Hemophilia B Market Outlook 2025-2035:

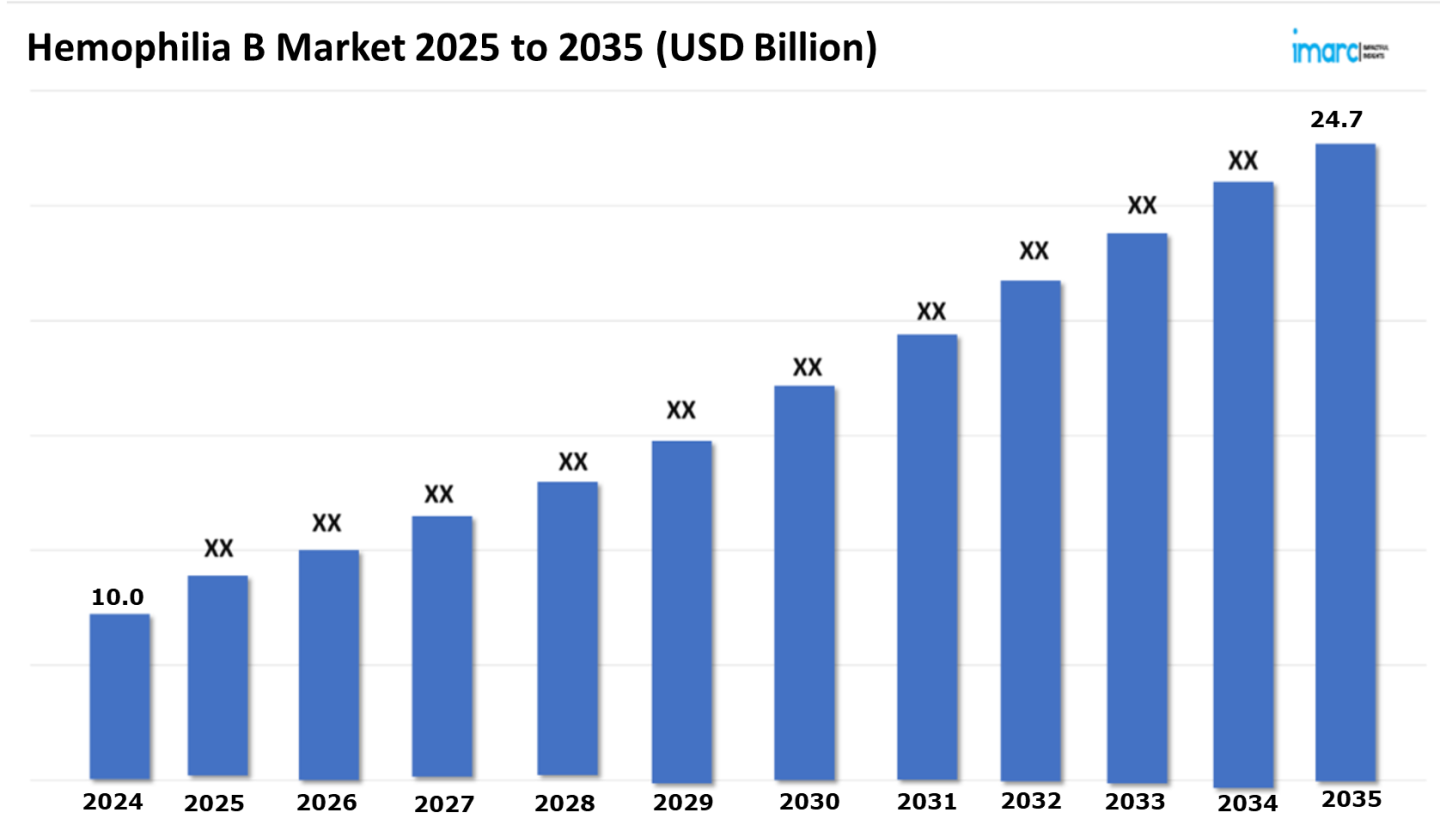

The 7 major hemophilia B market reached a value of USD 10.0 Billion in 2024. Looking forward, IMARC Group expects the 7MM to reach USD 24.7 Billion by 2035, exhibiting a growth rate (CAGR) of 8.59% during 2025-2035. The market is driven by the escalating utilization of gene therapy, which involves introducing a functional copy of the faulty gene into the patient's cells, thereby encouraging the production of factor IX in the body. This revolutionary approach not only improves patient quality of life but also significantly reduces the overall treatment burden. The success of gene therapies is driving the expansion of the hemophilia B market, fueling increased investment and research.

Advances in Early Detection and Diagnostic Technologies: Driving the Hemophilia B Market

Advances in the technology of early detection and diagnostic aids are at the forefront in advancing the hemophilia B market by improving diagnostic accuracy, early intervention, and proper management of the patient. Development in genetic testing technologies enabled early detection in newborns and populations at risk of having the condition. This leads to easy identification of the factor IX gene with next-generation sequencing (NGS) and DNA-based testing, which might provide early diagnosis through a more personalized approach to treatment. Early diagnosis makes sure that a child born with hemophilia B receives prophylactic treatment. This improves quality of life for children and prevents bleeding episodes from occurring. Besides that, there were advancements in clotting factor assays that resulted in improved diagnosis and monitoring of the progression of diseases in patients affected by hemophilia B. From the measurement of factor IX in blood, a proper evaluation for the deficiency may be given as well as suggested treatment programs for the patients. The advent of point-of-care diagnostic devices can also help patients monitor coagulation levels real-time, very helpful for those undergoing home therapy. In addition, the increased application of genetic counseling has equipped patients and families with knowledge about the inherited nature of hemophilia B, which has led to better-informed decisions and preventive care. The increasing integration of molecular diagnostics into routine clinical practice is improving the ability to tailor treatments, including gene therapies and novel clotting factor therapies, thus contributing to the overall expansion of the hemophilia B market.

Request a PDF Sample Report: https://www.imarcgroup.com/hemophilia-b-market/requestsample

Development of Novel Therapies and Pharmacological Treatments: Contributing to Market Expansion

New treatments and pharmacological drugs are among the significant drivers for the hemophilia B market as they offer new options for treatment with higher efficacy, convenience, and long-term benefits. Long-acting clotting factor therapies are significant and one of the most promising developments, designed to extend the duration of activity of clotting factors in the bloodstream. Thus, it reduces the number of infusions, thereby improving patient convenience and compliance. For example, idursulfase beta and eftrenonacog alfa are engineered to be longer-lasting than conventional factor IX concentrates, which reduces the burden of routine treatments. Gene therapy is another area of transformation. This has the potential to be a one-time treatment that actually corrects the cause of hemophilia B. Gene therapy accomplishes this through the transduction of a functional copy of the factor IX gene into the liver, which maintains continuous, endogenous production of clotting factor IX. Such an interest in this market has been tremendous since its success in clinical trials and the approval of gene therapies like Valoctocogene roxaparvovec can potentially reduce or eradicate the need for frequent infusions of factor IX products. Bispecific antibodies and non-factor replacement therapies are the latest in emerging treatments for hemophilia B patients, allowing alternative approaches to manage bleeding episodes with mechanisms of action. Increasing diversity in treatment modalities combined with personalized medicine approaches are opening up new opportunities for growth in the hemophilia B market as patient care is improved, the burden of treatment is reduced, and a cure is on the horizon.

Buy Full Report: https://www.imarcgroup.com/checkout?id=7896&method=809

Marketed Therapies in Hemophilia B Market

Rixubis (Recombinant factor IX): Baxalta

Rixubis (Recombinant factor IX) is an injectable drug used to restore missing clotting factor IX in adults and children with hemophilia B (also known as congenital factor IX deficiency or Christmas disease). Rixubis works by replacing the missing clotting factor IX in hemophilia B patients, allowing the blood to clot properly by essentially replenishing the deficient factor required for effective hemostasis, thereby preventing and controlling excessive bleeding episodes associated with the condition. It accomplishes this by being injected intravenously, where it enters the bloodstream and functions similarly to the naturally occurring factor IX protein.

Rebinyn (Nonacog beta pegol): Novo Nordisk

Rebinyn (Nonacog beta pegol) is a recombinant factor IX derivative used to treat hemophilia B. Rebinyn replaces the missing coagulation Factor IX in hemophilia B patients, effectively functioning as a substitute for the defective clotting factor and permitting appropriate blood clot formation by re-entering the normal coagulation cascade. The pegol component of the molecule is a polyethylene glycol attachment that increases Factor IX's half-life, which means it stays in the bloodstream longer and requires fewer injections.

BeneFix (Nonacog alfa): Pfizer

BeneFIX includes recombinant coagulation FIX (nonacog alfa). Recombinant coagulation FIX is a recombinant DNA-based protein therapy with structural and functional properties like endogenous FIX. In the extrinsic pathway, factor VII/tissue factor complex activates FIX, while factor XIa activates it in the intrinsic coagulation pathway. Activated FIX, when combined with activated factor VIII, activates factor X. This leads to the transformation of prothrombin to thrombin. Thrombin then transforms fibrinogen into fibrin, which allows a clot to form. In patients with hemophilia B, FIX activity is missing or significantly diminished, and substitution therapy may be required.

Emerging Therapies in Hemophilia B Market

BE-101: Be Biopharma

BE-101 is a first-in-class engineered B Cell Medicine (BCM) that treats hemophilia B by introducing the human Factor IX (FIX) gene into primary human B cells, allowing for continuous expression of active FIX. BE-101 has the potential for sustained therapeutic FIX activity levels with a single infusion, which can be titrated and/or re-dosed, and does not require preconditioning. By maintaining sustained and constant therapeutic FIX activity levels while reducing the dosing frequency required by current FIX replacement regimens, BE-101 could alleviate the significant infusion burden faced by people with hemophilia B, potentially lowering annualized bleeding rates and FIX usage.

Fitusiran: Alnylam Pharmaceuticals/Sanofi

Fitusiran, developed by Alnylam Pharmaceuticals and Sanofi, is an RNA interference (RNAi) therapy for hemophilia B. It works by targeting and silencing the ANT3 gene, which produces antithrombin, a protein that inhibits blood clotting. By reducing antithrombin levels, Fitusiran enhances the body's ability to generate thrombin, promoting blood clot formation and preventing bleeding episodes in patients with hemophilia B.

Detailed list of emerging therapies in Hemophilia B is provided in the final report…

Leading Companies in the Hemophilia B Market:

The market research report by IMARC encompasses a comprehensive analysis of the competitive landscape in the market. Across the global hemophilia B market, several leading companies are at the forefront of developing integrated platforms to enhance the management of hemophilia B. Some of the major players include Baxalta, Novo Nordisk, and Pfizer. These companies are driving innovation in the hemophilia B market through continuous research, diagnostic tools, and expanding their product offerings to meet the growing demand for the illness.

Key Players in Hemophilia B Market:

The key players in the Hemophilia B market who are in different phases of developing different therapies are Baxalta, Novo Nordisk, Pfizer, Bioverativ, CSL Behring, Regeneron Pharmaceuticals, rEVO Biologics, LFB Biotechnologies, Swedish Orphan Biovitrum, Be Biopharma, Alnylam Pharmaceuticals, Sanofi, and Others.

Regional Analysis:

The major markets for hemophilia B include the United States, Germany, France, the United Kingdom, Italy, Spain, and Japan. The United States has the largest patient pool for hemophilia B and is also the biggest market for its treatment, according to projections by IMARC. This can be attributed to the introduction of long-acting recombinant factor IX products, such as Alprolix and Idelvion, that significantly reduce the frequency of infusions, improving patient convenience and adherence.

Another breakthrough in gene therapy is the potential it holds as a transformative treatment for hemophilia B. Valoctocogene roxaparvovec, among the latest advancements in gene therapy, has the possibility of being a long-term or permanent cure because it will enable the body to produce its factor IX. This is highly marketable since patients are seeking sustainable treatment options.

In addition to this, increasing awareness of hemophilia B and advances in early diagnosis are also propelling the market forward. Early diagnosis of the disorder helps in timely intervention and better treatment outcomes. Advancements in diagnostic technologies, such as genetic testing and clotting factor assays, are facilitating better management and personalized treatments for hemophilia B patients.

Recent Developments in Hemophilia B Market:

Base Year: 2024

Historical Period: 2019-2024

Market Forecast: 2025-2035

Countries Covered

This report offers a comprehensive analysis of current hemophilia B marketed drugs and late-stage pipeline drugs.

In-Market Drugs

IMARC Group Offer Other Reports:

Adrenal Cortex Neoplasms Market: The 7 major adrenal cortex neoplasms markets reached a value of USD 23.5 Million in 2024. Looking forward, IMARC Group expects the 7MM to reach USD 29.8 Million by 2035, exhibiting a growth rate (CAGR) of 2.20% during 2025-2035.

Argininosuccinic Aciduria Market: The 7 major argininosuccinic aciduria markets are expected to exhibit a CAGR of 3.3% during 2024-2034.

Brain Hemorrhage Market: The 7 major brain hemorrhage markets reached a value of US$ 136.6 Million in 2023. Looking forward, IMARC Group expects the 7MM to reach US$ 211.0 Million by 2034, exhibiting a growth rate (CAGR) of 4.03% during 2024-2034.

Cerebral Aneurysm Market: The 7 major cerebral aneurysm markets are expected to exhibit a CAGR of 7.06% during 2024-2034.

Traumatic Brain Injury Market: The 7 major traumatic brain injury markets are expected to exhibit a CAGR of 3.36% during 2024-2034.

Antiphospholipid Syndrome Market: The 7 major antiphospholipid syndrome markets reached a value of US$ 29.5 Million in 2023, and projected the 7MM to reach US$ 74.5 Million by 2034, exhibiting a growth rate (CAGR) of 8.79% during 2024-2034.

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Phone Number: - +1 631 791 1145, +91-120-433-0800

The 7 major hemophilia B market reached a value of USD 10.0 Billion in 2024. Looking forward, IMARC Group expects the 7MM to reach USD 24.7 Billion by 2035, exhibiting a growth rate (CAGR) of 8.59% during 2025-2035. The market is driven by the escalating utilization of gene therapy, which involves introducing a functional copy of the faulty gene into the patient's cells, thereby encouraging the production of factor IX in the body. This revolutionary approach not only improves patient quality of life but also significantly reduces the overall treatment burden. The success of gene therapies is driving the expansion of the hemophilia B market, fueling increased investment and research.

Advances in Early Detection and Diagnostic Technologies: Driving the Hemophilia B Market

Advances in the technology of early detection and diagnostic aids are at the forefront in advancing the hemophilia B market by improving diagnostic accuracy, early intervention, and proper management of the patient. Development in genetic testing technologies enabled early detection in newborns and populations at risk of having the condition. This leads to easy identification of the factor IX gene with next-generation sequencing (NGS) and DNA-based testing, which might provide early diagnosis through a more personalized approach to treatment. Early diagnosis makes sure that a child born with hemophilia B receives prophylactic treatment. This improves quality of life for children and prevents bleeding episodes from occurring. Besides that, there were advancements in clotting factor assays that resulted in improved diagnosis and monitoring of the progression of diseases in patients affected by hemophilia B. From the measurement of factor IX in blood, a proper evaluation for the deficiency may be given as well as suggested treatment programs for the patients. The advent of point-of-care diagnostic devices can also help patients monitor coagulation levels real-time, very helpful for those undergoing home therapy. In addition, the increased application of genetic counseling has equipped patients and families with knowledge about the inherited nature of hemophilia B, which has led to better-informed decisions and preventive care. The increasing integration of molecular diagnostics into routine clinical practice is improving the ability to tailor treatments, including gene therapies and novel clotting factor therapies, thus contributing to the overall expansion of the hemophilia B market.

Request a PDF Sample Report: https://www.imarcgroup.com/hemophilia-b-market/requestsample

Development of Novel Therapies and Pharmacological Treatments: Contributing to Market Expansion

New treatments and pharmacological drugs are among the significant drivers for the hemophilia B market as they offer new options for treatment with higher efficacy, convenience, and long-term benefits. Long-acting clotting factor therapies are significant and one of the most promising developments, designed to extend the duration of activity of clotting factors in the bloodstream. Thus, it reduces the number of infusions, thereby improving patient convenience and compliance. For example, idursulfase beta and eftrenonacog alfa are engineered to be longer-lasting than conventional factor IX concentrates, which reduces the burden of routine treatments. Gene therapy is another area of transformation. This has the potential to be a one-time treatment that actually corrects the cause of hemophilia B. Gene therapy accomplishes this through the transduction of a functional copy of the factor IX gene into the liver, which maintains continuous, endogenous production of clotting factor IX. Such an interest in this market has been tremendous since its success in clinical trials and the approval of gene therapies like Valoctocogene roxaparvovec can potentially reduce or eradicate the need for frequent infusions of factor IX products. Bispecific antibodies and non-factor replacement therapies are the latest in emerging treatments for hemophilia B patients, allowing alternative approaches to manage bleeding episodes with mechanisms of action. Increasing diversity in treatment modalities combined with personalized medicine approaches are opening up new opportunities for growth in the hemophilia B market as patient care is improved, the burden of treatment is reduced, and a cure is on the horizon.

Buy Full Report: https://www.imarcgroup.com/checkout?id=7896&method=809

Marketed Therapies in Hemophilia B Market

Rixubis (Recombinant factor IX): Baxalta

Rixubis (Recombinant factor IX) is an injectable drug used to restore missing clotting factor IX in adults and children with hemophilia B (also known as congenital factor IX deficiency or Christmas disease). Rixubis works by replacing the missing clotting factor IX in hemophilia B patients, allowing the blood to clot properly by essentially replenishing the deficient factor required for effective hemostasis, thereby preventing and controlling excessive bleeding episodes associated with the condition. It accomplishes this by being injected intravenously, where it enters the bloodstream and functions similarly to the naturally occurring factor IX protein.

Rebinyn (Nonacog beta pegol): Novo Nordisk

Rebinyn (Nonacog beta pegol) is a recombinant factor IX derivative used to treat hemophilia B. Rebinyn replaces the missing coagulation Factor IX in hemophilia B patients, effectively functioning as a substitute for the defective clotting factor and permitting appropriate blood clot formation by re-entering the normal coagulation cascade. The pegol component of the molecule is a polyethylene glycol attachment that increases Factor IX's half-life, which means it stays in the bloodstream longer and requires fewer injections.

BeneFix (Nonacog alfa): Pfizer

BeneFIX includes recombinant coagulation FIX (nonacog alfa). Recombinant coagulation FIX is a recombinant DNA-based protein therapy with structural and functional properties like endogenous FIX. In the extrinsic pathway, factor VII/tissue factor complex activates FIX, while factor XIa activates it in the intrinsic coagulation pathway. Activated FIX, when combined with activated factor VIII, activates factor X. This leads to the transformation of prothrombin to thrombin. Thrombin then transforms fibrinogen into fibrin, which allows a clot to form. In patients with hemophilia B, FIX activity is missing or significantly diminished, and substitution therapy may be required.

Emerging Therapies in Hemophilia B Market

BE-101: Be Biopharma

BE-101 is a first-in-class engineered B Cell Medicine (BCM) that treats hemophilia B by introducing the human Factor IX (FIX) gene into primary human B cells, allowing for continuous expression of active FIX. BE-101 has the potential for sustained therapeutic FIX activity levels with a single infusion, which can be titrated and/or re-dosed, and does not require preconditioning. By maintaining sustained and constant therapeutic FIX activity levels while reducing the dosing frequency required by current FIX replacement regimens, BE-101 could alleviate the significant infusion burden faced by people with hemophilia B, potentially lowering annualized bleeding rates and FIX usage.

Fitusiran: Alnylam Pharmaceuticals/Sanofi

Fitusiran, developed by Alnylam Pharmaceuticals and Sanofi, is an RNA interference (RNAi) therapy for hemophilia B. It works by targeting and silencing the ANT3 gene, which produces antithrombin, a protein that inhibits blood clotting. By reducing antithrombin levels, Fitusiran enhances the body's ability to generate thrombin, promoting blood clot formation and preventing bleeding episodes in patients with hemophilia B.

| Drug Name | Company Name | MOA | ROA |

| BE-101 | Be Biopharma | Factor IX replacements; Gene transference | Intravenous |

| Fitusiran | Alnylam Pharmaceuticals/Sanofi | Antithrombin III expression inhibitors; Haemostasis stimulants; RNA interference | Subcutaneous |

Leading Companies in the Hemophilia B Market:

The market research report by IMARC encompasses a comprehensive analysis of the competitive landscape in the market. Across the global hemophilia B market, several leading companies are at the forefront of developing integrated platforms to enhance the management of hemophilia B. Some of the major players include Baxalta, Novo Nordisk, and Pfizer. These companies are driving innovation in the hemophilia B market through continuous research, diagnostic tools, and expanding their product offerings to meet the growing demand for the illness.

Key Players in Hemophilia B Market:

The key players in the Hemophilia B market who are in different phases of developing different therapies are Baxalta, Novo Nordisk, Pfizer, Bioverativ, CSL Behring, Regeneron Pharmaceuticals, rEVO Biologics, LFB Biotechnologies, Swedish Orphan Biovitrum, Be Biopharma, Alnylam Pharmaceuticals, Sanofi, and Others.

Regional Analysis:

The major markets for hemophilia B include the United States, Germany, France, the United Kingdom, Italy, Spain, and Japan. The United States has the largest patient pool for hemophilia B and is also the biggest market for its treatment, according to projections by IMARC. This can be attributed to the introduction of long-acting recombinant factor IX products, such as Alprolix and Idelvion, that significantly reduce the frequency of infusions, improving patient convenience and adherence.

Another breakthrough in gene therapy is the potential it holds as a transformative treatment for hemophilia B. Valoctocogene roxaparvovec, among the latest advancements in gene therapy, has the possibility of being a long-term or permanent cure because it will enable the body to produce its factor IX. This is highly marketable since patients are seeking sustainable treatment options.

In addition to this, increasing awareness of hemophilia B and advances in early diagnosis are also propelling the market forward. Early diagnosis of the disorder helps in timely intervention and better treatment outcomes. Advancements in diagnostic technologies, such as genetic testing and clotting factor assays, are facilitating better management and personalized treatments for hemophilia B patients.

Recent Developments in Hemophilia B Market:

- In October 2024, Pfizer Inc. announced that the U.S. FDA had approved HYMPAVZI (marstacimab-hncq) for routine prophylaxis to prevent or reduce the frequency of bleeding episodes in adults and pediatric patients 12 years of age and older with hemophilia B (congenital factor IX deficiency) without factor IX inhibitors.

- In May 2024, Be Biopharma, Inc. reported that the United States FDA had approved its Investigational New Drug application (IND) for BE-101, a first-in-class BCM being developed for the potential treatment of hemophilia B. The BeCoMe-9 Phase 1/2 clinical trial is a multi-center, first-in-human dose escalation study aiming to evaluate the safety and preliminary efficacy of BE-101 in adult patients with moderately severe to severe hemophilia B.

- In June 2023, CSL Behring stated that the first patient had received the FDA-approved HEMGENIX (etranacogene dezaparvovec-drlb) for hemophilia B in the United States. HEMGENIX is the first and only gene therapy approved for the treatment of people with hemophilia B who are presently receiving factor IX prophylactic therapy, have current or previous life-threatening bleeding, or have experienced repeated, severe spontaneous bleeding episodes.

Base Year: 2024

Historical Period: 2019-2024

Market Forecast: 2025-2035

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the hemophilia B market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the hemophilia B market

- Reimbursement scenario in the market

- In-market and pipeline drugs

This report offers a comprehensive analysis of current hemophilia B marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

IMARC Group Offer Other Reports:

Adrenal Cortex Neoplasms Market: The 7 major adrenal cortex neoplasms markets reached a value of USD 23.5 Million in 2024. Looking forward, IMARC Group expects the 7MM to reach USD 29.8 Million by 2035, exhibiting a growth rate (CAGR) of 2.20% during 2025-2035.

Argininosuccinic Aciduria Market: The 7 major argininosuccinic aciduria markets are expected to exhibit a CAGR of 3.3% during 2024-2034.

Brain Hemorrhage Market: The 7 major brain hemorrhage markets reached a value of US$ 136.6 Million in 2023. Looking forward, IMARC Group expects the 7MM to reach US$ 211.0 Million by 2034, exhibiting a growth rate (CAGR) of 4.03% during 2024-2034.

Cerebral Aneurysm Market: The 7 major cerebral aneurysm markets are expected to exhibit a CAGR of 7.06% during 2024-2034.

Traumatic Brain Injury Market: The 7 major traumatic brain injury markets are expected to exhibit a CAGR of 3.36% during 2024-2034.

Antiphospholipid Syndrome Market: The 7 major antiphospholipid syndrome markets reached a value of US$ 29.5 Million in 2023, and projected the 7MM to reach US$ 74.5 Million by 2034, exhibiting a growth rate (CAGR) of 8.79% during 2024-2034.

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Phone Number: - +1 631 791 1145, +91-120-433-0800