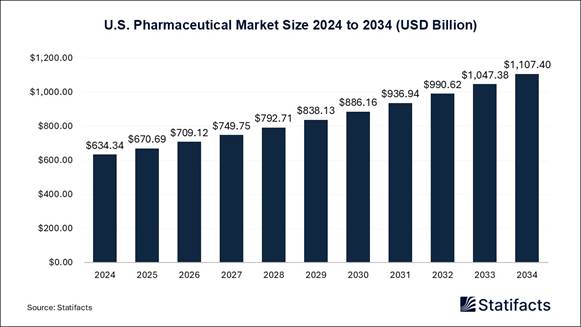

The global U.S. pharmaceutical market size is anticipated to reach around USD 1,107.4 billion by 2034, increasing from USD 634.34 billion in 2024 and representing a remarkable CAGR of 5.73% from 2025 to 2034.

According to Statifacts, the worldwide U.S. pharmaceutical market size was valued at approximately USD 634.34 billion in 2024 and is estimated to hit around USD 936.94 billion by 2031. The U.S. pharmaceutical market is driven by the increasing consumer awareness about the health benefits to enhance consumer health and wellness.

This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.statifacts.com/stats/databook-download/7942

U.S. Pharmaceutical Market Highlights

• Molecule Type: In 2024, the small molecules (conventional drugs) segment led the U.S. pharmaceutical market in terms of revenue. However, biologics and biosimilars are forecast to experience the fastest growth during the forecast period.

• Product Type: Branded products held the largest revenue share in the U.S. pharmaceutical market in 2024. In contrast, generic products are expected to exhibit the highest growth rate over the coming years.

• Prescription vs OTC: The prescription drug segment accounted for the highest revenue share in 2024, while over-the-counter (OTC) products are anticipated to see the fastest growth in the forecast period.

• Disease Focus: Cancer remained the leading therapeutic area by revenue in 2024. However, cardiovascular diseases are projected to experience the fastest growth rate throughout the forecast period.

• Administration Route: Oral administration dominated the market in 2024, while the parenteral (injectable) route is expected to show the most significant growth in the upcoming years.

• Formulation Type: Tablets led the pharmaceutical market in 2024. Looking ahead, spray formulations are expected to see a rapid expansion.

• Age Group: The adult demographic represented the largest portion of the market in 2024 and is forecast to experience the highest growth rate in the coming years. The children and adolescent age group is also expected to show substantial growth.

• Distribution Channels: Hospital pharmacies represented the dominant distribution channel by revenue in 2024. The "other" distribution channels are expected to experience significant growth during the forecast period.

How is Pharmaceutical Industry in United States Growing?

The U.S. pharmaceutical market is driven by factors such as rising adoption of technological advancements, growing geriatric population, increasing prevalence of chronic diseases, increasing healthcare expenditure, increasing demand for advanced and specialty therapies, rising investment in R&D activities, increasing government regulation and initiatives in the U.S. and rising significant investment in advanced therapies.

AI Impact on Pharmaceutical Market in the U.S.

AI is rapidly revolutionizing the pharmaceutical market in the U.S. by enabling personalized medicine, enhancing supply chain efficiency, optimizing clinical trials and speeding up drug discovery and development via advanced data analysis. AI provides data-driven insights, improves product quality and safety and reduces costs and timelines for more patient management and effective treatments by automating tasks, predicting outcomes, identifying drug targets.

Case Study: Pfizer’s AI-Driven Drug Discovery Partnership with IBM Accelerates Oncology Research

Overview

In August 2025, Pfizer Inc. announced an expanded collaboration with IBM Watson Health to accelerate AI-powered drug discovery and development in oncology and rare disease therapeutics. This partnership aims to leverage generative AI and quantum computing algorithms to identify potential drug targets, optimize molecule design, and reduce clinical trial durations by up to 35% compared to traditional R&D methods.

Objectives / Purpose

This

case study highlights how AI integration is transforming the U.S.

pharmaceutical landscape, aligning perfectly with the AI discussion in your

report’s section “AI Impact on Pharmaceutical Market in the U.S.”.

It demonstrates how leading firms like Pfizer are redefining R&D

efficiency, reducing costs, and accelerating time-to-market for next-generation

therapies.

Methodology / Approach

• Collaboration Framework: IBM’s AI model “Watson Discovery for Life Sciences” was trained on millions of molecular datasets, literature archives, and genomic data.

• Pfizer’s Role: Leveraged proprietary oncology datasets and advanced lab automation to identify drug candidates faster.

• Outcome: A pipeline of over 12 new oncology molecules moved into preclinical testing within months of AI integration.

Key Insights

• Validation of AI in Pharma: Reinforces your report’s assertion that AI enhances efficiency, safety, and personalization across pharmaceutical operations.

• Economic Relevance: Reflects the growing digitalization trend mentioned under your “Market Opportunities” section.

• Investor Confidence: Demonstrates how large-scale tech collaborations are reshaping R&D investment strategies across the U.S. pharmaceutical ecosystem.

Market & Industry Impact

This

case exemplifies how digital transformation and AI collaboration

are driving market acceleration - key drivers behind the U.S. Pharmaceutical

Market’s projected growth to USD 1,107.4 billion by 2034 at a CAGR of 5.73%.

It underscores the role of innovation partnerships in reinforcing America’s

leadership in global biopharma, fostering faster regulatory approvals, and

supporting precision medicine expansion.

Kindly use the following link to access our scheduled meeting@ https://www.statifacts.com/schedule-meeting

What are Latest Trends in U.S. Pharmaceutical Market:

• Rise of Specialty and Personalized Medicines

There is growing emphasis on targeted therapies and personalized medicine, particularly in oncology, rare diseases, and genetic disorders.

• Growth in Biologics and Biosimilars

Biologic drugs continue to dominate revenue, while biosimilars are gaining momentum as cost-effective alternatives.

• Increased Adoption of Digital Health Technologies

Pharmaceutical companies are integrating digital tools, including remote monitoring, mobile health apps, and AI-based platforms, to support drug adherence and real-world evidence collection.

• Focus on Cell and Gene Therapies

Advanced therapies such as CAR-T cell therapy and gene editing are emerging as transformative treatments for conditions previously considered untreatable.

• Expansion of mRNA-Based Therapeutics

Following the success of COVID-19 vaccines, mRNA technology is being applied to other areas like cancer, flu, and rare genetic diseases.

• Regulatory Innovation and Accelerated Approvals

The FDA is increasingly supporting fast-track, breakthrough, and accelerated approval pathways to speed up access to critical therapies.

U.S. Pharmaceutical Market Opportunity:

Rising Digitalization in Pharmaceutical Industry

The integration of digital technologies in the U.S. pharmaceutical industry across all operations improve patient engagement, supply chain management, manufacturing and research and development. It uses advanced tools such as cloud computing, IoT, big data, machine learning and AI to create personalized patient experiences, ensure compliance, automate production, enhance clinical trial efficiency and accelerate drug discovery.

This transformation leads to improved patient outcomes, increased efficiency, better quality and faster innovation, which further expected to revolutionize the growth of the U.S. pharmaceutical market.

Market Challenge:

High cost in drug development

One of the major challenging factors restraining market growth is the increasing high cost in drug development. The development of new drugs is a expensive, complex and lengthy process, which can affect manufacturing production, which expected to restrain the growth of the U.S. pharmaceutical market.

Shape the insights, trends and strategic planning your way 50% customization is on us!

Customize This Study as Per Your Requirement@ https://www.statifacts.com/stats/customization/7942

Pharmaceutical Market Key Country Analysis:

What has made U.S. the Leader in Industry in Recent Years?

The market growth in the U.S. is attributed to the factors such as the increasing demand for personalized medicine, rising technological innovation in targeted therapies such as gene therapies, cell and biologics, increasing prevalence of chronic diseases and growing geriatric population.

In the U.S., favourable regulatory policies enhance the launch of new orphan and specialty drugs and accelerated approval pathways. In addition, increasing robust healthcare expenditure, rising integration of digital tools and AI in drug discovery and increasing R&D investment in the U.S. are also contributed to drive the market growth in the U.S.

U.S. Pharmaceutical Market Scope

|

Report Attributes |

Statistics |

|

Market Size in 2024 |

USD 634.34 Billion |

|

Market Size in 2025 |

USD 670.69 Billion |

|

Market Size in 2030 |

USD 886.16 Billion |

|

Market Size in 2032 |

USD 990.62 Billion |

|

Market Size by 2034 |

USD 1,107.4 Billion |

|

CAGR 2025-2034 |

5.73% |

|

Base Year |

2024 |

|

Forecast Years |

2025-2034 |

|

Segments Covered |

Molecule Type, Product, Type, Disease, Route of Administration, Age Group, Distribution Channel Group, and Region |

|

Key Players |

F. Hoffmann-La Roche Ltd, Novartis AG, AbbVie Inc., Johnson & Johnson Services, Inc., Merck & Co., Inc., Pfizer Inc., Bristol-Myers Squibb Company, Sanofi, GSK plc., Takeda Pharmaceutical Company Limited, and Others. |

U.S. Pharmaceutical Market Segmentation Analysis

Molecule Type Analysis

Why Did the Conventional Drugs Segment Dominate the Market in 2024?

The conventional drugs segment dominated the pharmaceutical market revenue in 2024. The segment growth in the market is driven by factors such as increasing availability of biosimilars, increasing demand for revenue models and therapeutic strategies, increasing demand for biologics in treating autoimmune and cancer diseases and increasing growth in monoclonal antibody approvals.

Product Type Analysis

What Factors Help the Branded Product Segment to Grow in 2024?

The branded product segment dominated the U.S. pharmaceutical market revenue in 2024, due to their increased significance in specialized therapy areas such as rare diseases, immunology and oncology.

Type Analysis

How the Prescription Type Segment Dominates the Pharmaceutical Market Revenue in 2024?

The prescription type segment dominated the market revenue in the U.S. in 2024, due to the specialization and complexity of treatments, particularly in life-threatening and chronic diseases. These include diseases such as cancer, autoimmune disorders, rare genetic conditions, and cardiovascular diseases, which often require complex biologics, personalized formulations, or controlled substances none of which can be safely or legally administered without a physician’s oversight. The growing prevalence of these conditions, combined with advancements in targeted therapies and precision medicine, has further reinforced the reliance on prescription-based treatments.

Disease Type Analysis

Why Did Cancer Disease Held the Largest Market Revenue in 2024?

The cancer disease segment dominated the U.S. pharmaceutical market revenue in 2024. The combination regimens, targeted small molecules and immunotherapies have transformed cancer into more curable disease in various cases. Drugs such as Lynparza, Keytruda and Opdivo are being used in various cancer therapies.

Route of Administration Analysis

Why the Oral Route of Administration Segment Dominates the Market Revenue in 2024?

The oral route of administration segment dominated the pharmaceutical market in the U.S. in 2024. They are suitable for both chronic and acute treatments and offer better patient compliance and ease of use. From a healthcare provider’s perspective, oral medications reduce the need for clinical supervision and specialized administration, lowering overall treatment costs and resource utilization. Additionally, advancements in drug formulation technologies, such as controlled-release systems and improved bioavailability have expanded the range of drugs that can be effectively delivered orally, further cementing this route’s dominance in the market.

Formulation Type Analysis

What Factors Help the Tablets Segment to Grow in 2024?

The tablets segment dominated the U.S. pharmaceutical market revenue in 2024 due to their ease of mass production, stability and affordability. Tablets remain the most common format for complex therapies such as hypertension or diabetes.

Age Group Analysis

How the Children & Adolescent Segment Dominates the Market Revenue in 2024?

The children and adolescent segment dominated the pharmaceutical market in the U.S. in 2024. The segment growth in the U.S. market is drive by factors such as the growing working-age population and increasing prevalence of acute infections, mental health diseases and lifestyle diseases.

End Use Analysis

Why the Hospital Pharmacy Distribution Channel Segment Held the Largest Market Revenue in 2024?

The hospital pharmacy distribution channel segment dominated the U.S. pharmaceutical market revenue in 2024. The segment growth in the U.S. market is driven by the increasing need for various therapies such as complex antibiotics, gene therapies and cancer therapies.

Browse More Research Reports:

• The global pharmaceutical inventory management software market, valued at USD 4,071 million in 2024, is projected to reach nearly USD 7,500 million by 2034. Growth is driven by increasing digitization in healthcare, rising demand for real-time inventory tracking, and enhanced regulatory compliance, advancing at a CAGR of 6.3%.

• The global pharmaceutical grade salidroside market, valued at USD 423 million in 2024, is projected to reach approximately USD 1067.6 million by 2034. This growth, driven by rising demand for natural health supplements and pharmaceutical applications, is expected at a CAGR of 9.7%.

• The global pharmaceutical CDMO for formulations market size was estimated at USD 45.43 billion in 2024 and is projected to be worth around USD 96.57 billion by 2034, growing at a CAGR of 7.83% from 2025 to 2034.

• The U.S. pharmaceutical CDMO for formulations market size surpassed USD 10.15 billion in 2024 and is predicted to reach around USD 21.92 billion by 2034, registering a CAGR of 8% from 2025 to 2034.

• The global biopharmaceuticals market size was estimated at USD 442.88 billion in 2024 and is projected to be worth around USD 975.20 billion by 2034, growing at a CAGR of 8.3% from 2025 to 2034.

• The global radiopharmaceuticals market size surpassed USD 6,740 million in 2024 and is predicted to reach around USD 14,440 million by 2034, registering a CAGR of 8.2% from 2025 to 2034.

• The Europe pharmaceutical excipients market size was calculated at USD 2.41 billion in 2024 and is predicted to attain around USD 4.31 billion by 2034, expanding at a CAGR of 5.98% from 2025 to 2034.

• The global pharmaceutical and biotechnology environmental monitoring market size was estimated at USD 1,002 million in 2024 and is projected to be worth around USD 1,744 million by 2034, growing at a CAGR of 5.7% from 2025 to 2034.

• The global pharmaceutical temperature controlled packaging solutions market size was calculated at USD 5,950 million in 2024 and is predicted to attain around USD 11,600 million by 2034, expanding at a CAGR of 6.9% from 2025 to 2034.

• The global biopharmaceuticals contract manufacturing market size was evaluated at USD 40.12 billion in 2024 and is expected to grow around USD 115.99 billion by 2034, registering a CAGR of 11.2% from 2025 to 2034.

Ready to Dive Deeper? Visit Here to Buy Databook and In-depth Report Now! https://www.statifacts.com/order-databook/7942

Top Companies in U.S. Pharmaceutical Market:

|

Company |

Key Offerings / Therapeutic Areas |

|

AbbVie |

Immunology (Humira, Skyrizi, Rinvoq), Oncology, Neuroscience, Aesthetics, Eye care |

|

AstraZeneca |

Oncology (Tagrisso, Imfinzi), Respiratory (Symbicort), Cardiovascular, Rare diseases |

|

Bristol Myers Squibb |

Oncology (Opdivo, Revlimid), Immunology, Cardiovascular (Eliquis), Hematology |

|

GSK |

Vaccines, Infectious diseases, Respiratory (Trelegy), HIV (ViiV Healthcare JV), Immunology |

|

Johnson & Johnson |

Immunology (Stelara, Tremfya), Oncology (Darzalex), Vaccines, Neuroscience, Medical Devices |

|

Merck & Co. |

Oncology (Keytruda), Vaccines (Gardasil), Infectious diseases, Cardiometabolic, Animal Health |

|

Novartis |

Oncology, Neuroscience, Gene therapy (Zolgensma), Cardiovascular, Biosimilars |

|

Pfizer |

Vaccines (Comirnaty – COVID-19), Oncology, Internal Medicine, Rare Diseases, Anti-infectives |

|

Roche Holding |

Oncology (Avastin, Herceptin), Diagnostics, Immunology, Neuroscience, Personalized healthcare |

|

Sanofi |

Immunology (Dupixent), Vaccines (Flu, COVID-19), Rare diseases, Hematology, Diabetes & Cardiovascular |

What is Going Around the World?

• In July 2025, Sun Pharma launched alopecia drug Leqselvi in the U.S. and settled a patent row with American biopharma company Incyte Corporation over its hair-loss drug.

• In May 2025, Egypt launched a major joint venture agreement with US-based Dawah Pharma to export and manufacture nutritional supplements and pharmaceutical products to global markets. The aim behind this launch was to expand its pharmaceutical exports and attract foreign investment to its health sector.

Segments Covered in the Report

By Molecule Type

• Biologics & Biosimilars (Large Molecules)

o Monoclonal Antibodies

o Vaccines

o Cell & Gene Therapy

o Others

• Conventional Drugs (Small Molecules)

By Product

• Branded

• Generics

By Type

• Prescription

• OTC

By Disease

• Cardiovascular diseases

• Cancer

• Diabetes

• Infectious diseases

• Neurological disorders

• Respiratory diseases

• Autoimmune diseases

• Mental health disorders

• Gastrointestinal disorders

• Women’s health diseases

• Genetic and rare genetic diseases

• Dermatological conditions

• Obesity

• Renal diseases

• Liver conditions

• Hematological disorders

• Eye conditions

• Infertility conditions

• Endocrine disorders

• Allergies

• Others

By Route of Administration

• Oral

• Topical

• Parenteral

o Intravenous

o Intramuscular

• Inhalations

• Other Route of Administration

By Formulation

• Tablets

• Capsules

• Injectable

• Sprays

• Suspensions

• Powders

• Other Formulations

By Age Group

• Children & Adolescents

• Adults

• Geriatric

By End Market

• Hospitals

• Clinics

• Others

Ready to Dive Deeper? Visit Here to Buy Databook and In-depth Report Now! https://www.statifacts.com/order-databook/7942

𝐀𝐛𝐨𝐮𝐭 𝐔𝐬:

Statifacts is a global market intelligence and consulting leader, committed to delivering deep strategic insights that fuel innovation and transformation. With a sharp focus on the fast-evolving landscape of life sciences, we excel at navigating the intricacies of cell and gene therapies, oncology, and drug development. We empower our clients, ranging from biotech pioneers to institutional investors with the intelligence needed to lead in high-impact areas like regenerative medicine, cancer therapeutics, and precision health. Our broad expertise across the pharma-biotech value chain is backed by robust, statistically driven data for every market we cover, ensuring decisions are informed, forward-looking, and built for impact.

Statifacts offers subscription services for data and analytics insights. This page provides options to explore and purchase a subscription tailored to your needs, granting access to valuable statistical resources and tools. Access here - https://www.statifacts.com/get-a-subscription

Connect with Us

Ballindamm 22, 20095 Hamburg, Germany

Europe: +44 7383092044

Web: https://www.statifacts.com/

For Latest Update Follow Us: https://www.linkedin.com/company/statifacts

Our Trusted Data Partners:

Precedence Research | Towards Healthcare | Nova One Advisor