Deals

Novartis and Unnatural Products did not specify which disease targets they’re going after, only noting that the latter’s macrocyclic platform can generate potentially next-generation therapies that could apply to cardiovascular conditions.

FEATURED STORIES

Henry Gosebruch, who has $3.5 billion in capital to deploy, is thinking broad as he steers the decades-old biotech out of years of turmoil.

Speaking on the sidelines of the J.P. Morgan Healthcare Conference, Novo business development executive Tamara Darsow said the company is gunning for obesity and diabetes assets.

Buying vaccine biotech Dynavax was an easy choice for Sanofi despite anti-vaccine moves by the Trump administration.

Subscribe to BioPharm Executive

Market insights and trending stories for biopharma leaders, in your inbox every Wednesday

THE LATEST

The Japanese biotechnology and food company has bought into the gene therapy space with its $620 million acquisition of Ohio-based CDMO and clinical-stage biotech Forge Biologics.

The cell therapy-focused biotech will use most of the net proceeds from its initial public offering to fund Phase II clinical trials for its lead program, a novel CAR T-cell candidate.

The New York-based genetic medicine company, which expects gross proceeds of approximately $100 million, joins a small group of biotechs that have launched initial public offerings this year.

The Swiss drugmaker gains rights to RVT-3101 in the U.S. and Japan. Telavant was formed in late 2022 by Roivant and Pfizer, which had a 25% stake in the venture and retains rights to the antibody in other countries.

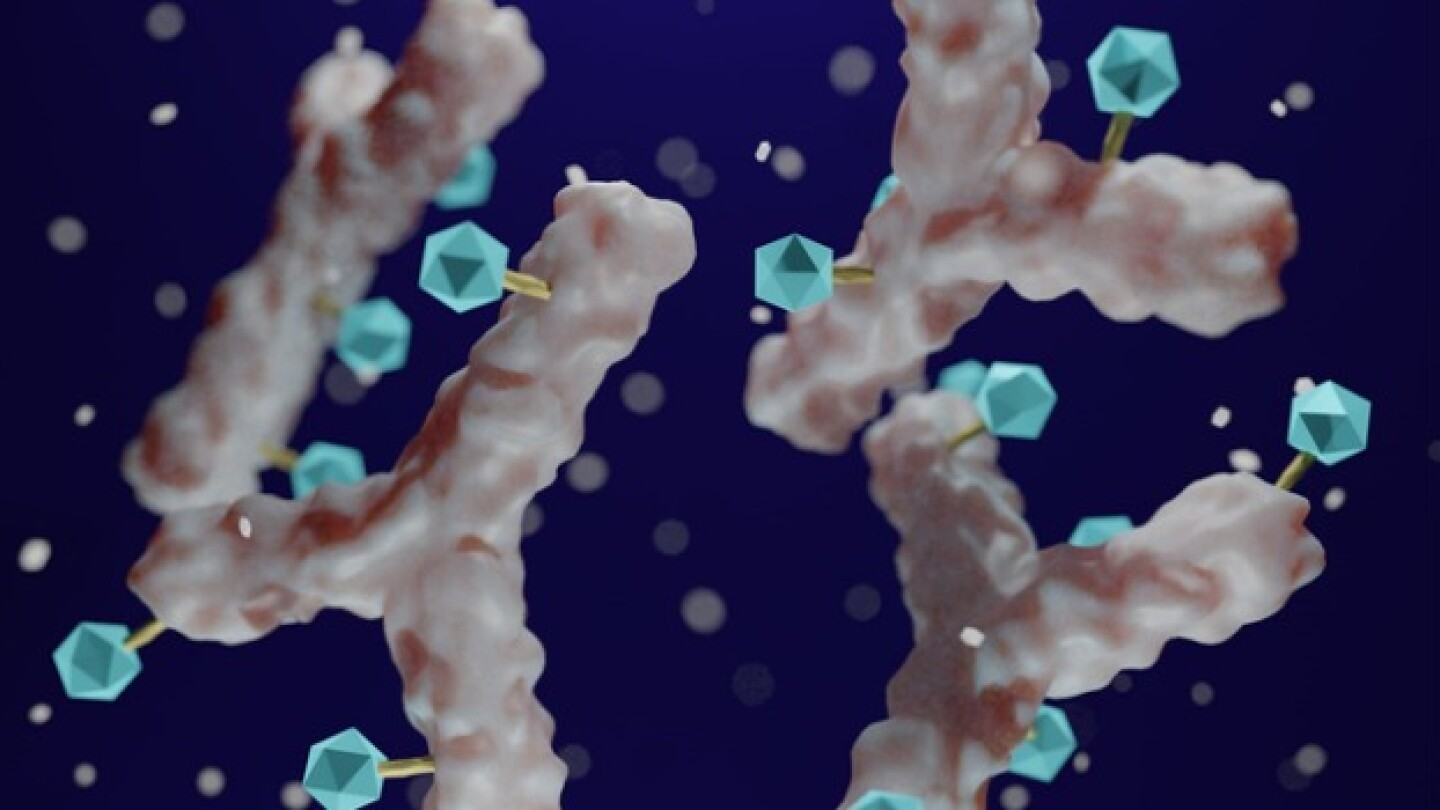

While Merck lost out to Pfizer earlier this year in snapping up Seagen, this week the company closed a deal worth a potential $22 billion with Daiichi Sankyo—further evidence of the industry’s insatiable appetite for ADC technology.

Despite increasing antitrust scrutiny across the biopharma industry, the European Commission on Thursday said it found no competitive issues with Pfizer’s buyout of the antibody-drug conjugate company.

Sail Biomedicines combines Laronde’s circular eRNA platform with Senda’s nanoparticle delivery technology in the pursuit of a new class of programmable medicines across therapeutic areas.

The Danish pharma announced Monday that it is buying a Phase III hypertension candidate from Singapore-based KBP Biosciences. It is Novo Nordisk’s third high-value purchase in as many months.

The first two weeks of October saw BMS’s $4.8 billion buyout of Mirati, Lilly’s $1.4 billion purchase of Point, Kyowa Kirin’s $387 million acquisition of Orchard and AbbVie’s $110 million Mitokinin deal.

An increase in funding share and available lab space helps to keep the Bay State’s biotech and pharma sectors strong.