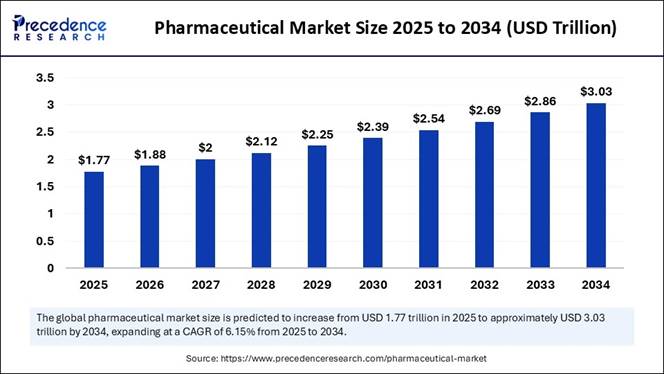

The global pharmaceutical market size is projected to reach nearly USD

3.03 trillion by 2034. The market is valued at USD 1.77 trillion in 2025 and is

expected to grow from USD 1.88 trillion in 2026 to USD 2 trillion in 2027, with

a healthy CAGR of 6.15% from 2025 to 2034. The industry is driven by

accelerating demand for advanced therapies, expanding R&D investments,

innovative drug pipelines, and rising prevalence of chronic diseases worldwide.

The Complete Study is Now Available for Immediate Access | Download the Sample

Pages of this Report@ https://www.precedenceresearch.com/sample/6227

AI adoption is reshaping the pharmaceutical landscape by reducing R&D costs, improving success rates for new drugs, and supporting personalized treatment strategies. Key regions leading this transformation include North America, with advanced healthcare infrastructure, and Asia Pacific, which is witnessing rapid expansion in pharmaceutical and biopharmaceutical production.

Major pharmaceutical companies, such as Pfizer, Johnson & Johnson, Novartis, and AstraZeneca, are leveraging AI technologies to strengthen pipelines, enhance clinical outcomes, and scale innovative drug production. The integration of AI is particularly impactful in areas like biologics, biosimilars, and targeted therapies, driving growth in high-value segments of the market.

With rising chronic and lifestyle-related diseases worldwide, AI-driven solutions are expected to accelerate market growth, streamline drug development, and deliver cost-effective, patient-centric therapies, positioning the pharmaceutical industry for a robust expansion toward USD 3.03 trillion by 2034.

✚ Turn AI disruption into Opportunity. Visit Here@ https://www.precedenceresearch.com/ai-precedence

Key Highlights of the Pharmaceutical Market

💡Regional Insights

🔸North America held the largest share of the global market in 2024 with 42% revenue contribution.

🔸Asia Pacific is projected to register the fastest CAGR from 2025 to 2034.

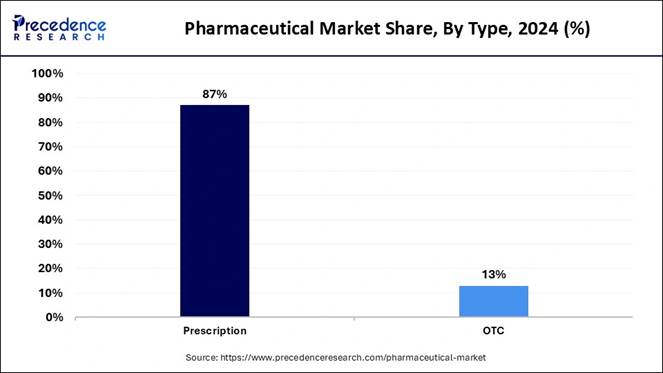

💡By Type

🔸Prescription drugs accounted for the largest share (87%) in 2024.

🔸Over-the-counter (OTC) drugs are expected to grow at the fastest rate in the upcoming years.

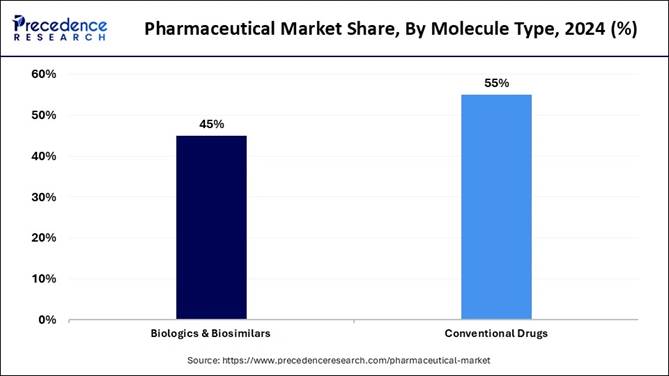

💡By Molecule Type

🔸Conventional drugs (small molecules) constituted the largest share (55%) in 2024.

🔸Biologics and biosimilars (large molecules) are projected to record the highest CAGR between 2025 and 2034.

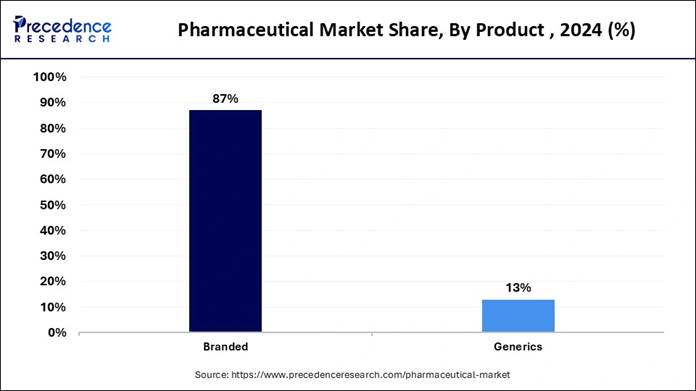

💡By Product

🔸Branded pharmaceuticals dominated the market with an 87% share in 2024.

🔸The generic drugs segment is expected to expand at the fastest CAGR during the forecast period.

💡By Disease Area

🔸The cancer segment accounted for the largest revenue share (19%) in 2024.

🔸The obesity segment is anticipated to grow at a notable CAGR from 2025 to 2034.

💡By Route of Administration

🔸Oral drugs represented the largest share (58%) in 2024.

🔸Parenteral formulations are forecast to grow at a significant CAGR in the coming years.

💡By Age Group

🔸Adults captured the largest share (64%) in 2024.

🔸The geriatric population is predicted to grow at a significant CAGR during the analysis period.

💡By Distribution Channel

🔸Hospital pharmacies dominated with a 54% share in 2024.

🔸Retail pharmacies are projected to grow at the fastest rate over the forecast timeline.

Rising Chronic Diseases Boosting the Growth of the Pharmaceutical Industry

The growing prevalence of chronic and infectious diseases among people of different age groups is one of the major factors driving the growth of the pharmaceutical market. It further leads to higher demand for different types of pharmaceutical solutions. Availability of over-the-counter drugs and prescribed drugs helps to manage chronic diseases with ease.

The availability of branded and generic drug options, which help ensure affordable healthcare for patients across sectors, also helps fuel the market's growth in the foreseeable period. Government support, higher demand for precision medicine, and higher demand for biologics, biosimilars, and targeted drug therapy are also major growth factors for the market.

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

What is the Growth Potential of the Pharmaceutical Market?

The growing demand for pharmaceuticals, leading to increased manufacturing, is one of the major factors driving market growth. Such medicines are low-cost compared to branded medications, making them helpful for patients to afford healthcare with effective results. Such medications are also useful to control the growing prevalence of chronic and infectious diseases, hampering the health of patients. Hence, these factors collectively help fuel the market's growth.

New Trends in the Pharmaceutical Market

🔹Growing chronic and infectious diseases, such as cardiovascular diseases, obesity, and diabetes, leading to high demand for personalized medicines and innovative therapies, are some of the major factors for the growth of the market.

🔹The growing aging population and the rise of chronic diseases in the segment are other major factors driving industry growth.

🔹Increased healthcare spending and lowering the cases of lifestyle-related disorders are other major factors for the growth of the market.

What is the Major challenge faced by the Pharmaceutical Market?

Regulatory issues and high research and development costs are among the factors restraining the market's growth. Regulatory issues related to drug safety and quality, lengthy approval processes, lack of reimbursement policies, and intellectual property protection are major factors restraining the market’s growth. The additional costs required for procedures, such as testing, safety, efficacy, and marketing, may also hamper market growth.

What are the Opportunities helpful for the Growth of the Pharmaceutical Market?

The rising development of biologics and biosimilars is a major opportunity for market growth. Biosimilars and biologics help the healthcare domain provide economic and effective therapies to patients, fueling market growth. They help develop innovative treatments that support the market’s growth. Rising chronic diseases among patients across age groups and the higher demand for effective medications are major factors driving the market’s growth.

📥 Dive into the Complete Report ➡️ https://www.precedenceresearch.com/pharmaceutical-market

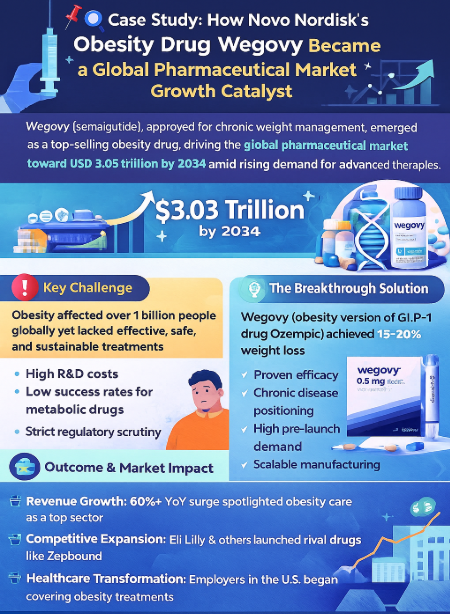

Case Study: How Novo Nordisk’s Obesity Drug Wegovy Became a Global Pharmaceutical Market Growth Catalyst

Overview

Novo Nordisk’s Wegovy (semaglutide), approved for chronic weight management, has become one of the most influential pharmaceutical products globally. Its rapid adoption demonstrates how innovation, unmet medical needs, and strong clinical evidence can reshape market dynamics. The drug is a major contributor to the surge in demand for advanced therapies, supporting the pharmaceutical market’s rise toward USD 3.03 trillion by 2034.

🎯 Key Challenge

The global obesity epidemic—affecting over 1 billion people—has long lacked effective, safe, and sustainable treatment solutions. Traditional weight-loss medications delivered limited benefits with side effects and poor long-term adherence.

Pharmaceutical companies faced:

🔹 High R&D costs

🔹 Low success rates in metabolic drugs

🔹 Strict regulatory scrutiny

🔹 High patient demand but limited clinical outcomes

💡 The Breakthrough Solution

Novo Nordisk introduced Wegovy, a GLP-1 receptor agonist, originally used for diabetes but repurposed to target obesity.

Why Wegovy Became a Market Game-Changer

🔹 Proven weight loss of 15–20%, significantly higher than existing drugs

🔹 Strong safety profile backed by robust clinical trials

🔹 Chronic disease positioning, shifting obesity from cosmetic to medical

🔹 High demand even before launch, driven by physician advocacy and patient awareness

🔹 Scalable manufacturing investments to meet global demand

This combination positioned Wegovy as one of the fastest-growing drugs in the pharmaceutical sector.

📈 Outcome & Market Impact

1. Revenue Growth

🔹 Novo Nordisk’s obesity care revenue grew >60% YoY in multiple quarters (2023–2025).

🔹 Wegovy became one of the top-selling prescription drugs globally in a short time.

2. Market Expansion

Wegovy triggered industry-wide investments in obesity therapeutics:

🔹 Eli Lilly launched Zepbound, intensifying competition

🔹 Pfizer, Amgen, and AstraZeneca accelerated GLP-1 drug development

🔹 Over 40 obesity pipeline drugs entered clinical trials worldwide

3. Healthcare System Transformation

🔹 Payers began evaluating obesity drugs as long-term chronic disease treatments

🔹 Governments initiated metabolic health programs using GLP-1 drugs

🔹 Employers in the U.S. started covering obesity treatments to reduce workforce health risks

4. Supply Chain and Manufacturing Shifts

The unprecedented demand forced Novo Nordisk to:

🔹 Expand manufacturing facilities

🔹 Partner with contract manufacturers

🔹 Invest billions in increasing injectable and oral formulation capacity

This directly contributes to the projected growth trajectory of the pharmaceutical market.

🔍 Why This Case Study Matters for Pharmaceutical Market Analysis

Wegovy is a perfect example showing how:

🔹 Advanced therapies (biologics & GLP-1 drugs) are reshaping market value

🔹 Chronic disease prevalence (obesity, diabetes) creates enormous commercial opportunity

🔹 Pharmaceutical innovation drives multi-billion-dollar segments

🔹 Pipeline expansion and competitive dynamics accelerate market growth

🔹 Biologics and biosimilars will dominate future market share

This aligns with the report’s key findings:

🔹 Rising demand for

advanced and targeted therapies

🔹 Strong clinical outcomes

accelerating adoption

🔹 Rapid expansion of

biologics and large molecule drugs

🔹 Growing chronic disease

burden driving pharmaceutical demand

📘 Key Takeaways for Readers

🔹 Wegovy shows how one breakthrough therapy can transform an entire market segment.

🔹 The pharmaceutical market will continue shifting toward innovative biologics, precision medicine, and chronic disease management solutions.

🔹 Companies that invest in R&D, clinical trial strength, and scalable manufacturing will lead the USD 3.03 trillion market by 2034.

Don’t Miss Out! | Instant Access to This Exclusive Report 👉 https://www.precedenceresearch.com/checkout/6227

Pharmaceutical Market Report Scope

|

Report Coverage |

Key Insights |

|

Market Size in 2025 |

USD 1.77 Trillion |

|

Market Size in 2026 |

USD 1.88 Trillion |

|

Market Size by 2034 |

USD 3.03 Trillion |

|

CAGR (2025–2034) |

6.15% |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2034 |

|

Dominating Region |

North America (largest share) |

|

Fastest Growing Region |

Asia Pacific |

|

U.S. Market Outlook |

USD 490.98 Billion in 2024 → USD 907.86 Billion by 2034 |

|

Segments Covered |

Type, Molecule Type, Product, Disease, Route of Administration, Age Group, Distribution Channel, Region |

|

Molecule Type (2024) |

Small-molecule drugs dominated (~55%) |

|

Fastest-Growing Molecule Type |

Biologics & biosimilars |

|

Product Type (2024) |

Branded pharmaceuticals dominated (~87%) |

|

Fastest-Growing Product Segment |

Generic pharmaceuticals |

|

Drug Type (2024) |

Prescription drugs dominated (~87%) |

|

Fastest-Growing Drug Type |

over-the-counter (OTC) drugs |

|

Leading Disease Area (2024) |

Cancer (~19% share) |

|

High-Growth Therapy Areas |

Obesity, metabolic disorders, chronic diseases |

|

Route of Administration (2024) |

Oral formulations dominated (~58%) |

|

Growing Administration Route |

Parenteral (injectables), especially for biologics |

|

Age Group (2024) |

Adults segment largest (~64%) |

|

Fastest-Growing Age Group |

Geriatric population |

|

Distribution Channel (2024) |

Hospital pharmacies dominated (~54%) |

|

Fastest-Growing Channel |

Retail pharmacies & alternative digital channels |

|

Key Market Drivers |

Rising chronic diseases, aging population, biologics & biosimilars growth, expanding R&D investments, increasing OTC adoption |

|

Emerging Opportunities |

Precision medicine, personalized therapeutics, biosimilar expansion, generic affordability, growth in emerging economies |

For inquiries regarding discounts, bulk purchases, or customization

requests, please contact us at sales@precedenceresearch.com How is AI

Transforming the Pharmaceutical Industry? Artificial Intelligence

(AI) is revolutionizing the pharmaceutical sector by accelerating drug

discovery, clinical trials, and personalized medicine. The global AI in

pharmaceutical market is projected to grow from USD 1.94 billion in 2025

to USD 16.49 billion by 2034, at a robust CAGR of 27%. What Are the Key Benefits of AI in Pharma? Which Regions Are Leading in AI Adoption? Who Are the Major Players Using AI? Global

pharmaceutical leaders like Pfizer, Novartis, AstraZeneca, and Johnson &

Johnson are actively integrating AI into drug

development, while AI startups are innovating new solutions to speed up research and

improve outcomes. What Opportunities Does AI Bring to the Pharmaceutical Market? Immediate

Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1485 Pharmaceutical

Market Regional Analysis North

America led the Pharmaceutical Market in 2024 North

America led the market in 2024 due to the region's increasing prevalence of

chronic and infectious diseases. Higher demand for precision medicine, targeted

therapies, and targeted drug delivery to achieve effective results also helps

fuel the market's growth in the foreseeable period. Increased automation,

research and development, and advancements in the region's pharmaceutical

industry are another major factor driving the market’s growth. The U.S.

plays a major role in market growth due to higher investment in research and

development and greater demand for mRNA vaccines, biologics, and biosimilars. What is

the U.S. Pharmaceutical Market Size? According to

Precedence Research, the U.S. pharmaceutical market size is estimated at USD 520.38 billion

in 2025 and is predicted to grow from USD 552.72 billion in 2026 to USD 907.86

billion by 2034, growing at a solid CAGR of 6.34% from 2025 to 2034. The market

is witnessing substantial growth due to the rising demand for personalized and

regenerative therapies for chronic diseases. This expansion is fueled by

technological advancements, notably the integration of AI and machine learning, which accelerate R&D and drug discovery in the upcoming years. U.S. Pharmaceutical Market Key Insights: Government Initiatives Supporting the U.S. Pharmaceutical Market Initiative Description Key Provisions Inflation Reduction Act (IRA) Lowers drug costs for

Medicare by allowing price negotiation and capping out-of-pocket costs. Drug Price Negotiation:

Medicare can negotiate prices for certain high-cost drugs. Part D Cost Cap: Implements a

$2,000 annual out-of-pocket cap for Medicare Part D enrollees (starts 2025). Most Favored Nation (MFN)

Pricing An initiative to tie U.S.

drug prices to lower prices in other developed countries. TrumpRx Website: A

government-run site to offer discounted drugs directly to consumers at

MFN-level prices. Negotiated Deals: Secures

discounted pricing from companies like Pfizer in exchange for temporary

tariff exemptions. FDA Domestic Manufacturing

Initiatives Programs to boost U.S.

pharmaceutical production and reduce reliance on foreign supply chains. FDA PreCheck Program:

Streamlines the review and construction process for new U.S. manufacturing

facilities. ANDA Prioritization:

Expedites review for generic drug applications (ANDAs) made in the U.S. FDA Regulation Modernization Updates to the FDA's regulatory

processes to encourage competition and innovation. Generic Drug Competition:

Uses the Drug Competition Action Plan (DCAP) to speed up generic drug

approvals. Advanced Technology Guidance:

Released guidance on using AI in drug development.

U.S. Pharmaceutical Market Top Companies Tier Companies Rationale/Role Estimated Cumulative Share Tier I Major Players Johnson & Johnson; Pfizer; Merck &

Co.; AbbVie; Bristol Myers Squibb; Eli Lilly These are large, diversified pharmaceutical

and biotechnology firms with strong leading product portfolios,

heavy U.S. sales, deep R&D pipelines, and considerable commercial scale

across many therapeutic areas. Their U.S. operations contribute substantially

to their global revenues, making them dominant in the U.S. pharma market. 45-50% Tier II Established Players Amgen; Gilead Sciences; Regeneron; Biogen; Vertex

Pharmaceuticals These firms are major specialty / biologics /

biotech players with significant U.S. presence, often focused on niche or

high-value therapies. They may not have the breadth of Tier I in volume, but

their high-margin products give them strong influence in the market. 20-25% Tier III Emerging / Niche / Specialty Players Sarepta Therapeutics; Incyte; Alnylam Pharmaceuticals;

Jazz Pharmaceuticals; Moderna (beyond vaccines) These are smaller or more narrowly focused firms,

often with fewer blockbuster products or with emerging pipelines. They

contribute meaningfully, especially in their therapeutic niches or via novel

modalities, but do not command the broader market share of the larger

players. 15-25%

Note: This report is readily available for immediate delivery. We can

review it with you in a meeting to ensure data

reliability and quality for decision-making.

Asia

Pacific is expected to grow in the foreseeable period Asia Pacific

is expected to be the fastest-growing region over the forecast period due to

the region's growing pharmaceutical and biopharmaceutical sectors. The market

is also seeing growth due to rising biologics production in the region. The growing

prevalence of chronic diseases in the region, such as cardiovascular problems,

obesity, diabetes, and other similar issues, is another major factor for the

market’s growth. India has made a major contribution to the region's market

growth due to increased spending on the healthcare industry and higher demand

for high-quality pharmaceuticals. Europe

is observed to have a Notable Growth in the foreseeable period Europe is

expected to show notable growth in the forecast period due to rising healthcare

expenditure, increased research and development, and higher investment by major

players in the region's healthcare sector. Germany has made a major

contribution to the region's growth due to increasing R&D activities,

rising investments, and rising healthcare expenditure, helping drive market

growth. Pharmaceutical

Market Segmental Insights By Type

Insight The

prescription segment led the pharmaceutical market in 2024 due to higher demand

for prescription medicines worldwide across different age groups. Prescription

medicines are in high demand compared to over-the-counter drugs because of

patients' trust in prescription drugs, further fueling the market's growth. The

growing population of the aged is another major factor driving market growth,

as rising lifestyle-related and age-related health issues are observed in this

segment. Hence, the segment makes a major contribution to market growth. The

over-the-counter (OTC) segment is expected to grow fastest in the foreseeable

period, as it is convenient, easily accessible, and highly demanded compared to

prescription medicines. The growing trends of self-medication and the higher

demand for easily accessible drugs to maintain preventive healthcare are

another major factor driving the market's growth. Hence, the segment is

expected to grow significantly in the forecast period. By

Molecule Type Insight The

conventional drugs (small molecules) segment led the market in 2024 due to

their effectiveness and cost-effectiveness. The market also observes growth due

to the high usage of conventional drugs for therapeutic purposes. It helps to

provide effective results cost-effectively, further fueling the market’s

growth. High usage of conventional drugs for oral consumption purposes also

aids the market’s growth. The biologics

and biosimilars (large molecules) segment is the fastest-growing due to high

demand for innovation, easy access to drugs for patients, and lower financial

burden. The growing prevalence of chronic diseases and rising healthcare costs,

leading to higher demand for biologics and biosimilars, is another major factor

driving the market's growth in the foreseeable future. By

Product Type Insight The branded

segment dominated the pharmaceutical market in 2024 due to patients ' trust in

patient-branded drugs, fueling the market’s growth. The market also observes

growth due to high investment in research and development of companies' own

brands, which helps keep the market competitive. It also helps enhance the

quality and effectiveness of such drugs, fueling market growth. The generic

segment is expected to grow over the forecast period due to its affordability

and accessibility for consumers. Affordable generic alternatives to branded

medications in generic stores are a major factor driving the pharmaceutical

industry's growth in the foreseeable future. The market also shows growth due

to government support for generic stores, encouraging people to opt for

affordable healthcare options, and fueling the market's growth. By

Disease Insight The cancer

segment dominated the pharmaceutical market in 2024 due to rising cases of

cancer worldwide in recent times. Higher demand for cost-effective and

effective treatment options is a major factor driving market growth. The

segment has also led to higher demand for targeted therapies to enhance

treatment effectiveness. The growing aging population, higher risks of chronic

diseases among them, and the higher demand for targeted therapies and clinical oncology trials are also major factors driving

market growth. The obesity

segment is expected to grow in the foreseeable period due to rising obesity

among people and other lifestyle-related health issues as well. Rising

awareness of the disadvantages of obesity is a major factor driving market

growth. Hence, it has further led to higher demand for personalized medicine

and effective medications targeting obesity. Easy access to telehealth and

higher demand for effective medications are helping to fuel the market’s growth

in the foreseeable period. By Route

of Administration Insight The oral

segment led the pharmaceutical market in 2024 due to its high demand,

especially for long-term treatments and medications required for them. They easily

absorb into the body, allowing the active pharmaceutical ingredient to do its

work. Patients highly prefer such drugs as they are easy to consume and

cost-effective to manufacture, further fueling the market's growth. The

parenteral segment is expected to grow over the forecast period due to its high

effectiveness in therapeutic applications and its sustainability. The effects

are long-lasting and beneficial for the elderly population, further fueling the

pharmaceutical industry’s growth. Higher needs for accurate dosing and targeted

treatments are another major growth driver, which is beneficial for the

market. By Age

Group Insight The adult

segment led the pharmaceutical market in 2024, driven by the rising prevalence

of chronic and infectious diseases among adults, which fueled market growth.

Hence, such factors lead to higher demand for effective and economical

healthcare options. Advancements in the medical domain and higher adoption of

telehealth also help fuel the market's growth in the foreseeable period.

Increasing cases of obesity among adults are another major factor driving

market growth. The

geriatric segment is expected to grow over the forecast period due to an aging

population, fueling the market’s growth. The market also shows growth driven by

the prevalence of chronic diseases in the segment, further fueling growth.

Advanced pharmaceutical treatments for the elderly also help fuel the market's

growth in the foreseeable future. By

Distribution Channel Insight The hospital

pharmacy segment dominated the pharmaceutical market in 2024, as the location

of these pharmacies was beneficial for market growth. The pharmaceutical

companies are also supported by the government, further fueling the market’s

growth. The hospital pharmacies are a key distribution channel for

time-sensitive medications, further fueling the market’s growth. Government

funding and hospital coverage for patients also encourage patients to purchase

from hospital pharmacies, further fueling the market’s growth. The retail

pharmacy segment is expected to grow in the foreseeable period due to the easy

availability of over-the-counter drugs and prescription medicines in retail

pharmacies. Medicines in such pharmacies are available at economical prices,

further fueling the market’s growth in the foreseen period. Higher demand for

OTC drugs and online pharmacies also helps boost the market's growth in the

foreseeable future. ✚ Related Topics You May Find Useful: ➡️ Pharmaceutical

Manufacturing Market: Explore innovations and efficiency trends shaping global

drug production. ➡️ Active

Pharmaceutical Ingredient (API) Market: Understand the rising demand for

high-quality APIs in modern drug development. ➡️ Pharmaceutical

Water Market: Discover how purified water solutions support safe and compliant

pharmaceutical production. ➡️ Pharmaceutical

Contract Manufacturing Market: Analyze outsourcing trends and partnerships driving

cost-effective drug manufacturing. ➡️ Generative

AI in Pharmaceutical Market: See how AI is transforming drug discovery, clinical

trials, and R&D efficiency. ➡️ Pharmaceutical

CDMO Market: Track the growth of Contract Development and Manufacturing

Organizations supporting pharma innovation. ➡️ Pharmaceutical

CRO Market: Explore how Contract Research Organizations are accelerating clinical

trials and drug development. ➡️ Pharmaceutical

Intermediates Market: Learn about the key compounds enabling efficient active

pharmaceutical ingredient production. ➡️ Pharmaceutical

Drug Delivery Market: Discover trends in advanced drug delivery systems improving

efficacy and patient compliance. ➡️ Pharma 4.0 Market: Understand the digital

transformation of pharmaceutical manufacturing with automation and smart

technologies. Recent

Developments in the Pharmaceutical Market 🔸In December 2025, Sun Pharmaceutical

Industries launched its innovative drug Illumya (tildrakizumab) in India. The

new drug is useful for treating plaque psoriasis and is a safe and effective

option. (Source- https://m.economictimes.com) 🔸 In December 2025, Nexus

Pharmaceuticals announced the launch of Tacrolimus Injection, USP 5 mg/mL. The

launch signified the first and only cost-effective healthcare solution in the

Tacrolimus vial format. (Source- https://www.businesswire.com) Top

Companies of the

Pharmaceutical Market ➢ Merck & Co., Inc. ➢ F. Hoffmann-La Roche Ltd ➢ Johnson & Johnson Services, Inc. ➢ Novartis AG ➢ AbbVie Inc. ➢ GlaxoSmithKline plc. ➢ AstraZeneca ➢ Pfizer Inc. ➢ Bristol-Myers Squibb Company ➢ Sanofi ➢ Takeda Pharmaceutical Co., Ltd. Segment

Covered In the Report By Type 🔹 Prescription 🔹 OTC By Molecule Type 🔹 Biologics &

Biosimilars (Large Molecules) 🔹 Monoclonal

Antibodies → Vaccines → Cell & Gene Therapy → Others 🔹 Conventional Drugs

(Small Molecules) By Product 🔹 Branded 🔹 Generics By Disease 🔹 Cardiovascular

diseases 🔹 Cancer 🔹 Diabetes 🔹 Infectious diseases 🔹 Neurological

disorders 🔹 Respiratory

diseases 🔹 Autoimmune diseases 🔹 Mental health

disorders 🔹 Gastrointestinal

disorders 🔹 Women's health

diseases 🔹 Genetic and rare

genetic diseases 🔹 Dermatological

conditions 🔹 Obesity 🔹 Renal diseases 🔹 Liver conditions 🔹 Hematological

disorders 🔹 Eye conditions 🔹 Infertility

conditions 🔹 Endocrine disorders 🔹 Allergies 🔹 Others By Route of Administration 🔹 Oral

→ Tablets → Capsules → Suspensions → Other 🔹 Topical 🔹 Parenteral

→ Intravenous → Intramuscular 🔹 Inhalations 🔹 Other By Age Group 🔹 Children &

Adolescents 🔹 Adults 🔹 Geriatric By Distribution Channel 🔹 Hospital Pharmacy 🔹 Retail Pharmacy 🔹 Others By Region 🔹 North America 🔹 Europe 🔹 Asia Pacific 🔹Latin America 🔹Middle East & Africa (MEA) Thanks for reading you can also get individual

chapter-wise sections or region-wise report versions such as North America,

Europe, or Asia Pacific. Don’t Miss Out! | Instant Access to This

Exclusive Report 👉 https://www.precedenceresearch.com/checkout/6227 You can place an order or ask any questions, please feel free

to contact at sales@precedenceresearch.com | +1 804

441 9344 Stay Ahead with Precedence Research Subscriptions Unlock

exclusive access to powerful market intelligence, real-time data, and

forward-looking insights, tailored to your business. From trend tracking to

competitive analysis, our subscription plans keep you informed, agile, and

ahead of the curve. Browse

Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription About Us Precedence

Research is a global market intelligence and consulting powerhouse, dedicated

to unlocking deep strategic insights that drive innovation and transformation.

With a laser focus on the dynamic world of

life sciences,

we specialize in decoding the complexities of cell and

gene therapy,

drug development, and oncology markets, helping our clients stay ahead in

some of the most cutting-edge and high-stakes domains in healthcare. Our

expertise spans across the biotech and pharmaceutical ecosystem, serving

innovators, investors, and institutions that are redefining what’s possible in regenerative medicine, cancer care, precision

therapeutics, and beyond. Web: https://www.precedenceresearch.com ✚ Explore More Market

Intelligence from Precedence Research: ➡️ Generative

AI in Life Sciences: Explore how AI innovations are revolutionizing drug

discovery, research efficiency, and precision medicine. ➡️ Biopharmaceuticals

Growth:

Understand the accelerating expansion of biologics, therapeutic proteins, and

cutting-edge pharma pipelines. ➡️ Digital

Therapeutics: Discover how technology-driven treatments are reshaping patient care

and improving clinical outcomes. ➡️ Life

Sciences Growth: Gain insights into emerging opportunities, market

expansion, and innovation trends in the life sciences sector. ➡️ Viral

Vector & Gene Therapy Manufacturing: Analyze the production advancements

powering next-generation gene therapies and precision medicine. ➡️ Wellness

Transformation: See how consumer wellness trends are shaping supplements,

functional foods, and lifestyle-driven markets. ➡️ Generative

AI in Healthcare: Unlocking Novel Innovations in Medical and Patient Care: Explore AI applications

enhancing diagnostics, treatment personalization, and patient engagement. Our

Trusted Data Partners: Towards Healthcare | Nova One Advisor | Onco Quant

| Statifacts Get

Recent News 👉 https://www.precedenceresearch.com/news For

Latest Update Follow Us: LinkedIn | Medium | Facebook | Twitter

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/7082

📥 Download Sample Pages for

Informed Decision-Making 👉 https://www.precedenceresearch.com/sample/7082