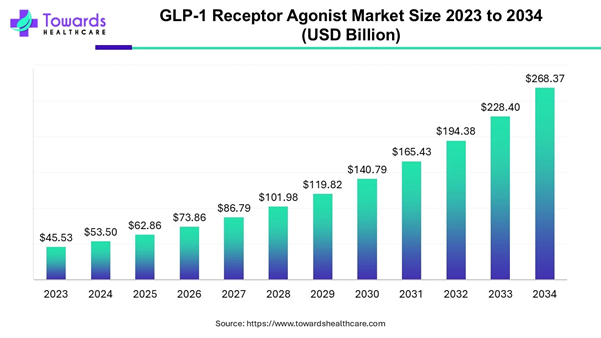

The global GLP-1 receptor agonist market size is valued at USD 53.5 billion in 2024 and is expected to grow to USD 62.86 billion by 2025. Looking ahead, the market is projected to reach approximately USD 268.37 billion by 2034, growing steadily at a strong CAGR of 17.5% from 2025 to 2034. This reflects the rapidly rising demand and expanding use of GLP-1 therapies across the globe.

Get a sneak peek into key market insights with our free sample report: https://www.towardshealthcare.com/download-sample/5410

The market is fueled by factors including increasing cases of type 2 diabetes and obesity, along with the combined advantages of these agonists in glycemic control and weight management. Also, other contributing factors, such as raised R&D activities, the development of oral formulations, and the potential for accelerated therapeutic applications, are driving the market growth.

GLP-1 Receptor Agonist Market Highlights:

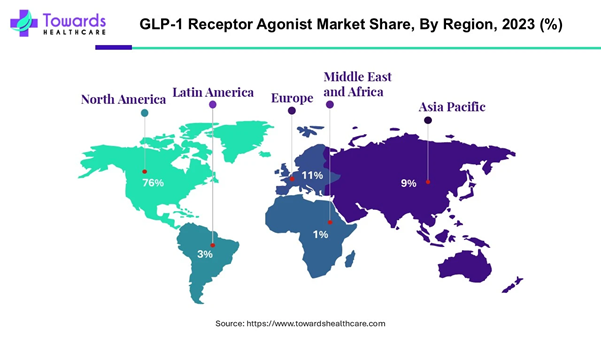

• North America registered dominance of the global market share by 76% in 2024.

• Asia-Pacific is expected to grow at the fastest CAGR during 2025-2034.

• By product, the Ozempic segment dominated the market in 2024.

• By product, the Zepbound segment is expected to grow rapidly during the forecast period.

• By application, the type 2 diabetes mellitus segment held a major share of the global GLP-1 receptor agonist market in 2024.

• By application, the obesity segment is expected to grow significantly in the upcoming years.

• By route of administration, the parenteral segment led the market in 2024.

• By route of administration, the oral segment is expected to be the fastest-growing in the studied years.

• By distribution channel, the hospital pharmacies segment dominated the market in 2024.

• By distribution channel, the online pharmacies segment is expected to expand at the fastest CAGR during 2025-2034.

Access comprehensive market data, trends, and forecasts in one downloadable databook: https://www.towardshealthcare.com/download-databook/5410

Market Overview: Novel Use in Different Areas

A class of drugs used in the management of type 2 diabetes and obesity is called GLP-1 receptor agonists. Currently, a changed lifestyle with the adoption of a sedentary approach and consumption of packaged and fast food is fueling a rise in diabetes and obesity cases. These growing cases and raised efficacy with enhanced glycemic control and weight loss make them a preferred treatment option for many patients. Furthermore, ongoing developments on the use of GLP-1 receptor agonists beyond diabetes in neurodegenerative diseases, cardiovascular conditions, and even obstructive sleep apnea, are propelling the global GLP-1 receptor agonist market growth.

Broad Application in Cardiovascular Concerns: Major Potential

In 2025, crucial research activities will be developing new applications of GLP-1 receptor agonists in heart conditions, including protective effects on the heart and blood vessels, probably decreasing the risk of heart attack, stroke, and other cardiovascular events. As well as, it has beneficial action in NASH (Non-alcoholic Steatohepatitis) treatment, which is connected with liver issues with obesity and type 2 diabetes. Furthermore, studies such as the STEP-HFpEF trial with GLP-1 receptor agonists have shown optimized exercise capacity and reduced heart failure symptoms in patients.

High Expenditure and Supply Chain Issues: Major Limitations

In the global GLP-1 receptor agonist market, arising challenges are the high expenses of these drugs, which pose a hurdle for many patients; besides this, shortages and supply chain difficulties by pharma companies with constrained production capacity and a risk of counterfeit products in the market.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

The GLP-1 Receptor Agonist Market: Regional Analysis

Around the world, North America dominated the market share by 76%, due to an acceleration in both type 2 diabetes and obesity rates. With significant results of GLP-1 receptor agonists in clinical trials, such as weight loss (up to 20%) and improved glycemic control, making them a preference for both physicians and patients. Along with this, the region is introducing novel and enhanced GLP-1 medications, with long-acting formulations, and Wegovy and Zepbound in diabetes and obesity, which is driving the market growth.

However, major expansion of the GLP-1 receptor agonist market in the US is fueled by heavy investments in research and development of new therapies by many pharmaceutical industries. Besides this, increasing awareness of the advantages of these drugs through marketing efforts and direct-to-consumer advertising, particularly on social media, and a favorable regulatory landscape are enabling approvals and boosting demand in the market.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Latest Updates in the U.S. GLP-1 Receptor Agonist Market

|

Company |

Latest Updates |

|

Illumina (May 2025) |

Along with Ovation.io has launched the first-of-its-kind GLP-1 dataset to expand new therapy development. |

|

Novo Nordisk (April 2025) |

Collaborated with Hims & Hers Health, Inc. to create proven obesity care and treatments more available, more affordable, and more connected for millions of Americans |

|

Meitheal Pharmaceuticals (April 2025) |

Announced approval and launch of Liraglutide injection in the United States |

|

Biolinq (April 2025) |

Raised $100m to support the US launch of the intradermal glucose sensor |

|

CordenPharma (March 2025) |

Signed a long-term planned partnership with Viking Therapeutics for the integrated supply of GLP-1 Peptides, injectables, and oral formulations |

On the other hand, the Canadian government is initiating plans, including Canada's Diabetes 360°, aimed at minimizing diabetes prevalence, with funding allocated to novel treatment choices like GLP-1 receptor agonists. Also, the inclusion of the drugs in public drug formularies and expanded insurance coverage for chronic condition management escalates accessibility, especially for underserved populations, and is driving the demand and growth of the market.

The Asia Pacific is Predicted to Grow at the Fastest CAGR In the Upcoming Years

Asia Pacific is estimated to grow rapidly, due to its larger pool of diabetes cases, including major countries such as China and India. Basically, in ASAP, the broad adoption of early cooked or ripened foods, Flour added food materials, is fueling a rise in diabetes cases, which ultimately accelerates demand for GLP-1 receptor agonists. As well as, various governments in ASAP are promoting awareness about the elimination of the diabetes burden by coupling with detecting the disease early, and improving management strategies.

Crucial country in ASAP is India, which is experiencing critical expansion in type 2 diabetes and obesity are driving the GLP-1 receptor agonist market growth. As well as favorable reimbursement policies with government support for diabetes and obesity treatments, are a boost in access to cost-effective medications.

For this market,

• In July 2025, Medtronic, a global leader in medical technology, invested $50M in the India Diabetes Center.

China has a huge and rising population with type 2 diabetes, and the number of individuals who are overweight or obese is also growing. Also, the development of orally formulated GLP-1 drugs, usually administered via injection, is accelerating availability and patient compliance with enhanced convenience. In China, a continuous R&D pipeline in novel drug discovery, coupled with injectable and oral formulations, is employed in non-alcoholic steatohepatitis (NASH) and Alzheimer's disease, escalating market growth.

Elevate your healthcare strategy with Towards Healthcare. Enhance efficiency and drive better outcomes schedule a call today: https://www.towardshealthcare.com/schedule-meeting

The GLP-1 Receptor Agonist Market: Segmentation Analysis

By product analysis

The Ozempic segment held the biggest revenue share of the GLP-1 receptor agonist market in 2024. Mostly involved benefits of Ozempic, such as its robust clinical performance, wide use for type 2 diabetes, and rising off-label application for weight management, and positive results in cardiovascular concerns, are helping to boost the segment growth.

On the other hand, the Zepbound segment will show rapid expansion, due to its possession of GLP-1 and GIP receptor agonists are used in dual action, including in both glucose control and weight loss benefits, appealing to individuals with type 2 diabetes and those seeking weight management solutions.

By application analysis

In 2024, the type 2 diabetes mellitus segment led the GLP-1 receptor agonist market due to the high incidence of the disease and the major efficacy of these drugs in controlling blood sugar levels and encouraging weight loss, contributing majorly to the expansion of the type 2 diabetes mellitus segment.

Whereas, the obesity segment will expand at a significant CAGR, with the raised adoption of GLP-1 receptor agonist along with its possession of dual action are fueling the overall market growth. Also, growing awareness about the risk of obesity to health is supporting to enhancement of weight loss, including these medications.

By route of administration analysis

The parenteral segment was dominant in the global GLP-1 receptor agonist market in 2024. The segment is impelled by the broad use and proven efficacy of various injectable formulations, including dulaglutide (Trulicity), semaglutide (Ozempic, Wegovy), and liraglutide (Victoza, Saxenda) in managing type 2 diabetes and obesity.

However, the oral segment will expand rapidly, due to the launch of novel medications like Rybelsus (oral semaglutide) and the widespread trend towards proactive health management. Also, for patients, they are easy to consume, with increased affordability and accessibility, enhancing the development of the oral medications used in diabetes and obesity.

By distribution channel analysis

In 2024, the hospital pharmacies segment led the global GLP-1 receptor agonist market. Around the globe, increasing collaborations between pharmaceutical companies and hospitals are escalating patient treatment rates. As well as hospitals with specialized care and treatment strategies for patients with complex medical requirements, generating a key setting for GLP-1 receptor agonist distribution.

The online pharmacies segment is estimated to grow fastest during the forecast period. The market is influenced by rising digitalization, with major factors like the convenience of online purchasing, home delivery, and the integration of telehealth services.

Top Companies and Their Contributions to the GLP-1 Receptor Agonist Market

|

Company |

Contribution & Offerings |

|

Amneal Pharmaceuticals |

Primarily a generics and biosimilars specialist, R&D efforts target biosimilar GLP-1 therapies, leveraging its global manufacturing footprint in the U.S., India, and Ireland to expand access. |

|

Ascendis Pharma |

Developing long-acting, once-weekly peptide prodrug GLP-1 analogs via its TransCon technology, aimed at enhancing adherence and reducing injection frequency. |

|

AstraZeneca |

Commercializes exenatide (Bydureon) and advances next-gen candidates focused on improved cardiovascular-renal outcomes alongside GLP-1 activity. |

|

Boehringer Ingelheim |

Co-develops dual agonists (e.g., amylin/GLP‑1) with Zealand Pharma; pipeline aims at better tolerability and metabolic efficacy. |

|

Eli Lilly & Company |

Offers tirzepatide (Mounjaro for diabetes; Zepbound for obesity) – a dual GIP/GLP‑1 agonist leading market sales; developing oral orforglipron expected by 2026. |

|

Hansoh Pharma |

(Limited public data) A Chinese biotech advancing GLP-1 molecules domestically, aiming to capture growing regional demand alongside global players. |

|

Innovent Biologics |

Partnering on injectable biologics; reportedly advancing pipeline GLP-1 variants and co-agonists for metabolic disorders in China. |

|

Merck |

Focused on oral GLP‑1 and combination therapies; labs engaged in late-stage R&D targeting convenient dosing forms. |

|

Novo Nordisk A/S |

Market leader: semaglutide-based Ozempic, Wegovy, Rybelsus, and Saxenda dominate diabetes and obesity; strong R&D mid‑pipeline (e.g., CagriSema combo, oral semaglutide) and major capacity investments in Brazil, France, U.S. to meet rising demand. |

|

Metsera, Inc. |

A clinical-stage biotech developing novel oral GLP‑1 hybrids; pipeline includes co-agonists with early-phase results. |

GLP-1 Receptor Agonist Market Companies

• Amneal Pharmaceuticals

• Ascendis Pharma

• AstraZeneca

• Boehringer Ingelheim

• Eli Lilly & Company

• Hansoh Pharma

• Innovent Biologics

• Merck

• Metsera, Inc.

• Novo Nordisk A/S

• Pfizer, Inc.

• Sanofi

• Viking Therapeutics, Inc.

What is Going Around the Globe?

• In March 2025, Roche and Zealand Pharma launched an Up-to-$5.3B obesity collaboration to co-develop and co-commercialize Zealand’s petrelintide for overweight and obesity indications.

• In December 2024, Eli Lilly, the US pharmaceutical giant, announced the launch of its blockbuster drug, Tirzepatide, in India in 2025.

• In October 2024, Amneal Pharma invested Rs 1,600 crore in Gujarat to manufacture GLP-1 drugs.

GLP-1 Receptor Agonist Market Segmentation

By Product

• Ozempic

• Trulicity

• Mounjaro

• Wegovy

• Rybelsus

• Saxenda

• Victoza

• Zepbound

• Other Products

By Application

• Type 2 Diabetes Mellitus

• Obesity

By Route of Administration

• Parenteral

• Oral

By Distribution Channel

• Hospital Pharmacies

• Retail Pharmacies

• Online Pharmacies

By Region

• North America

• US

• Canada

• Asia Pacific

• China

• Japan

• India

• South Korea

• Thailand

• Europe

• Germany

• UK

• France

• Italy

• Spain

• Sweden

• Denmark

• Norway

• Latin America

• Brazil

• Mexico

• Argentina

• Middle East and Africa (MEA)

• South Africa

• UAE

• Saudi Arabia

• Kuwait

To invest in our premium strategic solution and customized market report options, click here: https://www.towardshealthcare.com/price/5410

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Gain access to the latest insights and statistics in the healthcare industry by subscribing to our Annual Membership. Stay updated on healthcare industry segmentation with detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead of the curve with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities in the dynamic world of healthcare: Get a Subscription

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics to the healthcare sector, committed to forming creative connections that result in actionable insights and creative innovations. We are a global strategy consulting firm that assists business leaders in gaining a competitive edge and accelerating growth. We are a provider of technological solutions, clinical research services, and advanced analytics to the healthcare sector, committed to forming creative connections that result in actionable insights and creative innovations.

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire

For Latest Update Follow Us: https://www.linkedin.com/company/towards-healthcare

Browse More Insights of Towards Healthcare:

The global peptide receptor radionuclide therapy market size is estimated at US$ 2.34 billion in 2024, is projected to grow to US$ 2.58 billion in 2025, and is expected to reach approximately US$ 6.1 billion by 2034. The market is projected to expand at a compound annual growth rate (CAGR) of 10.06% between 2025 and 2034.

The global G-protein coupled receptors market size is calculated at US$ 3.86 in 2024, grew to US$ 4.06 billion in 2025, and is projected to reach around US$ 6.37 billion by 2034. The market is expanding at a CAGR of 5.14% between 2024 and 2034.

The global thrombopoietin receptor agonists market was estimated at US$ 1.85 billion in 2023 and is projected to grow to US$ 3.74 billion by 2034, rising at a compound annual growth rate (CAGR) of 6.6% from 2024 to 2034.

The global oral thrombopoietin receptor agonists market was estimated at US$ 4.73 billion in 2023 and is projected to grow to US$ 9.95 billion by 2034, rising at a compound annual growth rate (CAGR) of 7% from 2024 to 2034.

The global bronchitis treatment market size is calculated at US$ 6.85 in 2024, grew to US$ 7.21 billion in 2025, and is projected to reach around US$ 11.45 billion by 2034. The market is expanding at a CAGR of 5.28% between 2025 and 2034.

The global invisible orthodontics market size is calculated at USD 7.7 billion in 2024, grows to USD 9.91 billion in 2025, and is projected to reach around USD 96.27 billion by 2034. The market is expanding at a CAGR of 28.54% between 2025 and 2034.

The multiple myeloma CAR-T market is rapidly advancing on a global scale, with expectations of accumulating hundreds of millions in revenue between 2025 and 2034.

The worldwide AAV gene therapy market is experiencing significant expansion, with projections indicating a revenue increase reaching several hundred million dollars by the end of the forecast period, spanning 2025 to 2034.

The global 3D printed hip and knee implants market size is calculated at US$ 5.81 in 2024, grew to US$ 6.83 billion in 2025, and is projected to reach around US$ 28.87 billion by 2034. The market is expanding at a CAGR of 17.49% between 2025 and 2034.

The global microfluidics in oncology market is on an upward trajectory, poised to generate substantial revenue growth, potentially climbing into the hundreds of millions over the forecast years from 2025 to 2034.