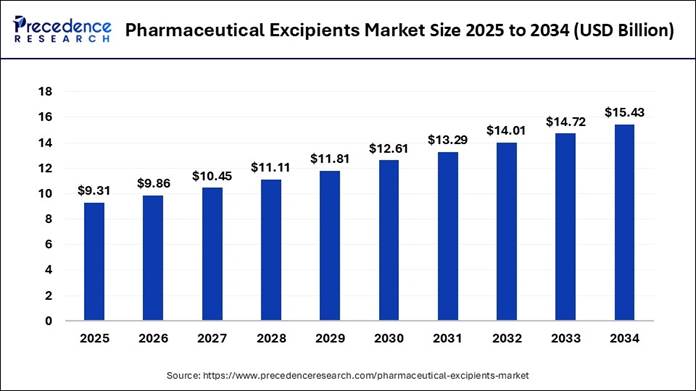

According to Precedence Research, the pharmaceutical excipients market size is calculated at USD 9.31 billion in 2025 and is expected grow from USD 9.86 billion in 2026 to nearly USD 15.43 billion by 2034. In terms of CAGR, the market is expanding at a strong compound annual growth rate (CAGR) of 5.75% from 2025 to 2034.

Pharmaceutical excipients, which are pharmacologically inactive, are crucial in the preparation, stability, and efficacy of drugs. They are added together with active pharmaceutical ingredients (APIs) to facilitate the manufacturing process as well as to ensure that the end product is safe, effective, and user-friendly.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

📥 Download Sample Pages for Informed Decision-Making 👉 https://www.precedenceresearch.com/sample/1761

Market Key Takeaways

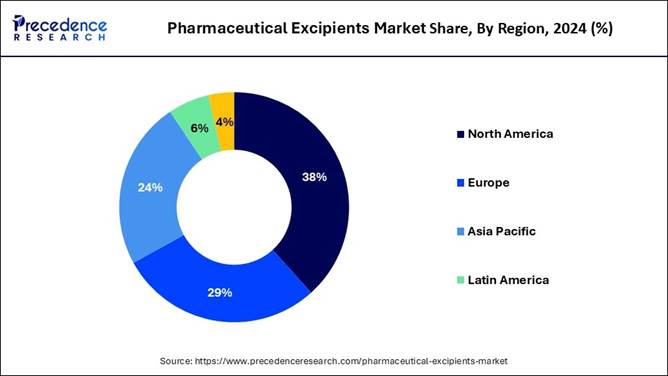

🔹North America accounted for the largest market share of 38.32% in 2024.

🔹 By excipient type, the lactose-based excipients segment contributed the highest market share of 41.26% in 2024.

🔹 By functionality, the fillers and diluents segment generated the largest market share in 2024.

🔹 By functionality, the coating agents segment is expected to grow significantly CAGR over the forecast period.

🔹 By excipient type, the lactose-based excipients segment held a major share in 2024.

🔹 By excipient type, the cellulose-based segment is growing at a notable CAGR from 2025 to 2034.

Pharmaceutical Excipients Market Size, Growth and Forecast

🔹 Market Size in 2025: USD 9.31 Billion

🔹 Market Size in 2026: USD 9.86 Billion

🔹 Market Size by 2034: USD 15.43 Billion

🔹 CAGR (2025-2034): 5.75%

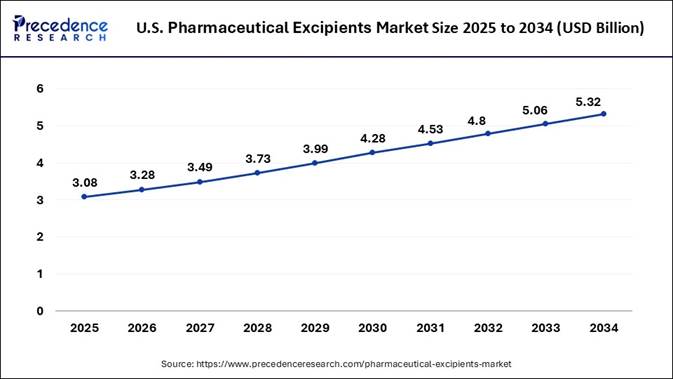

🔹U.S. Market Size in 2025: USD 3.08 Billion

🔹U.S. Market Size by 2034: USD 5.32 Billion

🔹 Largest Region in 2024: North America

🔹 Fastest Growing Region: Europe

Pharmaceutical Excipients Market Regional Landscape

🔹 The North America pharmaceutical excipients market was valued at USD 3.15 billion in 2024 and is projected to reach approximately USD 5.66 billion by 2034, registering a CAGR of 6.04% from 2025 to 2034. The region continues to dominate due to its advanced pharmaceutical manufacturing infrastructure, strong R&D base, and presence of leading global drug makers.

🔹 The Europe pharmaceutical excipients

market stood at USD 2.35 billion in 2024 and is anticipated to expand to around

USD 3.95 billion by 2034, growing at a steady CAGR of 5.30%. Rising investments

in sustainable formulations and the growing biologics sector are driving market

expansion across key economies such as Germany, the U.K., and France.

🔹 The Asia Pacific pharmaceutical

excipients market accounted for USD 1.94 billion in 2024 and is forecast to

grow at the fastest rate, with a CAGR of 6.53% from 2025 to 2034, reaching

about USD 3.65 billion by 2034. The region’s growth is fueled by large-scale

generic drug production, favorable government policies, and increasing

pharmaceutical exports from India and China.

🔹 The Middle East and Africa (MEA) pharmaceutical excipients market was valued at USD 294.40 million in 2024 and is projected to rise to USD 454.85 million by 2034, expanding at a CAGR of 4.44%. Market growth is supported by healthcare infrastructure development, expanding drug manufacturing capacity, and gradual adoption of international quality standards.

Pharmaceutical Excipients Market Overview and Industry Potential

Innovation in Drug Formulation Propels Excipients Market Forward

The pharmaceutical excipients market is anticipated to experience fast-paced growth in the coming years, akin to the increased need for stable, effective, and easier-to-consume medicine in recent years. Also, the innovations in biologics and increasing patient base across the world are actively contributing to the industry's growth. Moreover, the manufacturers are heavily investing in the development of multifunctional and plant-based excipients in the current period.

Eco-Friendly, Bio-Derived Excipients Set to Transform Drug Delivery

Developing functional and sustainable excipients that go beyond basic roles is expected to create lucrative opportunities for the manufacturer in the upcoming years. Manufacturers can create eco-friendly, bio-derived materials with enhanced performance-like excipients that improve solubility or control drug release naturally. Another fast-emerging opportunity is customized excipient design using AI-assisted formulation modeling, allowing precise combinations tailored to specific APIs.

Why Pharmaceutical Excipients Are the Next Frontier in Biopharma Innovation?

Pharmaceutical excipients are emerging as the next frontier in biopharma innovation, transforming from passive ingredients into strategic enablers of advanced drug delivery. Traditionally used to stabilize or bulk up formulations, excipients now play a pivotal role in enhancing bioavailability, controlling release rates, and improving patient compliance—especially for complex biologics and personalized therapies.

As biologic drugs, mRNA vaccines, and gene therapies grow in prominence, the demand for multifunctional, high-purity, and bio-derived excipients is accelerating. Innovations such as plant-based polymers, lipid nanoparticles, and AI-assisted formulation design are reshaping how drugs are developed and delivered. Furthermore, sustainability and clean-label requirements are driving manufacturers to invest in green chemistry and renewable excipient sources.

Regulatory Barriers Slow Innovation in the Advancements

The high cost and complexity of regulatory approvals for new excipients are anticipated to hinder market growth during the forecast period. Pharmaceutical companies are cautious about using novel materials because each one requires extensive testing, safety data, and compatibility studies. This slows down innovation and increases costs for manufacturers.

Explore the Full Report for Deeper Insights 👉 https://www.precedenceresearch.com/pharmaceutical-excipients-market

Pharmaceutical Excipients Market’s Regulatory Landscape: Global Regulations

|

Country / Region |

Regulatory Body |

Key Regulations |

Focus Areas |

Notable Notes |

|

United States |

Food and Drug Administration (FDA). |

GMP requirements (21 CFR Part 211) |

Drug product manufacturer's responsibility |

These agencies are ensuring drug safety in the country. |

|

European Union |

European Medicines Agency (EMA) |

Falsified Medicines Directive (2011/62/EU) |

Harmonized standards |

The EMA aims for consistent regulation across EU member states, using centralized procedures for marketing authorization and guidance documents.. |

|

China |

National Medical Products Administration (NMPA). |

"Drug Master File (DMF) System |

Stricter oversight |

China has uniquely high regulatory requirements for excipients, with mandatory registration for all non-exempt items. |

Market

Dynamics: Market

Drivers: 🔹 Surge in biologics, biosimilars, and personalized medicine

driving excipient innovation. 🔹 Growing demand for

oral solid dosage forms in chronic disease management. 🔹 Expansion of

clean-label, natural, and plant-based excipient adoption. Market

Restraints: 🔹 High regulatory

costs and lengthy approval timelines for new excipient types. 🔹 Limited

standardization in excipient compatibility testing for novel active pharmaceutical

ingredients. Opportunities: 🔹 AI-assisted

excipient design for precision drug formulation. 🔹 Growth in lipid nanoparticles

(LNPs) and polymer-based excipients for mRNA vaccines. 🔹 Increasing

outsourcing of excipient manufacturing to Asia Pacific and Eastern Europe. Challenges: 🔹 Raw material price

volatility. 🔹 Supply chain

dependency for critical excipient categories post-pandemic. Emerging

Trends in Pharmaceutical Excipients: 🔹 Integration of machine

learning in formulation design for predictive stability and performance

modeling. 🔹 Nanotechnology-based

excipients

improving solubility and targeted drug delivery. 🔹 Shift toward smart

excipients with dual or multifunctional roles (e.g., binder + stabilizer). 🔹 Development of 3D printing-compatible excipients for personalized dosage

manufacturing. 🔹 Adoption of green

chemistry and biodegradable excipients to meet ESG standards. Pharmaceutical

Excipients Market Perspective Report

Attributes Key Statistics Market Size in 2025 USD 9.31 Billion Market Size in 2025 USD 9.86 Billion Market Size by 2034 USD 15.43 Billion CAGR from 2025 to 2034 5.75% Largest Market North America Fastest Growing Market Europe Base Year 2024 Forecast Period 2025 to 2034 Segments Covered Functionality, Excipient Type, Regional Key Market Drivers Rising demand for advanced drug formulations, increasing

biologics production, and sustainable excipient innovation Key Market Restraints Stringent regulatory requirements and high R&D costs for new

excipients Opportunities Growth in bio-derived, plant-based, and multifunctional

excipients; AI-assisted formulation modeling Key Players BASF SE, Ashland Global, Evonik Industries AG, Roquette Frères,

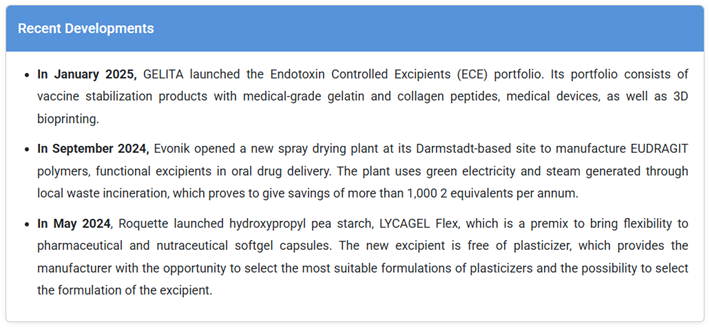

DuPont, Lubrizol Corporation Recent Developments Evonik’s new spray drying plant (2024); GELITA’s Endotoxin

Controlled Excipients launch (2025) Regional Insights North America leads; Europe growing fastest; Asia Pacific

emerging with strong pharma manufacturing base Research Methodology Top-down and bottom-up approaches, primary and secondary data

validation

Why Choose

This Report? ➢ This report comes with 12 months of

online access and quarterly update provisions. ➢ Get the latest report

version on request. ➡️ Become a valued research partner with

us ☎ https://www.precedenceresearch.com/schedule-meeting One

of the most notable industry examples underscoring innovation in the

pharmaceutical excipients market is Evonik Industries AG’s advancement in

functional polymer excipients. The company’s flagship EUDRAGIT® polymer

line demonstrates how excipient innovation is redefining modern drug

delivery. Challenge: Solution: Impact: Key

Takeaway: For

inquiries regarding discounts, bulk purchases, or customization requests,

please contact us at sales@precedenceresearch.com How

the Growth of the Global Pharmaceutical Market Accelerates the Pharmaceutical

Excipients Market Expanding

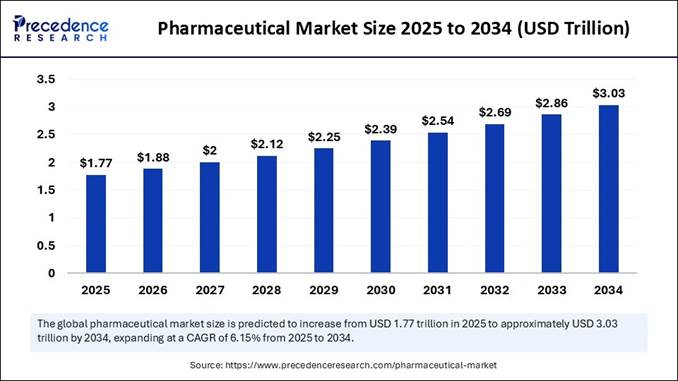

Pharmaceutical Market Underpins Excipient Demand According

to Precedence Research, the global pharmaceutical market size is projected to reach

around USD 2.87 trillion by 2034, growing from an estimated USD 1.64 trillion in 2024 at

a strong CAGR of 5.8% from 2025 to 2034. This exponential growth

directly strengthens the pharmaceutical excipients market, which is forecast to

rise from USD 9.31 billion in 2025 to USD 15.43 billion by 2034. The

correlation is clear — as pharmaceutical manufacturing, R&D spending, and

drug commercialization expand, the requirement for high-quality, functional,

and sustainable excipients intensifies proportionally. Drug

Innovation Drives the Need for Advanced Excipients The Complete Study is Now Available

for Immediate Access | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/6227 Massive

Drug Production and Generic Expansion Boost Consumption Sustainability

and Regulatory Alignment Strengthen Market Synergy Conclusion:

A Symbiotic Growth Path Between Pharmaceuticals and Excipients Don’t

Miss Out! | Instant Access to This Exclusive Report 👉 https://www.precedenceresearch.com/checkout/6227 Pharmaceutical

Excipients Market Key Regional Analysis: Strong

Pharmaceutical Infrastructure Positions North America at the Forefront? North

America held the dominant share of the pharmaceutical excipients market in

2024, owing to the presence of a stronger pharmaceutical infrastructure and access

to advanced formulation technologies in the current period. Furthermore, the United

States has major drug makers which is contributing to the industry graph in

recent years. What

is the United States Pharmaceutical Excipients Market Size? Precedence

Research predicts that, the U.S. pharmaceutical excipients market size is

projected to reach approximately USD 5.32 billion by 2034, increasing from USD

3.08 billion in 2025, with a solid CAGR of 6.26% from 2025 to 2034. The

U.S. represents one of the most mature and highly regulated pharmaceutical

excipients markets globally. Driven by advanced R&D capabilities, strong

demand for novel drug delivery systems, and a high concentration of innovative

drug manufacturers, the country shows strong demand for functional and

specialty excipients. Key

areas of focus include solubility enhancement, sustained release, and

biologics-supportive excipients, particularly for injectables and lipid-based

systems. Regulatory scrutiny from the FDA ensures that excipient manufacturers

maintain strict quality, safety, and traceability standards. Furthermore,

domestic production is increasingly being favored to reduce dependence on

international supply chains, particularly post-pandemic. What

Makes Asia Pacific a Magnet for Pharma Manufacturing? Asia

Pacific is expected to expand notably during the forecast period, owing to its enlarged

pharmaceutical production capacity and exceptional government support in recent

years. Also, the region has unique benefits like the presence of a skilled

workforce, low labor cost, and an enlarged base due to a huge population, which

has actively driven the regional growth over the past few years. India's

pharmaceutical excipients market is witnessing steady growth, driven by the

country's expanding generic drug manufacturing sector and its position as a

global pharmaceutical hub. The increasing domestic demand for affordable

medicines, alongside exports to regulated markets like the U.S. and Europe, is

encouraging the use of high-quality excipients. Indian manufacturers are

focusing on improving GMP compliance and adopting international pharmacopeial

standards to meet global quality benchmarks. Additionally,

there's a growing trend toward producing plant-based and clean-label

excipients, aligning with both domestic and international preferences.

Government initiatives supporting pharmaceutical infrastructure and bulk drug

parks are also positively impacting excipient production and localization. China's

pharmaceutical excipients market is growing rapidly, supported by the country's

expanding pharmaceutical manufacturing base and increasing domestic consumption

of medicines. As China strengthens its regulatory framework, there is rising

demand for high-purity, pharma-grade excipients that meet both Chinese and

international standards. Local companies are scaling up capabilities in

functional excipients and investing in R&D for customized solutions. Additionally,

government policies encouraging self-reliance in pharmaceutical ingredients are

promoting local excipient production. While historically focused on commodity

excipients, the market is gradually shifting toward value-added,

multifunctional, and clean-label products to meet evolving domestic and export

requirements. Pharmaceutical

Excipients Market Segmentation Analysis: Functionality

Insights: Why

Did Fillers and Diluents Segment Dominate the Market in 2024? The

fillers and diluents segment held the largest share of the pharmaceutical

excipients market in 2024, owing to its being considered the most essential

in almost every oral solid dosage form, such as tablets and capsules. Also, by

helping in adjusting drug size while improving compressibility, the filler and

diluent segment has gained major industry attention in recent years. Moreover,

the versatility of the fillers and diluents is likely to create lucrative

opportunities in the industry for the upcoming years. Excipient

Type: How

the Lactose-Based Excipients Segment Maintains Its Dominance in the Current

Industry? The

lactose-based

excipient segment

held the largest share of the market in 2024 due to its being considered the

most effective segment for delivering therapeutic genes in the cells. Moreover,

having unique properties such as targeting specific tissues and long-lasting

effects, the viral vectors have gained immense industry attention in recent

years, as per the current market survey. You can

place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804

441 9344 Competitive

Landscape of Pharmaceutical Excipients Market: Top

Companies Company Headquarters Key

Offerings / Strengths Ashland

Global Holdings Wilmington,

Delaware, USA Offers a

broad portfolio of cellulose-based polymers (e.g., HPMC, CMC), film coatings,

binders, disintegrants, and controlled release agents. Strong in oral solid

dosage forms and biologics support. BASF SE Ludwigshafen,

Germany Provides a

wide range of pharmaceutical-grade excipients including polymers,

polyethylene glycols, and functional solubilizers. Focus on controlled

release and poorly soluble APIs. DuPont Wilmington,

Delaware, USA Supplies

functional polymers and resins used in taste masking and controlled release

applications across various dosage forms. Roquette

Frères Lestrem,

France Specializes

in plant-based excipients such as starch derivatives, sugars, and polyols.

Offers excipients for oral, injectable, and nutraceutical formulations. Evonik

Industries AG Essen /

Darmstadt, Germany Strong in

functional and custom polymers like EUDRAGIT®. Offers excipients for oral,

parenteral, and topical delivery. Also involved in lipid systems and LNPs. Associated

British Foods London, UK Focuses

primarily on food and nutritional ingredients. May contribute to excipient

markets via starches, sugars, and basic ingredients, though less

pharma-specific. Archer

Daniels Midland (ADM) Chicago,

Illinois, USA Supplies

plant-based raw materials like starches and sugars. Plays a role in the

excipient supply chain, particularly in basic feedstock materials. Lubrizol

Corporation Wickliffe,

Ohio, USA Known for

specialized excipients like Carbopol®, polycarbophil, and solubility

enhancers. Strong in injectables, controlled release, and formulation

support. Croda

International East

Yorkshire, UK Offers

natural and specialty chemical-based excipients including surfactants and

bio-based functional ingredients for drug delivery and formulation. Kerry

Group Tralee,

County Kerry, Ireland Provides

ingredients for health and nutrition sectors. Involved in stabilizers,

emulsifiers, and basic excipient functions, particularly for nutraceuticals.

What

is Going Around the Globe? The

global pharmaceutical excipients market is witnessing notable developments as

leading manufacturers introduce advanced, sustainable, and high-performance

excipients to meet evolving drug formulation needs. Additional

Developments Across the Industry: 🔹 Ashland Global

Holdings

is expanding its range of hypromellose-based coatings for

sustained-release oral dosage forms to improve patient compliance. 🔹 BASF SE is investing in

next-generation solubilizers and binders optimized for poorly soluble

APIs to address bioavailability challenges in modern therapeutics. 🔹 Lubrizol Corporation is enhancing its Carbopol®

platform for injectables, offering higher purity and consistency for use in

biologic formulations. 🔹 Croda International is advancing its bio-based

surfactants and emulsifiers aimed at improving solubility and absorption in

lipid nanoparticles (LNPs) and mRNA delivery systems. 🔹 DuPont is focusing on controlled-release

excipient technology tailored for personalized medicine and micro-dose

formulations. Pharmaceutical

Excipients Market Segmentation: By

Functionality 🔹Fillers and Diluents 🔹Suspending and Viscosity Agents 🔹Coating Agents 🔹Binders 🔹Disintegrants 🔹Colorants 🔹Lubricants and Glidants 🔹Preservatives 🔹Emulsifying Agents 🔹Flavoring Agents and Sweeteners 🔹Other Functionalities By

Excipient Type 🔹 Lactose-based Excipients • α-lactose monohydrate •

Anhydrous

α-lactose •

Anhydrous

β-lactose •

Amorphous

Lactose 🔹 Cellulose-based •

Microcrystalline

Cellulose (MCC) •

Cellulose

Ethers •

Others 🔹 Starches 🔹 Carboxymethylcellulose Sodium (CCS) 🔹 Sodium Starch Glycolate (SSG) 🔹 Fine Chemicals 🔹 Mannitol 🔹 Biopharma Excipients 🔹 Others By Regions 🔹 North America 🔹 Europe 🔹 Asia Pacific 🔹Latin America 🔹Middle East & Africa (MEA) Thanks for reading you can also get individual

chapter-wise sections or region-wise report versions such as North America,

Europe, or Asia Pacific. Don’t Miss Out! | Instant Access to This

Exclusive Report 👉 https://www.precedenceresearch.com/checkout/1761 Pharmaceutical

Excipients Market — FAQs ✚ What is the market size

and growth outlook? ✚ What drives this market’s

growth? ✚ What restrains market

expansion? ✚ Which regions matter most? ✚ Which functionality

segment leads today? ✚ Which functionality will

grow fastest? ✚ Which excipient types

dominate? ✚ How does broader pharma

growth affect excipients? ✚ What innovation themes

define the next cycle? ✚ What are key

opportunities? ✚ How are sustainability

goals impacting suppliers? ✚ Which companies are

prominent? Stay

Ahead with Precedence Research Subscriptions Unlock

exclusive access to powerful market intelligence, real-time data, and

forward-looking insights, tailored to your business. From trend tracking to

competitive analysis, our subscription plans keep you informed, agile, and

ahead of the curve. Browse Our

Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription About Us Precedence

Research is a global market intelligence and consulting powerhouse, dedicated

to unlocking deep strategic insights that drive innovation and transformation.

With a laser focus on the dynamic world of

life sciences, we

specialize in decoding the complexities of cell and

gene therapy,

drug development, and oncology markets, helping our clients stay ahead in

some of the most cutting-edge and high-stakes domains in healthcare. Our

expertise spans across the biotech and pharmaceutical ecosystem, serving

innovators, investors, and institutions that are redefining what’s possible in regenerative medicine, cancer care, precision therapeutics,

and beyond. Web: https://www.precedenceresearch.com Our

Trusted Data Partners: Towards Healthcare | Nova One Advisor Get Recent

News 👉 https://www.precedenceresearch.com/news For Latest

Update Follow Us: ✚ Related Topics You May Find Useful: ➡️ Nutraceutical

Excipients Market: Explore how functional

food innovation and clean-label nutrition are shaping the future of

nutraceutical formulations ➡️ High

Potency Active Pharmaceutical Ingredients (HPAPI) Market: Examine the rise of

targeted therapies and precision oncology driving HPAPI demand globally ➡️ Pharmaceutical

Intermediates Market: Uncover how growing API

production and outsourcing trends are fueling intermediate manufacturing ➡️ Pharmaceutical

Chemicals Market: Learn how innovation in

fine chemicals and green synthesis supports modern drug development ➡️ Pharmaceutical

Quality Control Market:

Understand how digital validation and AI-based testing are transforming

pharmaceutical quality standards ➡️ Drug Formulation Market: See how advanced

formulation science and novel delivery systems are revolutionizing therapeutic

effectiveness ➡️ Pharmaceutical

Impurity Synthesis and Isolation Services Market: Discover how regulatory

pressure and analytical precision are driving demand for impurity profiling

services ➡️ Pharmaceutical

Stability and Storage Services Market: Analyze how temperature-controlled

logistics and stability testing ensure long-term drug efficacy ➡️ Generic Drugs Market: Track how affordability,

patent expirations, and healthcare reforms are accelerating the global generics

boom

Case

Study: Evonik’s EUDRAGIT® Polymers Revolutionize Oral Drug Delivery

Pharmaceutical companies face a growing need to enhance the solubility,

bioavailability, and targeted release of poorly soluble active pharmaceutical

ingredients (APIs). Traditional excipients often fail to maintain consistent

performance in complex formulations, leading to inefficiencies and higher

development costs.

Evonik developed a new generation of EUDRAGIT® polymers designed for controlled

and sustained drug release in oral solid dosage forms. In September 2024,

the company opened a state-of-the-art spray drying plant in Darmstadt,

Germany, specifically dedicated to producing these polymers under

sustainable conditions. The plant operates using green electricity and steam

sourced from local waste incineration, achieving an estimated reduction

of over 1,000 tons of CO₂ annually.

This innovation not only enhances excipient performance and stability but also

aligns with the pharmaceutical industry’s growing emphasis on eco-friendly

and regulatory-compliant excipient manufacturing. The project demonstrates

how sustainability and advanced functionality can coexist in excipient design, setting

a benchmark for the future of drug formulation.

Evonik’s approach highlights a larger industry trend — the integration of

sustainability, precision engineering, and functional design in excipient

innovation. As regulatory pressures rise and biologics gain prominence, such

multifunctional excipients are becoming essential for ensuring both therapeutic

efficacy and environmental responsibility.

The surge in novel drug formulations, biologics, biosimilars, and gene

therapies has transformed excipients from passive ingredients into critical

enablers of drug performance. As pharmaceutical companies innovate new delivery

mechanisms and biologic molecules, they increasingly depend on multifunctional

excipients that enhance bioavailability, control drug release, and improve

patient adherence. This ongoing innovation in the global pharmaceutical

industry directly drives demand for high-purity and bio-derived excipients that

meet evolving regulatory and therapeutic standards.

Rising global demand for affordable medicines and generic drugs, especially in Asia

Pacific, Latin America, and Eastern Europe, is rapidly increasing excipient

consumption. India and China — leading producers of generics — are scaling

manufacturing to meet international export demands, further expanding the

excipients market. The pharmaceutical production surge across emerging

markets creates consistent, high-volume demand for essential excipients like

fillers, binders, and diluents, reinforcing global market growth.

The pharmaceutical industry’s pivot toward eco-friendly, compliant, and

sustainable production models is reshaping excipient innovation.

Manufacturers are investing in bio-derived and plant-based excipients to

align with clean-label and environmental standards. Simultaneously, stricter

regulatory oversight from agencies such as the FDA, EMA, and NMPA ensures that

excipient suppliers maintain top-tier quality and traceability. This alignment

between pharmaceutical regulation and excipient innovation creates a mutually

reinforcing cycle that sustains long-term market expansion.

The pharmaceutical excipients market’s forecasted value of USD 15.43 billion

by 2034 is inseparable from the broader pharmaceutical industry’s

transformation. As global drug pipelines diversify and new therapeutic classes

emerge, excipients are evolving into strategic components of modern drug

development. The synergy between the pharmaceutical and excipient markets

ensures that innovation in one continually fuels advancement in the other —

solidifying excipients as indispensable pillars of the global pharmaceutical

ecosystem.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1761United States Pharmaceutical Excipients Market Analysis

India Pharmaceutical Excipients Market Analysis

China Pharmaceutical Excipients Market Analysis

➡️ The market is valued at USD 9.31

billion in 2025 and is projected to reach USD 15.43 billion by 2034, at a

2025–2034 CAGR of 5.75%.

➡️ Rising demand for advanced drug

formulations, the scale-up of biologics and biosimilars, and increasing

adoption of bio-derived, sustainable excipients.

➡️ High regulatory costs, lengthy

approval timelines for new excipients, and inconsistent compatibility standards

with novel APIs.

➡️ North America leads in 2024; Europe is

the fastest-growing region; Asia Pacific is expanding rapidly on the back of

generics manufacturing.

➡️ Fillers and diluents hold the largest

share in 2024, reflecting ubiquity in oral solid dosage manufacturing.

➡️ Coating agents are expected to post

significant growth over the forecast period, supported by controlled-release

and taste-masking needs.

➡️ Lactose-based excipients hold the

highest 2024 share; cellulose-based excipients show notable growth through

2034.

➡️ As global pharma scales R&D,

launches, and manufacturing, excipient demand rises proportionally for volume,

quality, and specialized performance.

➡️ Multifunctional/smart excipients,

plant-based and clean-label inputs, AI-assisted formulation design,

nanotechnology carriers, and 3D-printing-ready grades.

➡️ AI-guided excipient design, lipid

nanoparticles and polymer systems for mRNA/biologics, and contract

manufacturing/outsourcing in Asia Pacific and Eastern Europe.

➡️ Green chemistry, renewable feedstocks,

and eco-efficient manufacturing (e.g., reduced CO₂ operations) are becoming

selection criteria alongside performance.

➡️ BASF SE, Ashland Global, Evonik

Industries, Roquette Frères, DuPont, Lubrizol, Croda, ADM, Kerry Group, and

others across polymers, solubilizers, and plant-based portfolios.

______________________________________________________________________________