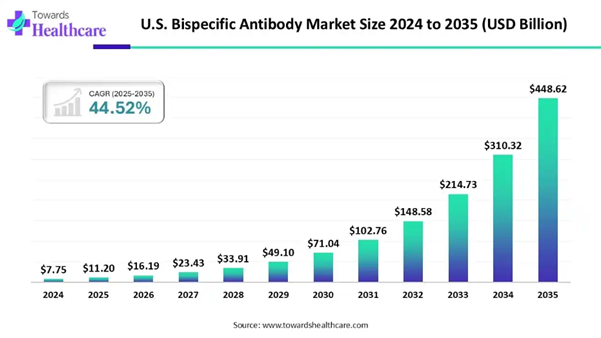

The U.S. bispecific antibody market size to surpass USD 11.20 billion in 2025 and is estimated to hit around USD 448.62 billion by 2035, growing at a CAGR of 44.52% from 2025 to 2034. The widespread clinical applications of numerous bispecific antibodies for hematological malignancies, solid tumors, and many other healthcare conditions are approved by the U.S. Food and Drug Administration (FDA).

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6406

Key Takeaways

➤ Northeast & Mid-Atlantic, U.S. dominated the market in 2024, with a revenue share of approximately 32%.

➤ South, U.S., is expected to grow at the fastest CAGR in the market during the forecast period.

➤ By therapeutic area/indication, the oncology segment dominated the market in 2024, with a revenue share of approximately 68%.

➤ By therapeutic area/indication, the ophthalmology/rare diseases/others segment in the market is expected to grow at the fastest CAGR during the forecast period.

➤ By format/architecture, the dual-variable/IgG-based bispecifics segment dominated the market in 2024, with a revenue share of approximately 38%.

➤ By format/architecture, the T-cell engagers segment is expected to grow at the fastest CAGR in the market during the forecast period.

➤ By development stage, the phase I/I–II trials segment dominated the market in 2024, with a revenue share of approximately 35%.

➤ By development stage, the late-stage segment is expected to witness the fastest growth during the forecast period.

➤ By end user/payer channel, the oncology hospitals/cancer centers segment dominated the market in 2024, with a revenue share of approximately 52%

➤ By end user/payer channel, the academic medical centers segment is expected to witness the fastest growth during the forecast period.

Market Overview and Industry Potential

What is the U.S. Bispecific Antibody?

The novel mechanism of action of this antibody has led to improved patient outcomes in those dealing with relapsed/refractory (R/R) hematological malignancies, after traditional therapies. Research driving the U.S. bispecific antibody market is focusing on new bispecific antibodies in development for infectious diseases, autoimmune diseases, and rare conditions. The strategic collaborations and licensing agreements among the leading pharmaceutical companies aim to boost the discovery and development of next-generation bispecific antibodies.

Quick Facts Table

|

Table |

Scope |

|

Market Size in 2026 |

USD 16.19 Billion |

|

Projected Market Size in 2035 |

USD 448.62Bbillion |

|

CAGR (2026 - 2035) |

44.52% |

|

Market Segmentation |

By Therapeutic Area/Indication, By Format/Architecture, By Development Stage, By End User/Payer Channel, By Region within the U.S. |

|

Top Key Players |

Regeneron Pharmaceuticals, Genentech/Roche, Bristol Myers Squibb, Gilead/Kite, Pfizer Inc., Merck & Co., Inc., Xencor Inc., AbbVie Inc., Johnson & Johnson

|

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Major Trends in the U.S. Bispecific Antibody Market

What makes Revolution in the U.S. Bispecific Antibody Market?

➤ Strong Product Development and Clinical Pipeline: Continuous progress in product pipelines is fueled by successive clinical trials and ongoing innovations. Additionally, supply chain optimization enhances both resilience and transparency, supporting the reliable development and delivery of bispecific antibody therapies.

➤ Major Investments in Healthcare: Merck, Johnson & Johnson, Pfizer, Roche, Ipsen, Biomunex Pharmaceuticals, and Myers Squibb are some of the major investors, focusing on targeted therapies. The biopharmaceutical companies are expanding their footprint in the U.S. bispecific antibody market through their novel innovations in healthcare and across various sectors.

Growth Factors in the U.S. Bispecific Antibody Market

Which Potential Measures are Driving the U.S. Bispecific Antibody Market?

➤ Promising Clinical Research: The majorly focused areas of research are gastric cancer, lung cancer, and solid tumors. Many clinical research organizations perform robust clinical trial activities.

➤ Strategic Collaborations and Investments: The leading companies in the U.S. bispecific antibody market, like Pfizer, Amgen, Roche, Johnson & Johnson, etc., are committed to developing and commercializing bispecific antibodies.

What is the Role of AI in the U.S. Bispecific Antibody Market?

AI is transforming the U.S. bispecific antibody market by enabling more efficient design and optimization of therapeutics. It plays a pivotal role in early risk prediction and AI-guided formulation, leading to improved safety and efficacy profiles. Additionally, AI accelerates the drug discovery workflow by streamlining screening processes and significantly reducing both development timelines and costs.

Opportunities in the U.S. Bispecific Antibody Market

How is the Future of the U.S. Bispecific Antibody Market?

➤ In September 2025, Dualitas Therapeutics announced the investment of $65 million for the development of next-generation specific antibodies.

➤ In November 2025, Neok Bio reported the investment of $75 million to develop dual-targeting antibody drug conjugates.

Limitations and Challenges in the U.S. Bispecific Antibody Market

What are the Major Impacts on the U.S. Bispecific Antibody Market?

➤ Manufacturing and Development: These challenges faced by the U.S. bispecific antibody market are related to complexity, cost, scalability, talent, infrastructure, stability, and quality.

➤ Clinical Aspects and Safety: The specific limitations are associated with efficacy in solid tumors, adverse events, immunogenicity, and biomarker development.

Insights from Key Regions

How does Northeast & Mid-Atlantic Dominate the U.S. Bispecific Antibody Market in 2024?

Northeast & Mid-Atlantic dominated the market in 2024, with a revenue share of approximately 32%, owing to venture capital funding and robust product development. The biotechnology companies and their significant investments potentially drive the U.S. bispecific antibody market. The life sciences sector in this region within the U.S. strongly focuses on research, innovation, and approvals for numerous bispecific antibodies. The Northeast & Mid-Atlantic countries, like Massachusetts, launched tax incentive programs and provided refundable tax credits to life sciences companies, aiming to expand operations in the state.

New Jersey (NJ), U.S. Bispecific Antibody Market Analysis

It remains a major hub for R&D of bispecific antibodies, where the life sciences industry is driven by the state and federal government programs. Biocon, a leading biotechnology player, holds its presence in New Jersey through its new manufacturing facility.

What is the Potential of the U.S. Bispecific Antibody Market in the South, U.S.?

South, U.S., is expected to grow at the fastest CAGR in the market during the forecast period due to the rapid shift towards personalized medicine and technological advancements in the oncology sector. The advanced platforms used in healthcare bring scalability in production and improve drug stability. The various innovations made in antibody engineering have introduced efficient bispecific formats. The effective treatment options are driven by biotechnology research and development efforts, driving the U.S. bispecific antibody market.

Texas, U.S. Bispecific Antibody Market Analysis

The state's Cancer Prevention and Research Institute of Texas (CPRIT) provides funding for numerous bispecific antibody projects at leading research institutions. Additionally, a Texas-based biotech startup is working to develop a pipeline of bispecific antibody drug candidates by raising capital for clinical trials. This startup is actively pursuing partnerships with pharmaceutical companies to advance its research and development efforts.

Market Segmentation

Therapeutic Area/Indication Insights

How does the Oncology Segment Dominate the U.S. Bispecific Antibody Market in 2024?

The oncology segment dominated the market in 2024, with a revenue share of approximately 68%, owing to the recent product approvals for multiple myeloma, hematologic malignancies, and solid tumors that have accelerated the oncology sector. Major growth drivers include the adoption of combination therapies, recent U.S. FDA product approvals, and the strong impact of the industry. Furthermore, high levels of investment in cancer research continue to support technological innovation and advancement in oncology treatments.

The ophthalmology/rare diseases/others segment is expected to grow at the fastest CAGR in the U.S. bispecific antibody market during the forecast period due to robust research and development in autoimmune diseases, coupled with significant investments in innovation and strategic collaborations. The emergence of novel treatments for rare diseases, increased regulatory focus on orphan conditions, and ongoing product development further drive market expansion. Additionally, the presence of a strong biopharmaceutical hub, a supportive regulatory environment, and sustained R&D investments boost the U.S. market’s leadership position in the field of bispecific antibodies.

Format/Architecture Insights

What made Dual-variable/IgG-based bispecifics the Dominant Segment in the U.S. Bispecific Antibody Market in 2024?

The dual-variable/IgG-based bispecifics segment dominated the market in 2024, with a revenue share of approximately 38%, owing to an enhanced focus on oncology, increasing regulatory approvals, and advances in IgG-based bispecific formats, which are also shaping the market. Growing investments in dual-variable and IgG bispecific antibodies for medical conditions such as autoimmune and infectious diseases are driving broader adoption. Furthermore, novel development platforms are improving drug properties and scalability, enabling the creation of new bispecific antibody candidates.

The T-cell engagers segment is estimated to grow at the fastest rate in the U.S. bispecific antibody market during the predicted timeframe due to next-generation therapeutics, improved patient accessibility, and the rise of combination therapies, which are further contributing to market growth. This momentum is supported by robust R&D efforts and numerous strategic collaborations and partnerships. In particular, T-cell engagers show immense potential for targeting hematologic malignancies such as multiple myeloma and lymphoma, expanding treatment options for patients with these conditions.

Development Stage Insights

How did the Phase I/I–II Trials Segment Dominate the U.S. Bispecific Antibody Market in 2024?

The phase I/I-II trials segment dominated the market in 2024, with a revenue share of approximately 35%, owing to the U.S., which serves as a major R&D hub, attracting high-value investments and maintaining a strong focus on oncology research. Progress through clinical trial phases is increasingly driven by the shift toward combination therapies and advanced antibody engineering. Notably, investments by U.S.-based companies such as Johnson & Johnson have played a significant role in advancing clinical research and development in the bispecific antibody market.

The late-stage segment is anticipated to grow at a notable rate in the U.S. bispecific antibody market during the upcoming period due to the successful commercialization of innovative cancer therapies that have been further supported by accelerated FDA approvals for both solid tumors and hematologic cancers. Notably, companies such as Amgen have received FDA clearance for the first bispecific T-cell engager targeting a solid tumor, specifically for extensive-stage small cell lung cancer. These advances underscore the rapid progress and growing impact of bispecific antibody therapies in oncology.

End User/Payer Channel Insights

Which Segment by End User/Payer Channel Dominated the U.S. Bispecific Antibody Market in 2024?

The oncology hospitals/cancer centers segment dominated the market in 2024, with a revenue share of approximately 52%, owing to the primary measures of care that are expanding access to treatment and supporting clinical development, with an increasing focus on bispecific antibodies. These centers are adopting next-generation technologies and benefiting from rapid regulatory approvals, which accelerate the integration of innovative therapies into clinical practice.

The academic medical centers segment is predicted to grow at a rapid rate in the U.S. bispecific antibody market during the studied period due to successive clinical research and ongoing innovations, enabling healthcare providers to manage complex treatments and establish new standards and protocols. These advancements also drive progress in personalized medicine by enabling precision targeting and biomarker identification, resulting in more tailored and effective bispecific antibody therapies for patients.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Competitive Landscape in the U.S. Bispecific Antibody Market

➤ MacroGenics

➤ Innovent/I-Mab

➤ Genmab

➤ Zai Lab/Akeso/IGM Biosciences

➤ Regeneron/Genentech

➤Xencor/Mereo/Morphosys

➤Sutro Biopharma/CytomX

➤Merck & Co.

➤Amgen

➤Regeneron Pharmaceuticals

➤Genentech/Roche

➤Bristol Myers Squibb/Celgene-era assets

➤Gilead/Kite

➤Xencor

➤MacroGenics

➤Zymeworks

➤Merus

What is Going Around the Globe?

➤ In June 2024, Regeneron Pharmaceuticals announced positive clinical trial results for its multiple myeloma antibody, linvoseltamab, from the Phase I/II LINKER-MM1 (NCT03761108) study. These results were presented at the European Hematology Association (EHA) Congress.

➤ In June 2024, Amgen reported its continued excellence in Bispecific T-cell Engager (BiTE) technology, emphasizing advancements in this revolutionary approach and ongoing efforts to assess its impact on patients with difficult-to-treat cancers.

Segments Covered in the Report

By Therapeutic Area/Indication

○ Oncology (solid tumors & hematologic cancers)

○ Immuno-inflammation/Autoimmunity

○ Infectious Diseases (antiviral, antibacterial bispecifics)

○ Ophthalmology/Rare Diseases/Others

![]() By

Format/Architecture

By

Format/Architecture

○ Dual-variable/IgG-based bispecifics (full-length, knob-into-hole, CrossMab)

○ T-cell Engagers (BiTEs, DARTs, CD3-engagers)

○ Bispecific Fc-fusion/Fc-silent multispecifics

○ Trispecific/multispecific/conjugated bispecifics

○

Bispecific

fragments & alternative scaffolds (nanobodies, scFv pairs) ![]()

By Development Stage

○ Preclinical & Discovery

○ Phase I/I–II Trials

○ Late-Stage (Phase III/Filing/Approved)

○

Commercial/Launched

Products ![]()

By End User/Payer Channel

○ Oncology hospitals/cancer centers

○ Specialty infusion clinics

○ Academic medical centers (clinical trials & early adoption)

○ Community oncology & outpatient practices

By Region

○ North America:

○ South America:

○ Europe:

○ Asia Pacific:

○ MEA:

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/6406

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest