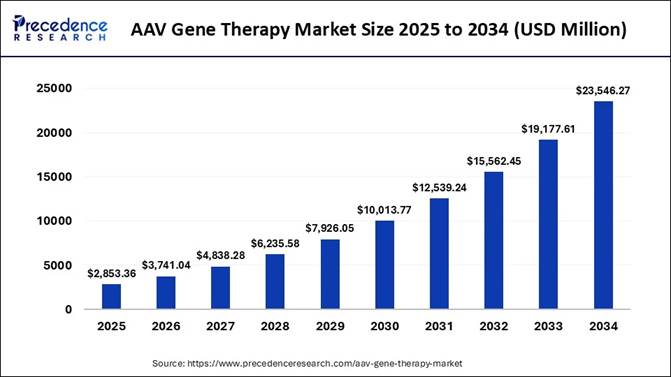

The global AAV gene therapy market size is expected to be worth USD 23,546.27 million by 2034, driven by rising approvals, expanding therapeutic applications, and increasing investments in advanced genetic treatment innovations.

According to Precedence Research, the global AAV gene therapy market size is calculated at USD 2,853.36 million in 2025 and is expected to grow from USD 3,741.04 million in 2026 to nearly USD 23,546.27 million by 2034. In terms of CAGR, the market is expected to expand at a healthy compound annual growth rate (CAGR) of 26.43% from 2025 to 2034.

AAV Gene Therapy Market Highlights:

🔹 North America dominated the

global AAV gene therapy market with a 42.19% share in 2024.

🔹

Asia Pacific is projected to grow at the fastest CAGR between 2025 and 2034.

🔹

Neurological disorders led the therapeutic area segment with a 29.4% share in

2024.

🔹

Muscular disorders are expected to record the fastest CAGR through the forecast

period.

🔹

AAV9 was the leading vector serotype, contributing 27.60% of the market in

2024.

🔹

Engineered / synthetic / hybrid capsids are anticipated to grow at a notable

CAGR over the projected period.

🔹

Intravenous (I.V.) administration held the highest share at 36.80% in 2024.

🔹

Intrathecal (I.T.) administration is expected to grow at a notable CAGR during

the forecast period.

🔹

Clinical therapies captured the largest share at 48.7% within the application

stage in 2024.

🔹

Commercialized therapies are projected to expand at a notable CAGR over the

forecast period.

🔹

In-house manufacturing accounted for 54.1% of the market in 2024.

🔹

CDMOs / vector production facilities are expected to grow at a notable CAGR

over the projected period.

🔹

Pharmaceutical and biotechnology companies generated the highest end-user share

at 52.8% in 2024.

🔹 Contract

research organizations (CROs) are projected to expand at a

notable CAGR during the forecast period.

AAV Gene Therapy Market Overview

and Industry Potential

The adeno-associated virus (AAV) gene therapy market is poised for transformative growth as demand accelerates for safer, more stable, and more efficient gene-delivery technologies. AAV vectors have become the preferred platform for numerous gene therapy programs because they offer a strong balance of safety, tissue specificity, and long-term expression.

As gene therapy shifts from experimental to clinically validated treatment options, AAVs are increasingly being incorporated into therapeutic pipelines addressing both rare and common diseases. Advancements in vector engineering, improved manufacturing systems, and rising investments from biotechnology and pharmaceutical companies further strengthen the commercial potential of this market. With a growing number of late-stage clinical trials and increasing regulatory support, the AAV gene therapy space is expected to expand rapidly, reshaping the future of genetic medicine.

Dive Into the Full Evidence-Backed Market Blueprint, Visit

Here 👉https://www.precedenceresearch.com/aav-gene-therapy-market

AAV

Gene Therapy Market Opportunity The

greatest growth potential for AAV gene therapy lies in its expanding use for

rare and ultra-rare diseases, where traditional treatments are limited or

nonexistent. Many of these conditions stem from a single genetic defect, making

them ideal candidates for AAV-mediated correction. As a result, biotech

companies are aggressively pursuing regulatory approvals for AAV-based

therapies, aiming to secure first-mover advantage in underserved therapeutic

areas.

Regulatory agencies increasingly encourage innovation in rare disease

treatments through accelerated approval pathways, orphan drug designations, and

financial incentives, further boosting the market’s attractiveness. As several

AAV therapies progress through late-stage development and approach

commercialization, they are expected to unlock substantial revenue

opportunities and draw significant attention as next-generation therapeutic

breakthroughs. Restraint:

High Production Cost and Manufacturing Complexity Despite

strong growth prospects, the AAV gene therapy market faces substantial barriers

due to the complexity and cost of vector manufacturing. Producing AAV at

clinical-grade quality requires highly controlled environments,

state-of-the-art bioreactors, stringent purification processes, and extensive

quality testing to ensure safety and consistency. These requirements

significantly increase production costs, posing challenges for both emerging

companies and large-scale manufacturers. Additionally,

the industry suffers from limited availability of skilled personnel with

expertise in gene vector development and GMP manufacturing. The combined burden

of specialized infrastructure, long production timelines, and stringent

regulatory requirements may slow market expansion and hinder new entrants from

competing effectively. Until scalable, cost-efficient manufacturing

technologies are widely adopted, production constraints will remain a notable

restraint on industry growth. ➡️

Become a valued

research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting AAV Gene Therapy Market Scope and Strategic

Coverage

|

Report Attributes |

Key Details |

|

Market Size in 2025 |

USD 2,853.36 Million |

|

Market Size in 2026 |

USD 3,741.04 Million |

|

Market Size by 2034 |

USD 23,546.27 Million |

|

Growth Rate (2025–2034) |

CAGR of 26.43% |

|

Dominating Region (2024) |

North America (42.19% market share) |

|

Fastest-Growing Region |

Asia Pacific (Strongest CAGR through 2034) |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2034 |

|

Market Drivers |

Rising FDA approvals, expanding gene therapy pipelines, and increased investment in advanced vector engineering |

|

Market Challenges |

High manufacturing costs, GMP capacity shortages, and limited large-scale vector production infrastructure |

|

Market Opportunities |

Growing demand for rare disease therapies, rapid expansion of AAV-based CNS and muscular disorder treatments, and advancements in synthetic/engineered capsids |

|

Leading Vector Serotype (2024) |

AAV9 (27.60% share) |

|

Fastest-Emerging Vector Type |

Engineered/Synthetic/Hybrid AAV Capsids |

|

Top Route of Administration (2024) |

Intravenous (I.V.) – 36.80% share |

|

High-Growth Delivery Route |

Intrathecal (I.T.) for CNS gene delivery |

|

Largest Application Stage (2024) |

Clinical Therapies (48.7% share) |

|

Fastest-Growing Application Stage |

Commercialized Therapies |

|

Leading Manufacturing Type (2024) |

In-house Manufacturing (54.1% share) |

|

Fastest-Growing Manufacturing Type |

CDMOs / Vector Production Facilities |

|

Top End User (2024) |

Pharmaceutical & Biotechnology Companies (52.8% share) |

|

Fastest-Growing End User |

Contract Research Organizations (CROs) |

|

Segments Covered |

Therapeutic Area, Vector Serotype, Route of Administration, Application Stage, Manufacturing Type, End-User, Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Key Clinical Focus Areas |

Neurological Disorders, Muscular Disorders, Ophthalmic Diseases, Hematologic Conditions, Metabolic Disorders |

|

Regulatory Tailwinds |

Orphan drug designations, accelerated approvals, and supportive frameworks for rare disease gene therapies |

|

Commercial Momentum |

Increasing approvals of AAV therapies (e.g., Zolgensma, Luxturna) and expanding late-stage pipelines in CNS and muscular diseases |

|

Technological Advancement |

Rapid evolution of AI-driven vector design, improved tropism engineering, and scalable bioreactor-based AAV production |

Immediate Delivery Available | Buy This Premium Research Report@

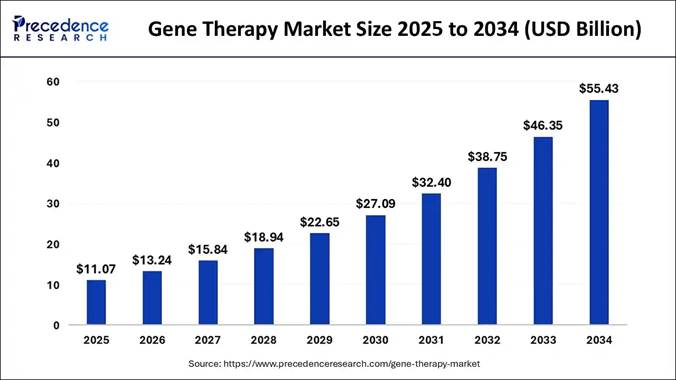

https://www.precedenceresearch.com/checkout/6873 How the Global Gene Therapy Market

Accelerates Growth in the AAV Gene Therapy Market The global

gene therapy market size is projected to

surpass USD 55.43 Billion by 2034 with a healthy CAGR of 19.60% from 2025 to

2034, as the parent ecosystem, establishes the

scientific, regulatory, and commercial foundation that directly accelerates the

rise of the AAV gene therapy market. As gene therapy gains broader acceptance in

clinical practice—especially in treating rare diseases, oncology, and inherited

disorders—AAV vectors benefit from strengthened R&D pipelines, improved

regulatory pathways, and a rapidly expanding manufacturing infrastructure. 🔹 The

parent gene therapy market drives technological innovation, including advanced

viral vector engineering, scalable bioprocessing systems, and improved delivery

mechanisms, all of which enhance AAV efficiency and safety. Together, these dynamics show how the broader

gene therapy landscape acts as both a catalyst and growth engine

for the AAV segment, enabling faster commercialization, wider therapeutic

applicability, and sustained market expansion. The

Complete Study is Now Available for Immediate Access | Download the Sample

Pages of this Report@ https://www.precedenceresearch.com/sample/1462 Key Ways the

Gene Therapy Market Supports AAV Gene Therapy Advancement 🔹 Shared

Clinical & Manufacturing Infrastructure – GMP suites, QC systems, and clinical trial networks built for

gene therapy reduce barriers for AAV development. Browse Detailed Insight 👉 https://www.precedenceresearch.com/gene-therapy-market Strategic Market Comparison: Positioning AAV

Gene Therapy Within the Global Gene Therapy Ecosystem

Parameter AAV

Gene Therapy Market Gene

Therapy Market (Parent Market) Market

Size in 2025 USD

2.85 Billion USD

11.07 Billion Market

Size in 2026 USD

3.74 Billion USD

13.24 Billion Market

Size by 2034 USD

23.54 Billion USD

55.43 Billion Growth

Rate (CAGR) 26.43%

(2025–2034) ~ 19.60 % (2025–2034) Market

Nature Specialized

sub-segment focused on AAV vector delivery Broad

market covering all gene therapy modalities Key

Drivers AAV9

adoption, rare disease focus, CNS & muscular disorder pipelines, FDA

approvals Oncology

dominance, rare disease demand, improved vector engineering, global

regulatory support Core

Technologies AAV

serotypes (AAV1–AAV12), engineered/synthetic capsids, IV/IT delivery AAV,

lentiviral, adenoviral, retroviral vectors, CRISPR & gene editing Dominating

Region North

America (42.19%) North

America (54%) Fastest-Growing

Region Asia

Pacific Asia

Pacific Major

Applications CNS,

muscular, ophthalmology, metabolic, hematology Oncology,

rare diseases, chronic disorders, regenerative medicine Industry

Maturity Early–growth

stage with rapid clinical expansion More

mature, with multiple approved therapies globally Growth

Catalysts from Parent Market Regulatory

familiarity, shared GMP capacity, strong investment pipeline Clinical

validation, robust trial ecosystem, major pharma involvement

Set up a meeting at your convenience

to get more insights instantly! https://www.precedenceresearch.com/schedule-meeting Case Study: AAV9 Gene Therapy Transforms

Early SMA Management Through a Precision-Driven Clinical Pathway A leading North American pediatric

neuromuscular center successfully redefined clinical outcomes for infants with Type

1 Spinal Muscular Atrophy (SMA) by implementing a structured,

multidisciplinary AAV9 gene therapy program. This shift—from reactive, crisis-focused

care to precision-timed intervention—demonstrates the transformative potential

of AAV-based therapies when embedded into an optimized care ecosystem. Challenge: Intervention: This model reduced variability, accelerated

treatment timelines, and ensured clinical consistency across all patient

cohorts. Outcomes: Early administration emerged as the defining

variable—infants treated before six months consistently demonstrated the

strongest functional recovery. Implications for the AAV Gene Therapy

Market: AAV Gene Therapy Market Key Regional

Analysis: North America Industry Analysis North America dominated the AAV gene therapy market in

2024, supported by its advanced research infrastructure, strong clinical trial

ecosystem, and substantial public and private investment in AAV technologies.

The region benefits from a high concentration of specialized hospitals,

well-established biotechnology hubs, and regulatory frameworks that encourage

rapid development and approval of advanced therapies. The United States leads the market with extensive

manufacturing capacity, FDA-backed innovation programs, and numerous

academic–industry collaborations, while Canada continues to grow through

national genomic

medicine initiatives, expanded rare disease research funding, and rising

partnerships with global biotech companies. These factors collectively

reinforce North America’s position as the primary center for AAV gene therapy

innovation and commercialization. Asia Pacific Industry Trends Asia Pacific is expected to experience significant

expansion in the AAV gene therapy market over the forecast period, driven by

rising investment in genetic medicine, rapid biomanufacturing advancements, and

government-supported rare disease programs. China is leading regional growth by

constructing new GMP-certified AAV production facilities and increasing

clinical trial activity, while Japan supports innovation through accelerated

regulatory pathways and strong academic, industry collaboration. South Korea is emerging as a competitive hub with

dedicated cell

and gene therapy industrial clusters and national biotech

development strategies, and India is gradually expanding its capabilities

through public–private partnerships and improved manufacturing infrastructure.

Together, these developments position Asia Pacific as one of the

fastest-growing regions for AAV gene therapy research, production, and clinical

adoption. ✚ Related

Topics You May Find Useful: ➡️ Adeno-Associated Virus Vector Manufacturing

Market:

Explore how scalable vector production is becoming the backbone of

next-generation gene therapy expansion ➡️ Single Dose Gene Therapy Market:

Understand why one-time curative treatments are reshaping pricing models,

clinical workflows, and patient outcomes ➡️ Cell and Gene Therapy Quality Control &

Analytics Market:

See how advanced QC frameworks and analytical tools are ensuring safety, purity,

and regulatory compliance in complex therapies ➡️ Viral Vectors-Based Gene Therapy for

Non-Human Primates Market:

Analyze how NHP-focused vector research is accelerating translational insights

for human gene therapy programs ➡️ Cell and Gene Therapy Infrastructure and

Delivery Models Market:

Discover how hospitals are redesigning infrastructure, infusion suites, and

operational models for gene therapy readiness ➡️ Neurological Rare Disease Biologics Market:

Track breakthroughs in biologics targeting ultra-rare CNS disorders with high

unmet need ➡️ Cell and Gene Therapy CDMO Market:

Examine how CDMOs are scaling manufacturing capacity, innovation, and

regulatory support for global gene therapy pipelines ➡️ Next-Gen Delivery Systems for Genetic Drug

Market:

Learn how novel delivery platforms are improving tissue targeting, durability,

and safety in genetic medicine ➡️ Cancer Gene Therapy Market:

Explore how genetic medicines are transforming oncology through targeted tumor

modulation and personalized treatments ➡️ RNA Editing Therapies Market:

Gain insights into precision RNA-level interventions driving the next frontier

of functional genetic repair ➡️ Gene

Silencing Market:

Understand how gene-suppression technologies are enabling durable therapeutic

effects in previously untreatable diseases AAV Gene Therapy Market Segmentation

Analysis: Therapeutic Area Analysis: The neurological disorders segment accounted for the

largest share of 29.4% in the AAV gene therapy market in 2024, reflecting the

strong demand for advanced treatments targeting complex neurodegenerative and

genetic conditions. This dominance is supported by the rapid rise in diseases

such as Alzheimer’s, Parkinson’s, spinal muscular atrophy, and rare inherited

neuropathies, where conventional treatments offer limited effectiveness. The muscular disorders segment is projected to grow at

the fastest CAGR from 2025 to 2034, driven by rising awareness of genetic

muscle diseases, advancements in genome delivery methods, and the growing

pipeline of AAV-based therapies for conditions such as Duchenne muscular

dystrophy and limb-girdle muscular dystrophy. Pharmaceutical and biotech

companies are heavily investing in next-generation vector engineering and

optimized dosing strategies to improve treatment durability and safety. Growing

collaboration between research institutions, increased patient advocacy

programs, and supportive regulatory pathways are further accelerating the

development and market expansion of muscular disorder therapies. Vector Serotype Analysis: In 2024, the AAV9 serotype contributed the largest market

share at 27.60%, solidifying its role as one of the most widely used vectors in

gene therapy. AAV9’s ability to efficiently target both systemic tissues and

the central nervous system makes it ideal for treating a broad range of genetic

diseases. Its extensive use in approved therapies and late-stage clinical

trials has contributed to its strong market presence. Continued advancements in

AAV9 manufacturing and growing adoption in pipeline programs across neurology,

cardiology, and metabolic disorder treatments further reinforce its market

leadership. Engineered, synthetic, and hybrid AAV capsids are

expected to witness notable growth during the forecast period as developers

seek improved vector specificity, enhanced tissue tropism, and reduced immune

responses. These next-generation capsids are designed to overcome limitations

associated with naturally occurring AAV types, enabling more effective gene

delivery with lower doses. Growing R&D investment in precision gene

therapy, combined with the increasing shift toward customized vectors for rare

and ultra-rare diseases, is driving strong interest and adoption in this

rapidly evolving segment. Route of Administration Analysis: The intravenous (I.V.) route of administration captured

36.80% of the market share in 2024, making it the most widely used delivery

method for AAV-based treatments. Its non-invasive nature, ease of

administration, and ability to distribute vectors throughout the bloodstream

make it suitable for treating multi-organ diseases and systemic genetic

disorders. Manufacturers and clinical researchers prefer I.V. delivery due to

its well-established safety profile and broad applicability across pediatric

and adult patient populations. Ongoing improvements in dosing regimens and

vector engineering are further supporting the strong use of intravenous

administration in clinical practice. The intrathecal (I.T.) route is projected to expand at a

notable CAGR over the forecast period, driven by increasing use of targeted CNS

delivery for neurological disorders. Intrathecal injection enables direct

deposition of AAV vectors into the cerebrospinal fluid, allowing highly

efficient gene transfer to spinal and brain tissues while minimizing systemic

exposure. This route is gaining momentum as more therapies for ALS, spinal

muscular atrophy, and other CNS disorders progress through clinical stages. Its

rising adoption is also supported by ongoing advancements in minimally invasive

neurosurgical delivery techniques. Application Stage Analysis: Clinical therapies held the largest market share of 48.7%

in 2024, reflecting the rapid expansion of AAV gene therapy candidates

advancing through Phase I–III clinical trials. A growing number of

biopharmaceutical companies are increasing their R&D investments to

accelerate the development of novel treatments targeting rare genetic diseases

and chronic disorders. Strong support from regulatory agencies, coupled with expanding

patient enrollment and improved clinical trial infrastructure, has further

strengthened the position of this segment. These factors collectively highlight

the robust progress in translating AAV-based innovations from laboratory

research to human studies. The commercialized therapies segment is expected to grow

significantly over the forecast period, supported by increasing regulatory

approvals and broader market acceptance of AAV gene therapies. As more

therapies demonstrate strong safety and long-term efficacy data, adoption is

rising across global healthcare systems. Growing payer support, expanded

reimbursement programs, and improvements in vector production scalability are

all contributing to the rapidly evolving commercial landscape. The segment’s

growth will also benefit from expanding indications and ongoing progress in

addressing manufacturing bottlenecks. Manufacturing Type Analysis: In-house manufacturing accounted for the largest share,

54.1%, in 2024, as companies sought greater control over production quality,

timelines, and regulatory compliance. Building internal AAV production capacity

allows biopharma companies to streamline scale-up processes and maintain

consistency in vector purity and potency. The complexity of AAV manufacturing,

combined with increasing regulatory scrutiny, has motivated developers to

invest heavily in their own GMP-compliant facilities. This trend further

supports rapid clinical development and minimizes dependency on external

suppliers. Contract development and manufacturing organizations

(CDMOs) and dedicated vector production facilities are anticipated to expand at

a notable CAGR, driven by increasing outsourcing demand from small- and

mid-sized biotech companies. As AAV therapies progress toward commercialization,

the need for scalable, high-quality manufacturing has intensified. CDMOs

provide specialized expertise, advanced bioprocessing technologies, and

large-scale capacity, making them essential partners in accelerating product

development. The surge in global gene therapy pipelines is expected to further

boost demand for third-party manufacturing services. End User Analysis: The pharmaceutical and biotechnology companies segment

generated the largest market share at 52.8% in 2024 due to significant R&D

investments, strategic partnerships, and ongoing efforts to develop innovative

AAV-based therapies. These companies are leading the charge in clinical trial

activity, manufacturing expansion, and commercialization strategies. Their

strong financial capability and access to advanced scientific resources

position them at the forefront of the AAV gene therapy landscape. Continuous

collaboration with academic institutions and technology providers further

strengthens this segment’s market dominance. Contract research organizations (CROs) are projected to

grow at a notable CAGR over the forecast period, as biopharmaceutical companies

increasingly outsource preclinical research, clinical trial management,

regulatory support, and analytical testing. The complexity of AAV gene therapy

development often requires specialized expertise and advanced laboratory

capabilities that CROs are well-equipped to provide. Rising global trial

activity, expanding regulatory requirements, and the need for cost-effective

development strategies are further propelling the expansion of CRO services

within the market. For questions or customization requests, please reach out

to us @ sales@precedenceresearch.com

| +1 804 441 9344 AAV Gene Therapy Market Top Companies ➢

Advanced

Energy Industries, Inc. ➢ MKS

Instruments, Inc. ➢ Samco

Inc. ➢ PVA

TePla AG ➢ Axcelis

Technologies, Inc. ➢ Lam

Research Corporation ➢ ULVAC,

Inc. ➢ Plasma

Etch, Inc. ➢ PIE

Scientific LLC ➢ Tokyo

Electron Limited (TEL) ➢ Trion

Technology, Inc. ➢ Diener

Electronic GmbH and Co. KG ➢ Nordson

MARCH ➢ Veeco

Instruments Inc. What is Going Around the Globe? 🔸In April 2025, the

U.S. Pharmacopeia (USP) launched a package of reference standards, materials,

and other resources to provide a clear understanding for developers and

manufacturers of AAV-based gene therapies. Fouad Atouf, Ph.D., Senior Vice

President of Global Biologics for USP, stated, “Innovative AAV-based therapies

are approved and in development for many therapeutic categories, including

previously untreatable genetic and rare diseases.” (Source: https://www.usp.org) AAV Gene Therapy Market Segmentation: 🔹 Neurological

Disorders → Spinal Muscular Atrophy (SMA) (e.g., Zolgensma) → Parkinson's Disease → Alzheimer's Disease → Rett Syndrome → Amyotrophic Lateral Sclerosis (ALS) → Canavan Disease → Aromatic L-amino acid decarboxylase (AADC) Deficiency → Huntington's Disease → Friedreich's Ataxia 🔹 Ophthalmic

Disorders → Leber Congenital Amaurosis (LCA) (e.g., Luxturna) → Retinitis Pigmentosa → Wet Age-related Macular Degeneration (AMD) → Stargardt Disease → Choroideremia 🔹 Hematologic

Disorders → Hemophilia A (e.g., Roctavian) → Hemophilia B (e.g., Hemgenix) → Thalassemia → Sickle Cell Disease 🔹 Muscular

Disorders → Duchenne Muscular Dystrophy (DMD) (e.g., Elevidys) → Limb-Girdle Muscular Dystrophy (LGMD) 🔹 Metabolic

Disorders → Alpha-1 Antitrypsin Deficiency → Phenylketonuria (PKU) → Glycogen Storage Diseases → Hereditary Lipoprotein Lipase Deficiency (LPLD) (e.g.,

Glybera - though withdrawn) 🔹 Rare

Genetic Disorders (Other) → Mucopolysaccharidosis (MPS) → Batten Disease → Cystic Fibrosis → Sanfilippo Syndrome 🔹 Oncology/Cancer → Various cancer types where AAVs are used for targeted

delivery of anti-cancer genes. → Cardiovascular Diseases By Vector Serotype 🔹 AAV1 🔹 AAV2 🔹 AAV3 🔹 AAV4 🔹 AAV5 🔹 AAV6 🔹 AAV7 🔹 AAV8 🔹 AAV9 🔹 AAV10 🔹 AAV11 🔹 AAV12 🔹 Engineered/Synthetic/Hybrid

Capsids By Route of Administration 🔹 Intravenous

(I.V.) 🔹 Intrathecal

(I.T.) (for CNS delivery) 🔹 Intraocular

(I.O.) (e.g., intravitreal, subretinal) 🔹 Intramuscular

(I.M.) 🔹 Intracerebral 🔹 Subcutaneous 🔹 Local/Direct

Injection (e.g., into specific organs) By Application Stage 🔹Preclinical

Therapies 🔹Clinical

Therapies → Phase I → Phase II → Phase III 🔹Commercialized

Therapies By Manufacturing Type 🔹In-house

Manufacturing 🔹CDMOs/Vector

Production Facilities By End-User 🔹Pharmaceutical

and Biotechnology Companies 🔹Academic

and Research Institutes 🔹Contract

Research Organizations (CROs) By Region 🔹North

America 🔹Europe 🔹Asia-Pacific 🔹Latin

America 🔹Middle

East and Africa Thanks for reading

you can also get individual chapter-wise sections or region-wise report

versions such as North America, Europe, or Asia Pacific. Don’t Miss Out!

| Instant Access to This Exclusive Report 👉 https://www.precedenceresearch.com/checkout/6873 You can place an order or ask any questions,

please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344 Stay Ahead with Precedence

Research Subscriptions Unlock exclusive access to powerful market intelligence,

real-time data, and forward-looking insights, tailored to your business. From

trend tracking to competitive analysis, our subscription plans keep you

informed, agile, and ahead of the curve. Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription About Us Precedence Research is a global market intelligence and

consulting powerhouse, dedicated to unlocking deep strategic insights that

drive innovation and transformation. With a laser focus on the dynamic world of life sciences, we

specialize in decoding the complexities of cell and gene therapy,

drug development, and oncology markets, helping our clients stay

ahead in some of the most cutting-edge and high-stakes domains in healthcare.

Our expertise spans across the biotech and pharmaceutical ecosystem, serving

innovators, investors, and institutions that are redefining what’s possible in regenerative medicine, cancer care, precision

therapeutics, and beyond. Web: https://www.precedenceresearch.com ✚ Explore

More Market Intelligence from Precedence Research: ➡️

Digital Therapeutics:

How software-based interventions are restructuring chronic-disease management

and clinical-grade behavioral therapy ➡️

Life Sciences Growth:

Forces driving expansion across biotech, biopharma, and advanced therapeutic

platforms ➡️

Viral Vector Gene Therapy Manufacturing:

Manufacturing constraints, scalability limits, and innovations shaping next-generation

gene-delivery systems ➡️

Wellness Transformation:

How prevention-centric health models are shifting consumer behavior, product

pipelines, and care delivery ➡️

Generative AI in Healthcare:

How generative models are unlocking new diagnostics, clinical automation, and

patient-care innovations Our Trusted Data Partners: Towards Healthcare | Nova One

Advisor | Onco Quant | Statifacts Get Recent News 👉 https://www.precedenceresearch.com/news For Latest Update Follow Us:

🔹 As approvals for

gene therapies increase globally, regulatory agencies become more familiar with

AAV-based products, reducing uncertainty and accelerating development timelines

for AAV pipelines.

🔹 Greater industry

investment—from pharma, biotech, and venture capital—flows into specialized AAV

vector programs, supported by the larger

trend toward personalized medicine and

genetic medicine.

🔹 Expansion of High-Value Therapeutic Areas – CNS, muscular,

metabolic, and rare genetic programs rely heavily on AAV vectors, boosting

downstream demand.

🔹 Technology Spillover from the Parent Market – Breakthroughs

in viral vector engineering, computational optimization, and immune-evasion

strategies strengthen AAV pipelines.

🔹 Investment Momentum & Regulatory Tailwinds – Growth in

the gene therapy market attracts capital, accelerates late-stage AAV trials,

and strengthens regulatory alignment.

Before gene therapy integration, infants with Type 1 SMA often arrived late in

the disease course, faced rapid motor deterioration, and required prolonged

ventilatory support. Standard treatments slowed decline but could not alter the

underlying genetic pathology. The center needed a model that enabled ultra-early

intervention and improved long-term outcomes.

The hospital created a dedicated AAV9 gene therapy pathway that included:

The program delivered significant clinical and operational improvements:

This case underscores why neurological disorders dominate AAV adoption

and why AAV9 remains the leading vector in clinical pipelines. It highlights

the importance of:

For inquiries regarding discounts, bulk purchases, or customization requests,

please contact us at sales@precedenceresearch.com

AAV vectors particularly AAV9, have demonstrated strong therapeutic potential

due to their capability to cross the blood–brain barrier, making them a

preferred choice for CNS-targeted therapies. Increasing funding for

neurological research, combined with expanding clinical trials targeting the

central nervous system, continues to strengthen this segment’s position.

By

Therapeutic Area/Disease Indication