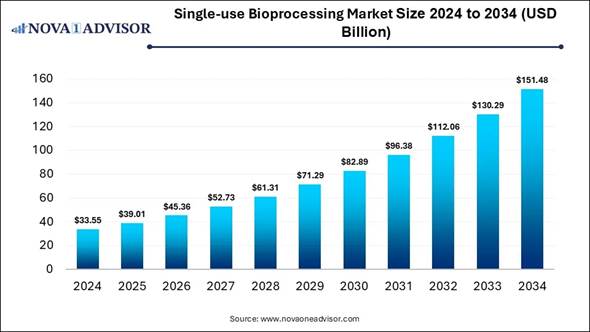

According to Nova One Advisor, the global single-use bioprocessing market size is expected to be worth around 151.48 billion by 2034, increasing from USD 39.01 billion in 2025, representing a healthy CAGR of 16.27% from 2025 to 2034.

The single-use bioprocessing market is growing due to single-use technologies are reusable products that are planned for one-time use. Single-use bioprocessing is beneficial as it lowers contamination challenges and rapid turnaround times. They need lower energy use as compared to stainless steel systems since it is not necessary to clean or sterilise them between batches. The absence of standardisation practices and supply chain safety presents further complexities to the adoption of single-use systems.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.novaoneadvisor.com/report/sample/5765

Single-use Bioprocessing Market Highlights:

⬥︎North America dominated the single-use bioprocessing market with a revenue share of approximately 42% in 2024.

⬥︎Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

⬥︎By product, the simple & peripheral elements segment held the largest market share in 2024.

⬥︎By product, the apparatus & plants segment is expected to grow at the fastest CAGR in the market during the forecast period.

⬥︎By workflow, the upstream bioprocessing segment dominated the market with a major revenue share in 2024.

⬥︎By workflow, the fermentation segment is expected to grow at the fastest CAGR in the market during the forecast period.

⬥︎By end use, the biopharmaceutical manufacturers segment led the market in 2024.

⬥︎By end use, the academic & clinical research institutes segment is expected to grow at the fastest CAGR in the market during the forecast period.

Market Overview and Industry Potential

Single-use bioprocessing is the use of single-use technologies in the manufacturing of biopharmaceuticals. In contrast to multi-use technologies, single-use bioprocessing services are used in the manufacture of a single batch and later disposed of. Single-use bioprocessing is considered to be supportable, in that fewer resources are bound in an involved cleaning process.

🔹For Instance, In July 2024, the World Health Organization (WHO) introduced an online platform called MeDevIS (Medical Devices Information System), the first global open-access clearing house for information on medical devices. It is designed to support governments, regulators, and users in their decision-making on selection, procurement, and use of medical devices for diagnostics, testing, and treatment of diseases and health conditions.

Single-use systems in bioprocessing improve speed and effectiveness, allowing for quick bioprocessing management and broad-minded manufacturing of many products at different scales in the same facility. The suppleness of SUS allows more adaptability, enabling seamless transitions from R&D to full-scale production or for the manufacturing of various products. Single-use biomanufacturing is a process in biotechnology where single-use systems are used throughout the manufacturing of biopharmaceutical products.

The next generation of single-use systems: Market’s Largest Potential

The growing application of automation, such as the prominent use of the next generation of single-use systems, drives the growth of the market. Presently, entirely automated systems bring flow rates and pressure rates to process a 2,000 L bioreactor. These systems have Raman spectroscopy technology added in-line to provide real-time Raman analysis in single-use bioreactors and downstream systems. With the proper software, these systems are connected and controlled while analyzing their process data in person or remotely. The next generation of single-use systems focuses on improved automation, sustainability, and integration for more efficiency, specifically in biopharmaceutical manufacturing.

🔹For Instance, In October 2025, Invert, a pioneer in AI-driven bioprocess software solutions, announced the launch of Invert Assist, an AI-powered analysis interface for bioprocess that enables users to perform data analysis and process modeling using natural language prompts. Invert Assist represents a major milestone towards Invert's mission of applying AI to reduce development and manufacturing timelines across the biopharmaceutical industry, accelerating the process of making life-saving therapeutics.

Buy Now Full Report: https://www.novaoneadvisor.com/report/checkout/5765

Single-use Bioprocessing Market Report Scope

|

Report Attribute |

Details |

|

Market Size in 2025 |

USD 39.01 Billion |

|

Market Size by 2034 |

USD 151.48 Billion |

|

Growth Rate From 2025 to 2034 |

CAGR of 16.27% |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2034 |

|

Segments Covered |

Product, Workflow, End-use, Region |

|

Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Key Companies Profiled |

Sartorius AG; Danaher Corporation; Thermo Fisher Scientific, Inc.; Merck KGaA; Avantor, Inc; Eppendorf SE; Corning Incorporated; Lonza; PBS Biotech, Inc.; Meissner Filtration Products, Inc. |

Single-use Bioprocessing Market Segmentation

Analysis: By Product Analysis: The simple and peripheral elements segment

dominates in the single-use bioprocessing market, as these elements include

tubing, connectors, filters, and bags, providing the foundational benefits of

single-use bioprocessing over traditional stainless steel systems. It has

rising flexibility, lowering contamination, and reducing expenses compared to

traditional stainless-steel apparatus. On the other hand, the apparatus &

plants segment is expected to grow significantly during the forecast period, as

using single-use vessels in bioprocessing provides many advantages, including

significant affordability, lowering the challenges of contamination, and

growing operational flexibility. By substituting traditional stainless-steel

apparatus with disposable components, manufacturers streamline production,

enhance efficiency. By Workflow Analysis: The upstream

bioprocessing segment dominated the market in 2024, as this type of

bioprocessing involves the identification and screening of microorganisms, the

multiplication of microbes inside bioreactors,

and media preparation. Upstream processing comprises formulation of the

fermentation medium, sterilization of air, fermentation medium, and the

fermenter, inoculum preparation, and inoculation of the medium. Upstream

bioprocessing offers many advantages, such as accelerating research advancement

and enhancing cell

culture media. On the other hand, the fermentation segment

is expected to grow at the fastest CAGR in the market during the forecast

period, as it lowers the ecological footprint, aligns with moral standards, and

improves the quality of plant-based proteins’ nutritious value and sensory

attributes, providing a trustworthy substitute to animal products. Single-use

fermentation is an ideal choice because one vessel is dedicated to each

patient. There is no requirement to clean it, leading to faster improvements. By End Use Analysis: The biopharmaceutical manufacturers segment

dominated the market in 2024, as single-use bioprocesses lower the challenges

of contamination by removing the need for cleaning and sterilization processes.

Cross-contamination is a major concern in biopharmaceutical manufacturing. They

offer flexibility to rapidly scale out, scale down, or scale up to accommodate quick

changes in production volume needs. On the other hand, the academic &

clinical research institutes segment is expected to grow at the fastest CAGR in

the market during the forecast period, as single-use bioprocessing is broadly

used in the biopharmaceutical industry for applications. Single-use technology,

or disposable bioprocessing equipment, provides significant benefits to

clinical research institutions by improving safety, effectiveness, flexibility,

and affordability compared to traditional stainless-steel equipment, so this

process is mainly used by academic & clinical research institutes. Single-use Bioprocessing Market Size By

End-use, 2024 to 2034 (USD Billion) Year 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 Biopharmaceutical

Manufacturers 23.49 27.29 31.63 36.92 43.18 50.20 57.86 66.77 79.69 91.27 105.71 Academic &

Clinical Research Institutes 10.07 11.72 13.73 15.82 18.13 21.09 25.03 29.60 32.37 39.02 45.77

By Regional North America dominated the single-use

bioprocessing market in 2024, due to its massive, well-funded pharmaceutical

companies, a strong focus on R&D, and early adoption of novel techniques.

North America is a hub of a high concentration of leading biopharmaceutical

and biotechnology

research centers that are rapid adopters of single-use technologies. This

region has well-established CMOs and Contract

Development and Manufacturing Organizations (CDMOs) that commonly use

single-use bioprocessing, which contributes to the growth of the market. 🔹

For Instance, In October 2025, MilliporeSigma, the

U.S. and Canada Life Science business of Merck KGaA, Darmstadt, Germany, a

leading science and technology company, entered into a partnership with Promega

Corporation, a global life science solutions and service leader based in

Madison, Wisconsin, to co-develop novel technologies that advance drug

screening and discovery. In the U.S., substantial investments in

biotechnology research, particularly in the United States, drive the

development and growing adoption of novel bioprocessing processes, including

single-use systems. Employing single-use systems usually requires lower initial

capital investment as compared to outdated stainless-steel devices. 🔹

For Instance, In October 2025, Merck, a leading

science and technology company, announced the signing of a definitive agreement

to acquire the chromatography business of JSR Life Sciences, a leader in

contract development and manufacturing, preclinical and translational clinical

research, and bioprocessing solutions. Why is Asia Pacific the Fastest Growing

in the Single-use Bioprocessing Market? APAC is the fastest-growing region in the

market, with rising local biopharmaceutical organizations, significant

expenditure from governments and private companies, and the inherent

affordability and flexibility of single-use technologies. An increasing

incidence of chronic diseases, like diabetes and cancer, and a growing aging

population contribute to the demand for single-use bioprocessing, which

contributes to the growth of the market. Single-use Bioprocessing Market Size By

Region, 2024 to 2034 (USD Billion) Year 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 North America 11.74 13.74 16.05 18.80 21.67 24.29 28.12 33.76 41.45 43.55 52.22 Europe 8.39 9.77 11.18 12.94 15.55 17.79 20.38 23.98 27.11 30.97 36.90 Asia Pacific 8.39 9.72 11.26 13.14 15.43 18.49 21.38 25.10 28.12 33.72 38.29 Latin America 2.68 3.09 3.74 4.20 4.61 5.40 6.75 6.86 8.82 11.38 13.96 Middle East and

Africa (MEA) 2.35 2.69 3.12 3.65 4.06 5.32 6.26 6.68 6.57 10.66 10.12

Single-use Bioprocessing Market

Companies: • Sartorius AG • Thermo Fisher Scientific, Inc. • Corning Incorporated • Boehringer Ingelheim International GmbH • Lonza What is Going Around the Globe? 🔹 In June 2025, Ecolab Life Sciences is launching its new Purolite

AP+50 affinity chromatography resin at the Biotechnology Innovation

Organization (BIO) International Convention, which is being held in Boston. 🔹 In June 2025, Sartorius Stedim Biotech expands manufacturing and

R&D capacities for innovative bioprocess solutions in France. Cleanroom

space almost doubled, with automated production lines for single-use bags. Automated

logistics and warehouse platform to further increase delivery capability and

speed 🔹 In September 2025, Repligen Corporation, a life sciences company

focused on bioprocessing technology leadership, announced that it had entered

into a definitive agreement to acquire privately held Metenova AB (Metenova) of

Mölndal, Sweden. Metenova is projected to generate revenues of $24 million to

$25 million for fiscal year 2023. 🔹 In September 2025, Thermo Fisher Completes $4B Acquisition of

Solventum’s Purification & Filtration Business, Expanding Bioprocessing and

Industrial Reach. With the transaction complete, the business, which is now

Thermo Fisher’s Filtration and Separation business, is part of the Life

Sciences Solutions segment. You can place an order or ask any

questions, please feel free to contact at sales@novaoneadvisor.com |

+1 804 441 9344 Related Report – ⬥︎ India Single-use Bioprocessing Probes And Sensors Market - https://www.novaoneadvisor.com/report/india-single-use-bioprocessing-probes-and-sensors-market ⬥︎ Single-use Bioprocessing Probes & Sensors Market - https://www.novaoneadvisor.com/report/single-use-bioprocessing-probes-sensors-market

⬥︎ U.S. Large And Small-scale Bioprocessing Market - https://www.novaoneadvisor.com/report/us-large-and-small-scale-bioprocessing-market

⬥︎ Large And Small-scale Bioprocessing Market - https://www.novaoneadvisor.com/report/large-small-scale-bioprocessing-biopharmaceutical-manufacturing-market

⬥︎ Continuous Bioprocessing Market - https://www.novaoneadvisor.com/report/continuous-bioprocessing-market

Segments Covered in the Report By Product • Simple & Peripheral Elements o Tubing, Filters,

Connectors, & Transfer Systems o Bags o Sampling Systems o Probes &

Sensors §

pH Sensor §

Oxygen Sensor §

Pressure Sensors §

Temperature Sensors §

Conductivity Sensors §

Flow Sensors §

Others o Others • Apparatus & Plants o Bioreactors §

Upto 1000L §

Above 1000L to 2000L §

Above 2000L o Mixing, Storage,

& Filling Systems o Filtration

System o Chromatography

Systems o Pumps o Others • Work Equipment o Cell Culture

System o Syringes o Others By Workflow • Upstream Bioprocessing • Fermentation • Downstream Bioprocessing By End-use • Biopharmaceutical Manufacturers o CMOs & CROs o In-house

Manufacturers • Academic & Clinical Research

Institutes By Region • North America o U.S. o Canada • Europe o UK o Germany o France o Italy o Spain o Denmark o Sweden o Norway • Asia Pacific o Japan o China o India o South Korea o Australia o Thailand • Latin America o Brazil o Mexico o Argentina • Middle East & Africa o South Africa o Saudi Arabia o UAE o Kuwait Immediate Delivery Available | Buy This

Premium Research https://www.novaoneadvisor.com/report/checkout/5765

About-Us Nova One Advisor is a global leader

in market intelligence and strategic consulting, committed to delivering deep,

data-driven insights that power innovation and transformation across

industries. With a sharp focus on the evolving landscape of life sciences, we

specialize in navigating the complexities of cell and gene therapy, drug

development, and the oncology market, enabling our clients to lead in some of

the most revolutionary and high-impact areas of healthcare. Our expertise spans the entire

biotech and pharmaceutical value chain, empowering startups, global

enterprises, investors, and research institutions that are pioneering the next

generation of therapies in regenerative medicine, oncology, and precision

medicine. Web: https://www.novaoneadvisor.com/ Contact Us USA: +1 804 420 9370 Email: sales@novaoneadvisor.com For Latest Update Follow Us: LinkedIn Towards

Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Market Stats Insight | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals

Analytics