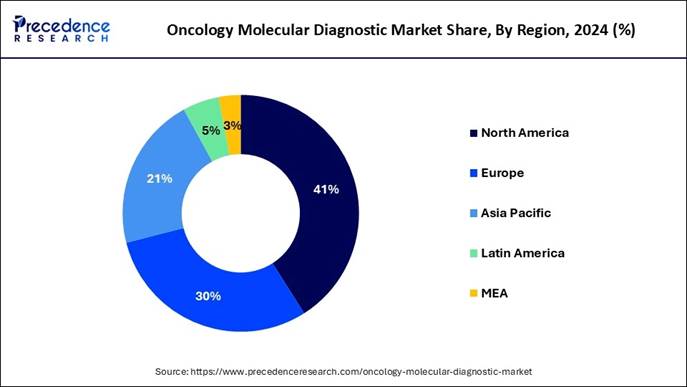

According to Precedence Research, the global oncology molecular diagnostic market size is valued at USD 3.06 billion in 2025 and is expected to be worth over USD 8.50 billion by 2034, growing at a strong CAGR of 11.99% from 2025 to 2034. North America accounted for over 41% of the market share in 2024, while Asia-Pacific is projected to record the fastest CAGR from 2025 to 2034.

This Report is Readily Available for Immediate Delivery | Download the Sample Pages

of this Report@ https://www.precedenceresearch.com/sample/3677

Oncology Molecular Diagnostic Market Highlights:

- North America accounted for the highest market share of 41% in 2024.

- The Asia-Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

- By type, the breast cancer segment held mor than 22% of the market share in 2024.

- By type, the liver cancer segment is growing at a strong CAGR of 13.9% between 2025 and 2034.

- By technology, the polymerase chain reaction (PCR) segment contributed the biggest market share of 32% in 2024.

- By technology, the sequencing segment is expanding at the fastest CAGR from 2025 to 2034.

- By product, the reagents segment accounted for the highest market share of 59% in 2024.

- By product, the instruments segment is expected to expand at the fastest CAGR between 2025 and 2034.

How Precision Diagnostics Is Taking Centre Stage in Modern Cancer Treatment

The oncology molecular

diagnostic market is expanding rapidly as

healthcare systems prioritise early detection and personalised cancer therapy. New

advances in next-generation sequencing, liquid

biopsy platforms, and tumor

profiling assays are helping clinicians identify actionable genetic mutations

that support targeted treatment decisions. The widespread integration of

companion diagnostics in cancer therapy selection has further strengthened the

market.

Rising global cancer incidence, improved access to biomarker-based

testing, and the introduction of AI-supported analytic tools are positioning

molecular diagnostics as a central feature of modern oncology

care. These tools enable clinicians to classify tumors more accurately, predict

treatment response, and monitor disease progression with higher precision than

traditional diagnostic methods.

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

What Factors Are Driving Oncology Molecular Diagnostic Investments

Key growth drivers include the rising need for non-invasive cancer detection, increased adoption of precision medicine, and global expansion of cancer screening programs. Diagnostic companies are investing in platforms that allow comprehensive genomic profiling from blood and tissue samples. The acceleration of targeted therapy approvals worldwide is also increasing demand for companion diagnostics that match patients to biomarker-driven treatments.

Governments and national cancer agencies

continue to expand screening initiatives for breast, colorectal, and cervical

cancer, contributing to growing testing volumes across public and private

healthcare settings.

Revolutionary Trends in the Oncology Molecular Diagnostic Market

• Next-generation sequencing becomes mainstream as laboratories shift

toward multi-gene panels that analyse large sets of cancer mutations in a

single test.

• Liquid biopsy adoption rises quickly, supported by interest in early

cancer detection, treatment monitoring, and recurrence analysis using

blood-based assays.

• AI-enabled molecular pathology tools emerge, offering automated

analytics for genomic

data interpretation and reducing manual workload for oncology laboratories.

• Home-based molecular cancer testing expands as companies develop

compact, easy-to-use devices for self-sampling using saliva, urine, and small

blood samples.

What Barriers Exist to Adoption

The high cost of advanced molecular testing and instruments remains a major barrier

in the oncology molecular diagnostic market, especially for smaller

laboratories and emerging economies. Many tests require highly trained

specialists and complex equipment, limiting accessibility for new entrants.

Integration of molecular platforms into existing hospital information systems

also presents challenges. Reimbursement gaps for new genomic assays and unequal

access to cancer care further slow widespread adoption.

📥 Dive into the Comprehensive Global Study 👉 https://www.precedenceresearch.com/oncology-molecular-diagnostic-market

Oncology Molecular Diagnostic Market Report Coverage

|

Report Attributes |

Key Statistics |

|

Market Size in 2025 |

USD 3.06 Billion |

|

Market Size in 2026 |

USD 3.42 Billion |

|

Market Size by 2034 |

USD 8.50 Billion |

|

Growth Rate (2025–2034) |

CAGR of 11.99% |

|

Largest Market (2024) |

North America (> 41% share) |

|

Fastest-growing Region |

Asia-Pacific |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2034 |

|

Segments Covered |

Type, Technology, Product, Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Key Type Insight (2024) |

Breast cancer segment held ~22% share |

|

Fastest-growing Type Segment |

Liver cancer (CAGR ~13.9%) |

|

Key Technology Insight (2024) |

PCR-based diagnostics held ~32% share |

|

Fastest-growing Technology Segment |

Sequencing technologies |

|

Key Product Insight (2024) |

Reagents accounted for ~59% share |

|

Fastest-growing Product Segment |

Instruments |

|

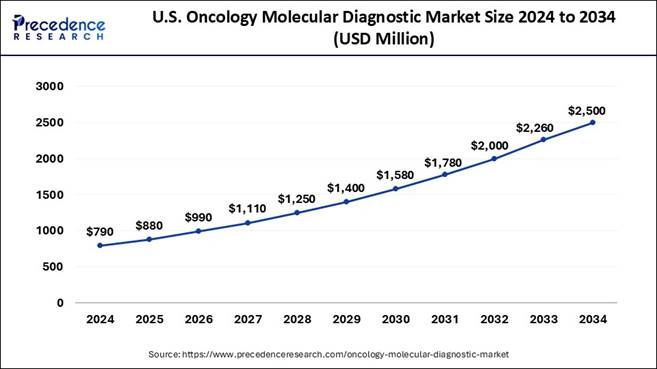

Major Country Highlight |

U.S. market valued at ~USD 790 million in 2024; projected to reach ~USD 2.5 billion by 2034 |

✚ Turn AI disruption into Opportunity. Click to Get the Insights Shaping Tomorrow.

Case Study: How Precision Oncology Is Transforming the Global Oncology Molecular Diagnostic Market (2024–2034)

Executive Summary

The global Oncology Molecular Diagnostic

Market is undergoing a major transformation, driven by the rapid adoption

of precision oncology, next-generation sequencing (NGS), and non-invasive

testing solutions.

Valued at USD 2.74 billion in 2024, the market is projected to soar to USD

8.50 billion by 2034, registering a powerful CAGR of 11.99% between

2025 and 2034.

1. Background: Why Molecular Diagnostics Became the Backbone of Modern Oncology

Over the past decade, oncology care shifted

from generic, one-size-fits-all treatment strategies to highly personalized,

gene-driven therapy frameworks.

Clinicians increasingly rely on molecular diagnostics to:

- Detect cancers at earlier stages

- Identify genetic mutations and biomarkers

- Match patients with tailored targeted therapies

- Track treatment response and relapse

- Reduce diagnostic uncertainty

2. Client Challenge: Global Cancer Burden & the Urgent Need for Precision Testing

Healthcare systems worldwide are overwhelmed by rising cancer cases. The challenge is threefold:

2.1 Late Cancer Diagnosis

More than 50% of cancers in developing nations are diagnosed at advanced stages, leading to low survival and high treatment cost.

2.2 Limited Access to Molecular Testing

High-cost genomic platforms, low laboratory capacity, and reimbursement gaps have slowed adoption, especially in Asia-Pacific, Latin America, and Africa.

2.3 Growing Demand for Tailored Therapies

As targeted therapies multiply globally, clinicians need actionable molecular insights for therapy selection.

The industry responded with breakthroughs in:

- NGS multi-gene panels

- Liquid biopsy (blood-based) assays

- Rapid PCR oncology kits

- AI-enabled molecular pathology analytics

3. Strategic Solution: How the Industry Is Innovating

3.1 Expansion of Precision Medicine Infrastructure

Governments, biotech companies, and healthcare providers are investing heavily in:

- Advanced genomic sequencing labs

- Distributed molecular pathology networks

- Large-scale cancer screening programs

- AI-assisted diagnostic systems

For example, the U.S. and Europe have integrated companion diagnostics into the cancer treatment approval process, accelerating clinical adoption.

3.2 Digital and AI-Driven Diagnostic Tools

AI now helps automate:

- Biomarker detection

- Variant interpretation

- Tissue classification

- Risk prediction

3.3 Shift Toward Non-Invasive Cancer Detection

Liquid biopsy

is emerging as a preferred method due to its ability to detect DNA fragments

shed by tumors into the bloodstream.

4. Market Transformation: Segment-Wise Insights

4.1 Type Insights

- Breast cancer diagnostics commanded 22% market share in 2024 due to strong awareness and widespread BRCA testing.

- Liver cancer diagnostics are projected to grow fastest (CAGR ~13.9%) due to rising disease incidence in Asia.

4.2 Technology Insights

- PCR contributed 32% of revenue—trusted for accuracy, affordability, and rapid detection.

- Sequencing technologies are the fastest-growing as NGS platforms become more accessible.

4.3 Product Insights

- Reagents dominated with 59% share in 2024 due to high recurring consumption.

- Instruments are witnessing the fastest growth, fueled by laboratory automation and genomic workload expansion.

5. Regional Dynamics: Where the Opportunities Lie

5.1 North America – The Global Leader

Holding 41% market share, North America benefits from:

- Advanced precision oncology infrastructure

- High adoption of NGS and liquid biopsy

- Strong reimbursement frameworks

- Continuous innovation from market leaders

The U.S. alone is expected to grow from USD 790 million in 2024 to USD 2.5 billion by 2034.

5.2 Asia-Pacific – The Fastest-Growing Market

Asia-Pacific is the growth engine, driven by:

- Expanding national cancer screening

- Healthcare modernization

- Rapid adoption of sequencing platforms

- Rising prevalence of liver, lung, and colorectal cancers

Countries like China, Japan, India, and South Korea are building state-of-the-art genomic labs to scale precision oncology.

6. Impact Assessment: How These Shifts Affect Stakeholders

6.1 For Healthcare Providers

- Faster, more accurate diagnosis

- Personalized treatment selection

- Reduced diagnostic uncertainty

6.2 For Investors

- Strong ROI due to high CAGR markets

- Rapid expansion of sequencing and liquid biopsy

- Opportunities in emerging regions

6.3 For Diagnostic Companies

- Higher demand for instruments, reagents, AI platforms

- Strategic partnerships for co-developed companion diagnostics

- Increased regulatory support

Recent partnership example:

Agilus Diagnostics and Lucence (2025) collaborated to integrate advanced

molecular oncology solutions into clinical workflows—reflecting a major

industry trend

7. Key Market Drivers

- Rising global cancer incidence

- Shift toward precision and personalized oncology

- Adoption of liquid biopsy for early detection

- Companion diagnostics supporting targeted therapies

- Expansion of national cancer screening programs

- AI-driven improvements in diagnostic interpretation

8. Market Barriers

Despite strong growth potential, challenges remain:

- High cost of instruments and assays

- Requirement for specialized workforce

- Limited integration with hospital information systems

- Reimbursement gaps for genomic testing

- Accessibility inequality in low-income countries

9. Future Outlook (2025–2034)

The next decade will witness:

- Large-scale adoption of NGS-driven multi-cancer early detection (MCED) tests

- Mainstream integration of AI-powered molecular pathology

- Rapid expansion of at-home molecular test kits

- Growth of precision oncology companion diagnostics

- Wider acceptance of liquid biopsy for treatment monitoring

Major players include Roche, Abbott, Thermo Fisher, Illumina, Qiagen, Bio-Rad, Myriad Genetics, Guardant Health, and Foundation Medicine.

10. Conclusion: Why Decision-Makers Must Act Now

The Oncology Molecular Diagnostic Market

offers one of the strongest long-term investment opportunities in

healthcare.

As the world shifts toward measurable, gene-driven cancer treatment, demand for

accurate molecular testing will surge globally.

Organizations that invest now—in NGS infrastructure, liquid biopsy technologies, AI-enabled pathology, or diagnostic reagents—are positioned to:

- Lead the precision oncology revolution

- Capture high-growth revenue segments

- Establish competitive dominance through 2034

Don’t Miss Out! | Instant Access to This Exclusive Report 👉 https://www.precedenceresearch.com/checkout/3677

Oncology Molecular Diagnostic Market Regional Analysis

How Big is the U.S. Oncology Molecular Diagnostic Market Size?

According to Precedence Research, the U.S. oncology molecular diagnostic market size is calculated at USD 880 million in 2025 and is predicted to rise from USD 990 million in 2026 to nearly USD 2,500 million by 2034. The market is expanding at a healthy CAGR of 12.21% from 2025 to 2034.

Note:

This report is readily available for immediate delivery. We can review it

with you in a meeting to ensure data reliability and quality for

decision-making.

📥 Download

Sample Pages for Informed Decision-Making 👉

https://www.precedenceresearch.com/sample/3677

Why North America Leads the Oncology

Molecular Diagnostic Market

North America dominated the market in 2024 due to strong

adoption of precision oncology

technologies, advanced healthcare infrastructure, and early access to

innovative diagnostic platforms. The presence of leading

genomic testing companies and

continuous investment in targeted therapies reinforces regional leadership. Ongoing

expansion of cancer screening programs, biomarker-driven clinical

trials, and integration of AI

tools in diagnostic labs support continued growth.

Why Asia Pacific Is the Fastest-Growing Region

Asia Pacific is projected to grow rapidly between 2025 and 2034, driven by rising cancer incidence, a growing population, and significant investment in healthcare modernisation. Countries such as China, India, Japan, and South Korea are expanding national screening programs, building genomics laboratories, and integrating molecular diagnostics into oncology care. Increasing healthcare funding and improving access to precision medicines are also contributing to regional expansion.

Oncology Molecular Diagnostic Market Segment Insights:

Type Insights

Why Did the Breast Cancer Segment

Dominate in 2024

The breast cancer segment held the largest

share in 2024 because early detection significantly improves survival outcomes.

Molecular diagnostics for breast cancer, including BRCA1 and BRCA2 mutation

testing, have become widely used in assessing hereditary risk and guiding

treatment decisions. Rising awareness of genetic testing and large-scale

screening programs also supports segment dominance.

Technology Insights

How the PCR Segment Maintained Its Dominance

The PCR segment accounted for the largest

share in 2024 because it is highly accurate, rapid, and cost-effective for

detecting cancer-related DNA mutations. It is widely used for the detection of

minimal residual disease and tumor profiling. Its ability to identify even very

small amounts of cancer-derived genetic material makes it essential for early

diagnosis.

Product Insights

Reagents held the largest share of the market in 2024 since they are required for every molecular test, including PCR, sequencing, and biomarker assays. Global increases in cancer testing volumes and expansion of molecular laboratories have driven higher consumption of diagnostic reagents. Instruments are expected to grow fastest as demand for automated, high-throughput diagnostic systems increases.

✚ Related Topics You May Find Useful:

➡️ Cancer Diagnostics Market: Explore how early-detection technologies are reshaping global cancer care

➡️ Infectious Disease Molecular Diagnostics Market: Learn how rapid molecular platforms are transforming real-time pathogen detection

➡️ Point-of-Care Molecular Diagnostics Market: Track the shift toward decentralized, near-patient testing solutions

➡️ Molecular Cytogenetics Market: Understand how advanced chromosomal analysis supports precision medicine growth

➡️ Minimal Residual Disease (MRD) Testing Market: See how ultra-sensitive assays are redefining cancer relapse monitoring

➡️ Oncology Clinical Trials Market: Discover how biomarker-driven studies are accelerating targeted therapy development

➡️ Next-Generation Cancer Diagnostics Market: Explore innovations propelling early detection beyond traditional diagnostics

➡️ Bladder Cancer Therapeutics & Diagnostics Market: Analyze treatment advancements and diagnostic breakthroughs improving outcomes

➡️ Diagnostic Testing Market: Gain insights into evolving global demand for laboratory, imaging, and molecular testing services

Top Companies in the Oncology Molecular Diagnostic Market

➢ Roche Diagnostics

➢ Abbott Laboratories

➢ Thermo Fisher Scientific Inc.

➢ Illumina, Inc.

➢ Qiagen N.V.

➢ Bio-Rad Laboratories, Inc.

➢ Genomic Health, Inc.

➢ Myriad Genetics, Inc.

➢ Agilent Technologies, Inc.

➢ Siemens Healthineers

➢ Danaher Corporation (Cepheid)

➢ Sysmex Corporation

➢ Hologic, Inc.

➢ Guardant Health, Inc.

➢ Foundation Medicine, Inc.

What is Going Around the Globe?

🔸In

February 2025, Agilus Diagnostics, a diagnostic company in India, and Lucence,

a molecular diagnostics firm, entered into a collaboration to integrate

advanced molecular testing technologies for cancer detection, treatment

selection, and monitoring. As part of this partnership, Lucence’s molecular

testing solutions will be incorporated into Agilus’ oncology diagnostics

portfolio.

Oncology Molecular Diagnostic Market Segmentation:

By Type

🔹 Breast Cancer

🔹 Prostate Cancer

🔹 Colorectal Cancer

🔹 Cervical Cancer

🔹 Liver Cancer

🔹 Lung Cancer

🔹 Blood Cancer

🔹 Kidney Cancer

🔹 Other Cancer

By Technology

🔹 PCR

🔹 In Situ Hybridization

🔹 INAAT

🔹 Chips and Microarrays

🔹 Mass Spectrometry

🔹 Sequencing

🔹 TMA

🔹 Others

By Product

🔹 Instruments

🔹 Reagents

🔹 Others

By Region

🔹 North America

🔹 Europe

🔹 Asia Pacific

🔹Latin America

🔹Middle East & Africa (MEA)

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or Asia Pacific.

Don’t Miss Out! | Instant Access to This Exclusive Report 👉 https://www.precedenceresearch.com/checkout/3677

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a global market intelligence and consulting powerhouse, dedicated to unlocking deep strategic insights that drive innovation and transformation. With a laser focus on the dynamic world of life sciences, we specialize in decoding the complexities of cell and gene therapy, drug development, and oncology markets, helping our clients stay ahead in some of the most cutting-edge and high-stakes domains in healthcare. Our expertise spans across the biotech and pharmaceutical ecosystem, serving innovators, investors, and institutions that are redefining what’s possible in regenerative medicine, cancer care, precision therapeutics, and beyond.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Nova One Advisor | Onco Quant | Statifacts

Get Recent News 👉 https://www.precedenceresearch.com/news

For Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter

✚ Explore More Market Intelligence from Precedence Research:

➡️ Digital Therapeutics: How software-based interventions are restructuring chronic-disease management and clinical-grade behavioral therapy

➡️ Life Sciences Growth: Forces driving expansion across biotech, biopharma, and advanced therapeutic platforms

➡️ Viral Vector Gene Therapy Manufacturing: Manufacturing constraints, scalability limits, and innovations shaping next-generation gene-delivery systems

➡️ Wellness Transformation: How prevention-centric health models are shifting consumer behavior, product pipelines, and care delivery

➡️ Generative AI in Healthcare: How generative models are unlocking new diagnostics, clinical automation, and patient-care innovations