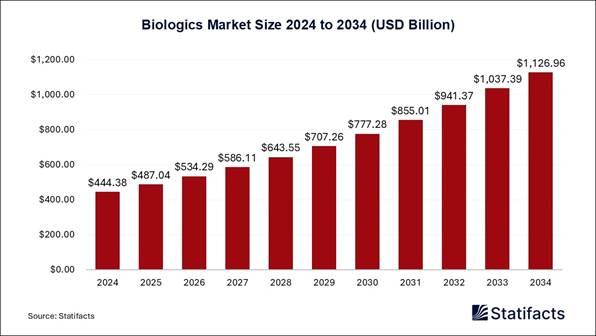

The global biologics market size is estimated to hit around USD 1,126.96 billion by 2034, increasing from USD 444.38 billion in 2024 and expanding at a CAGR of 9.75% from 2025 to 2034.

In terms of revenue, the worldwide

biologics market size was calculated at USD 444.38 billion in 2024 and is

anticipated to reach around USD 1,126.96 billion by 2031. Growing adoption of

biosimilars, advancements in biotechnology and gene therapy, innovation in gene

therapy and biotechnology, rising prevalence of chronic diseases, accelerated

biologic therapeutics, investing in GMP infrastructure development, and growing

advancements in recombinant protein technologies are contributing to the growth

of the market.

This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.statifacts.com/stats/databook-download/6997

Biologics Market Highlights

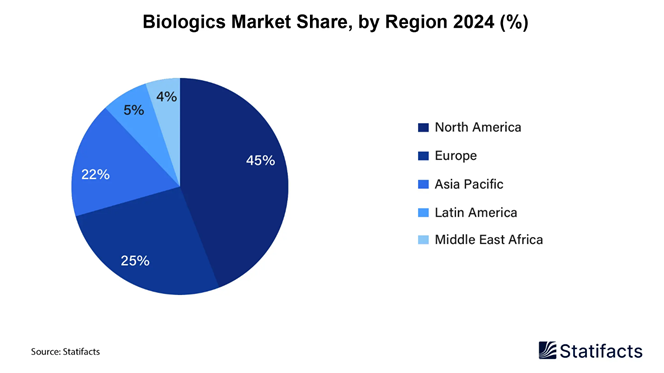

• North America led the global biologics market in 2024, accounting for a 45% market share, driven by advanced healthcare infrastructure and high R&D investments.

• The Asia Pacific biologics market is forecasted to grow at the fastest CAGR from 2025 to 2034, fueled by rising healthcare spending and expanding pharmaceutical manufacturing capabilities.

• Microbial-based biologics dominated in 2024 with a 59% market share, supported by cost-effective production and established applications.

• The mammalian cell-based biologics segment is projected to be the fastest-growing source category during the forecast period due to increasing demand for complex therapeutic proteins.

• Monoclonal antibodies (mAbs) held a dominant 57% share of the biologics market in 2024, continuing to lead due to their widespread use in cancer and autoimmune disease treatment.

• The vaccines segment is expected to register the highest growth rate between 2025 and 2034, driven by increased global immunization efforts and pandemic preparedness.

• Oncology-related biologics captured a 30% share in 2024, solidifying cancer treatment as the largest therapeutic area in the market.

• The cardiovascular disorders segment is set to grow at the fastest pace, fueled by rising disease prevalence and innovation in biologic therapies.

• In-house manufacturing of biologics dominated the market with an 84% share in 2024, favored for quality control and proprietary process management.

• The outsourced biologics manufacturing segment is anticipated to grow significantly, reflecting increased partnerships with contract manufacturing organizations (CMOs).

• Hospital pharmacies were the primary distribution channel in 2024, holding a 40% market share, due to the complexity and administration needs of biologic therapies.

• Retail pharmacies are projected to experience notable growth as biologic products become more accessible and patient-centric distribution models expand.

Biologics Industry Size Analysis:

Biologics Market, By Product Type 2023-2026 (USD Billion)

|

Segments |

2023 |

2024 |

2025 |

2026 |

|

Monoclonal Antibody |

229.39 |

251.23 |

275.65 |

302.73 |

|

Recombinant Insulin |

44.87 |

49.04 |

53.69 |

58.85 |

|

Vaccine |

81.28 |

87.65 |

94.66 |

102.31 |

|

Human Growth Hormone |

7.00 |

7.70 |

8.49 |

9.36 |

|

Cell & Gene Therapy |

25.97 |

29.52 |

33.56 |

38.15 |

|

Recombinant Enzyme |

4.00 |

4.44 |

4.93 |

5.48 |

|

Interferon |

10.00 |

10.86 |

11.81 |

12.86 |

|

Others |

3.69 |

3.95 |

4.24 |

4.55 |

Biologics Market, By Source 2023-2026 (USD Billion)

|

Segments |

2023 |

2024 |

2025 |

2026 |

|

Microbial |

239.37 |

261.20 |

285.54 |

312.43 |

|

Mammalian |

130.49 |

143.81 |

158.78 |

175.45 |

|

Others |

36.34 |

39.37 |

42.73 |

46.41 |

Biologics Market, By Disease Category 2023-2026 (USD Billion)

|

Segments |

2023 |

2024 |

2025 |

2026 |

|

Oncology |

122.00 |

134.87 |

149.36 |

165.54 |

|

Infectious Diseases |

68.28 |

74.51 |

81.47 |

89.15 |

|

Immunological Disorders |

52.84 |

57.38 |

62.42 |

67.97 |

|

Cardiovascular Disorders |

96.70 |

106.13 |

116.70 |

128.43 |

|

Hematological Disorders |

37.92 |

41.05 |

44.52 |

48.31 |

|

Others |

28.47 |

30.44 |

32.58 |

34.89 |

Biologics Market, By Manufacturing 2023-2026 (USD Billion)

|

Segments |

2023 |

2024 |

2025 |

2026 |

|

Outsourced |

63.92 |

71.27 |

79.58 |

88.92 |

|

In-house |

342.28 |

373.11 |

407.46 |

445.37 |

Biologics Market, By Distribution Channel 2023-2026 (USD Billion)

|

Segments |

2023 |

2024 |

2025 |

2026 |

|

Hospital Pharmacy |

162.78 |

177.99 |

194.96 |

213.75 |

|

Retail Pharmacy |

135.96 |

147.90 |

161.18 |

175.80 |

|

Online Pharmacy |

107.45 |

118.49 |

130.90 |

144.73 |

You can place an order or ask any questions, please feel free to contact us at sales@statifacts.com

What is the Remarkable Potential of the Biologics Market?

The biologics market refers to the production, distribution, and use of

biologics, which are medications that come from living organisms, like proteins

and genes. Only living cells reproduce living organisms. Biologic drugs are

more expensive and harder to use than normal drugs. Rising biosimilars

adoption, innovation in biotechnology and cell therapy, increasing

prevalence of chronic diseases, increasing R&D investment in cell and gene

therapies, and supportive government and regulatory authorities are driving the

growth of the biologics market.

Biologics are powerful drugs that can slow or stop inflammation that may damage

joints and organs in arthritis and other inflammatory diseases. Biologics can

treat chronic inflammatory and autoimmune diseases. Biologics can efficiently

control chronic inflammation and pain, preventing the need for corticosteroids.

According to data from clinical studies suggested that between 30 and 65% of

ulcerative colitis patients will achieve remission after taking a biologic

medication for one year.

• “The increasing prevalence of chronic diseases, the shift toward personalized medicine is poised to drive significant growth. Biologics offer tailored therapies for individual patients, addressing specific needs and delivering more effective treatments."

Biologics Launched by Prominent Players

|

Sr. No. |

Name of the Product |

Name of the Brand |

Product Specification |

|

1. |

Yesafili (aflibercept), a biosimilar to Eylea |

Biocon Biologics |

Yesafili, a biosimilar to Eylea, is a vascular endothelial growth factor (VEGF) inhibitor indicated for treating many retinal conditions that cause visual impairment. |

|

2. |

WuXiHigh 2.0 |

WuXi Biologics |

WuXiHigh 2.0 is a high-throughput formulation development platform designed for high-concentration biologics. |

|

3. |

Psoriatic Arthritis Injection ‘Ustekinumab BS Subcutaneous Injection [YD]’ |

Biocon Biologics |

Ustekinumab, a monoclonal antibody, is approved for the treatment of psoriasis vulgaris and psoriatic arthritis (PsA). |

|

4. |

Sintilimab |

Mankind Pharma and Innovent Biologics |

Sintilimab, a cutting-edge PD-1 immunotherapy, provides access to a transformative cancer treatment option. |

Eli Lilly & Company, Samsung Biologics, F Hoffmann La Roche, Celltrion Addgene, Amgen, AbbVie Inc., Sanofi, Pfizer Inc., Merck & Co. Inc, and Novo Nordisk A/S dominate the biologics market. Pfizer leads in oncology biologics, while Biocon continues to make strides in the U.S. market with its biosimilars. Companies are forming partnerships to strengthen their R&D and manufacturing capabilities.

• Strategic Partnerships: For instance, Samsung Biologics is partnering with other biopharmaceutical companies to expand its contract manufacturing services, anticipating a 15% year-over-year increase in contract manufacturing revenue.

Source: Business Standard, Bio Spectrum Asia, Medical Dialogues, and EHealth

Customize this Study as Per Your Requirement@ https://www.statifacts.com/stats/customization/6997

Major Trends in the Biologics Market

How do Technological Advancements drive the Global Biologics Market?

Advancement in gene therapy & biotechnology, and increasing investment in

cell and gene therapies driving the growth of the biologics market.

• Advancement in gene therapy and biotechnology: Genetic

therapies are used to prevent, treat, or cure specific inherited disorders like

sickle cell disease, beta thalassemia, hemophilia, alpha-1 antitrypsin

deficiency, and cystic fibrosis. They may also maybe used to treat cancers or

infections, including HIV. Recent technological advancements have propelled the

field of gene therapy forward,

opening up new avenues for clinical translation. Two mainly noteworthy

developments are using viral vectors for gene delivery and the advent of

CRISPR-Cas9 for precise gene editing. From revolutionary healthcare

advancements to groundbreaking approaches in agriculture and environmental

conservation, biotechnology harnesses

the power of scientific research to propel us towards a more sustainable and

healthier future.

• Increasing investment in cell and gene therapies: Cell and gene therapy, despite its potential to cure rare diseases like sickle cell disease. Gene therapy can be used to reduce disease levels of a disease-causing version of a protein, increase production of disease-fighting proteins, or produce new or modified proteins. Cell therapy is the transfer of intact, live cells into a patient to help lessen or cure a disease. The rising demand for cell and gene therapy products is driving investment from both private and government organizations.

Market Drivers and Restraints

Drivers

• Rising Biosimilars Adoption: Biosimilars, highly similar to already approved biologic drugs, are driving growth due to their lower cost. The global biosimilars market is expected to grow by 30% by 2025 as healthcare systems and payers increasingly favor these more affordable alternatives.

•

Technological

Advancements: Technologies such as CRISPR-Cas9 for gene editing are

revolutionizing biologic therapies, especially in areas like gene therapies for

inherited disorders, cancers, and autoimmune diseases.

•

Rising

Chronic Diseases: The prevalence of chronic diseases like cancer, diabetes, and

cardiovascular diseases is rising globally. According to the WHO, chronic

diseases are responsible for 71% of all deaths worldwide, fueling the demand

for biologics to manage and treat these conditions effectively.

Restraints

• Regulatory Challenges: The regulatory process for biologics is more stringent compared to traditional drugs due to the complexity of their production. For example, biologics take, on average, 1-2 years longer for approval compared to small-molecule drugs.

•

High

Production Costs: The complex manufacturing process for biologics results in

significantly higher production costs than for small-molecule drugs. These

costs, in some cases, can exceed USD 1,000 to 2,000 per unit.

Which Potential Factors Impose Significant Concerns Related Market’s Growth?

Regulatory complexities and high production costs are potential factors that

impose significant concerns related to the market’s growth.

• Regulatory complexities: Regulatory complexities

in biologics due to manufacturing and characterizing a biologic. Biologics are

sensitive to manufacturing conditions. Minor differences in manufacturing can

impact the safety and efficacy of biologics. The manufacturing process, controls,

limits, and specifications can vary due to the intrinsic variability of the

manufacturing processes, but are controlled within. Biological drug developers

must adeptly manage these complexities to improve their therapies through

clinical trials.

• High production costs: High production costs of biologics are due to they are very complex to make. They are derived from living cells, unlike traditional drugs, which are made from chemicals. Scientists need advanced technology to create biologics. The production of biologics needs intricate manufacturing processes within a highly regulated environment, leading to high production expenses. The development and manufacturing costs of biologics are significantly higher than those for small-molecule drugs.

How Big is the Development of the Biologics Platforms?

A biologic platform is a software solution that centralizes and streamlines the

discovery, development, and manufacturing of biological products. It includes

tools for experiment tracking, sample management, inventory, data analysis, and

workflow automation. Modern biologics platform benefits include automating

routine tasks, reducing errors, easy-to-maintain audit trials &

documentation, collaboration tools, sample & inventory management, easy to

access & analyze, and integrated workflow support.

Biologic software platforms

can allow informed, data-driven decision making, manage plate layouts &

experimental conditions, track samples and their complete lineage, and

centralize & standardize experimental data. It also supports regulatory

compliance, automates repetitive tasks, and fosters collaboration for

fast-paced research environments.

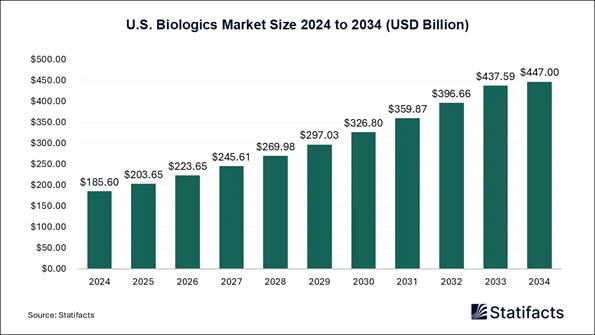

U.S. Biologics Market Size 2024 to 2034

The U.S. biologics market size accounted for USD 185.6 billion in 2024 and is predicted to touch around USD 447 billion by 2034, growing at a CAGR of 9.18% from 2025 to 2034.

How Big is the Success of the North American Biologics Market?

North America dominated the global biologics market in 2024. Growing adoption

of biosimilars, focus on core competencies like drug discovery, research,

and market strategy, making outsourcing a strategic choice, increasing

investment in research and development, and increasing investment in

infrastructure development required for large-scale biologics manufacturing, contributing

to the growth of the market in the North American region.

• In April 2025, multi-billion-dollar investments to significantly expand manufacturing and R&D infrastructure in the United States to meet growing demand for biologics and innovation were individually announced by Regeneron and Roche.

Source: Pharmexec

How is the Opportunistic rise of Asia Pacific in the Biologics Market?

Asia Pacific is projected to host the fastest-growing market in the coming

years. Accelerating timelines for clinical trials, government

funding for biopharmaceutical innovation,

accelerating product development, and rising regulatory support for biologics

development are contributing to the growth of the biologics market in the Asia

Pacific region.

How is the Prestigious move of India, China, and Japan?

• In May 2025, market access coverage for its biosimilar Ustekinumab, marketed as Yesintek, in the United States was secured by Biocon Biologics Ltd (BBL), a subsidiary of Biocon Ltd, which is a significant step for India’s biopharmaceutical innovation on the global stage. This development marks a major commercial breakthrough for the company, with the product now covered across health plans representing over 100 million insured lives, a sizeable portion of the U.S. population.

Source: Ehealth

Ready to Dive Deeper? Visit Here to Buy Databook and In-depth Report Now! https://www.statifacts.com/order-databook/6997

Biologics Market Report Coverage:

|

Report Attributes |

Statistics |

|

Market Size in 2024 |

USD 444.38 Billion |

|

Market Size in 2025 |

USD 487.04 Billion |

|

Market Size in 2030 |

USD 777.28 Billion |

|

Market Size in 2032 |

USD 941.37 Billion |

|

Market Size by 2034 |

USD 1,126.96 Billion |

|

CAGR 2025-2034 |

9.75% |

|

Leading Region in 2024 |

North America |

|

Fastest Growing Region |

Asia Pacific |

|

Base Year |

2024 |

|

Forecast Years |

2025-2034 |

|

Segments Covered |

Source, Product, Indication, Manufacturing, Distribution Channel, and Region |

|

Region Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

|

Key Players |

Eurofins Scientific, Evotec, Twist Bioscience, Genscript Technology Corporation, Biocytogen, Sartorius AG, Danaher Corporation, Fairjourney Biologics S.A, Creative Biolabs, Charles River Laboratories |

Biologics Market Segmentation

Source Insights

The microbial segment held a dominant presence in the biologics market in 2024. Microbial biotechnology, the technological application of microorganisms, has been instrumental in producing significant natural bioactive products. These include therapeutic enzymes, toxoid vaccines, immunosuppressants, antivirals, antiparasitic, anticancer drugs, antifungals, and antibiotics. Microbial biotechnology has the potential to transform a range of industries.

The mammalian segment is expected to grow at the fastest rate in the market

during the forecast period of 2025 to 2034. Mammalian have the ability to

closely mimic cellular processes and responses, making them a preferred choice

in drug discovery, therapy production, and research. Mammalian cell line

provides a cellular environment that matches the native environment for protein

production. These treatments can complement other cancer treatments to help

fight the disease from multiple angles.

Product Insights

The monoclonal antibodies (MABs) segment accounted for a considerable share of the biologics market in 2024. One key benefit of the monoclonal antibodies (MABs) is that they have been used to make drugs that have been more successful at treating specific diseases, like some cancers.

The vaccines segment is projected to experience the fastest rate of market

growth from 2025 to 2034. Vaccines help our immune system fight infections

faster and more effectively. Vaccinations are effective tools to reduce the

detrimental effects of infectious disease, decrease child mortality rates, and

eradicate major pathogens and viruses like smallpox. It uses our body’s natural

defenses to build resistance to specific infections and makes our immune system

stronger.

Indication Insights

The oncology segment leads the biologics market. Biological therapy for cancer is a treatment that helps the body’s immune system kill cancer cells. Biologics make cancer cells grow like normal cells, to make them less likely to spread. Block the process that changes a normal cell into a cancer cell. Help repair normal cells damaged by chemo or radiation therapy. It helps to prevent cancer cells from spreading to other parts of our body.

The cardiovascular diseases segment is set to experience the highest growth

rate from 2025 to 2034. The clinical use of biologics is limited for

cardiovascular diseases, which are the primary cause of morbidity and mortality

worldwide. The advent of biologic therapy has improved our ability to treat

disease in an increasingly targeted manner. In cardiovascular disease (CVD),

the use of biologics has steadily increased over the past several decades.

Manufacturing Insights

The in-house manufacturing segment registered its dominance over the biologics market in 2024. With an in-house production team, it is easier to keep an eye on the quality of the product. The tasks conducted by every member of the team can be assessed and calibrated on the spot. Additionally, it is more convenient to ensure that everyone is meeting the deadlines and that the planned workflow is running smoothly.

The outsourced manufacturing segment is anticipated to grow with the highest

CAGR in the market during the studied years. Out-sourced manufacturing benefits

include allowing businesses to access specialized expertise, reduce costs,

enhance customer service, and focus on core activities that drive growth. In

addition, outsourcing provides scalability, flexibility, and risk mitigation,

making it an essential strategy in today’s competitive marketplace.

Distribution Channel Insights

The Hospital Pharmacies segment dominated the biologics market. The main goal of hospital pharmacy is to manage the use of medications in hospitals and other medical centers. Hospital pharmacy has access to continuous learning and professional development through hospital training programs, opportunities for specialization in areas like critical care, oncology, and infectious disease.

The Online pharmacies segment is projected to expand rapidly in the market in

the coming years. Online pharmacies' benefits include quick delivery, medicine

substitutes, improved patient assistance, discreet purchasing, consolidating

prescriptions, availability, wider product range, competitive pricing on

medications, medication management, lower costs, time saving, and convenient.

See More Related Reports:

• The global inhalable biologics market size was calculated at USD 3,796 million in 2024 and is predicted to attain around USD 19,368 million by 2034, expanding at a CAGR of 17.7% from 2025 to 2034.

• The global self-administered biologics market size is predicted to gain around USD 147.48 billion by 2034 from USD 94.06 billion in 2024 with a CAGR of 4.6%.

• The global biopharmaceuticals manufacturing consumables testing market size accounted for USD 638 million in 2024 and is predicted to touch around USD 2,072 million by 2034, growing at a CAGR of 12.5% from 2025 to 2034.

• The global synthetic biology market size is calculated at USD 16,260 million in 2024 and is predicted to reach around USD 80,870 million by 2034, expanding at a CAGR of 17.4% from 2025 to 2034.

• The U.S. biopharmaceuticals

market size is worth around USD 163.19 billion in 2024 and is

predicted to hit around USD 635.37 billion by 2034, growing at a CAGR of 14.56%

from 2024 to 2034.

Competitive Landscape in the Biologics Market

• Eli Lilly & Company

• Samsung Biologics

• F Hoffman La Roche

• Celltrion Addgene

• Amgen

• AbbVie Inc.

• Sanofi

• Pfizer Inc.

• Merck & Co. Inc

• Novo Nordisk A/S

What is Going Around the Globe?

• In June 2025, the launch of Samsung Organoids advanced drug screening services to support clients in drug discovery and development was announced by Samsung Biologics, a leading contract development and manufacturing organization (CDMO). Samsung organoids support precision screening to predict patient responses, streamline preclinical development, and accelerate timelines toward investigational new drug (IND) filings through data-driven analysis of candidate molecules.

Source: PR Newswire

• In July 2025, the launch of NIOPEG®, the Company’s first Biosimilar drug on the market, was announced by Nora Pharma Inc., a wholly owned Canadian subsidiary of Sunshine Biopharma Inc., a pharmaceutical company offering and researching life-saving medicines in a variety of therapeutic areas, including oncology and antivirals.

Source: Access News Wire

Segments Covered in the Report

By Source

• Microbial

• Mammalian

• Others

By Product

• Monoclonal Antibodies

o Human mABs

o Humanized mABs

o Chimeric mABs

o Murine mABs

• Vaccines

• RecombinantProteins

• Antisense, RNAi & molecular therapy

• Cell Based Therapies

• Stem Cell Therapy

o CAR-T Cell Therapy

o Tissue Engineering

o Others

By Indication

• Oncology

• Immunological Disorders

• Cardiovascular Disorders

• Hematological Disorders

• Others

By Manufacturing

• Outsourced

• In-house

By Distribution Channel

• Hospital Pharmacies

• Retail Pharmacies

• Online Pharmacies

By Region

• North America

• Europe

• Asia-Pacific

• Latin America

• Middle East and Africa

Ready to Dive Deeper? Visit Here to Buy Databook and In-depth Report Now! https://www.statifacts.com/stats/databook-download/6997

𝐀𝐛𝐨𝐮𝐭 𝐔𝐬:

Statifacts is a global market intelligence and consulting leader, committed to delivering deep strategic insights that fuel innovation and transformation. With a sharp focus on the fast-evolving landscape of life sciences, we excel at navigating the intricacies of cell and gene therapies, oncology, and drug development. We empower our clients, ranging from biotech pioneers to institutional investors with the intelligence needed to lead in high-impact areas like regenerative medicine, cancer therapeutics, and precision health. Our broad expertise across the pharma-biotech value chain is backed by robust, statistically driven data for every market we cover, ensuring decisions are informed, forward-looking, and built for impact.

Statifacts offers subscription services for data and analytics insights. This page provides options to explore and purchase a subscription tailored to your needs, granting access to valuable statistical resources and tools. Access here - https://www.statifacts.com/get-a-subscription

Connect with Us

Ballindamm 22, 20095 Hamburg, Germany

Europe: +44 7383092044

Web: https://www.statifacts.com/

For Latest Update Follow Us: https://www.linkedin.com/company/statifacts

Our Trusted Data Partners:

Precedence Research | Towards Healthcare | Nova One Advisor