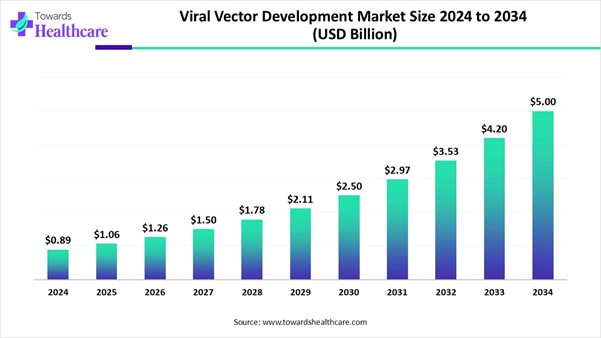

According to Towards Healthcare, the global viral vector development market size is valued at USD 0.89 billion in 2024 and is expected to grow to USD 1.06 billion in 2025, projected to reach approximately USD 5 billion by 2034, expanding at a robust CAGR of 18.84% from 2025 to 2034.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.towardshealthcare.com/download-sample/5783

Growth factors in the global viral vector development market are the rising number of gene and cell therapy products in development, with major investments by many governments and private firms in the healthcare system and R&D sector. As well as numerous breakthroughs in vector design and manufacturing, like cell lines, purification methods, and expansion of clinical trials, are driving the overall market growth.

The Viral Vector Development Market: Highlights

• The viral vector development market will likely exceed USD 0.89 billion by 2024.

• Valuation is projected to hit USD 5 billion by 2034.

• Estimated to grow at a CAGR of 18.84% from 2025 to 2034.

• North America was dominant in the market in 2024.

• Asia Pacific is expected to be the fastest-growing region during 2025-2034.

• By virus, the adeno-associated viral vectors segment dominated the market in 2024.

• By virus, the retrovirus segment is expected to grow at a notable CAGR in the upcoming years.

• By expression system, the transient segment led the market in 2024.

• By expression system, the stable segment is expected to register rapid expansion during the forecast period.

• By application, the gene therapy segment dominated the global viral vector development market in 2024.

• By application, the cancer therapy segment is expected to grow rapidly in the studied years.

• By end user, the pharmaceutical & biotechnology companies segment held a major revenue share of the market in 2024.

• By end user, the contract research organization (CRO) segment is expected to show the fastest growth during 2025-2034.

Market Overview: Cell and Gene Therapy Pipeline

Necessarily altered viruses that are employed in delivering genetic material into cells, especially for gene therapy or vaccine development, can be done by using a viral vector. The viral vector development market is fueled by advances in production technologies, expansion in the gene and cell therapy pipeline, and enhanced investments in healthcare systems. Nowadays, accelerated focus on vector engineering, delivery methods, and a higher understanding of safety profiles, resulting in escalated promise in their use, even in vulnerable populations like infants and the elderly.

Key Metrics and Overview

|

Metric |

Details |

|

Market Size in 2025 |

USD 1.06 Billion |

|

Projected Market Size in 2034 |

USD 5 Billion |

|

CAGR (2025 - 2034) |

18.84% |

|

Leading Region |

North America |

|

Market Segmentation |

By Virus, By Expression System, By Application, By End User, By Region |

|

Top Key Players |

Lonza Group AG, Merck KGaA, Thermo Fisher Scientific Inc., Catalent Inc., WuXi AppTec, FUJIFILM Corporation, Oxford Biomedica. |

You can place an order or ask any

questions, please feel free to contact us at sales@towardshealthcare.com Progress in Gene Therapy and Vaccinology

Area: Major Potential Many kinds of applications are comprised in

the market, mainly gene therapy and vaccinology, which are being highly

influenced. In the viral vector development market, gene therapy encompasses

the utilization of viral vectors to replace damaged genes. Also, this developed

gene therapy is incorporated into in vivo or cells, which can be changed by ex

vivo approaches. Whereas, in the case of vaccinology, viral vectors are widely

employed in vaccine development by inserting emerging genetic material from a

pathogen into a harmless viral vector, triggering an immune response. Production Difficulties and Scalability:

Major Limitation The arising production complexities due to

a shortage of specialized knowledge and high expenditure for infrastructure are

creating a major hurdle for the market. Moreover, scaling up from small-scale

to commercial-scale manufacturing raises concerns regarding vector yield,

stability, and purity. The Viral Vector Development Market:

Regional Analysis In 2024, North America held the largest

share of the market. Due to its strong

biotechnology infrastructure, major research and development

capabilities, and significant funding for gene therapy initiatives are

increasingly impacting the regional market. Besides this, the COVID-19 pandemic

fostered the complete vaccine development, especially in adenoviral vectors are

further fuelling this region’s market growth. The US is a major region in the viral

vector development market, which has boosted the adoption of innovative

technologies in scalable manufacturing, with optimized vector design. This

supports the production of robust and inexpensive viral vectors across the US. For instance, • In February 2025, Cellevate AB, a biotech company developing

next-generation cell culture systems to transform biomanufacturing, launched

Cellevat3d® nanofiber microcarriers at the third Viral Vector Process

Development & Manufacturing Summit. Around Canada, proactive government

assistance, such as the Strategic Innovation Fund (SIF), is notably expanding

domestic manufacturing capacity and boosting the growth of viral vector

production hubs. As well as increasing collaborations

among pharmaceutical companies, research institutions, and biotech

firms, they are supporting the development and application of viral vectors in

this region. Become a valued research partner with us

- https://www.towardshealthcare.com/schedule-meeting The Asia Pacific is Anticipated to Grow

at the Fastest CAGR During the Forecast Period In the upcoming years, the Asia Pacific

will expand rapidly, due to the growing incidence of chronic diseases and

infectious diseases in the region is fostering the demand for efficient

therapeutic solutions, where viral vectors play a crucial role. As well as

the huge pool of biotechnology companies in this ASAP, are driving the

widespread production of different therapies, including cell and gene therapy,

and vaccine development. From this ASAP region, the Chinese

government is widely encouraging the biopharmaceutical

industry through many initiatives, such as funding for research and

development, robust regulatory frameworks, and incentives. Besides this,

various biopharmaceutical companies in China are actively investing in cell and

gene therapies, like viral vector development, resulting in greater demand for

manufacturing capabilities in the viral vector development market. For instance, • In June 2025, Tofersen, an advanced gene-targeted drug for

amyotrophic lateral sclerosis (ALS) patients, was commercially launched by

pharmaceutical giant Biogen in China. However, India is facing a significant

burden of cancer cases, which ultimately enhances their focus on precision

cancer treatments, particularly CAR-T

cell therapies, which are escalating market growth. Also, India’s

many CMOs are playing a vital role in offering viral vectors on demand, which

is expanding drug development timelines for major healthcare firms. The Viral Vector Development Market: Segmentation

Analysis By virus analysis The adeno-associated viral vectors segment

held the biggest share of the market in 2024. These types of vectors are safe

due to their non-pathogenic nature and rarely integrate into the host genome.

The segment is driven by rising demand for gene therapies and vaccine research,

alongside advancements in vector design and production. Moreover, AAVs are

widely used in the development

of targeted therapies in different conditions, like cystic fibrosis and

Duchenne muscular dystrophy, neurological disorders, cancers, and eye diseases. For instance, • In July 2025, Myrtelle Inc., a clinical-stage gene therapy company,

introduced commercial-stage manufacturing for oligotrophic recombinant

adeno-associated virus (rAAV) product MYR-101, which has been established to

treat Canavan disease. The retrovirus segment will expand fastest

in the viral vector development market. Basic utilization of retroviral vectors

in gene therapy to convey therapeutic genes into patient cells, providing

potential treatments for genetic disorders and other diseases. Besides

this, enhanced research funding in biotechnology, mainly in gene therapy and

vaccine development, is driving demand for viral vectors, including retroviral

vectors. Latest Drifts in Retrovirus Segment Company/Organization Recent Trends AscellaHealth HUB (July 2025) Partnered with Abeona Therapeutics to offer the launch success of

novel cell-based gene therapy and access to treatment for rare disease

patients. ViroCell Biologics (July 2025) Collaborated with AvenCell Therapeutic on retroviral vector

manufacturing to expand the development of novel allogeneic CAR-T therapies

for blood cancers.

Get the latest insights on life science

industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership By expression system analysis In 2024, the transient segment was dominant

in the global viral vector development market. Because of its broad flexibility

and faster production of proteins, it is attractive for early-stage drug

discovery and development, where flexibility is important. As compared

to other expressions, the transient system is more affordable, mainly in

small-scale or initial phase research activities. On the other hand, the stable segment is

anticipated to grow fastest during 2025-2034, due to long-term transgene

expression in both dividing and non-dividing cells, especially when used in AAV

vectors, which fuels the segment growth. Also, the minimized immunogenicity of

the vector design is assisting the adoption of a stable expression system.

Continuous research is needed to highlight concerns like immunotoxicity and

off-target effects, which can impact stable expression. By application analysis Primarily, the gene therapy segment led the

global viral vector development market in 2024. Along with the growing genetic

disorder cases, faster innovations in genetic engineering and biotechnology are

boosting the segment growth with the safe use of viral vectors. And, the

integration of CRISPR and AI in production processes is

promoting therapy precision and production efficiency. Moreover, enhanced

awareness of the efficacy of gene-based treatments is propelling adoption among

diverse therapeutic areas. Although the cancer therapy segment is

predicted to be the fastest-growing during the forecast period, combined

factors are contributing to the overall segment and market growth, such as a

rise in cancer prevalence, advancements in targeted therapies, and ongoing

R&D activities in the oncology area. As well as different regions

are promoting various cancer programs to boost awareness about novel and

advanced therapies conveniently and affordably. Phenomenal therapies

development is increasingly supporting the market expansion. By end-user analysis In the global viral vector development

market, the pharmaceutical & biotechnology companies segment accounted for

a major share in 2024. Enormous innovations in viral vector production, like optimized

cell culture systems and downstream processing techniques, have

accelerated production efficiency and reduced expenses. Furthermore,

regulatory bodies are highly supportive of gene therapies and other advanced

therapies, promoting the development and commercialization of viral

vector-based treatments. The contract research organization (CRO) segment

will grow fastest in the projected period. The ongoing number of clinical

trials for both therapeutic and vaccine development necessitates the assistance

of CROs for many stages of research and development. Due to inexpensive

outsourcing and crucial management approaches to handle the associated

difficulties in viral vector development and manufacturing, CROs play a major

role. Additionally, CROs provide specialized expertise in viral vector design,

development, production, and quality control, which can be a barrier for many

companies. Top Companies and Their Contributions to

the Market Company Contributions & Offerings Lonza Group AG Lonza offers end-to-end viral vector development and manufacturing

services, including plasmid production, process development, and

cGMP-compliant manufacturing. Merck KGaA Through its MilliporeSigma division, Merck provides viral vector

platforms, analytical tools, and custom manufacturing to support gene and

cell therapy development. Thermo Fisher Scientific Inc. Offers comprehensive solutions for viral vector production,

including reagents, cell culture systems, purification technologies, and CDMO

services. Catalent Inc. Catalent delivers integrated services from plasmid DNA to viral

vector production, with expertise in AAV and lentiviral vectors for gene

therapy applications. WuXi AppTec Provides viral vector CDMO services globally, covering vector

design, cell line development, process optimization, and large-scale GMP

manufacturing. FUJIFILM Corporation FUJIFILM Diosynth Biotechnologies offers viral vector

manufacturing for gene therapy, leveraging advanced bioprocessing platforms

and scalable production facilities. Oxford Biomedica Specializes in lentiviral vector development, offering proprietary

platform technologies, process development, and GMP manufacturing for

advanced therapy products.

Browse Viral Vector and Related Market

Outlooks Through 2034 The global viral vector gene therapy market is

experiencing strong growth momentum, with substantial revenue increases

anticipated from 2025 through 2034. The non-viral transfection reagents market was valued at USD 1.85 billion in 2024, rising to USD 2.01 billion

in 2025, and is projected to reach USD 4.29 billion by 2034, expanding at a

CAGR of 8.73% during the forecast period. The viral sensitizers market is also

demonstrating accelerated growth, expanding from USD 2.04 billion in 2024 to

USD 2.34 billion in 2025, and is forecasted to achieve USD 8.02 billion by

2034, with a CAGR of 14.63% between 2025 and 2034. The viral vaccine cell culture media market reached USD 1.83 billion in 2024, grew to USD 1.94 billion in 2025,

and is projected to hit USD 3.24 billion by 2034, reflecting a CAGR of 5.84%

over the forecast period. The lentiviral vector market is

expanding rapidly, increasing from USD 360 million in 2024 to USD 426.82

million in 2025, and is expected to reach USD 1.94 billion by 2034, growing at

a CAGR of 18.56%. The viral vector manufacturing market is

forecasted to grow significantly, from USD 1.5 billion in 2024 to USD 1.82

billion in 2025, and expected to reach USD 10.53 billion by 2034, at a CAGR of

21.64%. The Asia-Pacific viral vector and plasmid DNA manufacturing market is set to grow from USD 1.38 billion in 2024 to USD 1.68 billion in

2025, and reach approximately USD 10.01 billion by 2034, expanding at a robust

CAGR of 21.93%. The global viral vector and plasmid DNA manufacturing market, which stood at USD 6.01 billion in 2023, is projected to surge to

USD 43.04 billion by 2034, with an impressive CAGR of 20.7% from 2024 onward. Meanwhile, the anti-viral nasal spray market is

gaining traction and is poised for significant revenue growth, with projections

indicating it may reach several hundred million dollars by 2034. Viral Vector Development Market Top

Companies • Lonza Group AG • Merck KGaA • Thermo Fisher

Scientific Inc. • Catalent Inc. • WuXi AppTec • FUJIFILM Corporation • Oxford Biomedica. Recent Developments in the Viral Vector Development Market ➢ In July 2025, CD Bioparticles, a global

manufacturer and supplier of numerous drug delivery products and services,

introduced its expanded, one-stop AAV Vector Design services to help

researchers in progressing advancements in gene therapy and delivery, such as

the design, construction, and cloning of custom Adeno-Associated Virus (AAV)

vectors, as well as professional virus packaging services. ➢ In May 2025, Coave Therapeutics, a

biotechnology company, launched a CNS-targeted gene therapy capsid developed

with its proprietary platform. ➢ In May 2024, Charles River Laboratories

International, Inc., unveiled its reference materials for adeno-associated

virus (AAV) and lentiviral vector (LVV) portfolio, created to simplify Cell and

Gene Therapy (CGT) research and development as it scales to Good Manufacturing

Practice (GMP) quality. Viral Vector Development Market

Segmentation By Virus • Lentiviral Vectors • Adenoviral Vectors • Adeno-Associated

Viral Vectors- dominated • Retrovirus-

significant By Expression System • Transient • Stable By Application • Gene Therapy-

dominated • Vaccines • Cancer Therapy-

fastest • Others By End User • Pharmaceutical

& Biotechnology Companies- dominated • Contract Research

Organization (CRO)- fastest • Academic and

Research Institutes By Region • North America • Asia Pacific • Europe • Latin America • Middle East and

Africa (MEA) Immediate Delivery Available | Buy

This Premium Research: https://www.towardshealthcare.com/price/5783 Access our exclusive, data-rich dashboard

dedicated to the healthcare market - built specifically for decision-makers,

strategists, and industry leaders. The dashboard features comprehensive

statistical data, segment-wise market breakdowns, regional performance shares,

detailed company profiles, annual updates, and much more. From market sizing to

competitive intelligence, this powerful tool is one-stop solution to your

gateway. Access the Dashboard: https://www.towardshealthcare.com/access-dashboard About Us Towards Healthcare is a leading global provider of technological solutions, clinical

research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we

build strategic partnerships that generate actionable insights and

transformative breakthroughs. As a global strategy consulting firm, we empower

life science leaders to gain a competitive edge, drive research excellence, and

accelerate sustainable growth. You can place an order or ask any

questions, please feel free to contact us at sales@towardshealthcare.com Europe Region: +44 778 256 0738 North America Region: +1 8044 4193 44 Web: https://www.towardshealthcare.com Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest