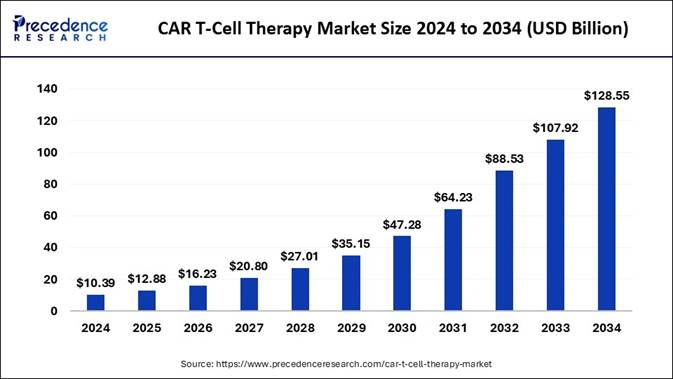

The global CAR T-cell therapy market size is expected to be worth USD 128.55 billion by 2034, increasing from USD 12.88 billion in 2025. The market reflects a huge compound annual growth rate (CAGR) of 29.10% from 2025 to 2034, a study published by Precedence Research.

In terms of revenue, the worldwide CAR T-cell therapy market reached USD 10.39 billion in 2024 and is poised for explosive growth set to rise from USD 12.88 billion in 2025 to USD 128.55 billion by 2034. Fueled by advances in immuno-oncology and rising global cancer rates, CAR T therapies are fast becoming the gold standard in treating relapsed hematologic cancers.

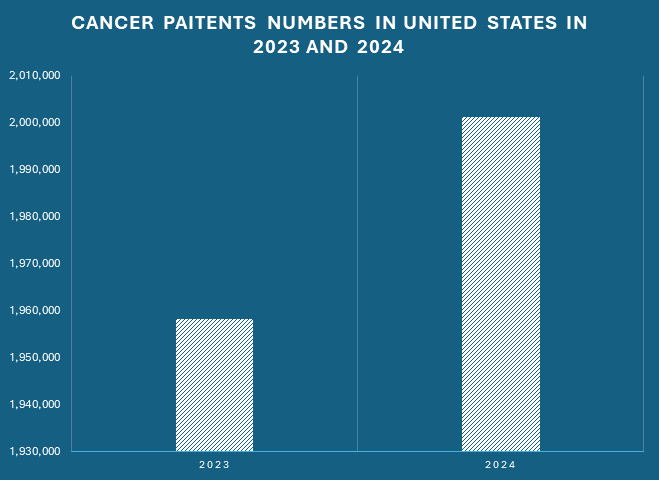

CAR T-cell therapy is a type of T-cell therapy or cancer therapy that accounts for approximately 27% of the overall T-cell therapy market. The rising incidence of cancer worldwide is anticipated to propel the development of CAR T-cells for therapeutic applications. The potential use of synthetic T-cell receptors in treating various cancers has been widely accepted.

Note: This report is

readily available for immediate delivery. We can review it with you in a

meeting to ensure data reliability and quality for decision-making.

📥 Download Sample Pages

for Informed Decision-Making 👇 https://www.precedenceresearch.com/sample/2545

CAR T-cell Therapy Market Quick Insights:

🔹The CAR T-cell therapy market surpassed USD 10.39 billion in 2024.

🔹It is projected to surpass USD 128.55 billion by 2034.

🔹The market is expected to expand at a double-digit CAGR of 29.10% from 2025 to 2034.

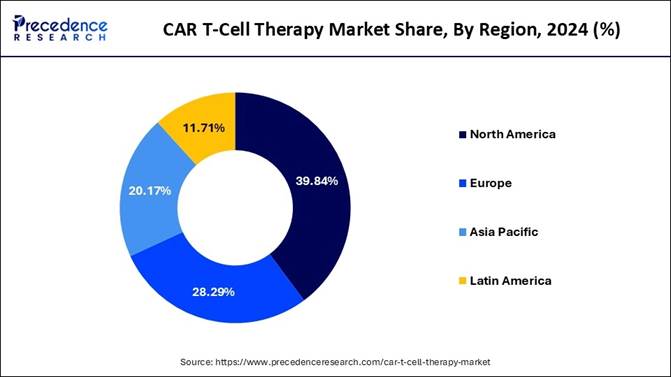

🔹Regional Leader: North America held the largest share (39.84%) in 2024.

🔹Top Drug: Axicabtagene ciloleucel led with a 29.33% market share in 2024.

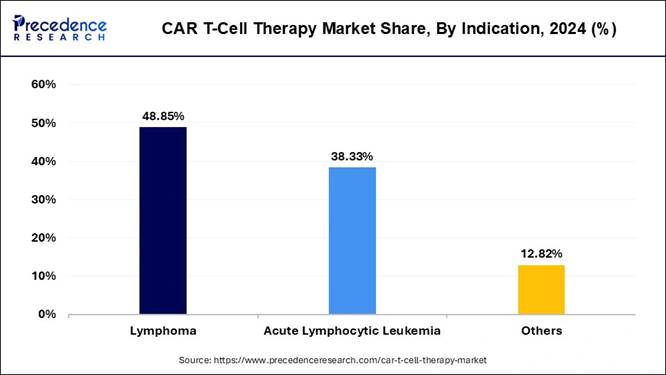

🔹Key Indication: Lymphoma dominated with 48.85% share in 2024.

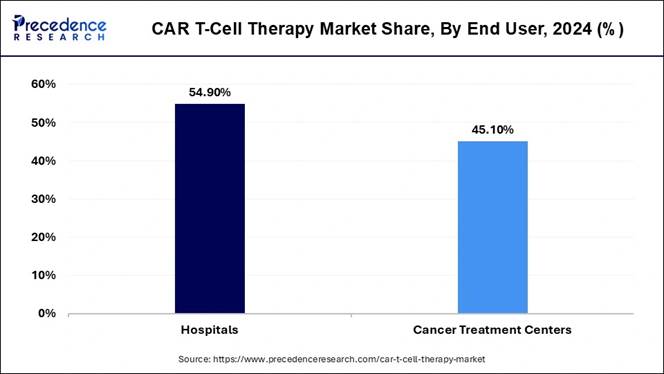

🔹Main End User: Hospitals accounted for over 54.90% of the market in 2024.

CAR T-cell Therapy Market Revenue Analysis:

CAR T-Cell Therapy Market Revenue (USD Million) By Drug Type, 2022 to 2024

|

Drug Type |

2022 |

2023 |

2024 |

|

Axicabtagene Ciloleucel |

1,118.3 |

2,472.3 |

3,046.7 |

|

Tisagenlecleucel |

971.1 |

2,143.5 |

2,637.3 |

|

Brexucabtagene Autoleucel |

814.8 |

1,808.5 |

2,237.5 |

|

Others |

922.8 |

2,020.3 |

2,465.2 |

CAR T-Cell Therapy Market Revenue (USD Million) By Indication, 2022 to 2024

|

Indication |

2022 |

2023 |

2024 |

|

Lymphoma |

1,881.0 |

4,137.9 |

5,073.9 |

|

Acute Lymphocytic Leukemia |

1,454.4 |

3,223.1 |

3,981.5 |

|

Others |

491.6 |

1,083.6 |

1,331.4 |

CAR T-Cell Therapy Market Revenue (USD Million) By End User, 2022 to 2024

|

End User |

2022 |

2023 |

2024 |

|

Hospitals |

2,076.4 |

4,608.8 |

5,702.2 |

|

Cancer Treatment Centers |

1,750.6 |

3,835.8 |

4,684.6 |

📘Premium Research Report

Available | 🕒 Instant Delivery

Guaranteed!

Make data-driven decisions

today 👉 https://www.precedenceresearch.com/checkout/2545

CAR T-cell Therapy Market Overview and Industry Potential:

Could CAR T Cell Therapy Unlock New Hope for Cancer Patients Worldwide?

The CAR T-cell therapy market is expected to see steady growth owing to the increased number of cancers worldwide and the need for effective treatment for hard-to-treat cancers such as lymphoma and leukemia. Moreover, having a higher effectiveness rate than other treatments, the CAR T cell therapy has gained immense industry attention in recent years. Also, several major hospitals and cancer treatment centers are adopting this effective treatment, which can create huge opportunities in the healthcare sector in the coming years.

Also Read 👉 Breakthroughs in CAR T-Cell Therapy Driving Targeted Cancer Treatment

In recent years, thousands of patients with relapsed leukemia and lymphoma once

considered untreatable, have experienced long-term remission thanks to CAR

T-cell therapy. Its ability to re-engineer a patient’s own immune cells is

opening new frontiers in personalized cancer care.

CAR T-cell therapy is reshaping cancer care by offering targeted and potentially curative options for relapsed patients,” said Deepa Pandey, Principal Consultant at Precedence Research. “The projected 10X growth by 2034 signals a profound shift in how we treat hematologic malignancies.

💡 Discover What’s Driving the Market 👉 https://www.precedenceresearch.com/car-t-cell-therapy-market

What is the Largest Opportunity in CAR T-cell Therapy Market?

The ongoing research in the CAR T cell therapy for the treatment of other diseases is expected to create significant opportunities for manufacturers in the projected period. As several scientists are seen in under research for the CAR T cell therapy for the other common diseases such as solid tumors, lung diseases, breast diseases, and brain cancers as per the recent observations.

Also Read 👉 How CAR T-Cell Therapy Is Reshaping the Future of Cancer Treatment

Top Companies in CAR T-cell Therapy Market & Their Recent Breakthroughs:

|

Company |

Recent Breakthrough |

|

F. Hoffmann |

Columvi® (glofitamab): First bispecific CD20-CD3 antibody approved in U.S., Canada & EU |

|

Bristol-Myers Squibb |

Breyanzi® (liso-cel): FDA approved for CLL/SLL (Mar 2024); EU expanded label to follicular lymphoma |

|

AbbVie Inc |

AbbVie–Umoja deal (Jan 2024): Developing in-situ CAR-T using VivoVec™ gene platform enabling in-body CAR T generation |

|

Johnson & Johnson |

CARVYKTI® (cilta-cel): New data showing 33% of multiple myeloma patients remain progression-free for 5+ years after a single infusion (June 2025) |

|

Celgene |

Assets integrated into BMS’s CAR T suite, particularly Abecma, with BMS acquiring 2seventy bio to consolidate Abecma rights |

CAR T-cell Cell Therapy Market Challenges and Limitations:

Precision Demands Put Pressure on CAR T Cell Therapy Affordability

The high cost with certain complexity of the development of the CAR T cell therapy is likely to hinder the industry growth in the coming years. The personalization of the treatment and the precision lab work can create high-cost challenges which includes the hiring the skilled professionals and advanced machinery during the forecast period as per the recent industry observation.

Treatment cost for CAR T-cell therapy can range from $375,000 to over $500,000 per patient. Delays in manufacturing (typically 2–4 weeks) and challenges in reimbursement continue to restrict access in low-income and even some high-income countries. Furthermore, toxicity risks like cytokine release syndrome demand highly skilled medical teams, adding to infrastructure burdens.

CAR T-Cell Therapy Market – Detailed Scope

|

Report Attributes |

Key Statistics |

|

Market Size in 2024 |

USD 10.39 Billion |

|

Market Size in 2025 |

USD 12.88 Billion |

|

Market Size in 2030 |

USD 47.28 Billion |

|

Market Size in 2032 |

USD 88.53 Billion |

|

Market Size by 2034 |

USD 128.55 Billion |

|

CAGR 2025 to 2034 |

29.10% |

|

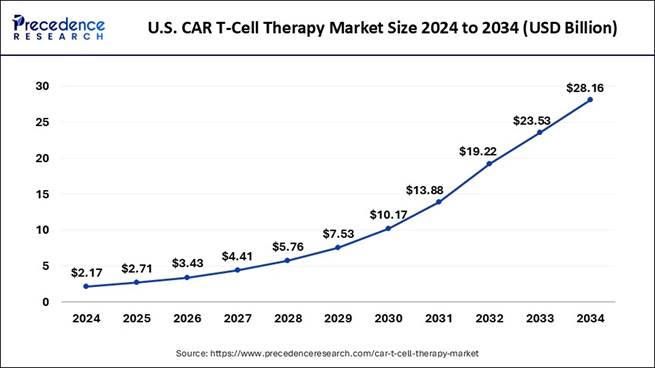

U.S. Market Size in 2025 |

USD 2.71 Billion |

|

U.S. Market Size in 2034 |

USD 28.16 Billion |

|

U.S. Market CAGR (2025-2034) |

29.70% |

|

Base Year |

2024 |

|

Historic Years |

2021 to 2023 |

|

Forecast Years |

2025 to 2034 |

|

Market Drivers and Challenges |

Comprehensive analysis of key growth drivers, restraints, and future opportunities |

|

Technology Trends |

Innovations in gene editing, viral vector design, and next-gen CAR constructs |

|

Competitive Landscape |

Detailed profiles of major players, market share analysis, strategic initiatives, product pipeline |

|

Regulatory Insights |

Overview of FDA, EMA, and other key regulatory guidelines impacting CAR T-cell therapy adoption |

|

Segments Covered |

Drug Type, Indication, End User, and Region |

|

Key Drug Types Analyzed |

Axicabtagene Ciloleucel, Tisagenlecleucel, Brexucabtagene Autoleucel, Lisocabtagene Maraleucel |

|

Key Indications Covered |

Lymphoma, Leukemia, Multiple Myeloma, Others |

|

End Users Analyzed |

Hospitals, Cancer Research Centers, Specialty Clinics |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

|

Country-Level Breakdown |

U.S., Canada, Germany, U.K., France, China, Japan, India, Brazil, South Africa, and more |

📞 Set up a meeting at your convenience to get more insights instantly! https://www.precedenceresearch.com/schedule-meeting

Case Study: CARVYKTI® Shows 5-Year Remission in Multiple Myeloma Patients

In a major clinical milestone shared in June 2025, Johnson & Johnson and its partner Legend Biotech announced that 33% of patients with relapsed or refractory multiple myeloma who were treated with a single infusion of CARVYKTI® (ciltacabtagene autoleucel) remained progression-free for more than five years.

These results came from the CARTITUDE-1 clinical trial, one of the most closely watched studies in the CAR T-cell therapy space. What makes this breakthrough remarkable is not just the survival rate — but the durability of remission from a one-time therapy in a patient group that typically faces very limited options.

CARVYKTI® is a BCMA-directed CAR T-cell therapy that works by reprogramming a patient’s own immune cells to recognize and attack myeloma cells. Approved by the U.S. FDA in 2022, it continues to demonstrate long-term survival benefits even in patients with heavily pretreated disease histories.

🗣️ “These

five-year results are a landmark moment for CAR T-cell therapy. They show that

a single treatment has the potential to control disease long-term in patients

who previously had no remaining options,” said Ying Huang, Ph.D., CEO of Legend

Biotech.

Source: Johnson & Johnson Press Release, June 2025

This clinical success strengthens market confidence in CAR T-cell therapy’s future. As the CAR T-cell therapy market is projected to grow more than 10-fold — from USD 12.88 billion in 2025 to USD 128.55 billion by 2034 — such real-world breakthroughs highlight not only the science but the scalability of this once-niche treatment. They also reflect growing regulatory momentum and improved patient access across global markets.

⏳ Don’t Miss Out! | ⚡ Instant Access to This Exclusive Report 👉 https://www.precedenceresearch.com/checkout/2545

CAR T-cell Therapy Market Key Regional Analysis:

North America Sets the Standard for CAR T Cell Innovation

North America held the dominant share of the CAR T-cell therapy market in 2024, owing to the modern and advanced research infrastructure and capabilities in the region. Furthermore, the region has seen heavy investments in innovative and effective cancer treatment in recent years. Also, the region has the advantage of fast drug approvals, and the presence of the top biotechnology companies can maintain the regional growth in the coming years, as per the latest industry observation. Moreover, having health professionals with integrated technology can create further opportunities in the market for the future years.

Also Read 👉 From Early Detection to CAR T-Cell Therapy – A New Era in Cancer Care

What is the Market Size of U.S. CAR T-Cell Therapy Market?

According to Principal Consultant, the U.S. CAR T-cell therapy market size is valued at USD 2.71 billion in 2025 and is expected to cross USD 28.16 billion by 2034. The market is growing at a solid CAGR of 29.70% from 2025 to 2034.

The Complete Study is Immediately Accessible | Download the Sample Pages of this Report 👉 https://www.precedenceresearch.com/sample/2545

U.S CAR T-cell Therapy Market: Trends, Insights & Potential

The United States has maintained its dominance in the North America region, akin to the presence of the technology-integrated healthcare and research infrastructure in recent years. Moreover, having strong governmental support for the R&D activities further encourages the healthcare and healthcare sectors to develop innovative approaches in the past few years, as per the recent industry reports. Also, the country’s heavy technology adoption has supported the treatment goals, which is likely to drive the industry growth in the coming years.

In 2024, the U.S. FDA expanded the label of Breyanzi® to treat chronic lymphocytic leukemia (CLL), while Carvykti® data showed a 33% progression-free survival at five years. These milestones reflect rapid advancement and strong regulatory momentum in the U.S. CAR T pipeline.

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Will Asia Pacific Lead the Global Race in Specialized Cancer Treatments?

Asia Pacific is expected to witness the fastest growth, led by China, Japan, South Korea, and India. Countries in this region are investing heavily in CAR T infrastructure, supported by streamlined clinical trial pathways, local manufacturing capabilities, and growing patient demand for cutting-edge therapies. Regulatory agencies across the region, such as China’s NMPA and Japan’s PMDA, have accelerated approval timelines for innovative cell and gene therapies, creating a fertile environment for commercialization.

In China, local biotech companies like Legend Biotech and JW Therapeutics are driving rapid innovation, with government-backed funding fueling domestic production and global collaboration. Japan is focusing on integrating CAR T therapies into its universal healthcare system, ensuring broader access. Meanwhile, India is emerging as a cost-effective hub for CAR T research and pilot programs, with increasing public-private partnerships aiming to reduce treatment costs and improve scalability.

Additionally, the rising cancer burden in Asia Pacific,

particularly in hematologic malignancies, combined with increasing medical tourism and advanced

healthcare infrastructure, positions the region as a pivotal growth engine for

the global CAR T-cell therapy market.

CAR T-cell Therapy Market Segmentation Analysis:

By Drug Type Analysis:

Why Did the Axicabtagene Celuleucel Segment Dominate the Market in 2024?

The axicabtagene ciloleucel segment held the largest share of the CAR T-cell therapy market in 2024, owing to it was one of the first CAR-T therapies approved and has shown strong results in treating large B-cell lymphoma. Developed by Kite Pharma (a Gilead company), it has been widely used in the U.S. and Europe. Its fast-manufacturing time and high response rates make it a preferred choice for doctors. Hospitals are familiar with their administration and side effects, which increases their use. Its early approval, reliable outcomes, and broad use in major treatment centers have helped axicabtagene ciloleucel take a leading position in the CAR-T drug market.

The tisagenelecleucel segment is expected to grow at a notable rate during the predicted timeframe, as it works well for both children and adults with leukemia and lymphoma. It was the first CAR-T therapy approved and is expanding its uses for different cancers. Novartis is investing in faster manufacturing and global distribution. As more hospitals adopt CAR-T and treat younger patients, demand for tisagenlecleucel will rise. The therapy's versatility, strong safety profile, and ongoing clinical trials for new uses make it likely to grow faster than other therapies and lead the market in the coming years.

Also Read 👉 Plasma Derived Therapy Market Size, Share, and Trends 2025 to 2034

By Indication Analysis:

How Lymphoma Segment Maintains Its Dominance in the Current Industry?

The lymphoma segment held the largest share of the market in 2024. CAR-T therapy has been especially effective in treating large B-cell lymphoma and other hard-to-treat forms. Most of the early CAR-T approvals were for lymphoma, and success rates were high compared to traditional treatments. Doctors have more experience using CAR-T for lymphoma, and it's often used when other therapies fail. Since lymphoma is one of the most common blood cancers and CAR-T has become a standard treatment in severe cases, this segment has naturally become the largest indication in the CAR-T market so far.

The acute lymphocytic leukemia segment is expected to grow at a notable rate during the predicted timeframe, as CAR-T therapies like tisagenlecleucel have shown high success rates in treating relapsed or hard-to-treat ALL cases. As more pediatric hospitals adopt this therapy and insurance coverage improves, access will grow. Ongoing trials are also testing CAR-T for broader ALL cases and earlier treatment stages. The strong results, safety for younger patients, and increasing hospital readiness make ALL a key future driver of CAR-T demand globally, especially as approvals expand in new regions.

Also Read 👉 Cell Therapy Market Size, Share, and Trends 2025 to 2034

By End User Analysis:

Why Did the Hospital Segment Dominate the Market in 2024?

The hospital segment dominated the market with the largest share in 2024, having services like complex care handling and special facilities in the current period. As the hospital has the greatest advantages of the presence of skilled professionals at any time, this has led the industry to growth in recent years. Moreover, the senior aged population has trust issues with other treatments and places, where hospitals have gained a significant advantage over the past few years.

The cancer treatment centers segment is expected to grow at a significant rate during the predicted timeframe, owing to these centers being truly established cancer treatment centers, where there is nothing to handle other diseases, which is likely to dominate the industry in the coming years. Moreover, having better focus on research and ongoing latest variant treatments of cancer, the cancer care centers are expected to gain immense attention in the coming years.

Related Topics You May Find Useful:

➢ Engineered T Cells Market 2025 to 2034: The global engineered T cells market size is expected to be valued at USD 35.73 billion in 2024 and is anticipated to reach around USD 616.91 billion by 2034, expanding at a CAGR of 32.96% over the forecast period from 2024 to 2034.

➢ Gene Therapy Market 2025 to 2034: The global gene therapy market size accounted for USD 9.26 billion in 2024, grew to USD 11.07 billion in 2025 and is expected to be worth around USD 55.43 billion by 2034, registering a healthy CAGR of 19.60% between 2024 and 2034.

➢ Stem Cell Therapy Market 2025 to 2034: The global stem cell therapy market size accounted for USD 16.02 billion in 2024, and is expected to reach around USD 54.15 billion by 2034, expanding at a CAGR of 12.95% from 2025 to 2034.

➢ Personalized Cell Therapy Market 2025 to 2034: The global personalized cell therapy market size was calculated at USD 30.19 billion in 2024 and is predicted to increase from USD 37.29 billion in 2025 to approximately USD 235.65 billion by 2034, expanding at a CAGR of 22.81% from 2025 to 2034.

➢ Cell Therapy Manufacturing Market 2025 to 2034: The global cell therapy manufacturing market size was estimated at USD 4.83 billion in 2024 and is predicted to increase from USD 5.55 billion in 2025 to approximately USD 18.89 billion by 2034, expanding at a CAGR of 14.61% from 2025 to 2034.

➢ Autologous Cell Therapy Market 2025 to 2034: The global autologous cell therapy market size was garnered at USD 9.55 billion in 2024 and is expected to hit around USD 53.73 billion by 2034, growing at a CAGR of 18.86% during the forecast period from 2025 to 2034.

➢ Automated And Closed Cell Therapy Processing System Market 2024 to 2034: The global automated and closed cell therapy processing system market size is expected to be valued at USD 1.51 billion in 2024 and is anticipated to reach around USD 12.40 billion by 2034, expanding at a CAGR of 23.44% over the forecast period from 2024 to 2034.

➢ Cell and Gene Therapy Bioanalytical Testing Services Market 2025 to 2034: The global cell and gene therapy bioanalytical testing services market size is projected to reach around USD 1,113.86 million in 2034 from USD 548.55 million in 2024, at a CAGR of 7.34% between 2024 and 2034.

➢ Cell and Gene Therapy CDMO Market 2025 to 2034: The global cell and gene therapy CDMO market size was estimated at USD 6.31 billion in 2024 and is predicted to increase from USD 8.07 billion in 2025 to approximately USD 74.03 billion by 2034, expanding at a CAGR of 27.92% from 2025 to 2034.

CAR T-Cell Therapy Market Top Companies

🔹F. Hoffmann-La Roche AG

🔹Bristol-Myers Squibb Company

🔹AbbVie, Inc.

🔹Johnson & Johnson

🔹Celgene Corporation

🔹AstellasPharma, Inc.

🔹Pfizer, Inc.

🔹Novartis AG

🔹Merck KGaA

🔹Eli Lilly and Company

Beyond product approvals, the CAR T market is buzzing with M&A activity. Notably, Bristol-Myers Squibb’s acquisition of 2seventy bio strengthens its position in autologous therapies. Novartis and AbbVie have also expanded investments into in vivo CAR T platforms, signaling long-term confidence.

The CAR T-cell therapy space remains competitive, with Bristol-Myers Squibb, Novartis, and Gilead Sciences leading the race in both revenue and innovation. However, smaller biotechs focusing on solid tumor applications are beginning to disrupt traditional dominance with next-gen technologies.

What is Going Around the Globe?

🔹In 2024, the FDA provided

authorization for pembrolizumab. This is chemotherapy for adult patients who

are suffering from endometrial carcinoma. Moreover, as per the observation of

the FDA, the adverse effects of pembrolizumab and chemoradiotherapy were

similar, as per the report.

(Source: https://www.fda.gov)

🔹Approval: In 2024, an article published by AstraZeneca says the FDA recently approved chemotherapy of AstraZeneca's chemotherapy. Chemotherapy is called Imfinzi plus. Also, this chemotherapy will be used as a treatment for adult patients who are suffering from primary advanced endometrial cancer, as per the company's claim.

CAR T-Cell Therapy

Market Segments Covered in the Report

By Drug Type

🔹Axicabtagene Ciloleucel

🔹Tisagenlecleucel

🔹Brexucabtagene Autoleucel

🔹Others

By Indication

🔹Lymphoma

🔹Acute Lymphocytic Leukemia

🔹Chronic Lymphocytic Leukemia (CLL)

🔹Multiple Myeloma (MM)

🔹Others

By End User

🔹 Hospitals

🔹 Cancer Treatment Centers

By Regions

🔹 North America

🔹 Europe

🔹 Asia-Pacific

🔹 Latin America

🔹 The Middle East and Africa

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or Asia Pacific.

⏳ Don’t Miss Out! | ⚡ Instant Access to This Exclusive Report 👉 https://www.precedenceresearch.com/checkout/2545

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans 👉 https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a global market intelligence and consulting powerhouse, dedicated to unlocking deep strategic insights that drive innovation and transformation. With a laser focus on the dynamic world of life sciences, we specialize in decoding the complexities of cell and gene therapy, drug development, and oncology markets, helping our clients stay ahead in some of the most cutting-edge and high-stakes domains in healthcare. Our expertise spans across the biotech and pharmaceutical ecosystem, serving innovators, investors, and institutions that are redefining what’s possible in regenerative medicine, cancer care, precision therapeutics, and beyond.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

🔸 Towards Healthcare 🔸 Statifacts 🔸 Nova One Advisor

Get Recent News 👉 https://www.precedenceresearch.com/news

For Latest Update Follow Us: