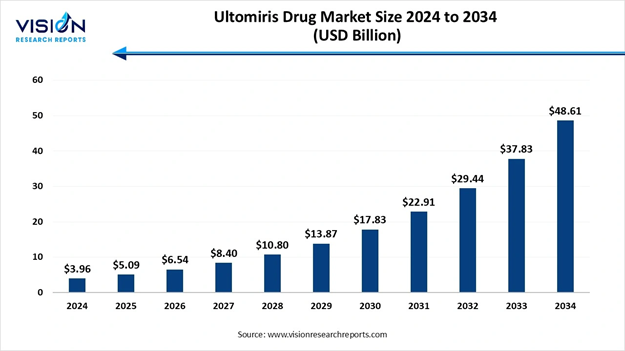

The global ultomiris drug market size was calculated at USD 3.96 billion in 2024 and is expected to grow steadily from USD 5.09 billion in 2025 to reach around USD 48.61 billion by 2034, registering at an impressive CAGR of 28.5% from 2025 to 2034, Study Published by Vision Research Reports.

The market growth is driven by its extended dosing regimen, expanding clinical applications across rare complement-mediated and neurological disorders, increasing prevalence of conditions such as PNH and gMG, advancements in diagnostic tools enabling early detection, and rising adoption in both adult and pediatric populations.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Preview the Report Before You Buy – Get Sample Pages 👉 https://www.visionresearchreports.com/report/sample/41718

What is an Ultomiris Drug?

Ultomiris (ravulizumab-cwvz) is an intravenous infusion medication that is used to treat certain rare autoimmune conditions, including myasthenia gravis, Paroxysmal Nocturnal Hemoglobinuria (PNH) and atypical hemolytic uremic syndrome (aHUS). Ultomiris is a biologic drug, which means it’s made from parts of living organisms. It’s available only as a brand-name medication. It isn’t available in a biosimilar form. Biosimilars are like generic drugs. Just as generics can be an alternative to brand-name medications, biosimilars are an effective alternative to biologics.

Ultomiris Drug Market Key Highlights

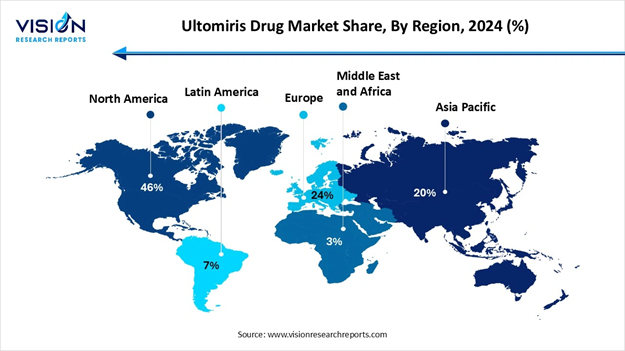

• By region, North America led the market with the largest share of 46% in 2024.

• By region, Asia-Pacific is expected to have the fastest growth rate throughout the forecast period.

• By indication, the paroxysmal nocturnal hemoglobinuria segment registered the maximum market share of 49% in 2024.

• By indication, the generalized myasthenia gravis segment is predicted to grow at the fastest rate throughout the forecast period.

• By end use, the adult segment contributed to the largest market share in 2024.

• By end use, the pediatric segment is expected to grow at the fastest rate during the forecast period.

• By distribution channel, hospital pharmacies segment generated the maximum market share in 2024.

• By distribution channel, online pharmacies are seen to be the fastest growing segment.

What are the Growth Factors in the Ultomiris Drug Market?

The rising incidence of rare autoimmune and hematologic conditions is a major key driver that is driving demand for Ultomiris. Improved diagnostic tools and updated clinical guidelines have identified eligible patient populations earlier. Strategic marketing efforts and partnerships by key global players have also helped expand awareness among clinicians and treatment centers.

The Ultomiris (ravulizumab) market is witnessing a rise in innovations, especially in long-acting complement inhibitors. It is aiming to extend dosing intervals and improve treatment adherence in rare autoimmune conditions. Continuous efforts are being made in order to expand indications, as seen by approvals for PNH, aHUS, gMG, and ongoing exploration in NMOSD. Formulation innovations are underway, aiming to reduce infusion times and support subcutaneous delivery for adult and pediatric populations.

What are the Key Trends in the Ultomiris Drug Market?

• The market is witnessing the integration of digital platforms for patient engagement, rising awareness campaigns, and data-driven clinical advancements.

• Pharmaceutical companies all over the world are seen utilizing artificial intelligence and real-world data in order to optimize dosing strategies and monitor long-term patient outcomes.

• Global collaborations and expanded patient-assistance programs ensuring equitable access. Additionally, there is also focus on subcutaneous formulations promises greater convenience and wider adoption in the future.

• The growing recognition of iron deficiency in the world, without anemia being the clinically significant condition is further expanding the potential patient population.

• The increasing prevalence of chronic kidney disease, inflammatory bowel disease and cancer at a global level also creates a high demand for specialized iron replacement therapy.

Discover the Full Market Insights 👉

https://www.visionresearchreports.com/ultomiris-drug-market/41718

Ultomiris Drug Market: International Government Initiatives

Governments have focused on regulatory approval, reimbursement pathways, and national access programmes to manage the availability of Ultomiris (ravulizumab). This medication is widely used for rare complement-mediated diseases.

- In the United States, Ultomiris has been approved by the FDA and is subject to standard regulatory controls and payer prior-authorization processes; manufacturers and payers operate patient support and access programmes to navigate coverage and safety requirements.

- In the European Union, the European Commission granted a centralized marketing authorisation in 2019, after EMA review, and member states manage national reimbursement and pricing negotiations that determine patient access and uptake. National health technology assessment processes and negotiated agreements shape real-world availability.

- India regulates novel biologics through CDSCO clinical and import/manufacture approvals, and the government has signalled industrial support for biologics manufacturing under programmes such as Make in India and BIRAC initiatives; however, registration, import authorisations, and local pricing negotiations affect whether Ultomiris is marketed and accessible.

- China has recently expanded access to C5 complement inhibitors, and the launch and indication approvals for Ultomiris have advanced through the National Medical Products Administration. Chinese market entry often follows local regulatory review and may be accompanied by national reimbursement negotiations that drive uptake.

What are the Major Challenges in the Ultomiris Drug Market?

Despite various growth prospects, the market does have a fair share of challenges. The higher costs of intravenous iron formulations than compared to oral supplements is one such challenge that limits adoption, especially in cost-sensitive healthcare environments. Safety concerns regarding rare but serious adverse reactions, including anaphylaxis and iron overload, also lead to cautious adoption and require careful patient monitoring under specialized administration protocols.

Competition from newer oral iron formulations with improved tolerability may also impact demand for an intravenous alternative. In addition to that, regulatory complexity for parenteral iron products requires extensive safety data and manufacturing quality standards. All these factors together can slow down market growth and potential.

What are the Key Opportunities in the Ultomiris Drug Market?

The ultomiris drug market has vast opportunities for expansion and development, as researchers all over the world continue exploring its efficacy across new indications. There is rising interest in leveraging Ultomiris’s mechanism for broader immunological and hematological applications, potentially expanding its market footprint. New avenues are being opened due to advancements in drug formulations, such as subcutaneous delivery methods and pediatric-friendly options, which could further enhance patient convenience and compliance.

The market’s growth is further fueled by Ultomiris potential for offering a significantly longer dosing interval (every 8 weeks) than compared to its predecessor, Soliris, which enhances patient convenience and adherence. This longer duration between treatments improves the patient's quality of life and reduces the burden associated with frequent infusions, thus making it popular in the market.

Ultomiris Drug Market Report Coverage

|

Report Attribute |

Key Statistics |

|

Market Size in 2025 |

USD 5.09 Billion |

|

Market Size in 2026 |

USD 6.54 Billion |

|

Market Size in 2030 |

USD 17.83 Billion |

|

Market Size in 2032 |

USD 29.44 Billion |

|

Market Size by 2034 |

USD 48.61 Billion |

|

Growth rate from 2025 to 2034 |

CAGR of 28.5% |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2034 |

|

Segments Covered |

By Indication, By End Use, By Distribution Channel |

|

Companies Covered |

Roche Holding AG, Novartis AG, Pfizer Inc., Sanofi S.A., Johnson & Johnson, Amgen Inc., Biogen Inc., Regeneron Pharmaceuticals, Inc., and Takeda Pharmaceutical Company Limited. |

For Orders or Inquiries, Don’t Hesitate to Reach Out: sales@visionresearchreports.com

Trade Analysis for Ultomiris Drug Market

Market Dynamics and Trade Flows

• Export hubs and routing. Finished drug product and infusion kits are shipped from AstraZeneca/Alexion manufacturing and packaging sites and distributed to regional supply hubs. European manufacturing and packaging capacity acts as an export base into EMEA and APAC, while Asia-Pacific and North American distribution centres supply local hospitals and infusion centres.

• Procurement patterns. Because Ultomiris is an infusion biologic, trade is characterized by:

• High unit value, low shipment frequency: smaller volumes by weight but high invoice values.

• Project and tender-based purchases: hospital systems and national health services place tenders or negotiate multi-year supply and service agreements.

• Channel mix: direct manufacturer shipments to national distributors, followed by secondary distribution to infusion centres or specialty pharmacies.

• Substitution and switching. In many markets, uptake reflects switching from eculizumab to ravulizumab, where payers and clinicians accept the clinical profile, changing demand composition, and influencing tender volumes for complement inhibitors.

Reimbursement, Pricing, and Market Access (Trade Implications)

• Public reimbursement affects import volumes. National reimbursement listings or hospital formulary acceptance unlock consistent import demand. Example: Australia’s listing of Ultomiris on the PBS for aHUS created an on-ramp for public procurement and infusion centre ordering from January 2024. Such listings convert clinical approvals into sustained trade flows.

• Prior authorization and managed access. Many payers require prior authorization and managed-distribution programs, which shape invoicing, export documentation and contracted shipment patterns to ensure compliance with risk-management and vaccination requirements.

Supply Chain and Manufacturing Notes

• Manufacturing sites and lot traceability. EMA product information identifies Alexion manufacturing facilities used in supply chains, and batch/lot traceability is required for biologics exports. Exporters and importers must coordinate cold-chain controls, although Ultomiris is more forgiving than live biologics because it is a formulated monoclonal therapy.

• Service component. Trade is not only about boxes of drugs. Supply contracts commonly include clinical training, infusion scheduling support, and patient-assistance logistics. These service elements are often included in export bids and increase the administrative burden of cross-border sales.

Regulatory and Safety Constraints Affecting Trade

• Restricted distribution programs. Due to infection risk (meningococcal), Ultomiris is available under restricted programs requiring vaccination and surveillance. Importers must ensure their distribution and clinical partners can implement these safety programs before placing procurement orders.

• National registration timelines. Even after FDA or EMA approval, local country registration and HTA decisions create a lag between approval and steady import volumes. Traders should map registration status country by country to forecast inbound demand windows.

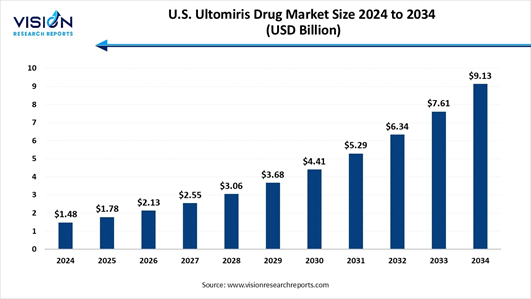

How big is the U.S. Ultomiris Drug Market?

The U.S. ultomiris drug market size was valued at USD 1.48 billion in 2024 and is projected to grow to USD 1.78 billion in 2025, continuing its expansion to around USD 9.13 billion by 2034. This represents a robust CAGR of 19.95% from 2025 to 2034.

Ultomiris Drug Market Regional Analysis

Why did North America Dominate the Market in 2024?

North America dominated the market in 2024. The region benefits from a sophisticated healthcare infrastructure, advanced diagnostic capabilities, robust clinical trial networks and also has widespread specialized care centers. Early approvals of ultomeries, especially in the United States, have allowed for quicker uptake than compared to other regions. Extensive awareness campaigns and robust clinical trials activity in the region have ensured that both healthcare professionals and patients are well-informed about Ultomiris and its potential to treat rare disorders.

What are the Advancements in Asia-Pacific?

Asia Pacific is expected to have the fastest growth rate during the forecast period. The growing awareness and diagnosis of rare diseases, rapid economic growth in countries such as China and India, have led to its rapid growth and development. Healthcare professionals in this region are becoming increasingly familiar with complement inhibitors like Ultomiris, thus leading to greater confidence in prescribing it. Increased patient and caregiver awareness about rare conditions and available treatment options contributes to higher adoption rates, highlighting the region’s potential for expansion.

Need a Tailored Version of the Report? | Get Customization Options Here: https://www.visionresearchreports.com/report/customization/41718

Ultomiris Drug Market Segmental Analysis

Indication Analysis

Which Indication Segment Dominated the Segment in 2024?

The paroxysmal nocturnal hemoglobinuria (PNH) segment dominated the market in 2024. This dominance is because this segment offers a more convenient dosing schedule than its predecessor, Soliris. This improvement coupled with its strong clinical efficacy and comparable safety profile has driven a widespread patient switch from Soliris to Ultomiris. As the first indication approved for Ultomiris, the well-established PNH patient population fueled the drug's initial market success.

The generalized myasthenia gravis segment is seen to be the fastest-growing in the Ultomiris drug market during the forecast period. The Ultomiris's strong clinical effectiveness and convenient, long-acting dosing schedule. Regulatory approvals and the expanding utility of the drug for gMG patients have further boosted this segment’s position. This combination of clinical benefits, ease of use, and strategic market expansion has made this segment popular in today’s market.

End Use Analysis

Which End Use led the Market as of this Year?

The adult segment led the market as of this year. This is due to higher prevalence of its primary indications, PNH and aHUS in adults. The segment’s position is further solidified by established adult treatment protocols, the drug's extended dosing interval and the widespread transition of patients from older therapies. Moreover, the adult population's higher disease burden will help maintain its leading position.

The pediatric segment is experiencing the fastest growth in the market during the forecast period. This growth is driven by better standardized pediatric formulations and dosing protocols, which are promoting wider usage of Ultomiris in children. Increasing awareness of rare diseases in children among caregivers and healthcare professionals, along with improved diagnostic tools, help to support earlier detection and treatment initiation.

Distribution Channel Analysis

Which Distribution Channel was the Most Dominant as of this Year in 2024?

The hospital pharmacies segment held the largest market share in 2024. These pharmacies ensure safe handling, storage, and administration, often managing complex treatment protocols and patient monitoring. Hospital pharmacies also possess all the necessary expertise and infrastructure which is needed to handle and store high-cost biologics like Ultomiris, thus maintaining quality and ensuring patient safety.

The online pharmacies segment is experiencing the fastest growth in the market during the forecast period. This rapid growth is driven by increased patient demand for convenience and accessibility. This growth is further supported by the rise of home infusion services, which online specialty pharmacies are well equipped to handle, as well as the integration with digital health tools for prescription management and patient support.

Browse More Insights:

• Drug of Abuse Testing Services Market: https://www.visionresearchreports.com/drug-of-abuse-testing-services-market/41255

• Drug Discovery Market: https://www.visionresearchreports.com/drug-discovery-market/41160

• U.S. Antibody Drug Conjugates Market: https://www.visionresearchreports.com/us-antibody-drug-conjugates-market/41773

• Local Anesthesia Drugs Market: https://www.visionresearchreports.com/local-anesthesia-drugs-market/41721

• Antifungal Drugs Market: https://www.visionresearchreports.com/antifungal-drugs-market/41717

• Contraceptive Drugs and Devices Market: https://www.visionresearchreports.com/contraceptive-drugs-and-devices-market/41596

• Antibody Drug Conjugates Market: https://www.visionresearchreports.com/antibody-drug-conjugates-market/41295

• U.S. Generic Drugs Market: https://www.visionresearchreports.com/us-generic-drugs-market/41282

Top Key Players in Ultomiris Drug Market

• Roche Holding AG

• Novartis AG

• Pfizer Inc.

• Sanofi S.A.

• Johnson & Johnson

• Amgen Inc.

• Biogen Inc.

• Regeneron Pharmaceuticals, Inc.

• Takeda Pharmaceutical Company Limited

Segments Covered in the Report

By Indication

• Paroxysmal Nocturnal Hemoglobinuria (PNH)

• Atypical Hemolytic Uremic Syndrome (aHUS)

• Generalized Myasthenia Gravis (gMG)

• Neuromyelitis Optica Spectrum Disorder (NMOSD)

By End Use

• Adult

• Pediatric

By Distribution Channel

• Hospital Pharmacies

• Retail Pharmacies

• Online Pharmacies

By Region

• North America

• Latin America

• Europe

• Asia-Pacific

• The Middle East and Africa

Instant Delivery Available | Purchase This Exclusive Research Report Now: https://www.visionresearchreports.com/report/checkout/41718

You can place an order or ask any questions, please feel free to contact at: sales@visionresearchreports.com

About Us

Vision Research Reports is a premier service provider offering strategic market insights and solutions that go beyond traditional surveys. We specialize in actionable market research, delivering in-depth qualitative insights and strategies to global industry leaders and executives, helping them navigate future uncertainties. Our offerings include consulting services, syndicated market studies, and bespoke research reports.

We are committed to excellence in qualitative market research, fostering a team of experts with deep industry knowledge. Our goal is to help clients understand both current and future market trends, empowering them to expand their portfolios and achieve their business objectives with the right guidance.

Web: https://www.visionresearchreports.com

Our Trusted Data Partners

Precedence Research | Statifacts | Nova One Advisor

For Latest Update Follow Us: LinkedIn

Discover More Market Trends and Insights from Vision Research Reports:

• U.S. Active Pharmaceutical Ingredients CDMO Market: https://www.visionresearchreports.com/us-active-pharmaceutical-ingredients-cdmo-market/41732

• Vaccine Market: https://www.visionresearchreports.com/vaccine-market/41731

• Allergy Diagnostics Market: https://www.visionresearchreports.com/allergy-diagnostics-market/41729

• Onychomycosis Market: https://www.visionresearchreports.com/onychomycosis-market/41728

• U.S. Veterinary Neurodegenerative Disease Diagnostics Market: https://www.visionresearchreports.com/us-veterinary-neurodegenerative-disease-diagnostics-market/41727

• U.S. Companion Animal Imaging Market: https://www.visionresearchreports.com/us-companion-animal-imaging-market/41726

• U.S. Veterinary Dental Health Market: https://www.visionresearchreports.com/us-veterinary-dental-health-market/41725

• Polycystic Ovarian Syndrome Treatment Market: https://www.visionresearchreports.com/polycystic-ovarian-syndrome-treatment-market/41722

• Microbiome Analysis Market: https://www.visionresearchreports.com/microbiome-analysis-market/41715