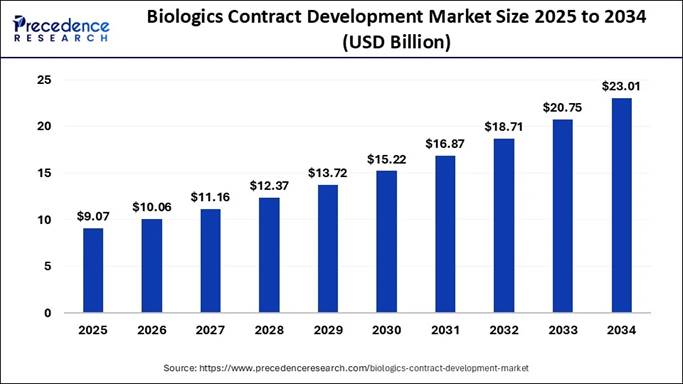

According to Precedence Research, the global biologics contract development market size is expected to surpass approximately USD 23.01 billion by 2034, fueled by outsourcing demand, oncology therapeutics, and personalized medicine.

The global biologics contract development market size accounted for USD 9.07 billion in 2025 and is expected to grow from USD 10.06 billion in 2025 to approximately USD 23.01 billion by 2034. The market is representing a double-digit compounding annual growth rate (CAGR) of 10.90% from 2025 to 2034.

The biologics contract development market is an important part of the development of complicated procedures of drug development and production methods. Genetically engineered proteins sourced from human gene technologies, referred to as biologics, are designed to target immune cascades and vary extensively to cover several products, including gene therapy, vaccines, blood components, and recombinant proteins. The growing demand for personalized or individualized medicine, soaring cases of chronic and genetic ailments, and the fast-tracking of cutting-edge biologic treatments.

Note: This

report is readily available for immediate delivery. We can review it with you

in a meeting to ensure data reliability and quality for decision-making.

📥 Download Sample Pages

for Informed Decision-Making 👉 https://www.precedenceresearch.com/sample/3056

Biologics Contract

Development Market Key Highlights: 🔹In terms of revenue, the

biologics contract development market was calculated at USD 8.18 billion in

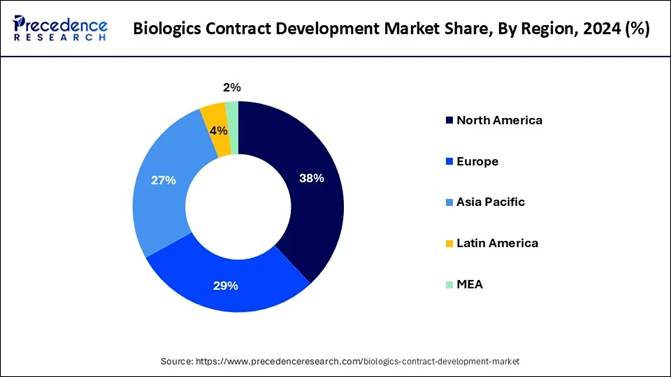

2024. 🔹It is anticipated to reach USD 23.01 billion by 2034. 🔹The North

America accounted for the largest market share of 38% in 2024. 🔹Asia Pacific is

expected to grow at a notable CAGR during the projected period. 🔹By Indication,

the oncology segment

captured the biggest market share in 2024. 🔹By Indication,

the immunological disorders segment is expected to expand at the fastest CAGR

in the coming years 🔹By product service, the

process development segment contributed the highest market share in 2024. 🔹By product service, the

cell line development segment is expected to expand at a rapid pace in the

coming years. 🔹By source, the mammalian segment generated the major

market share in 2024. Biologics Contract

Development Market Overview and Industry Potential Outsourcing and Innovation

Boost Biologics Development Market The increasing tendency of pharmaceutical and biopharmaceutical companies to outsource

their production can be considered one of the leading factors in the biologics

contract development market. This strategy also provides an opportunity to

access high-tech platforms and products, unique facilities, and regulatory

expertise that are essential to the complicated development of biologics,

including gene therapies, monoclonal antibodies, and vaccines. Outsourcing to biologics CDMOs, as

pharmaceutical companies focus on efficiency, cost-effectiveness, and

innovation, is projected to remain a robust growth driver of the industry. Major Trends in Biologics

Contract Development Market: ➡️ Rising Demand for Biologics:

Increasing

prevalence of chronic diseases and the shift toward biologic therapies is

driving the need for specialized development services. ➡️ Expansion of Outsourcing: Biopharmaceutical companies

are increasingly outsourcing development stages to reduce cost, time, and

complexity. ➡️ Technological Advancements:

Adoption of artificial intelligence (AI), automation, and

high-throughput screening in biologics development is accelerating timelines

and enhancing accuracy. ➡️ Growth in Monoclonal

Antibody Development: High

demand for monoclonal antibodies is fueling

contract development projects, especially in oncology and

autoimmune diseases. ➡️ Focus on Biosimilars: As patents expire, the demand

for biosimilar development services is

increasing,

creating opportunities for CDMOs. ➡️ Emergence of Small and

Virtual Biotech Firms: Smaller

biotech firms, often lacking in-house capabilities, are increasingly relying on

contract development partners. Mergers and Collaborations

Strengthen Biologics Contract Development Capabilities The mergers and alliances are significantly

helping to fortify the potential of the biologics contract development market.

Mergers and acquisitions allow CDMOs to increase their service offerings,

incorporate advanced technologies, and offer end-to-end capabilities, including

drug development to large-scale commercial production. Through these

partnerships, companies are better positioned to speed up time-to-market, to

mitigate risks, as well as address the increasing global demand for innovative

biologics. High Production Costs

Challenge the Biologics Contract Development Market Biologics are complex and complicated, and

all these factors make it even more expensive; they need advanced manufacturing

facilities, have intricate bio-processing equipment, and regulatory compliance.

The small and mid-sized companies, especially, encounter financial limitations

when intensifying outsourcing with CDMOs since the price of expertise and

quality control may prove to be too high. This has resulted in high capital

demand for biologics development and little adaptability in production, as a major

inhibiting factor in the market. Scope of Biologics

Contract Development Market

Report Attributes Key Statistics Market Size in 2024 USD 8.18 Billion Market Size in 2025 USD 9.07 Billion Market Size in 2031 USD 16.87 Billion Market Size by 2034 USD 23.01 Billion Growth Rate 2025 to 2034 CAGR of 10.89% Leading Region in 2024 North America Base Year 2024 Forecast Period 2025 to 2034 Segments Covered Source, Product Service, Indication, and Region Regions Covered North America, Europe, Asia-Pacific, Latin America, and Middle

East & Africa

➡️ Become a valued research

partner with us ☎ https://www.precedenceresearch.com/schedule-meeting Biologics Contract

Development Market Key Regional Analysis: How Big is the U.S.

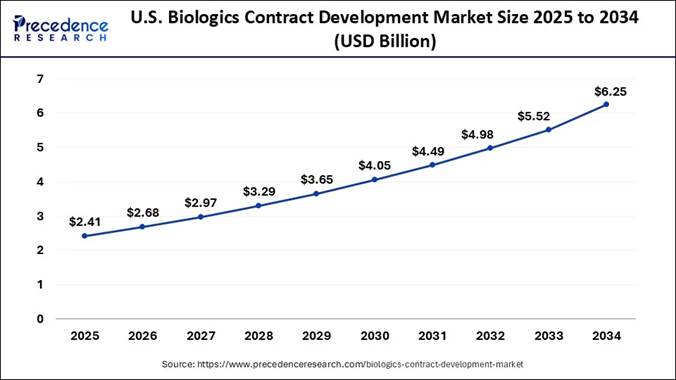

Biologics Contract Development Market? According to Precedence Research, the U.S.

biologics contract development market size has been evaluated at USD 2.41

billion in 2025 and is expected to exceed USD 6.25 billion by 2034. The market

is projected to grow at a notable CAGR of 11.11% from 2025 to 2034. North America held the

dominant share of the biologics contract development market in 2024, due to the

high industry and the increasing healthcare needs. This region is taking

advantage of the increasing incidence of chronic conditions that include

cancer, diabetes, and autoimmune diseases, contributing to the increased demand

for advanced biologics. Also, the major presence of key CDMO industry players,

well-developed infrastructure, and investments in research and development

facilitate the region's dominance. The region is also the leader in new drug

approvals, providing an opportunity to produce and commercialize biologics. What’s Driving Asia

Pacific’s Surge in Biologics Contract Development Market? Asia Pacific is expected

to expand notably during the forecast period, supported by an increasing

number of medical investments, affordable clinical trials, and affordable

medical expertise. India, China, and South Korea have become one of the most

preferred countries in clinical research with the availability of good

infrastructure, growing pharmaceutical industries, and supportive government

policy towards encouraging outsourcing and foreign investment. Biologics Contract

Development Market Segmentation Analysis: By Source Analysis: Why Did the Mammalian

Segment Dominate the Biologics Contract Development Market in 2024? The mammalian segment

dominated the market with the largest share in 2024, attributed to its high

application level in the production of complex biologics like synthetic

hormones, monoclonal antibodies, and therapeutic enzymes. The mammalian

cell cultures are important

in the production of viral vaccines, which are critical in fighting infectious

diseases in the world. As new forms of chronic illnesses and the need to access

new forms of advanced biologics are on the rise, the use of mammalian systems

results in the gold standard of biopharmaceutical manufacturing. The microbial segment is

the second-largest segment in 2023 and is projected to grow steadily in the

coming years, driven by its high productivity, affordability, and the growing

list of applications. In the production of recombinant proteins, including

insulin, antibody fragments, enzymes, and vaccines, microbial systems –

especially bacteria and yeast are commonly used. Pharmaceutical and

biotechnology companies are interested in them due to their affordability in

the provision of high-volume production. The growing use of biologics in all

therapeutic areas has also enhanced the demand for microbial-based contract development.

By Product Service

Analysis: How Does the Process

Development Segment Maintain Its Dominance in the Current Industry? The process development segment

held the largest share of the market in 2024, driven by the critical

potential in assuring the efficiency, scalable, and high-quality production of

biologic products. There are crucial techniques used in the biologics process

development, and they include upstream and downstream processing. Upstream

process engineering focuses on cell line expression and bioreactor hardware

variable operating conditions to obtain the desired optimal yield and

efficiency. Conversely, downstream processing is a technique that deals with

the purification and isolation of the biologics from host cell proteins to render the

product safe and efficacious. The cell line development

segment is expected to expand at a rapid pace in the coming years because of the

rising demand for recombinant proteins, monoclonal antibodies, and complex

biologics to treat chronic and genetic diseases. High-expression

biopharmaceutical proteins are important using recombinant cell lines that

allow the scalability of drug development and cost-effective drug development.

The increasing incidence of cancer, autoimmune diseases, and other chronic

disorders has led to an augmented demand for innovative protein-based therapies,

creating the necessity to have quality cell line development services. By Indication Analysis: Why Did the Oncology

Segment Dominate the Biologics Contract Development Market in 2024? The immunological

disorders segment is expected to expand at the fastest CAGR in the coming years, due to the

increasing incidence of autoimmune disorders like arthritis, lupus, and

rheumatologic disorders. The rising awareness among patients regarding the

disorders has enhanced the need to know more about early diagnosis, prevention,

and effective treatment of these disorders. Biologics are highly useful in the treatment

of autoimmune conditions that control abnormal immune responses and exert a

specific therapeutic effect. Key Companies and Market

Share Insights The top players in the biologics contract

development market are the Lonza Group, WuXi AppTec, and Samsung Biologics.

Lonza has the benefit of worldwide expertise with biomanufacturing in both the

clinical and commercial space, and WuXi AppTec can integrate all services and

provide flexible outsourcing. Prominent competing companies such as

Fujifilm Diosynth Biotechnologies, Thermo Fisher Scientific, and AGC Biologics

are expanding their potential through internationalization, innovativeness, and

strategic alliances, which are chief factors in establishing growth and

competitiveness within the fields of biologics CDMOs. Top Companies in Biologics

Contract Development Market & Their Contribution ➢ Abzena Ltd – Provides fully

integrated solutions for biologic drug discovery, development, and

manufacturing with strong capabilities in antibody engineering. ➢ AGC Biologics – Offers comprehensive

biologics CDMO services including cell line development, process development,

and clinical to commercial manufacturing. ➢ Bionova Scientific, Inc. – Specializes in cell line

and process development for complex biologics, particularly monoclonal

antibodies. ➢ BioXcellence – A division of Merck KGaA

delivering high-quality biologics development and GMP manufacturing services. ➢ Curia Global, Inc. – Delivers biologics

development and manufacturing solutions leveraging advanced technologies and

global infrastructure. ➢ Fujifilm Diosynth

Biotechnologies

– Recognized for its expertise in microbial and mammalian biologics development

and large-scale manufacturing. ➢ Genscript – Offers biologics

discovery and development services with a focus on gene synthesis, protein

engineering, and cell therapy support. ➢ KBI Biopharma – Provides end-to-end

biologics development and manufacturing, including analytical services and

formulation development. ➢ STC Biologics – Specializes in

biosimilar and biologic formulation development, with strong regulatory and

analytical support. ➢ Thermo Fisher Scientific

Inc.

– Offers comprehensive CDMO services for biologics through its Patheon

division, with global manufacturing facilities. ➢ WuXi Biologics – One of the largest

biologics CDMOs globally, providing integrated development and manufacturing

platforms from concept to commercial. What is Going Around the

Globe? 🔹In October

2024, Samsung Biologics launched S-HiCon, a high-concentration formulation

platform to help develop and manufacture higher-dose biopharmaceuticals. This

breakthrough is able to improve delivery efficiency with an improved solution

to complex biologics.

🔹In May 2024,

AGC Biologics, in partnership with BioConnection, established end-to-end

biopharmaceutical development and manufacturing capabilities. The partnership

will aim at combining the drug substance manufacturing with aseptic filling

into vials and syringes as clinical and commercial products.

🔹In June 2024,

Abzena partnered with Argonaut Manufacturing Services to deliver a complete

drug substance and drug product manufacturing solution. The alliance boosts the

availability of biopharmaceutical organizations to efficient development,

manufacture, and bioconjugate production. Biologics Contract

Development Market Segmentation: By Source 🔹 Microbial 🔹 Mammalian 🔹 Others By Product

Service 🔹 Cell Line

Development • Microbial • Mammalian • Others 🔹 Process Development • Upstream → Microbial → Mammalian → Others • Downstream → Impurity,

isolation, & identification → Physicochemical

characterization → Pharmaceutical

analysis → Others • By Product → MABs → Recombinant

proteins → Others 🔹Others By Indication 🔹 Oncology 🔹 Immunological

disorders 🔹 Cardiovascular

disorders 🔹 Hematological

disorders 🔹 Others By Geography 🔹 North America 🔹 Europe 🔹 Asia-Pacific 🔹 Latin America 🔹 Middle East and

Africa Thanks for reading you can also get individual

chapter-wise sections or region-wise report versions such as North America,

Europe, or Asia Pacific. ⏳ Don’t Miss Out!

| ⚡ Instant Access to

This Exclusive Report 👉 https://www.precedenceresearch.com/checkout/3056 You can place an order or

ask any questions, please feel free to contact at sales@precedenceresearch.com | +1

804 441 9344 Stay

Ahead with Precedence Research Subscriptions Unlock exclusive access to

powerful market intelligence, real-time data, and forward-looking insights,

tailored to your business. From trend tracking to competitive analysis, our

subscription plans keep you informed, agile, and ahead of the curve. Browse Our Subscription

Plans@ https://www.precedenceresearch.com/get-a-subscription About Us Precedence Research is a

global market intelligence and consulting powerhouse, dedicated to unlocking

deep strategic insights that drive innovation and transformation. With a laser focus

on the dynamic world of life sciences, we specialize in decoding the

complexities of cell and gene therapy, drug development, and oncology markets, helping our clients stay

ahead in some of the most cutting-edge and high-stakes domains in healthcare.

Our expertise spans across the biotech and pharmaceutical ecosystem, serving

innovators, investors, and institutions that are redefining what’s possible in regenerative

medicine,

cancer care, precision therapeutics, and beyond. Web: https://www.precedenceresearch.com Our Trusted Data Partners: Towards Healthcare | Nova One Advisor Get Recent News 👉 https://www.precedenceresearch.com/news For Latest Update Follow

Us: LinkedIn | Medium | Facebook | Twitter ___________________________________________________________________________ Frequently Asked Questions: ✚ What is the

biologics contract development market size? ➢ The global

biologics contract development market size is expected to increase USD 23.01

billion by 2034 from USD 8.18 billion in 2024. ✚ What will be

the CAGR of global biologics contract development market? ➢ The global

biologics contract development market will register growth rate of 10.90%

between 2025 and 2034. ✚ Who are the

prominent players operating in the biologics contract development market? ➢ The major

players operating in the biologics contract development market are Abzena Ltd,

AGC Biologics, Bionova Scientific, Inc., BioXcellence, Curia Global, Inc., Fujifilm

Diosynth Biotechnologies, Genscript, KBI Biopharma, STC Biologics, Thermo

Fisher Scientific Inc., WuXi Biologics, Boehringer Ingelheim Group, Samsung

Biologics, Lonza Group, and Others. ✚ Which are the

driving factors of the biologics contract development market? ➢ The driving

factors of the biologics contract development market are the rising adoption of

advanced technologies for biological production, increasing R&D activities

by biopharma and pharma firms, rising the number of small and medium pharmaceutical

manufacturing companies, increasing demand for pharmaceutical drugs, and

increasing merger and acquisition activities. ✚ Which region

will lead the global biologics contract development market? ➢ North America

region will lead the global biologics contract development market during the

forecast period 2025 to 2034. ➡️ Explore More Market

Intelligence from Precedence Research: 💡 Next

Generation Biologics Market: Explore how advanced biologics are

reshaping therapies and patient outcomes 💡 Biotechnology

Contract Manufacturing Market: Understand outsourcing trends

driving innovation and large-scale biologics production 💡 Fibroblast

Growth Factors Market: See how regenerative medicine and wound healing

therapies are boosting demand 💡 Contract

Manufacturing Partnerships Market: Analyze collaborations fueling

biopharma efficiency and global scalability 💡 CDMO Market Insights: Gain perspective on how

CDMOs are transforming the drug development landscape 💡 Cell

and Gene Therapy CDMO Market: Discover why cell and gene therapy

outsourcing is accelerating clinical pipelines 💡 Pharmaceutical

CDMO Market:

Track how pharma companies rely on CDMOs for speed, quality, and compliance 💡 U.S.

Pharmaceutical CDMO Market: Explore why the U.S. leads in

advanced outsourcing and biologics partnerships 💡 Topical

Drugs CDMO Market: Understand rising demand for CDMOs in dermatology and

transdermal drug delivery 💡 Europe

Pharmaceutical CDMO Market: See how European CDMOs are scaling

biologics and complex formulations 💡 mRNA

Therapeutics CDMO Market: Discover outsourcing opportunities

fueled by rapid mRNA-based therapy adoption 💡 Pharmaceutical

CDMO for Formulations Market: Explore CDMO capabilities in drug

formulation, stability, and delivery solutions 💡 Investigational

New Drug CDMO Market: Learn how CDMOs accelerate IND applications and

clinical trial readiness 💡 Contract

Development and Manufacturing Organization Outsourcing Market: See how outsourcing is

shaping global drug development strategies 💡 Anti-Inflammatory

Biologics Market:

Analyze how biologics are redefining treatment for autoimmune and chronic

diseases 💡 Vaccine

Contract Manufacturing Market: Track how outsourcing supports

vaccine scale-up and global immunization efforts 💡 Drug

Discovery Services Market: Understand how AI and outsourcing

accelerate early-stage drug innovation 💡 Biopharmaceutical

CMO and CRO Market: Explore synergies between CMOs and CROs driving

efficiency in biopharma 💡 Small

Molecule Innovator CDMO Market: Learn how CDMOs support novel small

molecule development and commercialization 💡 Healthcare

Contract Manufacturing Market: See how outsourcing strengthens

medical devices, diagnostics, and pharma supply chains 💡 Drug

Discovery Outsourcing Market: Discover how outsourcing reduces R&D

costs and accelerates therapeutic pipelines