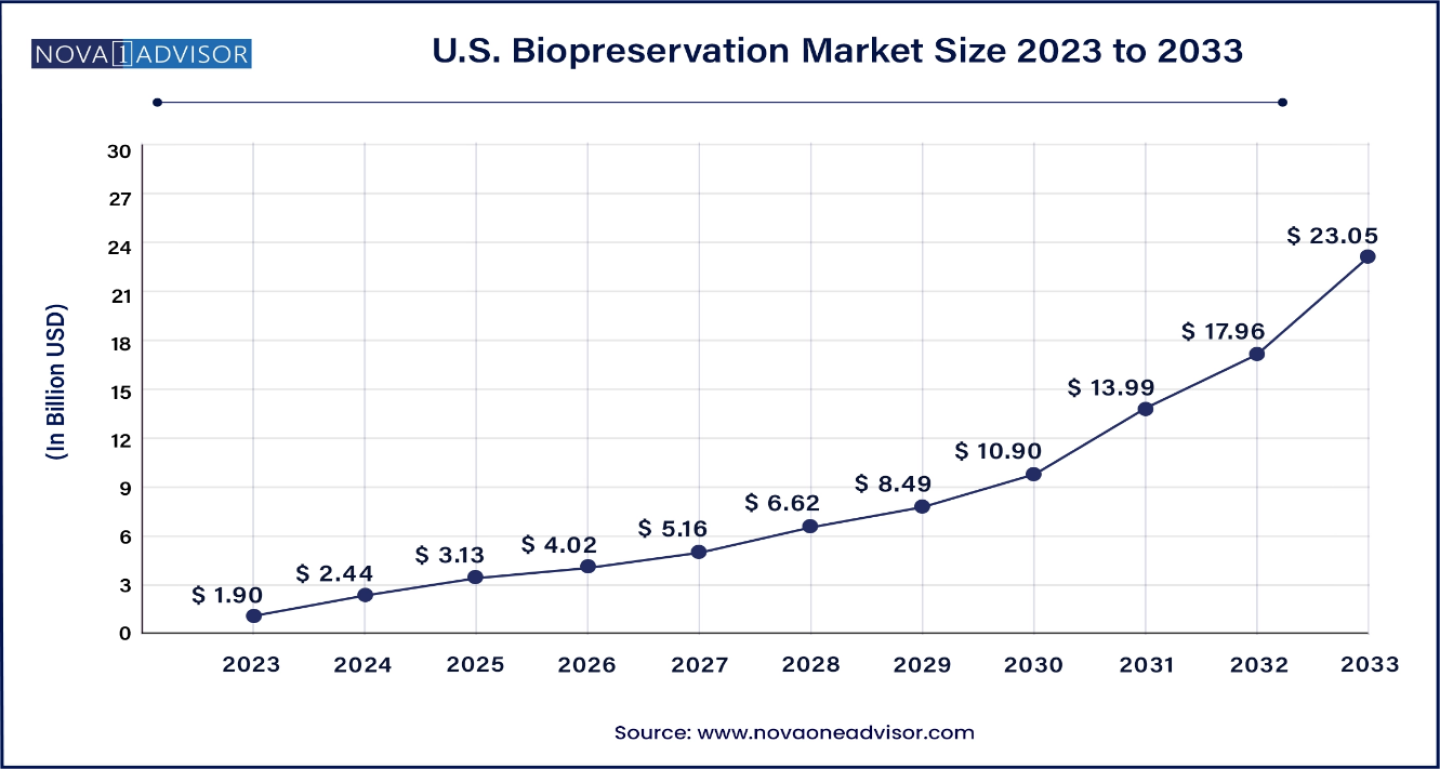

According to latest study, the U.S. biopreservation market size was USD 1.90 billion in 2023, calculated at USD 2.44 billion in 2024 and is expected to reach around USD 23.05 billion by 2033, expanding at a CAGR of 28.35% from 2024 to 2033.

Get Sample Copy of Report@ https://www.novaoneadvisor.com/report/sample/8519

The In the U.S., traditional food preservation techniques often lead to alterations in food status and nutrient loss, prompting a shift towards more modern preservation methods to ensure food safety and quality. This transition is particularly relevant in today's globalized food market, marked by the introduction of novel foods, technological innovations, and consumer demand for minimally processed products with ready-to-eat quality and extended shelf life.

The U.S. biopreservation market is experiencing rapid growth fueled by the adoption of bio-preservation techniques aimed at extending the shelf life of food using natural or controlled microbiota and antimicrobials. These techniques leverage fermentation products and beneficial bacteria, particularly lactic acid bacteria (LAB) and their metabolites, to control spoilage and deactivate pathogens. LAB, known for its antimicrobial properties, produces major compounds such as bacteriocins, organic acids, and hydrogen peroxide. Bacteriocins, peptides or proteins with antimicrobial activity, are divided into four classes based on size, structure, and post-translational modification.

LAB bacteriocins, notably nisin, are prized for their non-toxic, non-immunogenic, thermo-resistant characteristics and broad bactericidal activity, making them ideal bio-preservative agents. Nisin and other bacteriocins find extensive applications in the vegetable, dairy, and meat industries, with nisin being FDA-approved. Bacteriophages and endolysins show promise in food processing, preservation, and safety. Bacteriocins and endolysins are particularly suitable for DNA shuffling and protein engineering, enabling the creation of highly potent variants with expanded activity spectra. The increasing utilization of LAB metabolites, bacteriophages, and endolysins underscores the significant growth potential of the U.S. biopreservation market, driven by advancements in food safety, quality, and preservation techniques.

U.S. Biopreservation Market Key Takeaways

- In 2023, biobanking emerged as the largest application of biopreservation, accounting for a substantial 70.22% of the market revenue share.

- The regenerative medicine segment is expected to witness the fastest CAGR over the forecast period.

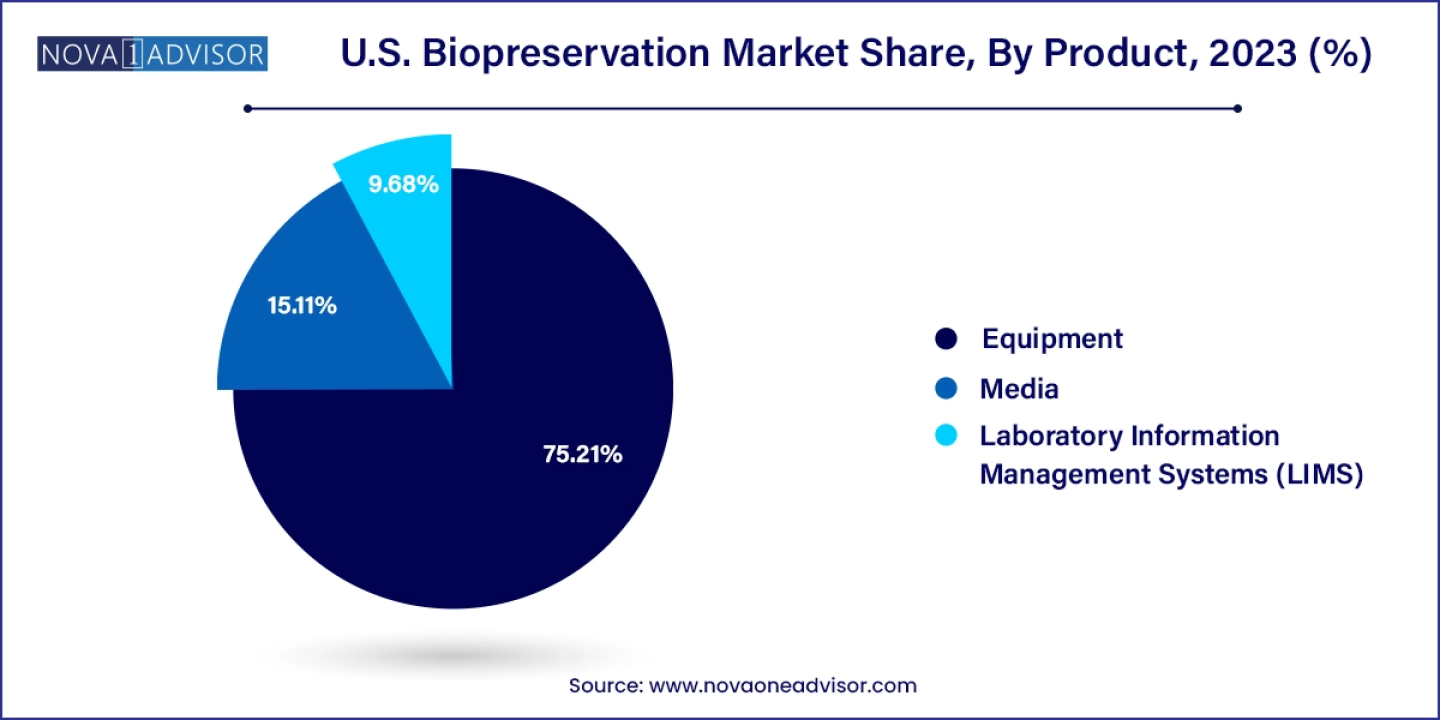

- Biopreservation equipment occupied the largest share of the market in 2023, accounting for over 75.21% of the revenue generated.

- Media segment is expected to exhibit the fastest compound annual growth rate (CAGR) between 2024 and 2033

Biopreservation Market Size and Companies

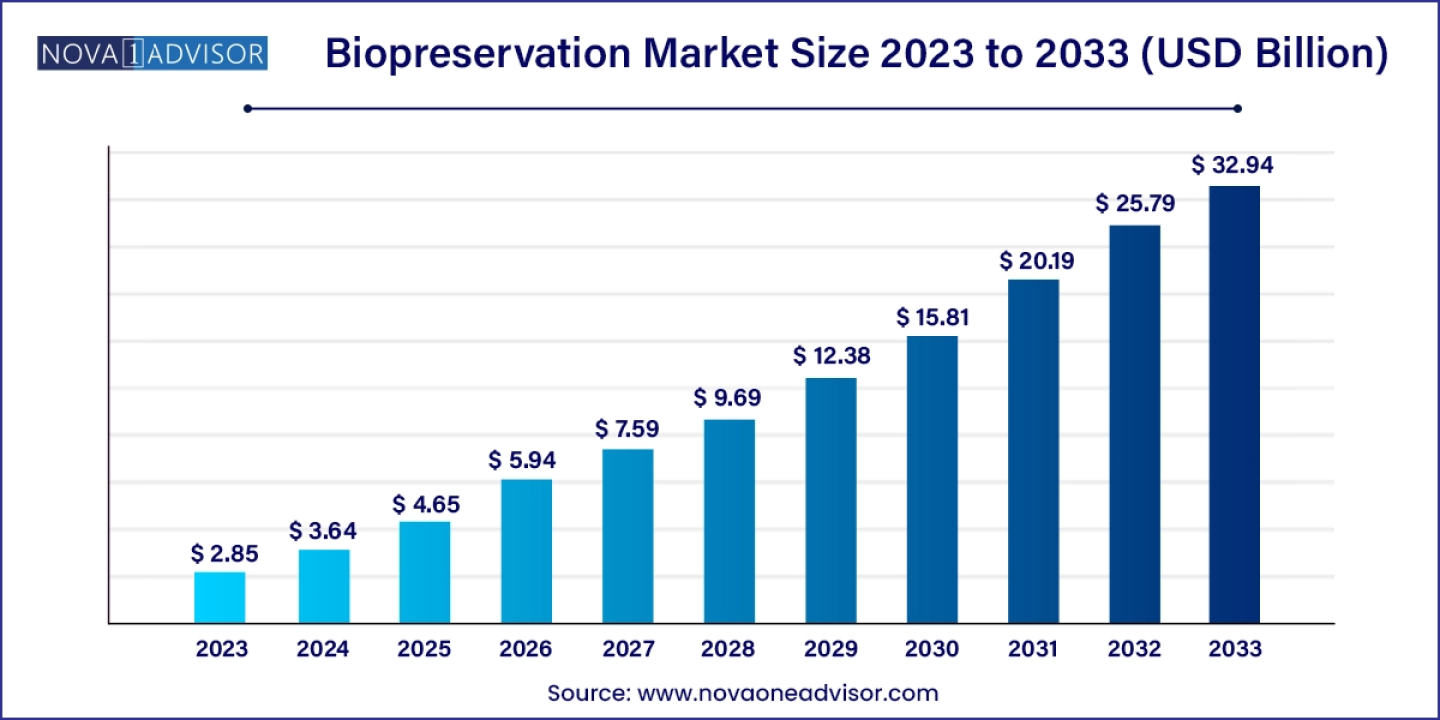

The global biopreservation market size was estimated at USD 3.64 billion in 2024 and is projected to hit around USD 32.94 billion by 2033, growing at a CAGR of 27.73% during the forecast period from 2024 to 2033. North America led the market with the largest revenue share of 46.89% in 2023.

Personalized your customization here@

https://www.novaoneadvisor.com/report/customization/6790

Market Dynamics

Driver

Expanding Role Food Safety and Quality

Bio-preservation, leveraging the antimicrobial potential of naturally occurring organisms and their metabolites, offers a strategic approach to harmonize safety standards while meeting the modern demand for food safety and quality. Techniques employing biological antimicrobial systems such as lactic acid bacteria (LAB), bacteriocins, bacteriophages, and endolysins are instrumental in maintaining the texture, flavor, and safety of food products in the food industry. These bio-preservatives play a vital role in food processing and preservation, offering a promising avenue for enhancing food safety. Bacteriocins and endolysins, in particular, are well-suited for DNA shuffling and protein engineering to create highly potent variants with expanded activity spectra. The incorporation of bacteriocins into packaging films and their combination with modified atmosphere packaging (MAP) present innovative solutions for extending shelf life and ensuring food safety. While genetically modified bacteriophages hold potential in bio-preservation, addressing safety concerns is crucial for their widespread adoption as bio-preservative agents. The increasing adoption of bio-preservation techniques in the food industry is driving the growth of the U.S. biopreservation market.

Restraint

Functional Limitations of Bacteriocins

In spite of their potential in food preservation, bacteriocins face significant functional limitations that restrict their widespread application. These limitations include their relatively narrow spectrum of inhibitory activity, typically targeting only specific microorganisms and often proving ineffective against gram-negative bacteria. Bacteriocins stability is compromised when they interact with food components, leading to loss of activity through binding with lipids and proteins or degradation by proteolytic enzymes. These factors collectively limit the growth potential of the U.S. biopreservation market, as the effectiveness of bacteriocins as natural preservatives is undermined by their functional constraints.

Opportunity

Growing Demand for Natural Food Preservatives

Modern consumers are increasingly concerned about the nutritional content of their diet and the potential adverse health effects of chemical additives in food. As a result, there is a heightened focus on natural and fresh foods without chemical preservatives. This trend has sparked research interest in finding natural and effective preservatives, such as bacteriocins, which can inhibit or destroy undesirable microorganisms in food, thereby enhancing food safety and extending shelf life. This shift towards natural preservatives presents a significant opportunity for the U.S. biopreservation market to meet the evolving needs of consumers and capitalize on the growing demand for safer, healthier food options.

Report Highlights

By Application Insights

In 2023, biobanking emerged as the largest application of biopreservation, accounting for a substantial 70.22% of the market revenue share. These storage facilities are pivotal in storing and managing biological samples, or biosamples, crucial for research purposes. Notably, biobanks have played a critical role in initiatives like the Cancer Genome Atlas (TCGA), which aims to create a comprehensive catalog of cancer genomic profiles by analyzing major cancer-causing genomic alterations. By leveraging human specimens with associated clinical data, researchers can analyze large cohorts of over 30 tumors using large-scale genome sequencing. This approach has led to the identification of novel molecular alterations in cancer, enabling the classification of tumor subtypes based on distinct genomic profiles. This precision medicine approach has revolutionized patient care by tailoring treatments to individual genetic characteristics. As such, the prominence of biobanking in the biopreservation market underscores its pivotal role in driving advancements in medical research and personalized healthcare solutions.

The regenerative medicine segment is poised to experience the fastest compound annual growth rate (CAGR) over the forecast period. Regenerative medicine encompasses the process of replacing or regenerating human cells, tissues, or organs to restore normal function. This field holds immense promise in repairing damaged tissues and organs by either replacing them directly or by stimulating the body's natural repair mechanisms. Regenerative medicine enables the growth of tissues and organs in laboratory settings, which can be safely implanted when the body's own healing mechanisms are insufficient. With approximately one in three Americans potentially benefiting from regenerative medicine, the field represents a significant opportunity for healthcare advancement. Stem cells play a crucial role in regenerative medicine, with applications including cell therapies involving the injection of stem cells or progenitor cells, immunomodulation therapy utilizing biologically active molecules, and tissue engineering for transplanting laboratory-grown organs and tissues. Overall, the rapid growth of regenerative medicine underscores its potential to revolutionize clinical therapies and address unmet medical needs.

By Product Insights

Biopreservation equipment occupied the largest share of the market in 2023, accounting for over 75.21% of the revenue generated, driven by its crucial role in maintaining the quality and safety of biopreserved products. Utilizing biopreservation processes is a strategic approach to ensure the production of high-quality goods that meet consumer demands. While genomic tools based on amplicon sequencing are powerful for describing food microbial ecosystems, they may have limitations when applied to biopreserved products. Typically, bioprotective cultures are inoculated at high levels, dominating the product's microbiome, particularly at the onset of storage. This dominance underscores the importance of effective biopreservation equipment in maintaining product integrity throughout storage and distribution, highlighting its significance in the biopreservation market landscape.

The biopreservation media segment is poised to significantly contribute to the overall market expansion, with expectations of exhibiting the fastest compound annual growth rate (CAGR). Biopreservation media plays a pivotal role in ensuring the effectiveness of preservation efforts. The selection of the appropriate type of media depends on factors such as the desired storage duration, the type of biological material being preserved, and the intended purpose of biopreservation. Optimal biopreservation media should facilitate good cell recovery, maintain cell viability, and ensure no compromise in functionality post-preservation and thawing processes. As such, the demand for high-quality biopreservation media is expected to rise steadily, driving growth in the biopreservation market as a whole.

Immediate Delivery Available, Get Full Access@ https://www.novaoneadvisor.com/report/checkout/8519

U.S. Biopreservation Market Concentration & Characteristics

The U.S. biopreservation market is fairly concentrated with few large players accounting for most of the market. These players are constantly engaged in various strategic initiatives such as M&A, new product/technology development, and geographic expansion to improve their market presence.

The industry is characterized by a high degree of innovation, as is evident with advancements such as the development of new microbial cultures, incorporation of bioprotective agents in food packaging, and the utilization of bacteriophages as biocontrol agents. These developments demonstrate the industry’s continuous efforts to enhance technology and find more efficient preservation solutions. For instance, in January 2023, Essent Biologics introduced its Human Native Tissue-Derived Type I Atelocollagen for the cell and tissue engineering industry, which has various applications in cell culture, labware coating, drug delivery, bioprinting, and tissue engineering.

Key players are implementing strategic initiatives such as mergers and acquisitions, product development, and business expansions, indicating a trend of strategic moves by companies to expand their reach and enhance their business operations. For instance, in August 2023, Thermo Fisher Scientific Inc. completed the acquisition of CorEvitas, LLC, a leading real-world evidence provider for medical treatments, enhancing decision-making and accelerating innovation in the industry.

Key participants in the industry are not only enriching their product lines with innovative preservation technologies but also broadening their service scope to address varied customer requirements. This adaptability helps them cater to a wider client base and stay competitive in the industry. For instance, in January 2023, the Thermo Fisher Scientific Inc. merger with The Binding Site Group, a prominent player in specialty diagnostics, not only expanded Thermo Fisher’s presence in specialty diagnostics but also strengthened its service offerings by incorporating The Binding Site Group’s expertise.

Companies in the U.S. biopreservation industry are broadening their horizons by expanding across different regions within the country. This strategic move aims to explore diverse industries, utilize local resources more effectively, and fortify their overall presence. Furthermore, American biopreservation firms are extending their product offerings globally, thereby enhancing their geographical influence. For instance, in March 2024, X-Therma Inc., a biotech company specializing in regenerative medicine and organ preservation, successfully concluded an oversubscribed USD 22.4 million Series B funding round, which helped them expand their global commercial operations and advanced them into the clinical stage with FDA Breakthrough Device status.

Related Report

Biologics Market: https://www.biospace.com/article/biologics-market-size-to-hit-around-usd-1-37-trillion-by-2033/

Liquid Biopsy Market : https://www.biospace.com/article/releases/liquid-biopsy-industry-is-rising-rapidly-up-to-usd-32-54-bn-by-2033/

Biotechnology Market : https://www.biospace.com/article/biotechnology-market-size-to-reach-usd-5-68-trillion-by-2033/

Cell And Gene Therapy Manufacturing Market : https://www.biospace.com/article/cell-and-gene-therapy-manufacturing-market-is-rising-rapidly/

Biopharmaceuticals Contract Manufacturing Market : https://www.biospace.com/article/biopharmaceuticals-contract-manufacturing-market-size-to-hit-usd-31-92-bn-by-2032/

Cell And Gene Therapy Manufacturing Market : https://www.biospace.com/article/cell-and-gene-therapy-manufacturing-market-is-rising-rapidly/

Cell and Gene Therapy Market : https://www.biospace.com/article/releases/u-s-cell-and-gene-therapy-clinical-trial-services-industry-is-rising-rapidly/

Biomarkers Market: https://www.biospace.com/article/releases/biomarkers-market-size-to-hit-usd-284-76-billion-by-2033/

U.S. Biotechnology Market : https://www.biospace.com/article/releases/u-s-biotechnology-market-size-to-increase-usd-1-79-trillion-by-2033/

U.S. Biopreservation Market Recent Developments

- In September 2023, Merck became the first CTDMO to offer fully integrated services for all stages of mRNA development, manufacturing, and commercialization. With new sites in Darmstadt and Hamburg, Merck’s recent expansion is expected to aid the U.S. market with pre-clinical as well as commercial offerings.

- In June 2023, BioLife Solutions launched the IntelliRate i67C, a large-capacity controlled-rate freezer that catered to the growing need for higher volume production of cell therapies, expanding its product line to three form factors.

- In March 2023, BioLife Solutions introduced Ultraguard, a groundbreaking non-toxic, non-hazardous, and non-flammable −70°C phase change material for ultra-low temperature protection. This innovation serves two primary applications: providing temperature holdover support during power outages in ULT freezers and offering a safer, more cost-effective alternative to dry ice for benchtop biologic material storage

- In February 2022, OriGen Biomedical Inc. introduced the FLEX Freezing Bag from CryoStore in both Europe and the U.S. This innovative product, contributing to advancements in cell culture, cryopreservation, and respiratory devices, showcases the company’s commitment to driving progress in these fields.

The U.S. biopreservation market exhibits consolidation, characterized by continuous strategic collaborations and mergers & acquisitions. Companies actively pursue these moves to gain a competitive edge by seizing untapped opportunities in the market. Azenta US, Inc.; Biomatrica, Inc.; BioLife Solutions Inc.; MVE Biological Solutions; LabVantage Solutions, Inc.; Taylor-Wharton; and Thermo Fisher Scientific, Inc. are some key companies operating in the U.S. biopreservation market.

Companies in the U.S. biopreservation market are strongly motivated to broaden their service offerings, penetrate new markets, benefit from economies of scale, and fortify their competitive positions. These objectives drive their expansion strategies and contribute to the industry’s growth and diversification.

For instance, in January 2022, Ori Biotech Ltd., a CGT manufacturing technology leader, secured over USD 100 million in an oversubscribed Series B funding round, led by Novalis LifeSciences with Puhua Capital and Chimera Abu Dhabi as new investors. This platform, designed for automation and standardization, enhanced CGT manufacturing efficiency, quality, and cost-effectiveness.

U.S. Biopreservation Market Top Key Companies:

- Azenta US, Inc.

- Biomatrica, Inc.

- BioLife Solutions Inc.

- MVE Biological Solutions

- LabVantage Solutions, Inc.

- Taylor-Wharton

- Thermo Fisher Scientific, Inc.

- Panasonic Corporation

- X-Therma Inc.

- PrincetonCryo

- BioCision LLC

- Lifeline Scientific Inc.

- Merck KGaA

- VWR International, LLC

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Biopreservation market.

By Product

- Equipment

- Freezers

- Refrigerators

- Consumables

- Vials

- Straws

- Microtiter

- Bags

- Liquid Nitrogen

- Media

- Pre-formulated

- Home-brew

- Laboratory Information Management Systems (LIMS)

- Regenerative Medicine

- Cell Therapy

- Gene Therapy

- Others

- Biobanking

- Human Eggs

- Human Sperm

- Veterinary IVF

- Drug Discovery

https://www.novaoneadvisor.com/report/checkout/8519

Frequently Asked Questions

- What geographic regions does your market research cover for the U.S. Biopreservation market?

- We have a global reach, with expertise spanning across continents, including North America, Europe, Asia-Pacific, Latin America, and the Middle East. We leverage a combination of primary and secondary research methodologies to offer country-level analysis.

- How does your firm conduct cross-sectional analysis for the U.S. Biopreservation market?

- We conduct cross-sectional analysis by examining data from different individuals at a single point in time to identify patterns and trends across diverse segments of the market.

- Can your firm customize market research solutions to meet specific client needs?

- Our experienced team works closely with clients to gain a thorough understanding of their business goals and target markets. We have the expertise and flexibility to develop bespoke research solutions.

- Do you offer ongoing support or consultation to clients after the completion of a market research project?

- Our team of experienced analysts is available to address any questions, concerns and needs that may arise following the delivery of the report.

- Can your market research firm help with competitor analysis for U.S. Biopreservation market?

- Through a combination of quantitative and qualitative research methodologies, we meticulously assess the strengths, weaknesses, strategies, and market positioning of your competitors.

https://www.novaoneadvisor.com/report/checkout/8519

Call: USA: +1 650 460 3308 | IND: +91 87933 22019 |Europe: +44 2080772818

Email: sales@novaoneadvisor.com

Web: https://www.novaoneadvisor.com/