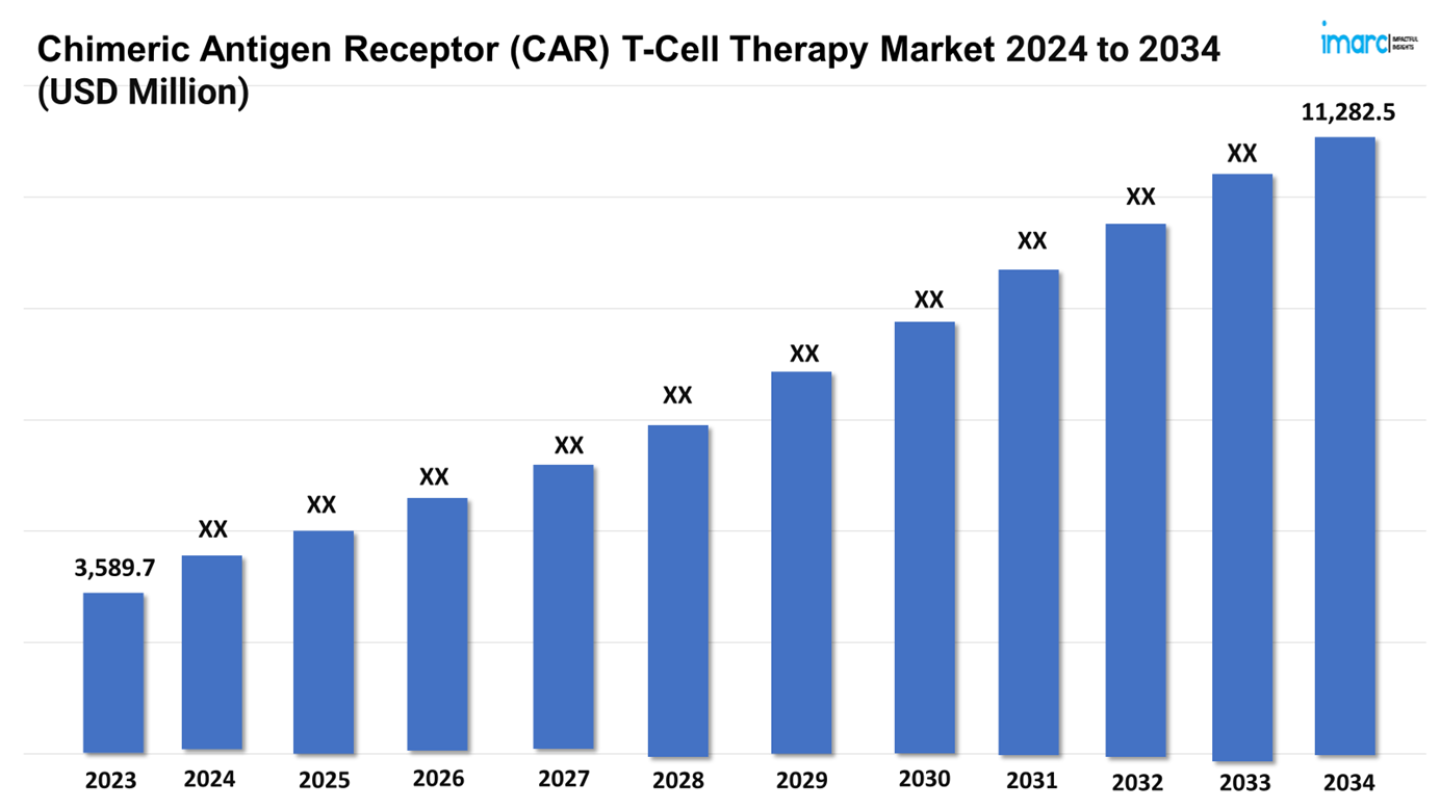

The CAR T-Cell Therapy Market Size reached a value of USD 3,589.7 Million in 2023. Looking forward, IMARC Group expects the 7MM to reach USD 11,282.5 Million by 2034, exhibiting a growth rate (CAGR) of 10.85% during 2024-2034.

The market is driven by the rising occurrence of cancer, which has surged the need for advanced therapies. Moreover, regulatory approvals of new CAR T-cell therapies and growing investments in biotechnology research are fostering rapid market development.

Advancements in CAR T-Cell Technology: Driving the Chimeric Antigen Receptor (CAR) T-Cell Therapy Market

One of the major trends that is revolutionizing CAR T-cell therapy is the advancements in chimeric antigen receptor T-cell technology that transformed cancer treatment by improving the specificity, efficacy, as well as safety of immunotherapy treatments. CAR T-cell therapy involves engineering patients' T-cells to express receptors specific to cancer cells, enabling targeted attack and destruction. One of the most significant advancements is the development of next-generation CAR constructs. These innovative designs incorporate safety switches that allow for CAR T-cells' controlled activation and deactivation, minimizing potential toxicities. For example, the introduction of suicide genes or “on/off” switches can halt CAR T-cell activity if severe side effects occur, improving patient safety. Another notable advancement is the creation of dual-targeting CAR T-cells, which address the challenge of tumor heterogeneity. Traditional CAR T-cells target a single antigen, but tumors often exhibit multiple antigens, leading to resistance and relapse. Dual-targeting CAR T-cells are engineered to recognize and attack two different antigens simultaneously, thereby reducing the likelihood of tumor escape. An example of this is the development of CAR T-cells targeting both CD19 and CD22 antigens in B-cell malignancies, which has shown promising results in preclinical and clinical trials.

Request a PDF Sample Report: https://www.imarcgroup.com/chimeric-antigen-receptor-t-cell-therapy-market/requestsample

Moreover, integrating gene-editing technologies like CRISPR/Cas9 has enabled precise modifications in CAR T-cells to enhance their function and persistence. For instance, gene-edited CAR T-cells can be designed to resist immunosuppressive tumor microenvironments, improving their durability and effectiveness in solid tumors. Additionally, efforts are being made to create “universal” CAR T-cells derived from healthy donors, which can be administered to multiple patients, overcoming the limitations of autologous CAR T-cell therapies. The successful application of CRISPR technology to knock out the T-cell receptor (TCR) and beta-2 microglobulin (B2M) genes has led to the creation of these off-the-shelf CAR T-cells, potentially making CAR T-cell therapy more accessible and cost-effective. These technological advancements are paving the way for broader and more effective applications of CAR T-cell therapy in oncology and beyond.

Regulatory Approvals and Expanding Indications: Contributing to Market Expansion

Regulatory approvals and expanding indications are pivotal drivers in the Chimeric Antigen Receptor (CAR) T-cell therapy market, facilitating broader adoption and application of these therapies. Regulatory bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have been instrumental in this growth. For instance, the FDA's approval of Kymriah (tisagenlecleucel) and Yescarta (axicabtagene ciloleucel) marked significant milestones in the CAR T-cell therapy landscape. Kymriah was the first CAR T-cell therapy approved for treating pediatric and young adult patients with refractory B-cell acute lymphoblastic leukemia (ALL). Similarly, Yescarta was approved for adult patients with relapsed or refractory large B-cell lymphoma. These approvals not only validated the clinical efficacy and safety of CAR T-cell therapies but also set a precedent for further regulatory endorsements.

The scope of CAR T-cell therapy is continually expanding beyond hematologic malignancies to include a broader range of indications, including solid tumors and other disease areas. For example, recent advancements have led to the development of CAR T-cell therapies targeting the HER2 antigen in solid tumors such as breast and gastric cancers. This expansion is fueled by ongoing clinical trials demonstrating promising efficacy in these traditionally challenging areas. Additionally, CAR T-cell therapies are being explored for non-cancerous conditions, such as autoimmune diseases, where their ability to specifically target and modulate immune responses holds significant therapeutic potential. Furthermore, the approval processes are becoming more streamlined, with accelerated pathways such as the FDA’s Breakthrough Therapy Designation and Priority Review programs, expediting the availability of these therapies to patients. These regulatory mechanisms are crucial for bringing innovative treatments to market more rapidly, addressing unmet medical needs, and fostering continued research and development. As CAR T-cell therapies gain approval for new indications, their market presence is expected to grow substantially, offering new hope to patients with a variety of challenging conditions.

Integration of Artificial Intelligence (AI) and Machine Learning (ML):

The integration of artificial intelligence (AI) and machine learning (ML) is transforming the chimeric antigen receptor (CAR) T-cell therapy market by enhancing various aspects of research, development, and clinical applications. AI and ML are being leveraged to optimize the identification of target antigens, streamline CAR T-cell design, and predict patient responses. For example, AI algorithms can analyze vast datasets to identify novel tumor-specific antigens, improving the precision and efficacy of CAR T-cell therapies. Additionally, ML models can predict the potential toxicity and efficacy of CAR constructs before clinical trials, thereby accelerating the development process and reducing costs. AI and ML are also enhancing personalized treatment approaches in CAR T-cell therapy. By integrating patient-specific data, including genetic, molecular, and clinical information, AI-driven platforms can tailor CAR T-cell therapies to individual patient profiles. This customization improves treatment outcomes and minimizes adverse effects. For instance, the use of AI in processing patient data has enabled the development of personalized CAR T-cell therapies that adapt to the unique tumor microenvironment of each patient. Companies like Novartis and Gilead are investing in AI and ML technologies to refine their CAR T-cell therapies, ensuring higher efficacy and safety.

Moreover, AI and ML are being utilized to improve the manufacturing processes of CAR T-cells. Automation and real-time monitoring, powered by AI, enhance the efficiency and consistency of CAR T-cell production. This not only increases the scalability of these therapies but also ensures higher quality and reliability. For example, AI-driven bioreactors can monitor and adjust conditions during CAR T-cell expansion, optimizing yield and functionality. Additionally, predictive maintenance powered by ML can minimize downtime and ensure uninterrupted production. The integration of AI and ML in CAR T-cell therapy is driving significant advancements, from discovery and development to manufacturing and clinical application, promising a new era of precision oncology.

Buy Full Report: https://www.imarcgroup.com/checkout?id=6383&method=587

Leading Companies in the Chimeric Antigen Receptor (CAR) T-Cell Therapy Market:

The market research report by IMARC encompasses a comprehensive analysis of the competitive landscape in the market. Across the global chimeric antigen receptor (CAR) T-cell therapy market, several leading companies are pioneering advancements and driving innovation in this transformative field. Some of the major players include Juno Therapeutics, 2seventy Bio, and Janssen Biotech. These companies are at the cutting edge of CAR T-cell therapy, continuously pushing the boundaries of what is possible in cancer treatment through innovation, collaboration, and research and development efforts.

Juno Therapeutics, a subsidiary of Bristol-Myers Squibb, has recently achieved significant milestones with its CAR T-cell therapy, Breyanzi (lisocabtagene maraleucel). The FDA approved Breyanzi for the treatment of adult patients with relapsed or refractory mantle cell lymphoma (MCL) who have received at least two prior lines of systemic therapy, including a Bruton tyrosine kinase inhibitor (BTKi). This approval is based on the efficacy demonstrated in the TRANSCEND-MCL trial, where Breyanzi showed an overall response rate (ORR) of 85.3%, with a complete response rate of 67.6% and a median duration of response of 13.3 months.

Moreover, 2seventy Bio, in collaboration with Bristol Myers Squibb, has recently made significant strides with its CAR T-cell therapy, Abecma (idecabtagene vicleucel). The FDA approved Abecma for the treatment of adults with relapsed or refractory multiple myeloma who have undergone at least two prior lines of therapy, including an immunomodulatory agent, a proteasome inhibitor, and an anti-CD38 monoclonal antibody. This approval is based on the results from the Phase III KarMMa-3 clinical trial, which demonstrated a median progression-free survival (PFS) of 13.3 months for patients treated with Abecma compared to 4.4 months for those on standard regimens.

Apart from this, Janssen Biotech, in collaboration with Legend Biotech, has recently made significant progress with its CAR T-cell therapy, Carvykti (ciltacabtagene autoleucel). The FDA approved Carvykti for the earlier treatment of adult patients with relapsed or refractory multiple myeloma who have received at least one prior line of therapy, including a proteasome inhibitor and an immunomodulatory agent. This approval is a major expansion of Carvykti's indications, originally approved for patients after four or more lines of therapy.

Regional Analysis:

The major markets for chimeric antigen receptor (CAR) T-cell therapy include the United States, Germany, France, the United Kingdom, Italy, Spain, and Japan. According to projections by IMARC, the United States has the largest patient pool for chimeric antigen receptor (CAR) T-cell therapy while also representing the biggest market for its treatment. This can be attributed to the increasing incidence of cancer and the growing need for effective treatments. Additionally, the substantial investment in research and development by both the public and private sectors is accelerating the pace of innovation and approval for new therapies.

Moreover, the FDA has granted approvals for several CAR T-cell therapies, such as Novartis' Kymriah, Gilead's Yescarta, and Bristol Myers Squibb's Breyanzi, for treating various types of lymphoma and leukemia. Technological advancements in genetic engineering and cell processing are enhancing the efficacy and safety profiles of these therapies. Additionally, there is a notable trend towards integrating artificial intelligence and machine learning to optimize patient selection and therapy customization, which promises to further improve outcomes.

Besides this, the expanding insurance coverage for CAR T-cell therapies and growing patient awareness are expected to bolster market growth. As the landscape evolves, the focus on developing next-generation CAR T-cell therapies with broader applications and reduced side effects is anticipated to drive the future of the market in the United States.

Key information covered in the report.

Base Year: 2023

Historical Period: 2018-2023

Market Forecast: 2024-2034

Countries Covered

This report offers a comprehensive analysis of current CAR T-cell therapy marketed drugs and late-stage pipeline drugs.

In-Market Drugs

IMARC Group Offer Other Reports:

Smoking Cessation Market: The 7 major smoking cessation market is expected to exhibit a CAGR of 7.32% during the forecast period from 2024 to 2034.

Abdominal Aortic Aneurysm Market: The 7 major abdominal aortic aneurysm market reached a value of US$ 1,692.4 Million in 2023, and projected the 7MM to reach US$ 3,235.2 Million by 2034, exhibiting a growth rate (CAGR) of 6.07% during the forecast period from 2024 to 2034.

Acute Lymphoblastic Leukemia Market: The 7 major acute lymphoblastic leukemia market reached a value of US$ 2,145.2 Million in 2023, and projected the 7MM to reach US$ 4,003.7 Million by 2034, exhibiting a growth rate (CAGR) of 5.84% during the forecast period from 2024 to 2034.

Age-Related Macular Degeneration Market: The 7 major age-related macular degeneration market reached a value of US$ 10.1 Billion in 2023, and projected the 7MM to reach US$ 12.0 Billion by 2034, exhibiting a growth rate (CAGR) of 1.54% during the forecast period from 2024 to 2034.

Alopecia Areata Market: The 7 major alopecia areata market is expected to exhibit a CAGR of 6.05% during the forecast period from 2024 to 2034.

Amyotrophic Lateral Sclerosis (ALS) Market: The 7 major Amyotrophic Lateral Sclerosis (ALS) market reached a value of US$ 494.1 Million in 2023, and projected the 7MM to reach US$ 715.4 Million by 2034, exhibiting a growth rate (CAGR) of 3.4% during the forecast period from 2024 to 2034.

Anti-Hypertension Market: The 7 major anti-hypertension market is expected to exhibit a CAGR of 2.13% during the forecast period from 2024 to 2034.

Chemotherapy-Induced Anemia Market: The 7 major chemotherapy-induced anemia market is expected to exhibit a CAGR of 7.2% during the forecast period from 2024 to 2034.

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Phone Number: - +1 631 791 1145, +91-120-433-0800

The market is driven by the rising occurrence of cancer, which has surged the need for advanced therapies. Moreover, regulatory approvals of new CAR T-cell therapies and growing investments in biotechnology research are fostering rapid market development.

Advancements in CAR T-Cell Technology: Driving the Chimeric Antigen Receptor (CAR) T-Cell Therapy Market

One of the major trends that is revolutionizing CAR T-cell therapy is the advancements in chimeric antigen receptor T-cell technology that transformed cancer treatment by improving the specificity, efficacy, as well as safety of immunotherapy treatments. CAR T-cell therapy involves engineering patients' T-cells to express receptors specific to cancer cells, enabling targeted attack and destruction. One of the most significant advancements is the development of next-generation CAR constructs. These innovative designs incorporate safety switches that allow for CAR T-cells' controlled activation and deactivation, minimizing potential toxicities. For example, the introduction of suicide genes or “on/off” switches can halt CAR T-cell activity if severe side effects occur, improving patient safety. Another notable advancement is the creation of dual-targeting CAR T-cells, which address the challenge of tumor heterogeneity. Traditional CAR T-cells target a single antigen, but tumors often exhibit multiple antigens, leading to resistance and relapse. Dual-targeting CAR T-cells are engineered to recognize and attack two different antigens simultaneously, thereby reducing the likelihood of tumor escape. An example of this is the development of CAR T-cells targeting both CD19 and CD22 antigens in B-cell malignancies, which has shown promising results in preclinical and clinical trials.

Request a PDF Sample Report: https://www.imarcgroup.com/chimeric-antigen-receptor-t-cell-therapy-market/requestsample

Moreover, integrating gene-editing technologies like CRISPR/Cas9 has enabled precise modifications in CAR T-cells to enhance their function and persistence. For instance, gene-edited CAR T-cells can be designed to resist immunosuppressive tumor microenvironments, improving their durability and effectiveness in solid tumors. Additionally, efforts are being made to create “universal” CAR T-cells derived from healthy donors, which can be administered to multiple patients, overcoming the limitations of autologous CAR T-cell therapies. The successful application of CRISPR technology to knock out the T-cell receptor (TCR) and beta-2 microglobulin (B2M) genes has led to the creation of these off-the-shelf CAR T-cells, potentially making CAR T-cell therapy more accessible and cost-effective. These technological advancements are paving the way for broader and more effective applications of CAR T-cell therapy in oncology and beyond.

Regulatory Approvals and Expanding Indications: Contributing to Market Expansion

Regulatory approvals and expanding indications are pivotal drivers in the Chimeric Antigen Receptor (CAR) T-cell therapy market, facilitating broader adoption and application of these therapies. Regulatory bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have been instrumental in this growth. For instance, the FDA's approval of Kymriah (tisagenlecleucel) and Yescarta (axicabtagene ciloleucel) marked significant milestones in the CAR T-cell therapy landscape. Kymriah was the first CAR T-cell therapy approved for treating pediatric and young adult patients with refractory B-cell acute lymphoblastic leukemia (ALL). Similarly, Yescarta was approved for adult patients with relapsed or refractory large B-cell lymphoma. These approvals not only validated the clinical efficacy and safety of CAR T-cell therapies but also set a precedent for further regulatory endorsements.

The scope of CAR T-cell therapy is continually expanding beyond hematologic malignancies to include a broader range of indications, including solid tumors and other disease areas. For example, recent advancements have led to the development of CAR T-cell therapies targeting the HER2 antigen in solid tumors such as breast and gastric cancers. This expansion is fueled by ongoing clinical trials demonstrating promising efficacy in these traditionally challenging areas. Additionally, CAR T-cell therapies are being explored for non-cancerous conditions, such as autoimmune diseases, where their ability to specifically target and modulate immune responses holds significant therapeutic potential. Furthermore, the approval processes are becoming more streamlined, with accelerated pathways such as the FDA’s Breakthrough Therapy Designation and Priority Review programs, expediting the availability of these therapies to patients. These regulatory mechanisms are crucial for bringing innovative treatments to market more rapidly, addressing unmet medical needs, and fostering continued research and development. As CAR T-cell therapies gain approval for new indications, their market presence is expected to grow substantially, offering new hope to patients with a variety of challenging conditions.

Integration of Artificial Intelligence (AI) and Machine Learning (ML):

The integration of artificial intelligence (AI) and machine learning (ML) is transforming the chimeric antigen receptor (CAR) T-cell therapy market by enhancing various aspects of research, development, and clinical applications. AI and ML are being leveraged to optimize the identification of target antigens, streamline CAR T-cell design, and predict patient responses. For example, AI algorithms can analyze vast datasets to identify novel tumor-specific antigens, improving the precision and efficacy of CAR T-cell therapies. Additionally, ML models can predict the potential toxicity and efficacy of CAR constructs before clinical trials, thereby accelerating the development process and reducing costs. AI and ML are also enhancing personalized treatment approaches in CAR T-cell therapy. By integrating patient-specific data, including genetic, molecular, and clinical information, AI-driven platforms can tailor CAR T-cell therapies to individual patient profiles. This customization improves treatment outcomes and minimizes adverse effects. For instance, the use of AI in processing patient data has enabled the development of personalized CAR T-cell therapies that adapt to the unique tumor microenvironment of each patient. Companies like Novartis and Gilead are investing in AI and ML technologies to refine their CAR T-cell therapies, ensuring higher efficacy and safety.

Moreover, AI and ML are being utilized to improve the manufacturing processes of CAR T-cells. Automation and real-time monitoring, powered by AI, enhance the efficiency and consistency of CAR T-cell production. This not only increases the scalability of these therapies but also ensures higher quality and reliability. For example, AI-driven bioreactors can monitor and adjust conditions during CAR T-cell expansion, optimizing yield and functionality. Additionally, predictive maintenance powered by ML can minimize downtime and ensure uninterrupted production. The integration of AI and ML in CAR T-cell therapy is driving significant advancements, from discovery and development to manufacturing and clinical application, promising a new era of precision oncology.

Buy Full Report: https://www.imarcgroup.com/checkout?id=6383&method=587

Leading Companies in the Chimeric Antigen Receptor (CAR) T-Cell Therapy Market:

The market research report by IMARC encompasses a comprehensive analysis of the competitive landscape in the market. Across the global chimeric antigen receptor (CAR) T-cell therapy market, several leading companies are pioneering advancements and driving innovation in this transformative field. Some of the major players include Juno Therapeutics, 2seventy Bio, and Janssen Biotech. These companies are at the cutting edge of CAR T-cell therapy, continuously pushing the boundaries of what is possible in cancer treatment through innovation, collaboration, and research and development efforts.

Juno Therapeutics, a subsidiary of Bristol-Myers Squibb, has recently achieved significant milestones with its CAR T-cell therapy, Breyanzi (lisocabtagene maraleucel). The FDA approved Breyanzi for the treatment of adult patients with relapsed or refractory mantle cell lymphoma (MCL) who have received at least two prior lines of systemic therapy, including a Bruton tyrosine kinase inhibitor (BTKi). This approval is based on the efficacy demonstrated in the TRANSCEND-MCL trial, where Breyanzi showed an overall response rate (ORR) of 85.3%, with a complete response rate of 67.6% and a median duration of response of 13.3 months.

Moreover, 2seventy Bio, in collaboration with Bristol Myers Squibb, has recently made significant strides with its CAR T-cell therapy, Abecma (idecabtagene vicleucel). The FDA approved Abecma for the treatment of adults with relapsed or refractory multiple myeloma who have undergone at least two prior lines of therapy, including an immunomodulatory agent, a proteasome inhibitor, and an anti-CD38 monoclonal antibody. This approval is based on the results from the Phase III KarMMa-3 clinical trial, which demonstrated a median progression-free survival (PFS) of 13.3 months for patients treated with Abecma compared to 4.4 months for those on standard regimens.

Apart from this, Janssen Biotech, in collaboration with Legend Biotech, has recently made significant progress with its CAR T-cell therapy, Carvykti (ciltacabtagene autoleucel). The FDA approved Carvykti for the earlier treatment of adult patients with relapsed or refractory multiple myeloma who have received at least one prior line of therapy, including a proteasome inhibitor and an immunomodulatory agent. This approval is a major expansion of Carvykti's indications, originally approved for patients after four or more lines of therapy.

Regional Analysis:

The major markets for chimeric antigen receptor (CAR) T-cell therapy include the United States, Germany, France, the United Kingdom, Italy, Spain, and Japan. According to projections by IMARC, the United States has the largest patient pool for chimeric antigen receptor (CAR) T-cell therapy while also representing the biggest market for its treatment. This can be attributed to the increasing incidence of cancer and the growing need for effective treatments. Additionally, the substantial investment in research and development by both the public and private sectors is accelerating the pace of innovation and approval for new therapies.

Moreover, the FDA has granted approvals for several CAR T-cell therapies, such as Novartis' Kymriah, Gilead's Yescarta, and Bristol Myers Squibb's Breyanzi, for treating various types of lymphoma and leukemia. Technological advancements in genetic engineering and cell processing are enhancing the efficacy and safety profiles of these therapies. Additionally, there is a notable trend towards integrating artificial intelligence and machine learning to optimize patient selection and therapy customization, which promises to further improve outcomes.

Besides this, the expanding insurance coverage for CAR T-cell therapies and growing patient awareness are expected to bolster market growth. As the landscape evolves, the focus on developing next-generation CAR T-cell therapies with broader applications and reduced side effects is anticipated to drive the future of the market in the United States.

Key information covered in the report.

Base Year: 2023

Historical Period: 2018-2023

Market Forecast: 2024-2034

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the CAR T-cell therapy market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the CAR T-cell therapy market

- Reimbursement scenario in the market

- In-market and pipeline drugs

This report offers a comprehensive analysis of current CAR T-cell therapy marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

IMARC Group Offer Other Reports:

Smoking Cessation Market: The 7 major smoking cessation market is expected to exhibit a CAGR of 7.32% during the forecast period from 2024 to 2034.

Abdominal Aortic Aneurysm Market: The 7 major abdominal aortic aneurysm market reached a value of US$ 1,692.4 Million in 2023, and projected the 7MM to reach US$ 3,235.2 Million by 2034, exhibiting a growth rate (CAGR) of 6.07% during the forecast period from 2024 to 2034.

Acute Lymphoblastic Leukemia Market: The 7 major acute lymphoblastic leukemia market reached a value of US$ 2,145.2 Million in 2023, and projected the 7MM to reach US$ 4,003.7 Million by 2034, exhibiting a growth rate (CAGR) of 5.84% during the forecast period from 2024 to 2034.

Age-Related Macular Degeneration Market: The 7 major age-related macular degeneration market reached a value of US$ 10.1 Billion in 2023, and projected the 7MM to reach US$ 12.0 Billion by 2034, exhibiting a growth rate (CAGR) of 1.54% during the forecast period from 2024 to 2034.

Alopecia Areata Market: The 7 major alopecia areata market is expected to exhibit a CAGR of 6.05% during the forecast period from 2024 to 2034.

Amyotrophic Lateral Sclerosis (ALS) Market: The 7 major Amyotrophic Lateral Sclerosis (ALS) market reached a value of US$ 494.1 Million in 2023, and projected the 7MM to reach US$ 715.4 Million by 2034, exhibiting a growth rate (CAGR) of 3.4% during the forecast period from 2024 to 2034.

Anti-Hypertension Market: The 7 major anti-hypertension market is expected to exhibit a CAGR of 2.13% during the forecast period from 2024 to 2034.

Chemotherapy-Induced Anemia Market: The 7 major chemotherapy-induced anemia market is expected to exhibit a CAGR of 7.2% during the forecast period from 2024 to 2034.

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Phone Number: - +1 631 791 1145, +91-120-433-0800