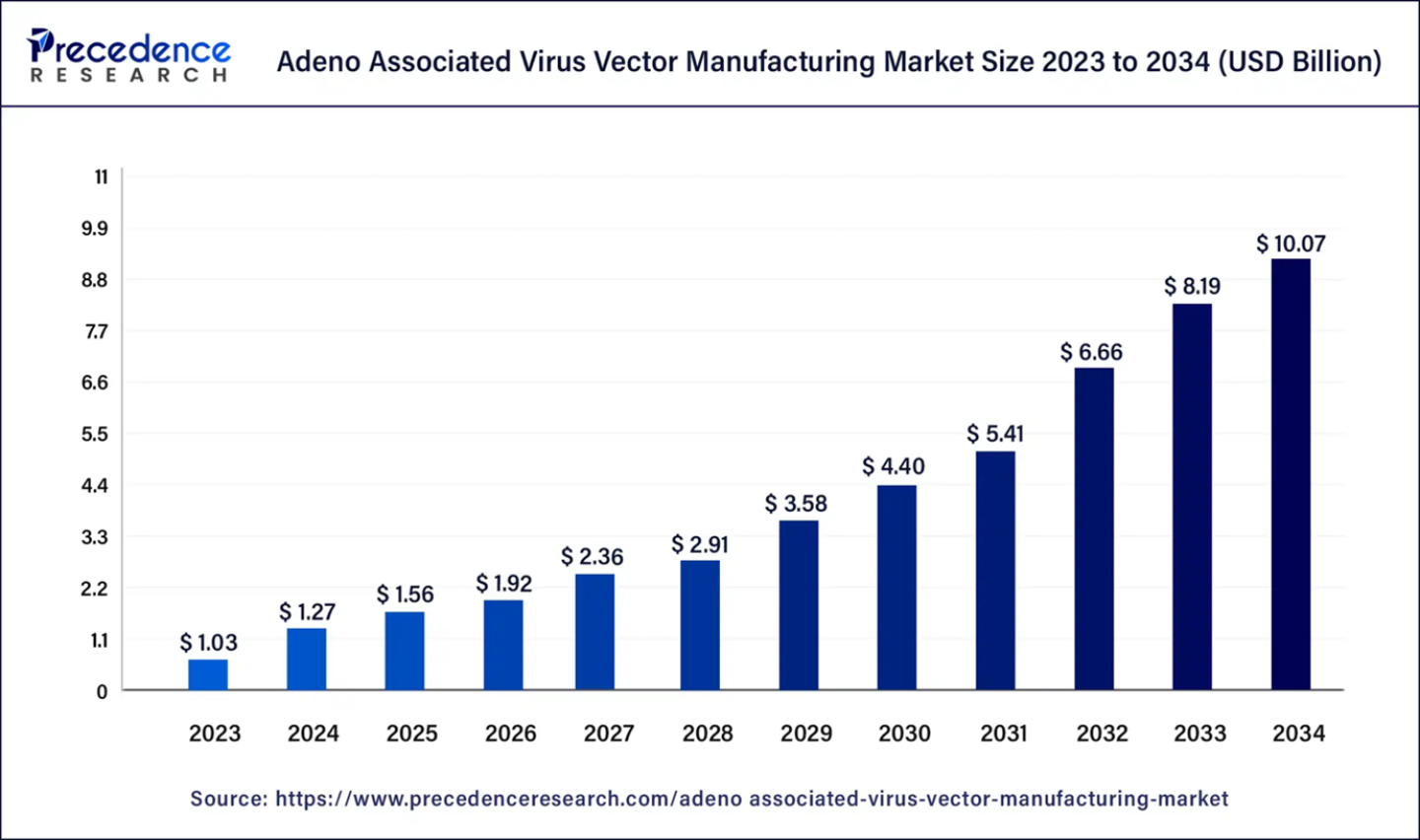

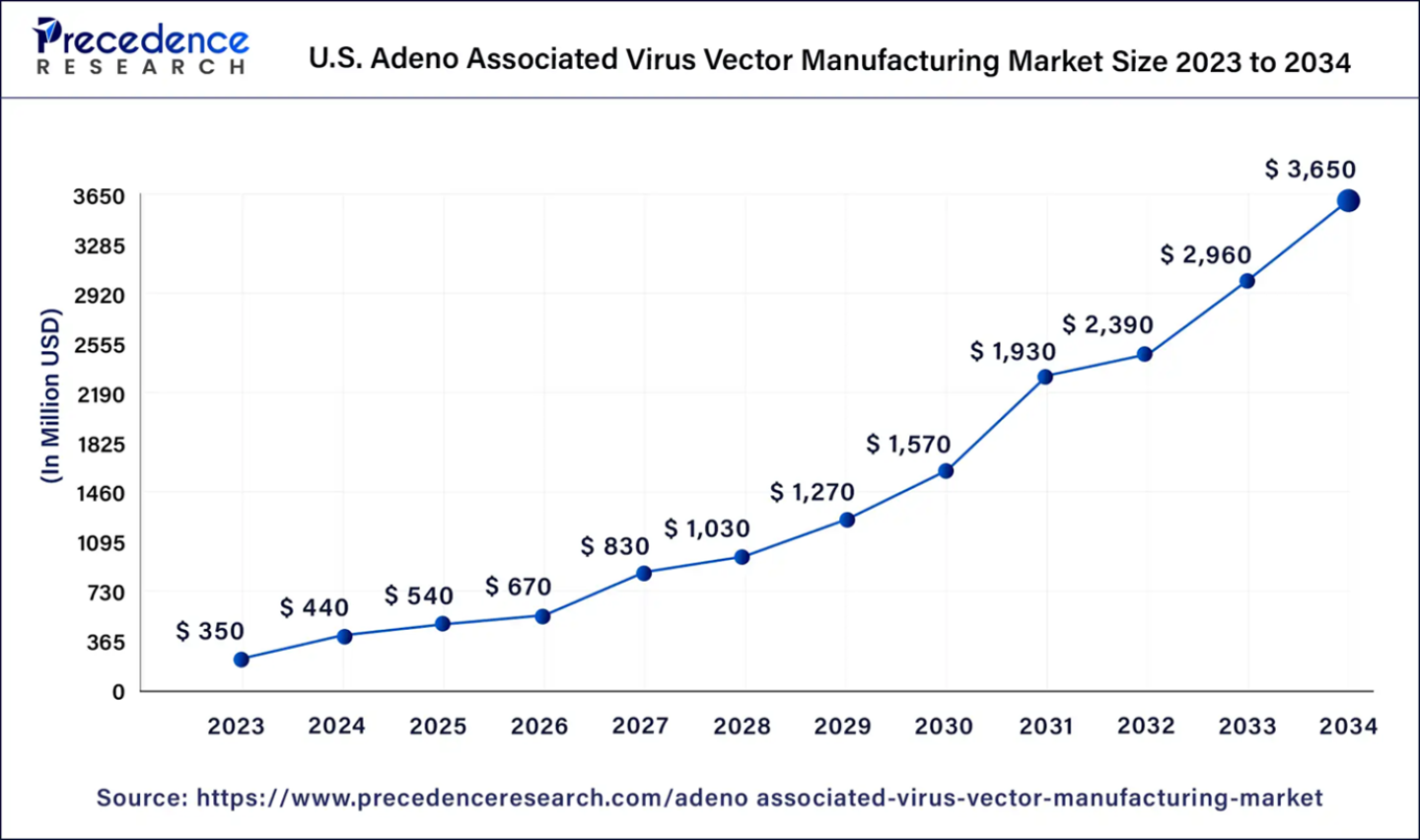

The global adeno associated virus vector manufacturing market size was evaluated at US$ 1.03 billion in 2023 and is expected to attain around US$ 10.07 billion by 2034, growing at a CAGR of 23% from 2024 to 2034. North America adeno associated virus vector manufacturing market has accounted 49.13% of market share in 2023. The U.S. adeno associated virus vector manufacturing market size is expected to reach around USD 50.22 million by 2034, growing at a CAGR of 17.8% from 2024 to 2034.

Adeno-associated viral (AAV) vectors, known for their replication-defective, single-stranded DNA structure and reliance on a helper adenovirus for replication, are pivotal in gene therapy for genetic diseases and cancer. These vectors can integrate into a specific site on human chromosome 19, establishing latency in the absence of a helper virus.

AAV vectors offer long-term gene expression, exceptional safety, and the unique capability to introduce genes into non-dividing cells, such as neurons. These attributes are driving the robust expansion of the adeno-associated virus vector manufacturing market, as demand surges for advanced and reliable gene therapy solutions.

FREE sample includes data points, ranging from trend analyses to estimates and forecasts@ https://www.precedenceresearch.com/sample/2865

Market Overview

The adeno-associated virus (AAV) vector manufacturing market is experiencing rapid growth, driven by the vectors' ability to carry up to 5 kb of exogenous DNA and their utilization in gene therapy. AAV vectors, constructed with transgenes that require their own promoters, can integrate viral genomes into host chromosomes, although randomly in current iterations. Their simple genomic structure, AAV vector systems necessitate components that supply capsid proteins, transgene-containing vectors, and helper viruses. These vectors are predominantly developed for gene transfer and therapy in clinical settings due to their nonpathogenic nature, broad host range, and tissue tropism. A key advantage is their ability to infect non-dividing cells and potential for targeted integration, making them highly attractive for advanced therapeutic applications.

· In April 2023, Ginkgo Bioworks bolstered its end-to-end R&D capabilities in gene therapy through the acquisition of StrideBio's AAV capsid discovery and engineering platform assets.

Key Insights

· North America generated largest market share and is anticipated to sustain its dominance during the estimated period.

· Asia-Pacific is considered the fastest-growing region in the forecast period.

· By Scale of Operations, the commercial segment had the largest share in the forecast period.

· By Method, the in vivo segment is predicted to record maximum growth throughout the estimated period.

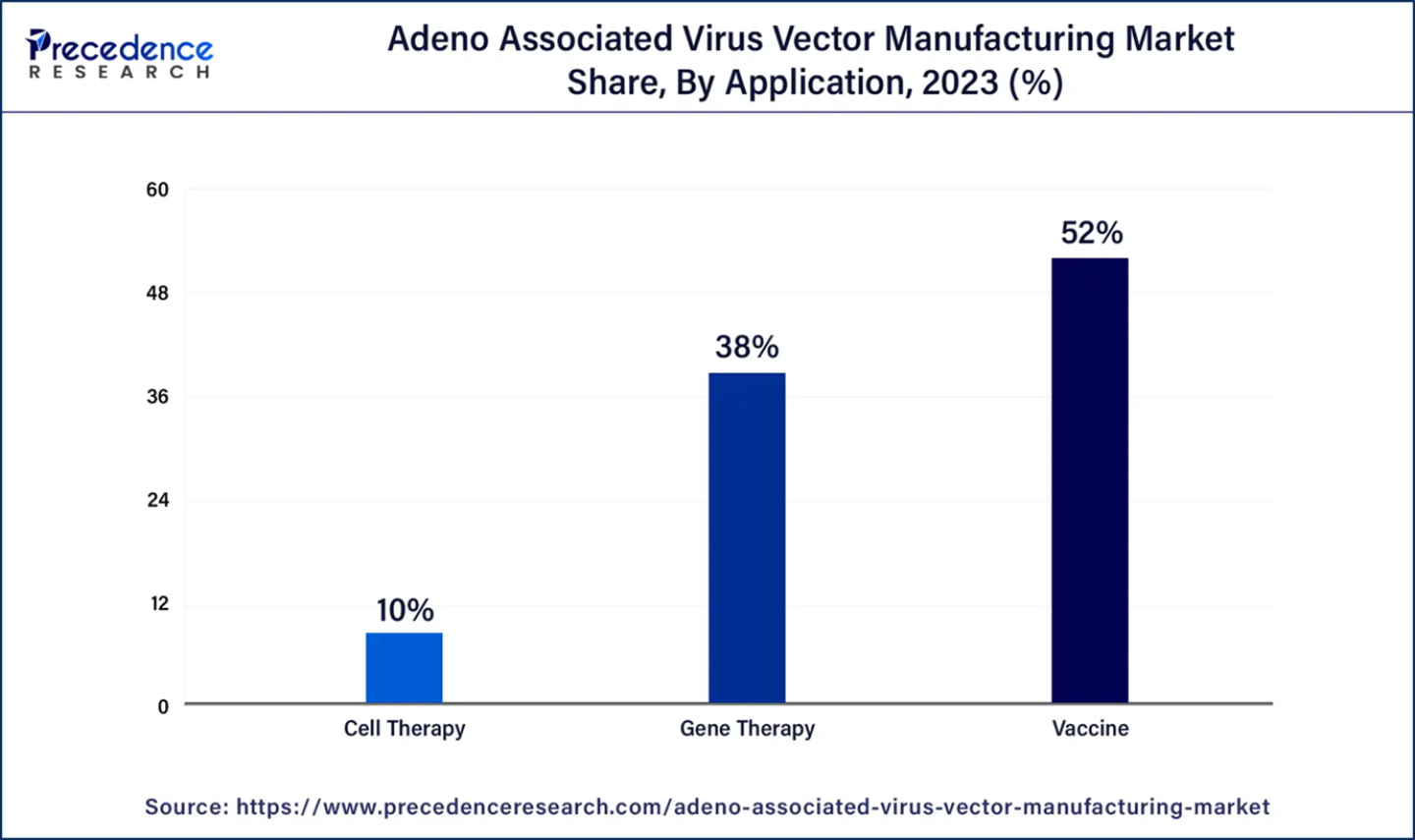

· By Application, the vaccine segment contributed largest market share and is dominating with the highest CAGR during the projected period.

· By Therapeutic Area, the neurological disorder segment anticipated in dominating the adeno associated virus vector manufacturing market worldwide.

Get Full Access of This Report@ https://www.precedenceresearch.com/checkout/2865

Why does North America capture the largest market share?

During the projection period, North America captured the largest market share, driven by substantial investments and robust infrastructure. The Canadian government has committed over $2.2 billion to 38 projects within the biomanufacturing, vaccine, and therapeutics ecosystem, enhancing domestic pandemic response capabilities and fostering life science innovation. As a global life sciences hub, Canada attracts leading biosciences, pharmaceutical, and medical technology companies, bolstered by a strong R&D environment, highly skilled professionals, premier academic institutions, extensive research networks, and collaborative opportunities in research and skills development. Home to the world's top pharmaceutical companies, Canada offers a responsive and efficient regulatory environment conducive to pharmaceutical operations. Concurrently, the United States government is expanding training and education opportunities in biotechnology and biomanufacturing, further reinforcing the region's leadership in the sector.

· In May 2024, Andelyn Biosciences was selected as the viral vector manufacturing partner for the California Institute for Regenerative Medicine (CIRM) Accelerating Medicines Partnership (AMP) Bespoke Gene Therapy Consortium (BGTC).

Why is the Asia-Pacific region anticipated to be the fastest-growing market?

The Asia-Pacific region is anticipated to be the fastest-growing market for Adeno-associated virus (AAV) vector manufacturing, driven by escalating biotech investments fueled by increased funding, precision medicine advancements, and technological progress. The region's continuous growth and innovation promise further exciting developments in the biotech industry. Precision medicine is a significant growth driver, with advancements in genomics, proteomics, and related fields enabling the development of more targeted therapies, improving patient outcomes. Companies such as Japan's Astellas and South Korea's Celltrion are at the forefront of this field, highlighting the region's burgeoning interest and leadership in precision medicine.

We value your investment, get customization@ https://www.precedenceresearch.com/customization/2865

Market Scope

Market Dynamics

Report Highlights

By Scale of Operations

The commercial segment is projected to dominate the global Adeno-associated virus (AAV) vector manufacturing market during the forecast period. AAV vectors have emerged as a promising tool for gene therapy, with significant potential to treat a wide array of genetic disorders. This versatile viral vector technology can be engineered for highly specific functionality in gene therapy applications, making it an attractive option for large-scale commercial operations focused on developing advanced therapeutic solutions. The increasing adoption of AAV vectors in commercial gene therapy underscores their growing importance in the biotechnology and pharmaceutical industries.

The clinical segment is the fastest-growing segment in the global Adeno-associated virus (AAV) vector manufacturing market. AAV has become a pivotal delivery tool in clinical gene therapy due to its minimal pathogenicity and ability to establish long-term gene expression across various tissues. AAV vectors are the preferred choice for clinical trials and FDA-approved applications, attributed to their broad tissue tropism, favorable safety profile, and versatile manufacturing processes. AAV is non-pathogenic, rarely integrates into the host genome, and sustains long-term transgene expression. Vectors based on certain AAV serotypes are inherently efficient in cellular entry and transgene expression, further enhancing transduction efficacy and solidifying their role in advanced clinical gene therapy applications.

By Method

The in vivo segment dominates the Adeno-associated virus (AAV) vector manufacturing market and is expected to sustain its growth during the forecast period. AAV vectors are the most widely used delivery system for in vivo gene therapy, demonstrating significant clinical benefits for patients with monogenetic disorders. Leveraging natural AAV isolates, these vectors have achieved high transduction efficiency, safety, and extended stable gene expression, making them ideal for both in vitro and in vivo applications. Recent clinical trials have further underscored the full potential of AAVs in human gene therapy, solidifying their prominence in the market.

By Application

The vaccines segment holds the largest share in the Adeno-associated virus (AAV) vector manufacturing market. Propagation of AAV in tissue culture necessitates the assistance of helper viruses, traditionally adenovirus (AdV) and herpes virus (HSV). The AAV vector, a recombinant variant of the wild-type AAV virus, replaces its native coding and non-coding regions with the gene of interest while retaining the lateral ITR, the only cis-acting element required for AAV DNA replication and encapsidation. These modifications render recombinant adeno-associated viruses (rAAV) replication-defective, enabling them to infect cells and deliver DNA to the nucleus efficiently. This application in vaccine development underscores the pivotal role of AAV vectors in advancing innovative and effective vaccine solutions.

Gene therapy is the fastest-growing segment in the Adeno-associated virus (AAV) vector manufacturing market during the projected period. AAV is poised to become the vector of choice for most gene therapy applications due to its demonstrated safety and tolerability in virtually every clinical setting. The field is beginning to explore localized delivery of AAV for gene therapy, leveraging the virus's stability and broad tropism for various cell and tissue types. There is an AAV variant option for nearly every tissue type, with ongoing engineering and novel AAV discovery efforts expected to create specialized variants on demand. These advancements will undoubtedly result in new therapeutic strategies for numerous indications, further solidifying AAV's role in the gene therapy landscape.

By Therapeutic Area

The neurological disorders segment held the highest revenue share in the Adeno-associated virus (AAV) vector manufacturing market throughout the estimated period. Recent advancements in AAV technology have significantly aided the treatment of known therapeutic targets for neurological diseases. AAVs are characterized by their low immunogenicity, ability to penetrate the blood-brain barrier (BBB), selective neuronal tropism, stable transgene expression, and pleiotropic effects. These features make AAVs particularly effective for developing therapies targeting neurological disorders, driving substantial market growth in this therapeutic area.

The genetic disorders segment is poised for significant growth during the projection period, fueled by advancements in genetic understanding and therapeutic possibilities. With the discovery of DNA as the basis of genetic inheritance and disease, the potential for therapies targeting mutant or damaged genes has expanded greatly. Recent advancements in human genetics, including the ability to sequence complete genomes affordably and rapidly, have provided a wealth of nucleic acid sequence data. This has facilitated the identification of genes underlying specific diseases. Adeno-associated virus (AAV) has emerged as a leading gene therapy vehicle, originally identified as a contaminant in adenovirus preparations. AAV's structure, consisting of a protein shell protecting a small, single-stranded DNA genome, makes it highly promising for developing treatments for genetic disorders. These factors underscore the growing significance of AAV-based therapies in addressing genetic diseases, driving growth in this therapeutic area within the market.

Market Dynamics

Driver

Advancements in AAV Vector Production

Adeno-associated virus (AAV) has garnered significant attention in clinical-stage experimental therapies for its ability to efficiently deliver DNA to target cells. Engineered recombinant AAV particles, devoid of viral genes and carrying therapeutic DNA sequences, are recognized as one of the safest gene therapy strategies. The primary method for producing recombinant AAV (rAAV) involves transfecting HEK293 cells with plasmids encoding the gene of interest, AAV rep/cap genes, and helper genes from adenovirus or herpes viruses. Initially optimized in adherent cells using roller bottles or cell stacks, production rates of approximately 10^5 genome copies (GC)/cell, translating to 10^14 GC/L, are now achievable in suspension-adapted HEK293 cells. These advancements are driving significant growth in the Adeno-associated virus vector manufacturing market, enhancing production efficiency and expanding therapeutic application possibilities.

Restraint

Challenges in AAV Vector Manufacturing

The production of AAV viral vectors presents complex challenges, necessitating innovative approaches to meet stringent safety and efficacy requirements, clinical demands, and cost targets. Ensuring the stability of viral vectors throughout manufacturing, handling, and storage, while maintaining long-term efficacy, is critical yet challenging. Developing scalable and robust manufacturing processes for gene therapy products requires a combination of traditional methodologies and novel technologies. These challenges pose constraints on the growth of the Adeno-associated virus vector manufacturing market, underscoring the need for ongoing advancements in manufacturing technologies and processes.

Opportunity

Enhanced Therapeutic Potential

Significant technological advancements over decades have paved the way for treating and managing life-threatening diseases more effectively. Adeno-associated virus (AAV) has emerged as a leading gene delivery platform for its exceptional safety profile and efficient transduction across various tissues. Challenges in large-scale production and long-term storage of viral vectors, resulting in lower yields, moderate purity, and shorter shelf-life compared to recombinant protein therapeutics, present opportunities for innovation in the Adeno-associated virus vector manufacturing market. Addressing these challenges through improved production technologies and storage methods could unlock enhanced therapeutic potential and expand market opportunities for AAV-based gene therapies.

In July 2023, Alexion, a subsidiary of AstraZeneca Rare Disease, entered into an agreement with Pfizer to acquire a portfolio of preclinical rare disease gene therapies.

Related Reports

· Viral Vectors & Plasmid DNA Manufacturing Market: https://www.precedenceresearch.com/viral-vectors-and-plasmid-dna-manufacturing-market

· IVD Contract Manufacturing Market: https://www.precedenceresearch.com/ivd-contract-manufacturing-market

· Plasmid DNA Manufacturing Market: https://www.precedenceresearch.com/plasmid-dna-manufacturing-market

Recent Developments

· In August 2022, Merck became one of the pioneering Contract Development and Manufacturing Organizations (CDMOs) to introduce a comprehensive viral vector offering with the launch of its VirusExpress 293 Adeno-Associated Virus Production Platform.

· In January 2024, Charles River Laboratories launched Rep/Cap plasmids to streamline the manufacturing of Adeno-Associated Viral Vectors.

· In October 2023, NIIMBL initiated a Viral Vector Program aimed at enhancing patient access to AAV gene therapy.

· In May 2023, Forge initiated a gene therapy production partnership with Life Biosciences.

Who are the top Key Players operating in the Adeno Associated Virus Vector Manufacturing Market?

· Roche

· Audentes Therapeutics

· WuXi AppTec

· BioMarin Pharmaceutical

· Oxford BioMedica

· YPOSKESI

· Sarepta Therapeutics

· GenScript

· Pfizer

· Audentes Therapeutics

· LifeSpan BioSciences, Inc.

Market Segmentation

By Scale of Operations

· Clinical

· Preclinical

· Commercial

By Method

· In Vivo

· In Vitro

By Application

· Vaccine

· Cell Therapy

· Gene Therapy

By Therapeutic Area

· Genetic Disorders

· Infectious Diseases

· Neurological Disorders

· Hematological Diseases

· Ophthalmic Disorders

By Geography

· North America

· Europe

· Asia Pacific

· Latin America

· Middle East & Africa (MEA)

Get Full Access of this Report@ https://www.precedenceresearch.com/checkout/2865

USA : +1 650 460 3308 | IND : +91 87933 22019 | Europe : +44 2080772818

Email@ sales@precedenceresearch.com

Adeno-associated viral (AAV) vectors, known for their replication-defective, single-stranded DNA structure and reliance on a helper adenovirus for replication, are pivotal in gene therapy for genetic diseases and cancer. These vectors can integrate into a specific site on human chromosome 19, establishing latency in the absence of a helper virus.

AAV vectors offer long-term gene expression, exceptional safety, and the unique capability to introduce genes into non-dividing cells, such as neurons. These attributes are driving the robust expansion of the adeno-associated virus vector manufacturing market, as demand surges for advanced and reliable gene therapy solutions.

FREE sample includes data points, ranging from trend analyses to estimates and forecasts@ https://www.precedenceresearch.com/sample/2865

Market Overview

The adeno-associated virus (AAV) vector manufacturing market is experiencing rapid growth, driven by the vectors' ability to carry up to 5 kb of exogenous DNA and their utilization in gene therapy. AAV vectors, constructed with transgenes that require their own promoters, can integrate viral genomes into host chromosomes, although randomly in current iterations. Their simple genomic structure, AAV vector systems necessitate components that supply capsid proteins, transgene-containing vectors, and helper viruses. These vectors are predominantly developed for gene transfer and therapy in clinical settings due to their nonpathogenic nature, broad host range, and tissue tropism. A key advantage is their ability to infect non-dividing cells and potential for targeted integration, making them highly attractive for advanced therapeutic applications.

· In April 2023, Ginkgo Bioworks bolstered its end-to-end R&D capabilities in gene therapy through the acquisition of StrideBio's AAV capsid discovery and engineering platform assets.

Key Insights

· North America generated largest market share and is anticipated to sustain its dominance during the estimated period.

· Asia-Pacific is considered the fastest-growing region in the forecast period.

· By Scale of Operations, the commercial segment had the largest share in the forecast period.

· By Method, the in vivo segment is predicted to record maximum growth throughout the estimated period.

· By Application, the vaccine segment contributed largest market share and is dominating with the highest CAGR during the projected period.

· By Therapeutic Area, the neurological disorder segment anticipated in dominating the adeno associated virus vector manufacturing market worldwide.

Get Full Access of This Report@ https://www.precedenceresearch.com/checkout/2865

Why does North America capture the largest market share?

During the projection period, North America captured the largest market share, driven by substantial investments and robust infrastructure. The Canadian government has committed over $2.2 billion to 38 projects within the biomanufacturing, vaccine, and therapeutics ecosystem, enhancing domestic pandemic response capabilities and fostering life science innovation. As a global life sciences hub, Canada attracts leading biosciences, pharmaceutical, and medical technology companies, bolstered by a strong R&D environment, highly skilled professionals, premier academic institutions, extensive research networks, and collaborative opportunities in research and skills development. Home to the world's top pharmaceutical companies, Canada offers a responsive and efficient regulatory environment conducive to pharmaceutical operations. Concurrently, the United States government is expanding training and education opportunities in biotechnology and biomanufacturing, further reinforcing the region's leadership in the sector.

· In May 2024, Andelyn Biosciences was selected as the viral vector manufacturing partner for the California Institute for Regenerative Medicine (CIRM) Accelerating Medicines Partnership (AMP) Bespoke Gene Therapy Consortium (BGTC).

Why is the Asia-Pacific region anticipated to be the fastest-growing market?

The Asia-Pacific region is anticipated to be the fastest-growing market for Adeno-associated virus (AAV) vector manufacturing, driven by escalating biotech investments fueled by increased funding, precision medicine advancements, and technological progress. The region's continuous growth and innovation promise further exciting developments in the biotech industry. Precision medicine is a significant growth driver, with advancements in genomics, proteomics, and related fields enabling the development of more targeted therapies, improving patient outcomes. Companies such as Japan's Astellas and South Korea's Celltrion are at the forefront of this field, highlighting the region's burgeoning interest and leadership in precision medicine.

We value your investment, get customization@ https://www.precedenceresearch.com/customization/2865

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 1.27 Billion |

| Market Size by 2034 | USD 10.07 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 23% |

| Largest Market | North America |

| Fastest-Growing Market | Asia-Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Scale of Operations, By Method, By Application, and By Therapeutic Area |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Report Highlights

By Scale of Operations

The commercial segment is projected to dominate the global Adeno-associated virus (AAV) vector manufacturing market during the forecast period. AAV vectors have emerged as a promising tool for gene therapy, with significant potential to treat a wide array of genetic disorders. This versatile viral vector technology can be engineered for highly specific functionality in gene therapy applications, making it an attractive option for large-scale commercial operations focused on developing advanced therapeutic solutions. The increasing adoption of AAV vectors in commercial gene therapy underscores their growing importance in the biotechnology and pharmaceutical industries.

The clinical segment is the fastest-growing segment in the global Adeno-associated virus (AAV) vector manufacturing market. AAV has become a pivotal delivery tool in clinical gene therapy due to its minimal pathogenicity and ability to establish long-term gene expression across various tissues. AAV vectors are the preferred choice for clinical trials and FDA-approved applications, attributed to their broad tissue tropism, favorable safety profile, and versatile manufacturing processes. AAV is non-pathogenic, rarely integrates into the host genome, and sustains long-term transgene expression. Vectors based on certain AAV serotypes are inherently efficient in cellular entry and transgene expression, further enhancing transduction efficacy and solidifying their role in advanced clinical gene therapy applications.

By Method

The in vivo segment dominates the Adeno-associated virus (AAV) vector manufacturing market and is expected to sustain its growth during the forecast period. AAV vectors are the most widely used delivery system for in vivo gene therapy, demonstrating significant clinical benefits for patients with monogenetic disorders. Leveraging natural AAV isolates, these vectors have achieved high transduction efficiency, safety, and extended stable gene expression, making them ideal for both in vitro and in vivo applications. Recent clinical trials have further underscored the full potential of AAVs in human gene therapy, solidifying their prominence in the market.

By Application

The vaccines segment holds the largest share in the Adeno-associated virus (AAV) vector manufacturing market. Propagation of AAV in tissue culture necessitates the assistance of helper viruses, traditionally adenovirus (AdV) and herpes virus (HSV). The AAV vector, a recombinant variant of the wild-type AAV virus, replaces its native coding and non-coding regions with the gene of interest while retaining the lateral ITR, the only cis-acting element required for AAV DNA replication and encapsidation. These modifications render recombinant adeno-associated viruses (rAAV) replication-defective, enabling them to infect cells and deliver DNA to the nucleus efficiently. This application in vaccine development underscores the pivotal role of AAV vectors in advancing innovative and effective vaccine solutions.

Gene therapy is the fastest-growing segment in the Adeno-associated virus (AAV) vector manufacturing market during the projected period. AAV is poised to become the vector of choice for most gene therapy applications due to its demonstrated safety and tolerability in virtually every clinical setting. The field is beginning to explore localized delivery of AAV for gene therapy, leveraging the virus's stability and broad tropism for various cell and tissue types. There is an AAV variant option for nearly every tissue type, with ongoing engineering and novel AAV discovery efforts expected to create specialized variants on demand. These advancements will undoubtedly result in new therapeutic strategies for numerous indications, further solidifying AAV's role in the gene therapy landscape.

By Therapeutic Area

The neurological disorders segment held the highest revenue share in the Adeno-associated virus (AAV) vector manufacturing market throughout the estimated period. Recent advancements in AAV technology have significantly aided the treatment of known therapeutic targets for neurological diseases. AAVs are characterized by their low immunogenicity, ability to penetrate the blood-brain barrier (BBB), selective neuronal tropism, stable transgene expression, and pleiotropic effects. These features make AAVs particularly effective for developing therapies targeting neurological disorders, driving substantial market growth in this therapeutic area.

The genetic disorders segment is poised for significant growth during the projection period, fueled by advancements in genetic understanding and therapeutic possibilities. With the discovery of DNA as the basis of genetic inheritance and disease, the potential for therapies targeting mutant or damaged genes has expanded greatly. Recent advancements in human genetics, including the ability to sequence complete genomes affordably and rapidly, have provided a wealth of nucleic acid sequence data. This has facilitated the identification of genes underlying specific diseases. Adeno-associated virus (AAV) has emerged as a leading gene therapy vehicle, originally identified as a contaminant in adenovirus preparations. AAV's structure, consisting of a protein shell protecting a small, single-stranded DNA genome, makes it highly promising for developing treatments for genetic disorders. These factors underscore the growing significance of AAV-based therapies in addressing genetic diseases, driving growth in this therapeutic area within the market.

Market Dynamics

Driver

Advancements in AAV Vector Production

Adeno-associated virus (AAV) has garnered significant attention in clinical-stage experimental therapies for its ability to efficiently deliver DNA to target cells. Engineered recombinant AAV particles, devoid of viral genes and carrying therapeutic DNA sequences, are recognized as one of the safest gene therapy strategies. The primary method for producing recombinant AAV (rAAV) involves transfecting HEK293 cells with plasmids encoding the gene of interest, AAV rep/cap genes, and helper genes from adenovirus or herpes viruses. Initially optimized in adherent cells using roller bottles or cell stacks, production rates of approximately 10^5 genome copies (GC)/cell, translating to 10^14 GC/L, are now achievable in suspension-adapted HEK293 cells. These advancements are driving significant growth in the Adeno-associated virus vector manufacturing market, enhancing production efficiency and expanding therapeutic application possibilities.

Restraint

Challenges in AAV Vector Manufacturing

The production of AAV viral vectors presents complex challenges, necessitating innovative approaches to meet stringent safety and efficacy requirements, clinical demands, and cost targets. Ensuring the stability of viral vectors throughout manufacturing, handling, and storage, while maintaining long-term efficacy, is critical yet challenging. Developing scalable and robust manufacturing processes for gene therapy products requires a combination of traditional methodologies and novel technologies. These challenges pose constraints on the growth of the Adeno-associated virus vector manufacturing market, underscoring the need for ongoing advancements in manufacturing technologies and processes.

Opportunity

Enhanced Therapeutic Potential

Significant technological advancements over decades have paved the way for treating and managing life-threatening diseases more effectively. Adeno-associated virus (AAV) has emerged as a leading gene delivery platform for its exceptional safety profile and efficient transduction across various tissues. Challenges in large-scale production and long-term storage of viral vectors, resulting in lower yields, moderate purity, and shorter shelf-life compared to recombinant protein therapeutics, present opportunities for innovation in the Adeno-associated virus vector manufacturing market. Addressing these challenges through improved production technologies and storage methods could unlock enhanced therapeutic potential and expand market opportunities for AAV-based gene therapies.

In July 2023, Alexion, a subsidiary of AstraZeneca Rare Disease, entered into an agreement with Pfizer to acquire a portfolio of preclinical rare disease gene therapies.

Related Reports

· Viral Vectors & Plasmid DNA Manufacturing Market: https://www.precedenceresearch.com/viral-vectors-and-plasmid-dna-manufacturing-market

· IVD Contract Manufacturing Market: https://www.precedenceresearch.com/ivd-contract-manufacturing-market

· Plasmid DNA Manufacturing Market: https://www.precedenceresearch.com/plasmid-dna-manufacturing-market

Recent Developments

· In August 2022, Merck became one of the pioneering Contract Development and Manufacturing Organizations (CDMOs) to introduce a comprehensive viral vector offering with the launch of its VirusExpress 293 Adeno-Associated Virus Production Platform.

· In January 2024, Charles River Laboratories launched Rep/Cap plasmids to streamline the manufacturing of Adeno-Associated Viral Vectors.

· In October 2023, NIIMBL initiated a Viral Vector Program aimed at enhancing patient access to AAV gene therapy.

· In May 2023, Forge initiated a gene therapy production partnership with Life Biosciences.

Who are the top Key Players operating in the Adeno Associated Virus Vector Manufacturing Market?

· Roche

· Audentes Therapeutics

· WuXi AppTec

· BioMarin Pharmaceutical

· Oxford BioMedica

· YPOSKESI

· Sarepta Therapeutics

· GenScript

· Pfizer

· Audentes Therapeutics

· LifeSpan BioSciences, Inc.

Market Segmentation

By Scale of Operations

· Clinical

· Preclinical

· Commercial

By Method

· In Vivo

· In Vitro

By Application

· Vaccine

· Cell Therapy

· Gene Therapy

By Therapeutic Area

· Genetic Disorders

· Infectious Diseases

· Neurological Disorders

· Hematological Diseases

· Ophthalmic Disorders

By Geography

· North America

· Europe

· Asia Pacific

· Latin America

· Middle East & Africa (MEA)

Get Full Access of this Report@ https://www.precedenceresearch.com/checkout/2865

USA : +1 650 460 3308 | IND : +91 87933 22019 | Europe : +44 2080772818

Email@ sales@precedenceresearch.com