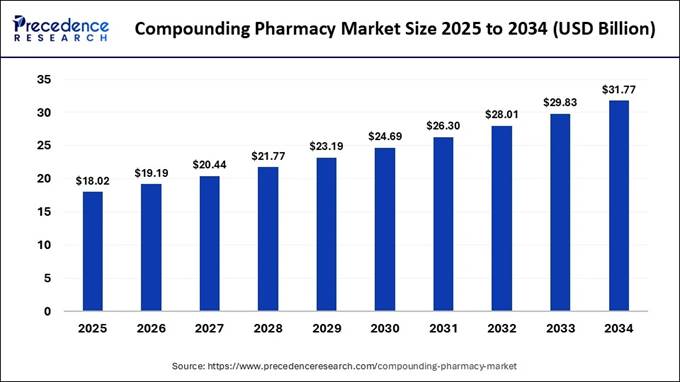

The global compounding pharmacy market size is expected to be worth nearly USD 31.77 billion by 2034, increasing from USD 18.02 billion in 2025 and it is growing at a compound annual growth rate (CAGR) of 6.50% from 2025 to 2034. Growing due to rising demand for personalized medicine and customized dosages.

Compounding Pharmacy Market Highlights:

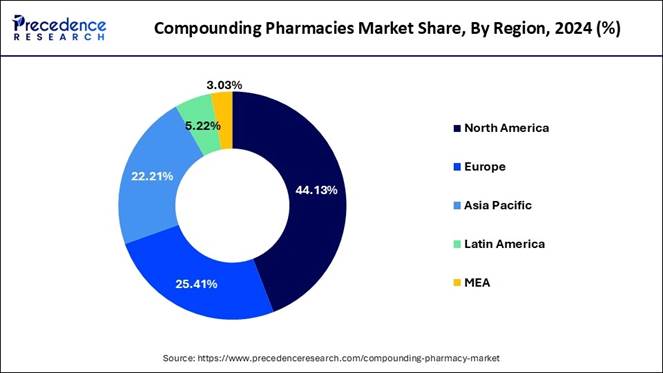

🔹 North America strengthens its leadership, capturing 44.13% of the global revenue—driven by advanced healthcare infrastructure and strong adoption of personalized therapies.

🔹 Pharmaceutical Ingredient Alteration (PIA) remains the top compounding type, accounting for a commanding 38% share, reflecting rising demand for dosage customization and allergen-free formulations.

🔹 Sterile compounded preparations lead the market with a robust 58.8% share, supported by growing use in hospitals, injectables, ophthalmics, and high-precision clinical applications.

🔹 Adults represent the largest consumer base, generating 44.5% of total demand, as chronic diseases and personalized treatment needs continue to rise.

🔹 Pain management emerges as the most dominant therapeutic segment, capturing 33.6% share, fueled by the shift toward customized, safer alternatives to conventional pain medications.

🔹 PIA once again reinforces its dominance, holding the highest market share (38%), driven by increasing physician preference for tailored ingredient combinations.

What is Compounding Pharmacy?

The compounding pharmacy market in 2025 is expanding steadily as demand for personalized medications, customized dosages, and alternative formulations rises across hormone therapy, pain management, dermatology, and pediatric care. Key drivers include drug shortages, supply chain challenges, and the need for patient-specific treatments not available in mass-produced pharmaceuticals.

Advances in automated compounding systems, digital prescribing platforms, and sterile/non-sterile preparation techniques are improving efficiency, safety, and scalability. Supportive government policies, increased healthcare spending, and telehealth integration further strengthen the market, positioning compounding pharmacies as a critical component of modern, patient-centered healthcare.

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

Private Industry Investments in Compounding Pharmacy

🔹Walgreens Boots Alliance (acquired by Sycamore Partners), the major retail pharmacy chain was acquired by private equity firm Sycamore Partners in August 2025, a move that could accelerate investment in differentiated services like compounding, free from public market pressures.

🔹Fagron, this public company, which operates globally in the compounding sector, is making a $29 million one-off investment to expand Anazao's 503B compounding facility in Las Vegas, highlighting a significant investment in specialized, high-volume sterile preparation capacity.

🔹Revelation Pharma Network, backed by private equity firm Osceola Capital Management, Revelation Pharma has been consolidating the market by acquiring and expanding its national network of compounding pharmacies to provide broader wholesale services to healthcare providers.

🔹Wedgewood Pharmacy A leading provider in both veterinary and human compounded medications, Wedgewood Pharmacy is a significant player whose operations demonstrate ongoing private investment in specialized compounding services, particularly in the animal health sector.

🔹Empower Pharmacy recognized as one of the leading players in the compounding pharmacy market. Empower Pharmacy represents a major investment in the industry, focusing on providing a wide range of compounded medications.

Unlock detailed insights on AI’s impact in the compounding pharmacy market 👉 https://www.precedenceresearch.com/ai-precedence

Key Trends of the Compounding Pharmacy Market

🔹Rising Demand for Personalized Medicine: Patients increasingly require medications tailored to their unique needs, such as specific dosages, allergen-free formulations, or alternative delivery forms (e.g., liquids, topical creams) not available commercially. This focus on patient-centric care is particularly significant for specialized treatments like hormone replacement therapy and pain management, improving patient adherence and treatment outcomes.

🔹Mitigating Persistent Drug Shortages: Compounding pharmacies play a vital role when commercial manufacturers struggle to meet demand or discontinue certain drugs, ensuring patients have continued access to essential treatments. This ability to quickly produce needed medications in smaller batches provides supply chain resilience and helps healthcare providers avoid treatment delays during crises.

🔹Integration of Technology and Automation: The adoption of advanced technology, such as automated compounding systems, robotic dispensing, and specialized software, is streamlining pharmacy operations. These technologies enhance the precision, efficiency, and safety of compounded medications while helping pharmacies meet stringent regulatory and quality control standards.

Compounding Pharmacy Market Opportunity

Personalized Medicine: The Next Frontier Driver in Compounding Pharmacy

The rise of personalized medicine represents the most significant opportunity in the compounding pharmacy market, as patients increasingly demand treatments tailored to their unique health needs, age, and physiology.

Compounded medications allow for customized dosages, alternative formulations, and specific delivery methods, such as creams, gels, transdermal patches, or liquid suspensions, that are not available in standard mass-produced pharmaceuticals. Hormone replacement therapy, pediatric and geriatric care, dermatology treatments, and pain management are key therapeutic areas where personalization is particularly critical.

📥 Dive into the Complete Report ➡️ https://www.precedenceresearch.com/compounding-pharmacy-market

Compounding Pharmacy Market Report Coverage

|

Report Attributes |

Key Statistics |

|

Market Size (2025) |

USD 18.02 Billion |

|

Market Size (2026) |

USD 19.19 Billion |

|

Forecast Market Size (2034) |

USD 31.77 Billion |

|

Growth Rate (2025–2034) |

CAGR of 6.50% |

|

Base Year |

2025 |

|

Forecast Period |

2025 to 2034 |

|

Largest Market |

North America |

|

Fastest Growing Region |

Asia-Pacific |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Segments Covered |

Therapeutic Area, Route of Administration, Age Group, Compounding Type, Sterility, Distribution Channel, Region |

|

Therapeutic Areas |

Pain Management, Hormone Replacement, Dermatology, Nutritional Supplements, Others |

|

Route of Administration |

Oral, Topical, Parenteral, Others |

|

Age Groups |

Pediatric, Adult, Geriatric, Veterinary |

|

Compounding Types |

Pharmaceutical Ingredient Alteration (PIA), Pharmaceutical Dosage Alteration (PDA), Currently Unavailable Pharmaceutical Manufacturing (CUPM), Others |

|

Sterility Type |

Sterile, Non-Sterile |

|

Distribution Channels |

Compounding Pharmacies, Hospital Pharmacies, Specialty Clinics, Others |

|

Key Market Drivers |

Increased demand for personalized therapies, surge in drug shortages, rising need for allergen-free and dose-adjusted medications |

|

Market Opportunities |

Growth in sterile injectable compounding, pediatric-specific formulations, hormone therapy, and personalized nutritional supplements |

|

Technology Trends |

Adoption of automated compounding systems, advanced cleanroom technologies, digital prescribing platforms |

|

Demographic Insights |

Adults dominate demand; pediatric and veterinary segments showing rapid growth |

|

Market Characteristics |

Highly fragmented, increasing private investments, growing regulatory focus, accelerated adoption of custom formulations |

Don’t

Miss Out! | Instant Access to This Exclusive Report 👉 https://www.precedenceresearch.com/checkout/3185 Case

Study: How Compounding Pharmacy Transformed Treatment Outcomes for a Chronic

Pain Patient Background Chronic

pain affects millions of adults globally, and many struggle with standard, mass-produced

medications due to: 🔹intolerance to certain ingredients 🔹inadequate dose strengths 🔹side effects (e.g., drowsiness,

gastrointestinal issues) 🔹lack of alternative delivery options A

52-year-old patient suffering from chronic neuropathic pain had been on

multiple commercially available oral medications but faced severe side

effects, preventing long-term adherence. Physicians sought a personalized

approach to balance efficacy and tolerability. Case Details 👩⚕️ The Challenge The

patient reported: 🔹Burning and tingling neuropathic pain 🔹Intolerance to oral medications due

to nausea and dizziness 🔹Allergy to certain inactive

ingredients in standard drugs 🔹Limited response to existing

therapies The

clinician required a customized treatment that ensured: 🔹controlled local delivery 🔹reduced systemic side effects 🔹absence of allergenic components 🔹improved patient adherence Compounded Solution Customized Topical Cream Formulation A

compounding pharmacy prepared a multi-ingredient topical analgesic using

Pharmaceutical Ingredient Alteration (PIA), combining: 🔹Ketamine 🔹Gabapentin 🔹Baclofen 🔹Lidocaine 🔹Amitriptyline The

formulation was: 🔹Topical (to bypass GI side

effects) 🔹Allergen-free (removing intolerant

excipients) 🔹Customized dose strength tailored to the patient 🔹pH-balanced to avoid skin irritation The

pharmacy also adjusted concentration and absorption enhancers to build a personalized

pain-relief profile. Outcome & Impact 1. 60% Reduction in Pain Scores in the First 4 Weeks The

customized topical cream allowed localized relief with minimal systemic

absorption. 2. Zero GI Side Effects Compared to Oral Therapy The

topical route eliminated nausea, dizziness, and fatigue. 3. Improved Medication Adherence Once-daily

application increased consistency and overall treatment compliance. 4. Iterative Dose Optimization Over

two months, the compounding pharmacy fine-tuned ingredient ratios based on

patient feedback—something impossible with commercially available drugs. 5. Better Quality of Life The

patient reported the ability to resume daily activities, reduced dependence on

opioid therapy, and sustained functional improvement. For

inquiries regarding discounts, bulk purchases, or customization requests,

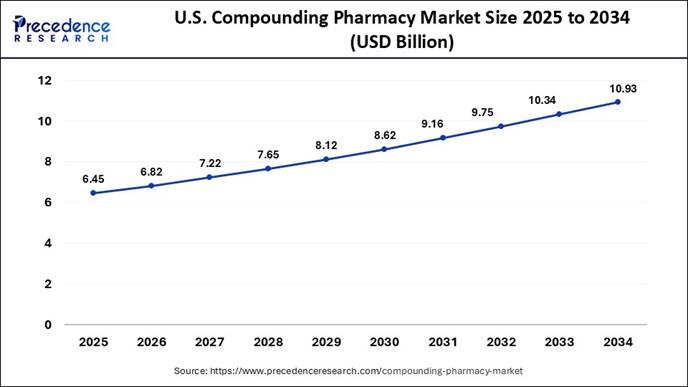

please contact us at sales@precedenceresearch.com Compounding Pharmacy Market Regional Outlook U.S. Compounding Pharmacy Market Size? According to

Precedence Research, the U.S. compounding pharmacy market size is valued at USD 6.45 billion in

2025 and is expected to cross USD 10.93 billion by 2034, with a CAGR of 6.04%

from 2025 to 2034.

U.S. Compounding Pharmacies Market Key

Takeaways

🔹 By Product, the oral medications

segment dominated the market with the largest market share of 36.21% in 2024. 🔹 By Pharmacy Type, 503A segment accounted

for more than 72.99% of revenue share in 2024. 🔹 By Sterility, the non-sterile

segment dominated the market with the highest revenue of 71.97% in 2024. 🔹 By Application, the adult segment is

expected to significantly boost during the anticipated timeframe. U.S. Compounding Pharmacies Market Size, By Pharmacy

Type, 2022 to 2024 (USD Billion)

By Pharmacy Type 2022 2023 2024 503A 3.99 4.21 4.45 503B 1.49 1.57 1.65

U.S. Compounding Pharmacies Market Size, By Sterility,

2022 to 2024 (USD Billion) By Sterility 2022 2023 2024 Sterile 1.53 1.62 1.71 Non-Sterile 3.95 4.16 4.39 By Therapeutic Area 2022 2023 2024 Hormone Replacement 1.05 1.17 1.17 Pain Management 0.48 0.51 0.54 Dermatology 0.25 0.26 0.28 Pediatrics 0.19 0.20 0.21 Urology 0.15 0.16 0.17 Others 0.54 0.56 0.58

Don’t

Miss Out! | Instant Access to This Exclusive Report 👉 https://www.precedenceresearch.com/checkout/1662 Leading Companies in the U.S.

Compounding Pharmacies Market & Their Offerings Company Headquarters Key Strengths Latest Info (2025) Triangle compounding pharmacy North Carolina High-quality medication Triangle Compounding Pharmacy creates personalised

compounded medications to meet medical needs. Fagron Belgium Strong brand reputation and expertise In November 2025, Fagron, the global leader in

pharmaceutical compounding, reinforced its EMEA position with the

acquisitions of a book of business from Amara (Poland) and Magilab (Hungary). B. Braun melsungen ag Germany Innovation and R&D spending In 2025, B. Braun Melsungen AG continues its focus

on providing products and solutions that support safe and efficient pharmacy

operations, including automated compounding systems and related supplies. Fresenius Kabi AG Germany Specialized Product Portfolio Fresenius Kabi AG is a significant provider of

sterile compounded medications and related services. Pencol Compounding Pharmacy Denver, Colorado Technology and innovation Pencol Compounding Pharmacy significantly provides

customized, patient-specific compounded medications across various

specialties.

Other Key Players ➢ Triangle compounding

pharmacy ➢ Fagron ➢ B.

Braun melsungen ag ➢ Fresenius

kabi ag ➢ Pencol

Compounding Pharmacy ➢ US

Compounding Inc. ➢ Avella

specialty pharmacy ➢ Institutional

pharmacy solutions, llc ➢ Pharmedium

services llc ➢Vertisis custom pharmacy

Note: This report is readily available for immediate delivery. We can

review it with you in a meeting to ensure data

reliability and quality for decision-making. North America Dominates: The Powerhouse of the

Compounding Pharmacy Market North America dominated the market in 2025 due to a

combination of high healthcare spending, advanced medical infrastructure, and

widespread adoption of personalized medicine. The region has a strong presence

of leading compounding pharmacies and technology providers offering automated

systems, sterile and non-sterile formulations, and digital prescribing

platforms. Rising demand for hormone replacement therapy, pain management, dermatology, and pediatric

medications has further fueled growth, supported by patient awareness and

physician preference for customized treatments. Canada Compounding Pharmacy Market

Trends In 2025, Canada's market experienced

steady growth driven by increasing demand for personalized medications across

hormone therapy, pain management, dermatology, and pediatric care. The market

benefited from advanced compounding practices, including sterile and

non-sterile formulations, and the adoption of automated systems and digital

prescribing platforms that improve accuracy and efficiency. Asia Pacific Emerges as the Fastest

Region in the Compounding

Pharmacy Market Asia Pacific emerged as the

fastest-growing region in the market in 2025, driven by increasing healthcare

access, rising awareness of personalized medicine, and rapid expansion of

pharmaceutical infrastructure across countries like China, India, Japan, and

South Korea. Growing demand for customized medications in hormone therapy, pain

management, dermatology, and pediatric care is fueling the adoption of

compounded drugs. The region benefits from a rising number

of local compounding pharmacies, strategic partnerships with global players,

and investments in automated compounding systems and digital prescribing

platforms, improving efficiency, safety, and scalability. India Compounding Pharmacy Market Trends In 2025, India's market showed rapid

growth due to rising demand for personalized medications in hormone therapy,

pain management, dermatology, and pediatric care. Increased awareness of

patient-specific treatments, combined with expanding healthcare infrastructure

and telehealth services, boosted the adoption of compounded drugs. Local compounding pharmacies and

partnerships with global suppliers improved access to high-quality

formulations, including sterile and non-sterile medications. Technological

advancements, such as automated compounding systems and digital prescribing

platforms, have enhanced efficiency, safety, and scalability. Compounding Pharmacy Market Segment

Insights Therapeutic Area Insights The pain management segment led the

market in 2024 due to rising demand for personalized treatments that address

chronic pain, post-surgical recovery, and patient-specific conditions not

adequately managed by standard medications. Compounded formulations, including

topical creams, gels, transdermal patches, and customized oral dosages, allowed

healthcare providers to tailor therapies to individual patient needs, improving

efficacy and minimizing side effects. The nutritional supplements segment is projected to experience the

fastest growth over the forecast period due to rising consumer demand for

personalized vitamins, minerals, and specialty nutrients tailored to individual

health needs. Patients increasingly sought customized formulations to address

deficiencies, improve immunity, support aging, or manage chronic conditions,

which standard over-the-counter supplements could not provide. Growing health

awareness, preventive care trends, and physician recommendations for

patient-specific regimens further boosted adoption. Route of Administration Insights The oral segment dominated the market in

2024 due to its versatility, ease of administration, and high patient

compliance, making it ideal for customized medications such as capsules,

tablets, liquids, and suspensions. Healthcare providers increasingly rely on

oral formulations to deliver patient-specific dosages for hormone therapy,

pediatric care, chronic conditions, and pain management. Rising demand for

personalized treatments that are not available in standard commercial products,

combined with advancements in compounding technologies and automated systems,

enabled pharmacies to efficiently produce safe and accurate oral medications. The parenteral segment is the

second-largest segment, leading the market due to growing demand for sterile,

injectable medications that require precise, patient-specific dosages,

particularly for oncology, intravenous therapies, pain management, and critical

care. Hospitals, clinics, and specialized healthcare providers increasingly

rely on compounded parenteral formulations to address shortages of commercially

available injectables and to provide customized treatments for patients with

unique medical needs. Age Insights In 2024, the adult segment led the

market due to the rising prevalence of chronic diseases, hormone imbalances,

and age-related health conditions that required personalized treatment

solutions. Adults often need customized dosages, alternative formulations, or

specific delivery methods, such as capsules, liquids, or topical applications,

that are not available in mass-produced medications. Growing awareness among healthcare

providers and patients about the benefits of tailored therapies, including

improved efficacy and reduced side effects, further boosted adoption. The pediatric segment is growing fastest

in the market due to the need for customized medications that are safe,

accurately dosed, and age-appropriate for children. Standard commercial drugs

often lack suitable formulations or dosages for pediatric patients, creating a

strong demand for compounded liquids, suspensions, flavored medications, and

chewable forms. Healthcare providers increasingly rely on compounding

pharmacies to address specific pediatric needs, including chronic conditions,

rare diseases, and post-surgical care. Compounding Type Insights The pharmaceutical ingredient alteration (PIA) segment led the market in

2024 segment led the compounding pharmacy market in 2024 due to growing demand

for medications tailored to individual patient needs, including dosage

adjustments, ingredient substitutions, and allergen-free formulations. Patients

with allergies, sensitivities, or unique therapeutic requirements often require

customized compounds that standard commercial drugs cannot provide. Healthcare

providers increasingly rely on PIA to optimize efficacy, reduce side effects,

and enhance patient compliance. The currently unavailable pharmaceutical

manufacturing (CUPM) segment is expected to grow fastest over the forecast

period due to growing shortages and limited availability of certain

commercially manufactured drugs. Patients and healthcare providers turned to

compounding pharmacies to access essential medications that were otherwise out

of stock, discontinued, or unavailable in specific dosages or formulations.

This segment allowed customized production of both sterile and non-sterile

medications to meet urgent therapeutic needs, ensuring continuity of care. Sterility Insights The sterile segment dominated the market

in 2024 due to rising demand for injectable and intravenous medications that

require strict sterility, precision dosing, and safety. Hospitals, clinics, and

specialty care providers increasingly relied on compounded sterile preparations

for oncology, pain management, ophthalmology, and critical care, where commercially available drugs

were insufficient or unavailable. Advances in automated sterile compounding

systems, cleanroom technologies, and stringent quality-control protocols

enhanced accuracy, safety, and regulatory compliance. The non-sterile segment is expected to

grow fastest over the forecast period due to high demand for customizable oral,

topical, and transdermal medications that do not require strict sterility but

still need precise dosing. Patients sought personalized creams, gels, liquids,

capsules, and suspensions for hormone therapy, pain management, dermatology,

and pediatric care, which standard products could not provide. Compounding

pharmacies leverage advanced formulation techniques, automated systems, and

digital prescribing platforms to ensure accuracy, safety, and efficiency in

producing non-sterile medications. Distribution Channel Insights In 2024, the compounding pharmacy

segment led the market due to increasing demand for personalized medications

tailored to individual patient needs, including customized dosages, alternative

formulations, and specific delivery methods. Patients with chronic conditions,

hormone imbalances, pediatric or geriatric requirements, and allergies

increasingly relied on compounded drugs when standard commercial medications

were insufficient. The hospital pharmacy segment is growing

fastest in the market due to high demand for customized medications required in

inpatient and critical care settings, including oncology, pain management,

intravenous therapies, and specialty treatments. Hospitals relied on

compounding pharmacies to provide patient-specific dosages, sterile preparations,

and formulations unavailable commercially, ensuring continuity of care and

improved treatment outcomes. Advances in automated compounding systems,

cleanroom facilities, and quality-control protocols enhanced precision, safety,

and efficiency in hospital pharmacy operations. ✚ Related Topics You May Find Useful: ➡️ U.S.

Pharmaceutical CDMO Market: Explore how outsourcing, biologics expansion, and

capacity upgrades are reshaping America’s drug manufacturing landscape ➡️ Active

Pharmaceutical Ingredient (API) Market: Understand how supply chain shifts

and high-potency APIs are driving next-gen pharmaceutical production ➡️ U.S.

503B Compounding Pharmacies Market: Track sterile outsourcing facility

growth amid rising hospital demand and injectable drug shortages ➡️ U.S.

503A Compounding Pharmacies Market: Discover how personalized medicine,

chronic care needs, and telehealth adoption are boosting traditional

compounding practices ➡️ Pharmacy

Automation Market: See how robotics, AI verification, and automated dispensing

systems are transforming medication safety and workflow efficiency ➡️ U.S.

Pain Management Drugs Market: Analyze evolving treatment trends as non-opioid therapies

and personalized pain solutions gain momentum ➡️ Pharmacy

Management System Market: Explore how digitalization, cloud platforms, and integrated

e-prescribing are modernizing pharmacy operations ➡️ ePharmacy Market: Gain insights into how

online prescription services, home delivery, and telehealth integration are

reshaping modern pharmacy retail Top

Companies in the Compounding Pharmacy Market & Their Offerings ➢ Fresenius

Kabi provides automated

compounding systems and ready-to-administer injectable medications to

hospitals. ➢ Fagron NV supplies APIs, excipients, and outsourced

compounding services to pharmacists for personalized medicine. ➢ B. Braun

Medical Inc. offers infusion

therapy products and automated compounding systems for hospital drug

preparation. ➢ Rx3

Compounding Pharmacy specializes

in custom sterile and non-sterile compounded medications for individuals in the

central Virginia area. ➢ Clinigen

Group PLC has exited the

compounding business to concentrate on global access to specialty licensed and

unlicensed medicines. ➢ Dougherty's

Pharmacy, Inc. is an independent

pharmacy offering sterile and non-sterile custom human and veterinary

compounding services. ➢ Lorraine's

Pharmacy prepares personalized

medications using unique ingredient combinations to meet specific patient

requirements. ➢ Wedgewood

Pharmacy is a major compounding

pharmacy that provides a wide range of customized sterile and non-sterile

medications for animal patients nationwide. ➢ Institutional

Pharmacy Solutions (IPS) provides

custom compounding and onsite pharmacy management services, primarily for

behavioral health facilities. ➢ McGuff

compounding pharmacy services (The

McGuff Companies, Inc.) offers various compounding services and raw materials

to healthcare providers and patients. Recent

Developments in the Compounding Pharmacy Industry 🔸 In November 2025, the compounding PATH for

Technicians, a compounding program designed for elevating pharmacy technicians

to nationally recognized training standards, was launched by the National

Community Pharmacists Association (NCPA), the Pharmacy Technician Certification

Board (PTCB), and PCCA. This program represents an unprecedented collaboration

in organization for helping compounding technicians best serve patients. (Source:

https://ncpa.org)

🔸In September 2024, a leader in

personalized medicine since 1999, MediVera Compounding Pharmacy got an official

license to serve in residents in 18 new state across the West, Southest,

Southeast, Midwest, and Northeast regions. The licnes allows MediVera for

filling compounding prescriptions like semaglutide and tirzepatide across these

states. (Source: https://www.accessnewswire.com) Segment

Covered in the Report By Therapeutic Area 🔹Pain Management 🔹Hormone Replacement 🔹Dermal Disorders 🔹Nutritional Supplements 🔹Others By Route of Administration 🔹Oral 🔹Topical 🔹Parenteral 🔹Others By Age 🔹Pediatric 🔹Geriatric 🔹Adult 🔹Veterinary By Compounding Type 🔹Pharmaceutical Dosage Alteration (PDA) 🔹Pharmaceutical Ingredient Alteration

(PIA) 🔹Currently Unavailable Pharmaceutical

Manufacturing (CUPM) 🔹Others By Sterility 🔹Sterile 🔹Non-sterile By Distribution Channel 🔹Compounding Pharmacy 🔹Hospital Pharmacy 🔹Others By Region 🔹 North America 🔹 Europe 🔹 Asia Pacific 🔹Latin America 🔹Middle East & Africa (MEA) Thanks for reading you can also get individual

chapter-wise sections or region-wise report versions such as North America,

Europe, or Asia Pacific. Don’t Miss Out! | Instant Access to This

Exclusive Report 👉 https://www.precedenceresearch.com/checkout/3672 You can place an order or ask any questions, please feel free

to contact at sales@precedenceresearch.com | +1 804

441 9344 Stay Ahead with Precedence Research Subscriptions Unlock

exclusive access to powerful market intelligence, real-time data, and

forward-looking insights, tailored to your business. From trend tracking to

competitive analysis, our subscription plans keep you informed, agile, and

ahead of the curve. Browse

Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription About Us Precedence

Research is a global market intelligence and consulting powerhouse, dedicated

to unlocking deep strategic insights that drive innovation and transformation.

With a laser focus on the dynamic world of

life sciences,

we specialize in decoding the complexities of cell and

gene therapy,

drug development, and oncology markets, helping our clients stay ahead in

some of the most cutting-edge and high-stakes domains in healthcare. Our

expertise spans across the biotech and pharmaceutical ecosystem, serving

innovators, investors, and institutions that are redefining what’s possible in regenerative medicine, cancer care, precision

therapeutics, and beyond. Web: https://www.precedenceresearch.com Our

Trusted Data Partners: Towards Healthcare | Nova One Advisor | Onco Quant

| Statifacts Get

Recent News 👉 https://www.precedenceresearch.com/news For

Latest Update Follow Us: LinkedIn | Medium | Facebook | Twitter ✚ Explore More Market

Intelligence from Precedence Research: ➡️ Generative

AI in Life Sciences: Explore how AI innovations are revolutionizing drug

discovery, research efficiency, and precision medicine. ➡️ Biopharmaceuticals

Growth:

Understand the accelerating expansion of biologics, therapeutic proteins, and

cutting-edge pharma pipelines. ➡️ Digital

Therapeutics: Discover how technology-driven treatments are reshaping patient care

and improving clinical outcomes. ➡️ Life

Sciences Growth: Gain insights into emerging opportunities, market

expansion, and innovation trends in the life sciences sector. ➡️ Viral

Vector & Gene Therapy Manufacturing: Analyze the production advancements

powering next-generation gene therapies and precision medicine. ➡️ Wellness

Transformation: See how consumer wellness trends are shaping supplements,

functional foods, and lifestyle-driven markets. ➡️ Generative

AI in Healthcare: Unlocking Novel Innovations in Medical and Patient Care: Explore AI applications

enhancing diagnostics, treatment personalization, and patient engagement.

U.S. Compounding Pharmacies Market Size, By Therapeutic Area, 2022 to 2024 (USD

Billion)

📥 Download Sample Pages for

Informed Decision-Making 👉 https://www.precedenceresearch.com/sample/1662