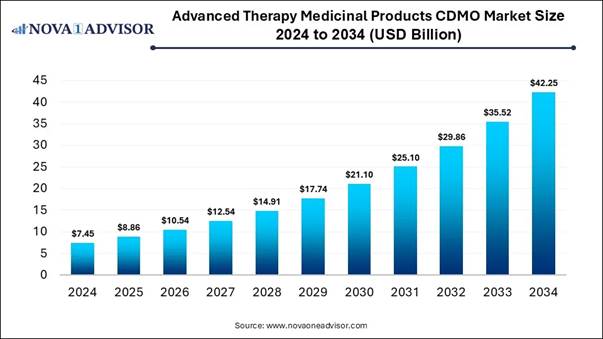

According to Nova One Advisor, the global advanced therapy medicinal products CDMO market size was estimated at USD7.45 billion in 2024 and is projected to grow to USD 42.25 billion by 2034, rising at a compound annual growth rate (CAGR) of 18.95% from 2025 to 2034.

Key Takeaways

⬥︎North America held a major share of the market in 2024.

⬥︎Asia Pacific is expected to grow at the fastest CAGR in the studied years.

⬥︎By product, the gene therapy segment led the advanced therapy medicinal products CDMO market in 2024.

⬥︎By product, the cell therapy segment is expected to grow notably during 2025-2034.

⬥︎By phase, the phase II segment registered dominance in the market in 2024.

⬥︎By phase, the phase III segment is expected to witness rapid expansion in the coming years.

⬥︎By indication, the oncology segment registered dominance in the market in 2024.

⬥︎By indication, the neurological and genetic disorders segment is expected to witness rapid expansion in the coming years.

The Complete Study is Now Available for

Immediate Access | Download the Sample Pages of this Report@ https://www.novaoneadvisor.com/report/sample/8439

What is an Advanced Therapy Medicinal

Products CDMO? The global advanced

therapy medicinal products CDMO market mainly refers to the contract

development and manufacturing organizations that offer specialized, end-to-end

services for complex gene, cell, and tissue-based therapies. Key advantages for

pharmaceutical

and biotech companies include accessing specialized manufacturing facilities,

ensuring regulatory compliance, and accelerating time-to-market without

significant capital investment. The market is driven by the increasing

prevalence of rare diseases, a growing pipeline of cell

and gene therapies in clinical

trials, and advancements in gene-editing

technologies like CRISPR. What are the Key Drivers in the Advanced

Therapy Medicinal Products CDMO Market? A prominent driver is the rising number of

clinical trials, innovation in gene-editing tools like CRISPR-Cas9, advanced

bioprocessing techniques, and the integration of automation and artificial

intelligence, which are improving manufacturing efficiency,

scalability, and quality control. The increasingly significant investment and

grants in ATMP research are accelerating the development of new therapies and

creating opportunities for market expansion. Increasing personalized medicine

and growth of cell

and gene therapy pipelines. You can place an order or ask any

questions, please feel free to contact at sales@novaoneadvisor.com |

+1 804 441 9344 Advanced Therapy Medicinal Products CDMO

Market Report Scope Report Attribute Details Market size value in 2025 USD 8.86 billion Revenue forecast in 2034 USD 42.25 billion Growth rate CAGR of 18.95% from 2025 to 2034 Base year for estimation 2024 Historical data 2018 - 2024 Forecast period 2025 - 2034 Quantitative units Revenue in USD million/billion and CAGR

from 2025 to 2034 Report coverage Revenue forecast, company ranking,

competitive landscape, growth factors, and trends Segments covered Product, Phase, Indication, Region Regional scope North America; Europe; Asia Pacific;

Latin America; MEA Country scope U.S.; Canada; UK; Germany; France; Italy;

Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand;

South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE;

Kuwait Key companies profiled Celonic; Bio Elpida; CGT Catapult;

Rentschler Biopharma SE; AGC Biologics; Catalent; Lonza; WuXi Advanced

Therapies; BlueReg; Minaris Regenerative Medicine; Patheon Customization scope Free report customization (equivalent up

to 8 analyst’s working days) with purchase. Addition or alteration to

country, regional & segment scope.

Buy Now Full Report: https://www.novaoneadvisor.com/report/checkout/8439

What Are the Growing Trends Associated

with the CDMO Services for Pharma and Biotech Market? ⬥︎ Rise of advanced and specialised therapies: The growing complexity of new drugs, such

as antibody-drug conjugates, oligonucleotides, and cell and gene therapies, is

driving demand for CDMOs with highly specialised expertise and technology. ⬥︎ Demand for personalised medicine: The move towards tailored treatments

requires flexible manufacturing processes that many CDMOs are developing, often

using automation and modular systems to accommodate varying batch sizes and

patient-specific needs. ⬥︎ Globalisation and supply chain complexity Pharmaceutical companies are increasingly

relying on CDMOs to navigate complex global supply chains and ensure consistent

product quality across different markets. ⬥︎ Specialization There is a growing trend of CDMOs

specialising in specific therapeutic areas or manufacturing processes, allowing

them to offer deep expertise in a particular niche. ⬥︎ Growth of outsourcing by smaller companies: Smaller and mid-sized pharmaceutical

companies are increasingly using CDMOs to avoid large capital investments in

manufacturing facilities, which is a key growth driver for the CDMO market. What are the Major Trends in the

Advanced Therapy Medicinal Products CDMO Market? 🔹In May 2024, Catalent and Siren Biotechnology, the companies formed

a strategic agreement to advance and manufacture Siren Biotechnology's AAV

immuno-gene treatments for cancer. 🔹In December 2024, Novo Holdings acquired Catalent, a major

acquisition (USD 16.5 billion), creating a multi-modal manufacturing giant,

significantly consolidating capacity in the biomanufacturing space. What is the Emerging Challenge in the

Advanced Therapy Medicinal Products CDMO Market? The market is mainly facing a hurdle in

ATMPs involve complex, often patient-specific (autologous) processes using

living cells or viral vectors, which are difficult to scale up from small-scale

clinical production to large-scale commercial manufacturing while maintaining

product consistency and quality. High cost of affordability and shortage of

proficient and experienced personnel in the manufacturing of cell and gene

therapies. Regional Analysis How did North America Dominate the

Market in 2024? In 2024, North America captured the biggest

revenue share of the market. The robust ecosystem of scientific innovation and

significant investment. The United States, in particular, led with a high

concentration of specialized biotechnology

firms and extensive R&D activity. Supportive regulatory pathways from the

FDA, coupled with a large number of clinical

trials, accelerated the development and commercialization of new

therapies. 🔹For instance, In March 2024, Alcami Corporation collaborated with

Tanvex CDMO to provide integrated services. Large CDMOs like Thermo Fisher have

also acquired smaller, niche players to expand their ATMP capabilities. United States Advanced Therapy Medicinal

Products CDMO Market: The United States is experiencing increased

M&A activity among CDMOs, growing adoption of advanced digital

manufacturing, and strategic partnerships to secure domestic manufacturing

capacity amid supply chain concerns. A booming pipeline of complex cell and

gene therapies and strong R&D investment. This growth is supported by

favorable FDA regulations, like accelerated approvals and a shift towards more

scalable allogeneic therapies. Why did Asia Pacific Grow Notably in the

Market in 2024? Asia Pacific is anticipated to expand at a

rapid CAGR during 2025-2034 in the advanced therapy medicinal products CDMO

market. The strong government support and a cost-effective manufacturing

ecosystem. Favourable regulatory pathways in countries like China and Australia

attracted increased R&D and clinical trial activity. Substantial regional

investment and expanding infrastructure solidified the region as a competitive

and attractive hub for global biopharmaceutical

companies seeking efficient ATMP production. 🔹For instance, In October 2024, Samsung Biologics, a

major CDMO, continued its significant expansion in South Korea. It

announced a record $1.24 billion manufacturing deal with an Asian

pharmaceutical company. China Advanced Therapy Medicinal

Products CDMO Market: China's advanced therapy medicinal products

CDMO market is rapidly expanding due to a surge in clinical trials and strong

government support through favourable regulations. A boom in domestic biotech

firms, particularly in cell therapy for oncology, is driving significant demand

for specialized manufacturing services. Despite rapid growth, geopolitical

tensions, such as the U.S. BIOSECURE Act, are influencing supply chain

strategies. Immediate Delivery Available, Get Full

Access @ https://www.novaoneadvisor.com/report/checkout/8439

Segmental Insights By product analysis Which Product Led the Advanced Therapy

Medicinal Products CDMO Market in 2024? The gene

therapy CDMO services segment accounted for a dominant share of the

market in 2024. The technical complexity and high demand for viral vector

manufacturing, a process often outsourced to specialized CDMOs. Innovations in

gene editing technologies like CRISPR, combined with increasing R&D for

rare genetic disorders, ensure the gene

therapy segment maintains a significant and influential role in market

dynamics. 🔹In October 2024, Forge Biologics, a member of Ajinomoto Bio-Pharma

Services, launched its FUEL manufacturing platform specifically designed for

high-yield AAV production to accelerate gene therapy development. However, the cell

therapy segment is predicted to expand at a lucrative CAGR. The

commercial success of CAR-T treatments and a pipeline expanding into new

therapeutic areas. The industry-wide shift towards scalable, cost-effective

allogeneic "off-the-shelf" therapies, which CDMOs are increasingly

capable of manufacturing efficiently. Adoption of advanced automation and

closed-system manufacturing, making outsourcing an attractive option for

numerous small and mid-sized biotech firms. By phase analysis What Made the Phase II Segment Dominant

in the Market in 2024? The phase II segment held a major revenue

share of the advanced therapy medicinal products CDMO market in 2024. A high

volume of successful early-stage candidates transitioning to larger efficacy

trials. This phase necessitates crucial manufacturing scale-up, process

optimization, and adherence to complex GMP standards, driving a high demand for

specialized CDMO expertise and infrastructure. On the other hand, the phase III segment is

estimated to expand rapidly in the predicted timeframe. The high volume of

therapies is advancing into pivotal trials and preparing for commercial launch.

This phase demands significantly larger-scale production and stringent

regulatory validation, requirements that often exceed the in-house capabilities

of many biotech firms. Consequently, developers rely heavily on the specialized

expertise and capacity of CDMOs to manage manufacturing complexities and

navigate the final regulatory hurdles efficiently. By indication analysis What Made the Oncology Segment Dominant

in the Market in 2024? The oncology

segment held a major revenue share of the advanced therapy medicinal products

CDMO market in 2024. The intense clinical trial activity and substantial

investment in cancer-related advanced therapies. The unique potential and high

unmet medical need for treatments like CAR-T and TCR therapies drove

significant R&D efforts. Manufacturing these complex immunotherapies requires

specialized expertise and infrastructure, leading biotech firms to heavily rely

on expert CDMO partners. On the other hand, the neurological and

genetic disorders segment is estimated to expand rapidly in the predicted

timeframe. The vast unmet medical need and technological breakthroughs in gene

editing. The increasing number of clinical trials and regulatory support for

orphan drugs is accelerating the development pipeline for these complex

conditions. The biopharma companies are heavily relying on specialized CDMOs

for the development and manufacturing expertise required for these advanced,

often curative, therapies. Top Key Players in Advanced Therapy

Medicinal Products CDMO Market: ⬥︎Celonic GmbH – Provides end-to-end

development and GMP manufacturing services for cell and gene therapies, with

expertise in viral vector and biologics production. ⬥︎Bio Elpida – Specializes in small-batch

GMP manufacturing for cell and gene therapies, focusing on process development

and aseptic fill-finish for early clinical stages. ⬥︎Cell and Gene Therapy Catapult (CGT Catapult) – A UK-based innovation and manufacturing center supporting

technology transfer, process optimization, and scale-up of advanced therapies. ⬥︎Rentschler Biopharma SE – Offers

full-service biopharmaceutical development and GMP manufacturing, including

viral vector and gene therapy production capabilities. ⬥︎AGC Biologics – Provides integrated

development, manufacturing, and analytical services for viral vectors, plasmid

DNA, and cell therapies, serving both clinical and commercial stages. ⬥︎Catalent, Inc. – A leading global CDMO

offering viral vector manufacturing, plasmid DNA production, and advanced

therapy fill-finish services through its Cell & Gene Therapy segment. ⬥︎Lonza Group Ltd. – Delivers comprehensive

solutions for cell and gene therapy development and manufacturing, including

viral vector platforms and commercial-scale production. ⬥︎WuXi Advanced Therapies (WuXi AppTec Group) – Provides integrated cell and gene therapy CDMO services, including

process development, testing, and GMP manufacturing for viral vectors and cell

therapies. ⬥︎BlueReg Group – Offers specialized

regulatory consulting and strategy support for ATMP developers, focusing on

market access, compliance, and product lifecycle management. ⬥︎Minaris Regenerative Medicine – Focuses

on global contract development and manufacturing of cell and gene therapies,

with expertise in autologous and allogeneic manufacturing solutions. What are the Revolutionary Developments

in the Advanced Therapy Medicinal Products CDMO Market? 🔹In March 2024, Alcami Corporation partnered with Tanvex CDMO to

provide clients with a complete solution from bulk drug substance production to

finished drug products. 🔹In January 2024, Pluri Inc. created its PluriCDMO business division

to offer specialized expertise and access to its GMP cell therapy production

facility. 🔹In October 2024, Forge Biologics (a member of Ajinomoto Bio-Pharma

Services) launched its proprietary FUEL platform in October 2024 to accelerate

AAV gene therapy manufacturing Related Report ⬥︎ Active Pharmaceutical Ingredients CDMO Market - The global active

pharmaceutical ingredients CDMO market size was valued at USD 129.25

billion in 2024 and is anticipated to reach around USD 273.92 billion by 2034,

growing at a CAGR of 7.8% from 2025 to 2034. ⬥︎ Biopharmaceutical CDMO Market - The

global biopharmaceutical

CDMO market was valued at USD 21.15 billion in 2024 and is projected to

hit around USD 49.61 billion by 2034, expanding at a CAGR of 8.9% during the

forecast period of 2025 to 2034. ⬥︎ Biologics CDMO Market - The global biologics

CDMO market size is calculated at USD 22.45 billion in 2024, grows to

USD 25.92 billion in 2025, and is projected to reach around USD 94.60 billion

by 2034, growing at a solid CAGR of 15.47% from 2025 to 2034. ⬥︎ Oligonucleotide CDMO Market - The

global oligonucleotide

CDMO market size is calculated at USD 3.15 billion in 2024, grows to

USD 3.84 billion in 2025, and is projected to reach around USD 22.73 billion by

2034, at a compound annual growth rate (CAGR) of 21.85% from 2024 to 2034. ⬥︎ Cell And Gene Therapy CDMO Market - The

global Cell

And Gene Therapy CDMO market size was estimated at USD 7.52 billion in

2024 and is projected to hit around USD 88,84 billion by 2034, growing at a

CAGR of 28.1% during the forecast period from 2025 to 2034. ⬥︎ U.S. Active Pharmaceutical Ingredients CDMO Market - The U.S.

active pharmaceutical ingredients CDMO market size is calculated at USD

25.85 billion in 2024, grows to USD 27.22 billion in 2025, and is projected to

reach around USD 43.33 billion by 2034, growing at a CAGR of 5.3% from 2025 to

2034. ⬥︎ North America Topical Drugs CDMO Market - The North

America topical drugs CDMO market size was exhibited at USD 15.25

billion in 2024 and is projected to hit around USD 42.87 billion by 2034,

growing at a CAGR of 10.89% during the forecast period 2025 to 2034. ⬥︎ Topical Drugs CDMO - The topical

drugs CDMO market size was exhibited at USD 46.15 billion in 2024 and

is projected to hit around USD 137.06 billion by 2034, growing at a CAGR of

11.5% during the forecast period 2024 to 2034. ⬥︎ U.S. Pharmaceutical CDMO Market - The U.S.

pharmaceutical CDMO market size was exhibited at USD 40.65 billion in

2024 and is projected to hit around USD 83.86 billion by 2034, growing at a

CAGR of 7.51% during the forecast period 2024 to 2034. ⬥︎ Veterinary CRO and CDMO Market - The Veterinary

CRO and CDMO market size was exhibited at USD 7.15 billion in 2024 and

is projected to hit around USD 17.56 billion by 2034, growing at a CAGR of 9.4%

during the forecast period 2025 to 2034. ⬥︎ U.S. Small Molecule Innovator API CDMO Market - The U.S.

small molecule innovator API CDMO market size was exhibited at USD 8.50

billion in 2023 and is projected to hit around USD 15.48 billion by 2033,

growing at a CAGR of 6.18% during the forecast period 2024 to 2033. Segments Covered in the Report This report forecasts revenue growth at

country levels and provides an analysis of the latest industry trends in each

of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc.

has segmented the advanced therapy medicinal products cdmo market. By Product • Gene Therapy • Cell Therapy • Tissue Engineered • Others By Phase • Phase I • Phase II • Phase III • Phase IV By Indication • Oncology • Cardiology • Central nervous system • Musculoskeletal • Infectious disease • Dermatology • Endocrine, metabolic, genetic • Immunology & inflammation • Ophthalmology • Hematology • Gastroenterology • Others By Region • North America • Europe • Asia-Pacific • Latin America • Middle East & Africa (MEA) Immediate Delivery

Available | Buy This Premium Research https://www.novaoneadvisor.com/report/checkout/8439 About-Us Nova One Advisor is a global leader

in market intelligence and strategic consulting, committed to delivering deep,

data-driven insights that power innovation and transformation across industries.

With a sharp focus on the evolving landscape of life sciences, we specialize in

navigating the complexities of cell and gene therapy, drug development, and the

oncology market, enabling our clients to lead in some of the most revolutionary

and high-impact areas of healthcare. Our expertise spans the entire

biotech and pharmaceutical value chain, empowering startups, global

enterprises, investors, and research institutions that are pioneering the next

generation of therapies in regenerative medicine, oncology, and precision medicine.

Web: https://www.novaoneadvisor.com/ Contact Us USA: +1 804 420 9370 Email: sales@novaoneadvisor.com For Latest Update Follow Us: LinkedIn Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Market Stats Insight | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals

Analytics