Funding

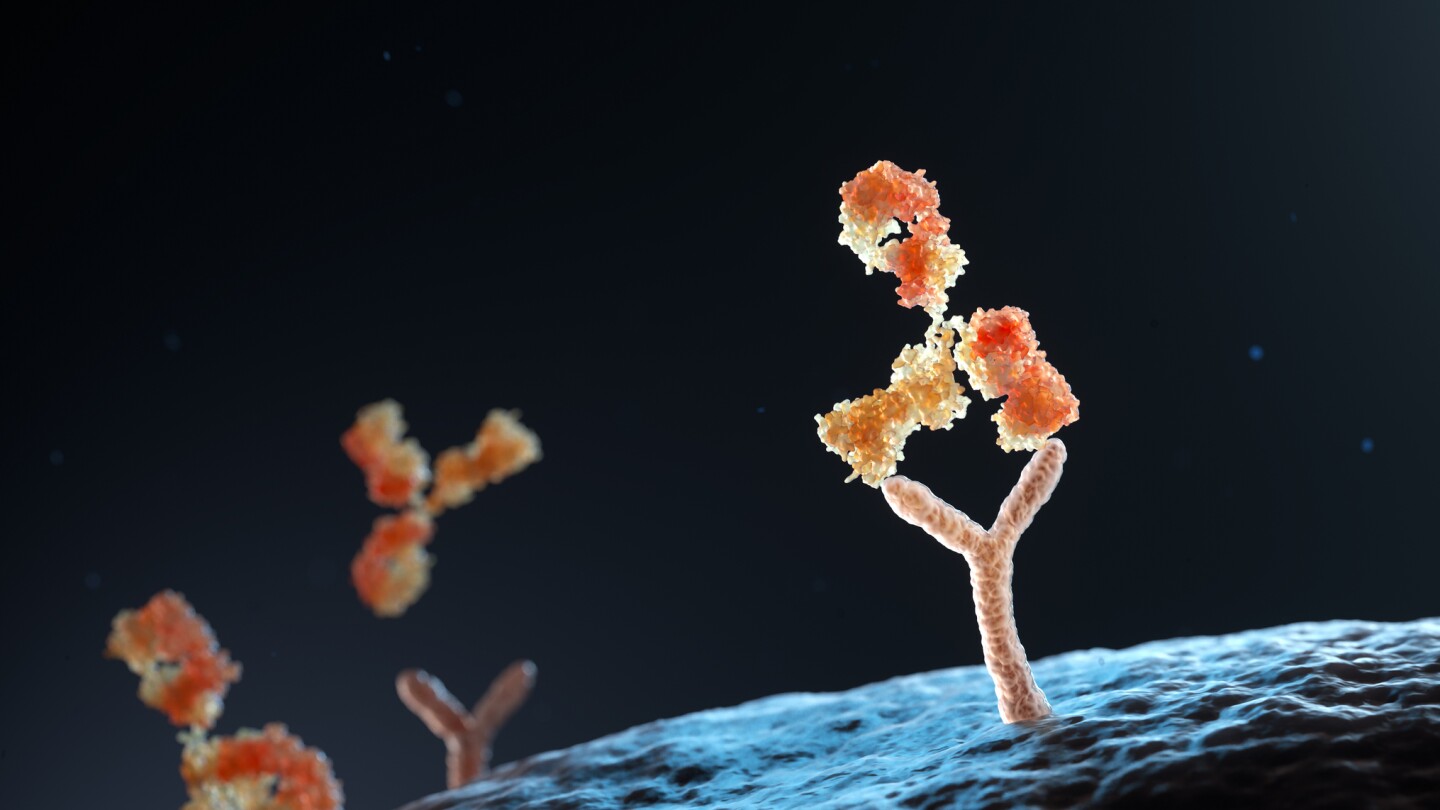

Third Arc Bio, led by three former Johnson & Johnson executives, is advancing a portfolio of multifunctional antibodies for cancer and inflammatory and immune-mediated diseases.

GRO Biosciences will use the Series B funds to launch a Phase I trial for ProGly-Uricase, its investigational therapy for gout.

After completing a buyout transaction with The Column Group to remove it from the stock exchange, NGM Bio has raised a $122M Series A to fund a registrational study for a rare liver disease drug and a Phase II trial in hyperemesis gravidarum.

Backed by Bain Capital, Cardurion Pharmaceuticals will use the Series B funds to advance two assets for heart failure and other cardiovascular conditions.

Asceneuron, which develops small molecules targeting tau protein aggregation, plans to use the funds to advance its Alzheimer’s disease asset into Phase II.

Eli Lilly becomes the latest to make a major investment in immunology and inflammation, while antibody-drug conjugate biopharma Myricx Bio nets a large Series A round and new research highlights the potential and possible risks of GLP-1s.

The U.K.-based biotech is the latest to cash in on the hot antibody-drug conjugate space, closing a $115.5 million Series A round co-led by Novo Holdings and participation from Eli Lilly.

Cartesian Therapeutics’ mRNA CAR-T therapy met its primary endpoint in a mid-stage trial for the chronic autoimmune disorder and expects to raise $130 million via private placement equity financing.

Orna Therapeutics announced Thursday it is acquiring ReNAgade Therapeutics, which launched in May 2023 with $300 million in Series A financing and is on BioSpace’s NextGen Class of 2024 startups to watch this year.

SixPeaks Bio emerged from stealth Wednesday with up to $110 million, a deal with AstraZeneca and plans to take weight-loss candidates designed to preserve muscle mass toward the clinic.

PRESS RELEASES