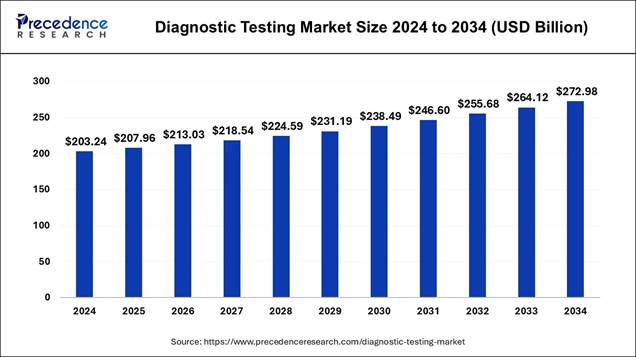

According to Precedence Research, the global diagnostic testing market size is estimated at USD 207.96 billion in 2025 and is forecasted to reach nearly USD 272.98 billion by 2034, with a CAGR of 3% from 2025 to 2034.

The technological advancements include liquid biopsies for cancer, point-of-care testing, genetic testing, molecular diagnostics, and the integration of AI and big data, which enhance speed, accuracy, and accessibility of diagnostic testing.

This Report is Readily Available for Immediate Delivery | Download the Sample

Pages of this Report@ https://www.precedenceresearch.com/sample/1984

Diagnostic Testing Market Key Takeaways

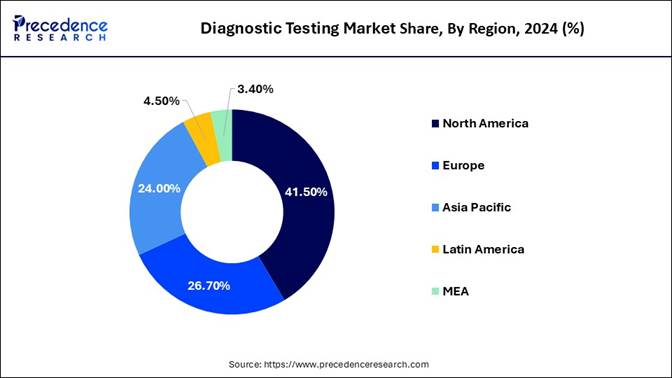

🔹Regional Insights: North America led the market with a commanding 41.5% share in 2024, while the Asia Pacific is poised for robust growth, registering a strong CAGR from 2025 to 2034.

🔹By Type: The clinical diagnostic segment dominated in 2024, whereas home diagnostics are expected to experience the fastest growth during the forecast period.

🔹By Application: Cardiology held the largest market share in 2024, while neurology is projected to witness the highest CAGR going forward.

🔹By Approach: Molecular diagnostic instruments led in 2024, with point-of-care testing instruments growing at the fastest rate.

🔹By Solution: The products segment dominated in 2024, while services are anticipated to surge at the fastest CAGR during the forecast period.

🔹By Technology: Immunoassay-based technology held a major share in 2024, whereas next-generation sequencing is expected to expand at the fastest pace.

🔹By Mode of Testing: Prescription-based testing dominated in 2024, with OTC testing predicted to grow at the fastest CAGR.

🔹By Sample Type: Blood remained the most utilized sample in 2024, while saliva-based testing is expected to grow rapidly in the coming years.

🔹By Testing Type: Biochemistry testing led the market in 2024, whereas microbiology is poised for the fastest growth.

🔹By Age Group: The adult & geriatric segment dominated in 2024, while the pediatric segment is set to grow at the fastest CAGR.

🔹By Distribution Channel: Direct tenders held the largest share in 2024, while online sales are expected to experience the fastest growth.

🔹By End User: Hospitals and diagnostic centers dominated in 2024, with homecare emerging as the fastest-growing segment.

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

Diagnostic Testing Market Overview and Industry Potential

What is Diagnostic Testing?

Diagnostics introduces quality and regulatory requirements, as well as ethical aspects such as data privacy, security, and proficiency testing. Multiplex PCR assays detect resistance mutations in fungi, while PCR treats invasive fungal infections quickly. The molecular testing leads to a more accurate diagnosis and better treatment decisions.

Personalized medicine and precision diagnostics include targeted therapies and an increased focus on genomics, expanding the diagnostic testing market. The leading diagnostics companies are Roche Diagnostics, GE Healthcare, Abbott Laboratories, Philips Healthcare, Danaher, Quest Diagnostics, Fujifilm, Becton-Dickinson and Company, Siemens Healthineers, and Thermo Fisher Scientific.

🔸 In January 2025, the World Health Organization (WHO) prequalified the first diagnostic test for glucose-6-phosphate dehydrogenase (G6PD) deficiency to prevent relapse of Plasmodium vivax (P. vivax) infection and support safer administration of WHO-recommended P. vivax malaria treatments. (Source: https://www.who.int)

📥 Dive into the Complete Report ➡️ https://www.precedenceresearch.com/diagnostic-testing-market

Major Trends in the Diagnostic Testing Market

What are the Rising Trends in the Diagnostic Testing Market?

🔹Mass Spectrometry in Diagnostic Processes: According to the recent study by precedence research, the global mass spectrometry market size is expected to reach USD 43.66 billion by 2034, up from USD 21.97 billion in 2025. It has also been reported that the global mass spectrometry market reached a compound annual growth rate (CAGR) of 7.93 % year-on-year from now until 2034. This technology is becoming more affordable and accessible, and is used by many laboratories in their workplace. It enables more accurate analysis in clinical studies and a detailed study of proteins and metabolic pathways, driving the diagnostic testing market.

🔹Point-of-Care Testing: Decentralizing Diagnosis: The global point of care testing market size is valued at USD 44.48 billion in 2025 and is expected to be worth nearly USD 125.33 billion by 2034, expanding at a healthy CAGR of 12.20% from 2025 to 2034. There are many opportunities and an increased focus on developing point-of-care testing devices that are user-friendly, compact, and capable of delivering accurate results. The point-of-care testing is becoming an essential part of modern healthcare, allowing for convenient and faster testing for patients.

Growth Factors in the Diagnostic Testing Market

How does the Diagnostic Testing Market advance in Modern Healthcare?

🔹 Non-Invasive Diagnostics: It includes methods such as transdermal sensors, sweat monitoring, and breath analysis, which improve the ease of use and patient comfort. The extensive clinical validation and research build trust with patients and healthcare providers, flourishing the diagnostic testing market. There is an increased focus on addressing regulatory concerns early in the development process.

🔹Telemedicine and Remote Diagnostics: A rapid growth of telemedicine is expanding the need for diagnostic devices that can operate remotely and allow monitoring of patients at remote distances. There is an increased shift of manufacturers towards the design of devices. It has resulted in the integration of telemedicine platforms and the reliable transmission of data.

How is Artificial Intelligence Changing the Diagnostic Testing Market?

Artificial intelligence AI enhances diagnostic accuracy in dermatology, pathology, radiology, and ophthalmology by analyzing images using deep learning algorithms. AI potentially transforms modern medicine by creating regulatory frameworks and ethical principles. They ensure more efficient, safer, and tailored healthcare solutions, accelerating the growth of the diagnostic testing market.

✚ Turn AI disruption into Opportunity. Click to Get the Insights Shaping Tomorrow.

Opportunities in the Diagnostic Testing Market

How is the Opportunistic Rise of the Diagnostic Testing Market?

🔸The

prominent diagnostics companies are expanding into major international markets.

For instance, in November 2025, Morphle Labs, a

Bengaluru-based deep-tech healthcare automation startup, raised $5 million to

revolutionize cancer diagnostics with physical AI, accelerate global market

expansion, scale manufacturing, invest in global regulatory approvals, and

strengthen its IP leadership and technology. (Source: https://www.biospectrumindia.com)

🔸Many

diagnostics companies focus on building their organizational presence and

advancing their R&D capabilities. For instance, in April 2025, Craif, a

molecular diagnostic company, raised US$22 million in series C

funding through the development of a miRNA-based early cancer detection

platform to expand its R&D and testing services in Japan. (Source: https://craif.com)

Limitations and Challenges in the Diagnostic Testing Market

What are the Potential Concerns in the Diagnostic Testing Market?

🔹Regulatory Challenges: These include insufficient funding, a lack of qualified resources, and inadequate infrastructure. These issues can reduce the effectiveness of regulatory frameworks that drive the diagnostic testing market.

🔹Clinical Diagnostics Concerns: These are related to laboratory and computational workflows, which are sensitive to bias and errors. There is a growing need for standardisation across microbiome analysis to ensure accurate and comparable results.

Diagnostic Testing Market Report Scope

|

Report Coverage |

Details |

|

Market Size in 2025 |

USD 207.96 Billion |

|

Market Size in 2025 |

USD 213.03 Billion |

|

Market Size by 2034 |

USD 272.98 Billion |

|

Growth Rate (2025–2034) |

CAGR of 3% |

|

Largest Market (2024) |

North America |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Segments Covered |

Type, Application, Approach, Solution, Technology, Mode of Testing, Sample Type, Testing Type, Age, Distribution Channel, End User, Geography |

|

Key Market Drivers |

• Increasing prevalence of chronic diseases globally |

|

Key Market Challenges |

• High cost associated with advanced diagnostic tests and

equipment |

|

Key Opportunities |

• Integration of digital health and AI-driven diagnostic solutions

|

|

Additional Insights from Report |

• Includes market dynamics, value chain analysis, and competitive

landscape |

|

Report Format Availability |

PDF, Excel Sheet, PowerPoint Presentation |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2034 |

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Case Study: How a Leading Diagnostic Provider Accelerated Market Penetration Through Technology & Decentralized Testing

Background

A global diagnostic company “Roche Diagnostics” operating across North America, Europe, and Asia-Pacific was facing slowing growth, increasing competition, and rising operational costs in traditional laboratory diagnostics.

Market trends indicated a shift toward:

🔸Point-of-care (POC) testing

🔸Companion diagnostics for precision medicine

🔸Home-based test kits (post-COVID legacy demand)

To remain competitive, Roche Diagnostics needed to reposition its value proposition and adopt a scalable diagnostics model.

Key Challenge

Roche Diagnostics was experiencing:

🔸High dependency on centralized labs

🔸Delayed turnaround times (TAT) affecting patient satisfaction

🔸Competitive pressure from digital-first diagnostic startups

🔸Rising cost per test

🔸Limited presence in the fast-growing home testing segment

Strategic Actions Taken

A. Adoption of Liquid Biopsy Platforms

🔸Partnered with a biotech firm specializing in next-generation sequencing (NGS)

🔸Launched cancer early-detection panels (lung, colorectal, breast)

🔸Reduced sample-to-report time from 7 days → 48 hours

Impact:

🔸Gained access to the USD 10+ billion oncology diagnostics segment

🔸Improved clinical adoption among oncology centers by 38% within 12 months

B. Expansion into Point-of-Care (POC) Diagnostic Ecosystems

The company invested in compact, AI-driven POC devices used in clinics and pharmacies.

Features implemented:

🔸Cloud-connected test readers

🔸Automatic result uploading to physician dashboards

🔸Rapid tests for infectious diseases (flu, RSV, COVID-19), metabolic markers, and cardiac risks

Impact:

🔸POC test volume increased by 55% year-over-year

🔸Helped penetrate rural and underserved areas where centralized labs were not feasible

C. Launch of Home-Based Diagnostic Kits

Roche Diagnostics developed consumer-friendly kits for:

🔸HbA1c

🔸Lipid profiling

🔸Thyroid markers

🔸Fertility & hormone panels

🔸Genetic carrier testing

Logistics transformation:

🔸Partnered with a digital health logistics provider

🔸Introduced teleconsultation integration

Impact:

🔸Direct-to-consumer (D2C) sales grew 5x in 18 months

🔸Reduced dependency on hospital-based referrals

🔸Strengthened brand presence in the self-testing market, projected to grow strongly through 2034

D. Pricing Optimization & Operational Efficiency

The company implemented a centralized AI-based pricing engine to optimize margins and demand forecasting across regions.

Operational improvements:

🔸Automated workflow in sample processing

🔸Reduced reagent waste by 12%

🔸Improved equipment throughput by 30%

Impact:

🔸Increased annual EBITDA margin by 4.2%

🔸Reduced test cost per patient by 14%

Results Summary (12–18 Months)

|

Performance Indicator |

Before |

After |

Improvement |

|

Test processing TAT |

7 days |

48 hrs |

72% faster |

|

POC market share |

6% |

9.5% |

+3.5% |

|

Home-based test sales |

Low |

5x growth |

400%+ |

|

EBITDA Margin |

— |

+4.2% |

Significant |

|

Cost per test |

— |

-14% |

Major savings |

|

Oncology diagnostics revenue |

— |

+38% |

Strong adoption |

Primary Market Growth Drivers (2025–2034)

1. Technological Advancements

🔸Liquid biopsies enabling non-invasive cancer detection

🔸AI & machine-learning–powered diagnostic algorithms

🔸Microfluidic POC systems

🔸Integration of diagnostics with digital health platforms

2. Rising Disease Burden

🔸Global increases in cancer, diabetes, cardiovascular disease

🔸Higher demand for early screening

3. Shift Toward Decentralized & Home Testing

🔸Consumer preference for privacy and convenience

🔸Pharmacies and retail clinics becoming primary diagnostic centers

4. Precision Medicine Growth

🔸Surge in companion diagnostics linked to personalized treatments

🔸FDA fast-tracking genomic assay approvals

5. Government & Insurance Support

🔸Reimbursement expansions for POC and home diagnostics

🔸Public health screening programs

Conclusion

This case study shows how technology adoption, market repositioning, and consumer-centric diagnostic solutions can rapidly accelerate growth in a traditionally slow-moving market.

Roche Diagnostics successfully transitioned from conventional lab-based testing to a hybrid diagnostic ecosystem, leading to strong revenue gains and long-term competitive resilience.

Don’t Miss Out! | Instant Access to This Exclusive Report 👉 https://www.precedenceresearch.com/checkout/1984

Diagnostic Testing Market Key Regional Outlook

How does North America Dominate the Diagnostic Testing Market in 2024?

North America dominated the market in 2024, owing to the growing adoption of point-of-care and at-home testing, emphasis on preventive healthcare, personalized medicine, and favorable healthcare policies. The specific government initiatives focused on improving diagnostic capabilities through policy reforms, technological advancements, and public-private collaboration.

The early and rapid monitoring of diseases expanded the growth of point-of-care diagnostics and the diagnostic testing market. There is expanded access to preventive healthcare services, including diagnostic testing, due to government initiatives and healthcare reforms. The growing need for precision medicine and advanced imaging analytics has resulted in the rapid growth of AI in diagnostics.

How Big is the U.S. Diagnostic Testing Market Size?

The U.S. diagnostic testing market size is estimated to grow from USD 69.91 billion in 2025 to reach USD 71.13 billion in 2026 and it is projected to exceed USD 86.37 billion by 2034.

U.S. Diagnostic Testing Market Analysis

In August 2025, Cyted Health, a leading gastrointestinal (GI) molecular diagnostics company, secured $44 million in a series B financing round to accelerate its U.S. expansion, strengthen its commercial success across the UK, and expand its portfolio of advanced diagnostic tests. Recently, the U.S. Food and Drug Administration (FDA) released a final rule that regulates laboratory-developed tests as medical devices.

Note: This report is readily available for immediate delivery. We

can review it with you in a meeting to ensure data reliability and quality for

decision-making.

📥 Download Sample Pages for Informed Decision-Making 👉 https://www.precedenceresearch.com/sample/1984

What is the Potential of the Diagnostic Testing Market in the Asia

Pacific?

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period due to the rise of home testing and telehealth, increasing disease burden, and growing healthcare awareness. In November 2025, South Korea launched $600 million initiative to accelerate medical device innovations.

Many Asian Pacific government initiatives and health organizations focused on digital health, in-vitro diagnostics, and cancer screening, which boost diagnostic testing capabilities. There is a huge adoption of advanced technologies like AI and digital health solutions to improve health outcomes and expand diagnostic access in the evolving diagnostic testing market.

🔸 In July 2024, the World Health Organization (WHO) reported that the MeDevIS platform planned to boost access to medical devices and technologies, which will also support regulators, governments, and users in their decision-making on selection, procurement, and use of medical devices for testing, diagnostics, and treatment of diseases and health conditions. (Source: https://www.who.int)

What is the India Diagnostic Testing Market Size?

According to Precedence Research, the India diagnostic testing market size accounted for USD 12.01 billion in 2025 and is anticipated to reach approximately USD 16.74 billion by 2034, poised to grow at a CAGR of 3.68% between 2025 and 2034.

India Diagnostic Testing Market Analysis

In September 2025, Smt. Anupriya Patel, the Union Minister of State for Health and Family Welfare, introduced the National Virus Research & Diagnostic Laboratory Conclave- 2025. The government of India launched India-oriented performance standards for diagnostic laboratories to achieve consistency, accuracy, and reliability of test results and build patients’ confidence in the healthcare system.

How Big is the Europe in the Diagnostic Testing Market?

The Europe diagnostic testing market size is calculated at USD 55.29 billion in 2025, and it is projected to surpass USD 71.03 billion by 2034. Europe is expected to grow at a CAGR of 2.75% between 2025 and 2034. This regional growth is attributed to the technological innovations such as next-generation sequencing, AI, molecular diagnostics, and susceptibility of the elderly population to various age-related health conditions.

The European Commission and the European Union focused on upgrading medtech and diagnostics regulations by introducing a regulatory framework and policy reforms that also help to expand the diagnostic testing market. The European Commission launched its pilot project, named the COMBINE pilot, to streamline the approval of studies that involve medicinal products and in vitro diagnostic medical devices.

🔸In October 2025, the European Commission launched a ‘call for evidence’ on the future of the medical device regulation and in vitro diagnostics regulation, which aims to reduce administrative burden, enhance cost-efficiency, and strengthen international competitiveness. (Source: https://www.medtecheurope.org)

What is the France Diagnostic Testing Market Size?

The France diagnostic testing market size is projected to grow from USD 7.28 billion in 2025 to USD 9.17 billion by 2034, registering a CAGR of 2.52% during the forecast period from 2025 to 2034.

France Diagnostic Testing Market Analysis

In April 2025, France announced the improvement in the validation and implementation of medical diagnostics innovation, which will support personalized medicine approaches and boost the decision on reimbursement. France launched the Fourth National Rare Diseases Plan, which aims to improve care for people with rare diseases, support innovation in healthcare, and speed up research.

Diagnostic Testing Market Segmentation Insights

By Type Insights

How does the Clinical Diagnostic Segment Dominate the Diagnostic Testing Market in 2024?

The clinical diagnostic segment dominated the market in 2024, owing to the growing demand for clinical laboratories to access next-generation offerings, customized solutions, and diverse service offerings. Clinical laboratories serve as the backbone of in vitro diagnostics, which help in the analysis of many disorders. The clinical testing tracks disease progression, guides medicinal treatments, and informs personalized care plans.

The home diagnostic segment is expected to grow at the fastest CAGR in the diagnostic testing market during the forecast period due to its crucial role in preventative and chronic healthcare management. It enables proactive health monitoring, early detection, and enhanced patient convenience. It is supported by the integration of technologies such as AI, data analytics, telehealth, and wearable biosensors.

By Application Insights

What made Cardiology the Dominant Segment in the Diagnostic Testing Market in 2024?

The cardiology segment dominated the market in 2024, owing to the enhanced diagnostic accuracy, genetic testing, remote patient monitoring, and shift to non-invasive approaches. The major diagnostic methods in clinical practice include stress testing, electrocardiogram, echocardiography, and advanced imaging. The diagnostic testing enables more precise, personalized, and early detection of heart conditions.

The neurology segment is estimated to grow at the fastest rate in the diagnostic testing market during the predicted timeframe due to the rise of less invasive blood biomarkers and integration of AI with traditional methods. Neurological testing brings precision, personalization, early detection, prevention, disease monitoring, treatment efficacy, and improved accessibility. The genomic and molecular testing are used to detect hereditary neurological disorders.

By Approach Insights

How did the Molecular Diagnostic Instrument Segment Dominate the Diagnostic Testing Market in 2024?

The molecular diagnostic instrument segment dominated the market in 2024, owing to its superior accuracy, speed, and ability to deliver personalized medicine. The major technologies and the rising trends include liquid biopsies, next-generation sequencing, point-of-care testing, automation, AI, and CRISPR-based diagnostics. CRISPR-based diagnostic tools introduce high precision and enable diagnostics in point-of-care settings.

The point-of-care testing instrument segment is anticipated to grow at a notable rate in the diagnostic testing market during the upcoming period due to its assistance in clinical decision-making, improved patient outcomes, enhanced accessibility, and infectious disease management. It allows integration with technologies, chronic disease management, and streamlining of processes. It requires overcoming challenges associated with accuracy, reliability, cost, scaling, and implementation.

By Solution Insights

Which Segment by Solution Dominated the Diagnostic Testing Market in 2024?

The products segment dominated the market in 2024, owing to the critical role of diagnostic testing products in guiding treatment and prognosis, enabling personalized medicine, and combating global health challenges. The emerging trends are point-of-care and at-home kits, digital health integration, molecular diagnostics, and non-invasive methods. The digital health technologies, like wearable devices, mobile applications, and telemedicine, enable remote patient monitoring and real-time communication between patients and healthcare providers.

The services segment is predicted to grow at a rapid rate in the diagnostic testing market during the studied period due to the expansion of diagnostic infrastructure and a broad range of routine diagnostics. The diagnostic testing services are expanding through innovation and improved accessibility to deliver patient-centric care. The advanced services, like home testing and telehealth, are integrated with telemedicine platforms for data sharing and remote consultations.

By Technology Insights

How does the Immunoassay-Based Segment Dominate the Diagnostic Testing Market in 2024?

The immunoassay-based segment dominated the market in 2024, owing to the expansion of technologies and the growing demand for automation, point-of-care solutions, and early disease detection. There is a wide adoption of high-sensitivity techniques, the development of multiplex assays, and the integration of AI. Immunoassays are vital across various medical fields, such as oncology, endocrinology, infectious diseases, therapeutic drug monitoring, etc.

The next-generation sequencing segment is expected to grow at the fastest CAGR in the diagnostic testing market during the forecast period due to its speed, flexibility, accuracy, and scalability. It ensures early medical intervention and personalized treatment strategies. It boosts treatment efficacy, reduces side effects, and improves patient outcomes.

By Mode of Testing Insights

What made Prescription-Based Testing the Dominant Segment in the Diagnostic Testing Market in 2024?

The prescription-based testing segment dominated the market in 2024, owing to its key roles in ensuring accuracy and reliability, medical supervision, and medical interpretation. It manages complex diseases and enables integration with clinical settings. The regulatory bodies make efforts to ensure the safety, efficacy, and quality of all diagnostic tests.

The OTC testing segment is estimated to grow at the fastest rate in the diagnostic testing market during the predicted timeframe due to its major role in empowering proactive health management and aiding in infectious disease detection. It enables the integration with digital health and telemedicine, and manages chronic conditions. It is important in clinical diagnostics in supporting evidence-based decisions and offering timely consultations.

By Sample Type Insights

How did the Blood Segment Dominate the Diagnostic Testing Market in 2024?

The blood segment dominated the market in 2024, owing to the importance of blood tests in the prevention, diagnosis, and management of chronic diseases. There is a huge preference for blood samples in personalized medicine, point-of-care testing, and standardization. The whole blood is essential for tests such as blood typing, certain genetic tests, and complete blood counts.

The saliva segment is anticipated to grow at a notable rate in the diagnostic testing market during the upcoming period due to the ideal use of saliva biomarkers as diagnostic tools for detecting systemic diseases. Saliva is proven to be vital in personalized medicine, for early disease detection and real-time health monitoring. Saliva is becoming a popular choice for medical professionals for diagnostic methods, including blood and tissue samples.

By Testing Type Insights

Which Segment by Testing Type Dominated the Diagnostic Testing Market in 2024?

The biochemistry segment dominated the market in 2024, owing to the greater precision, efficiency, and accessibility offered by biochemistry testing in healthcare. It helps to assess organ function by providing insights about the endocrine glands, kidneys, and liver. This testing is used in routine health screenings to detect early cancer markers and high cholesterol before the arrival of symptoms, allowing for prompt intervention.

The microbiology segment is predicted to grow at a rapid rate in the diagnostic testing market during the studied period due to the core role of microbiology testing in the diagnosis of infectious diseases, antimicrobial susceptibility testing, public health, and industrial safety. The novel innovations in microbiology testing are driven by efforts to combat global challenges of antimicrobial resistance. It also involves efforts to manage infectious disease outbreaks.

By Age Insights

How does the Adult & Geriatric Segment Dominate the Diagnostic Testing Market in 2024?

The adult & geriatric segment dominated the market in 2024, owing to advances like liquid biopsies and other non-invasive technologies for early cancer detection than traditional methods. The smart wearables and remote health monitoring systems help healthcare providers to track health data and early signs in real-time. They enable early insights and medical interventions without the need for frequent in-person visits.

The pediatric segment is expected to grow at the fastest CAGR in the diagnostic testing market during the forecast period due to the timely and accurate diagnosis, treatment decisions, monitoring, and screening offered by several diagnostic tests. Medical imaging, genetic testing, and clinical decision support are becoming vital in pediatric healthcare. Modern healthcare is shifting towards CRISPR-based detection methods and advanced molecular and genomic techniques.

By Distribution Channel Insights

What made Direct Tenders the Dominant Segment in the Diagnostic Testing Market in 2024?

The direct tenders segment dominated the market in 2024, owing to the urgent public health needs or emergencies, and specialized testing services. They introduce speed, efficiency, cost-efficiency, innovation, and standardization. They serve as an accountable medium for business operations.

The online sales segment is estimated to grow at the fastest rate in the diagnostic testing market during the predicted timeframe due to operational efficiency and data management. The online sales channels focus on preventive and personalized healthcare. They are transforming diagnostic testing through a patient-centric, convenient, and digitally integrated experience.

By End-User Insights

How did the Hospitals, Diagnostic Center Segment Dominate the Diagnostic Testing Market in 2024?

The hospitals, diagnostic center segment dominated the market in 2024, owing to more accessible and specialized services offered by diagnostic centers. They introduce a decentralized and patient-centric healthcare model. They use advanced data management systems that help them to streamline operations.

The homecare segment is anticipated to grow at a notable rate in the diagnostic testing market during the upcoming period due to proactive disease management and public health support. It helps patients in their medication management and intervention. The integration of telehealth, mobile applications, and home test kits allows seamless connectivity between the patient and healthcare provider.

✚ Related Topics You May Find Useful:

➡️ Self-Testing Market: Explore how consumer-led diagnostics are reshaping preventive healthcare at home

➡️ Esoteric Testing Market: Discover the surge in advanced, specialized diagnostics driven by precision medicine

➡️ Direct-to-Consumer Laboratory Testing Market: See how patient empowerment and online platforms are transforming access to lab testing

➡️ Influenza Diagnostic Market: Analyze how rapid detection technologies are improving response to seasonal and pandemic flu strains

➡️ Minimal Residual Disease Testing Market: Understand how cutting-edge molecular assays are advancing cancer monitoring and treatment decisions

➡️ Influenza Diagnostic Market: Track innovation in flu testing as healthcare moves toward faster, more accurate point-of-care solutions

➡️ Blood Testing Market: Gain insights into evolving technologies driving efficiency across routine and advanced blood diagnostics

➡️ Rapid Diagnostics Market: Examine the rising demand for fast, portable testing solutions across home, clinical, and emergency settings

➡️ Diagnostic Imaging Market: Discover how AI, 3D imaging, and advanced modalities are shaping the future of medical diagnostics

➡️ Medical Imaging Market: Explore how technology upgrades and precision healthcare are driving growth in imaging solutions

Diagnostic Testing Market Leading Companies

➢ F-Hoffman La-Rcohe Ltd. (Switzerland)

➢ Danaher (US)

➢ BD (US)

➢ Thermo Fisher Scientific Inc. (US)

➢ ACON Laboratories Inc. (US)

➢ Hemosure, Inc. (US)

➢ MicroGen Diagnostics (US)

➢ Grifols, S.A (Spain)

➢ BODITECH MED INC. (South Korea)

➢ Chembio Diagnostic Systems, Inc. (US)

➢ Nanoentek (South Korea)

➢ DiaSorin S.p.A. (Italy)

➢ Bio-Rad Laboratories, Inc. (US)

➢ BIOMEDOMICS INC (US)

➢ EKF Diagnostics Holdings plc (UK)

➢ Siemens Healthcare GmbH (Germany)

➢ PerkinElmer Inc. (US)

➢ bioMérieux SA (France)

➢ ARKRAY USA, Inc. (US)

➢ Biohit Oyj (Finland)

➢ Quidel Corporation (US)

➢ Illumina, Inc. (US)

➢ Lamdagen Corporation (US)

➢ LifeSign LLC. (US)

➢ Medixbiochemica (Finaland)

➢ Nova Biomedical (US)

➢ Ortho Clinical Diagnostics (US)

➢ Sannuo Biosensing Co., Ltd. (US)

➢ STRECK (US)

➢ Sysmex Corporation (Japan)

Strengths and Competitive Advantages

🔹 Roche Diagnostics: Broad portfolio covering immunoassays, molecular diagnostics, and point-of-care testing; strong global presence; continuous innovation.

🔹 Abbott Laboratories: Rapid diagnostics and point-of-care expertise; strong presence in emerging markets; diversified product range from lab-based to consumer-friendly devices.

🔹 Siemens Healthineers: Integrated diagnostics and imaging solutions; innovation in lab automation and advanced analyzers; strong hospital/lab network.

🔹 Danaher Corporation: Expertise in molecular diagnostics and lab automation; strategic acquisitions enhance portfolio; flexibility across clinical labs and research.

🔹 Thermo Fisher Scientific: Large-scale lab and diagnostics solutions; global distribution networks; strong in high-throughput testing.

🔹 Becton, Dickinson and Company (BD): Complementary testing solutions; recognized in reagents and instruments; collaboration-focused approach.

🔹 Quest Diagnostics: Extensive clinical laboratory network; strong in molecular diagnostics; adoption of advanced testing technologies.

🔹 Smaller/Niche Players (Bio-Rad, DiaSorin, bioMérieux, etc.): Focused expertise in specialized testing; agile in innovation; cater to niche or emerging diagnostic needs.

Market Dynamics

🔹 Moderate concentration: Top players dominate, but room exists for niche specialists in molecular diagnostics, POC testing, and rare disease assays.

🔹 Mergers & Acquisitions: Key strategy for filling capability gaps and expanding portfolios quickly.

🔹 POC and Home-Based Diagnostics: Growing demand for decentralized testing; rapid tests and home diagnostics are reshaping competition.

🔹 Integration with Digital Health: Companies leveraging data, analytics, and software platforms gain a competitive edge.

🔹 Pricing and Regulatory Pressures: Cost-effective solutions and compliance with global regulations are critical for market success.

Implications for Market Participants

🔹 New Entrants: Opportunities exist in specialized molecular diagnostics, rapid tests, and niche disease panels.

🔹 Investors: Firms combining broad diagnostic offerings with adaptability in POC and home-testing are best positioned for long-term growth.

🔹 Emerging Markets: Success favors cost-effective, decentralized testing solutions targeting growing healthcare accessibility.

What is Going Around the Globe?

|

🔸In August 2025, Siemens Healthineers announced the modernization of its entire range of ultrasound equipment by entering a technology partnership with the Klinikum Landkreis Erding in the field of ultrasound devices.

|

|

(Source: https://www.medicaldevice-network.com) |

Segments Covered in the Report

By Type

🔹 Clinical Diagnostic

🔹 Home Diagnostic

By Application

🔹 Cardiology

🔹 Oncology

🔹 Neurology

🔹 Orthopedics

🔹 Gastroenterology

🔹 Gynecology

🔹 Odontology

🔹 Others

By Approach

🔹 Molecular Diagnostic Instrument

🔹 In-Vitro Diagnostic Instrument

🔹 Point Of Care Testing Instrument

By Solution

🔹 Services

🔹 Products

By Technology

🔹 Immunoassay-Based

🔹 PCR-Based

🔹 Next-generation Sequencing

🔹 Spectroscopy-Based

🔹 Chromatography-Based

🔹 Microfluidics

🔹 Substrate Technology

Others

By Mode of Testing

🔹 Prescription-Based Testing

🔹 OTC Testing

By Sample Type

🔹 Urine

🔹 Saliva

🔹 Blood

🔹 Hair

🔹 Sweat

🔹 Others

By Testing Type

🔹 Biochemistry

🔹 Hematology

🔹 Microbiology

🔹 Histopathology

🔹 Others

By Age

🔹 Pediatric

🔹 Adult & Geriatric

By Distribution Channel

🔹 Direct Tenders

🔹 Retail Sales

🔹 Online Sales

By End Userf

🔹 Hospitals, Diagnostic Center

🔹 Research Labs and Institutes

🔹 Research Institute

🔹 Homecare

🔹 Blood Banks

🔹 Specialty Clinics

🔹 Ambulatory Surgical Centers

🔹 Others

By Region

🔹 North America

🔹 Europe

🔹 Asia Pacific

🔹Latin America

🔹Middle East & Africa (MEA)

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or Asia Pacific.

Don’t Miss Out! | Grab Your Discounted Report Before Prices Go Up! 👉 https://www.precedenceresearch.com/checkout/1984

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a global market intelligence and consulting powerhouse, dedicated to unlocking deep strategic insights that drive innovation and transformation. With a laser focus on the dynamic world of life sciences, we specialize in decoding the complexities of cell and gene therapy, drug development, and oncology markets, helping our clients stay ahead in some of the most cutting-edge and high-stakes domains in healthcare. Our expertise spans across the biotech and pharmaceutical ecosystem, serving innovators, investors, and institutions that are redefining what’s possible in regenerative medicine, cancer care, precision therapeutics, and beyond.

✚ Explore More Market Intelligence from Precedence Research:

➡️ Digital Therapeutics: How software-based interventions are restructuring chronic-disease management and clinical-grade behavioral therapy

➡️ Life Sciences Growth: Forces driving expansion across biotech, biopharma, and advanced therapeutic platforms

➡️ Viral Vector Gene Therapy Manufacturing: Manufacturing constraints, scalability limits, and innovations shaping next-generation gene-delivery systems

➡️ Wellness Transformation: How prevention-centric health models are shifting consumer behavior, product pipelines, and care delivery

➡️ Generative AI in Healthcare: How generative models are unlocking new diagnostics, clinical automation, and patient-care innovations

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Nova One Advisor | Onco Quant | Statifacts

Get Recent News 👉 https://www.precedenceresearch.com/news

For Latest Update Follow Us: