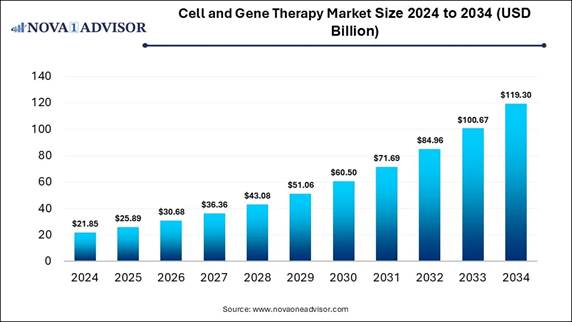

According to Nova One Advisor, the global cell and gene therapy market size is expected to be worth around 119.30 billion by 2034, increasing from USD 25.89 billion in 2025, representing a healthy CAGR of 18.5% from 2025 to 2034.

The cell and gene therapy market is growing, as these therapies are mainly focused on managing monogenic disorders produced by a mutation in a single gene, like SCID, muscular dystrophy, and haemophilia. CGT is increasing to target more complicated multigenic diseases like tumors, cardiac disease, and diabetes by changing the expression of multiple genes instantaneously.

The most frequent type of cell therapy is blood transfusion, and the transfusion of RBC, WBC, and platelets from a donor. Single therapies that restore healthy cellular function, eventually cultivating life expectancy and lowering the burden of chronic diseases.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.novaoneadvisor.com/report/sample/7720

Cell and Gene Therapy Market Highlights:

🔹By region, North America dominated the cell and gene therapy market with a revenue share of approximately 43% in 2024.

🔹By region, Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

🔹By therapy type, the cell therapy segment dominated the market with the highest revenue shares of approximately 55%.

🔹By therapy type, the gene therapy (in vivo) segment is expected to grow at the fastest CAGR in the Cell and Gene Therapy market during the forecast period.

🔹By vector type, the viral vectors segment held the highest revenue shares of approximately 68% in the market in 2024.

🔹By vector type, the non-viral vectors (LNPs) segment is expected to grow at the fastest CAGR in the market during the forecast period.

🔹By application, the oncology segment held the highest market share of approximately 47% in 2024.

🔹By application, the rare & genetic disorders segment is expected to grow at the fastest CAGR in the market during the forecast period.

🔹By end user, the pharmaceutical & biotechnology companies segment led the Cell and Gene Therapy market with the largest revenue share of approximately 41% in 2024.

🔹By end user, the CROs & CDMOs segment is expected to grow at the fastest CAGR in the market during the forecast period.

🔹By delivery mode, the ex vivo administration segment held the largest market share with the biggest revenue share of approximately 58% in 2024.

🔹By delivery mode, the in vivo administration segment is expected to grow at the fastest CAGR in the market during the forecast period.

🔹By industry vertical, the biotechnology segment held the largest market share with the biggest revenue share of approximately 37% in 2024.

🔹By industry vertical, the pharmaceuticals segment is expected to grow at the fastest CAGR in the market during the forecast period.

Market Overview and Industry Potential

Cell and gene therapies utilize cells and genes to treat genetic and rare diseases. This therapy has predominant potential to lay the foundation for the future big paradigm shift in drug development and manufacturing. It provides the ability for untreated syndromes or diseases caused by genetic alterations.

The development of cell and gene therapy is reforming drug discovery, offering new hope for rare diseases and cancer through advanced gene therapy. The potential of cell and gene therapies provides new management strategies for patients afflicted with genetic diseases.

With the rapid increase of cell and gene therapies over the last decade, biotech’s, biopharma, and nonprofits are taking on diseases that are conventionally complex to treat. Targeted cell and gene therapy has transformed precision medicine by enabling physicians to fix genetic defects that cause major illnesses.

Applications of Viral Vectors:

|

Application |

Function |

|

Sickle Cell Disease |

Correcting the underlying faulty genes |

|

Spinal Muscular Atrophy |

Providing a lasting solution |

|

Hemophilia |

Providing the gene for the missing clotting factor. |

|

Multiple Myeloma |

Target specific antigens on cancer cells. |

|

Neurodegenerative Diseases |

Delivering proteins that promote neuron survival |

Latest Trends of the Market ⬥︎ In July 2025, AscellaHealth, a global partner

delivering customizable solutions to support the specialty pharmaceutical

industry, highlights the value of its HUB partnership with Abeona Therapeutics

Inc. in the successful pre- and post-launch commercialization of ZEVASKYN, an

FDA-approved cell-based gene therapy. ⬥︎ In April 2025, INmune Bio Inc., a clinical-stage

biotechnology company targeting inflammation and immunology through the innate

immune system, partnered with the Cell and Gene Therapy Catapult to establish

large-scale, commercial-ready manufacturing for its cell therapy platforms. CGT

Catapult is an independent technology and innovation organization specializing

in the advancement of the cell and gene therapy industry. It was established by

and works in partnership with Innovate UK. Recent Advancements in CGT Tools and

Techniques: Market’s Largest Potential Recent advancements in new cutting-edge

tools and technologies for high-throughput, precise, and effective genome

editing for medical care claims. These advancements comprise new nucleic acid

formats and viral biosynthesis processes, non-viral gene therapy, cell

therapies, microfluidics or encapsulation-driven cell culture, in vivo

cell therapy, advanced GMP cell sorting, non-chromatographic separations, and

novel optical methods for nanoscale. CGT provides the advanced strength of novel

curative treatments for patients with excessive healthcare requirements in

immune conditions, hereditary diseases, oncology,

and other therapeutic areas. This rapid renovative advancement of the

therapeutic armamentarium is associated with current manufacturing to deliver

these sophisticated therapies. ⬥︎ For Instance, In September 2025,

INmune Bio Inc., a clinical-stage inflammation and immunology company focused

on developing treatments that harness the patient’s innate immune system to

fight disease, announced the successful completion of its first full-scale

pilot commercial manufacturing run of CORDStrom, an off-the-shelf, allogeneic,

umbilical cord tissue-derived mesenchymal stromal cell therapy for the

treatment of Recessive Dystrophic Epidermolysis Bullosa (RDEB). Buy Now Full Report: https://www.novaoneadvisor.com/report/checkout/7720 Cell and Gene Therapy Market Report

Scope Report Attribute Details Market Size in 2025 USD 25.89 Billion Market Size by 2034 USD 119.30 Billion Growth Rate From 2025 to 2034 CAGR of 18.5% Base Year 2024 Forecast Period 2025 to 2034 Segments Covered By Therapy Type, By Vector Type, By Application, By End User, By

Delivery Mode, By Industry Vertical, By Region Market Analysis (Terms Used) Value (US$ Million/Billion) or (Volume/Units) Report Coverage Revenue forecast, company ranking, competitive landscape, growth

factors, and trends Key Companies Profiled Novartis AG, Gilead Sciences (Kite Pharma), Bristol

Myers Squibb, Bluebird Bio, Orchard Therapeutics, Spark

Therapeutics (Roche), uniQure, CRISPR

Therapeutics, Editas Medicine, Intellia Therapeutics, Regenxbio, Sangamo Therapeutics, Fate

Therapeutics, Adaptimmune Therapeutics, Poseida Therapeutics, Mustang

Bio, Iovance Biotherapeutics, Pfizer Inc. (gene therapy

division), Bayer AG (cell & gene therapy investments), Takeda

Pharmaceutical

Regional Insights North America led the viral vector and

plasmid DNA

manufacturing market in 2024, due to the presence of an advanced

R&D ecosystem, such as strong pharmaceutical and industry leaders like

Biogen, Novartis, and Pfizer, which heavily invest in R&D. Increasing

government support to the healthcare sector, which approves fast clinical

therapies, drives the growth of the market. ⬥︎ For Instance, In September 2025,

ProteoNic, a leader in premium vector technology for biologics and cell and

gene therapy, announced the launch of its novel 2G UNic transposon platform,

available for licensing alongside the expansion of 2G UNic compatibility across

transposon systems used by biopharma customers. The U.S. is a leader in scientific and

technological services, with the presence of top research institutes such as

NIH, Harvard, and MIT. Increasing funding from the public sector, like BARDA

and ARPA-H, for cellular and genetic therapies, contributes to the growth of

the market. ⬥︎ For Instance, In September 2025,

Myrtelle Inc., a pioneering clinical-stage gene therapy company developing

transformative treatments for neurodegenerative diseases, announced the

publication of interim results from its Phase 1/2 clinical

trial of rAAV-Olig001-ASPA (MYR-101) in Nature Medicine. Why is the Asia Pacific the

fastest-growing Market? Asia Pacific is the fastest growing market

as the presence of a supportive government environment, like the FDA, approves

gene therapies rapidly than other regulatory bodies, allowing fast

commercialization. Huge network of specialty hospitals and different centers of

cell and gene therapy. Increasing demand for innovative treatment options, such

as advanced cell therapy, contributes to the growth of the market. ⬥︎ For Instance, In June 2025,

Singapore-based company Nuevocor received clearance from the FDA for an IND

application for NVC-001, an AAV vector-based gene therapy intended to treat

LMNA DCM. In light of the IND clearance, the company intends to go forward with

plans for a first-in-human phase 1/2 ascending-dose clinical trial. Nuevocor

expects to launch the 52-week trial, which will be open to adult patients,

early next year. Participants in the trial will receive a 1-time dose of the

gene therapy product via intravenous infusion. Cell and Gene Therapy Market, By Region,

2021-2024 (USD Million) By Region 2021 2022 2023 2024 North America 2,724.8 3,067.2 3,461.9 3,915.1 Europe 1,315.8 1,493.4 1,699.7 1,938.5 Asia Pacific 952.3 1,109.7 1,295.9 1,515.3 South America 95.9 105.5 116.3 128.3 Middle East & Africa 210.4 234.4 261.9 293.1

Cell and Gene Therapy Market

Segmentation Analysis: By Therapy Type Analysis: The cell therapy

segment dominates in the cell and gene therapy market, as these therapies are

used in patients to repair and regenerate tissues that are damaged or affected

by disease. It lessens patients' immune rejection challenges while endorsing

long-term curative processes. Prominent applications of cell therapies comprise

treating tumors, autoimmune disorders, UTI problems, and infectious diseases,

transforming damaged cartilage in joints, fixing spinal cord injuries, boosting

a weakened immune system, and supporting patients with brain-related disorders. On the other hand, the gene

therapy (in vivo) segment is the fastest-growing segment in the market,

as CGT offers advanced treatments for diseases that presently don’t have any

other options. Many gene therapies are single treatments, rather than

continuing medication that has to be taken. This therapy manages the cause of

the illness, not just the symptoms. Receiving gene therapy previously in the

course of a disease prevents the disease from causing severe damage. Cell and Gene Therapy Market By Therapy

Type, 2021-2024 (USD Million) By Therapy Type 2021 2022 2023 2024 Cell Therapy 3,330.1 3,766.3 4,271.5 4,854.2 Gene Therapy 1,969.1 2,244.0 2,564.2 2,936.0

By Vector Type Analysis: The viral vectors segment is dominating the

market in 2024, as it shows huge strength for cell and gene delivery to treat

various types of diseases such as cancer, metabolic diseases, heart defects,

and neurodegenerative disorders. Vectors have been engineered based on

adenoviruses, herpes simplex viruses, adeno-associated viruses, alphaviruses,

retroviruses, and lentiviruses. On the other hand, the non-viral vectors

segment is the fastest-growing segment in the market, as it ensures reduced

pathogenicity, reduced expenses, and simple production. Non-viral vectors offer

a greater safety advantage than viral vector approaches. Increasing

applications of non-viral vectors due to their bio-safety, including lower

immunotoxicity than the viral vector. Cell and Gene Therapy Market, By Vector

Type (Gene Delivery Method) 2021-2024 (USD Million) By Vector Type (Gene Delivery Method) 2021 2022 2023 2024 Viral Vectors 3,891.6 4,395.2 4,977.5 5,648.3 Adeno-Associated

Virus (AAV) 1,692.1 1,913.2 2,169.1 2,464.2 Lentivirus 1,162.6 1,307.9 1,475.3 1,667.4 Retrovirus 387.0 430.9 480.9 537.8 Herpes Simplex Virus

(HSV) 158.6 183.7 213.3 248.0 Adenovirus 294.4 344.2 403.0 472.4 Others 196.9 215.3 235.8 258.5 Non-Viral Vectors 1,407.6 1,615.1 1,858.2 2,142.0 Lipid Nanoparticles

(LNPs) 513.4 591.9 684.2 792.4 Naked DNA/RNA

Plasmids 353.5 402.6 459.7 525.8 Electroporation 205.8 235.8 270.9 311.8 Gene gun /

microinjection 89.6 101.7 115.8 132.1 CRISPR-Cas Delivery

Systems (non-viral) 166.5 194.1 226.7 265.2 Others 78.7 89.1 101.0 114.7

By Applications Analysis: The oncology segment dominated the market

in 2024, as CGT allows targeted interventions, ranging from the alteration of

faulty genes to the improvement of immune responses against cancer, therefore

providing novel opportunities for treating both solid and hematologic

malignancies. CGT tailored to a patient’s targeted genetic profile and the

genetic mutations driving their cancer. This personalized strategy increases

the likelihood of management success and reduces adverse effects. On the other hand, the rare and genetic

disorders segment is the fastest growing segment in the market, as gene therapy

rapidly provides a cure, fixing the genetic fault and freeing patients from

lifelong disease and the requirement for symptomatic or disease-modifying

treatment. Gene therapy is predominantly helpful because major rare and genetic

diseases are caused by a single genetic mutation. By fixing or compensating for

this mutation, gene therapy has the strength to offer a long-term, potentially

curative treatment. By End User Analysis: The pharmaceutical

and biotechnology segment dominated the market in 2024, as CGT provides

efficient therapy and treatments where none have been viable with outdated

pharma and small-molecule drugs. These therapies are significant to biopharma

because of the novel, targeted strategies they bring to cancer treatments.

Pharmaceutical organizations are harnessing cell and gene therapy to address

complicated healthcare conditions and advance therapeutic choices. On the other hand, the CROs & CDMOs

segment is the fastest-growing segment in the market, as CROs and CDMOs play a

significant role in progressing the growing pipeline of cell and gene products.

Researchers utilize the advantages of these strategic partnerships for

assurance of their projects. These organizations accelerate their healthcare

and commercial programs, and major biotech companies are choosing to work with

contract development and manufacturing organizations (CDMOs). ⬥︎ For Instance, In April 2025, AGC

Biologics Launched a New Dedicated Cell and Gene Business Division. The new

Cell and Gene Technologies Division will focus on elevating existing AGC

Biologics capabilities and supporting developers in need of capacity,

scientific capabilities, and technically qualified cell and gene CDMO

operators. Cell and Gene Therapy Market By End Use,

2021-2024 (USD Million) By End Use 2021 2022 2023 2024 Hospitals and

Specialty Clinics (administering therapies) 4,141.0 4,676.4 5,295.5 6,008.5 Government/Public

Health Bodies (NIH, EMA programs) 708.6 817.5 945.6 1,095.7 Others 449.6 516.4 594.6 686.0

By Delivery Mode Analysis: The ex vivo administration segment

dominated the market in 2024, as ex vivo therapies provide the capability to

exercise supplementary precise control over the process of producing or

manipulating genetic material. Ex vivo gene therapies are mostly utilized to

treat blood disorders and diseases, ranging from leukemia and lymphoma to

sickle cell disease (SCD) in children. On the other hand, the in vivo

administration segment is the fastest-growing segment in the market, as this

therapy involves directly introducing therapeutic genes into the patient’s

body. Innovative genetic material is first created in a laboratory by

scientists and then delivered to the patient’s cells directly, typically by

infusing it into the blood or injecting it directly into an intended organ. The

in vivo gene therapy process also includes CRISPR-Cas9

therapy, RNA Interference (RNAi), naked DNA injection, and more. By Industry Vertical Analysis: The biotechnology segment dominated the

market in 2024, as cell therapies show a major border and paradigm shift in biotechnology.

In contrast to conventional therapeutic modalities, cell therapies exist and

dynamically respond to biological cues to combat malignancies, restore impaired

tissues, regenerate tissues or lost biological functions, or increase the

body's own capability to defend against disease. On the other hand, the pharmaceuticals

segment is the fastest-growing segment in the market, as CGT has a lower cost,

quick supply of manufactured products in response to clinical demand, and

optimal organization and transport of cellular material. With progressive

engineering processes, scientists improve these cells to recognize better and

attack cancer. Cell and Gene Therapy Market Top

Companies • Gilead Sciences (Kite Pharma) • Bluebird Bio • Orchard Therapeutics • Spark Therapeutics (Roche) • uniQure • CRISPR Therapeutics • Intellia Therapeutics • Regenxbio • Sangamo Therapeutics • Adaptimmune Therapeutics • Poseida Therapeutics • Mustang Bio • Iovance Biotherapeutics • Pfizer

Inc. (gene therapy division) • Bayer

AG (cell & gene therapy investments) • Takeda Pharmaceutical What is Going Around the Globe? 🔹 In May 2025, through strategic acquisitions made by New York–based

investment firm Altaris, Minaris Regenerative Medicine and the U.S. and U.K.

operations of WuXi Advanced Therapies have been combined to form Minaris

Advanced Therapies, a global cell therapy CDMO and testing partner. The

company is headquartered in Philadelphia, Pennsylvania. 🔹 In April 2025, Artis officially emerged from stealth, marking its

launch as a San Diego-based cell and gene therapy CDMO with the acquisition of

personalized medicine compatriot Landmark Bio. 🔹 In October 2024, McKesson Corporation announced the launch of

InspiroGeneTM by McKesson, a dedicated business focused solely on supporting

the commercialization of cell and gene therapies (CGTs). With a scalable,

flexible suite of services and an experienced leadership team, InspiroGene

enables manufacturers, payers, and providers to navigate the complex CGT

commercialization landscape to ensure patients can access the life-changing

treatments they need. You can place an order or ask any

questions, please feel free to contact at sales@novaoneadvisor.com |

+1 804 441 9344 Related Report – 🔸Cell And Gene Therapy CDMO Market - https://www.novaoneadvisor.com/report/cell-and-gene-therapy-cdmo-market 🔸Advanced Therapy Medicinal Products CDMO Market- https://www.novaoneadvisor.com/report/advanced-therapy-medicinal-products-cdmo-market 🔸Oncology Clinical Trials Market- https://www.novaoneadvisor.com/report/oncology-clinical-trials-market 🔸Cell And Gene Therapy Manufacturing Market- https://www.novaoneadvisor.com/report/cell-and-gene-therapy-manufacturing-market 🔸U.S. Cell Therapy Market- https://www.novaoneadvisor.com/report/us-cell-therapy-market 🔸RNA Therapy Clinical Trials Market - https://www.novaoneadvisor.com/report/rna-therapy-clinical-trials-market 🔸Cell & Gene Therapy Contract Research Organizations Market- https://www.novaoneadvisor.com/report/cell-and-gene-therapy-contract-research-organizations-market Segments Covered in the Report This report forecasts revenue growth at country

levels and provides an analysis of the latest industry trends in each of the

sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has

segmented the Cell and Gene Therapy market. By Therapy Type • Cell Therapy o Autologous Cell

Therapy o Allogeneic Cell

Therapy o Stem Cell

Therapy (MSC, HSC, iPSC) o T-cell Therapy

(CAR-T, TCR-T, NK cells) o Dendritic Cell

Therapy o Others • Gene Therapy o Gene Addition /

Replacement o Gene Silencing

(RNAi, antisense) o Genome Editing

(CRISPR/Cas, TALEN, ZFN) o Ex Vivo Gene

Therapy o In Vivo Gene

Therapy o Others By Vector Type • Viral Vectors o Adeno-associated

Virus (AAV) o Lentivirus o Retrovirus o Adenovirus o Herpes Simplex

Virus (HSV) o Others • Non-Viral Vectors o Lipid Nanoparticles

(LNPs) o Electroporation o Naked DNA / RNA o Physical &

Chemical Methods (polymeric nanoparticles, nanocarriers) o Others By Application • Oncology (hematological malignancies,

solid tumors) • Rare & Genetic Disorders (hemophilia,

SMA, DMD) • Cardiovascular Diseases • Neurological Disorders • Ophthalmic Disorders • Infectious Diseases • Musculoskeletal Disorders • Others By End User • Hospitals & Clinics • Academic & Research Institutes • Pharmaceutical & Biotechnology

Companies • Contract Research & Manufacturing

Organizations (CROs/CDMOs) • Others By Delivery Mode • In Vivo Administration • Ex Vivo Administration By Industry Vertical • Pharmaceuticals • Biotechnology • Healthcare & Diagnostics • Research & Academia • Others By Region • North America • Europe • Asia-Pacific • Latin America • Middle East & Africa (MEA) Immediate Delivery Available | Buy This

Premium Research https://www.novaoneadvisor.com/report/checkout/7720 About-Us Nova One Advisor is a global leader

in market intelligence and strategic consulting, committed to delivering deep,

data-driven insights that power innovation and transformation across

industries. With a sharp focus on the evolving landscape of life sciences, we

specialize in navigating the complexities of cell and gene therapy, drug

development, and the oncology market, enabling our clients to lead in some of

the most revolutionary and high-impact areas of healthcare. Our expertise spans the entire

biotech and pharmaceutical value chain, empowering startups, global

enterprises, investors, and research institutions that are pioneering the next

generation of therapies in regenerative medicine, oncology, and precision

medicine. Web: https://www.novaoneadvisor.com/ Contact Us USA: +1 804 420 9370 Email: sales@novaoneadvisor.com For Latest Update

Follow Us: LinkedIn