The major trends in the antibody discovery space are related to

increasing interest in the applications of therapeutic antibodies and increased

investment by biotechnology and pharmaceutical companies.

• Growing demand for therapeutic antibodies: Therapeutic

antibodies are highly used in the treatment of many diseases and disease

conditions, including infections, malignancies, autoimmune disorders, and

cardiovascular diseases. One key benefit of using monoclonal antibody therapy

is that they have been used to make drugs that have been more successful at

treating specific diseases, like some cancers. The mechanism of action of

therapeutic antibodies includes neutralization to block the pathophysiological

function of their target molecules. Therapeutic antibodies are high molecular

weight biopharmaceuticals obtained by

culturing microorganisms and animal cells through genetic engineering. Due to

high specificity, target identification of the drug becomes clear, and higher

efficacy and fewer side effects can be expected.

• High research and development expenditure in pharmaceutical

and biotechnology companies: R&D expenditure in pharmaceutical and

biotechnology companies has a profound global impact. It advances global health

by developing treatments for a broad range of diseases and reduces the burden,

especially in developing countries, by tackling infectious diseases.

Biotechnology research and development is the process of creating new products,

technologies, and therapies using biological processes to solve challenges in

healthcare, agriculture, and environmental science. Research and development

are one of the biggest drivers of innovation in business. These can result in

the development of new products and services, enhanced processes, and new ways

to interact with customers.

Which potential factors impose significant concerns related to

the antibody discovery markets growth?

The

significant concerns related to growth in the antibody discovery sector relate

to the prohibitive costs of antibody production and increasing federal

regulations due to safety and disease transmission considerations.

• High cost involved in the antibody production:

Antibodies are expensive to produce. Most costs in monoclonal antibody

production include raw materials, labor, equipment, and facility expenses.

According to a report, the cost of antibody manufacturing generally exceeds $50

per gram of purified antibody or drug substance ($50/g of DS), which is far

higher than the target of $10/g of DS required to make them affordable in some

of the world’s poorest regions.

Source: - GCGH. Grand Challenges

• Stringent government regulations: Stringent government

regulations divert resources away from core business activities and

time-consuming and complex compliance processes. It may include limited

flexibility, interest rate risk, inflation risk, and lower returns. Government

reports may be biased or inaccurate, can be out of date, and non-specific to

the business.

Ready to Dive Deeper? Visit Here to Buy Databook and In-depth

Report Now! https://www.statifacts.com/order-databook/7769

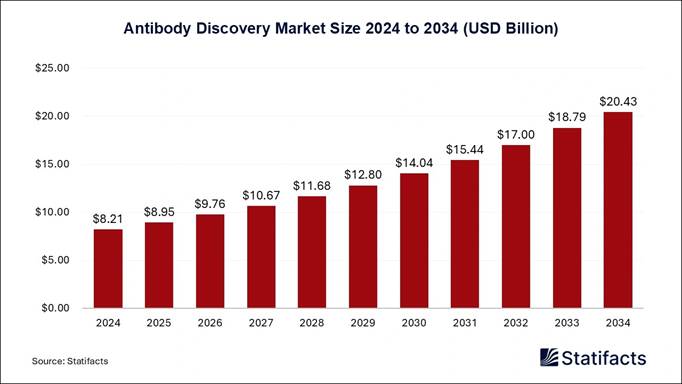

Antibody

Discovery Market Report

Coverage:

|

Report

Attributes

|

Statistics

|

|

Market

Size in 2024

|

USD

8.21 Billion

|

|

Market

Size in 2025

|

USD

8.95 Billion

|

|

Market

Size in 2030

|

USD

14.04 Billion

|

|

Market

Size in 2032

|

USD

17 Billion

|

|

Market

Size by 2034

|

USD

20.43 Billion

|

|

CAGR

2025-2034

|

9.54%

|

|

Leading

Region in 2024

|

North

America

|

|

Fastest

Growing Region

|

Asia

Pacific

|

|

Base

Year

|

2024

|

|

Forecast

Years

|

2025-2034

|

|

Segments

Covered

|

Method,

Antibody Type, End-user, and Region

|

|

Region

Covered

|

North

America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA)

|

|

Key

Players

|

Eurofins

Scientific, Evotec, Twist Bioscience, Genscript Technology Corporation, Biocytogen,

Sartorius AG, Danaher Corporation, Fairjourney Biologics S.A, Creative

Biolabs, Charles River Laboratories

|

How Big Is the Development of the Antibody Discovery Platforms?

Antibody discovery platform allows specific, epitope-directed discovery for

optimal functionality, specificity, affinity, internalization, and

developability. Antibody discovery offers benefits like high stability, solubility,

and tissue penetration, making them attractive for therapeutic applications.

Antibody discovery platform addresses the challenges, including improving

binding precision & affinity, and design strategies for specific targets.

Antibody discovery improves sensitivity in diagnostics like affimer proteins as

synthetic antibodies, quantum plasmonic immunoassay sensing,

development of therapeutic antibodies, advancements in lateral flow assays

(LFAs), and improved antigen-antibody interaction.

Source: - Precision Antibody

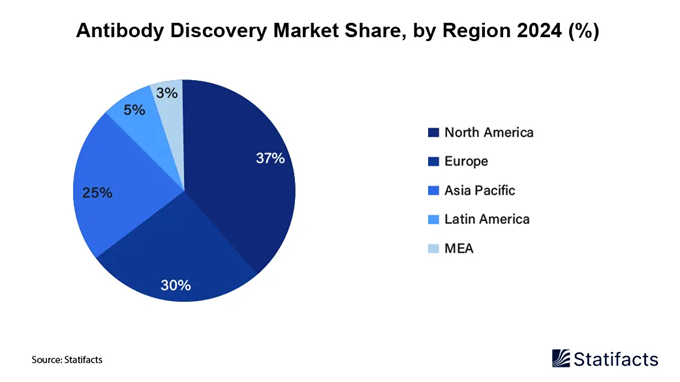

How Big Is the Success of the North American Antibody Discovery Market?

North America dominated the global antibody discovery market share of 37% in

2024. Rising applications of monoclonal antibodies, booming biologics market, elevated

rate of approval and adoption in the U.S. & Europe, growing research and

development activities, as well as increasing use of these antibodies due to

their high specificity, allowing for precision therapies to combat several

diseases. These factors are driving expansion in the in North American market.

• In November 2024, the U.S. Food and Drug Administration (FDA)

accelerated approval of Ziihera 50mg/mL for injection for intravenous use for

the treatment of adults with previously treated unresectable or metastatic

HER2-positive (IHC 3+) biliary tract cancer (BTC), as detected by an

FDA-approved test, was announced by Jazz Pharmaceuticals, plc.

Source: - Jazz Pharmaceuticals

How is the Opportunistic Rise of the Asia

Pacific in the Antibody Discovery Market?

Asia Pacific is anticipated to grow at the fastest rate in the market during

the forecast period. Growing demand for therapeutic antibodies, increasing

R&D in pharmaceutical and biotechnology companies, and increasing adoption of personalized

medicine and companion diagnostics are contributing to the expansion of

the antibody discovery market in the Asia Pacific region.

How Is the State of the Antibody Discovery Market in China, India, and Japan?

• In October 2020, to develop SARS-CoV-2 neutralizing monoclonal

antibodies (mAbs) co-invented by the Scripps Research and International AIDS

Vaccine Initiative as innovative interventions to address the COVID-19

pandemic, International AIDS Vaccine Initiative, a non-profit research

organization aiming to address the urgent and unmet global health challenges

around the treatment of AIDS, and Serum Institute of India Pvt. Ltd, a major

manufacturer of biologics including vacines, announced an agreement with Merck

KGaA, Darmstadt, Germany, a leading science and technology company.

Source: - iavi

• In June 2025, the key technology of the independently

developed RenMab fully human antibody mouse platform has been granted an

innovation patent by the Japan Patent Office (JPO) was announced by Biocytogen

Pharmaceuticals (Beijing) Co., Ltd. This milestone denotes a significant leap

in strengthening the global intellectual property portfolio of the RenMice

fully human antibody platform family.

Source: - BusinessWire

Antibody Discovery Market Segmentation Analysis

Methods Analysis

Antibody Discovery Market Size by Methods, 2024 to 2034 (USD

Billion)

|

Segments

|

2024

|

2025

|

2026

|

2034

|

|

Phage

Display

|

4.134

|

4.427

|

4.743

|

8.609

|

|

Hybridoma

|

2.477

|

2.762

|

3.082

|

7.674

|

|

Others

|

1.596

|

1.759

|

1.938

|

4.146

|

The phage display segment held a dominant presence in the

antibody discovery market in 2024. One of the key benefits of phage display

is its unique characteristic to generate large libraries of diverse antibodies

relatively quickly. This is due to the technique involves inserting genes

encoding antibody fragments into bacteriophages, which are then used to create

a library of phages displaying many antibody fragments. Antibody phage display

(APD) allows in vitro selection of human mAbs of virtually any specificity and

affinity.

The hybridoma segment is expected to grow at the fastest rate in the market

during the forecast period of 2025 to 2034. Hybridoma techniques produce

monoclonal antibodies (mAb) by fusing a specific antibody-producing B-cell with

a myeloma cell, creating a hybrid cell called a hybridoma. Hybridoma technology

offers unlimited quantities of consistent, cost-effective, and homogenized

antibody production. Hybridoma is perfect for research, assay development, and

downstream research, diagnostic, and therapeutic uses.

Antibody Type Analysis

Antibody Discovery Market Size by Antibody Type, 2024 to 2034 (USD

Billion)

|

Segments

|

2024

|

2025

|

2026

|

2034

|

|

Humanized

Antibody

|

3.320

|

3.561

|

3.822

|

7.020

|

|

Human Antibody

|

2.154

|

2.340

|

2.545

|

5.178

|

|

Chimeric

Antibody

|

1.770

|

1.979

|

2.214

|

5.669

|

|

Murine

Antibody

|

0.963

|

1.068

|

1.183

|

2.562

|

The human antibody segment accounted for a considerable share of

the antibody discovery market in 2024. Fully human monoclonal

antibodies (mAbs) are derived completely from human subjects. These antibodies

mimic the structure and function of naturally occurring human immune proteins,

offering significant benefits in precision, safety, and therapeutic efficacy.

The human body has five different types of antibodies, including

immunoglobulins like IgA, IgD, IgG, IgE, and IgM are different immunoglobulin

isotypes.

The murine antibody segment is projected to experience the fastest rate of

market growth from 2025 to 2034. Murine antibodies are made by the immune

system in response to substances that are foreign to the organism. Donor

sources like mice and rats are being used for the production of specific

antibodies. Murine antibodies are engineered to reduce their natural

immunogenicity towards human patients.

End-users Analysis

Antibody Discovery Market Size by End-users, 2024 to 2034 (USD Billion)

|

Segments

|

2024

|

2025

|

2026

|

2034

|

|

Pharmaceutical

and Biotechnology industry

|

3.362

|

3.563

|

3.780

|

6.352

|

|

Research

laboratory

|

2.841

|

3.181

|

3.565

|

9.158

|

|

Others

|

2.004

|

2.203

|

2.419

|

4.919

|

The pharmaceutical & biotechnology industry segment led the

antibody discovery market. Antibodies are used in biotechnology in tests to

detect and monitor infectious agents like HIV, the cause of AIDS, or the

influenza virus causing pandemic flu, and for identifying diseases released by

biological weapons like anthrax and smallpox.

The academic laboratory segment is set to experience the highest

growth rate of the market between 2025 to 2034. Antibodies are the immune

system’s way of protecting us from infections, allergens, and toxins.

Antibodies are an increasingly indispensable component in several diagnostic

assays. Antibody uses include the detection of infections, the idenficiation of

allergens, and the measurement of hormones and other biological markers in

blood.

See More Related Reports:

• The U.S. antibody drug

conjugates market size was estimated at USD 4,020 million in

2024 and is projected to be worth around USD 12,050 million by 2034, growing at

a CAGR of 11.6% from 2024 to 2034.

• The global anti neurofilament L antibody market size was valued at USD

323 million in 2024 and is predicted to gain around USD 807.81 million by 2034

with a CAGR of 9.6%.

• The U.S. biosimilar monoclonal

antibody market size accounted for USD 3,210 million in 2024

and is expected to exceed around USD 26,500 million by 2034, growing at a CAGR

of 23.5% from 2025 to 2034.

• The global eDiscovery market size is

calculated at USD 13,141 million in 2024 and is predicted to attain around USD

29,439 million by 2034, expanding at a CAGR of 8.4% from 2024 to 2034.

• The global drug discovery market size is

calculated at USD 65.88 billion in 2024 and is predicted to reach around USD

160.31 billion by 2034, expanding at a CAGR of 9.3% from 2024 to 2034.

• The global cloud-based drug discovery platform

market

size is predicted to gain around USD 8,029 million by 2034 from USD 2,429

million in 2024 with a CAGR of 12.7%.

Competitive Landscape in the Antibody Discovery Market

• Danaher Corporation: Danaher is a leading innovator in

life sciences and diagnostics worldwide, committed to harnessing the tools of

science and technology to improve human health.

• Eurofins Scientific: Eurofins Scientific is a national

leader in laboratory services, serving food, environment, pharmaceutical, and

agroscience customers.

• Evotec: Evotec is a large drug discovery and

development company which often collaborates with other players in the space.

It discovers and develops small-molecule drugs spanning various disease areas.

• Twist Bioscience: This is a biotechnology company that

offers synthetic DNA solutions, gene synthesis, and variant libraries.

• Charles River Laboratories: Charles River

Laboratories supplies essential products and services to assist many

healthcare-related government agencies, pharmaceutical and biotechnology

companies, and leading academic institutions around the world in accelerating

their research undertakings and drug development efforts.

• Genscript Technology Corporation: Genscript Technology

Corporation accelerates innovation in biotechnology and healthcare by providing

researchers and companies with the building blocks needed to develop

groundbreaking treatments and products.

• Biocytogen: Biocytogen provides integrated solutions

for next-generation antibody drug development to the global biomedical

communities.

• Sartorius AG: Sartorius AG is a Germany-based supplier

of pharmaceutical and laboratory equipment.

• Fairjourney Biologics S.A.: They specialize in

customized services and technologies for optimal antibody solutions.

• Creative Biolabs: They offer world-class, cutting-edge

recombinant antibodies for biomedical research.

What Is Going Around the Globe in the Antibody Discovery Market?

• In June 2025, an innovative new resin to help achieve cost

savings and improve operations throughout the antibody manufacturing process

was launched by Ecolab Life Sciences.

Source: - Cleanroom Technology

• In May 2025, the global IDeate-Esophageal01 Phase 3 trial of a

new antibody drug conjugate in advanced esophageal squamous cell carcinoma was

launched by Merck and Daiichi Sankyo.

Source: - Applied Clinical Trials Online

Antibody Discovery Market Segments Covered in the Report

By Methods

• Phage Display

• Hybridoma

• Others

By Antibody Type

• Humanized Antibody

• Human Antibody

• Chimeric Antibody

• Murine Antibody

By End Users

• Pharmaceutical and Biotechnology industry

• Research laboratory

• Others

By Geography

• North America

• Europe

• Asia-Pacific

• Latin America

• Middle East and Africa

Ready

to Dive Deeper? Visit Here to Buy Databook and In-depth Report Now! https://www.statifacts.com/stats/databook-download/7769

𝐀𝐛𝐨𝐮𝐭 𝐔𝐬:

Statifacts is a global

market intelligence and consulting leader, committed to delivering deep

strategic insights that fuel innovation and transformation. With a sharp focus

on the fast-evolving landscape of life sciences, we excel at navigating the

intricacies of cell and gene therapies, oncology, and drug

development. We empower our clients, ranging from biotech pioneers to

institutional investors with the intelligence needed to lead in high-impact

areas like regenerative medicine, cancer therapeutics, and precision health.

Our broad expertise across the pharma-biotech value chain is backed by robust,

statistically driven data for every market we cover, ensuring decisions are

informed, forward-looking, and built for impact.

Statifacts offers subscription services for data and analytics

insights. This page provides options to explore and purchase a subscription tailored

to your needs, granting access to valuable statistical resources and tools.

Access here - https://www.statifacts.com/get-a-subscription

Connect with Us

Ballindamm 22, 20095 Hamburg, Germany

Europe: +44 7383092044

Web: https://www.statifacts.com/

For Latest Update Follow Us: https://www.linkedin.com/company/statifacts

Our Trusted Data Partners:

Precedence Research | Towards Healthcare | Nova One Advisor