Modality, By Indication, By Line of Therapy, By Combination Strategy, By End User and By Region |

|

Top Key Players |

Coloplast Corp (Denmark), Bristol Myers Squibb Company (US), Novartis AG (Switzerland), F. Hoffmann-La Roche Ltd. (Switzerland), Merck & Co., Inc. (US), GSK Plc. (UK), Eli Lilly and Company (US), Fresenius Kabi AG (Germany), Pfizer Inc. (US), AbbVie Inc. (US), Genentech Inc. (US), Sanofi (France), AstraZeneca (UK), Bayer AG (Germany), Bluebird Bio, Inc. (US), Regeneron Pharmaceuticals, Inc. (US), Amgen Inc. (US), Johnson & Johnson (US), Merck KGaA (Germany) and Ipsen (France) |

Dive into in-depth statistics, segment breakdowns, and projections with our exclusive databook: https://www.towardshealthcare.com/download-databook/5863

Immuno-Oncology Drugs Market Trends

• In January 2025, the Advanced Centre for Treatment, Research, and Education in Cancer (ACTREC), a key arm of Tata Memorial Centre (TMC), embarked on a major expansion to revolutionize cancer research, treatment, and patient care. This initiative aims to accelerate clinical breakthroughs, enhance oncology care, and establish cutting-edge therapeutic facilities, reinforcing India’s leadership in advanced cancer treatment and innovation.

• In September 2024, Sanofi, RadioMedix, and Orano Med announced a licensing agreement on next-generation radioligand medicine for rare cancers. This collaboration between Sanofi, RadioMedix, and Orano Med focuses specifically on the late-stage project, AlphaMedixTM, which is currently being evaluated for the treatment of adult patients with unresectable or metastatic, progressive somatostatin-receptor expressing neuroendocrine tumors (NETs), a rare cancer.

• In April 2025, BioNTech SE will present data for selected assets from its diversified oncology pipeline, including mRNA cancer immunotherapies, next-generation immunomodulators, and targeted therapies, at the American Association for Cancer Research (AACR).

What is the Role of AI in the Growth of the Immuno-Oncology Drugs Market?

Integration of AI in immuno-oncology drugs drives the growth of the market as AI-driven technology allows ground-breaking advancements in simulation techniques, molecular modelling, and the identification of new compounds, such as anti-tumor and antibodies, while expounding mechanisms of drug toxicity. AI emerged as a significant device in precision medicine, increasing the formulation and release of targeted therapies and enhancing the development of management for oncology and central nervous system diseases.

AI-driven technology rapidly understands how cancer cells become resistant to anticancer drugs, which supports improving drug development and adjusting drug use. AI manages the use of chemotherapy drugs and forecasts the tolerance of chemotherapy drugs, so as to optimize the chemotherapy treatment.

Market Dynamics

Driver

Rising Emphasis over Benefits of Oncology Drugs

The main objectives of biologics and immuno-oncology research are to activate and enhance responses by engaging specific targets to influence and regulate cellular functions. Certain immune-oncology therapies, like interleukins and colony-stimulating factors, work by boosting the immune system rather than directly attacking cancer cells.

These treatments are often combined with various other therapies to maximize patient benefits. They function by modifying the immune response or the tumor microenvironment, aiding the immune system in more effectively fighting cancer cells. This approach is driving the growth of the immune-oncology drugs market.

• In November 2024, BioNTech SE and Biotheus announced the signing of a definitive agreement for the acquisition of Biotheus, a clinical-stage biotechnology company dedicated to the discovery and development of novel antibodies to address unmet healthcare requirements of patients with oncological or inflammatory diseases.

Restraint

High Cost Challenges of Immuno-Oncology Drugs

The high cost of cancer drugs stems from multiple factors. It is extremely expensive to translate research findings into clinical treatments and to conduct all necessary regulatory studies, including phase 1, 2, and 3 trials, to obtain approval. Since most cancers are incurable, patients are often treated with various approved agents, either sequentially or in combination. This creates a virtual monopoly, as the use of one drug does not eliminate the need for others, thereby restricting the growth of the immuno-oncology drug market.

Opportunity

Why is the future of cancer research and treatment optimistic?

In the ever-evolving landscape of cancer research, immuno-oncology remains a beacon of hope, offering new options for treatment. Recent studies on homogeneous immuno-oncology drugs combined with standard therapy have demonstrated significantly improved clinical outcomes. While IO agents are rapidly changing the treatment options available to cancer patients, challenges remain, such as managing adverse effects and navigating different healthcare systems, including the costs associated with these expensive therapies. These obstacles, however, present opportunities for growth in the immuno-oncology drug market.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Segmental Insights

Why the Checkpoint Inhibitors Segment Dominated the Market?

By modality, the checkpoint Inhibitors segment led the Immuno-oncology drugs market, due to as immune checkpoint inhibitors stop the immune system from responding before cancer is removed. It is a type of immunotherapy. The immune system relies on T cells to fight cancer. These dedicated cells are tremendously significant and have the potential to damage healthy cells. Potential advantages of this inhibitor include its profitable availability, better survival time, and huge potency against cancer cells.

On the other hand, the CAR-T cell therapies segment is projected to experience the fastest CAGR from 2025 to 2035, as CAR T-cell therapy has a short treatment time required, managed with a single infusion that requires at most. It outperforms the other outdated cancer treatments in terms of long-term remission, with enhanced quality of the patient's life. As compared to stem cell transplants, which also involve aggressive chemotherapy, most patients experience a rapid recovery with CAR-T cell therapy. CAR-T therapy has offered durable remissions, that is, the cancer remains at bay for an extended period after the treatment.

Why the Melanoma & Lung Cancer Segment Dominated the Market?

By indication, melanoma & lung cancer dominated the immuno-oncology drugs market in 2024, as immunotherapy has established the ability to lower the chances of recurrence for melanoma, successive medical resection, and improve survival in patients with unresectable disease. It is significant to distinguish additional immunotherapy agents that provide medical advantages on their own or in combination with current therapies. Immunotherapy for melanoma has shown long-term benefits for patients, mostly in attaining continued remissions and prolonged survival.

The “Cold” Solid tumors segment is projected to grow at the highest CAGR from 2025 to 2035, as immunotherapy significantly aims to restore the essential antitumor immune response, energising and maintaining the tumor-specific immune pathway. The advancement and clinical application of IO therapies for different cancers have shown promising results. The effectiveness of immunotherapy differs in patients with the same cancer type, probably due to the immune features of the tumor. Immuno-oncology drugs play a significant role in modifiable tumor initiation, metastasis, progression, and the immune responses to standard cancer treatments.

Why is the Second-Line & Beyond Segment Dominant in the Market?

By line of therapy, the second-line & beyond segment led the market in 2024, due to immune-oncology, which demonstrated an enhanced overall survival (OS) and progression-free survival (PFS) as a second-line therapy and subsequent lines compared with chemotherapy. Second-line chemotherapy is considered comparatively ineffective. Novel immuno-oncology drugs introduced. Second-line drugs are medications used when first-line treatments are useless or cause improper adverse effects.

The first-line approvals segment is projected to experience the fastest CAGR from 2025 to 2035, as a first-line anti-angiogenic therapy, Avastin, approved for managing different types of cancer, including lung, colorectal, and ovarian malignancies. First-line approvals in cancer treatment provide numerous key advantages, mostly focusing on early access to possibly effective therapies and improved patient outcomes.

Why the IO Monotherapy Segment Dominated the Market?

By combination strategy, the IO monotherapy segment dominated in the immuno-oncology drugs market in 2024, as potential advantages of monotherapy include lower adverse effects and progressive tolerability, evading of drug-drug interactions, lower treatment expenses, and enhanced compliance. IO monotherapy usually has a lower occurrence of therapy-related adverse events (TRAEs) compared to combination chemotherapy or therapies.

On the other hand, the IO + other IO segment is expected to grow at the fastest CAGR over the forecast period, 2025 to 2035, as interventional oncology therapies utilize image-guided, negligibly invasive procedures to target cancer and cancer-linked diseases deep inside the body. Therapies are transported through incisions in the skin as small as pinholes, lowering pain, time, and challenges to cancer patients. Immune-oncology (IO) has arisen as a new and important strategy to cancer treatment through the stimulation of the body’s immune system to destroy cancer cells.

By End User

By end user, the hospitals & oncology centers segment led the market in 2024, as it has better access to a broad range of resources, with multidisciplinary teams of specialists. A cancer center is a dedicated medical institution that focuses on treating, diagnosing, and caring for cancer patients. A broad range of services is available at these services to help patients and their loved ones deal with the physical and emotional side effects of cancer treatment and access the most advanced therapies, clinical trials, and technologies.

On the other hand, the academic medical centers segment is expected to grow at the fastest CAGR over the forecast period, 2025 to 2035, as academic medical center has access to clinical trials. These are life-saving or life-changing substitutes to regular healthcare treatments. Academic medical center provides a scope of expertise, knowledge, scientific examination, and advanced technical resources superior to the community. Access to a high volume of patients, experienced researchers, specialized facilities, and advanced clinical trial programs.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Regional Insights

Why is North America dominant in the Immuno-Oncology Drugs Market?

North America dominated the immuno-oncology drugs market in 2024, as the presence of advanced R&D infrastructure caused the enhancement of health service technologies, which not only progress the quality of healthcare services but also serve to inspire related industries, increasing innovation in IO therapies. Lung cancer is the major reason for cancer death in North America, so cancer is the leading cause of premature death in North America. An estimated 2.1 million new cancer cases and 701,000 cancer deaths occur in North America annually, which increases the demand for immuno-oncology drugs.

For Instance,

• In May 2025, AbbVie announced that EMRELIS has been granted accelerated approval by the U.S. Food and Drug Administration (FDA) for the treatment of adult patients with locally advanced or metastatic, non-squamous non-small cell lung cancer (NSCLC) with high c-Met protein overexpression (OE) who have received a prior systemic therapy. High c-Met protein overexpression is defined as ≥ 50% of tumor cells with strong staining as determined by an FDA-approved test.

The U.S. Immuno-Oncology Drugs Market Trends

In the United States, increasing high-quality medical care services help prevent diseases and enhance the quality of life. Initiatives like Healthy People 2030 focus on enhancing health care quality and making sure entirely everyone gets the health care services they require. In the U.S., increasing aging population and cancer rates increase with age; other causes include obesity, highly processed foods, and sedentary lifestyles. In 2025, 2,041,910 new cancer cases and 618,120 cancer deaths are predicted to occur in the United States, which will drive the growth of the market.

For Instance,

• In June 2025, BioNTech SE and Bristol Myers Squibb announced that the companies agreed on the global co-development and co-commercialization of BioNTech’s new bispecific antibody BNT327 in several solid tumor types. Under the agreement, BioNTech and BMS will work jointly to broaden and accelerate the development of this clinical candidate.

Increasing Investment in Cancer Research in Canada

Canada delivers advanced therapies to patients more rapidly, reduces health-care expenses, and drives economic growth by developing a robust domestic life sciences field. Canada invests $500 million per year in cancer research, and the provision of these funds reveals a critical imbalance. About 70 % of this funding helps early-stage research, leaving an important gap in translational research and clinical trials, which drives the growth of the market.

Why Asia Pacific is the Fastest Growing in the Immuno-Oncology Drugs Market?

Asia Pacific is estimated to be the fastest-growing Immuno-Oncology Drugs Market during the forecast period, as the continually evolving regulatory landscape in APAC, therefore, promoters are prepared to develop a trial design that can be adapted to accommodate any changes. Enhancing effective strategies for patient recruitment is significant for oncology trials in APAC countries, which drives the growth of the market.

Growing Clinical Trials in China

China is increasing research in oncology drug development and clinical trials, creating novel opportunities, which is increasing the demand for immune-oncology drugs. China has the largest number of smokers and consumes over 40% of the global tobacco, which increases the rate of cancer, driving the market growth. In 2024, immune-oncology made very strong inroads against childhood cancers, which contributes to the growth of the market.

Increased Government Support to Cancer Research in India

India has made significant strides in cancer research, treatment, and prevention through policy reforms, prolonged healthcare infrastructure. India's goal is to build a comprehensive and comprehensive cancer care system, improving patient outcomes nationwide, which drives the growth of the market. In India, the incidence of cancer cases is likely to increase from 1.46 million in 2022 to 1.57 million in 2025.

Why is Europe Notably Growing in the Immuno-Oncology Drugs Market?

Europe has an excessively higher cancer incidence and mortality burden, given that the continent has one-fifth of the global cancer burden, which increases the demand of imuuno-oncology drugs. In Europe, 2.7 million people are diagnosed with cancer, and 1.3 million death due from this disease. If no further achievement is taken, the number of people newly diagnosed will increase to more than 3.2 million by 2040, contributing to the growth of the market.

Growing Incidence of Cancer in Germany

In Germany, an estimated 51% of men and 43% of women will develop cancer during their lifetime. The number of survivors has been growing steadily counting including patients with breast and prostate cancer, the two most common cancers, in contradiction to the backdrop of healthcare advances and high incidence among people of working age, which increases the growth of the market.

Increasing Demand of Healthcare Services in the UK

There is an increasing demand for health services due to an ageing population with progressively complex healthcare requirements. German hospitals prioritize both treatment effectiveness and patient comfort through progressive pain management processes during treatment, which increases the demand for the immuno-oncology drugs market.

Elevate your healthcare strategy with Towards Healthcare. Enhance efficiency and drive better outcomes schedule a call today: https://www.towardshealthcare.com/schedule-meeting

Top Companies in the Immuno-Oncology Drugs Market

• Merck & Co.

• Bristol-Myers Squibb

• Roche / Genentech

• AstraZeneca / MedImmune

• Novartis

• Gilead Sciences / Kite Pharma

• Bayer / BlueRock Therapeutics

• Pfizer

• Genmab

• Amgen

• Regeneron

• CytomX Therapeutics

• Juno Therapeutics (BMS)

• Allogene Therapeutics

• MacroGenics

• Adaptimmune

• Arcus Biosciences

• Merus

• BioNTech

• Gritstone bio

Latest Announcements by Industry Leaders

In May 2025, Roopal Thakkar, MD, executive vice president, research and development, chief scientific officer, AbbVie, stated, “EMRELIS, AbbVie's first internally developed solid tumor medicine and our first solid tumor FDA approval in lung cancer, is a testament to our commitment to develop cancer therapies that goal to enhance the course of treatment for patients facing this challenging disease.”

Recent Developments in the Immuno-Oncology Drugs Market

➢ In January 2025, BioMed X, an independent biomedical research institute based in Heidelberg, Germany, announced the launch of a novel collaboration with Daiichi Sankyo Co., Ltd., a global pharmaceutical company headquartered in Japan. This collaboration marks the start of a modern initiative to explore innovative approaches in cancer treatment using multi-specific biologics.

➢ In June 2025, Glenmark Pharmaceuticals Ltd., a research-driven global pharmaceutical company, officially launched TEVIMBRA in India, following approval from the Central Drugs Standard Control Organisation (CDSCO). This advancement marks Glenmark’s strategic entry into the country’s rapidly evolving immuno-oncology segment.

➢ In June 2025, Teva Pharmaceutical Industries Ltd. and Shanghai Fosun Pharmaceutical Co., Ltd. announced that the companies, through their respective subsidiaries, have entered a strategic partnership for the development of investigational TEV-56278, an anti-PD1-IL2 ATTENUKINE therapy. Teva’s internally developed ATTENUKINE technology offers a novel mechanism of action, potentially providing high efficacy and low toxicity in a broad array of oncology indications.

➢ In May 2025, Agilent Technologies Inc. announced the recent signing of a Memorandum of Understanding (MOU) with Ubix Therapeutics to accelerate highly targeted cancer therapy research and development in South Korea over the next five years.

Segments Covered in the Report

By Modality

• Checkpoint Inhibitors

• PD-1 inhibitors (e.g., pembrolizumab, nivolumab)

• PD-L1 inhibitors (e.g., atezolizumab, durvalumab)

• CTLA-4 inhibitors (e.g., ipilimumab)

• CAR-T Cell Therapies (Fastest Growing)

• Autologous CD19 CAR-T (e.g., Kymriah, Yescarta)

• Emerging allogeneic “off-the-shelf” CAR-T

• Bispecific T-Cell Engagers (BiTEs)

• Cancer Vaccines

• Cytokine Therapies (e.g., IL-2 variants)

• Oncolytic Virus Therapies

By Indication

• Melanoma & Lung Cancer

• Hematologic Malignancies (CAR-T focus)

• Urothelial & Renal Cell Carcinoma

• Head & Neck Cancer

• MSI-High / Tumor-Agnostic (Pembrolizumab label)

• “Cold” Solid Tumors (e.g., pancreatic, prostate)

By Line of Therapy

• Second-Line & Beyond (Dominant)

• First-Line Approvals (Fastest Growing)

• Combinations (IO + chemotherapy or targeted therapy)

By Combination Strategy

• IO Monotherapy

• IO + Chemotherapy

• IO + Targeted Therapy (e.g., VEGF inhibitors)

• IO + Other IO (e.g., PD-1 + CTLA-4)

• IO + Radiotherapy

By End User

• Hospitals & Oncology Centers

• Specialty Infusion Clinics

• Academic Medical Centers

• Outpatient Oncology Practices

By Region

• North America

• U.S.

• Canada

• Asia Pacific

• China

• Japan

• India

• South Korea

• Thailand

• Europe

• Germany

• UK

• France

• Italy

• Spain

• Sweden

• Denmark

• Norway

• Latin America

• Brazil

• Mexico

• Argentina

• Middle East and Africa (MEA)

• South Africa

• UAE

• Saudi Arabia

• Kuwait

Gain complete access to expert analysis and strategic market intelligence, download the full report now: https://www.towardshealthcare.com/price/5863

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Gain access to the latest insights and statistics in the healthcare industry by subscribing to our Annual Membership. Stay updated on healthcare industry segmentation with detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead of the curve with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities in the dynamic world of healthcare: Get a Subscription

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram

Browse More Insights of Towards Healthcare:

➢ The global cell-based immunotherapies market is valued at USD 4.59 billion in 2024, expected to rise to USD 5.28 billion in 2025, and projected to reach USD 18.62 billion by 2034, expanding at a CAGR of 15.02% between 2025 and 2034.

➢ The oncology drug discovery market is set for robust growth through 2034, fueled by innovations in precision medicine, AI-powered drug development, and a rapidly expanding pipeline of targeted therapies.

➢ The global microfluidics in oncology market is experiencing strong momentum and is anticipated to generate hundreds of millions in revenue from 2025 to 2034, supported by the rising need for miniaturized diagnostic tools and personalized cancer care.

➢ The multiple modalities in oncology market is witnessing global advancements, with expectations of achieving hundreds of millions in revenue during the 2025–2034 period, driven by the integration of various therapeutic strategies.

➢ The proteomics in oncology market is on a growth trajectory, poised to reach significant revenue milestones estimated in the hundreds of millions between 2025 and 2034, backed by advancements in biomarker discovery and targeted treatment development.

➢ The global oncology companion diagnostics market is estimated at USD 5.24 billion in 2024, growing to USD 5.7 billion in 2025, and forecasted to hit USD 12.07 billion by 2034, with a CAGR of 8.73% from 2025 to 2034.

➢ The U.S. oncology molecular diagnostics market stands at USD 810 million in 2024, expected to grow to USD 909.14 million in 2025, and reach approximately USD 2.57 billion by 2034, expanding at a CAGR of 12.24%.

➢ Globally, the oncology molecular diagnostics market is valued at USD 3.11 billion in 2024, projected to grow to USD 3.48 billion in 2025, and expected to reach USD 9.76 billion by 2034, with a CAGR of 12.13% between 2025 and 2034.

➢ The global oncology next-generation sequencing (NGS) market was valued at USD 508.95 million in 2024, rising to USD 589.01 million in 2025, and is projected to hit USD 2.19 billion by 2034, growing at a CAGR of 15.73%.

➢ The hemato-oncology testing market is forecasted to grow from USD 4.00 billion in 2025 to USD 11.47 billion by 2034, expanding at a CAGR of 12.4% during the forecast period.

➢ The global non-oncology precision medicine market is projected to increase from USD 91.17 billion in 2025 to USD 193.16 billion by 2034, advancing at a CAGR of 8.7%.

➢ The global precision oncology market is expected to surge from USD 120.9 billion in 2024 to USD 310.75 billion by 2034, reflecting a steady CAGR of 9.9% over the forecast period.